Rupert Resources Expands Land Package in Central Lapland Greenstone Belt to 595km2 Through Option of Prospective Ground From S2 Resources and New Applications

Rupert Resources Ltd (“Rupert” or “the Company,” TSX-V: RUP) reports that it has entered into an option agreement (“Agreement”) with Sakumpu Exploration OY (“Sakumpu”), a 100% held subsidiary of ASX listed, S2 Resources (“S2”) (S2R.ASX) on two exploration licence applications (“Licences”) in the Central Lapland Greenstone Belt, Finland. The Company has also expanded its 100% owned land package through the application of new reservations and exploration licences.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210816005568/en/

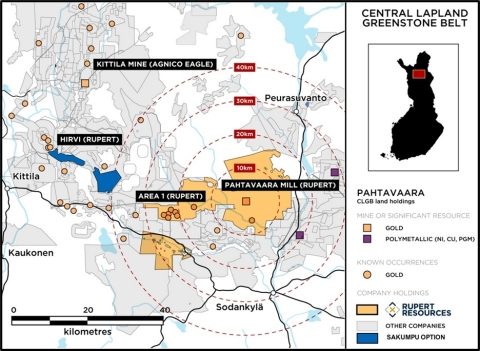

Figure 1. Location map showing Rupert’s landholding in the Central Lapland Greenstone Belt, Finland and the Licences under option from S2 Resources. Image excludes Kallo reservation application to the east of Kaukonen that covers 119km2

Highlights

- Option agreement with S2 adds 37km2 across two licences

- Sikavaara West is located circa 400 metres east of Rupert’s Hirvi project where 2019 diamond drilling included intercepts of 38 metres at 1.4g/t gold from 52 metres in hole 119202, and 53 metres at 1.3g/t gold from 72 metres in hole 119209 (see release March 16, 2020)

- Sikavaara East is located 16 kilometres west of Rupert’s standout Ikkari discovery, with potential for a similar structural setting as Area 1 (host to six discoveries including Ikkari)

- Rupert’s land holdings in the Central Lapland Greenstone Belt now total 595km2 covering key regional structural settings modelled by our exploration team

James Withall, CEO of Rupert Resources commented, “Our core focus remains the exploration and progression of the Ikkari Discovery. However, well-funded commercial exploration is still in its infancy in Central Lapland which has the potential to become a significant new gold camp. Rupert has opportunistically expanded its land package from 124km2 in 2016 to almost 600km2 today. We continue to apply our systematic and disciplined exploration approach to both our existing tenements and to ground which our team in Finland has identified as prospective for multi-million ounce gold discoveries based on their understanding of the regional geology and mineralising events that led to the deposition of Ikkari.”

The Agreement consists of an initial option period over 6 years under which Rupert can earn up to 70% interest in the Licences (see figure 1) and is the operator. Subsequently Rupert and Sakumpu would establish a joint venture with pro-rata contribution requirements. Should the interest of either party fall below 10% it will revert to a net smelter returns royalty.

Option Agreement terms

Rupert is required to spend a minimum of €1.2 million within 3 years on the licences (the Stage 1 expenditure) which comprise two exploration licence applications known as Sikavaara East (ML2016:0056) and Sikavaara West (ML2019:0107), of which a minimum expenditure of €400,000 must be spent within the first 12 months.

Upon satisfying the Stage 1 expenditure requirements, Rupert can elect to progress to a second stage to earn a 70% interest by spending a further €2.2 million expenditure within an additional 3 years of satisfying the Stage 1 expenditure requirements (Stage 2 expenditure).

The option for each Exploration Licence shall vest and commence on the date of grant of the either or both of the exploration licence applications to Sakumpu. If only one Licence is granted the expenditure commitment is reduced by half. If neither Licence is granted within 18 months the agreement terminates.

Rupert will be the operator during the option period and is responsible for meeting all amounts required to maintain the Licences in good standing.

In the case of each Licence, if Rupert does not complete either Stage 1 or Stage 2 expenditure, the Licence reverts to 100% Sakumpu ownership.

If Rupert completes both Stage 1 and Stage 2 of the earn-in, this will represent a total spend of €3.4 million (C$5M^).

Joint venture terms:

Should Rupert satisfy the Stage 1 expenditure requirement and progress to satisfy the Stage 2 expenditure requirements in respect to the licences, it will have the option to acquire a 70% participating interest (with Sakumpu retaining a 30% interest) and a joint venture will be established.

Rupert will be the operator whilst its participating interest in the joint venture is >50%.

Sakumpu can elect to contribute its pro rata share of joint venture expenditure or dilute.

Should either party dilute to 10% or less (or if a party’s participating interest is less than 30% and it fails to contribute its pro rata share of funding on three occasions whilst its participating interest remains at less than 30%), that party’s interest will automatically convert to a 2% net smelter returns (NSR) royalty, with the other party having the right to buy down half of this royalty (1%) for €1 million.

Note: ^ Assumes Euro / Canadian dollar exchange rate of 1.47

Dr Charlotte Seabrook, MAIG, RPGeo. Exploration Manager is the Qualified Person as defined by National Instrument 43-101 responsible for the accuracy of scientific and technical information in this news release.

About Rupert

Rupert is a Canadian based gold exploration and development company that is listed on the TSX Venture Exchange under the symbol “RUP”. The Company’s core focus is the Rupert Lapland Project including the Ikkari discovery and the permitted Pahtavaara mine and mill within a wider 509km2 regional licence holding in the Central Lapland Greenstone Belt of Northern Finland. The Pahtavaara mine previously produced over 420koz of gold and 474koz remains in an Inferred mineral resource (4.6 Mt at a grade of 3.2 g/t Au at a 1.5 g/t Au cut-off grade, see the technical report entitled “NI 43-101 Technical Report: Pahtavaara Project, Finland” with an effective date of April 16, 2018, prepared by Brian Wolfe, Principal Consultant, International Resource Solutions Pty Ltd., an independent qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects). The Company also holds a 100% interest in the Surf Inlet Property in British Columbia, a 100% interest in properties in Central Finland and a 20% carried participating interest in the Gold Centre property located adjacent to the Red Lake mine in Ontario.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking statements” within the meaning of applicable securities laws, including statements with respect to: results of exploration activities, mineral resources. The words “may,” “would,” “could,” “will,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended February 28, 2021 available at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210816005568/en/