QMX Gold Releases Maiden Resource at Bonnefond - Indicated 258,700 Ounces at 1.69 g/t Gold; Inferred 145,100 Ounces at 1.87 g/t Gold

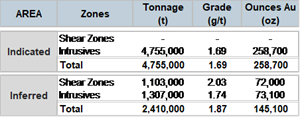

TORONTO, July 30, 2019 (GLOBE NEWSWIRE) -- QMX Gold Corporation (“QMX” or the “Company”) (TSX:V:QMX) is pleased to announce the release of a National Instrument 43-101: Standards of Disclosure for Mineral Projects (“NI 43-101”) resource estimate (the “2019 MRE”) on its Bonnefond South property, located approximately 25 km to the east of Val d'Or, Quebec. The 2019 MRE was completed independently by BBA Inc. in accordance with the NI 43-101 guidelines. A summary of the resource by zone is presented in Table 1.

Highlights include:

- An open pit constrained resource with a cut-off grade of 0.75 g/t Au,

- Over 60% of this initial resource estimate is at an indicated confidence level,

- Indicated resource of 4,755,00 tonnes at 1.69 g/t Au for 258,700 ounces,

- Inferred resource of 2,410,000 tonnes at 1.87 g/t Au for 145,100 ounces.

“We are very excited to report a resource with its largest part already being in the Indicated category”, says Dr. Andreas Rompel, VP Exploration. “The total ounces were inline with our expectations, however, we are thrilled that the grades were between 1.69 and 1.87 g/t, which compares favourably to our expectations and with other open pit operations in the Abitibi.”

“The QMX team is pleased to release our maiden resource for Bonnefond, which we just started drilling in early 2017”, stated Brad Humphrey, President and CEO. “I am proud of our exploration team and the fact that the majority of this initial resource already falls into the Indicated confidence category, a strong testament to the quality of their work. It is also important to note that this is just one of our many targets across our extensive land package in the Val d’Or East mining camp and that the Bonnefond deposit is located less than 25 km from our Aurbel mill, which we anticipate to commence custom milling in the coming months.”

The technical report related to the 2019 MRE will be filed on SEDAR at www.SEDAR.com within 45 days.

Table 1: Bonnefond Resource summary by zone:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f095d7f-366d-48f0-a59b-43d88c128e14

Notes to the MRE Table:

- The independent qualified person for the 2019 MRE, as defined by NI 43-101 guidelines, is Pierre-Luc Richard, P. Geo., of BBA Inc. The effective date of the estimate is July 18, 2019.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred resources in this 2019 MRE are uncertain in nature and there has been insufficient exploration to define these Inferred and Indicated resources as Measured, however it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- A cut-off grade of 0.75g/t Au was used for the 2019 MRE. The cut-off grade was calculated using the following parameters (amongst others): gold price = 1,300USD, CAD:USD exchange rate = 1.31, Mining cost = 3.50 CAD$/t mined, Processing cost = 26.50 CAD$/t processed, G&A = 4.00 CAD$/t processed, Transportation cost = 8.00 CAD$/t processed. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs.

- Resources are presented as undiluted and in situ for an open-pit scenario and are considered to have reasonable prospects for economic extraction. The pit optimization was done using Hexagon’s MineSight Version 15.10. The constraining pit shell was developed using pit slopes of 50 degree in hard rock and 26.5 degree in overburden. Other parameters are the same that were used for the cut-off grade (see above).

- The MRE was prepared using Geovia® GEMS 6.8.2.2 and is based on 94 surface drillholes, of which 83 intercepted mineralization, with a total of 7,334 assays. The resource database was validated before proceeding to the resource estimation. Grade model resource estimation was calculated from drillhole data using an Ordinary Kriging interpolation method in a block model using blocks measuring 5 m x 5 m x 5 m in size. The cut-off date for drillhole assays was June 10, 2019.

- The model comprises 12 mineralized shear zones (which have a minimum thickness of 3 m), 2 lithological units and 1 mineralized body included in the tonalite intrusive unit each defined by individual wireframes.

- High-grade capping was done on the composited assay data and established on a per unit basis. Capping grades used are 2.0 g/t Au for the Diorite unit, 2.5 g/t Au for the Tonalite unit, 25 g/t Au for the Shear Zones and 35 g/t Au for the Mineralized Tonalite. A value of zero grade was applied in cases of core not assayed.

