Roxgold Returns High Grade Exploration Results From S?(C)gu?(C)la Gold Project

Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) is pleased to announce further infill and extension drilling results from the Company’s Séguéla Gold Project (“Séguéla”) located in Côte d’Ivoire.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200723005167/en/

Séguéla Satellite Prospects

Séguéla Gold Project, Côte d’Ivoire:

Highlights from Reverse Circulation (“RC”) and Diamond (“DD”) drilling

Ancien

-

14 metres ("m") at 13.3 grams per tonne gold ("g/t Au") in drill hole SGRD732 from 71m including

- 4m at 24.5 g/t Au from 71m and

- 2m at 18.8 g/t Au from 82m

-

35m at 5.5 g/t Au in drill hole SGDD066 from 136m including

- 3m at 23.1 g/t Au from 137m and

- 3m at 23.4 g/t Au from154m

-

5m at 35.6 g/t Au in drill hole SGRD731 from 61m including

- 3m at 54.8 g/t Au from 63m

-

9m at 2.2 g/t Au in drill hole SGRD735 from 78m and

- 13m at 5.6 g/t Au from 95m

- 10m at 3.9 g/t Au in drill hole SGRC745 from 61m

Antenna North

- 15m at 2.8 g/t Au in drill hole SGRC807 from15m

- 7m at 3.0 g/t Au in drill hole SGRC812 from 26m

- 3m at 5.4 g/t Au in drill hole SGRC813 from 19m

- 5m at 7.5 g/t Au in drill hole SGRC815 from 20m

- 4m at 6.8 g/t Au in drill hole SGRC816 from 24m

“The exploration successes we continue to demonstrate at Séguéla builds our confidence that the Feasibility Study, due for completion early next year, will outline a larger more robust project than what was defined in the Preliminary Economic Assessment,” stated John Dorward, President and Chief Executive Officer. “The continuing high grade results from infill and extension drilling at Ancien further underpin the high grade, high value contribution potential of the deposit to the mine plan. With four rigs currently turning, I am confident that we will continue to unearth further upside from the existing four deposits, while preliminary testwork on a suite of early stage targets on the property has demonstrated encouraging results and will be accelerated for drill testing later this year.”

Paul Weedon, Vice President Exploration commented “The infill results of the high grade core of Ancien continue to support the excellent continuity we see from section to section, following on from the high grade results released on June 26th which included 20m at 28.0 g/t from SGRD730. With two RC/DD rigs continuing to test and infill depth extensions beyond the PEA conceptual pit, I am confident we will see further upside emerge from Ancien. In addition to the Ancien results, we have received very encouraging shallow infill results from the Antenna North satellite pit, extending mineralization further north within the PEA conceptual pit.”

Séguéla Project

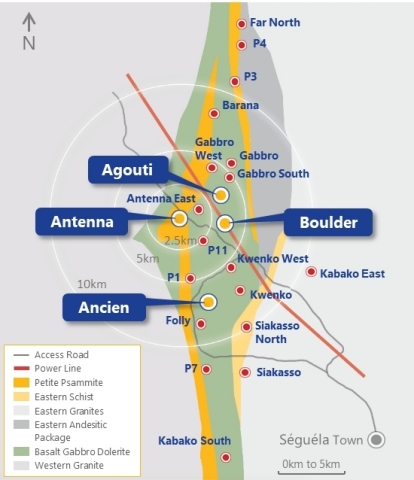

Exploration activities have continued to progress to extend and infill the existing Inferred Mineral Resources close to Antenna to support the Feasibility Study. Agouti, Boulder and Ancien, are within 6 kilometres of the Antenna deposit (Figure 1).

Figure 1. Séguéla Satellite Prospects

Ancien

Results from an additional 14 RC/DD holes have been received from Ancien, bringing to a total of 81 holes completed at Ancien since the drill hole data cutoff date (February 12th 2020) used to support the Inferred Resource estimate in the PEA of 261,000 ounces (refer Company release April 14th 2020).

These most recent results reflect the two objectives of the current program, namely a dedicated tightly spaced infill program for geostatistical support of the very high grade and continuous nature of the core Ancien mineralization, and targeting depth and strike extensions to the high-grade core beyond the PEA US$1,550/oz conceptual shell.

The results from the final four of six holes of the high grade infill program reinforce the broad nature of the high grade intervals previously intersected (Figure 2), both along strike as well as across the mineralized zone, and correlate well with the high levels of visible gold logged in the samples. These close-spaced infill results support the high grade tenor of the deposit and provide a strong degree of confidence in the geostatistical and geological continuity of the high grade core.

Infill drilling below the conceptual pit base returned 35m at 5.5g/t from SGDD066 in the centre of the high grade core while in an area previously modelled as waste in the conceptual pit, extension drilling returned 10m at 3.9 g/t Au from SGRC745 and 5m at 2.5 g/t Au from SGRC744, extending mineralization a further 25m to the south where it remains open.

