Probe Gold Triples Indicated Gold Resource to 2,038,900 Ounces and reports 357,200 Inferred at Monique, part of Novador (former Val d'Or East)

Monique Deposit Updated NI 43-101 Resource Estimate ("Resource Estimate") Highlights:

- In the first of three updated resource estimates (Monique, Pascalis and Courvan) to be released in Spring, drilling at Monique deposit has already achieved an overall substantial gain especially illustrated by over 1.3 million additional ounces in Indicated (upgrade from previous Inferred and significant new Indicated added) and is now comprised of 2,038,900 ounces in the Indicated category and 357,200 ounces in the Inferred category, up from 672,800 (Indicated) and 671,400 (Inferred) in the previous (2021) NI 43-101 resource estimate.

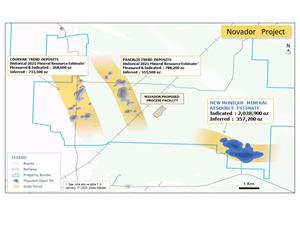

- Total Resources currently stand at 2,038,900 ounces Indicated and 357,200 ounces Inferred for Monique and 1,128,100 ounces Indicated (historical) and 1,638,200 Inferred ounces (historical) for Pascalis and Courvan deposits (neither the QPs nor the Company considers this historical estimate as current mineral resources (see Table 5 Notes)). Pascalis and Courvan are in the process of being updated and will be released in the coming months.

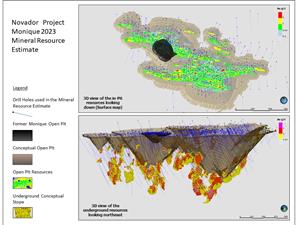

- Indicated mineral resources for Monique more than tripled to 2,038,900 ounces, mostly within the current mining lease and pit-constrained resource.

- Potential significant mine plan improvement with Monique gold resources now connecting multiple mining areas into a single open pit.

- Average gold grade in the Monique pit-constrained Indicated resource increases to 1.42 g/t gold, from 1.38 g/t gold at the same cut-off grade of 0.42 g/t gold.

- The Monique deposit is still open in all directions and four drills are currently turning on the 2023 expansion program as part of a planned 50,000-metre drill program for the Novador Project.

TORONTO, Jan. 17, 2023 (GLOBE NEWSWIRE) -- Probe Gold Inc. (TSX-V: PRB) (OTCQB: PROBF) (“Probe” or the “Company”) is pleased to announce the release of an Updated Resource Estimate for its Monique property (the “Property”), part of the Novador Project (formerly Val-d’Or East) located near Val-d’Or, Quebec. The mineral resource has shown significant improvement over the previous resource estimate and remains open for future expansion. The new resource at Monique stands at 2,038,900 ounces of gold within the indicated category and 357,200 ounces of gold within the inferred category, demonstrating a global increase of the overall project and excellent conversion rate from Inferred to Indicated. In addition to the substantial increase at Monique, the updated resource was also successful in converting an additional l,367,000 ounces to the indicated category from the 2021 resource estimate, more than tripling the Indicated resources for Monique. The Monique resource estimate was independently prepared by InnovExplo Inc. in accordance with National Instrument 43-101 (“NI 43-101”) and is dated January 16, 2023. This estimate includes the resource from the Monique property only and the resource updates on the Pascalis and Courvan trend deposits will follow later in Spring 2023 and are expected to show significant improvement in the indicated resource and a potential increase in the total gold inventory for the three combined deposits. Drills will be active throughout 2023 on further expansion and regional exploration with a significant drilling program totalling 50,000 metres at Novador (previously Val-d’Or East).

David Palmer, President and CEO of Probe, states, “Once again Monique has exceeded our expectations showing a significant increase in gold resources of more than a million ounces and more than tripling the amount of Indicated resource. With a 2.4 million ounces inventory now hosted by Monique, and 5.1 million ounces expected in total inventory, our expansion and conversion programs were highly successful and confirmed the consistency, and quality, of the Monique deposit. In addition, we also saw an increase in grade of the pit-constrained resources, reflecting the better-than-expected drill results throughout the year. The current Resource Update also demonstrates the potential for continued growth at Monique. Given the success of our drilling programs, we have commenced our 2023 expansion drilling program at Monique with four drills currently turning on the property. This, in addition to our large generative exploration drilling programs at Novador and Detour, we will continue to successfully advance our projects throughout 2023”.

