Plateau Energy Metals Provides an Update on Remaining Concession Resolutions from Administrative Procedure

TORONTO, Aug. 06, 2019 (GLOBE NEWSWIRE) -- Plateau Energy Metals Inc. (“Plateau” or the “Company”) (TSX-V: PLU | OTCQB: PLUUF) reports that its subsidiary, Macusani Yellowcake S.A.C. (“Macusani”), has received the last 25 administrative resolutions outlining that the Mining Council within the Ministry of Energy and Mines (“MINEM”) in Peru has dismissed the Company’s appeal to suspend the Institute of Geology, Mining and Metallurgy’s (“INGEMMET”) resolution recommending the cancellation of the validity of 32 the concessions by reason of ‘late receipt of annual concession payments’.

As announced on July 31, 2019, the Company had previously received administrative resolutions for seven of the 32 concessions under review to correct an error made as a result of a government process relating to the timing of payments for 32 of its 149 mineral concessions. A full chronology and background of events is included in the news release from July 31, 2019.

“Whilst we are disappointed with these remaining resolutions, we remain optimistic that the ultimate outcome will be a reversal of these decisions. Peru is a nation built on investments, respect for laws and regulations, and economic development working in harmony with all stakeholders. We believe that ultimately, reason and common sense in this matter should prevail,” stated Alex Holmes, CEO. “We have two strong projects, even in the worst-case scenario as a potential impact on our current resources, should all avenues to resolve this wrong be exhausted.”

Key Takeaways:

- The Company is pursuing all options available to resolve this matter, including an appeal process to the Mining Council.

- Evaluation of different mine plans for the Falchani Lithium Project preliminary economic assessment (“PEA”) are underway as a measure to not delay the project development, but to restrict the mining area to a reduced footprint accounting for the currently impacted lithium concession.

- Approximately 80% of lithium carbonate equivalent (“LCE”) tonnes in indicated resources and approximately 55% of LCE tonnes hosted in lithium-rich tuff resources are unimpacted (see Table 1).

- Approximately 63% of the indicated uranium resource estimates (54% of the indicated resource within the 2016 Macusani Uranium Project PEA) are unimpacted (see Table 4).

The 32 currently impacted concessions represent an aggregate of approximately 23,100 hectares (“ha”), or less than 25%, of the Company’s total 93,000 ha concession package and may have the following impact on each of Plateau’s projects:

Falchani Lithium Project

Only one concession for the Falchani Lithium Project is amongst the 32 currently impacted concessions and forms part of the March 1, 2019, mineral resource estimates for the Falchani Lithium Project (“Falchani Resources”), filed under the Company’s profile on SEDAR at www.sedar.com. As noted in the table below (see Table 1), approximately 81% of the contained LCE tonnes in indicated resources are unimpacted by the administrative procedure, and approximately 80% of the highest grade, lithium-rich tuff (LRT) zone, on an indicated basis, also unimpacted. The one concession and its mineral resources that may impact the Falchani Resources is listed below (see Table 2).

The Company is in the process of modifying the PEA for the Falchani Lithium Project to exclude the currently impacted concession as an alternate mine plan.

The recent lithium surface discoveries at Tres Hermanas and Quelcaya are not located on any of the 32 concessions in the administrative process.

Table 1: Falchani Lithium Project Resources1 Not Impacted

| 1,000 ppm cut-off | Zone | Tonnes (Mt) | Grade (Li ppm) | Li2O (%) | Li2CO3 (%) | Contained Li2CO3 (Mlbs) |

