Perseus Mining Updates Life of Mine Plan for Sissingu?(C) Gold Mine & Satellite Deposits

PERTH, Western Australia, March 27, 2022 (GLOBE NEWSWIRE) -- Perseus Mining Limited (ASX/TSX: PRU) has updated its Life of Mine Plan (“LOMP”) for its Sissingué Gold Mine (“SGM”) and satellite deposits, Fimbiasso and Bagoé, in Côte d’Ivoire (collectively “Sissingué”).

HIGHLIGHTS

- The mine life for Sissingué has been extended to March 2026 with potential for further extension by processing low grade ore stockpiles.

- Average annual gold production is currently forecast at 72,000 ounces at an average all-in site cost (ASIC) of US$1,261 per ounce.

- Updated Mineral Resources are estimated at 7.2 million tonnes grading 1.7 g/t gold containing 394,000 ounces of gold at December 31, 2021.

- Proved and Probable Ore Reserves1 total 5.0 million tonnes of ore grading 1.8g/t gold and containing 282,000 ounces of gold with ore drawn from pits at Sissingué, Fimbiasso and Bagoé deposits.

- Key Sissingué LOMP2 parameters include:

| KEY PARAMETERS | UNITS | UPDATED LIFE OF MINE PLAN | ANNUAL AVERAGE FY2023 – FY2025 |

| Total Ore + waste mined | Mt | 24.1 | 7.4 |

| Strip ratio | t:t | 4.6:1 | 4.4:1 |

| Ore processed | Mt | 5.5 | 1.5 |

| Head grade | g/t gold | 1.6 | 1.7 |

| Gold recovery rate | % | 91.2 | 91.4 |

| Gold production | ‘000 ozs | 252 | 72 |

| Production costs | US$/oz | 1,164 | 1,173 |

| Royalty1 | US$/oz | 63 | 63 |

| Sustaining capital | US$/oz | 25 | 25 |

| Average All-in site costs | US$/oz | 1,253 | 1,261 |

Notes:

- Assumes a gold price of US$1,500 per ounce for Ore Reserve and royalty calculations.

- LOMP commences on July 1, 2022.

Perseus’s Managing Director and CEO Jeff Quartermaine said:

“The Sissingué Gold Mine has been an important part of Perseus’s geopolitically diversified asset portfolio since commencing commercial production in 2018 with an estimated 4.5-year mine life. Since then, the mine has consistently produced gold in excess of forecasts and importantly, generated significant amounts of free cashflow. This updated LOMP incorporates the processing of ore from satellite deposits at Fimbiasso and Bagoé as well as the Sissingué Gold Mine, and results in the life of the Sissingué operation being extended out till at least March 2026 which enables Perseus to continue generating material benefits for all of our stakeholders, including the residents of our host communities at Fimbiasso and Bagoé.”

Overview of Sissingué

Sissingué is located in northern Cote d’Ivoire in the West African Craton where gold is mined in Paleoproterozoic (Birimian) rocks of the southern extension of the Syama Greenstone Belt and the western margin of the Senoufo Greenstone Belt. Gold deposits at Sissingué are orogenic, greenstone hosted.

The SGM main pit mineralisation is structurally controlled and mainly hosted within a granitic stock associated with a network of quartz-carbonate veins and veinlets with associated pyrite and arsenopyrite dissemination. Gold-bearing veins have a dominant NNW to NS trend and are steeply dipping. Disseminated mineralisation is also located in the alternation envelops of the mineralised quartz veins.

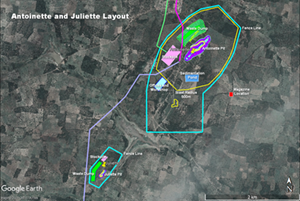

SGM commenced commercial gold production at the end of March 2018 and by 30 June 2022 approximately 367,500 ounces of gold are forecast to have been produced at the mine. The sources of ore to be processed at Sissingué during the remaining 3.7 years of mine life, as currently defined, are SGM, Fimbiasso and Bagoé deposits. Each deposit consists of multiple pits and the ore feed will be supplemented with stockpiles at SGM as detailed in Table 3. To ensure the mill is run at full capacity in the last seven months of mine life, reducing processing and general administration (G&A) unit rate costs, stockpiled mineralised waste will be used to supplement ore feed. Ore from Fimbiasso and Bagoé will be stockpiled temporarily on site then transported to Sissingué for process plant feed as per milling schedule. Waste material will be taken to the waste dump located near the pits. Tailings from the process plant will be stored in a single, plastic high-density polyethylene (HDPE) lined, tailings storage facility located near the Sissingué process plant.

Many of Sissingué’s operational workforce live in the communities located near the existing mine and processing facility, and the satellite deposits. An on-site camp has been constructed at SGM to accommodate members of the workforce who are not local residents.

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5849bbd8-5a71-4ea5-b894-1b15d5df0dda

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a82240f2-5b70-4f8f-8d4a-a921536cfd51

Figure 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2a80cbe4-6337-46ba-a22f-40b927965153

Figure 4 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bc888168-89f7-4939-b629-b8008ff7f6c3

MINERAL RESOURCES AND ORE RESERVES SUMMARY

For a comprehensive description of SGM Mineral Resources and Ore Reserves estimates, refer to the JORC tables included in Appendix 1, and to the news release titled “Perseus Mining Updates Mineral Resources and Ore Reserves” dated 26 August 2020 for all reference to the Fimbiasso Deposits and to the news release titled “Perseus Mining Updates Mineral Resources and Ore Reserves” dated 24 August 2021 for the Bagoé Deposits. Table 1, 2 and 3 below summarise the currently estimated Mineral Resources and Ore Reserves at Sissingué.

Table 1: Sissingué Measured and Indicated Mineral Resources – 31 December 2021 1,2

| PROJECT | DEPOSIT TYPE | MEASURED RESOURCES | INDICATED RESOURCES | MEASURED + INDICATED RESOURCES | ||||||

| Quantity Mt | Grade g/t gold | Gold '000 oz | Quantity Mt | Grade g/t gold | Gold '000 oz | Quantity Mt | Grade g/t gold | Gold '000 oz | ||

| Sissingué 3,4,5 | Open Pit | 1.2 | 1.4 | 50 | 1.3 | 1.4 | 56 | 2.4 | 1.4 | 107 |

| Fimbiasso 6,7 | Open Pit | 1.7 | 1.7 | 95 | 0.4 | 1.8 | 23 | 2.1 | 1.7 | 118 |

| Bagoé 8,9 | Open Pit | 0.7 | 2.2 | 53 | 1.0 | 2.3 | 73 | 1.7 | 2.3 | 126 |

| Sub Total | 3.6 | 1.7 | 198 | 2.7 | 1.8 | 152 | 6.2 | 1.8 | 351 | |

| Stockpiles | 0.7 | 1.3 | 30 | - | - | - | 0.7 | 1.3 | 30 | |

| Total | 4.3 | 1.6 | 227 | 2.7 | 1.8 | 152 | 7.0 | 1.7 | 379 | |

Table 2: Sissingué Inferred Mineral Resources – 31 December 2021 2

| PROJECT | DEPOSIT TYPE | INFERRED RESOURCES | ||

| Quantity Mt | Grade g/t gold | Gold '000 oz | ||

| Sissingué 3,4,5 | Open Pit | 0.1 | 1.1 | 2 |

| Fimbiasso 6,7 | Open Pit | 0.1 | 1.8 | 6 |

| Bagoé 8,9 | Open Pit | 0.1 | 2.2 | 6 |

| Sub Total | 0.3 | 1.5 | 14 | |

| Stockpiles | - | - | - | |

| Total | 0.3 | 1.8 | 15 | |

Notes:

1. Measured and Indicated Mineral Resources are inclusive of Ore Reserves.

2. Rounding of numbers to appropriate precisions may have resulted in apparent inconsistencies.

3. Based on February 2022 Mineral Resource model constrained to US$1,800/oz pit shell.

4. Depleted to 31 December 2021 mining surface.

5. 0.6g/t gold cut-off applied to in situ material.

