RTG Completes Acquisition of 90% Stake in the High Grade Chanach Gold Project in the Kyrgyz Republic

ANNOUNCEMENT TO THE AUSTRALIAN SECURITIES EXCHANGE, TORONTO STOCK EXCHANGE AND OTCQB

SUBIACO, WESTERN AUSTRALIA / ACCESSWIRE / October 23, 2019 / RTG Mining Inc. (ASX:RTG, TSX:RTG, OTCQB:RTGGF) ("RTG" or "the Company") is pleased to announce that the Company has completed the acquisition of the majority (90%) stake in the high grade Chanach Gold and Copper Project ("Chanach Project") in the Kyrgyz Republic ("Transaction") previously announced on 6 September 2019[1]. The deal represents an acquisition cost of only US$3.65/ Au resource ounce and US$0.0063/ Cu resource ounce with the limited exploration activities to date having defined an Inferred Mineral Resource of 2.95 Mt @ 5.11 g/t Au for 484,000 ounces of Au and 17.23 Mt @ 0.37% Cu for 64,000t of Cu[2].

The Company agreed to acquire a 90% interest in the Chanach Project through the acquisition of 100% of PB Partners (Malaysia) Pte Ltd, a wholly owned subsidiary of White Cliff Minerals Ltd ("WCN"). As required under Chapter 11.2 of the ASX Listing Rules, WCN shareholder approval for the disposal of the Chanach Project was provided at a WCN general meeting held on 15 October 2019. Subsequent to WCN shareholder approval, RTG has settled its Transaction payment obligations consisting of: (i) cash consideration of US$2.15 million: and (ii) US$0.5 million in new RTG shares issued at a price equal to the 5-day VWAP of the RTG shares on the ASX for the 5 trading days leading up to completion of the Transaction (10,312,577)[3]. The new RTG shares were issued at a deemed price of A$0.071 per share under the Company's Listing Rule 7.1 capacity and will be escrowed for a period of 12 months from the date of issue.

RTG is now the manager and operator of the Chanach Project Joint Venture company (Chanach LLC) and will solely fund operating expenditures until completion of a Bankable Feasibility Study at which time, funding will then be contributed on a pro-rata basis in accordance with Chanach Project interests.

We refer shareholders to the announcement of the deal dated 6 September 2019 which provides a more detailed overview of the Chanach Project, where both we, and our consultant Mr Greg Hall, former Chief Geologist of Placer Dome, believe the exploration potential is excellent, with a strong expectation that it will become a development project with further drilling.

PROPOSED DRILLING PROGRAM AT THE CHANACH PROJECT

RTG plans to undertake a drilling program in November of 2019, coinciding with the end of the exploration field season in Kyrgyzstan.