Yves Dessureault, COO of Probe, states, “This resource estimate is the culmination of the 2022 work programs at Monique from a dedicated team of employees and partners who have worked very hard to bring us this fantastic result. The quality of the resources has improved significantly and the excellent conversion rate from Inferred to Indicated is a testament to the quality of our geological model. The gold resources at Monique are now combined into a single expanded pit, compared to the 3 pits in the 2021 Resource, potentially enhancing the future mine plan and enabling us to consider the use of a smaller fleet with larger equipment. Given the increase in gold resources, we will now be performing trade-off studies to review, and potentially increase, the plant throughput and production profile from the currently contemplated 207,000 ounces average annual gold production. We continue to believe that the ore sorting technology has a role to play in our project with the potential to bring significant sustainable development benefits. As with the 2021 Resource, the additional ounces that could potentially be extracted from mineralized waste using this technology are presented in a separate table, which shows the potential for an additional 166,900 ounces in the Indicated resource and 56,500 in the Inferred resource categories that could be added to our gold inventory within Monique."

Monique Deposit, Novador Project - Summary of Mineral Resources

The Monique property is part of the Novador Project and is 100% owned by Probe.

Table 1: Monique Deposit 2023 Mineral Resource Estimate

| Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold (oz) | Tonnes | Grade (Au g/t) | Gold (oz) | Tonnes | Grade (Au g/t) | Gold (oz) | |

| Indicated | 36,914,400 | 1.42 | 1,685,300 | 4,929,300 | 2.23 | 353,600 | 41,843,700 | 1.52 | 2,038,900 |

| Inferred | 4,349,700 | 1.36 | 190,200 | 2,383,500 | 2.18 | 167,000 | 6,733,200 | 1.65 | 357,200 |

Notes:

- The independent and qualified persons (QPs) for the mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo. and Simon Boudreau, P.Eng., both from InnovExplo Inc. The effective date is January 16, 2023.

- These mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The mineral resource estimate follows current CIM definitions and guidelines.

- The results are presented undiluted and are considered to have reasonable prospects for eventual economic viability.

- The estimate encompasses the Monique gold deposit subdivided into 38 individual zones and one inter-zone envelop using the grade of the adjacent material when assayed or a value of zero when not assayed. The geological interpretation of the deposit was based on lithologies, alteration and mineralization and the spatial relation between mineralized zones occurring either within or proximal to sub-vertical dykes and trending sub-parallel to lithological contacts and deformation zones.

- High-grade capping supported by statistical analysis was done on raw assay data before compositing: 100 g/t Au.

- The estimate was completed using block models in GEOVIA Surpac 2021 with parent block size of 6 x 6 x 6m and sub-block of 1.5 x 1.5 x 1.5m.

- Grade interpolation was performed with the ID2 method on 1m composites.

- Density values of 2.88 g/cm3 (mineralized and unmineralized material) and 2.00 g/cm3 (overburden) were assigned.

- The mineral resource estimate is classified as Indicated and Inferred. The Inferred category is defined with a minimum of two (2) drill holes for areas where the drill spacing is less than 80 m, and reasonable geological and grade continuity have been shown. The Indicated category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 55 m, and reasonable geological and grade continuity have been shown. Clipping boundaries were used for classification based on those criteria.

- The estimate considered both open pit and underground scenarios. Bedrock slope angle of 48° to 59° and overburden slope angle of 30° were used for the pit-constrained scenario using Whittle. The out-pit mineral resource was constrained within potential stope volumes (potential underground long-hole extraction scenario) using Deswik Stope Optimizer.