6. Based on March 2020 Mineral Resource models constrained to US$1,800/oz pit shells.

7. 0.8g/t gold cut-off applied.

8. Based on May 2021 Mineral Resource models constrained to US$1,800/oz pit shells.

9. 0.8g/t gold cut-off applied to oxide, 1g/t applied to transition, 1.2g/t applied to fresh (Veronique deposit only).

Table 3: Proved and Probable Ore Reserves as at 31 December 2021 5, 7

| DEPOSIT | DEPOSIT TYPE | PROVED | PROBABLE | PROVED + PROBABLE | ||||||

| Quantity Mt | Grade g/t gold | Gold ‘000 oz | Quantity Mt | Grade g/t gold | Gold ‘000 oz | Quantity Mt | Grade g/t gold | Gold ‘000 oz | ||

| Sissingué1,2,3,4 | Open Pit | 1.0 | 1.3 | 40 | 0.9 | 1.3 | 37 | 1.9 | 1.3 | 78 |

| Fimbiasso2,4 | Open Pit | 1.1 | 2.0 | 70 | 0.2 | 2.2 | 13 | 1.3 | 2.0 | 83 |

| Bagoé2,3,4 | Open Pit | 0.5 | 2.6 | 40 | 0.6 | 2.6 | 51 | 1.1 | 2.6 | 91 |

| Sub Total | 2.6 | 1.8 | 150 | 1.7 | 1.9 | 101 | 4.3 | 1.8 | 251 | |

| Stockpiles6 | 0.7 | 1.3 | 30 | - | - | - | 0.7 | 1.3 | 30 | |

| Total | 3.3 | 1.7 | 181 | 1.7 | 1.9 | 101 | 5.0 | 1.8 | 282 | |

Notes:

1 Depleted to 31 December 2021 mining surface.

2 Based on February 2022 Mineral Resource model constrained to US$1,800/oz pit shell and depleted to 31 December 2021 mining surface.

3 Based on February 2022 Ore Reserve estimation.

4 Variable gold grade cut-off for each material type, ranging from 0.40 g/t to 1.00 g/t at Sissingué deposits, from 0.80 g/t to 1.50 g/t at Fimbiasso deposits and from 1.00 g/t to 3.00 g/t at Bagoé deposits.

5 Inferred Mineral Resource is considered as waste.

6 Based on EOM December 2021 stockpile balance report.

7 Rounding of numbers may result in apparent mathematical inconsistencies.

LIFE OF MINE PLAN

Based on detailed mining and processing schedules recently prepared as part of the life of mine planning process, the key forecast operating parameters for Sissingué are summarised in Table 4. To illustrate the changes to the FY23 LOMP from the previous FY22 LOMP published in August 2021, equivalent data is tabulated below. It should be noted that the FY23 LOMP commences 1 July 2022 and accounts for actual depletion of Ore Reserves between July 2021 to December 2021 and forecast depletion between 1 January 2022 and 30 June 2022.

Mining cost estimates in the updated LOMP are based on projected costs using the current contract with mining contractors, SFTP, who have been conducting mining activities on site since mining operations started. SFTP is expected to perform the full mining, drilling and grade control service required at Sissingué. Explosive costs are based on the projection of current contract prices provided by contractor, Maxam, a leading explosives manufacturer and distributor.

Gold recovery rates and processing costs are based on actual results achieved in the last 12 months and combined with forward projections based on a comprehensive metallurgical test work program for areas with no experiential data. Processing costs include costs associated with all consumables including maintenance, electricity, fuel, labour, and other processing overheads.

G&A and other costs are based on actuals and budget projections. G&A operating costs include all labour costs, Abidjan regional office costs, HR administration costs as well as all costs associated with the management of the environment, OH&S, security, government and community relations, general administration including insurances and other contracts.

Sustaining capital costs include stage lifting of the tailings storage facility (TSF), closure costs, progressive clearing, contractor demobilisation, and plant modifications. The total estimate of sustaining capital is US$7.6M million which over the current life of mine equates to US$30/oz of gold produced. Sustaining capital does not include any capital costs estimated for the delineation of additional Mineral Reserves and Ore Reserves or the establishment of new open pit or underground mining operations. Any such developments will be regarded as development capital and disclosed accordingly.

Table 4: Overview Key Parameters4

| UNITS | FY23 LOMP | ||

| Total FY23-26 | Annual Average FY23-25 | ||

| Mining | |||

| Total ore + waste mined | Mt | 24.11 | 7.4 |

| Waste mined | Mt | 19.81 | 6.0 |

| Ore mined | Mt | 4.31 | 1.4 |

| Mined grade | g/t gold | 1.81 | 1.7 |

| Strip ratio | t:t | 4.6:11 | 4.4:1 |

| Processing | |||

| Quantity ore processed | Mt | 5.5 | 1.5 |

| Head grade processed | g/t gold | 1.6 | 1.7 |

| Contained gold | ‘000ozs | 277 | 79 |

| Gold recovery rate | % | 91.2 | 91.4 |

| Gold production | ‘000ozs | 252 | 72 |

| Operating Costs2 | |||

| Average mining costs | US$/t mined | 5.822 | 5.96 |

| Average processing costs | US$/t processed | 15.96 | 16.47 |

| Average general & administration costs | US$/t processed | 12.02 | 12.11 |

| Production costs | US$/oz | 1,164 | 1,173 |

| Royalty3 | US$/oz | 63 | 63 |

| Sustaining capital | US$/oz | 25 | 25 |

| All-in site costs | US$/oz | 1,253 | 1,261 |

Notes:

1 Includes all ore and waste mined ex-pit but excludes rehandle movement.

2 Excludes pre-strip costs that have been capitalised.

3 Assumes a gold price of US$1,500/oz for Ore Reserve and Royalty calculations, and US$1,250/oz for the DFS.

4 LOMP commences 1 July 2022.

MINING AND PROCESSING SCHEDULES

Based on the estimated Ore Reserves summarised in Table 2: Sissingué Inferred Mineral Resources – 31 December 20212

| PROJECT | DEPOSIT TYPE | INFERRED RESOURCES | ||

| Quantity Mt | Grade g/t gold | Gold '000 oz | ||

| Sissingué 3,4,5 | Open Pit | 0.1 | 1.1 | 2 |

| Fimbiasso 6,7 | Open Pit | 0.1 | 1.8 | 6 |

| Bagoé 8,9 | Open Pit | 0.1 | 2.2 | 6 |

| Sub Total | 0.3 | 1.5 | 14 | |

| Stockpiles | - | - | - | |

| Total | 0.3 | 1.8 | 15 | |

Notes:

10. Measured and Indicated Mineral Resources are inclusive of Ore Reserves.

11. Rounding of numbers to appropriate precisions may have resulted in apparent inconsistencies.

12. Based on February 2022 Mineral Resource model constrained to US$1,800/oz pit shell.

13. Depleted to 31 December 2021 mining surface.

14. 0.6g/t gold cut-off applied to in situ material.

