Red Pine Files Updated NI 43-101 Technical Report including positive metallurgical results for the Wawa Gold Project with gold recoveries over 90%

TORONTO, July 08, 2021 (GLOBE NEWSWIRE) -- Red Pine Exploration Inc. (TSX-V: RPX) (“Red Pine” or the “Company”) announces it will be filing an updated NI 43-101 Technical Report including updates to the ownership structure, land position, additional drilling and surface exploration results as well as positive results from metallurgical test work. The resource statement in this report remains unchanged due to insufficient additional drill data.

Highlights of the metallurgical study:

- CIL cyanidation and gravity recoverable gold average of 90.3% for representative blends of the gold bearing mineralization forming the bulk of the resource of the Surluga Deposit.

- Flotation and gravity recoverable gold average of 93.3% for the localized domains of arsenopyrite-dominant mineralization in the Surluga Deposit.

- CIL cyanidation and gravity recoverable gold average of 95.4% for Minto mineralization forming the Minto Mine South deposit and locally present in the Surluga Deposit.

- The positive response of Surluga and Minto Mine South mineralization to conventional, industrially proven processes provides flexibility for project definition, design, and potential treatment of respective material types.

“We are pleased to have tested all mineralogy types currently pronounced in the Wawa Project resource and received back positive metallurgical results. The major resource, the Surluga Deposit, responds well to cyanidation, including the blends of pyrite and arsenopyrite bearing material that are representative of the majority of the higher-grade zones of the Surluga deposit. The tests have also proven that the domains with more abundant arsenopyrite (“APY”) are receptive to flotation resulting in 90% or higher recoveries in all cases.

The Minto deposit tests demonstrated recoveries in excess of 94%.

In summary our metallurgical work demonstrated that conventional processing methods provides flexibility and optionality in the selection of future processing options.” – Quentin Yarie, President and CEO.

Metallurgical study

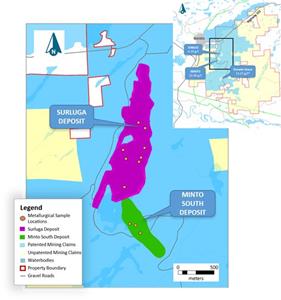

Red Pine commissioned McClelland Laboratories Inc., located in Sparks, Nevada, to determine the amenability of gold mineralization in the Surluga and Minto Mine South deposits to CIL cyanidation and flotation treatment. The metallurgical study was conducted on a total of eleven (11) samples of quartered HQ drill core (Figure 1). Note that additional details of the metallurgical study will be filed and available on SEDAR.

Figure 1 - Location of Metallurgical Samples

https://www.globenewswire.com/NewsRoom/AttachmentNg/5485069a-b13f-4754-98a0-e58047c44e7d

In the Surluga deposit, gold mineralization principally occurs as arrays of quartz veins of different thickness associated with pyrite as the main sulfide (pyrite-dominant mineralization). Accessory to absent pyrrhotite and arsenopyrite, and minor to absent chalcopyrite, occasional native gold, sphalerite and galena complete the main mineral assemblage. Pyrite-dominant mineralization is absent from the Minto Mine South deposit.

In the Minto Mine South deposit, and in certain zones of the Surluga deposit, gold mineralization is associated with quartz-tourmaline veins with variable pyrite, accessory pyrrhotite, minor to trace chalcopyrite and common native gold.

A third style of gold mineralization has arsenopyrite as the main sulfide (arsenopyrite-dominant). It occurs as variably preserved relicts in the resource of the Surluga deposit, absent from the Minto Mine South deposit. Where observed in the Surluga deposit, its formed of zones with extremely deformed arsenopyrite with or without strong quartz veining. Within the Surluga deposit, primary arsenopyrite-dominant mineralization tends to be spatially restricted to discrete zones and is more commonly an accessory to larger volumes formed by pyrite-dominant and Minto mineralization.

For the metallurgical study, three (3) samples from the Minto Mine South deposit were selected to characterize Minto mineralization. Five (5) samples were selected in the Surluga Deposit to represent a blend of pyrite-dominant with accessory to absent arsenopyrite-dominant mineralization to characterize the most likely metallurgical behavior of gold mineralization during production. Three (3) samples were also specifically selected to characterize the metallurgical behavior of primary arsenopyrite mineralization that is locally preserved in discrete zones of the Surluga Deposit.

