Sabina Gold & Silver Summarizes Exploration Results and Potential for Resource Growth at Goose Property

VANCOUVER, British Columbia, Sept. 05, 2019 (GLOBE NEWSWIRE) -- Sabina Gold & Silver Corp (SBB.T/SGSVF:OTCQX), (“Sabina” or the “Company”) has made considerable progress in demonstrating the potential for continued resource growth at its 100% owned Back River Gold Project (“Back River” or the “Project”) in Nunavut, Canada since the last National Instrument 43-101 (“NI 43-101”) compliant Back River Resource Estimate delivered in 2014.

Sabina’s Back River Project encompasses a highly prospective 80km gold district with a property wide NI 43-101 Resource Estimate (2014) of 5.3 million ounces of gold grading 5.87 g/t in the Measured and Indicated categories and an additional 1.9 million ounces of gold grading 7.43 g/t in the Inferred category. This resource includes a reserve of 2.5 million ounces of gold grading 6.30 g/t in the Proven and Probable categories (see tables below).

The Company is currently focused on advancing initial production at Back River on the 8km Goose Property while also continuing to explore for opportunities that may enhance the already robust Project economics. The economics of the 2015 Feasibility Study (FS) were based on a US$1,150 gold price with a 0.80 exchange rate (CAD:USD) and resulted in a post tax NPV of C$480 million and an internal rate of return (IRR) of 24.2%. Using the same parameters and exchange rate as the 2015 FS, the Project delivers a post tax NPV of C$923 million and an IRR of 37.6% at a US$1500 gold price.

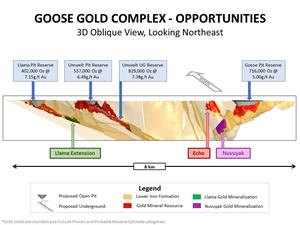

Exploration work at the Goose Property since the 2014 Resource Estimate has focused on new discovery and resource extension and optimization at the Goose Main, Umwelt, and Llama Deposits, the new Nuvuyak discovery and to a lessor extent the Echo Deposit (see Figure 1.0 below). This work was undertaken with the objectives of further improving the economics and life span of future mine operations.

Progress highlights at the Goose Property include;

- The significant extension of the Llama underground gold structure. Mineralization from the bottom of the Llama open pit reserve now extends for greater than 1200m down plunge. Recent successes include the extension from the existing Llama underground resource adding an additional plunge length of approximately 580m as well as the discovery of higher grade mineralization over numerous drill holes within this plunge extension. The mineralizing structure at Llama underground remains open to depth.

- The new discovery of a significant zone of gold mineralization, the Nuvuyak Zone, located approximately 1000m west of the Goose Main deposit. The Nuvuyak gold zone has now been tested by 14 drill holes which confirm a strongly mineralized, folded iron formation package over a plunge extent of 370m, open both up and down plunge. The Nuvuyak gold zone is analogous in size and mineral robustness to the other Goose Project deposits and is the most important discovery since the Umwelt discovery in 2010.

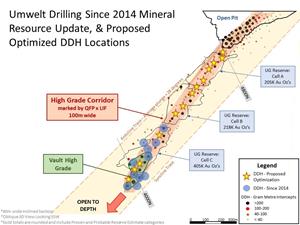

- The definition and expansion of a thickened, high grade corridor of mineralization within the Umwelt underground, initially at the Vault Zone and more recently in the up plunge direction. Recent drilling and modeling shows that the high grade zone or corridor extends through Vault, up and down plunge with excellent potential for significant optimization through additional drilling. See Figure 2.0 below.

- Discovery of over 25% more plunge length of mineralized iron formation at the Goose Property. Between Llama Extension and Nuvuyak, Sabina has identified an additional combined 950m of gold mineralized iron formation along plunge.

“The work we’ve done at Goose over the last three years highlights opportunities, not only for extended mine life, but also to potentially enhance project economics by developing higher grade underground opportunities earlier in the mine plan,” said Bruce McLeod, President & CEO. “While more work needs to be completed to define these opportunities, we are very excited about the development optionality the project provides, particularly given the high grade underground mineralization we are encountering. We believe that this could ultimately translate into a longer mine life than contemplated in our feasibility study. And, it is important to remember that the Goose Project is only 8km of an 80km area of prospective iron formation, one we believe will be a multi-generational mining district.”