15. Based on March 2020 Mineral Resource models constrained to US$1,800/oz pit shells.

16. 0.8g/t gold cut-off applied.

17. Based on May 2021 Mineral Resource models constrained to US$1,800/oz pit shells.

18. 0.8g/t gold cut-off applied to oxide, 1g/t applied to transition, 1.2g/t applied to fresh (Veronique deposit only).

, the mining production profile for Sissingué is forecast to be as shown in Error! Reference source not found. below. No Inferred Mineral Resources have been included as mill feed in the updated LOMP.

Ore and waste will be mined from all Sissingué pits. Ore from the Fimbiasso and Bagoé deposits will be stockpiled temporarily on their respective sites then transported to SGM for processing as per the mill feed schedule. Mill feed will be complimented with the remaining ore stockpiles at Sissingué, with additional feed supplement coming from mineralised waste material to ensure the mill runs full capacity in the final seven months of mine life, minimising the processing and G&A unit rate costs.

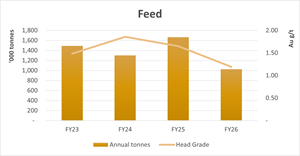

Mining is currently expected to be complete within four years of operation from 1 July 2022. Mining will start at SGM and Fimbiasso deposits in the first 18 months, the majority of ore feed will come from Fimbiasso. At this time mining at SGM will be mostly from satellite pits and waste stripping of the main pit, during which time mining will be accelerated at the Fimbiasso deposit. Current ore stockpiles will supplement mill feed as required. After mining at Fimbiasso is complete, Bagoé mining is scheduled to start following equipment relocation. Mining of the SGM deposit will continue while the Bagoé deposit is being mined. In this period, mining at SGM Main pit will be sufficiently advanced to mine high-grade ore and complement lower feed grade ore from Bagoé. This will result in higher gold production in FY25 compared to previous years.

Figure 5 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ff525f27-2fde-4fab-bde8-9293447fb844

Gold production in FY23 will mainly be derived from ore sourced from Fimbiasso deposit, oxide ore from SGM satellite deposits and existing stockpiles at SGM. Meanwhile, the pre-strip in the SGM main pit will be undertaken to access the ore zone. Pre-stripping at SGM main pit is expected to take 18 months before access into the main ore zone is achieved.

In FY24, mining in Fimbiasso will be completed in the first half of the year and will be replaced by Bagoé deposit as the main ore source. By second half of FY24, the main ore zone in the SGM main pit will be exposed. Stockpiled material will sustain mill feed at full capacity.

The highest production year in the LOMP is FY25. In this period, high grade ore will be mined from both the SGM main pit and the Bagoé deposit. Ore from Bagoé will provide the main source of high-grade mill feed ore. Mining at the SGM main pit will be completed by the third quarter of FY25, requiring ore from Bagoé deposit to be supplemented with remaining stockpiles available at SGM during the fourth quarter.

Based on the LOM schedule, mining and processing at SGM will be completed in FY26. Mining will be finished in February 2026 and processing will be completed the following month, March 2026. In this period the mill feed will be supplied from Bagoé deposit supplemented with stockpiled mineralised waste. The use of mineralised waste will enable the mill to operate at full capacity, resulting in lower unit processing costs and G&A. By the end of March 2026, approximately 650,000 tonnes of mineralised waste stockpiles will remain. This material may be processed at a later date subject to it being economically viable.

The processing rate is forecast to average 1.4 million tonnes per year over the 3.7 years of mine life. The processing rate in this LOM has been increased from the previous LOM from 220tpoh to 260tpoh and is based on experiential knowledge and current milling rates experienced at SGM.

The forecast average gold production for the remaining mine from 1 July 2022, is estimated at approximately 72,000 ounces at an average head grade of 1.7g/t and an average metallurgical recovery of 91.4%. A total of 252,000 ounces of gold are forecast to be recovered over the life of operation.

Figure 6 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b42f50db-eefc-426c-bc2c-b0a706db730e

This announcement was approved for release by Perseus Mining Limited’s Managing Director and CEO, Jeff Quartermaine.

Competent Person Statement:

All production targets referred to in this report are underpinned by estimated Ore Reserves which have been prepared by competent persons in accordance with the requirements of the JORC Code.

The information in this report that relates to Mineral Resources for Sissingué is based on information compiled by Ms Christine Shore, a Competent Person who is a Fellow of The Australian Institute of Mining and Metallurgy. Ms Shore is a full-time employee of Perseus Mining, and she has no economic, financial or pecuniary interest in the company. Ms Shore has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activities which she is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and a Qualified Person as defined in NI43-101. Ms Shore consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Reserves for the Sissingué deposit is based on information compiled by Mr Craig Fawcett, FAusIMM CP, who is a full-time employee of Perseus Mining. Mr Fawcett has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activities which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and a Qualified Person as defined in NI43-101. Mr Fawcett consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Fimbiasso deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Bagoé deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, in that market release continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Sissingué Gold Project, Côte d’Ivoire” dated 18 December 2017 continue to apply.

Caution Regarding Forward Looking Information:

This report contains forward-looking information which is based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of gold, continuing commercial production at the Sissingué Gold Mine, the Edikan Gold Mine and the Yaouré Gold Mine without any major disruption due to the COVID-19 pandemic or otherwise, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual market price of gold, the actual results of current exploration, the actual results of future exploration, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. The Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company’s ability to carry on its exploration and development activities, the timely receipt of required approvals, the price of gold, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Perseus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| ASX/TSX CODE: PRU REGISTERED OFFICE: Level 2, 437 Roberts Road Subiaco WA 6008 Telephone: +61 8 6144 1700 Email: IR@perseusmining.com WWW.PERSEUSMINING.COM | CONTACTS: Jeff Quartermaine Managing Director & CEO jeff.quartermaine@perseusmining.com Nathan Ryan Media Relations +61 4 20 582 887 nathan.ryan@nwrcommunications.com.au Claire Hall Corporate Communications +61 414 558 202 claire.hall@perseusmining.com |

APPENDIX 1:

Sissingué Gold Mine Mineral Resources & Ore Reserves

Mineral Resource Statement

Material information summary as required under ASX Listing Rule 5.8 and JORC 2012 reporting guidelines.

The Mineral Resource Statement for the Sissingué Gold Mine (SGM) is reported in accordance with the 2012 Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code). The classification categories of Measured, Indicated and Inferred under the JORC Code are equivalent to the Canadian Institute of Mining, Metallurgy and Petroleum categories of the same names (CIM, 2014).

This Mineral Resource Estimate (MRE) update includes an additional 24,700 m drilling from 528 Reverse Circulation (RC) holes, drilled in 2021 and is reported excluding mining activity, surveyed up to 31 December 2021 and limited within a constraining pit shell generated at US$1,800 an ounce with updated Sissingué mining and processing costs.

The SGM MRE is comprised of the remaining in situ mineralisation at the SGM mine and material on stockpiles as of 31 December 2021. A total of 46,377 metres of drilling from 13,703 drill holes was available for this MRE. Mineralisation interpretations were informed by Reverse Circulation and Diamond Drilling.

This MRE comprises Inferred Mineral Resources which are unable to have economic considerations applied to them, nor is there certainty that they will be converted to Measured or Indicated Resources through further sampling. The in situ Mineral Resources are potentially exploitable by open pit mining methods.

