Robex Resources Announces a Business Combination With Sycamore Mining Targeting Above 200,000 Oz of Production by 2024

QUÉBEC CITY, April 20, 2022 (GLOBE NEWSWIRE) -- Robex Resources Inc. (“Robex ”, “the Group” or “the Company”) (TSXV: RBX) and Sycamore Mining Ltd (“Sycamore”), a privately owned company of Cyprus, are pleased to announce that they have entered into a share purchase agreement (the “SPA”) whereby Robex and Sycamore will combine their respective businesses to build a multi-asset and multi jurisdiction gold mining company (the “Transaction”).

Transaction summary

- Purchase price payable through the issuance of a maximum of 403,600,000 common shares (less customary closing adjustments such as potential liabilities) in the share capital of Robex (“Robex Shares”).

- Resulting shareholding: Upon completion, Robex shareholders and former Sycamore shareholders will own, subject to adjustments, respectively 59.78 % and 40.22 % of Robex.

- The Transaction is an arm’s length transaction and there are no finder’s fees payable.

- Closing expected to occur before end of Q2 2022 after the publication of a new NI 43-101 report.

The Transaction has been unanimously approved by the Board of Directors of each of Robex and Sycamore.

Ramez Attieh, senior adviser of Eglinton Mining: “We are extremely pleased to work with the Robex management team. The experience of Robex has already shifted our business strategy on Kiniero to build a much larger project which will benefit all shareholders and Guinea. We are thrilled to embark in a journey to create a major West African gold producer with the pleasure to participate in the local economy of Guinea”.

George Cohen, Executive Chairman of the board of Robex: “With this transformational transaction Robex is moving forward to build a multi-mine multi-country group in West Africa. We welcome onboard the Sycamore management team and the shareholders of Sycamore in our new group. Kiniero is a world class asset with 3.4 Moz of historical resources** and one of the largest land packages in Guinea. Combined with our operational expertise and the synergies with Nampala we are excited for the future ahead. This will unlock value for our shareholders and for Guinea”.

About Sycamore Mining

Sycamore Mining is a Cyprus-based mining company focused on developing mining and mineral projects which currently owns an interest in two projects: (1) the Kiniero Project located in the Republic of Guinea held through its wholly-owned subsidiary Sycamore Mine Guinee SAU which includes a group of licenses and exploitation permits referred to as Kiniero and an option over an exploration license referred to as Mansounia, together forming the Kiniero District (see Details of the Kiniero Project: a district scale opportunity below) and (2) the Lomati Gold Mine located in the Kingdom of Eswatini (formerly Swaziland) which will be disposed as a condition precedent to closing (see Conditions of the Transaction).

Objectives of the Transaction

- Combine the two businesses to create a low cost, mid-tier gold producer with one of West Africa’s most prospective development portfolios.

- Short-term opportunity to bring a new mine into production (leveraging Robex’s expertise in plant development and operation and Sycamore’s strength in resource delineation) via the development and future operation of the Kiniero Project.

- Targeting the quadrupling of group gold production with a target above 200,000 oz per annum by the end of 2024.

Share Purchase Agreement

Pursuant to the terms of the Share Purchase Agreement executed between Robex, Sycamore and its shareholders on April 19th, 2022, Robex will acquire, directly and indirectly, 100% of the outstanding shares of Sycamore in exchange for a maximum aggregate of 403,600,000 Robex Shares to be issued as follows:

- 242,160,000 Robex shares due at closing;

- upon approval of the closing financial statements, a maximum of 60,540,000 Robex shares less a number of Robex Shares equal to the aggregate amount of liabilities of Sycamore (on a consolidated basis); and

- 100,900,000 shares of Robex less such number of Shares equal to certain liabilities of Sycamore or the sellers not addressed in (i) to be issued once a “Convention d’établissement” signed with the Government of Guinea providing for the conditions under which the Kiniero Project will be operated or (ii) another binding document addressing such liabilities.

