Probe Metals Announces Positive PEA for Val-d'Or East Project; Average Annual Production of 207,000 ounces, After-Tax NPV5% of C$598M, and IRR of 32.8%

Highlights:

- Robust economics with after-tax net present value (“NPV”) (discount rate 5%) of C$598M, internal rate of return (“IRR”) of 32.8% and payback of 2.7 years estimated with gold price of US$1,500 per ounce

- 12.5 year mine life producing 2.58 Million ounces of gold

- Average annual gold production of 207,000 ounces over life of mine (“LOM”), with an average of 231,000 ounces per year in the first eight years

- Average cash cost of US$786/oz and all-in sustaining (“AISC”) cost of US$965/oz gold

- Initial Capital Expenditure of C$353M

- Mill capacity of 10,000 tonnes per day (3.65M tonnes per annum) with average gold recovery of 94.7%

- Over 71% of mineable ounces coming from Beliveau and Monique deposits

- 73% of gold production mined from open pits and 27% extracted from underground operations

- Project is now advancing towards pre-feasibility, including an aggressive drilling program to upgrade and expand the gold resources

TORONTO, Sept. 07, 2021 (GLOBE NEWSWIRE) -- Probe Metals Inc. (TSX-V: PRB) (“Probe” or the “Company”) is pleased to announce positive results from the independent Preliminary Economic Assessment (“PEA”) for its 100% owned Val-d’Or East project (the “Project”) located near Val-d’Or, Québec. The PEA provides a base case assessment of developing the Val-d’Or East mineral resource by open pit and underground mining, and gold recovery with a standard free milling flowsheet, incorporating gravity and leaching of the gravity tails, with 50% estimated to be recovered via gravity. The economic model supports an operation with low capital cost and high rate of return over a 12.5-year mine life, with significant average annual production of 207,000 ounces. The PEA was prepared by Ausenco Engineering Canada Inc. (“Ausenco”) in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

David Palmer, President and CEO of Probe, states, “Our goal for Probe Metals has always been to find a project that could sustain profitable mining operations of 200,000 gold ounces per year for a minimum of 10 years. We are very pleased to say that we have not only been successful in achieving that goal, but that we have actually exceeded it with Val-d’Or East. The current PEA shows that Val-d’Or East is a large, sustainable mining project that is highly leveraged to gold price and can produce over 200,000 ounces of gold a year for at least 12.5 years, with an average of over 230,000 ounces a year in the first eight years. To have a project like this in Canada is remarkable, but to have a project like this in an established mining camp like Val-d’Or, which still has tremendous exploration upside and growth potential is even more rare. We have explored less than 15% of our property and will be accelerating our programs to capture this exploration upside while continuing to increase confidence in the resource. We will continue advancing the project on all fronts as we build Val-d’Or East into one of the preeminent Canadian development stories.”

Yves Dessureault, COO of Probe, states, “We are extremely pleased at the results of our first PEA on the Val-d’Or East project. It has exceeded all of our expectations in terms of size, annual production, initial capital costs and financial returns such as NPV and IRR. It truly is one of the more robust development projects in Canada, and being situated in the heart of mining infrastructure, 25 kilometres from downtown Val-d’Or and directly linked to power and rail, provides us with low execution risk. The project has performed extremely well in initial planning and we see many opportunities to further improve upon this study as we advance into the next phase of work. We also see potential for this project to be a leader in environmental and socially responsible mining, with low environmental impact, ore sorting, use of dry stacked tailings and access to green electricity for electrification of mining operations being just a few of the initiatives we will be working on. We look forward to unlocking further value as we progress Val-d’Or East towards development.”

Description of the Val-d’Or East Project and PEA

The Val-d’Or East Project includes the properties on the Pascalis Gold Trend, the Monique Gold Trend, the Courvan Gold Trend and the Lapaska property, which are all 100% owned by Probe. The Project benefits from world-class mining infrastructure, expertise for underground and open-pit operations and highly qualified personnel. It can be easily reached by roads that are well maintained in all seasons. Several large-scale mining operations and gold mills are currently active in the area. Since 1930, approximately 30 million ounces of gold have been produced at Val-d’Or.