The information provided in the JORC 2012 Table 1 – Section 3 Estimation and Reporting of Mineral Resources applies to this MRE.

The combined global Mineral Resource for the SGM is estimated as 2.6Mt grading 1.3 g/t gold, containing 108,000 ozs of gold. Additional stockpile inventory, provide a total global Mineral Resources of 7.3Mt @ 1.3g/t for 135,000ozs as shown below in Table 1.

Table 1: SGM Measured and Indicated Mineral Resources – 31 December 2021 1,2,3,4,5

| DEPOSIT | DEPOSIT TYPE | MEASURED RESOURCES | INDICATED RESOURCES | MEASURED + INDICATED RESOURCES | ||||||

| Quantity Mt | Grade g/t gold | Gold '000 oz | Quantity Mt | Grade g/t gold | Gold '000 oz | Quantity Mt | Grade g/t gold | Gold '000 oz | ||

| Sissingué | Open Pit | 1.2 | 1.4 | 50 | 1.3 | 1.4 | 56 | 2.4 | 1.4 | 107 |

| Stockpiles | Open Pit | 0.7 | 1.3 | 30 | - | - | - | 0.7 | 1.3 | 30 |

| Total | 1.8 | 1.3 | 80 | 1.3 | 1.4 | 56 | 3.1 | 1.4 | 135 | |

Table 2: SGM Inferred Mineral Resources – 31 December 2021 2,3,4,5

| DEPOSIT | DEPOSIT TYPE | INFERRED RESOURCES | ||

| Quantity Mt | Grade g/t gold | Gold '000 oz | ||

| Sissingué | Open Pit | 0.1 | 1.1 | 2 |

| Total | 0.1 | 1.1 | 2 | |

Notes:

1 Measured and Indicated Mineral Resources are inclusive of Ore Reserves.

2 Rounding of numbers may have resulted in apparent mathematical inconsistencies.

3 Based on February 2022 Mineral Resource model constrained to US$1,800/oz pit shell.

4 Depleted to 31 December 2021 mining surface.

5 0.6g/t gold cut-off applied to in situ material.

Geology and geological interpretation

The SGM is located in the West African Craton and covers the Paleoproterozoic (Birimian) rocks of the southern extension of the Syama Greenstone Belt and the western margin of the Senoufo Greenstone Belt. Gold deposits at the SGM are orogenic, greenstone hosted in nature.

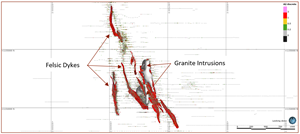

The SGM main pit mineralisation is structurally controlled and mainly hosted within a granitic stock associated with a network of quartz-carbonate veins and veinlets with pyrite and arsenopyrite dissemination. Gold-bearing veins have a dominant NNW to NS trend and are steeply dipping. Disseminated mineralisation is also located in the alteration envelops of the mineralised quartz veins.

Additional mineralisation is seen within interconnecting mineralised felsic dyke complexes that propagate from the main granite stock. These mineralised felsic dyke complexes, also trending NNW, host the mineralisation for the additional pits in the area, namely Binkadi, Bagoé, Western Arm and Boribana.

Interpretations of domain continuity were undertaken within Leapfrog3DTM software, with mineralisation intercepts correlating to individual lithological domains manually selected prior to creation of a vein and intrusion model (Figure 1). Interpretation was aided by geological pit mapping which ensured that modelling appropriately represented site-based observations and the current understanding of geology and mineralisation controls.

Mineralisation volume domains were delineated using a combination of:

- Geological information comprising: Lithology, structural interpretation, veining and sulphides;

- Utilising a nominal lower grade minimum cut-off of 0.3 g/t gold.

The main granite intrusions where modelled using lithological logging and a lower nominal 0.3 g/t gold cut-off, which provided a low grade (LG) halo mineralised domain. Statistical analysis of the Granite data showed a high grade (HG) sample population. Visually, this was supported by a consistent tenor of mineralisation lying as an internal, higher-grade core within the Granite. This HG internal sub-domain was then modelled, utilising a nominal 1.0 g/t lower cut-off. Cross cutting Felsic dyke complexes where then modelled using structural and lithological logging, assisted by a lower grade cut-off of 0.3 g/t gold.

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/115283c7-63d6-42dc-8b57-f0832cf4b60c

Sampling and Sub-Sampling

For all RC holes informing the resource estimate, samples were collected at 1 metre intervals and split at the drill sites using a multi-stage riffle splitter or cone splitter to produce sub-samples weighting 2-3 kilograms.

Diamond core was sawn in half with a diamond blade saw, with the right half sent for assaying and the left half stored in core trays for reference. Core was sampled in 1 metre intervals or to geological contacts.

RC and core samples were securely transported to either:

1) Perseus’s sample preparation facility at SGM where they were dried, crushed to 2mm and a 1kg riffle split portion pulverised to 90% passing 75 microns and assayed with Aqua Regia, or

2) Transported to a local laboratory and assayed using Fire Assay techniques.

Sample condition (dry, damp, wet) and a qualitative description of sample quality (high, moderate, low) were logged for RC holes. Holes were stopped if excessive water was intersected and the samples were considered at risk of smearing, or if sample recovery dropped to <90%.

For RC samples drilled for resource definition, the weight of each entire recovered 1 metre sample was recorded with sample recoveries averaging ~90%. There is no apparent relationship between sample recovery and gold grades in RC drill holes.

Recovered lengths of diamond core were measured for each drill run. Average core recoveries range from 85% in upper saprolite to 100% in fresh rock. There is no apparent relationship between core recovery and gold grades in diamond drill holes.

Sampling precision was monitored by inclusion of 1:20 duplicate field splits for RC samples. Additionally, duplicate pulps were created for 1:20 samples of all types.

Database checks were completed and included:

- Checking for duplicate drill hole names and duplicate coordinates in the collar table;

- Checking for missing drill holes in the collar, survey, assay and geology tables based on drill hole names;

- Checking for survey inconsistencies including dips and azimuths <0o, dips >90o, azimuths >360o, negative depth values;

- Checking for inconsistencies in the “From” and “To” fields of the assay and geology tables. These checks included the identification of negative values, overlapping intervals, duplicate intervals, gaps and intervals where the “From” value is greater than “To” value.

The drill hole samples are considered appropriate and representative.

Drilling techniques

The Mineral Resource at Sissingué are delineated from reverse circulation (RC) and diamond core drilling. Typical drill spacing is generally less than 25 metres x 25 metres with most holes drilled at-60 degrees toward either 090 (east) or 270 (west) degrees azimuth, perpendicular to the strike of mineralisation.

Grade Control drilling spacing is 8 metres x 6 metres, drilled either at 55 degrees or vertical, with samples collected every 1.5 metres.

The data type, spacing and distribution are considered sufficient to establish estimates of Mineral Resources.

Sample analysis methods

All gold assaying was completed by external or onsite commercial laboratories with samples dried, crushed to 10mm, and then pulverised to 85% passing 75 µm and assayed using a 25g or 50g charge for fire assay analysis with AAS finish.

Grade control samples were assayed on site using Aqua Regia and through several external laboratories using Fire Assay between 25g and 50g aliquots.

Quality Assurance and Quality Control

Assay accuracy and reliability were monitored by insertion of blanks at 1:20 samples and reference standards (CRMs) at 1:20 samples.

