Roxgold Reports Record Cash Flow Generation In 2019

Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) today reported its fourth quarter and full year financial results for the period ended December 31, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200305005879/en/

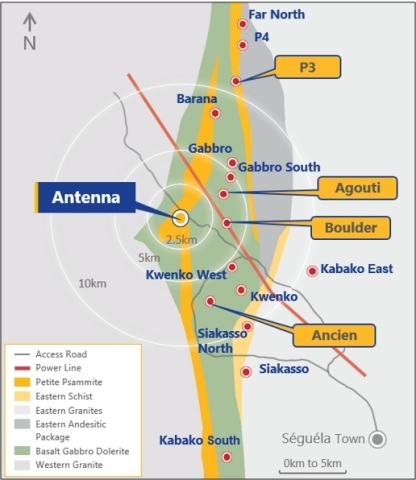

Figure 1: Seguela Location Plan (Graphic: Business Wire)

For complete details of the audited Consolidated Financial Statements and associated Management’s Discussion and Analysis please refer to the Company’s filings on SEDAR (www.sedar.com) or the Company’s website (www.roxgold.com). All amounts are in U.S. dollars unless otherwise indicated.

Full Year 2019 Highlights:

During the year ended December 31, 2019, the Company:

Safety

- Continued a strong safety record with no lost time injuries recorded over the last twelve months

Operations

- Record annual production of 142,204 ounces compared to 132,656 ounces in 2018

- Record plant throughput of 466,157 tonnes in 2019 exceeding nameplate capacity by 16%

- Cash operating cost2 of $489 per ounce produced and all-in sustaining cost2 of $844 per ounce sold

- Operating costs2 of $149 per tonne processed were 19% lower than 2018 due to increased throughput and improved efficiencies

Financial

- Sold 140,800 ounces of gold1 for a total of $196.2 million in gold sales1 in 2019 (133,030 ounces and $169.2 million respectively in 2018)

- Achieved an adjusted EBITDA2 and adjusted EBITDA margin2 of $83.3 million and 43% respectively in 2019 compared to $83.7 million and 49% in 2018

- Generated improved cash flow from mining operations2 totalling $98.3 million for cash flow from mining operations per share2 of $0.27 (C$0.34/share)

- Adjusted net income2 of $19.5 million ($0.05 per share) in 2019 compared to $37.4 million ($0.10 per share) in 2018

- Produced a mine operating margin2 of $825 per ounce and a return on equity2 of 11%

Growth

- Bagassi South achieved commercial production in September 2019

- Completion of the Séguéla Gold Project acquisition from Newcrest Mining in April 2019

- Reported an updated Mineral Resource Estimate for the Séguéla Gold Project in January 2020 with Total Indicated Mineral Resources increasing 7% to 529,000 ounces and Inferred Mineral Resources increasing 1,286% to 471,000 ounces

- New high grade discovery at Boussoura, Burkina Faso

Fourth Quarter 2019 Highlights:

During the quarter ended December 31, 2019, the Company:

- Record quarterly gold production of 41,162 ounces, an increase of 59% compared to 25,844 ounces produced in Q4 2018

- Plant throughout 131,439 tonnes in Q4 2019, exceeding nameplate capacity by 30%

- Achieved a cash operating cost2 of $466 per ounce produced for a total cash cost2 of $576 per ounce sold and all-in sustaining cost2 of $914 per ounce sold

- Generated cash flow from mining operations2 totalling $30.7 million for cash flow from mining operations per share2 of $0.08

“It has been a transformative year for Roxgold with the Séguéla Gold Project acquisition and recent exploration success with the new high grade discovery at Boussoura,” commented John Dorward, President and CEO of Roxgold. ”At Yaramoko, we continued to see strong operating performance and cashflow generation. Yaramoko achieved record production of 142,204 ounces of gold and record plant throughput of 466,157 tonnes exceeding nameplate capacity by 16% in 2019. We have also delivered on our growth objectives by successfully achieving commercial production at the Bagassi South mine in September 2019. As a result of the strong operational performance, we generated approximately $100 million in cash flow from mining operations for the year. This has enabled us to strengthen our balance sheet finishing the year with approximately $42 million in cash and in a net cash position of $16 million.