Since 2016, Probe has been consolidating its land position in the highly prospective Val-d’Or East area in the province of Québec. The Val-d’Or East Project is a district-scale land package comprising 436 square kilometres and represents one of the largest consolidated land holdings in the Val-d’Or mining camp. The current total resource stands at 1,800,900 ounces of gold in the Measured and Indicated category (M&I) and 2,309,600 ounces of gold in the Inferred category.

Ausenco was appointed as lead consultant in November of 2020 to prepare the PEA in accordance with NI 43-101, and was assisted by Moose Mountain Technical Services for the mine design.

The independent PEA was prepared through the collaboration of the following firms: Ausenco Engineering Canada Inc. (Ausenco), Moose Mountain Technical Services (MMTS), Goldminds Geoservices (Goldminds), Geologica Inc., Richelieu Hydrogéologie Inc., Lamont Inc. and Rock Engineering Consulting Services. These firms provided mineral resource estimates, design parameters and cost estimates for mine operations, process facilities, major equipment selection, rock and tailings storage, reclamation, permitting, and operating and capital expenditures.

Financial Analysis

The economic analysis was performed assuming a 5% discount rate. On a pre-tax basis, the NPV5% is $991 million, the IRR is 47.2% and the payback period is 1.8 years. On an After-Tax basis, the NPV5% is $598 million, the IRR is 32.8% and the payback period is 2.7 years. A summary of the Project economics, and the projected annual gold production is listed in Table 1 and Figure 1, respectively.

Table 1: Summary of Project Economics

| General | LOM Total / Avg. | |

| Gold Price (US$/oz) | $1,500 | |

| Exchange Rate (US$:C$) | 0.75 | |

| Mine Life (years) | 12.5 | |

| Total Waste Tonnes Mined (kt) | 366,924 | |

| Total Mill Feed Tonnes (kt) | 45,199 | |

| Strip Ratio (tonnes of waste: tonnes of mineralized material (pre-ore sorting) | 6.42 x | |

| Production | ||

| Mill Head Grade (g/t) | 1.88 | |

| Mill Recovery Rate (%) | 94.7% | |

| Total Mill Ounces Recovered (koz) | 2,584 | |

| Total Average Annual Production (koz) | 207 | |

| Operating Costs | ||

| Mining Cost (C$/t Mined) | $4.49 | |

| Processing Cost (C$/t Milled) | $13.26 | |

| G&A Cost (C$/t Milled) | $2.72 | |

| Refining & Transport Cost (C$/oz) | $2.50 | |

| Total Operating Costs (C$/t Milled) | $58.81 | |

| Cash Costs (US$/oz Au) | $786 | |

| AISC (US$/oz Au) | $965 | |

| Capital Costs | ||

| Initial Capital (C$M) | $353 | |

| Sustaining Capital (C$M) | $602 | |

| Closure Costs (C$M) | $30 | |

| Salvage Costs (C$M) | ($13) | |

| Financials | Pre-Tax | After-Tax |

| NPV (5%) (C$M) | $991 | $598 |

| IRR (%) | 47.2% | 32.8% |

| Payback (years) | 1.8 | 2.7 |

Notes:

* Cash costs consist of mining costs, processing costs, mine-level G&A and refining charges and royalties

** AISC includes cash costs plus sustaining capital, closure costs, and salvage value

Cautionary Statement - The reader is advised that the PEA summarized in this news release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of inferred mineral resources. Inferred mineral resources are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no guarantee that inferred mineral resources can be converted to indicated or measured mineral resources, and as such, there is no guarantee the project economics described herein will be achieved.

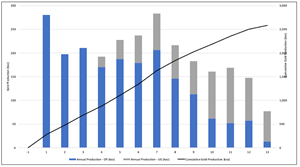

Projected gold production averages 231,000 ounces per year over years one to eight, peaking at 283,000 ounces in year seven. The LOM production averages 207,000 ounces per year.

Figure 1: Val-d’Or East Project Annual Gold Production

https://www.globenewswire.com/NewsRoom/AttachmentNg/2bace8a0-abf1-4623-88bf-b1667e244903

Mine Design and Production Schedule

The PEA considers open-pit mining from Monique, Courvan, Pascalis and Lapaska gold trends. Underground mining is used to extract material outside of the Monique, Courvan and Pascalis open pits. Underground mining areas are accessed from the bottom or ramps in the open pits after open-pit mining is completed in each respective area. The underground mining methods considered in this study are longhole retreat and mechanized drift and fill.