After giving effect to the Transaction, it is expected that the Sycamore shareholders will hold a maximum of approximately 40.22% of the issued and outstanding Robex Shares. All of the Robex Shares to be issued to the Sycamore shareholders will be held in escrow pursuant to the terms and conditions of an escrow agreement to be entered into with Computershare Trust Company of Canada until the date the first ounce of gold poured at the Kiniero Project or two years after closing of the Transaction.

As a result of the Transaction, Eglinton Mining will become an "Insider" (as that term is defined in the policies of the TSXV) of Robex as it will hold up to a maximum of 177,327,000 Robex Shares, which represents approximately 17.65% of the issued and outstanding Robex Shares (post-Transaction), on a non-diluted basis. Eglinton Mining is a corporation formed under the laws of Cayman Islands 50% owned by Mr Alan Konyar (a resident of Dubai, UAE) and 50% owned by Onex Mining a corporation formed under the laws of Cayman Islands in turn owned by Mr Saad Tayeb Hasan (a resident of Republic of Iraq). Eglinton’s core focus is on investing in strategic mining assets and resources in West Africa. No other person holds a controlling interest in, or otherwise exercises control or direction over, the outstanding securities of Onex Mining.

After closing of the Transaction, Robex shall, for so long as the Sycamore shareholders, as a group, hold at least 20% of the outstanding Robex Shares:

- support and cause to be placed on the ballot at each election of Directors of Robex, one name which shall be a nominee proposed to be appointed as a new member of the Board of Directors of Robex the name of whom shall have been notified in writing by the Sellers (Sellers' Director); and

- support and cause the nomination and appointment of the Sellers' Director to each of the Purchaser's Audit Committee, Remuneration Committee and Nomination Committee.

Significant Conditions to Closing

The completion of the Transaction is subject to a number of conditions precedent including, but not limited to: (i) the receipt by Robex of a NI43-101 technical report on the Kiniero Project and the acceptance of same by the TSX Venture Exchange (the Exchange); (ii) the approval of the Transaction by the Exchange, including the listing of the Robex Shares to be issued as consideration to the Sycamore shareholders pursuant to the Share Purchase Agreement; (iii) the absence of any material change or change in a material fact which might reasonably be expected to have a material adverse effect on the financial or operation conditions or the assets of either of Sycamore or Robex; (iv) dispose of its interest in the Lomati Project (and related entities) and (v) certain other conditions customary in a transaction of this nature. As a result of this Transaction, Kiniero and Mansounia will become material properties for Robex. On the other hand, the Lomati properties and related entities will be disposed prior to or concurrently with the closing of the Transaction and therefore not material.

Financial Information Concerning Sycamore

The following table sets out certain selected financial information regarding Sycamore and Sycamore Mine Guinee SAU as of December 31, 2021 (unaudited). The selected information was prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. The information provided below are not audited and should not be relied upon. These numbers are currently being audited by Sycamore Mining auditors for the Closing and will be published in full in the Business Acquisition Report.

| As of December 31, 2021 (unaudited) | USD | CAD (1) | ||

| Revenue | --- | --- | ||

| Net Results | $(14,088,525) | $(17,757,153) | ||

| Total Assets | $22,734,264 | $28,654,227 | ||

| Total Liabilities | $12,071,803 | $15,215,280 | ||

| Shareholders’ Equity | $10,662,460 | $13,438,946 | ||

| (1) 1 CAD = 0.7934 exchange closing rate as of April 18, 2022 | ||||

Directors and Senior Management of Sycamore Mining and Sycamore Mine Guinee SAU who will remain after closing

Sycamore Mining director:

- Loizos Timinis is chartered accountant and is working as a partner at Timkas Global, a tax, accounting and advisory firm based in Cyprus. He studied Economics at the London School of Economics and Political Science (LSE) and qualified with BSG Valentine as a Chartered Accountant.