“We are looking forward to an exciting 2020 as we rapidly advance the Séguéla Gold Project. The Séguéla Gold Project has become a substantial value accretive project for Roxgold, and we believe the updated mineral resource announced in January 2020 underscores the potential for this project to deliver on our aspirations of being the next West African multi-asset gold producer. Our next priority will be the completion of a preliminary economic assessment on the Séguéla Gold Project in the second quarter of this year. We are very excited by Séguéla’s significant potential, notably at the Ancien deposit which remains open at depth and along strike, as well as the potential within the Boulder-Agouti corridor and the additional 22 highly prospective targets that have been identified. At Boussoura, we look forward to growing the current mineralized footprint and setting up the potential for Roxgold’s third high grade project.”

2019 Review

Safety continues to be our priority with no lost time injuries recorded in 2019. At Yaramoko, we continued to see strong operating performance and cashflow generation. Yaramoko achieved record production of 142,204 ounces of gold relative to low end of guidance of 145,000 ounces. This represented a 7% increase from the previous year primarily due to record plant throughput of 466,157 tonnes exceeding nameplate capacity by 16% in 2019. We also delivered on our growth objectives by successfully achieving commercial production at the Bagassi South mine in September 2019.

Cash operating cost2 of $489 was above the guidance range of $440 to $470 per ounce primarily due to the lower gold production. All-in sustaining cost2 of $844 was above guidance range of $765 to $795 per ounce sold primarily due to lower than forecasted gold production and higher royalties and levies due to the higher gold price and the introduction of a 1% levy toward a mining fund for local development. This increased royalties by $26 per ounce sold relative to guidance.

In April 2019, the Company announced the successful acquisition of Séguéla Gold Project from Newcrest West Africa Holdings Pty Ltd. The Company immediately commenced drilling leading to an updated Mineral Resource Estimate for the Séguéla Gold Project in January 2020 with Total Indicated Mineral Resources increasing 7% to 529,000 ounces and Inferred Mineral Resources increasing 1,286% to 471,000 ounces (refer to the press release titled “Roxgold Announces a Significant Increase in Mineral Resources at the Séguéla Gold Project” dated January 29, 2020 for more information). This led to exploration spend being higher than guidance due to the accelerated drilling programs at Séguéla. This increase in Resources was value accretive as it was achieved at a cost of only $7 per ounce.

We continued to strengthen our balance sheet finishing the year with approximately $42 million in cash and in a net cash position2 of $16 million.

2020 Operating Outlook

- Gold production between 120,000 and 130,000 ounces

- Cash operating cost2 between $520 and $580/ounce

- All-in sustaining cost2 between $930 and $990/ounce

- Non-sustaining capital spend of $5-$10 million

- Growth spend (includes Exploration and Séguéla study spend) of $15-$20 million

The increase in AISC is attributed to higher projected capital spend as the Bagassi South decline development is completed in 2020 along with enhanced security infrastructure investment. Growth spend is forecast to increase this year to $15-$20 million due to accelerating the drilling program at Séguéla and Boussoura following recent exploration successes at these projects.

Mine Operating Activities

|

Year ended December 31 2019 |

Year ended December 31 2018 |

|

|

|

Operating Data |

|

|

Ore mined (tonnes) |

479,929 |

351,689 |

Ore processed (tonnes) |

466,157 |

307,591 |

Head grade (g/t) |

9.5 |

13.5 |

Recovery (%) |

98.2 |

98.6 |

Gold ounces produced |

142,204 |

132,656 |

Gold ounces sold1 |

140,800 |

133,030 |

|

|

|

Financial Data (in thousands of dollars) |

|

|

Revenues – Gold sales1 |

196,151 |

169,172 |

Mining operating expenses |

(69,371) |

(57,270) |

Government royalties |

(10,680) |

(7,529) |

Depreciation and depletion |

(51,823) |

(34,926) |

|

|

|

Statistics (in dollars) |

|

|

Average realized selling price (per ounce) |

1,393 |

1,272 |

Cash operating cost (per tonne processed)2 |

149 |

184 |

Cash operating cost (per ounce produced)2 |

489 |

426 |

Total cash cost (per ounce sold)2 |

568 |

485 |

Sustaining capital cost (per ounce sold)2 |

216 |

196 |

Site all-in sustaining cost (per ounce sold)2 |

784 |

683 |

All-in sustaining cost (per ounce sold)2 |

844 |

740 |

Health and safety performance

There were no Lost Time Injury (“LTI”) incidents in 2019 with over 2.5 million hours worked.