Measured, Indicated and Inferred Resources are all considered as potential economic mill feed in this PEA. The reader is cautioned that Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable categorization as Mineral Reserves. There is no certainty that Inferred Resources will be upgraded to Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The scheduled mill feed Resources by type are as follows: 9% Measured, 42% Indicated and 49% Inferred.

The owner-operated mining fleet will utilize conventional truck and shovel methods with 11 cubic metre loaders and 90-tonne haul trucks on 10m benches. Non-mineralized material will be placed as near as possible to the pit rims to reduce haulage costs. Mineralized material will be directed to stockpiles, the mineral-sorting facility or direct fed to the mill. Mineralized material will be hauled to the mill using 40-tonne highway capable trucks.

The project considers application of new technology such as ore sorting to increase the head grade to the mill and expand the resource. Ore sorting is applied to all open-pit material with gold grades between 0.25 g/t and 0.80 g/t. In general, lower-grade mineral sorted material (0.25 <= Au (g/t) < 0.38) is stockpiled and sorted/processed towards the end of the mine life. Material with Au >= 0.8 g/t is direct fed to the mill.

Underground material is also direct fed to the mill. Only mineral in the grade range of 0.38-0.8 g/t Au is processed by the mineral sorter to upgrade and increase the feed grade to the downstream plant. The average mill feed head grade during the first five years is 1.99 g/t. The project has strategically applied ore sorting to only marginal grade material and maximized Au extraction at lower cost.

The mining schedule considers one year of pre-production, followed by approximately 12.5 years of mill feed at 10,000 tonnes per day (tdp) throughput. During the first three years of production, only material with Au >= 0.8 g/t is planned for processing. In total there are 45.2 million tonnes of mill feed planned with an average mill feed head grade of 1.88 g/t. The mill feed is comprised of 38.1 million tonnes of open-pit material and 7.1 million tonnes of underground material. The average tonnage strip ratio is 6.42. Over the mine life, total payable gold production is forecasted to be 1,877koz from open-pit and 707koz from underground operations.

Metallurgy and Mineral Processing

The Val-d’Or East process plant employs gravity concentration, standard leaching with carbon-in-pulp (CIP) technology for gold recovery. The plant includes 3 stages of crushing followed by ball milling, classification, gravity concentration, leach and CIP, and cyanide detoxification before tailings filtration. The filtered tailings will be dry-stacked. The process plant will treat 3.65 Mt of material per year at an average throughput of 10,000 tpd.

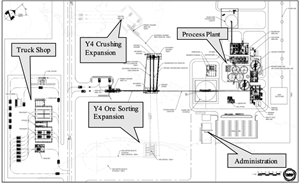

The Val-d’Or East crushing plant will be expanded in Year 4 of production to include ore sorting facilities. By applying ore sorting, the mine production and crusher feed is increased to 16,746 tpd but the mill feed is maintained at 10,000 tpd by rejecting the non-valuable material and upgrading the feed to the mill. The mill head grade from open pit ROM increases from 1.32 g/t to 1.62 g/t with application of ore sorting.

The mill design availability is 8,059 hours per year or 92%. The crushing and ore sorting design availability is 5,694 hours per year or 65%. The tailings filtration design availability is 7,183 hours per year or 82%. The plant has been designed to realize an average recovery of 94.7% of the gold over the life of the Project based on metallurgical test work completed at COREM in Québec City, Québec in 2020-2021. Of this, 50% of the gold will be extracted by gravity and a further 44.7% by the leach/CIP process.

Figure 2: Val-d'Or Process layout

https://www.globenewswire.com/NewsRoom/AttachmentNg/88c218f6-f185-449b-bae7-cefe1cbc8186

Site Location and Infrastructure

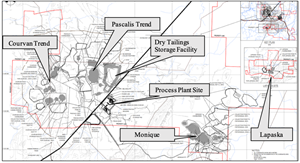

The Val-d’Or East Project is located approximately 25 kilometres east of the city of Val-d’Or in the province of Québec. The Project is in a rich mining area with easy access to power, labour, communities, highways, and a national railway adjacent to the proposed process plant. Figure 3 shows the site plan with pit locations, rock storage facilities, overburden stockpiles, water collection ponds, the process plant and buildings, and the dry tailings storage facility, among others.

