Sabina Gold & Silver Opens George Camp as Next Focus of Development on the Back River Gold District

VANCOUVER, British Columbia, July 12, 2022 (GLOBE NEWSWIRE) -- Sabina Gold & Silver Corp (SBB.T/SGSVF.OTCQX), (“Sabina” or the “Company”) is pleased to announce the start of a five-week exploration field mapping and sampling program at the George Project (“George”) on its 100%-owned Back River Gold Project (“Back River” or the “Project”) in Nunavut, Canada.

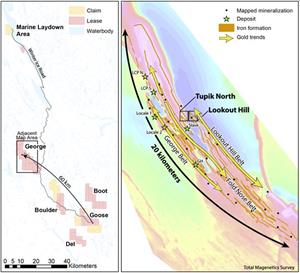

With the Goose Mine currently being advanced towards first gold production in 2025, exploration efforts now start to turn to George, the second most advanced of the five designated project areas within Sabina’s Back River Gold District. George, located approximately 60 km north of the Goose Mine, is host to 20 km of prospective iron formation with current resources of 7.1 M tonnes at 5.34 g/t Au for 1.2 M oz in the Indicated category and an additional 5.4 M tonnes at 6.12 g/t au for 1.1 M oz in the Inferred category. All deposits are open to depth.

The George Project hosts a stand-alone camp currently being readied for this year’s program with a capacity of up to 60 people. George has not been worked for almost 10 years, while Sabina focused on advancing the Goose Mine towards production. The opening of George camp and this year’s field program continues the phased strategy for pipeline growth in the Back River Gold District.

George offers significant potential as a satellite mine with a suite of over 25 compelling exploration targets. 2022 exploration will focus on evolving the structural framework and controls on gold mineralization to better understand and prioritize drilling targets for new discovery and resource growth both at George and at the other project areas on the District.

“George is the Back River Gold District’s second most advanced project. As we have been busy moving Goose forward, we have not operated at George for almost a decade. Since that time, significant progress and success has been made at Goose to unravel the geological signature of these Back River Iron formations. We are eager to apply some of these successful strategies to the prospective geology and existing deposits at George,” stated Bruce McLeod, President and CEO of Sabina. “With an expanded scale of over 20 km of iron formation identified to date at George versus the 8 km at Goose, there is significant opportunity for new discovery. With a strong gold endowment, an established resource estimate of over 2 million ounces of gold and a slate of prospects and drill targets, George makes Sabina unique with its own growth portfolio. We believe that the Back River Gold District is a world class project that will become a multi-generational gold producer.”

2022 Summer Field Program

Exploration at George will be carried out by Sabina geologists and consulting geologists with expertise in structural analysis and Archean gold systems. Programs will consist of re-logging of select historic drill core sections and targeted field evaluations to build a revised structural map that will provide critical controls on gold mineralization. Field work objectives are to better define stratigraphy, deposit and property scale mineral controls, and mineral paragenesis with the ultimate goal of building an enhanced property wide geologic model for George. Targeted mapping and sampling objectives will be completed at prioritized zones with anomalous gold values, as highlighted by historic data evaluation, and along projected strike of major gold trends. Results from the summer field program will be used to inform targeting and planning for future exploration drilling.

Tidy After 10 years - George Exploration Camp – July 2022: https://www.globenewswire.com/NewsRoom/AttachmentNg/5d6a1b46-2fa0-4779-a77e-ed302725c322

George Geology and Exploration Potential

The geology at the George property is similar to that at the Goose property where Beechey Lake Group turbiditic sediments are host to significant iron formation horizons and associated mineralization and intruding felsic to intermediate sills, dykes, and small shallow to steeply dipping felsic intrusions.

The rocks of both Goose and George properties have been affected by at least three deformational episodes with early folds defining the predominant northwest to southeast structural trend of the area. The main gold endowment at the George deposits is located within oxide iron formation, with minor gold mineralization hosted within silicate iron formation and surrounding sediments. Gold bearing zones are associated with sulphide concentrations in the iron formation and are commonly accompanied by increased quartz veining and increased alteration of the surrounding rocks. Visible gold is commonly associated with elevated sulphide occurrence primarily comprised of pyrrhotite, pyrite, and arsenopyrite.