Sycamore Mine Guinee SAU director:

- Michael Malka is currently deputy Director and the country manager for Sycamore Mine Guinée SAU. He has more than 30 years of experience in business transaction across the world (Canada, China, and Africa) in a wide range of industries. He graduated from the University of Quebec with a degree in Management and Finance.

Transaction Highlights

Scale of development portfolio: The Kiniero project combine >3.4Moz of recent and historical resources** estimates. NI 43-101 compliant resources and reserves are due early Q2 2022.

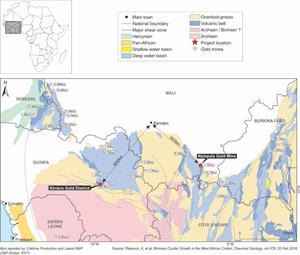

Further prospectivity: The Kiniero Project represents one of the largest exploitation packages in Guinea located in the highly prospective Kiniero Gold District - where immediate neighbours (Predictive Discovery PDI:ASX and Hummingbird Resources AIM:HUM) are advancing multimillion ounce projects.

A rapid mine development opportunity: The Kiniero Project represents a near-term mine development opportunity (targeting production in 2024). Sycamore has previously invested more than USD 20 million over several years (reaching DFS level designs), with mining and environmental permitting previously secured. A rapid conversion of this prior work is now underway to provide for the increased production scale that the combined group is planning for this asset.

A lower risk mine development opportunity: The Kiniero Project was a former producing operation (2002 to 2014) which means that its ore types are well understood with reported recoveries > 90%.

A fast-track mine development opportunity: All the infrastructure from the former mining operation have been refurbished and upgraded with an operational airstrip, a management camp (65 pax capacity), a village camp (110 pax capacity) and a workshop.

Social impact: The vision of the combined Robex and Sycamore boards is to scale up the Kiniero Project (from a previously envisaged 1Mtpa plant to 3Mtpa). This business approach drives a larger employment footprint for Guinea and the Kankan region. Given that Robex’s Nampala Mine is the only ISO 45001:2018 certified operation in Mali, Robex will be able to bring this standard in HSE practice to bear in the development of the Kiniero Mine and the training.

Complementary skill sets: Robex’s management have had success in the turnaround story of the Nampala mine is looking to bring that expertise in lean plant development to bear on Sycamore’s asset base. In turn, Sycamore’s strength in geology is helping to reappraise Robex’s own resource development pipeline.

Geographic Synergies: Both Nampala Mine and Kiniero are at equal distance from Bamako, share regionally similar geology, languages, and experienced suppliers.

Corporate strength: Combined group will have an existing production base, a strong balance sheet with no debt, a free cash flowing asset and a strong management team with proven experience in mine development and stakeholder value creation.

A short-term production opportunity: The Kiniero mine produced 436,346 oz at an average recovery of 90.4% from 5.36 Mt of ore. The operation was placed on care-and-maintenance in 2014 with 271 Koz of remaining Reserves at 2.27 g/t and 1,284 Koz of Resources at 2.43 g/t according to historical internal reporting.

The production strategy of the prior operators was to run lower volumes at higher grade (the plant had a capacity of 640 Ktpa). The new vision for the Kiniero Project’s restart is to process ore at higher volumes and lower average grades with a plant rated at 3Mtpa, with an estimated capital expenditure of circa USD 175 million.

Short-term program:

During the interim period up to closing of the Transaction, Robex will advance, from its working capital, the funds necessary to complete the NI43-101 technical report that will be required for the closing and approval of the Transaction. Following the closing of the Transaction, Robex is also expected to fund, through its working capital and the cash flow generated from its current operations, the work program up to the construction decision. The work program includes amongst other items: in-fill drilling, near mine exploration, geotech, plant design, mine scheduling/design, infrastructure, TSF (Tailings Storage Facility) and environmental.