“While we are fortunate to have several opportunities to add to the resources and extend mine life, we believe the most prudent course of action at this time would be to focus on drilling the high-grade corridor at Umwelt underground. This could provide a near term opportunity to enhance project economics and the modest capital required for this drilling would not detract from our main objective of advancing the project towards production. While we have estimated the infill drilling required to prepare a new resource for the Llama and Nuvuyak zones, we are not contemplating undertaking this infill program at this time.” (see Table 1.0 below)

Table 1. Priority Goose Project Resource Optimization and Growth Opportunities

| Zone | Opportunity | Target | Program Scope (Drilling) |

| Llama Underground (“UG”) | Optimize the significant resource growth potential of the Llama UG with infill drilling and focus around high grade zones. Inform decision for inclusion of a Llama UG in future development plans. | 1200m gold structure. Llama UG resource and Llama Extension Zone plus additional down plunge step outs. | Take entire existing resource and Extension Zone to Indicated Mineral Resource Classification. Estimated 35,000m drilling. |

| Nuvuyak Discovery | Confirm the extent of the mineralized zone which currently has plunge length of 370m. Demonstrate viability for significant high grade UG deposit. | Mineralized extensions up and down plunge from current mineralized zone. Down dip portions of fold limbs also show significant potential. | Continue sectional drilling with sufficient density to estimate an Indicated Mineral Resource Classification. Estimated 28,000m of drilling. |

| Umwelt Underground High Grade | Continue to detail and expand the extent of the high grade corridor of mineralization. Opportunity to inform a decision to fast track underground development for access to high grade zones and potential improved project economics. | Central core of high grade mineralization within the current UG resource is shown to extend up and down plunge from the Vault Zone with current potential at over 800m of plunge length. | Extend scoping for higher grade and thicker mineralized intersections within approximate 100 m wide corridor. Estimated 6,500m of drilling. |

Description of Currently Defined Goose Project Resource Opportunities

Llama Underground - Llama Extension

The Llama Deposit contains an estimated 3,557,000 tonnes at 6.50 g/t Au for 743,000 ounces of gold in the Measured and Indicated categories, and an additional 295,000 tonnes at 6.77 g/t Au for 64,000 ounces of gold in the Inferred category. Of this, 1,749,000 tonnes at an average grade of 7.15 g/t Au for 402,000 ounces in the Proven and Probable categories make up the open pit reserve. The current Feasibility Study does not contemplate an underground development at Llama. Exploration at Llama in 2017 aimed to test the down plunge continuity of the deposit, successfully returning significant high grades such as 9.48 g/t Au over 38.55m in drill hole 17GSE516B (see press release dated Sept 5, 2017) and 15.67 g/t over 23.25m in drill hole 18GSE530 (see press release dated Apr 23, 2018). To date 15 drill holes have extended the gold mineralization shell down plunge from the Inferred Mineral Resources (outside of the open pit shell) by approximately 580m with grades and thicknesses greater than those intersected in the current Llama underground Resource. This drilling has extended the total “outside” of the pit gold mineralization at Llama for over 1200m of strike extent and it remains open to depth. Total drilling required to upgrade the underground resource and extension to an Indicated Mineral Resource Classification is estimated to be 35,000m of drilling.

Nuvuyak Discovery

The Nuvuyak Zone was discovered in 2018 with drill hole 18GSE545 that returned 11.58 g/t Au over 39.50m (see press release dated August 20, 2018). The mineral zone which is located approximately 1,000m down plunge of the Goose Main deposit has now been drilled over 370m of plunge length in 14 drill holes and exhibits many of the geologic and mineralogic characteristics of the existing Goose property deposits; Llama, Umwelt and Goose Main. The deposit is open both up and down plunge as well as in the down dip direction along the limbs of the anticlinal fold. Examples of select significant intervals from recent Nuvuyak drilling include; drill holes 18GSE559W1 which returned 12.41 g/t Au over 8.70m, (see press release dated Jan 7, 2019) 18GSE558 which returned 16.39 g/t Au over 13.20m (see press release dated Oct 22, 2018) and 18GSE558W2 which returned 5.81 g/t Au over 34.60m (see press release dated Nov 19, 2019) and 19GSE566 which returned 10.04 g/t Au over 18.00m (see press release dated July 18, 2019). Opportunities at Nuvuyak include continuing sectional drilling with sufficient density to estimate an Indicated Mineral Resource Classification over this section of the Nuvuyak zone is estimated to total 28,000m of drilling.

High Grade Corridor - Umwelt Underground

The underground portion of the Umwelt Deposit currently hosts an estimated 3,491,000 tonnes of 7.38 g/t for 829,000 ounces of gold in Proven and Probable Reserves. The underground mineral structure is contiguous with that of the open pit which hosts 2,668,000 tonnes of 6.49 g/t Au for 557,000 ounces of gold in Proven and Probable Reserves. Exploration at Umwelt since the Mineral Resource Estimate in October of 2014 has focused on targeting a higher grade and thicker corridor demarked by a Quartz-Feldspar Porphyry (QFP) intersection with the Lower Iron Formation (LIF). The Vault Zone is situated along the QFP-LIF intersection at depth, and drilling during 2018 and 2019 illustrated that the exceptional high grade and thick intersections seen at Vault are present up-plunge from the Vault Zone; drill hole 18GSE532 returned 8.38 g/t Au over 11.45m (see press release dated June 5, 2018) and drill hole 19GSE569 returned 14.97 g/t Au over 21.75m (see press release dated June 19, 2019). These recent drill intercepts suggest an opportunity to improve the current grades and thicknesses within the existing Mineral Resources at Umwelt. To properly scope the higher grade and thicker mineralized intersections within approximate 100m wide corridor in the prospective area would require approximately 6,500m of additional drilling