- The pit-constrained mineral resource estimate is reported at a cut-off grade of 0.42 g/t Au, a value above the base case cut-off grade. A base case cut-off grade of 0.26 g/t Au was calculated using the following parameters: mining cost = CA$2.97; mining overburden cost = CA$2.70; processing cost = CA$17.82; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz; gold price = US$ 1,700/oz; USD:CAD exchange rate = 1.33; and mill recovery = 95%. The use of a higher cut-off at 0.42 g/t Au could allow the selection of in-pit mineralized waste (0.20 – 0.42 g/t Au) for its potential upgrade through an industrial sorter process.

- The underground mineral resource estimate is reported at a cut-off grade of 1.43 g/t Au. The cut-off grade was calculated using the following parameters: mining cost = CA$81.00; processing cost = CA$17.82; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz; gold price = US$ 1,700/oz; USD:CAD exchange rate = 1.33; and mill recovery = 95%.

- The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.

The Company has demonstrated with a series of performance tests that the industrial sorting technology works very well with the type of mineralization found on the Novador project. By applying industrial sorting to mineralized waste with very conservative gold recoveries, additional mineral material can be extracted from the mineralized waste and thus become additional mineral resource on the Project.

Table 2: Monique Deposit Additional Pit Constrained Resource from Industrial Sorting

| Resources Category | Tonnes | Grade (Au g/t) | Ounces (oz) |

| Indicated | 16,427,578 | 0.32 | 166,900 |

| Inferred | 6,305,600 | 0.28 | 56,500 |

Notes:

- This additional pit-constrained Mineral Resource represents mineralized waste between cut-off grades of 0.20 g/t Au and 0.42 g/t Au exclusive of pit-constrained Mineral Resource from Table 1. This lower cut-off was based on the following parameters: industrial sorting cost CA$1.73/t, gold recovery in the industrial sorting process 82% with an overall gold recovery with gravity and leaching at 68%, mass recovery in the industrial sorting process 42%. Potentially, the industrial sorting results on this material allow obtaining a product above 0.42 g/t Au. For more details on industrial sorting technique and parameters, see the "Val-d’Or East Project, NI 43-101 Technical Report & Preliminary Economic Analysis” (the "Val-d’Or East PEA"), dated October 20, 2021, and available on SEDAR (www.sedar.com) under Company's issuer profile.

Additions to the Current Resource Estimate Relative to the 2021 Resource Estimate at Monique

The 2021 mineral resource estimate hosted a NI 43-101 resource of 672,800 ounces of gold Indicated and 671,400 ounces of gold Inferred. A total of 128,978 metres (453 drill holes) has been drilled since this Resource Estimate. Using a gold price of US$ 1,700 per ounce, the updated NI 43-101 mineral resource hosts 2,038,900 ounces of gold Indicated, and 357, 200 ounces gold Inferred, representing an increase of 78% in total inventory and an increase of 203% in the Indicated category. A total of 78% of the new resources are pit constrained.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/424caa18-ee47-4481-acd2-ee7c804b0005

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a0af17df-9f49-4557-9864-a9f1ae1c3619

The following Tables 3 and 4 are not official estimates and are presented for illustrative purposes only. The reader should be cautioned that the following figures provided in those tables should not be interpreted as a mineral resource statement. The reported quantities and grade estimates at different cut-off grades are presented for the sole purpose of demonstrating the variability of the block model inside the selected US$ 1,700/oz pit shell caused by the selection of a different reporting cut-off grade.

Table 3 presents different block selections at different cut-offs contained within the official resource pit shell (optimized at US$ 1,700 /oz). This table helps to illustrate one form of sensitivity within this fixed pit shell for cut-offs ranging from 0.20 to 0.42 g/t Au.

Table 3: Monique Deposit Pit Constrained Mineralized Material for Variable Cut-Off Grades within Fixed Resource Pit Shell at US$ 1,700 /oz