Three distinct fold belts are defined and named from west to east, the George Belt, the Fold Nose Belt, and the Lookout Hill Belt. The relationship between these spatially separate domains has not been clearly established. However, common stratigraphy within the three belts suggests that they may represent one continuous sequence of iron formation that has been separated and repeated by faulting and folding. All belts contain gold occurrences, however the largest and most important deposits located to date occur within the George Belt where Locale 1, Locale 2, and the GH deposits combine for resources of 802,000 oz gold at 5.01 g/t Au in Indicated, plus 924,000 oz gold at 6.21 g/t Au in Inferred, are aligned along a 7 km plus strike length. This well-endowed gold trend remains under explored with the majority of past drilling occurring at the deposit scale to average depths of 300m. Significant exploration opportunity exists both laterally and at depth as deposit extensions, and along the gold trend between deposits within the George fold belt.

Figure 1. Back River gold belt with project areas and detail of the George Project area showing extent of the targeted iron formation geology with deposit locations, significant mineral zones and exploration targets and interpreted major gold trends: https://www.globenewswire.com/NewsRoom/AttachmentNg/859343ec-15fd-45b0-984f-bb0048989fa3

To the east of the George belt, the Fold Nose Belt and the Lookout Hill Belt are host to 2.2 M tonnes at 6.12 g/t Au for 425,000 oz in Indicated, and 742,000 tonnes at 5.53 g/t Au for 132,000 oz in Inferred resources, representing strong gold trends with considerable upside exploration potential for new discovery and deposit growth.

The current target book at George, a targeting work up of historic data, is comprised of over 25 prioritized exploration opportunities, each defined by compelling characteristics combining elements of gold anomalism, altered and mineralized iron formation host rock and variable combinations of geophysical survey response. Two examples of targets that represent prioritized drill targets at George are Tupik North and Lookout Hill.

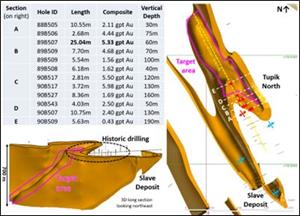

The Tupik North target is located approximately 1 km NW of the Tupik Deposit (formerly named Slave) resource (239,000 tonnes at 4.82 g/t Au for 37,000 oz in Indicated, plus 468,000 tonnes at 5.05 g/t au for 76,000 oz in Inferred) and is defined by a 15 to 25 meter thick north plunging package of folded iron formation in a synclinal/ anticlinal pair. Historic drilling completed in the late 80’s early 90’s targeted the upper portions of a mineralized zone in a limited series of relatively shallow drill holes depths. Two examples of the better mineralized intersections include drill hole 89B507 which returned 18.69 m of 6.88g/t Au and drill hole 90B507 which returned 10.75 m of 2.40 g/t Au.

Figure 2. Tupik North target with 3D representation of modeled iron formation horizon and location and table of select significant result from historic drilling. Note large plunge length of untested iron formation associated with favorable anticlinal fold setting: https://www.globenewswire.com/NewsRoom/AttachmentNg/57aa6bdf-8065-4bd7-bebb-cc0d00fbebd2

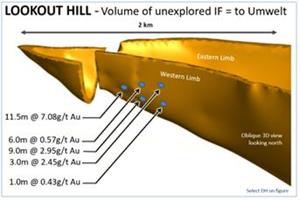

The Lookout Hill target has geometric and geologic aspects similar to the Llama Gold Deposit with both locations hosting significant iron formation in synformal structures over significant strike lengths greater than 1.5 km. Historic drilling at Lookout hill totals 2,949 m in 14 holes, with the deepest drill hole vertical depth being approximately 415 m. Results from drilling show significant intersection of moderately folded oxide iron formation, with strong quartz veining, shear controlled sulphide mineralization (dominantly pyrite with minor arsenopyrite) and local occurrences of visible gold. The best intercept to date is from hole 11GRL022 which returned 11.50 m of 7.08 g/t Au.