Operational performance

The Company’s gold production in 2019 was 142,204 ounces at a head grade of 9.5 g/t compared to 132,656 ounces at 13.5 g/t in 2018. The 7% increase in gold production was mainly driven by higher tonnes processed in 2019 partially offset by lower head grade. The lower average head grade was primarily due to the ramp-up of the Bagassi South underground mine which delivered lower grade development ore during the year.

During 2019, 479,929 tonnes of ore at 8.9 g/t were extracted from the underground mines along with completing 6,346 metres of development compared to 351,689 tonnes of ore at 11.7 g/t and 5,826 metres of development in 2018. The 55 Zone mine produced 357,376 tonnes at 9.9 g/t and the Bagassi South mine contributed 122,553 tonnes at a grade of 6.0 g/t.

The mining tonnage increase of 36% was due to more levels available to extract ore following commencement of stoping activities at the Bagassi South mine in July 2019. During 2019, approximately 64% of ore produced came from stoping activities and 36% from development.

In September 2019, Bagassi South achieved commercial rates of ore production having mined in excess of 75% of mine capacity with 39% of ore mined coming from stoping activities during that month. Development continued to progress well during the year with 5,629 metres of development completed.

Decline development at the 55 Zone mine reached the 4794 level, approximately 520 metres below surface. Ore development was completed between the 4913 and 4811 levels. The development of the Bagassi South decline reached the 5129 level and stoping operations commenced on the 5180 and 5197 levels. Both mines continue to be well positioned to meet future production requirements with developed reserves for stoping in line with the Company’s planned stoping objectives for 2020.

Mine reconciliation performance between the Ore Reserve and Grade Control model was 97% in the last quarter of 2019.

The plant processed a record 466,157 tonnes at an average head grade of 9.5 g/t in 2019 compared to 307,591 tonnes of ore at 13.5 g/t in 2018. The increased throughput is due to the completion and successful commissioning of the plant expansion project and represents a unit throughput rate that is 16% above nameplate capacity. Plant availability was 96.2% and overall recovery was 98.2% in 2019 compared to 95.4% and 98.6% in 2018.

Cash operating costs2 of $149 per tonne processed represented a 19% reduction compared to 2018 driven by increased throughput and strong cost control at Yaramoko Gold Mine.

Financial Performance

Gold sales1 in 2019 totalled $196.2 million from 140,800 ounces of gold1. During the year, the Company’s average realized gold price was $1,393 per ounce sold in line with the average market gold price of $1,393 per ounce.

The Company continued to extract cost and volume efficiencies with the cash operating cost2 per tonne processed reducing by 19% compared to the prior year ($149 per tonne in 2019 compared to $184 per tonne in 2018).

The cash operating cost2 per ounce produced totalled $489 per ounce for the period compared to $426 per ounce in the prior year mainly driven by the lower head grade.

The total cash cost2 per ounce sold of $568 in 2019 was higher compared to $485 per ounce sold in 2018. This was primarily impacted by the lower head grade and the higher gold price in the year which increased royalty payments by $19 per ounce sold. As a result, the Company achieved a site all-in sustaining cost2 of $784 per ounce sold and an all-in sustaining cost2 of $844 per ounce sold in the twelve-month period in 2019 compared to $683 per ounce and $740 per ounce sold, respectively in the comparable 2018 period. The Company generated a cash mine operating margin2 of $825 per ounce in 2019 which was 22% higher than in 2018 mainly due to the higher average gold sales price.

The Company invested $25.3 million in underground mine development at 55 Zone in 2019 and $5.1 million at Bagassi South in the last quarter of 2019. Additionally, the Company invested $18.1 million in pre-commercial production underground mine development at Bagassi South mine, compared to $5.4 million for the comparable period in 2018.

The Company generated strong cash flow from mining operations2 of $98.3 million in 2019, for cash flow from mining operations per share2 of $0.27 (C$0.34/share). Comparatively, the Company generated cash flow from mining operations2 of $88.8 million and $0.24 cash flow from mining operations per share2 in the prior year.