The performances of blanks and standards were monitored as assay results were received.

Intervals of significant gold grades were compared to logging of quartz veining, alteration and mineralisation and chip tray photographs.

Assays were plotted on cross-sections to check that significant intercepts conform to the expected locations of mineralisation and make geometric sense.

Diamond core holes have been drilled at Sissingué to twin RC holes. Portions of 247 RC drill holes were identified to have smeared assays and have been excluded from all resource estimates, statistics, and interpolations. They have been appropriately flagged in the database.

The Quality Assurance and Quality Control (QAQC) data show acceptable precision and no significant bias. Overall assaying quality is considered adequate to support estimates of Mineral Resource.

Estimation methodology – Open pit mineral resources

The 2022 MRE for the SGM was estimated using a combination of Local Uniform Conditioning (LUC) with Ordinary Kriging (OK) using Surpac 2021 and Isatis.

Estimation was constrained within mineralisation envelopes (wireframes) based on geological logging and grade thresholds. The three main host lithologies are Granite, Felsic Dykes and Sediments. Where geological contacts were not clearly controlling the distribution of mineralisation, a grade cut-off of 0.3 g/t gold was used to construct Mineral Resource boundaries. Analysis of the global grade distribution shows that there is a natural change in grade population at around 0.3 g/t gold.

The LUC methodology was used to estimate the gold grades within the major Granite and Sediment units due to the skewed nature of the grade populations. At the completion of the estimations, grade, density and estimation quality items were exported from Isatis and imported into a Surpac format block model for validation and reporting.

- Two metre downhole composite gold grade data were interpolated into 16 mE x 16 mN x 5 mRL sized panels using Ordinary Kriging (OK).

- Top cuts were used to remove outlier high grades by reviewing composite data globally and for each individual domain by using histograms, log-histograms, log-probability plots and high-grade metal sensitivity analysis, combined with spatial inspection of the grade distribution and outlier locations. Appropriate high-grade cuts were applied as required on an individual domain basis. Top cuts used ranged between 2 and 30 g/t Au.

- A two-pass estimation strategy was employed. The minimum number of composites was set at 8 and the maximum number of composites at 16 for the first pass. A first pass search ellipse radius was set at 60 metres for these domains. A second pass search had minimum number of composites set at 5 and the maximum number at 24. The second pass search ellipse radius was set at 250 metres to ensure all remaining blocks had been estimated. The orientation of the search ellipse was set by the variogram model.

- Change of Support (CoS) calculations were conducted, conditioned to the panel grade estimates, for selectivity on 2 mE x 4 mN x 2.5 mRL SMU-sized blocks to produce a recoverable resource estimate. The Gaussian-based Uniform Conditioning approach was applied to the OK check grade estimates. An information effect correction was applied during the CoS calculations, to account for a future theoretical grade control drill configuration. The CoS process yields a set of array variables, stored in the panel block model, detailing the estimates for tonnage, grade, and metal above a range of grade cut-offs.

- A process of localisation was completed, by which the output of the CoS is mapped into single grade estimate per 2mE x 4mN x 2.5mRL block in an SMU block model, which comprises the final product of the grade estimation.

The remaining Felsic Dyke domains were estimated using 2m downhole composite gold grade data into 16 mE x 16 mN x 5 mRL sized panels using Ordinary Kriging (OK).

- Top cuts were used to remove outlier high grades by reviewing composite data globally and for each individual domain by using histograms, log-histograms, log-probability plots and high-grade metal sensitivity analysis, combined with spatial inspection of the grade distribution and outlier locations. Appropriate high-grade cuts were applied as required on an individual domain basis. Top cuts used ranged between 2g/t and 30g/t Au.

- The orientation of the variogram model and search ellipse was dynamically set according to the orientation of the lodes, as well the trend of high-grade mineralisation within the unit.

- A three-pass search pass strategy was used with a 40 metre radii on the first pass, with the search ellipse doubling in size on successive passes.

- Minimum number of samples varied from 2 to 8, with a maximum of 16.

Within the Grade Control (GC) volume, which is limited to the immediate vicinity of the GC drill holes, an OK estimate of gold grade was produced using the GC drill data.

- A non-linear method was not considered necessary to reflect the grade distribution satisfactorily at the 2 mE x 4 mN x 2.5 mRL SMU block scale due to the very dense ~10 metres GC drill spacing available within this volume.

- A dynamic oriented ellipsoidal search radii of 20m was used.

- A three-pass search strategy was used with the search ellipse doubling in size on successive pass.

- Minimum number of samples varied from 2 to 8, with the maximum set at 14.

- Estimation was into blocks 16 mE x 16 mN x 5 mRL.

Block model validation was undertaken globally by comparing:

- The mean LUC and OK block grade estimates to the mean of the informing composite grades on a domain-by-domain basis

- Visual inspection of the estimated block grades viewed in conjunction with the sample data

- Using swath plots to compare the LUC and OK gold estimates to the sample data

- A comparison of the LUC and GC Models where the LUC local grade model, based only on the relatively wide spaced resource drill data, was compared to the high confidence GC OK estimates within the GC volume.

The GC OK estimates are considered to represent a benchmark by which to measure the success or otherwise of the LUC estimates.

Criteria for resource classification

The SGM MRE has been classified into Measured, Indicated and Inferred categories, in accordance with the 2012 Australasian Code for Reporting of Mineral Resources and Ore Reserves (JORC Code) and the CIM Definition Standards (CIM, 2014). A range of criteria has been considered in determining this classification, including geological and grade continuity, data quality and drillhole spacing resulting in the MRE being classified as Measured, Indicated and Inferred.

The portions of the MRE classified as Measured have been flagged using an interpreted volume defined by high quality estimation parameters, which includes an average distance to nearest sample of 7 metres and an average distance to all informing samples of 12 metres. The Measured portion of the resource has been drilled on a nominal 6 metres x 8 metres GC spacing.

The portions of the MRE classified as Indicated have been flagged using a sectional interpreted volume defined by medium to high quality of estimation parameters, an average distance to nearest sample of less than 20 metres and an average distance to all informing samples of less than 40 metres. For the Sediment and Granite domains within the main Sissingué pit, due consideration was also given to the geological and mineralisation continuity available due to mining and positive historical reconciliation.

The portions of the MRE classified as Inferred represent the material extending down dip within and peripheral within the mineralised Domains. In these portions, geological continuity is present but not consistently confirmed by 20 metres x 20 metres drilling and incorporates volume extensions past the deepest drilling by up to 40 metres where the domain has not been closed off by drilling. The Inferred portions of the MRE are defined by lower confidence of estimation parameters, an average slope of regression (true to estimated block) of < 0.4 and an average distance to composites used of > 35 metres.

Mineralisation within the model which did not satisfy the criteria for Mineral Resource remained unclassified.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. MRE’s do not account for selectivity, mining loss and dilution. This MRE includes Inferred Mineral Resources which are unable to have economic considerations applied to them, nor is there certainty that they will be converted to Measured or Indicated Resources through further sampling.

The Mineral Resource estimate appropriately reflects the Competent Person’s view of the deposit. Optimisations have been run at a USD$1,800 gold price to define the base of mineralisation potentially mineable by open pit mining. The Competent Person endorses the results and classification.

Cut-off grade

The MRE cut-off grade for reporting of global open pit global gold resources at Sissingué is 0.6 g/t and has been applied to all materials respectively, based on estimates from mining, ore transport and processing costs, expected metallurgical performances of the various material types and a gold price of US$1,800/oz.