Highlights from the most recent drilling at Ancien include:

Infill Drilling

-

14 metres ("m") at 13.3 grams per tonne gold ("g/t Au") in drill hole SGRD732 from 71m including

- 4m at 24.5 g/t Au from 71m and

- 2m at 18.8 g/t Au from 82m

-

35m at 5.5 g/t Au in drill hole SGDD066 from 136m including

- 3m at 23.1 g/t Au from 137m and

- 3m at 23.4 g/t Au from154m

-

5m at 35.6 g/t Au in drill hole SGRD731 from 61m including

- 3m at 54.8 g/t Au from 63m

-

9m at 2.2 g/t Au in drill hole SGRD735 from 78m and

- 13m at 5.6 g/t Au from 95m

- 12m at 2.3 g/t Au in drill hole SGRD734 from 73m

- 20m at 1.0 g/t Au in drill hole SGRC738 from 172m

Extension Drilling

- 10m at 3.9 g/t Au in drill hole SGRC745 from 61m

- 5m at 2.5 g/t Au in SGRC744 from 32m

Figure 2. Highlights of the Ancien results and assay status

Antenna North

An infill program designed to upgrade the drill spacing of the Antenna North deposits to Indicated spacing has been completed (Figure 3), with encouraging shallow results including:

- 15m at 2.8 g/t Au in drill hole SGRC807 from15m

- 7m at 3.0 g/t Au in drill hole SGRC812 from 26m

- 3m at 5.4 g/t Au in drill hole SGRC813 from 19m

- 5m at 7.5 g/t Au in drill hole SGRC815 from 20m

- 4m at 6.8 g/t Au in drill hole SGRC816 from 24m

Figure 3. Highlights of the Antenna North results

Séguéla Regional Reconnaissance

Mapping and reconnaissance sampling at Séguéla continues to emphasise the regional prospectivity of the property package with several prospects identified (Figure 4) where rock chip samples recorded several instances of high-grade visible gold. In addition to ongoing detailed field mapping, auger drilling is underway targeting the southern extensions of key favourable structural corridors that host the Antenna, Ancien-Boulder-Agouti, and Elephant-Kwenko North mineralization. Follow up scout RC drilling is planned in the second half of the year across these prospects.

Figure 4. Séguéla regional reconnaissance sampling program with key rock chip sample results

Click here to view the full listing of drill results from the recent drilling programs at the Séguéla Gold Project. Note: all results are reported as down-hole intervals which represent approximately 80% of true width.

Catalysts and Next Steps

Event |

Timing |

Drilling results from Boussoura |

Q3 2020 |

Ongoing infill, expansion and Feasibility-support drilling program at Séguéla |

Q3 2020 |

Satellite target exploration at Séguéla |

H2 2020 |

Underground drilling program in 55 Zone at Yaramoko Mine Complex |

H2 2020 |

Feasibility Study for Séguéla |

H1 2021 |

Séguéla construction decision |

H1 2021 |

Quality Assurance/Quality Control

All drilling data completed by Roxgold utilized the following procedures and methodologies. All drilling was carried out under the supervision of Roxgold personnel.

RC drilling used a 5.25 inch face sampling pneumatic hammer with samples collected into 60 litre plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Aircore (“AC”) drilling was collected in one metre intervals and sampled in a similar fashion to RC methods. Once collected, RC and AC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual 87.5% sample were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Company controlled core yard.

DD drill holes were drilled with HQ sized diamond drill bits. The core was logged, marked up for sampling using standard lengths of one metre. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at Séguéla. The other half was sampled, catalogued and placed into sealed bags and securely stored at the site until shipment.

All Séguéla RC, AC and DD core samples were shipped to ALS Laboratories preparation laboratory in Yamoussoukro for preparation. Samples were dried and crushed by the Lab and a 250-gram split prepared from the coarse crushed material, prior to pulverization and preparation of a 200g sample. Samples are then shipped via commercial courier to ALS’s analytical facility in Ouagadougou, Burkina Faso where routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the Lab inserted its own quality control samples.

Qualified Person

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release, including the QA/QC, sampling, analytical and test data underlying this information. Mr. Weedon verified the information in the news release by reviewing the drill logs, geological interpretations and supporting analytical data. No limitations were imposed on Mr. Weedon’s verification process. For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form dated December 31, 2018, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: economic statements related to the PEA, such as future projected production, capital costs and operating costs, statements with respect to Mineral Reserves and Mineral Resource estimates, recovery rates, timing of future studies including the feasibility study, environmental assessments and development plans. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. In certain cases, forward-looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the PEA, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, any potential upgrades of existing resource estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Company’s properties in the short and long-term, the progress of exploration and development activities, the receipt of necessary regulatory approvals, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: delays resulting from the COVID-19 pandemic, changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements, including the factors included in the Company’s annual information form for the year ended December 31, 2019. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200723005167/en/