PJX Resources Closes Private Placement

TORONTO, ON / ACCESSWIRE / October 2, 2020 / PJX Resources Inc. (TSXV:PJX) ("PJX" or "the Company") is pleased to announce the closing of its' previously announced non-brokered private placement (the "Offering") (see September 21, 2020 press release) for total proceeds of $1,230,800. The Company is pleased to announce the Offering was oversubscribed and the previously announced 25% overallotment option was undertaken.

Use of Proceeds

The Company intends to use the net proceeds of the Offering for expenditures on its properties located in Cranbrook, British Columbia and for general working capital. The gross proceeds from the issuance of the Flow-through Shares shall be used to fund exploration expenditures on the Cranbrook Properties and will qualify as Canadian exploration expenses (as defined in the "Income Tax Act (Canada)").

John Keating, President and CEO of PJX commented, "PJX has consolidated 100% of the mineral rights to the largest land holdings of a potential new gold camp in Canada that we call the Vulcan Gold Belt. The gold belt occurs within the Sullivan base metal mining district. Historical focus on Sullivan type zinc, lead and silver mining is in part why the district's gold potential has been overlooked. The Vulcan Gold Belt fits modern geological models and criteria for the formation of a world class gold camp. PJX has already identified a pipeline of priority target areas to explore and drill with potential to make multiple gold discoveries. (see https://pjxresources.com/gold-discovery-potential.pdf)."

Highlights

- Target type: Orogenic and Magmatic Gold Trend with Fort Knox (>5mm ozs), Telfer (>30 mm ozs), Sukhoi Log (>30mm ozs) and other deposit type potential.

- Vulcan Gold Belt - only place in North America where two regional crustal penetrating structures associated with gold deposits and gold mining camps in Canada and the United States intersect.

- Estimated 1.5 million ounces of placer gold produced since 1864 gold rush.

- Significantly underexplored - no bedrock source of placer gold identified to date - fewer than 150 holes drilled for gold exploration on entire 60 km trend.

- First time 100% owned mineral rights consolidated, covering 520 km².

- PJX has a pipeline of gold, silver and base metal (copper, lead, zinc) targets - 20 large targets identified to date.

- Gold Shear Property - high-grade David Gold Zone with historical resource is next to drill.