Review of Annual 2019 financial results

Mine operating profit

During the year ended December 31, 2019, revenues totalled $182.0 million (2018 - $168.9 million) while mine operating expenses and royalties totalled $59.9 million (2018 - $57.3 million) and $10.0 million (2018 - $7.5 million), respectively. The increase in sales is primarily due to increase in production driven by higher throughput and higher average realized gold price. During the year, the Company achieved total cash cost2 per ounce sold of $568 and a mine operating margin2 of $825 per ounce sold.

For more information on the cash operating costs2 see the financial performance of the Mine Operating Activities section of this MD&A.

During 2019, depreciation totalled $51.1 million compared to $34.9 million in 2018. The increase in depreciation is a result of the Company’s continued investment in the underground development of 55 Zone and Bagassi South combined with a higher throughput in our processing facility.

General and administrative expenses

General and administrative expenses remained consistent totaling $5.4 million for 2019 compared to $5.3 million in 2018.

Sustainability and other in-country costs

Sustainability and in-country costs totalled $3.0 million for the year ended December 31, 2019, respectively compared to $2.2 million for the comparative period. The increase in expenditures relates to the increased projects and investment in the community. These expenditures are incurred as part of Roxgold’s commitment to responsible operations in Burkina Faso including several sustainability and community projects.

Exploration and evaluation expenses (“E&E”)

Exploration and evaluation expenses totalled $16.1 million in 2019 compared to $8.0 million in 2018. In 2019, the Company increased its exploration spend primarily due to the acquisition of the Séguéla Gold Project and subsequent drilling to increase the Resource estimate as well as study costs. During the year ended December 31, 2019, E&E expenses totalled $8.6 million at the Séguéla Gold Project, $6.9 million at the Yaramoko Gold Mine and $0.6 million at Boussoura.

Drilling costs totalling $2.2 million that were incurred at the 55 Zone to convert resources to reserves or to extend the existing resource body have been capitalized in accordance with the Company’s accounting policy as future economic benefits are expected.

Share-based payments

Share-based payments totalled $2.5 million in 2019 compared to $1.9 million in 2018. The increase is due to the increase in the Company’s share price and issuance of Deferred Stock Units (“DSUs”), Performance Share Units (“PSUs”) and Restricted Share Units (“RSUs”) to the Company’s employees and directors.

Financial expenses

Net financial expense totalled $18.7 million in 2019 compared to $7.9 million in 2018. The increase is mainly attributed to the change in the fair value of the Company’s gold forward sales contracts, which represented a $7.7 million unfavourable change period over period. The remainder of the movement during the period related to an increase in other expenses and financing fees of $4.8 million primarily relating to the three items: the tax settlement for FY 2015 and 2016 of $1.5 million, the sale of approved VAT of $1.4 million and the net contribution to the local mining development fund for FY 2017 and 2018 of $1.1 million. The increase in financial expenses were partially offset by a positive movement in foreign exchange gain (loss) of $1.0 million.

Current and deferred income tax expense

The current income tax expense is higher than last year as the Company’s past cumulative losses were fully utilized in 2018. Therefore, the current income tax expense is due to the Company earning profits from its operations in Burkina Faso. The higher effective tax rate is also due to the significant increase in exploration expenditures in 2019 incurred in Burkina Faso and Cote d’Ivoire not being tax effected due to the Company’s status under the mining regulations.

Net income & EBITDA

The Company’s net income and EBITDA2 in 2019 was $5.7 million and $69.4 million, respectively compared to $36.1 million and $82.4 million, respectively in 2018. Net income was lower in the period primarily as a result of the Company’s focus on growth with significant investments in exploration and evaluation at Séguéla, higher depreciation due to increased capital investment, higher tonnes processed and an unfavourable change in the fair value of the Company’s gold forward sales contracts.

Income Attributable to Non-Controlling Interest

For the year ended December 31, 2019, the income attributable to the non-controlling (“NCI”) interest was $3.5 million. The Government of Burkina Faso holds a 10% carried interest in Roxgold SANU SA and as such is considered Roxgold’s NCI. The NCI attributable income is based on IFRS accounting principles and does not reflect dividend payable to the minority shareholder of the operating legal entity in Burkina Faso.

Growth Performance

Séguéla Gold Project

Exploration activities have continued to progress with the objective of delineating additional mineral resources within close proximity to Antenna. The current targets, including Agouti, Boulder and Ancien, are within 10 kilometres of the Antenna deposit (Figure 1). There were 4 RC/diamond core rigs active throughout the last quarter of 2019.