| Indicated | UBX | 5.38 | 1,472 | 0.32 | 0.78 | 0.04 |

| LRT1 | 6.15 | 3,718 | 0.80 | 1.98 | 0.12 | |

| LRT2 | 16.66 | 3,321 | 0.72 | 1.77 | 0.29 | |

| LRT3 | 11.03 | 3,696 | 0.80 | 1.97 | 0.22 | |

| LBX | 10.16 | 1,901 | 0.41 | 1.01 | 0.10 | |

| TOTAL | 49.39 | 2,961 | 0.64 | 1.57 | 0.78 | |

| Inferred | UBX | 8.44 | 1,515 | 0.35 | 0.86 | 0.07 |

| LRT1 | 13.84 | 3,290 | 0.71 | 1.75 | 0.24 | |

| LRT2 | 28.68 | 2,994 | 0.64 | 1.59 | 0.46 | |

| LRT3 | 16.13 | 3,292 | 0.71 | 1.75 | 0.28 | |

| LBX | 57.39 | 2,250 | 0.48 | 1.20 | 0.69 | |

| TOTAL | 124.48 | 2,629 | 0.57 | 1.40 | 1.74 | |

Table 2: Falchani Lithium Project Resources1 Currently Impacted Concession

| 1,000 ppm cut-off | Zone | Tonnes (Mt) | Grade (Li ppm) | Li2O (%) | Li2CO3 (%) | Contained Li2CO3 (Mlbs) |

| Indicated | UBX | 0.85 | 1,750 | 0.38 | 0.93 | 0.01 |

| LRT1 | 1.32 | 3,668 | 0.79 | 1.95 | 0.03 | |

| LRT2 | 5.37 | 3,232 | 0.70 | 1.72 | 0.09 | |

| LRT3 | 2.00 | 3,658 | 0.79 | 1.95 | 0.04 | |

| LBX | 2.00 | 1,379 | 0.30 | 0.73 | 0.01 | |

| TOTAL | 11.53 | 2,926 | 0.63 | 1.56 | 0.18 | |

| Inferred | UBX | 5.33 | 1,911 | 0.41 | 1.02 | 0.05 |

| LRT1 | 10.17 | 3,422 | 0.74 | 1.82 | 0.19 | |

| LRT2 | 33.62 | 3,292 | 0.71 | 1.75 | 0.59 | |

| LRT3 | 21.11 | 3,349 | 0.72 | 1.78 | 0.38 | |

| LBX | 65.36 | 2,297 | 0.49 | 1.22 | 0.80 | |

| TOTAL | 135.59 | 2,777 | 0.60 | 1.48 | 2.00 | |

UBX = upper breccia; LRT = lithium rich tuff; LBX = lower breccia

* Minor discrepancies due to rounding may occur. Li Conversion Factors as follows: Li:Li2O=2.153; Li:Li2CO3=5.323; Li2O:Li2CO3=2.473. Geological losses of 5% or 10% have been applied, based on geological structure and data density. The average geological loss is 6%. Density = 2.40.

Macusani Uranium Project

Of the 32 currently impacted concessions, six concessions contain mineral resources2, of which two are not included in the January 25, 2016, PEA for the Macusani Uranium Project3 (“Macusani PEA”), filed under the Company’s profile on SEDAR at www.sedar.com (see Table 3). Approximately 68% of the Company’s total uranium resource base will not be impacted by the 32 concessions in the administrative procedure. The four currently impacted concessions included in the Macusani PEA represent approximately 46% of the uranium mineral resources estimates on an indicated basis (52% on an indicated and inferred basis) (refer to Table 4). These currently impacted resources represent approximately 45% of the life of mine Macusani PEA production.