Tonnages were estimated on a dry basis.

REASONABLE PROSPECTS FOR EVENTUAL ECONOMIC EXRTRACTION

The SGM MRE, as reported, has been assessed to meet Reasonable Prospects for Eventual Economic Extraction (RPEEE) based on the following considerations.

Mineral resources are reported within optimal pit shells generated using estimates of mining, ore transport and processing costs, the expected metallurgical performances of the various material types and a gold price of US$1,800/oz.

Stockpiles

Mineral Resources contained in stockpiles are based on volume estimates calculated from ground survey data, loose bulk densities derived over time by reconciliation of volumes mined (at in situ densities) to stockpile movements and volumes and estimates of stockpile grades based on predicted grades of mined material transferred onto stockpiles and material depleted by processing.

Closing SGM stockpiles as at 31 December 2021 were estimated as shown in Table 3.

Table 3: SGM Closing Stockpiles – 31 December 2021 1

| Material | QUANTITY kt | GRADE G/t gold | GOLD Koz |

| Low grade oxide | 54 | 0.6 | 1 |

| Low grade fresh | 359 | 1.3 | 15 |

| High grade fresh | 249 | 1.5 | 12 |

| Total | 662 | 1.3 | 30 |

Notes:

1. Stockpile tonnage and grade estimates are considered sufficiently accurate to support their classification as Measured Mineral Resources.

ORE RESERVE STATEMENT

Material information summary as required under ASX Listing Rule 5.9 and JORC 2012 reporting guidelines.

The updated Ore Reserve estimate for SGM is a depletion of the previous SGM Ore Reserve and update of Ore Reserve estimation based on the latest Mineral Resource estimate for the Sissingué deposit. Further information regarding updates to the Sissingué Ore Reserves are detailed in JORC Table 1 – Section 4 Estimation and Reporting of Ore Reserves.

The SGM Ore Reserve is summarised below in Table 4 and is estimated at 2.6 Mt of ore, grading 1.3 g/t gold and containing 108k ounces of gold. The classification categories of Proved and Probable under the JORC Code (2012) are equivalent to the CIM categories of the same name (CIM, 2014).

Table 4: SGM Proved and Probable Ore Reserves as at 31 December 2021 5,7

| PROJECT | DEPOSIT TYPE | PROVED | PROBABLE | PROVED AND PROBABLE | ||||||

| QUANTITY Mt | GRADE G/t gold | GOLD ‘000 oz | QUANTITY Mt | GRADE G/t gold | GOLD ‘000 oz | QUANTITY Mt | GRADE G/t gold | GOLD ‘000 oz | ||

| Sissingué1,2,3,4 | Open Pit | 1.0 | 1.3 | 40 | 0.9 | 1.3 | 37 | 1.9 | 1.3 | 78 |

| Stockpiles6 | Stockpile | 0.7 | 1.3 | 30 | - | - | - | 0.7 | 1.3 | 30 |

| TOTAL | 1.7 | 1.3 | 71 | 0.9 | 1.3 | 37 | 2.6 | 1.3 | 108 | |

Notes:

1. Based on depletion to 31 December 2021 mining surfaces.

2. Based on Mineral Resource Estimates which were current at February 2022.

3. Based on February 2022 Ore Reserve estimation.

4. Variable gold grade cut-off for each material type, ranging from 0.40 g/t to 1.00 g/t

5. Inferred Mineral Resource is considered as waste.

6. Based on EOM December 2021 stockpile balance report.

7. Rounding of numbers to appropriate precisions may have resulted in apparent inconsistencies.

The changes in the Ore Reserve from last quoted in June 2021 are associated with ore depletion from mining since 30 June 2021 up to 31 December 2021 along with revised Sissingué Ore Reserves driven by an updated resource model. The waterfall graph (Figure 2) below summarises the changes in the SGM Ore Reserves.

Figure 7 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d80a4458-8379-4fab-8724-d6b7c43882d6

Economic assumptions

- Gold metal price US$1,600/oz is used for Sissingué deposit pit optimisation, with the cut-offs based on US$1,500/oz gold price.

- Average costs used in optimising pit designs are as shown in Table 5 below.

- A discount rate of 10% (real) has been assumed to calculate net present values of forecast cash flows.

Table 5: Assumed LOM average operating costs including Fimbiasso and Bagoé deposits

| MINING (OPEN PIT) | PROCESSING | G&A | SELLING | ROYALTIES | |

| US$5.67t/mined | US$16.11/milled | US$12.11t/milled | US$3.75/oz sold | 4.5 | % |

open pit mining parameters

- The chosen method for the Ore Reserves is conventional open pit mining utilising hydraulic excavators and trucks, mining bench heights of 5 metres with 2.5 metre flitches to minimise ore loss and dilution.

- The economic pit shell was defined using Whittle pit optimisation software (Whittle) with inputs such as geotechnical parameters, ore loss and dilution, metallurgical recovery and mining costs.

- The pit optimisation was run with revenue generated only by Measured and Indicated Mineral Resources. No value was allocated to Inferred Mineral Resources.

- Whittle 4X input parameters were based on Perseus’s operating site experience and supporting technical studies.

- The pit slope design assumptions are based on a geotechnical study by George Orr and Associates (Australia) Pty Ltd for Sissingué . Overall pit slopes are 30 to 50 degrees inclusive of berms spaced at between 5, 10 and 20 metres vertically and berm widths of 4 to 7 metres.

- Pit ramps have been designed for a 40 tonne articulated dump truck fleet and are set at 16 metres (dual lane) to 10 metres (single lane).

- Vertical mining advance has been capped to 75m/year based on Perseus’s operating experience.

- Minimum mining width of 40 metres was generally applied to the pit cutback designs.

- There are no physical constraints to mining within the lease areas. No property, infrastructure or environmental issues are known to exist which may limit the extent of mining within the mining areas.

- Ore from Sissingué pits will be stockpiled on designated location based on rock type and grade.

- Ore cut-off grades, based on the gold price, cost and processing parameters, are as shown in Table 6.

Table 6: Open Pit Cut-Off Grades

| DEPOSIT | CUT-OFF GRADE BY ORE TYPE (G/T GOLD) | |||

| OXIDE | TRANSITION | FRESH GRANITE | FRESH SEDIMENT/MAFIC | |

| Sissingué | 0.40 | 0.60 | 0.80 | 1.00 |

Processing parameters

- The process metallurgical recovery for gold is assigned by material type in each deposit. Gold recovery rates range from 93% for oxide ore to 89% for fresh ore. Recovery variation is a function of differing metallurgical properties of different material type of ores from each deposit. The metallurgical recoveries are as shown in Table 7.

- No deleterious material has been identified.

- Average annual processing throughput rate of ore is nominally 1.2Mtpa of combined ore from all deposits, with throughput rates variable by material type. The processing circuit involves single stage crushing, semi-autogenous grinding, gravity recovery and CIL.

Table 7: Metallurgical Recoveries by Material Type and Pit

| DEPOSIT | CUT-OFF GRADE BY ORE TYPE (G/T GOLD) | |||

| OXIDE | TRANSITION | FRESH GRANITE | FRESH SEDIMENT/MAFIC | |

| Sissingué | 93.11 | 95.0 | 90.0 | 88.82 |

Notes:

- Average value based on formula (6.0649 * ln (Au_grade) + 92.185)%

- Average value based on formula (7.63 * In (Au_grade) + 78.5)%

Stockpile parameters

Ore mined from Sissingué deposits will be temporarily stockpiled based on rock type and grade. Ore from Fimbiasso and Bagoé will be blended with remaining ore from the Sissingué deposit to keep the processing plant at full capacity.