The process plant site location selection considered various factors including social, environmental, topographic, accessibility, proximity to existing infrastructure and overall flow of material to the dry tailings disposal and ore sorting rejects stockpile. Centralized administration facilities, truck shop, wash bay, tire store, refueling station, warehousing and explosive magazine are optimized for efficient use of facilities.

Based on the preliminary environmental characterization and the geology of the various deposits (see news release of December 10th, 2020), it can be considered that the waste rock, mineralized material and tailings should not be acid-generating nor leachable. These positive characteristics for the project (simplified operation, easier water management and reduced closure risks) were incorporated into the project design.

Based on a preliminary siting and deposition study for the Val-d’Or Project, it was decided to filter the tailings and place them in a dry stack tailings facility (DSTF). Dry stacking tailings is one of the most sustainable methods for storing tailings as there is no need for a dam to hold them in place or potential long-term storage issues. The DSTF has been designed to safely accommodate the life of mine tailings production as described in the PEA. Tailings produced from the process plant will be filtered at the tailings filters immediately north of the main process plant. The filtered tailings (cake) will be conveyed to a stockpile immediately northwest of the tailings filters and loaded into haul trucks for deposition on the DSTF, approximately 2.8 kilometres north of the processing plant, by road. The filtered tailings will be end-dumped, spread in thin lifts, and compacted with dozers and compactors to improve overall stability of the DSTF. Waste rock may be used to create transportation corridors to improve trafficability for haul trucks during wet weather operation, if required. As lifts are completed, it is planned that they will be progressively closed by grading the outer slopes and covering them with a growth media and revegetated to reduce erosion and help stabilize the slopes.

Runoff from the tailings storage facility, as well as waste rock storage facilities and over burden stockpiles will be collected in series of water management ponds and drainage ditches. Consideration was taken for the main watershed between the Courvan and Pascalis to reroute the fish-bearing streams – as indicated on the site layout. There are at present two public roads running through the site, namely Chemin Perron and Chemin Pascalis. Consideration was taken for the relocation of these roads as indicated on the site layout.

Figure 3: Val-d'Or East Site Layout

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd07abb3-fec8-45fb-bead-622ebdcefbb2

Operating Cost

Operating costs were derived using benchmark information in the region and are estimated at $58.81 per tonne milled (Table 2).

Table 2: Total Life of Mine Operating Costs

| COST AREA | LOM ($M) | ANNUAL AVG. COST ($M) | AVG. LOM ($/T MINED) | AVG.LOM ($/T MILLED) | AVG. LOM (CAD$/OZ) | OPEX (%) | |||||

| Mine Operating | $1,936 | $155 | $4.49 | $42.83 | $750 | 73% | |||||

| Mill Processing | $600 | $48 | $1.39 | $13.26 | $232 | 23% | |||||

| G&A | $123 | $10 | $0.28 | $2.72 | $48 | 5% | |||||

| Total | $2,658 | $213 | $6.16 | $58.81 | $1,029 | 100% | |||||

Capital Cost

The total initial capital cost for the Val-d’Or East Project is estimated to be $353MM including allowances for indirect costs. Sustaining capital costs are estimated at $602M, including plant expansion for ore sorting in Year 4. The plant expansion is supported by underground mining that commences in Year 4 at Courvan, and then with contribution from either Monique, Pascalis and Courvan up to year 13.

