Scotiabank and National Bank Reiterate Outperform Rating on Cobalt 27; Canaccord Raises Price Target to C$22.50

TORONTO, ON / ACCESSWIRE / July 9, 2018 / New equity research reports out of Canada's major banks suggest that the current share price of Cobalt 27 Capital Corp. (TSX-V: KBLT; OTC PINK: CBLLF; FSE: 27O) remains highly undervalued relative to major new developments for the company.

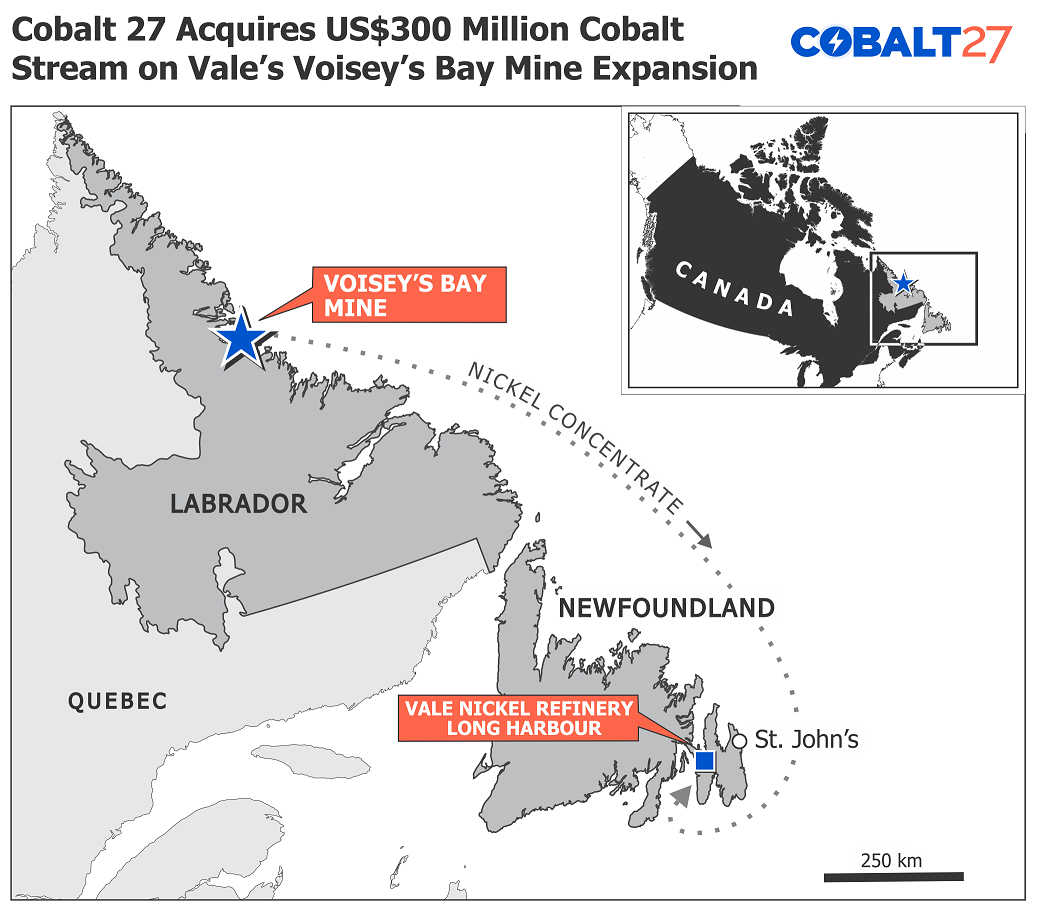

The new research reports come on the heels of Cobalt 27's acquisition of a 32.6% cobalt stream on the world-class Voisey's Bay mine. The transaction is expected to add attributable cobalt production equal to 1.9 million pounds annually to the company's bottom line beginning in 2021. The stream will be settled in physical cobalt and last for life of mine.

Scotiabank analyst Michael Doumet views the Voisey's Bay transaction as favourable and says that shares of Cobalt 27 remain clearly undervalued and quite cheap at these levels: "The company combines a physical cobalt inventory valued at approximately US$270 million (using spot prices), a royalty portfolio valued at roughly US$50 million, and two streams that we expect to generate cash flows of ~US$100 million per year (when combined, starting 2021). Netting out the physical inventory (assuming debt repayment as well), the share price effectively attributes approximately US$430 million to the steams." Scotiabank has a sector outperform rating and 1-year price target of C$15.00 on the stock.

Analyst Rupert Merer of National Bank of Canada says that the timing of the streaming deal coincides well with an upcoming cobalt supply shortage in 2021: "We believe that demand should continue to grow quickly, along with the battery market. Despite a move to reduce the cobalt content of batteries, we believe that it will be a number of years (maybe more than a decade) before new technologies can displace the existing commercially available lithium ion batteries. In addition, the move to lower use chemistries, like NMC 811, does not appear to be happening quickly." Merer goes on to say, "We believe that the market can support US$40/lb while achieving battery cost reduction targets (but maybe not much more). As an example of growing demand, Panasonic recently announced that it plans to triple its cobalt consumption in five years. With the potential for cobalt shortages, we believe that battery manufacturers could look to secure supply through long-term contracts. With a growing portfolio of supply from outside the DRC, KBLT's strategic position is improving." National Bank has maintained Cobalt 27's outperform rating with a 12-month price target of C$15.00 on the stock.

Meanwhile, Canaccord Genuity has aggressively raised its price target on Cobalt 27 to C$22.50 while reiterating their speculative buy rating. Canaccord says the increased price target "reflects the increase to the operating NAV from the company's acquisition of a cobalt stream from Vale's Voisey's Bay project. This is the second stream in the company's portfolio, showing the market that they are continuing to execute their business plan." Canaccord also noted that in addition to the two streams (Ramu and Voisey's Bay), the company also has physical cobalt holdings (2,980 tonnes), a royalty on the Dumont mine and an investment in the Highlands Pacific Limited company.

Canaccord incorporated the new Voisey's Bay cobalt stream into their base case scenario and noted that streams now make up 67% of the company's net asset value, suggesting a strong skew toward reward over risk.

About Voisey's Bay Mine

The Voisey's Bay mine, regarded as Robert Friedland's claim to fame discovery, is a tier one asset located in the politically secure mining jurisdiction of northern Labrador. The mine is owned by Vale S.A. (NYSE: VALE) and has been in operation since 2005. The Voisey's Bay Mine Extension, which will transition the existing mine from open pit to underground, is set to begin production in 2021. It is host to enough existing nickel-copper-cobalt reserves to support mine operations until 2034, with significant exploration potential to further extend the mine life at deeper depths.

Cautionary Statement: Junior Mining Network LLC ("JMN") is not a financial advisory or advisor, investment advisor or broker-dealer and does not undertake any activities that would require such registration. The information contained herein is not intended to be used as the basis for investment decisions and should not be considered as investment advice or a recommendation, nor is the information an offer or solicitation to buy, hold or sell any security. JMN does not represent or warrant that the information posted is accurate, unbiased or complete. JMN receives fees for producing and presenting content on financial news. Investors should consult with an investment advisor, tax and legal consultant before making any investment decisions. JMN make no representations as to the completeness, accuracy or timeless of the material provided. All materials are subject to change without notice.

SOURCE: Junior Mining Network