| Resources Category | Cut-Off Grade | Tonnes | Grade (Au g/t) | Ounces (oz.) |

| Block Selections at Different Cut-Off within Pit Shell at US$ 1,700 /oz | ||||

| Indicated | 0.20 | 53,341,999 | 1.08 | 1,852,153 |

| 0.30 | 45,060,170 | 1.23 | 1,781,893 | |

| 0.39 | 38,756,342 | 1.37 | 1,707,053 | |

| 0.42 | 36,914,422 | 1.42 | 1,685,265 | |

| 0.45 | 35,143,370 | 1.47 | 1,660,904 | |

| Inferred | 0.20 | 10,655,258 | 0.72 | 247,506 |

| 0.30 | 6,613,332 | 1.02 | 215,873 | |

| 0.39 | 4,766,746 | 1.28 | 196,162 | |

| 0.42 | 4,349,661 | 1.36 | 190,186 | |

| 0.45 | 4,039,360 | 1.43 | 185,709 | |

Table 4 presents different block selections at different cut-offs contained within the official resource underground constraining volumes (optimized at US$ 1,700 /oz). This table helps to illustrate one form of sensitivity within those fixed underground constraining volumes for cut-offs ranging from 1.43 to 2.00 g/t Au.

Table 4: Monique Deposit Underground Constrained Mineralized Material for Variable Cut-Off Grades at US$ 1,700 /oz

| Resources Category | Cut-Off Grade | Tonnes | Grade (Au g/t) | Ounces (oz.) |

| Block Selections at Different Cut-Off within Underground Constraining Volumes at US$ 1,700 /oz | ||||

| Indicated | 1,43 | 4,929,287 | 2.23 | 353,592 |

| 1,65 | 3,539,954 | 2.50 | 284,263 | |

| 2,00 | 2,237,733 | 2.90 | 208,810 | |

| Inferred | 1,43 | 2,383,494 | 2.18 | 166,977 |

| 1,65 | 1,856,897 | 2.35 | 140,558 | |

| 2,00 | 1,053,445 | 2.76 | 93,533 | |

Resource Estimation Methodology and Parameters

As part of the resource estimation process, the Company and InnovExplo compiled, verified, and modelled all technical information available from the Project, including 960 drill hole collars consisting of 124,181 gold assays, which represented 239,553 metres of drilling. 3D geological models were built for sub-vertical structures and included key structures hosting and constraining gold mineralization along the Monique Gold Trend. The drill holes database closing date is October 25th, 2022.

Novador Project – Other Estimates from Courvan and Pascalis Gold Deposits

In addition to the new Monique mineral resources (this Press Release), the Novador Project also includes the Courvan Trend and Pascalis Trend gold deposits.

The result from historical mineral resources estimates on Courvan, Pascalis and other smaller deposits on the Project were published previously by the Company and are available in “NI 43-101 Technical Report for the Val-d’Or East Project, Abitibi Greenstone Belt, Quebec, Canada”. The Report dated July 14th, 2021, was prepared in accordance with National Instrument 43-101 (“NI 43-101”) is available for review on both SEDAR (www.sedar.com) and the Company’s website (www.probemetals.com).Those mineral resources estimates were completed following NI 43-101 and CIM definitions standards and guidelines and were addressed to the Company. Those deposits have been significantly drilled (390 holes totaling 76,839 metres) since their estimations and the 2021 mineral resources estimates are not considered current but “historical” at this stage. The Company is currently in the process of compiling results and updating the mineral resources of these two additional gold deposits considering their potential synergy with Monique as demonstrated in the 2021 PEA ("Val-d’Or East Project, NI 43-101 Technical Report & Preliminary Economic Analysis” dated October 20, 2021). For illustrative purposes, those latest “historical” estimates for the Pascalis and Courvan deposits, independently prepared in 2021 by Merouane Rachidi, Ph.D. P.Geo. and Claude Duplessis, Eng. from GoldMinds Geoservices Inc. are presented in table 5.

Table 5: Novador Pascalis and Courvan deposits historical resource

| Deposit / Category | Historical Pit-Constrained Resources | Historical Underground Resources | Total | ||||||

| Tonnes | Gold Grade (Au g/t)14 | Gold (oz.) | Tonnes | Gold Grade (Au g/t)14 | Gold (oz.) | Tonnes | Gold Grade (Au g/t)14 | Gold (oz.) | |

| Pascalis Gold Deposits | |||||||||

| Measured | 4,491,000 | 2.20 | 317,300 | 640,000 | 2.40 | 49,400 | 5,131,000 | 2.22 | 366,700 |

| Indicated | 6,307,000 | 1.76 | 356,500 | 766,000 | 2.64 | 65,000 | 7,073,000 | 1.85 | 421,500 |