Table 3: Total Capital Costs

| DESCRIPTION | INITIAL CAPITAL COST (CAD$M) | SUSTAINING CAPITAL COST (CAD$M) | TOTAL CAPITAL COST (CAD$M) | ||

| MINING | $75.3 | $484.0 | $559.2 | ||

| MINING INFRASTRUCTURE | $10.2 | $5.7 | $15.9 | ||

| ON SITE INFRASTRUCTURE | $50.0 | $26.9 | $76.9 | ||

| PROCESS PLANT | $129.4 | $36.3 | $165.7 | ||

| OFF SITE INFRASTRUCTURE | $4.2 | - | $4.2 | ||

| TOTAL DIRECTS | $269.1 | $552.9 | $822.0 | ||

| PROJECT INDIRECTS | $7.8 | $2.8 | $10.5 | ||

| PROJECT DELIVERY | $27.3 | $7.9 | $35.2 | ||

| OWNER'S COSTS | $9.7 | - | $9.7 | ||

| PROVISIONS | $38.8 | $38.0 | $76.8 | ||

| TOTAL INDIRECTS | $83.5 | $48.7 | $132.2 | ||

| PROJECT TOTAL | $352.6 | $601.6 | $954.1 | ||

The $484M in sustaining mining capital includes $153M for the mining fleet and $331M for underground (“UG”) development, expected to be self-funded through operating cashflows. While the incremental underground production demands substantial capital injection, all underground mining enhances overall production profile and project value with the $1,500/oz gold price (base case for the PEA mine planning), while offering additional leverage to a potential increase in the gold price. Each UG operation will be evaluated in more details in the next phase to ensure that the sustaining and UG capital is providing incremental value.

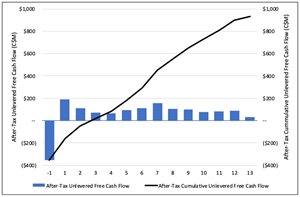

Cashflow Analysis

The projected cash flow and sensitivities are indicated below.The Year 4 expansion to include ore sorting as well as the supporting underground development and infrastructure will be self-funded.

Figure 4: Projected Annual and Cumulative LOM After-Tax Unlevered Free Cash Flow

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9c5e330-7f09-4bc8-9c31-8e16585f8f4a

Sensitivities

A sensitivity analysis was conducted on the base case pre-tax and after-Tax NPV and IRR of the Project, using the following variables: metal price, initial capex, total operating costs, and foreign exchange. Table 4 summarises the after-tax sensitivity analysis results.

As shown in Table 5 and Table 6, the sensitivity analysis revealed that the project is most sensitive to changes in gold prices, and foreign exchange and less sensitive to initial capex and operating costs.

Table 4: After-Tax Sensitivity Summary

| Gold Price US$/oz | $1,300 | $1,400 | $1,500 Base Case | $1,600 | $1,700 | $1,800 |

| After-Tax NPV5% | $288M | $444M | $598M | $751M | $902M | $1,051M |

| IRR | 19.1% | 26.2% | 32.8% | 39.2% | 45.5% | 51.6% |

| NPV5%/Capex | 0.82x | 1.26x | 1.70x | 2.13x | 2.56x | 2.98x |

| Payback (Years) | 5.1 | 3.8 | 2.7 | 2.1 | 1.8 | 1.6 |

Table 5: After-Tax NPV5% Sensitivity

| Gold Price | After-Tax NPV (5%) | Initial CAPEX | Total OPEX | FX | ||||||||||

| US$/oz | Base Case ($M) | (-20%) | (+20%) | (-20%) | (+20%) | (-20%) | (+20%) | |||||||

| $1,300 | $288 | $357 | $219 | $528 | $10 | $789 | ($92) | |||||||

| $1,400 | $444 | $513 | $375 | $680 | $186 | $977 | $58 | |||||||

| $1,500 | $598 | $667 | $529 | $831 | $357 | $1,161 | $205 | |||||||

| $1,600 | $751 | $820 | $682 | $979 | $513 | $1,344 | $340 | |||||||

| $1,700 | $902 | $970 | $833 | $1,125 | $668 | $1,525 | $470 | |||||||

| $1,800 | $1,051 | $1,120 | $982 | $1,271 | $821 | $1,705 | $598 | |||||||

Table 6: After-Tax IRR Sensitivity

| Gold Price | IRR | Initial CAPEX | Total OPEX | FX | ||||

| US$/oz | Base Case | (-20%) | (+20%) | (-20%) | (+20%) | (-20%) | (+20%) | |

| $1,300 | 19.1% | 26.4% | 14.2% | 29.3% | 5.6% | 40.8% | -% | |

| $1,400 | 26.2% | 35.1% | 20.2% | 35.6% | 14.6% | 48.6% | 8.0% | |

| $1,500 | 32.8% | 43.3% | 25.8% | 41.8% | 22.6% | 56.2% | 15.2% | |

| $1,600 | 39.2% | 51.4% | 31.2% | 47.8% | 29.7% | 63.7% | 21.5% | |

| $1,700 | 45.5% | 59.3% | 36.5% | 53.7% | 36.4% | 71.1% | 27.3% | |

| $1,800 | 51.6% | 67.0% | 41.6% | 59.6% | 43.0% | 78.4% | 32.8% | |

Opportunities for Project Enhancement

Recommendation has been made to investigate a trade-off between trucking vs. conveying the mineralized material from Monique to the plant location as part of the next phase.