Criteria for ore reserve classification

Ore Reserves have been classified based on the underlying Mineral Resource classifications and the level of detail in the mine planning. The Mineral Resources were classified as Measured, Indicated and Inferred. The Ore Reserves, based only on the Measured and Indicated Resources, have been classified as Proved and Probable Ore Reserves, respectively.

The Ore Reserve is classified as Proved and Probable in accordance with the JORC Code (2012) and CIM (2014), corresponding to the Mineral Resource classifications of Measured and Indicated and considering other factors where relevant. The deposits’ geological models are well constrained. The Ore Reserve classification is considered appropriate given the nature of the deposits, the moderate grade variability, drilling density, structural complexity and mining history.

JORC 2012 Table 1 – Section 1 sampling techniques and data

(Criteria in this section apply to all succeeding sections.)

| CRITERIA | JORC CODE EXPLANATION | COMMENTARY |

| Sampling techniques | Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling. Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. Aspects of the determination of mineralisation that are Material to the Public Report. In cases where ‘industry standard’ work has been done this would be relatively simple (e.g. ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay’). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (e.g. submarine nodules) may warrant disclosure of detailed information. |

|

| Drilling techniques | Drill type (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc.) and details (e.g. core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc.). |

|

| Drill sample recovery | Method of recording and assessing core and chip sample recoveries and results assessed. Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

|

| Logging | Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc.) photography. The total length and percentage of the relevant intersections logged. |

|

| Sub-sampling techniques and sample preparation | If core, whether cut or sawn and whether quarter, half or all core taken. If non-core, whether riffled, tube sampled, rotary split, etc. and whether sampled wet or dry. For all sample types, the nature, quality and appropriateness of the sample preparation technique. Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling. Whether sample sizes are appropriate to the grain size of the material being sampled. |

|

| Quality of assay data and laboratory tests | The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. For geophysical tools, spectrometers, handheld XRF instruments, etc., the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. Nature of quality control procedures adopted (e.g. standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

|

| Verification of sampling and assaying | The verification of significant intersections by either independent or alternative company personnel. The use of twinned holes. Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. Discuss any adjustment to assay data. |

|

| Location of data points | Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. Specification of the grid system used. Quality and adequacy of topographic control. |

|

| Data spacing and distribution | Data spacing for reporting of Exploration Results. Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. Whether sample compositing has been applied. |

|

| Orientation of data in relation to geological structure | Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

|

| Sample security | The measures taken to ensure sample security. |

|

| Audits or reviews | The results of any audits or reviews of sampling techniques and data. |

|

JORC 2012 Table 1 – Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| CRITERIA | JORC CODE EXPLANATION | COMMENTARY | |

| Mineral tenement and land tenure status | Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

| |

| Spot price per ounce - London PM Fix | Royalty Rate | ||

| Less than or equal to US$1000 | 3% | ||

| Higher than US$1000 and less than or equal to US$1300 | 3.5% | ||

| Higher than US$1300 and less than or equal to US$1600 | 4% | ||

| Higher than US$1600 and less than or equal to US$2000 | 5% | ||

| Higher than US$2000 | 6% | ||

| |||

| Exploration done by other parties | Acknowledgment and appraisal of exploration by other parties. |

| |

| Geology | Deposit type, geological setting and style of mineralisation. |

| |

| Drill hole Information | A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes:

|

| |

| Data aggregation methods | In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (e.g. cutting of high grades) and cut-off grades are usually Material and should be stated. Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. The assumptions used for any reporting of metal equivalent values should be clearly stated. |

| |

| Relationship between mineralization widths and intercept lengths | These relationships are particularly important in the reporting of Exploration Results. If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (e.g. ‘down hole length, true width not known’). |

| |

| Diagrams | Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |

| |

| Balanced reporting | Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. |

| |

| Other substantive exploration data | Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples – size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. |

| |

| Further work | The nature and scale of planned further work (e.g. tests for lateral extensions or depth extensions or large-scale step-out drilling). Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

| |

JORC 2012 Table 1 – Section 3 Estimation and Reporting of Mineral Resources

(Criteria listed in section 1, and where relevant in section 2, also apply to this section.)

| CRITERIA | JORC CODE EXPLANATION | COMMENTARY |

| Database integrity | Measures taken to ensure that data has not been corrupted by, for example, transcription or keying errors, between its initial collection and its use for Mineral Resource estimation purposes. Data validation procedures used. |

|

| Site visits | Comment on any site visits undertaken by the Competent Person and the outcome of those visits. |

|

| Geological interpretation | Confidence in (or conversely, the uncertainty of) the geological interpretation of the mineral deposit. Nature of the data used and of any assumptions made. The effect, if any, of alternative interpretations on Mineral Resource estimation. The use of geology in guiding and controlling Mineral Resource estimation. The factors affecting continuity both of grade and geology. |

|

| Dimensions | The extent and variability of the Mineral Resource expressed as length (along strike or otherwise), plan width, and depth below surface to the upper and lower limits of the Mineral Resource. |

|

| Estimation and modelling techniques | The nature and appropriateness of the estimation technique(s) applied and key assumptions, including treatment of extreme grade values, domaining, interpolation parameters and maximum distance of extrapolation from data points. If a computer assisted estimation method was chosen include a description of computer software and parameters used. The availability of check estimates, previous estimates and/or mine production records and whether the Mineral Resource estimate takes appropriate account of such data. The assumptions made regarding recovery of by-products. Estimation of deleterious elements or other non-grade variables of economic significance (e.g. sulphur for acid mine drainage characterisation). In the case of block model interpolation, the block size in relation to the average sample spacing and the search employed. Any assumptions behind modelling of selective mining units. Any assumptions about correlation between variables. Description of how the geological interpretation was used to control the resource estimates. Discussion of basis for using or not using grade cutting or capping. The process of validation, the checking process used, the comparison of model data to drill hole data, and use of reconciliation data if available. |

|

| Moisture | Whether the tonnages are estimated on a dry basis or with natural moisture, and the method of determination of the moisture content. |

|

| Cut-off parameters | The basis of the adopted cut-off grade(s) or quality parameters applied. |

|

| Mining factors or assumptions | Assumptions made regarding possible mining methods, minimum mining dimensions and internal (or, if applicable, external) mining dilution. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential mining methods, but the assumptions made regarding mining methods and parameters when estimating Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the mining assumptions made. |

|

| Metallurgical factors or assumptions | The basis for assumptions or predictions regarding metallurgical amenability. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider potential metallurgical methods, but the assumptions regarding metallurgical treatment processes and parameters made when reporting Mineral Resources may not always be rigorous. Where this is the case, this should be reported with an explanation of the basis of the metallurgical assumptions made. |

|

| Environmental factors or assumptions | Assumptions made regarding possible waste and process residue disposal options. It is always necessary as part of the process of determining reasonable prospects for eventual economic extraction to consider the potential environmental impacts of the mining and processing operation. While at this stage the determination of potential environmental impacts, particularly for a green fields project, may not always be well advanced, the status of early consideration of these potential environmental impacts should be reported. Where these aspects have not been considered this should be reported with an explanation of the environmental assumptions made. |