| Mes & Ind | 10,798,000 | 1.94 | 673,800 | 1,406,000 | 2.53 | 114,400 | 12,204,000 | 2.01 | 788,200 |

| Inferred | 6,007,000 | 1.63 | 315,500 | 2,694,000 | 2.77 | 239,900 | 8,701,000 | 1.99 | 555,500 |

| Courvan Gold Deposits | |||||||||

| Measured | 620,000 | 1.52 | 30,300 | 20,000 | 3.22 | 2,100 | 640,000 | 1.57 | 32,400 |

| Indicated | 2,710,000 | 1.93 | 168,200 | 604,000 | 3.50 | 68,000 | 3,314,000 | 2.22 | 236,200 |

| Mes & Ind | 3,330,000 | 1.85 | 198,500 | 624,000 | 3.49 | 70,100 | 3,954,000 | 2.11 | 268,600 |

| Inferred | 5,613,000 | 1.81 | 327,300 | 2,885,000 | 4.38 | 406,200 | 8,498,000 | 2.68 | 733,500 |

Notes:

- The mineral resource estimates mentioned above are “historical” and should not be relied upon. The Courvan and Pascalis 2021 historical estimate are included for illustrative purposes only. The QPs have not completed sufficient work to classify it as current. Neither the QPs nor the Company considers this historical estimate as current mineral resources or reserves.

- Historical mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market, or other relevant issues.

- The database used for this historical mineral estimate includes drill results obtained from historical to the 2020 drill program.

- The pit-constrained historical mineral resources were reported at a cut-off grade of 0.40g/t for Courvan and Pascalis deposits. These cut-offs were calculated at a gold price of US$1,600 with an exchange rate of 1.333 US$/C$ per troy ounce. They were based on the following parameters: mining cost 3.00 or 3.50$/t, processing + G&A costs $21.50/t, transport cost to the central processing facility based on distance on existing roads @ $0.15/t.km, Au recovery 95%, pit slopes from 48° to 59° as per the press release of February 23rd, 2021.

- The underground historical mineral resources were based on two main mining methods, long-hole retreat at $82/t depending on width of stopes, and mechanized cut & fill at $110/t and the same above ground unit cost as for the pit-constrained scenario, resulting in cut-off grades of 1.65 and 2.05 g/t Au. These cut-off grades were then used to delineate continuous underground mineral shapes above the calculated cut-off grades. Blocks within those UG mineral shapes that are below the cut-off were included as dilution material and the grade reported represents the average of all UG mineral shapes thus delineated.

- The geological interpretation of the deposits was based on lithologies and the observation that mineralized domains occur either within or proximal to sub-vertical dykes, deformation zones or as low dipping quartz tourmaline vein sets.

- The historical mineral resource presented here were estimated with a block size of 2.5m X 2.5m X 2.5m for Courvan and Pascalis.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped (capping maximum ranges from 28 to 100 g/t Au depending on the deposit). Depending on the deposit, the composites were 1.0 metre or 1.5 metres.

- The mineral estimation was completed using the inverse distance to the square methodology utilizing three passes. For each pass, search ellipsoids followed the geological interpretation trends were used.

- The historical mineral resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (2019), and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators NI 43-101.

- To accurately estimate the historical resources, underground voids (shaft, ramp, and drifts) and the existing pits were subtracted from the mineralized bodies modeled prior to the pit optimization.

- Tonnage estimates are based on measured rock densities by Gold Trend. 2.82 tonnes per cubic metre for the Courvan Gold Trend and 2.83 for the Pascalis Gold Trend. Results are presented undiluted and in situ for the pit-constrained resources and diluted for the UG resources.

- This historical mineral resource estimate is dated June 1, 2021, and the cut-off date for the drillhole database used to produce this updated mineral resource estimate is May 8, 2021. Tonnages and ounces in the tables are rounded to nearest thousand and hundred respectively. Numbers may not total due to rounding.

- Additional details are provided in the technical report.