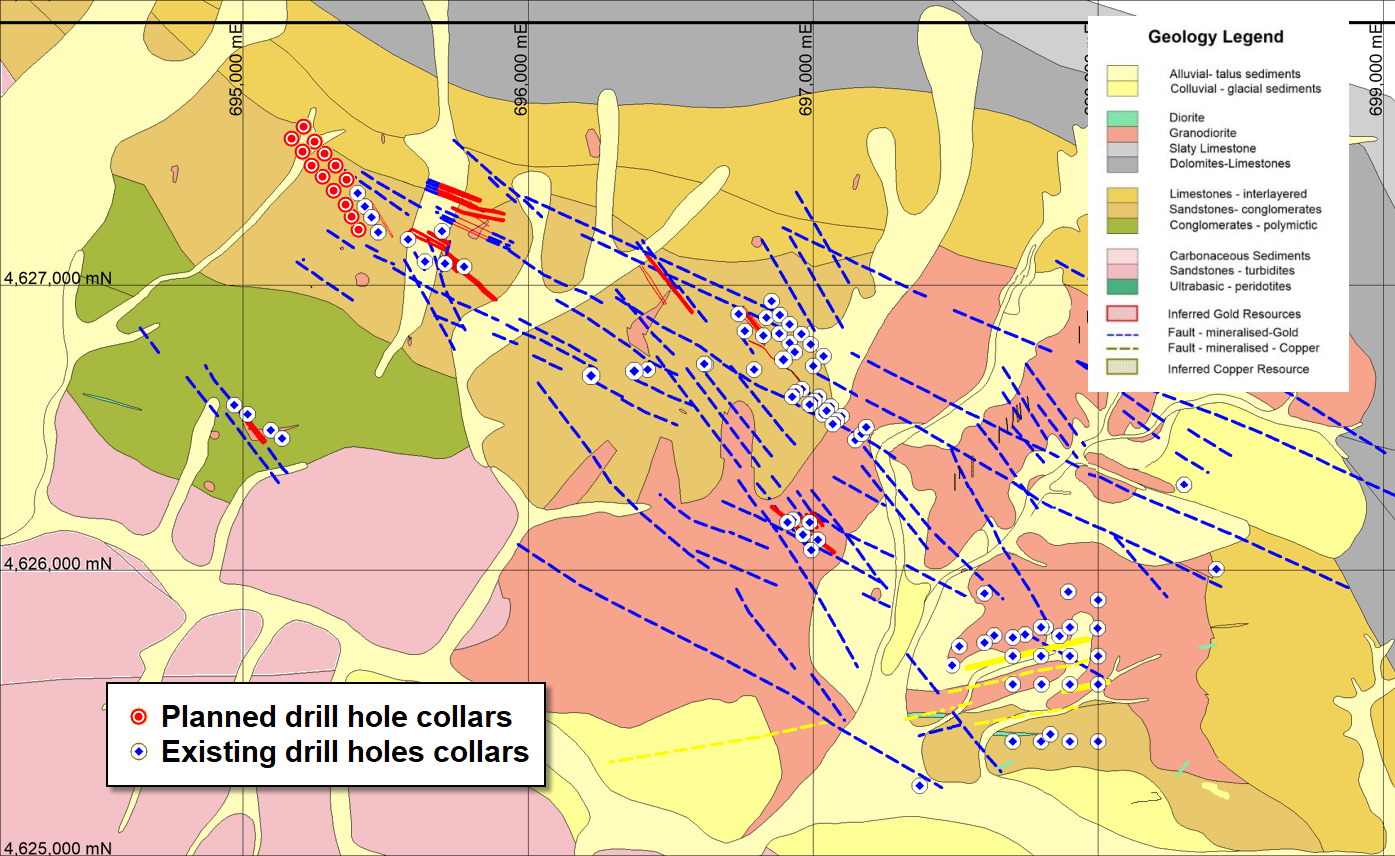

The objective of the drilling program is to test and extend the gold resource along strike in the Lower Gold Zone ("LGZ"). RTG expects the program will consist of 13 RC holes for a total estimated 1310 drill meters with hole depths ranging between 70m and 120m. The locations of the intended holes into the LGZ are shown in Figure 1 below.

Figure 1 - Drill Hole Locations

Assay results from the program can be expected in Quarter 1 of 2020. The 2019 program is targeted at seeking to grow the existing Inferred Gold Mineral Resource of 484,000 ounces at a similar grade of 5.1 g/t.

The current Gold Inferred Mineral Resource has been derived at an extremely cost-effective rate of US$11.80 / ounce and this metric is expected to improve with the ongoing enhancement and refinement of geological understanding and targeting.

The Chanach Gold Project has extensive outcropping mineralised geology with high grade gold veins from surface and significant gold and copper Inferred Mineral Resources. With only 5% of the identified strike length tested to date, RTG believes the Chanach Project has substantial upside potential.

The Chanach Project area is considered to be highly prospective for world class epithermal gold, porphyry copper-gold and polymetallic skarn deposits with numerous targets already identified. The current gold resources at Chanach are open at depth and along strike.