- Fixed density values were established on a per unit basis, corresponding to the median of the SG data of each unit ranging from 2.69 to 2.81. A fixed density of 2.00 g/cm3 was assigned to the overburden.

- The MRE presented herein is categorized as an Inferred and Indicated resource. The Inferred mineral resource category is defined for blocks that are informed by a minimum of two drillholes where drill spacing is less than 100 m for the mineralized intrusive-related mineralization and less than 80 m for the shear zones. Indicated Mineral Resources were defined for the mineralization contains in the altered tonalite where blocks have been informed by a minimum of three drillholes and where drill spacing is less than 50 m. No indicated resource was defined for the shear zones, the unaltered tonalite, and the diorite. Where needed, some material have been either upgraded or downgraded to avoid isolated blocks.

- The number of metric tons was rounded to the nearest thousand. The number of ounces were rounded to the nearest hundred.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

- The author is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issues not reported in this Technical Report, that could materially affect the Mineral Resource Estimate.

Bonnefond South Deposit

The Bonnefond South deposit is located on the Eastern portion of QMX Gold’s land package East of Val d’Or (Figure 1). Originally discovered by Aur Resources at the end of the 90's, QMX started drilling the Bonnefond intrusive in 2017 and has since completed 60 drill holes for a total of 25,570m. All holes are used for the 2019 MRE.

Indicated Resources are hosted by the Bonnefond Intrusive which is a tonalitic intrusion. The intrusion dips to the north-east and has a strike-length of 300 metres, averaging 60 to 70 metres in width. Gold is associated with sheared and tensional quartz-tourmaline veins and strong sericite-albite-fuchsite alteration. Figure 2 shows a typical cross section of the deposit.

Inferred Resources are located both within the Bonnefond intrusive and in a series of shear zones to the south in the surrounding volcanic rocks. The current interpretation suggests the shear zones are oriented east-west and dip at approximately 45 degrees. The mineralized shear zones are part of a larger deformation corridor which extends through the New Louvre and Bevcon deposits, two of QMX's other exploration targets in the area.

QMX is currently planning its next drilling campaign on the Bonnefond property. The program will focus on bringing inferred resources in the Intrusion up to the indicated resource confidence level and on further evaluation of the potential in the shear zones surrounding the intrusion.

Figure 1: QMX’s extensive and target-rich land package

https://www.globenewswire.com/NewsRoom/AttachmentNg/40f0df5e-9712-4de4-bd31-3c7e6f08ab3a

Figure 2: Bonnefond South typical cross section - Looking East

Bonnefond South deposit typical cross section showing the different geological units and shear zones.

https://www.globenewswire.com/NewsRoom/AttachmentNg/c46928c6-41ba-4d64-8f4b-dd3ccf5924a7

Qualified Persons

Mélanie Pichon, P.Geo., Exploration Manager for QMX Gold Corp. and qualified person as defined by NI 43-101 guidelines has reviewed and approved the scientific and technical content of this press release.

The independent qualified person for the 2019 MRE, as defined by NI 43-101 guidelines, is Pierre-Luc Richard, P. Geo., of BBA Inc.

About QMX Gold Corporation

QMX Gold Corporation is a Canadian based resource company traded on the TSX Venture Exchange under the symbol “QMX”. The Company is systematically exploring its extensive property position in the Val d’Or mining camp in the Abitibi District of Quebec. QMX is currently drilling in the Val d’Or East portion of its land package focused on the Bonnefond plug and in and around the Bevcon Intrusive. In addition to its extensive land package QMX owns the strategically located Aurbel gold mill and tailings facility, which is expected to commence custom milling in 2019.

| Contact Information: Brad Humphrey President and CEO Tel: (416) 861-5887 Toll free: +1 877-717-3027 | Email: info@qmxgold.ca | Louis Baribeau Public Relations Tel: (514) 667-2304 Website: www.qmxgold.ca |

Cautionary Note Regarding Forward-Looking Information:

This press release contains or may be deemed to contain “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements regarding the 2019 MRE, custom milling at the Aurbel gold mill and tailing facility, future exploration plans, operations and activities, projected mineralization, timing of assay results, and the ability of the Company to continue as a going concern. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, its properties and/or its projects to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the disclosure documents of the Company filed under the Company’s profile on SEDAR. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.