- Au = Gold

The mineral resource estimates mentioned above are “historical” and should not be relied upon. The Courvan and Pascalis 2021 historical estimate are included for illustrative purposes only. The QPs have not completed sufficient work to classify it as current. Neither the QPs nor the Company considers this historical estimate as current mineral resources or reserves.

Next Steps

A technical report with respect to the latest mineral resource estimate disclosed today will be filed within 45 days in accordance with NI 43-101.

About Novador Project

Since 2016, Probe Gold has been consolidating its land position in the highly prospective Val-d’Or East area in the province of Quebec with a district-scale land package of 436 square kilometers that represents one of the largest land holdings in the Val-d’Or mining camp. The Novador project is a sub-set of properties totaling 175 square kilometers hosting three past producing mines (Beliveau Mine, Bussière Mine and Monique Mine) and falls along three regional mine trends. Novador is situated in a politically stable and low-cost mining environment that hosts numerous active producers and mills. The Monique property, part of the Company’s Novador Project, consists of 21 claims and one mining lease, covering a large portion of the reported gold resource, with a total area of 5.5 square kilometres in Louvicourt township, located 25 kilometers east of Val-d’Or.

Monique Property Geology:

Gold mineralization on the Monique property is mainly associated with three deformation zones that cross the property with an orientation of 280° and a 75°- 80° dip to the north. Gold mineralization is defined by a network of quartz/carbonate/albite/±tourmaline veins and veinlets with disseminated pyrite in the altered wall rocks. More than thirty-eight (38) parallel gold zones have been discovered on the property, to-date. Some mineralized zones have been defined from surface to a depth of 700 metres and vary in width from 1 metre to up to 100 metres. Mineralized structures extend laterally up to 1,500 metres.

Independent Qualified Persons

The Monique Mineral Resource Estimate was prepared for Probe Gold Inc. by InnovExplo Inc. The Qualified Persons (“QPs”) have reviewed and approved technical information provided on Monique estimate presented in of this news release. The independent QPs from InnovExplo who have prepared and supervised the preparation of the technical information relating to this Mineral Resource Estimate are:

- Marina Iund, P.Geo., M.Sc., Senior Resources Geologist. Ms. Iund is a professional geologist in good standing with the OGQ (permit No. 1525), PGO (license No. 3123) and the NAPEG (licence No. L4431).

- Simon Boudreau, P.Eng., Senior Mine Engineer. Mr. Boudreau is a professional engineer in good standing with the OIQ (permit No. 1320338).

The technical content of this press release has been prepared, reviewed, and approved by Mr. Marco Gagnon, P.Geo., Executive Vice President of Probe Gold Inc.

Quality Control

During the 2021 and 2022 drilling program, assay samples were taken from the NQ core and sawed in half, with one-half sent to Activation Laboratories Ltd. or AGAT Laboratories Ltd. and the other half retained for future reference. A strict QA/QC program was applied to all samples, which includes insertion of mineralized standards and blank samples for each batch of 20 samples. The gold analyses were completed by fire-assayed with an atomic absorption finish on 50 grams of materials. Repeats were carried out by fire-assay followed by gravimetric testing on each sample containing 3.0 g/t gold or more. Total gold analyses (Metallic Sieve) were carried out on the samples which presented a great variation of their gold contents or the presence of visible gold. Historical drilling program assay sampling procedures are disclosed in the NI 43-101 technical report: Mineral Resource Val-d’Or East Project – July 14, 2021, and available on SEDAR (www.sedar.com) under Company's issuer profile.

About Probe Gold:

Probe Gold Inc. is a leading Canadian gold exploration company focused on the acquisition, exploration, and development of highly prospective gold properties. The Company is committed to discovering and developing high-quality gold projects, including its key asset the multimillion-ounce Novador Gold Project, Québec. The Company is well-funded and controls a strategic land package of approximately 1,500-square-kilometres of exploration ground within some of the most prolific gold belts in Québec. The Company was formed as a result of the $526M sale of Probe Mines Limited to Goldcorp. Eldorado Gold Corporation currently owns approximately 10% of the Company.

On behalf of Probe Gold Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probemetals.com or contact:

Seema Sindwani

Vice-President of Investor Relations

info@probemetals.com

+1.416.777.9467

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.