Figure 1: Séguéla Location Plan

Antenna

Fifteen RC and diamond holes (3,782 metres) were completed at Antenna and were included in the updated Séguéla Mineral NI 43-101 Resource which includes the Antenna deposit (refer to the Company’s press release dated January 29, 2020). This drilling was successful in defining extensions to the mineralization which were identified during the resource modelling process as having potential for additional mineralization.

Mineralization is preferentially associated with a rhyolitic porphyry and a series of north-south striking faults, bounded by volcaniclastics and mafic units in the footwall and ultramafic units in the hanging wall, and associated with sericite quartz-pyrite alteration and quartz veining. All results will be incorporated into a Preliminary Economic Assessment (“PEA”) anticipated for release in Q2 2020.

Boulder

4,573 metres of RC and diamond core holes were drilled to infill and extend mineralization at the Boulder prospect which formed the basis of the maiden Inferred Resource Estimate of 1.9Mt at 1.2g/t Au for 72koz (refer Company press release January 29, 2020). High grade mineralization is interpreted as associated with a series of north-east trending shear-controlled quartz veins along the contact of a rhyolite/mafic unit. Mineralization remains open at depth.

Agouti

Infill and extension RC and diamond core drilling at Agouti led to the development of a maiden Inferred Resource Estimate of 1.3Mt at 2.6g/t Au for 110koz (refer to Company press release January 29, 2020). Multiple zones of high-grade mineralization were intersected at Agouti, confirming the recently revised structural model and mineralization controls. Mineralization remains open at depth.

Ancien

At Ancien, approximately 7 kilometres south-east of Antenna, 28 RC/DD drill holes have been completed, infilling and extending a well-defined and broad zone of high-grade mineralization to more than 220 metres where it remains open. A maiden Inferred Resource Estimate of 1.1Mt at 6.6g/t Au for 224koz was released on January 29, 2020.

High grade gold is associated with zones of intense quartz veining and minor sulphides (pyrite-pyrrhotite) within a 30-50m wide envelope of strongly sheared tholeiite basalt. Additionally, the Ancien host structure can be traced in regional aeromagnetics for several kilometres to the north and south of Ancien.

Figure 2: Ancien Long Section Highlights

The Company released the following NI 43-101 Mineral Resource Estimate for the Séguéla Gold Project on January 29, 2020. The Qualified Persons responsible for the mineral resource estimates are detailed below.

Table 1: Séguéla Mineral Resource Statement Summary

|

Measured Mineral Resources(1) |

Indicated Mineral Resources(1) |

Inferred Mineral Resources(1) |

||||||

Tonnes |

Grade |

Ounces |

Tonnes |

grade |

Ounces |

Tonnes |

grade |

Ounces |

|

(000) |

g/t Au |

(000) |

(000) |

g/t Au |

(000) |

(000) |

g/t Au |

(000) |

|

Antenna |

- |

- |

- |

7,064 |

2.3 |

529 |

892 |

2.2 |

64 |

Boulder |

- |

- |

- |

- |

- |

- |

1,899 |

1.2 |

72 |

Agouti |

- |

- |

- |

- |

- |

- |

1,303 |

2.6 |

110 |

Ancien |

- |

- |

- |

- |

- |

- |

1,061 |

6.6 |

224 |

Total |

- |

- |

- |

7,064 |

2.3 |

529 |

5,155 |

2.8 |

471 |

Notes:

|

|||||||||

Boussoura Project

Located approximately 190km south of Yaramoko, RC and core drilling at the Boussoura project has led to a new high grade discovery at Galgouli, and excellent results following up historic drilling at Fofora (refer to Company press release February 3, 2020). The Boussoura project is located in the southern portion of the Houndé Greenstone Belt in southern Burkina Faso.

Galgouli

22 RC and diamond core drill holes were drilled at Galgouli identifying high grade mineralization along a >1km trend with drilling to a vertical depth of approximately 250m. High grade mineralization is associated with a series of steeply dipping quartz-chlorite-carbonate-pyrite veins with coarse gold (1-3mm) commonly identified on vein margins and selvedges. Veining is hosted by variably altered and sheared porphyritic andesites with 5-10m wide alteration zones hosting low grade (<1.5g/t) halos. Mineralization remains open along strike and at depth, with drilling continuing in Q1 2020 to infill and extend the strike extent where artisanal workings are indicative of further high grade extensions.