Table 3: Macusani Mineral Resource Estimates received that are not in the 2016 Macusani PEA2

| 75 ppm cut-off | Tonnes (Mt) | Grade (ppm U3O8) | Contained U3O8 (Mlbs) |

| Indicated | 3.4 | 166 | 1.2 |

| Inferred | 7.3 | 127 | 2.0 |

Note: figures have been rounded

Table 4: Macusani Mineral Resource Estimates – 2016 Macusani PEA3

| 75 ppm cut-off | Tonnes (Mt) | Grade (ppm U3O8) | Contained U3O8 (Mlbs) |

| Total resources of all 2016 Macusani PEA concessions: | |||

| Indicated | 47.7 | 279 | 29.3 |

| Inferred | 61.2 | 293 | 39.5 |

| Total resources of currently impacted concessions in the 2016 Macusani PEA: | |||

| Indicated | 32.5 | 255 | 18.2 |

| Inferred | 35.4 | 229 | 17.8 |

Note: figures have been rounded

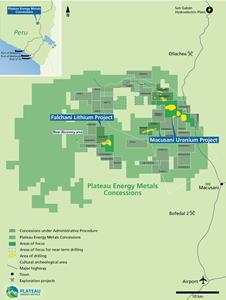

Image 1: Map of 32 Concessions is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0c35e75c-ea19-4ab9-bec1-455e2592380d

For more detail on the full background and chronology of events please see the news release from July 31, 2019.

Readers are encouraged to visit the ‘FAQ’ page and the Company invites the submission of additional questions regarding this or any other subject, directly through the website or by email at IR@plateauenergymetals.com.

Qualified Person

Mr. Ted O’Connor, P.Geo., a Director of Plateau, and a Qualified Person as defined by NI 43-101, has reviewed and approved the scientific and technical information contained in this news release.

About Plateau Energy Metals

Plateau Energy Metals Inc., a Canadian exploration and development company, is enabling the new energy paradigm through exploring and developing its Falchani lithium project and Macusani uranium project in southeastern Peru. The Company, with mineral concessions covering over 93,000 hectares (930 km2), controls all reported uranium mineral resources known in Peru and has significant and growing lithium mineral resources, all of which are situated near infrastructure.

| For further information, please contact: | ||

| Plateau Energy Metals Inc. Alex Holmes, CEO & Director +1-416-628-9600 IR@PlateauEnergyMetals.com | Facebook: www.facebook.com/pluenergy/ Twitter: www.twitter.com/pluenergy/ Website: www.PlateauEnergyMetals.com | |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains certain forward-looking information and forward-looking statements (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: (i) the potential outcome of an appeal against the mining council resolutions; (ii) the expected timing of the Falchani PEA; (iii) the outcome of any and all future remedies pursued by Plateau and its subsidiary Macusani to resolve the concession resolutions and (iv) the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government.

Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. Although the Company believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since the Company can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; the potential for delays in exploration or development activities; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which we operate; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the certainty of title to our properties; risks related to the uncertain global economic environment; and other risks and uncertainties related to our prospects, properties and business strategy, as described in more detail in Plateau’s recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Plateau cautions against placing undue reliance thereon. Except as required by applicable securities legislation, neither Plateau nor its management assume any obligation to revise or update these forward-looking statements.

Footnotes

- For further details on the Falchani resource estimates please review the technical report filed on SEDAR on April 18, 2019, entitled “Mineral Resource Estimates for the Falchani Lithium Project in the Puno District of Peru", with an effective date of March 1, 2019, prepared by Mr. Stewart Nupen, of The Mineral Corporation, an Independent Qualified Person as defined by NI 43-101. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Refer to report filed on SEDAR on June 22, 2015 entitled “Consolidated Mineral Resource estimates for the Kihitian, Isivilla and Corani Uranium Complexes controlled by Plateau Uranium Inc., in the Puno District of Peru”, prepared by Mr. David Young, of The Mineral Corporation, an Independent Qualified Person as defined by NI 43-101. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Refer to the "Macusani Project, Macusani, Peru, NI 43-101 Report – Preliminary Economic Assessment” prepared by Mr. Michael Short and Mr. Thomas Apelt, of GBM Minerals Engineering Consultants Limited; Mr. David Young, of The Mineral Corporation; and Mr. Mark Mounde, of Wardell Armstrong International Limited dated January 12, 2016, available under Plateau’s profile on SEDAR (www.sedar.com). The PEA includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.