This new strategic plan is underpinned by Historical resources**:

Table 1: Summary of Historic Resources (inclusive of Reserves)

| Tonnes (Mt MI&I) | Grade (g/t) | MOz | Source | |

| 2020 Kiniero | 50.6 | 1.29 | 2.1 | Independant report |

| 2012 Mansounia | 52 | 0.8 | 1.3 | Independent report |

| Total | 103 | 3.4 | ||

| Rounding may result in discrepancies. Values extracted from various reports by Sycamore. Resources inclusive of reserves. All historic resources are classified as Measured, Indicated, and Inferred as defined under the respective codes and CRIRSCO (2012). | ||||

The 3.4 Moz historic resources on Kiniero and Mansounia are comprised of:

- For Kiniero, an unpublished independent feasibility study of 2.1Moz completed by Sycamore according to JORC 2012 guidelines in 2020. This work details a complete review of the QA/QC, database, resources, and mining assumptions. It includes detailed work on the plant design, tailings storage facilities, hydrology and ESIA. The resources were completed by Sycamore geologists and reviewed independently. The reserves, plant design and TSF were based on a 1Mtpa plant with this work completed by independent contractors to a feasibility level. A full Table 1 was generated per JORC requirements. This report was not published due to fundamental changes in the project scope and economics which will be reflected in the 2022 Resource and NI 43-101 PFS at closing of the Transaction.The 3.4 Moz historic resources on Kiniero and Mansounia are comprised of:

- For Mansounia, a 1.3 Moz resources report under JORC (2004) guidelines published by Runge on behalf of the then owners Burey Gold (ASX:BYR) in 2012. This report was completed by independent consultants according to JORC 2012. The resource was estimated using ordinary kriging with acceptable assumptions and constraints. Reasonable limits were placed on classification. The JORC Table 1 was completed appropriately with no material exclusions noted. The resource was not constrained within an economic pit and is reported in-situ and undiluted at a cut-off of 0.4 g/t. A review of the modelling and report show that the results are appropriate for the level of information and assumptions at the time.

The historical resources** have been included to demonstrate the mineral potential of the Kiniero Project (inclusive of Mansounia) for which a new NI 43-101 compliant resources will be released at closing of the Transaction. This entire resource will be re-estimated in the new 2022 mineral resource estimate, in conjunction with the ongoing engineering work, will be the basis to prepare the Pre-Feasibility Study ("PFS") in accordance with NI 43-101 reporting guidelines with the addition of:

- 2 years of additional drilling and interpretation: A larger resource and reserve base driven by Sycamore’s development work over the last few years, and

- Mansounia property: The addition of Mansounia block adjacent to the Southern boundary of the Kiniero Project.

**Cautionary Statements on Resources

Kiniero Historical Resource** (2020): This resource estimate is effective 30 November 2020 and contains the following:

| Tonnes (Mt) | Grade (g/t) | Contained Gold (MOz) | |

| Indicated | 27.9 | 1.30 | 1.2 |

| Inferred | 22.6 | 1.28 | 0.9 |

| Rounding may affect totals | |||

The resource is based on validated historical RC and Diamond drilling along with more recent Sycamore RC drilling. The orebodies were modelled and constrained using indicator probability shells using iteratively derived indicators to best represent continuity of mineralization. The grades were estimated into parent blocks sized to half the data spacing using ordinary kriging with hard boundaries between mineralized envelopes. Classification was based on data density and was guided by historical performance. The resources were constrained within economic pits shells calculated using USD 1750/oz Au and 90% recovery. This resource has not been published and has not been reported to NI 43-101 standards. It was reported under JORC (2012) which is part of CRIRSCO as is Canada. This historical resource** estimate is not being treated as a current resource or reserve estimate. There has been additional drilling completed since the 2020 DFS and this new data will be included in a remodeling of the orebodies in an updated 2022 PFS under NI 43-101 standards.