Fofora

At Fofora, 13 RC and DD holes have intersected high grade mineralization along a 500m zone of artisanal workings which remains open at depth and along strike. Mineralization is associated with several quartz-chlorite-carbonate-pyrite veins hosted by sheared and altered porphyritic andesites, commonly with coarse gold (1-3mm) associated with vein margins and selvedges, with broad (up to 40m) alteration zones hosting low grade (<1.5g/t) halos. Drilling will continue in Q1 2020, testing for depth and strike extents to the currently defined mineralization.

Corporate social responsibility activities (“CSR”)

Roxgold continued to perform well in Health, Safety and Sustainability (HSS) due to its collaborative and participative approach with its stakeholders, including employees, contractors and communities.

For 2019, the highlights are:

- No Lost Time Injury (LTI) incident since September 2018 and 3 million hours worked without an LTI

- Implementation of a leadership training program to increase employees’ management skills and Roxgold’s culture of excellence, teamwork and responsibility

- Implementation of the 2019 Community Investment Program that granted 40 projects in education, health, water and sanitation and economic development of the host communities with projects that originated from the local communities and have been selected by community members’ representatives.

- Roxgold was also the proud recipient this year of the ‘’Médaille d’Honneur des collectivités locales’’ from the government of Burkina Faso for our performance in community engagement since the start of our operation.

Conference Call and Webcast Information

A webcast and conference call to discuss these results will be held on Friday, March 6, 2020, at 10:00AM Eastern time. Listeners may access a live webcast of the conference call from the events section of the Company’s website at www.roxgold.com or by dialing toll free 1-844-607-4367 within North America or 1-825-312-2266 from international locations and entering passcode: 7292609.

An online archive of the webcast will be available by accessing the Company’s website at www.roxgold.com. A telephone replay will be available for two weeks after the call by dialing toll free 1-800-585-8367 and entering passcode: 7292609.

Notes:

- For the twelve-month period ended December 31, 2019, gold ounces sold, and gold sales include pre-commercial production ounces sold of 10,144 ounces and revenues of $14.2 million (251 ounces and revenues of $0.3 million for the comparable period in 2018). The pre-commercial production gold sales and mining operating expenses were accounted against Property, Plant and Equipment.

- The Company provides some non-IFRS measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results. Please refer to note 16 “Non-IFRS financial performance measures” of the Company’s MD&A dated March 5, 2020, available on the Company’s website at www.roxgold.com or on SEDAR at www.sedar.com for reconciliation of these measures.

Qualified Persons

Paul Criddle, FAusIMM, Chief Operating Officer for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed, verified and approved the technical disclosure contained in this news release.

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has verified and approved the technical disclosure contained in this news release. This includes the QA/QC, sampling, analytical and test data underlying this information. For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form dated December 31, 2018, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

For further information regarding the Yaramoko Gold Mine, please refer to the technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Worodougou Region, Cote d’Ivoire” dated July 23, 2019 (the “Séguéla Technical Report”) and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: statements with respect to Mineral Reserves and Mineral Resource estimates (including proposals for the potential growth, extension and/or upgrade thereof and any future economic benefits which may be derived therefrom), future production and life of mine estimates, production and cost guidance, anticipated recovery grades, and potential increases in throughput, the anticipated increased proportion of mill feed coming from stoping ore, future capital and operating costs and expansion and development plans including with respect to the 55 zone and Bagassi South, and the expected timing thereof (including with respect to the delivery of ore and future stoping operations), proposed exploration plans and the timing and costs thereof, the anticipated operations, costs, proposed funding, timing and other factors set forth in the Technical Report, and sufficiency of future funding. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. In certain cases, forward-looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Yaramoko Gold Project and other properties including the Séguéla Gold Project in the short and long-term, the progress of exploration and development activities as currently proposed and anticipated, the receipt of necessary regulatory approvals and permits, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters, as well as assumptions set forth in the Company’s technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Worodougou Region, Cote d’Ivoire” dated July 23, 2019 (the “Séguéla Technical Report” and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and SEDAR at www.sedar.com. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel, failure to obtain permits as anticipated or at all, failure of exploration and/or development activities to progress as currently anticipated or at all, and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200305005879/en/