|

| Bulk density | Whether assumed or determined. If assumed, the basis for the assumptions. If determined, the method used, whether wet or dry, the frequency of the measurements, the nature, size and representativeness of the samples. The bulk density for bulk material must have been measured by methods that adequately account for void spaces (vugs, porosity, etc.), moisture and differences between rock and alteration zones within the deposit. Discuss assumptions for bulk density estimates used in the evaluation process of the different materials. |

|

| Classification | The basis for the classification of the Mineral Resources into varying confidence categories. Whether appropriate account has been taken of all relevant factors (i.e. relative confidence in tonnage/grade estimations, reliability of input data, confidence in continuity of geology and metal values, quality, quantity and distribution of the data). Whether the result appropriately reflects the Competent Person’s view of the deposit. |

|

| Audits or reviews | The results of any audits or reviews of Mineral Resource estimates. |

|

| Discussion of relative accuracy/ confidence | Where appropriate a statement of the relative accuracy and confidence level in the Mineral Resource estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the resource within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors that could affect the relative accuracy and confidence of the estimate. The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used. These statements of relative accuracy and confidence of the estimate should be compared with production data, where available. |

|

JORC 2012 Table 1 – Section 4 Estimation and Reporting of Ore Reserves

| CRITERIA | JORC CODE EXPLANATION | COMMENTARY | ||||

| Mineral Resource estimate for conversion to Ore Reserves | Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve. Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves. |

| ||||

| Site visits | Comment on any site visits undertaken by the Competent Person and the outcome of those visits. If no site visits have been undertaken indicate why this is the case. |

| ||||

| Study status | The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves. The Code requires that a study to at least Pre-Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered. |

| ||||

| Cut-off parameters | The basis of the cut-off grade(s) or quality parameters applied. |

| ||||

| PIT | OXIDE Au g/t | TRANSITION Au g/t | FRESH GRANITE Au g/t | FRESH SEDIMENT Au g/t | ||

| Sissingué Main | 0.40 | 0.60 | 0.80 | 1.00 | ||

| Boribana | 0.40 | - | - | - | ||

| West Arm | 0.40 | - | - | - | ||

| Binkadi | 0.40 | - | - | - | ||

| Bagoé | 0.80 | - | - | - | ||

| Mining factors or assumptions | The method and assumptions used as reported in the Pre-Feasibility or Feasibility Study to convert the Mineral Resource to an Ore Reserve (i.e. either by application of appropriate factors by optimisation or by preliminary or detailed design). The choice, nature and appropriateness of the selected mining method(s) and other mining parameters including associated design issues such as pre-strip, access, etc. The assumptions made regarding geotechnical parameters (e.g. pit slopes, stope sizes, etc.), grade control and pre-production drilling. The major assumptions made and Mineral Resource model used for pit and stope optimisation (if appropriate). The mining dilution factors used. The mining recovery factors used. Any minimum mining widths used. The manner in which Inferred Mineral Resources are utilised in mining studies and the sensitivity of the outcome to their inclusion. The infrastructure requirements of the selected mining methods. |

| ||||

| Metallurgical factors or assumptions | The metallurgical process proposed and the appropriateness of that process to the style of mineralisation. Whether the metallurgical process is well-tested technology or novel in nature. The nature, amount and representativeness of metallurgical test work undertaken, the nature of the metallurgical domaining applied and the corresponding metallurgical recovery factors applied. Any assumptions or allowances made for deleterious elements. The existence of any bulk sample or pilot scale test work and the degree to which such samples are considered representative of the orebody as a whole. For minerals that are defined by a specification, has the ore reserve estimation been based on the appropriate mineralogy to meet the specifications? |

| ||||

| PIT | OXIDE % | TRANSITION % | FRESH GRANITE % | FRESH SEDIMENT % | ||

| Sissingué Main | 91.9^ | 95.0 | 90.0 | 88.8* | ||

| Boribana | 91.7^ | - | - | - | ||

| West Arm | 94.9^ | - | - | - | ||

| Binkadi | 94.6^ | - | - | - | ||

| Bagoé | 92.1^ | - | - | - | ||

| ^ Average value based on formula (6.0649 * ln(Au_grade) + 92.185)% * Average value based on formula (7.63* In (Au_grade) + 78.5)% | ||||||

| Environment | The status of studies of potential environmental impacts of the mining and processing operation. Details of waste rock characterisation and the consideration of potential sites, status of design options considered and, where applicable, the status of approvals for process residue storage and waste dumps should be reported. |

| ||||

| Infrastructure | The existence of appropriate infrastructure: availability of land for plant development, power, water, transportation (particularly for bulk commodities), labour, accommodation; or the ease with which the infrastructure can be provided or accessed. |

| ||||

| Costs | The derivation of, or assumptions made, regarding projected capital costs in the study. The methodology used to estimate operating costs. Allowances made for the content of deleterious elements. The derivation of assumptions made of metal or commodity price(s), for the principal minerals and co- products. The source of exchange rates used in the study. Derivation of transportation charges. The basis for forecasting or source of treatment and refining charges, penalties for failure to meet specification, etc. The allowances made for royalties payable, both Government and private. |

| ||||

| Revenue factors | The derivation of, or assumptions made regarding revenue factors including head grade, metal or commodity price(s) exchange rates, transportation and treatment charges, penalties, net smelter returns, etc. The derivation of assumptions made of metal or commodity price(s), for the principal metals, minerals and co-products. |

| ||||

| Market assessment | The demand, supply and stock situation for the particular commodity, consumption trends and factors likely to affect supply and demand into the future. A customer and competitor analysis along with the identification of likely market windows for the product. Price and volume forecasts and the basis for these forecasts. For industrial minerals the customer specification, testing and acceptance requirements prior to a supply contract. |

| ||||

| Economic | The inputs to the economic analysis to produce the net present value (NPV) in the study, the source and confidence of these economic inputs including estimated inflation, discount rate, etc. NPV ranges and sensitivity to variations in the significant assumptions and inputs. |

| ||||

| Social | The status of agreements with key stakeholders and matters leading to social licence to operate. |

| ||||

| Other | To the extent relevant, the impact of the following on the project and/or on the estimation and classification of the Ore Reserves: Any identified material naturally occurring risks. The status of material legal agreements and marketing arrangements. The status of governmental agreements and approvals critical to the viability of the project, such as mineral tenement status, and government and statutory approvals. There must be reasonable grounds to expect that all necessary Government approvals will be received within the timeframes anticipated in the Pre-Feasibility or Feasibility study. Highlight and discuss the materiality of any unresolved matter that is dependent on a third party on which extraction of the reserve is contingent. |

| ||||

| Classification | The basis for the classification of the Ore Reserves into varying confidence categories. Whether the result appropriately reflects the Competent Person’s view of the deposit. The proportion of Probable Ore Reserves that have been derived from Measured Mineral Resources (if any). |

| ||||

| Audits or reviews | The results of any audits or reviews of Ore Reserve estimates. |

| ||||

| Discussion of relative accuracy/ confidence | Where appropriate a statement of the relative accuracy and confidence level in the Ore Reserve estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the reserve within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors which could affect the relative accuracy and confidence of the estimate. The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used. Accuracy and confidence discussions should extend to specific discussions of any applied Modifying Factors that may have a material impact on Ore Reserve viability, or for which there are remaining areas of uncertainty at the current study stage. It is recognised that this may not be possible or appropriate in all circumstances. These statements of relative accuracy and confidence of the estimate should be compared with production data, where available. |

| ||||