Mansounia Historical Resource** (2012): This resource was modelled and estimated by independent Consultants Runge Limited and was effective May 2012. The resource complies with the recommendations in the Australian Code for Reporting of Mineral Resources and Ore Reserves (2004) by the Joint Ore Reserves Committee (JORC). It contains the following in-situ, undiluted resource of:

| Tonnes (Mt) | Grade (g/t) | Contained Gold (MOz) | |

| Indicated | 6.1 | 0.7 | 0.132 |

| Inferred | 45.9 | 0.8 | 1.14 |

| Rounding may affect totals Reported at a cut-off of 0.4 g/t | |||

The 2012 Mineral Resource was estimated in Datamine. It also contains a prior resource estimate for the northern portion of the license which was completed in 2009. The interpolation was constrained by mineralisation envelopes prepared using a nominal 0.2 g/t Au cut-off. A series of north-east trending faults are interpreted to bound the primary mineralisation and have been accounted for in the modelling. The Mansounia Resource estimate is classified as Indicated where the laterite has been defined by 100 m by 40 m spaced drilling. However, the majority of the Mansounia Resource estimate, though showing geological continuity is classified as Inferred as a result of the sparse drill density particularly with respect to the definition of the primary lodes” (Runge 2012). The gold assays were done using Bulk Leach Extractable Gold (BLEG) process and AAS analysis as the intent was to heap leach the deposit. This assay technique is likely to have underestimated the gold recoverable through conventional CIL processing. The resource has not been tested for reasonable prospects of eventual extraction. This historical resource** estimate is not being treated as a current resource or reserve estimate. It will be necessary to redrill the deposit and re-model it as part of the greater Kiniero district. At this time the Mansounia licence is covered under an exploration permit with full ownership by Sycamore dependent on the completion of an agreed work program and a successful submission of an exploitation permit application in mid 2022.

Qualified Person

Justin Glanvill (MSc (Eng), Pr.Sci.Nat.), Mineral Resource Manager for Sycamore Mining, is the Qualified Person (QP) for the Company as defined by National Instrument 43-101 and has approved the technical disclosure contained in this press release. Mr Glanvill is representing that the historical resources** have been transcribed in this press release appropriately but is not signing of as a QP on historical resources** as described in the 2020 Kiniero and 2012 Runge resource statements.

About Robex Resources Inc

For more information:

Robex Resources Inc.

Benjamin Cohen, CEO

Aurélien Bonneviot, investors relations and corporate development

investor@robexgold.com

www.robexgold.com

Head office: +1 (581) 741-7421

Forward looking Statement

This news release contains statements that may be considered “forward looking information” or “forward looking statements” in terms of security legislation. These forward looking statements are subject to uncertainties and risks, some of which are beyond the control of Robex. Achievements and final results may differ significantly from forecasts made implicitly or explicitly. These differences can be attributed to many factors, including geopolitical risk, market volatility, the impact of the exchange rate and interest rate fluctuations, mispricing, the environment (hardening of regulations), unforeseen geological situations, unfavourable operating conditions, political risks inherent in mining in developing countries, changes in government policies or regulations (laws and policies), an inability to obtain necessary permits and approvals from government agencies, or any other risk associated with mining and development. In particular, this press release contains forward looking statements concerning the completion of the proposed acquisition of the Kiniero Project, the potential development and exploitation of the Kiniero Project and the Company’s existing mineral properties and business plan, including the completion of feasibility studies or the making of production decisions in respect thereof. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the ability of the Company to complete conditions precedent to the acquisition, including the receipt of regulatory approvals, the completion of the Company’s due diligence review in relation to the proposed acquisition, and the Company’s ability to complete the planned funding to undertake its future work programs, and results of future exploration activities by the Company. There can be no assurance that the circumstances set out in these forecasts will occur, or even benefit Robex, if any. The forecasts are based on the estimates and opinions of the Robex management team at the time of publication. Robex makes no commitment to make any updates or changes to these publicly available forecasts based on new information or events, or for any other reason, except as required by applicable security laws.

Completion of the Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as further disclosed in a subsequent news release in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Images accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab7434b2-0092-4d9d-9c47-e0c239141d2d

https://www.globenewswire.com/NewsRoom/AttachmentNg/55a2107d-97a9-4748-9c67-2d1885ce8449