Figure 3. Lookout Hill target showing 3D representation of modeled iron formation horizon and location of select significant result from historic drilling: https://www.globenewswire.com/NewsRoom/AttachmentNg/8bfed45d-e847-4c3b-8b2a-7be8281bbf1a

Qualified Persons

Nicole Lasanen P.Geo, Technical Services Manager for the Company, is a Qualified Person as defined by NI 43-101 as pertaining to the Back River Project, and has reviewed, verified and approved the technical contents of this news release.

All drill core and rock samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs which include the insertion of certified reference materials, blank materials and duplicates analysis. All samples are sent to ALS Global laboratories locations in Yellowknife, Northwest Territories and Vancouver, British Columbia where they are processed for gold analysis by 50 gram fire assay with finish by a combination of atomic absorption and gravimetric methods. Additionally, analysis by screen metallic processes is performed on select samples. ALS Global quality systems conform to requirements of ISO/IEC Standard 17025 guidelines and meets assay requirements outlined for NI 43-101.

About Sabina Gold & Silver Corp.

Sabina Gold & Silver Corp. is an emerging gold mining company that owns 100% of the district scale, advanced, high grade Back River Gold District in Nunavut, Canada.

Sabina filed an Updated Feasibility Study (the “UFS”) on its first mine on the district, the Goose Mine, which presents a project that will produce ~223,000 ounces of gold a year (first five years average of 287,000 ounces a year with peak production of 312,000 ounces in year three) for ~15 years with a rapid payback of 2.3 years, with a post-tax IRR of ~28% and NPV5% of C$1.1B at a gold price of $1,600 USD. See “National Instrument (NI) 43-101 Technical Report – 2021 Updated Feasibility Study for the Goose Project at the Back River Gold District, Nunavut, Canada” dated March 3, 2021.

The Project has received all major permits and authorizations for construction and operations.

The Company has arranged a comprehensive project financing package comprised of:

- A US$425 million senior secured debt facility, gold prepay and stream package with Orion Mine Finance and Wheaton Precious Metals Corp.; and

- US$216 million in equity including Zhaojin’s participation.

The Company is also very committed to its Inuit stakeholders, with Inuit employment and opportunities a focus. The Company has signed a 20-year renewable land use agreement with the Kitikmeot Inuit Association and has committed to various sustainability initiatives under the agreement.

The Company continues to advance exploration and project optimization, including advancing the planned plant expansion to 4,000 tpd from Year two to initial startup.

All news releases and further information can be found on the Company’s website at www.sabinagoldsilver.com or on SEDAR at www.sedar.com. All technical reports have been filed on www.sedar.com

For further information please contact:

Nicole Hoeller, Vice-President, Communications: 1 888 648-4218

nhoeller@sabinagoldsilver.com

Forward Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws (the “forward-looking statements”), including, but not limited to, statements related to the expected use of proceeds of the Offering and the projections and assumptions of the results of the UFS. These forward-looking statements are made as of the date of this news release. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the uncertainty of production, development plans and costs estimates for the Back River Gold Project; discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated development and operating costs; the interpretation of drill, metallurgical testing and other exploration results; the ability of the Company to retain its key management employees and skilled and experienced personnel; exploration, development and mining risks and the inherently dangerous nature of the mining industry, and the risk of inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties; property and mineral title risks including defective title to mineral claims or property; the effects of general economic conditions, commodity prices, changing foreign exchange rates and actions by government and regulatory authorities; and misjudgments in the course of preparing forward-looking statements. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with exploration and project development; the need for additional financing; the calculation of mineral resources and reserves; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; government regulation; obtaining and renewing necessary licenses and permits; environmental liability and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers or directors; the absence of dividends; currency fluctuations; labour disputes; competition; dilution; the volatility of the our common share price and volume; future sales of shares by existing shareholders; and other risks and uncertainties, including those relating to the Back River Project and general risks associated with the mineral exploration and development industry described in our Annual Information Form, financial statements and MD&A for the fiscal period ended December 31, 2020 filed with the Canadian Securities Administrators and available at www.sedar.com. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

Bruce McLeod, President & CEO

Suite 1800 – Two Bentall Centre

555 Burrard Street

Vancouver, BC V7X 1M7

Tel 604 998-4175 Fax 604 998-1051

http://www.sabinagoldsilver.com