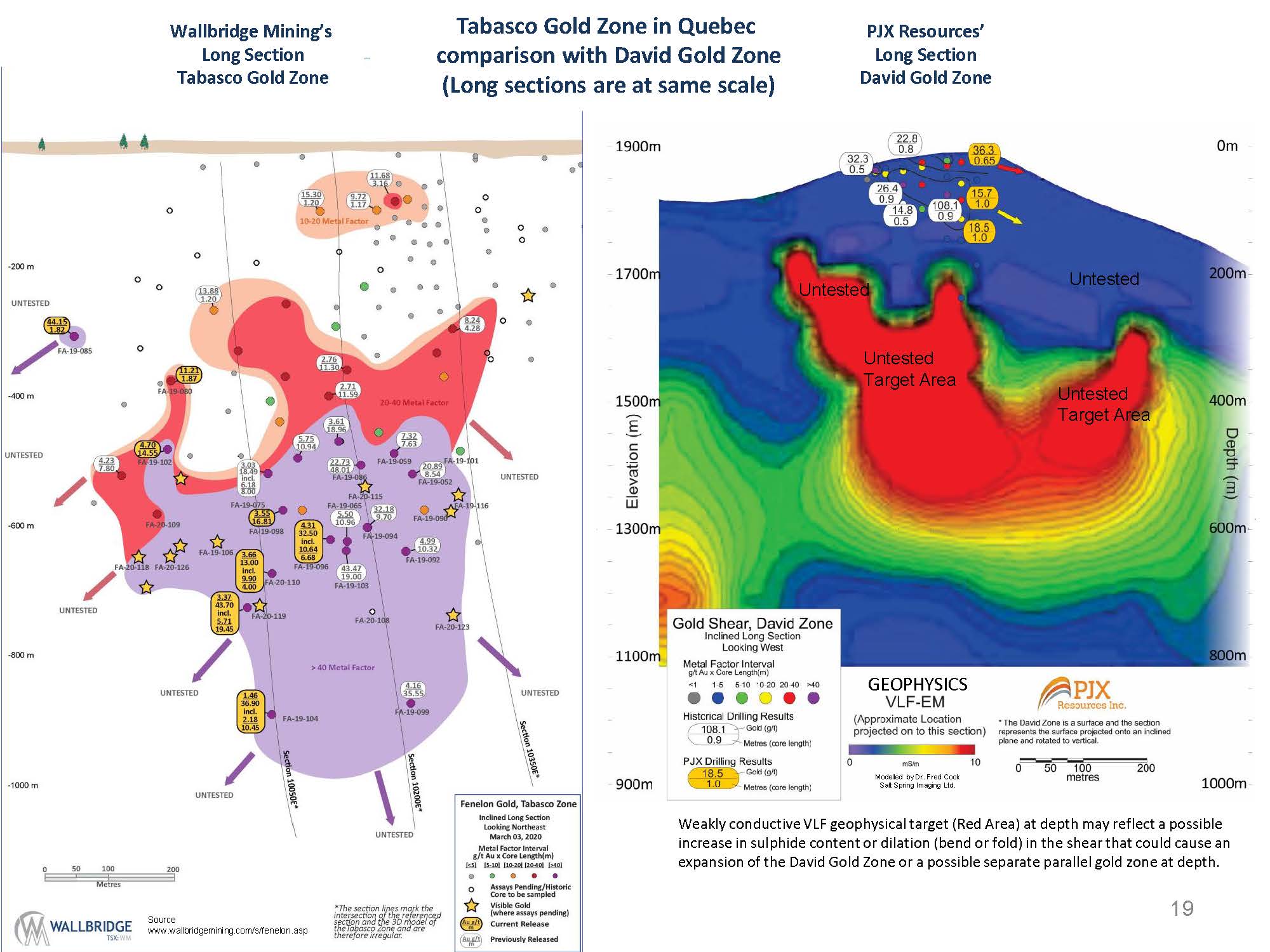

Gold Shear Property - Mapping and prospecting have traced the David Shear that hosts the high-grade David Gold Zone for over 2,000 metres along strike to date. Gold mineralization occurs with quartz veins along the shear that continues on to PJX's adjacent Eddy Property. Quartz vein grab samples from the shear range from anomalous to up to 256 g/t gold. PJX plans to drill at depth and on strike of the David Gold Zone to identify orogenic style structural dilations with potential to host widths and gold grades similar to Walbridge's Tabasco Zone in Quebec. (see Long Section Comparison)

The foregoing geological disclosure and content of this news release has been reviewed and approved by John Keating P.Geo. (qualified person for the purpose of National Instrument 43-101 Standards of Disclosure for Mineral Projects). Mr. Keating is the President, Chief Executive Officer and a Director of PJX.

Non-brokered Private Placement

The Company will, subject to TSXV Exchange approval, issue a cumulative total of 2,480,000 Flow-through Units ("Flow-Through Units") issued at a price of $0.15 per Flow-Through Unit for gross proceeds of $372,000, and 6,870,400 Units at a price of $0.125 per Unit for gross proceeds of $858,800 (cumulative proceeds of $1,230,800.

Each Flow-through Unit consists of one common share to be issued as a "flow-through share" within the meaning of the Income Tax Act (Canada) (the "Flow-through Shares") and one common share purchase warrant. Each Unit consists of one common share and one common share purchase warrant. Each common share purchase warrant, whether acquired as part of a Flow-through Unit or Unit, entitles the holder to purchase one common share at an exercise price of $0.20 for 24 months following completion of the Offering.

The closing of the Offering constituted a related party transaction within the meaning of Multilateral Instrument 61-101 ("MI 61-101") as certain insiders of the company subscribed for 840,000 Units and 80,000 Flow-Through Units. The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as the fair market value of the participation in the Offering by insiders does not exceed 25% of the market capitalization of the company, as determined in accordance with MI 61-101.

Certain eligible persons (the "Finders"), subject to TSXV Exchange approval, will be paid aggregate cash finder's commissions of $50,980 and 301,120 non-transferable Finder's common share purchase warrants in connection with the Offering. Each of the Finder's common share purchase warrants entitles the Finder to purchase one common share of the Company at a price of $0.20 per common share for 24 months following completion of the Offering.

All securities issued as part of the Offering are subject to a statutory four month hold period.

About PJX Resources Inc.

PJX is a mineral exploration company focused on building shareholder value and community opportunity through the exploration and development of mineral resources with a focus on gold. PJX's primary properties are located in the historical mining area of Cranbrook and Kimberley, British Columbia.

Please refer to our web site http://www.pjxresources.com for additional information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Linda Brennan, Chief Financial Officer

(416) 799-9205

info@pjxresources.com

Forward-Looking Information

This News Release contains forward-looking statements. Forward looking statements are statements which relate to future events. Forward-looking statements include, but are not limited to, statements with respect to exploration results, the success of exploration activities, mine development prospects, completion of economic assessments, and future gold production. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", believes", "estimates", "predicts", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking-statements.

Although PJX has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: PJX Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/608948/PJX-Resources-Closes-Private-Placement