Additional testing is planned to optimize grind size and leaching conditions with the intent of improving capital and operating costs. Recovery in gravity concentration was conservatively estimated based on available information. Additional gravity concentration testing across a range of samples may increase this value due to the presence of significant free gold.

Conservative recoveries were applied to ore sorting. Future testwork should be conducted to investigate conditions that provide higher recoveries. There is also an opportunity to investigate the sale of ore sorting rejects as aggregate material. The reject stockpile is in close proximity to a CN railway line and an access road for easy transport.

The project still has substantial exploration potential which could enable longer mine life beyond 12.5 years outlined in the PEA, and possibly increase annual production volumes.

Mineral Resource Estimate

The Val-d’Or East Project includes the properties on the Pascalis Gold Trend, the Monique Gold Trend and the Courvan Gold Trend, which are 100% owned by Probe.

Table 7: Val-d’Or East Property (100% interest)

| All Deposits / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au1 g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Measured | 5,111,000 | 2.12 | 347,600 | 660,000 | 2.43 | 51,500 | 5,771,000 | 2.15 | 399,100 |

| Indicated | 21,404,000 | 1.56 | 1,072,700 | 2,602,000 | 3.08 | 257,900 | 24,006,000 | 1.72 | 1,330,600 |

| Measured & Indicated | 26,515,000 | 1.67 | 1,420,300 | 3,262,000 | 2.95 | 309,400 | 29,777,000 | 1.81 | 1,729,700 |

| Inferred | 20,702,000 | 1.58 | 1,053,800 | 8,230,000 | 3.43 | 906,500 | 28,932,000 | 2.11 | 1,960,400 |

1 Au symbol for Gold

Notes:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources.

- The database used for this mineral estimate includes drill results obtained from historical to the recent 2020 drill program.

- The pit-constrained updated Mineral Resources are reported at a cut-off grade of 0.42g/t Au for the Monique deposit and 0.40g/t for the other deposits. These cut-offs were calculated at a gold price of US$1,600 with an exchange rate of 1.333 US$/C$ per troy ounce. They were based on the following parameters: mining cost 3.00 or 3.50$/t, processing + G&A costs $21.50/t, transport cost to the central processing facility based on distance on existing roads @ $0.15/t.km, Au recovery 95%, pit slopes from 48° to 59° as per the press release of February 23rd, 2021.

- The underground Mineral Resources were based on two main mining methods, long-hole retreat at $82/t depending on width of stopes, and mechanized cut & fill at $110/t and the same above ground unit cost as for the pit-constrained scenario, resulting in cut-off grades of 1.65 and 2.05 g/t Au. These cut-off grades were then used to delineate continuous underground mineral shapes above the calculated cut-off grades. Blocks within those UG mineral shapes that are below the cut-off were included as dilution material and the grade reported represents the average of all UG mineral shapes thus delineated.

- The geological interpretation of the deposits was based on lithologies and the observation that mineralized domains occur either within or proximal to sub-vertical dykes, deformation zones or as low dipping quartz tourmaline vein sets.

- The mineral resource presented here were estimated with a block size of 5m X 5m X 5m for the Monique pit-constrained Mineral Resource and a block size of 2.5m X 2.5m X 2.5m for all others.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped (capping maximum ranges from 28 to 100 g/t Au depending on the deposit). Depending on the deposit, the composites were 1.0 metre or 1.5 metres.

- The mineral estimation was completed using the inverse distance to the square methodology utilizing three passes. For each pass, search ellipsoids followed the geological interpretation trends were used.

- The Mineral Resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (2019), and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators NI 43-101.

- In order to accurately estimate the resources, underground voids (shaft, ramp and drifts) and the existing pits were subtracted from the mineralized bodies modeled prior to the pit optimization.

- Tonnage estimates are based on measured rock densities by Gold Trend. 2.82 tonnes per cubic metre for the Courvan Gold Trend, 2.83 for the Pascalis Gold Trend and 2.88 for the Monique Gold Trend. Results are presented undiluted and in situ for the pit-constrained resources and diluted for the UG resources.