Echo Deposit

The Echo Deposit currently hosts 916,000 tonnes of 6.14 g/t Au for 181,000 ounces of gold in Indicated Mineral Resources, as well as an additional 71,000 tonnes of 5.91 g/t for 14,000 ounces of gold in Inferred Mineral Resources. The current Feasibility Study does not include either an open pit or an underground development at Echo. Exploration since the Mineral Resource Update in October of 2014 has focused on identifying mineralization down dip of the current Resource with three drill holes. Results confirmed the presence of favourably altered and mineralized iron formation and variable gold; drill hole 18GSE550 returned 3.54 g/t Au over 1.0m (see press release dated Jan 7, 2019) and drill hole 17GSE518 returned 4.41 g/t Au over 1.45m (see press release dated Oct 19, 2017). These drill holes continue to develop strong exploration opportunities along the southern iron formation trend.

Reserves and Resources

| Mineral Resource Estimate Oct/14 | Mineral Reserve Estimate Aug/15 | ||||||||

| Classification | Tonnes (kt) | Au (g/t) | Metal (koz Au) | Location | Classification | Tonnes (kt) | Au (g/t) | Au (koz) | |

| Measured | 10,273 | 5.27 | 1,740 | Total Open Pit | Proven | 6,983 | 5.97 | 1,340 | |

| Indicated | 17,969 | 6.22 | 3,593 | Probable | 1,885 | 5.52 | 335 | ||

| Measured and Indicated | 28,242 | 5.87 | 5,333 | Total Underground | Proven | 20 | 9.52 | 6 | |

| Inferred | 7,750 | 7.43 | 1,851 | Probable | 3,471 | 7.37 | 822 | ||

| *Includes Open Pit and Underground Resources at both the George and Goose Projects | Total Back River Property | Proven | 7,003 | 5.98 | 1,346 | ||||

| Probable | 5,356 | 6.72 | 1,157 | ||||||

| *Includes the Open Pits for Llama, Umwelt and Goose Main, and Underground for Umwelt | |||||||||

Qualified Persons

The Qualified Person as defined by NI 43-101 as pertains to the Back River Project, is James Maxwell P.Geo, Exploration Manager, for the Company. All drill core samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs which include the insertion of certified reference materials, blank materials and duplicates analysis. All samples are sent to SGS Canada Inc. located in Burnaby, British Columbia where they are processed for gold analysis by 50 gram fire assay with finish by a combination of atomic absorption and gravimetric methods. Additionally, analysis by screen metallic processes is performed on select samples.

Sabina Gold & Silver Corp

Sabina Gold & Silver Corp. is well-financed and is an emerging precious metals company with district scale, advanced, high grade gold assets in one of the world’s newest, politically stable mining jurisdictions: Nunavut, Canada.

Sabina released a Feasibility Study on its 100% owned Back River Gold Project which presents a project that has been designed on a fit-for purpose basis, with the potential to produce ~200,000 ounces a year for ~11 years with a rapid payback of 2.9 years (see “Technical Report for the Initial Project Feasibility Study on the Back River Gold Property, Nunavut, Canada” dated October 28, 2015).

The Project received its final Project Certificate on December 19, 2017. The Project received its Type A Water License on November 14, 2018 and is now in receipt of all major authorizations for construction and operations.

In addition to Back River, Sabina also owns a significant silver royalty on Glencore’s Hackett River Project. The silver royalty on Hackett River’s silver production is comprised of 22.5% of the first 190 million ounces produced and 12.5% of all silver produced thereafter.

| For further information please contact: | Nicole Hoeller, Vice-President, Communications: |

| 1 888 648-4218 nhoeller@sabinagoldsilver.com |

All news releases and further information can be found on the Company’s website at www.sabinagoldsilver.com or on SEDAR at www.sedar.com. All technical reports have been filed on www.sedar.com

Forward Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws (the “forward-looking statements”), including our belief as to the extent, results and timing of exploration programs and exploration results, reserves estimates, potential production from and viability of the Company’s properties, timing and receipt of necessary permits and project approvals for future operations and access to project funding. These forward-looking statements are made as of the date of this news release. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, commodity prices, changing foreign exchange rates and actions by government and regulatory authorities and misjudgments in the course of preparing forward-looking statements. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with exploration and project development; the need for additional financing; the calculation of mineral resources and reserves; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; government regulation; obtaining and renewing necessary licenses and permits; environmental liability and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers or directors; the absence of dividends; currency fluctuations; labour disputes; competition; dilution; the volatility of the our common share price and volume; future sales of shares by existing shareholders; and other risks and uncertainties, including those relating to the Back River Project and general risks associated with the mineral exploration and development industry described in our Annual Information Form, financial statements and MD&A for the fiscal period ended December 31, 2018 filed with the Canadian Securities Administrators and available at www.sedar.com. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. This news release has been authorized by the undersigned on behalf of Sabina Gold & Silver Corp.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f945a250-e489-4197-aebe-8a4bee429b75

https://www.globenewswire.com/NewsRoom/AttachmentNg/d03b370c-644d-4492-8a9c-26e954c02c2d