The individual samples weighed 2 kg to 37 kg and each sample was crushed to a nominal 10-mm. The 10-mm material was then blended and split using a riffle or rotary type splitter to obtain approximately 5 kg for crushing to 100%-1.7 mm. In the case of the two samples that weighed less than 5 kg (RPX-1 and RPX-8), the samples were crushed entirely to -1.7 mm. The -1.7-mm material was blended and split using a rotary type splitter to obtain four (4) replicated samples (typically 1.25 kg each). One of the replicated splits from each sample was further split to obtain duplicate 100-g splits for head analysis. Each of these splits was analyzed for gold and silver content by conventional fire assay fusion procedures. One of the duplicate splits from each sample was also used for an ICP metals scan and for sulphide sulphur analysis.

Agitated CIL cyanidation bottle roll tests

Agitated CIL cyanidation bottle roll tests were conducted on the selected samples. Following the leach cycle, slurries were screened to recover the metallic fraction which was assayed separately from the remaining tails. This was done to capture any residual gravity recoverable gold. Tests were conducted at an 80%-75 µm feed size with a 32-hour leach cycle.

Samples representative of the main zones of mineralization in the Surluga and Minto Mine South deposits generally were readily amenable to CIL cyanidation treatment at the 80%-75 µm feed size. For the three (3) samples representative of Minto mineralization, CIL cyanidation and gravity recoverable gold average of 95.4%. For the five (5) samples representative of the blends of pyrite-dominant with accessory to absent arsenopyrite-dominant mineralization types in the Surluga Deposit, CIL cyanidation and gravity recoverable gold average of 90.3 %. The three (3) samples selected to specifically characterize arsenopyrite-dominant mineralization in the Surluga Deposit yielded a range of CIL cyanidation and gravity recoveries between 48.9% to 78.2% (average of 61.2%).

Bulk Sulphide Flotation Testing

A rougher bulk sulphide flotation test was conducted on each of the 11 Surluga/Minto composite samples to determine the response to flotation treatment. Splits from each sample (typically 1.25 kg) were batch ground in a steel ball mill to produce an 80%-75um feed for leaching. Each ground ore charge was screened prior to flotation to recover a metallics fraction which was assayed separately from the flotation products.

Flotation was conducted using a Denver laboratory scale flotation unit at 1,200 rpm. Slurry solids density of the ground ore was adjusted to 33 weight percent solids. Flotation was conducted in 4 stages with 0.015 kg/mt ore of PAX (potassium amyl xanthate) added at each of stages 1 and 2 and 0.010 kg/mt ore of AERO 3477 promoter (dithiophosphate) added at each of stages 2 through 4.

Samples representative of the main zones of mineralization in the Surluga and Minto Mine South deposits were amenable to gravity recovery and bulk sulphide flotation at the 80%-75 µm feed size. For the three (3) samples representative of Minto mineralization, bulk sulphide flotation and gravity recoverable gold average of 95.6%. For the five (5) samples representative of the blends of pyrite-dominant with accessory to absent arsenopyrite-dominant mineralization in the Surluga Deposit, bulk sulphide flotation and gravity recoverable gold average of 86.6 %. For the three (3) samples selected to specifically characterize arsenopyrite-dominant mineralization in the Surluga Deposit, bulk sulphide flotation and gravity recoverable gold average of 93.3%.

Qualified Person

Quentin Yarie, P.Geo. and Chief Executive Officer of Red Pine and the Qualified Person, as defined by National Instrument 43-101, has reviewed, and approved the news release’s technical information.

COVID-19 Precautions

Red Pine has developed and implemented compliant precautions and procedures according to guidelines for the Province of Ontario. Protocols were put in place to ensure our employees’ and contractors’ safety, thereby reducing the potential for community contact and spreading of the virus

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold exploration company headquartered in Toronto, Ontario, Canada. The Company's common shares trade on the TSX Venture Exchange under the symbol "RPX".

Red Pine is located in the Michipicoten greenstone belt of Ontario, a region that has seen major investment by several producers in the last five years. Its land package hosts numerous historic gold mines and is over 6,800 hectares in size. The Company is supported by Chairman of the Board Paul Martin, former CEO of Detour Gold and Directors boasting a high pedigree of experience at Alamos, Barrick, Generation Mining, Detour Gold, and the Ontario Energy Board. Led by CEO, Quentin Yarie, with over 25 years of experience in mineral exploration, Red Pine is strengthening its position by further validating its potential as a major resource and player in the Michipicoten region.

For more information about the Company, visit www.redpineexp.com

Or contact:

Quentin Yarie, President and CEO, (416) 364-7024, qyarie@redpineexp.com

Or Tara Asfour, Investor Relations Manager, (514) 833-1957, tasfour@redpineexp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.