ABOUT RTG MINING INC

RTG Mining Inc. is a mining and exploration company listed on the main board of the Toronto Stock Exchange, Australian Securities Exchange Limited and the OTCQB Venture Market. RTG is focused on a proposal with a landowner lead consortium to secure an exploration licence at the high tonnage copper-gold Panguna Project in Bougainville PNG and the high grade copper/gold/magnetite Mabilo Project in the Philippines, while also identifying major new projects which will allow the Company to move quickly and safely to production, such as the Chanach Gold and Copper Project.

RTG has an experienced management team which has to date developed seven mines in five different countries, including being responsible for the development of the Masbate Gold Mine in the Philippines through CGA Mining Limited, RTG has some of the most respected and international institutional investors as shareholders including Franklin Templeton, Sun Valley, Sprott and Equinox.

ENQUIRIES

Australian Contact US Contact

President & CEO - Justine Magee Investor Relations - Jaime Wells

Tel: +61 8 6489 2900 Tel: +1 970 640 0611

Fax: +61 8 6489 2920

Email: jmagee@rtgmining.com Email: jwells@rtgmining.com

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This announcement includes certain "forward-looking statements" within the meaning of Canadian and applicable securities legislation. Statements regarding the anticipated; future mine development plans at the Chanach Project, including anticipated drill programs and feasibility studies; interpretation of exploration results, exploration targets, plans for further exploration and accuracy of mineral resource and mineral reserve estimates and related assumptions and inherent operating risks, are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from RTG's expectations include uncertainties related to fluctuations in gold and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the development of RTG's mineral projects; the need to obtain additional financing to develop RTG's mineral projects; the possibility of delay in development programs or in construction projects and uncertainty of meeting anticipated program milestones for RTG's mineral projects and other risks and uncertainties disclosed under the heading "Risk Factors" in RTG's Annual Information Form for the year ended 31 December 2017 filed with the Canadian securities regulatory authorities on the SEDAR website at sedar.com. The forward?EUR?looking statements made in this announcement relate only to events as of the date on which the statements are made. RTG will not release publicly any revisions or updates to these forward?EUR?looking statements to reflect events, circumstances or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

QUALIFIED PERSON AND COMPETENT PERSON STATEMENT

The information in this release that relates to Exploration Results and Mineral Resource Estimates is based upon information compiled, reviewed and approved by Elizabeth Haren who is a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' who is a Member and Chartered Professional of the Australian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed by Haren Consulting Pty Ltd and is a consultant to RTG. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person and a Qualified Person for the purposes of NI 43-101. Elizabeth Haren consents to the inclusion in the release of the matters based on her information in the form and the context in which it appears.

The information in this release that relates to Exploration Targets is based upon information compiled, reviewed and approved by Greg Hall who is a Qualified Person under NI 43-101 and a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' who is a Member and Chartered Professional of the Australian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Greg Hall is employed by Golden Phoenix International Pty Ltd and is a consultant to RTG. Greg Hall has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person and a Qualified Person for the purposes of NI 43-101. Greg Hall consents to the inclusion in the release of the matters based on his information in the form and the context in which it appears.

[1] RTG Announcement, "RTG to Acquire 90% Stake in the High Grade Chanach Gold Project in the Kyrgyz Republic - https://www.asx.com.au/asxpdf/20190906/pdf/44896dzrztb9xq.pdf

[2] The Mineral Resource estimates were originally compiled and announced by WCN on 30 May 2018, in accordance with the JORC Code, 2012 and was last disclosed in WCN's March, 2019 quarterly report on 30 April, 2019. https://www.asx.com.au/asxpdf/20190430/pdf/444pg6f8t5ln5t.pdf

[3] The Company does not consider the Chanach Project to be a material property for the purposes of the National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

SOURCE: RTG Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/563899/RTG-Completes-Acquisition-of-90-Stake-in-the-High-Grade-Chanach-Gold-Project-in-the-Kyrgyz-Republic