- This mineral resource estimate is dated June 1, 2021 and the cut-off date for the drillhole database used to produce this updated mineral resource estimate is May 8, 2021. Tonnages and ounces in the tables are rounded to nearest thousand and hundred respectively. Numbers may not total due to rounding.

- Additional details are included in the technical report.

As part of its land consolidation strategy for the Val-d’Or East Project, Probe earned a 60% interest in the Cadillac Break East Property in joint venture with O3 Mining Inc., which includes the Sleepy deposit. The Company also owns a 100%-interest in the Val-d’Or East Lapaska and Senore properties.

Table 8: Val-d’Or East Other Properties

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Lapaska1 Total Inferred | 512,000 | 1.47 | 24,200 | 460,000 | 3.19 | 47,200 | 972,000 | 2.28 | 71,300 |

| Senore1 Total Inferred | 549,000 | 1.78 | 31,400 | 38,000 | 2.68 | 3,300 | 587,000 | 1.84 | 34,700 |

| Sleepy2 Total Inferred | 1,113,000 | 4.70 | 167,900 | 1,113,000 | 4.70 | 167,900 | |||

1 NI 43-101 Technical Report Val-d’Or East Project – October 2019, 100% interest

2 NI 43-101 Technical Report Sleepy Project – December 2014, Option to earn 60%, 60% presented

The Company has demonstrated with a series of performance tests that ore sorting technology works very well with the type of mineralization found at the Val-d’Or East Project. By applying ore sorting to mineralized waste with very conservative gold recoveries, the below cut-off grade material may be converted to valuable ore and hence expand the mineral resource of the project.

Table 9: Val-d’Or East Project – Additional Pit Constrained Resource from Ore sorting

| Resources Category | Tonnes | Grade (Au g/t) | Ounces (oz.) |

| Measured | 996,000 | 0.32 | 10,300 |

| Indicated | 5,799,000 | 0.33 | 60,900 |

| Measured & Indicated | 6,795,000 | 0.33 | 71,200 |

| Inferred | 7,438,000 | 0.31 | 75,300 |

Notes:

- This additional pit-constrained Mineral Resource represents low grade material between a cut-off of 0.25g/t and the cut-off grade of 0.40 or 0.42g/t Au of the pit-constrained Mineral Resource from Table 1. This lower cut-off was based on the following parameters: ore sorting cost $2.00/t, Gold recovery in the ore sorting process 75% with an overall gold recovery with gravity and leaching at 68%, mass recovery in the ore sorting process 40%.

Qualified Person:

The PEA has been prepared by the following “Qualified Persons”, all of whom are considered to be independent consultants of Probe for the purposes of section 1.5 of NI 43-101, and all of whom have reviewed the information in this press release that is summarized from the PEA in their areas of expertise:

- Tomasso Roberto Raponi, P.Eng., Metallurgy Process (Ausenco)

- Jesse Aarsen, P. Eng., Mining (MMTS)

- Merouane Rachidi, Ph.D. P.Geo., Resource and Reserve Estimation (Goldminds)

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this news release, such as initial capital cost, sustaining capital cost, total capital cost, AISC, and capital intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing and water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces.

AISC and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per ounce is calculated as AISC divided by payable gold ounces.

About Ausenco:

Ausenco is a global company based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value-add consulting studies, project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors.

About Probe Metals:

Probe Metals Inc. is a leading Canadian gold exploration company focused on the acquisition, exploration and development of highly prospective gold properties. The Company is committed to discovering and developing high-quality gold projects, including its key asset the multimillion-ounce Val-d’Or East Gold Project, Québec. The Company is well-funded and controls a strategic land package of approximately 1,000-square-kilometres of exploration ground within some of the most prolific gold belts in Québec. The Company was formed as a result of the $526M sale of Probe Mines Limited to Goldcorp. Eldorado Gold Corporation currently owns approximately 11.5% of the Company.

On behalf of Probe Metals Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probemetals.com or contact:

Seema Sindwani

Director of Investor Relations

info@probemetals.com

+1.416.777.9467

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan” and include, but are not limited to, statements with respect to: the results of the PEA, including future Project opportunities, future operating and capital costs, closure costs, AISC, the projected NPV, IRR, timelines, permit timelines, and the ability to obtain the requisite permits, economics and associated returns of the Project, the technical viability of the Project, the market and future price of and demand for gold, the environmental impact of the Project, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.