September 2021 Quarter Report

PERTH, Western Australia, Oct. 20, 2021 (GLOBE NEWSWIRE) -- Perseus Mining Limited (“Perseus” or the “Company”) (TSX & ASX: PRU) reports on its activities for the three months’ period ended September 30, 2021 (the “Quarter”).

Executive Summary

- Perseus has achieved another quarterly gold production record, producing 112,786 ounces of gold, up 10% on the June 2021 quarter and up 28% on the March 2021 quarter.

- Weighted average production cost of US$857 per ounce and a weighted average all-in site cost (AISC) of US$966 per ounce, US$81 per ounce or 8% less than in the last quarter.

- The Yaouré Gold Mine was the major contributor to the Group’s strong quarterly result, producing 64,558 ounces of gold at an AISC of US$671 per ounce, generating notional cashflow of US$65.8 million.

- Gold sales increased to 107,650 ounces at an average realised gold price of US$1,655 per ounce giving rise to a weighted average cash margin of US$689 per ounce of gold produced.

- Notional cashflow from operations was US$77.8 million, US$15.7 million or 25% more than in the June 2021 quarter.

Table 1: Operating and Financial Summary

| PERFORMANCE INDICATOR | UNIT | MARCH 2021 QUARTER | JUNE 2021 QUARTER | JUNE 2021 HALF YEAR | SEPTEMBER 2021 QUARTER | CALENDAR 2021 YEAR TO DATE |

| Gold recovered | Ounces | 88,458 | 102,788 | 191,246 | 112,786 | 304,032 |

| Gold poured | Ounces | 86,042 | 105,468 | 191,510 | 110,535 | 302,044 |

| Production Cost1 | US$/ounce | 852 | 921 | 894 | 857 | 880 |

| All-In Site Cost (AISC)1 | US$/ounce | 999 | 1,047 | 1,030 | 966 | 1,003 |

| Gold sales | Ounces | 87,215 | 106,899 | 194,114 | 107,650 | 301,764 |

| Average sales price1 | US$/ounce | 1,628 | 1,652 | 1,642 | 1,655 | 1,647 |

| Notional Cashflow1 | US$ million | 41.2 | 62.1 | 103.3 | 77.8 | 181.2 |

Notes: 1. Includes Yaouré data from 31 March 2021 following declaration of Commercial Production.

- Group gold production and AISC market guidance remain unchanged for the December 2021 half year at 225,000 to 255,000 ounces at an ASIC of US$925 to US$1,025 per ounce.

- At 30 September 2021, available cash and bullion on hand of US$196.2 million and debt of US$100.0 million, giving a net cash position of US$96.2 million, US$40.1 million more than at the end of last quarter.

- Exploration programmes on the Nkosuo prospect near Edikan and the CMA Underground prospect at Yaouré returned excellent drill results confirming the potential for strong organic growth of the Group’s inventory of Mineral Resources and Ore Reserves at each mine.

- Perseus has continued to strengthen its strong sustainability performance relative to our safety, social and environmental objectives and targets. The fully documented results as well as our approach to maintaining a sustainable business is contained in our third consolidated Sustainability Report covering the period 1 July 2020 to 30 June 2021.

OPERATIONS

GROUP PRODUCTION, COSTS AND NOTIONAL CASHFLOW

Perseus’s three operating gold mines, Yaouré and Sissingué in Côte d’Ivoire, and Edikan in Ghana have combined to produce a total of 112,786 ounces of gold in the September 2021 quarter, 10% more than in the prior quarter and 28% more than in the March 2021 quarter. The weighted average production costs at the operations were US$857 per ounce, while a weighted average AISC of US$966 per ounce of gold was recorded by the Group during the quarter. These costs were 7% and 8% respectively lower than comparative costs incurred in the previous quarter.

Table 2: Cost and Production Summary by Mine

| MINE | TOTAL GOLD PRODUCED (OUNCES) | ALL-IN SITE COST (US$/OUNCE) | ||||

| MARCH 2021 QUARTER | JUNE 2021 QUARTER | SEPTEMBER 2021 QUARTER | MARCH 2021 QUARTER | JUNE 2021 QUARTER | SEPTEMBER 2021 QUARTER | |

| Yaouré1 | 22,095 | 37,343 | 64,558 | - | 1,036 | 671 |

| Sissingué | 25,539 | 23,224 | 16,067 | 675 | 676 | 931 |

| Edikan | 40,824 | 42,221 | 32,161 | 1,202 | 1,217 | 1,574 |

| Perseus Group1 | 88,458 | 102,788 | 112,786 | 999 | 1,047 | 966 |

Gold sales from all three operations totalled 107,650 ounces, 1% more than last quarter. The weighted average gold price realised from sales of gold during the quarter was US$1,655 per ounce, slightly more than the price received in the June 2021 quarter. Perseus’s average cash margin for the September 2021 quarter was US$689 per ounce, US$84 per ounce or 15% more than that achieved during the June 2021 quarter. Notional operating cashflow from operations was US$77.8 million, US$15.7 million or 26% more than that generated in the prior period, driven by quarter-on-quarter production growth of 10% derived largely from the strong production performance at Yaouré, combined with a commensurate decline in AISC at that mine.

Table 3: Realised Gold Price and Notional Cash Flow by Mine

| MINE | REALISED GOLD PRICE (US$ PER OUNCE) | NOTIONAL CASH FLOW FROM OPERATIONS (US$ MILLION) | ||||

| MARCH 2021 QUARTER | JUNE 2021 QUARTER | SEPTEMBER 2021 QUARTER | MARCH 2021 QUARTER | JUNE 2021 QUARTER | SEPTEMBER 2021 QUARTER | |

| Yaouré1 | - | 1,684 | 1,690 | - | 24.2 | 65.8 |

| Sissingué | 1,693 | 1,637 | 1,624 | 26.0 | 20.5 | 11.1 |

| Edikan | 1,574 | 1,628 | 1,602 | 15.2 | 17.4 | 0.9 |

| Perseus Group1 | 1,628 | 1,652 | 1,655 | 41.2 | 62.1 | 77.8 |

Notes: 1. All costs and sales associated with gold produced at Yaouré in the March 2021 quarter are excluded from the Group’s reported combined AISC, sales price, cash margin and notional operating cash flow, as these were capitalised in accordance with IFRS until declaration of Commercial Production at Yaouré on 31 March 2021.

Production and cost guidance for the December 2021 Half Year and 2021 Calendar Year remain unchanged as follows:

Table 4: Production and Cost Guidance

| PARAMETER | UNITS | JUNE 2021 HALF YEAR (ACTUAL) | DECEMBER 2021 HALF YEAR (FORECAST) | 2021 CALENDAR YEAR (FORECAST) |

| Yaouré Gold Mine | ||||

| Production | Ounces | 59,438 | 130,000 – 140,000 | 189,438 – 199,438 |

| All-in Site Cost | USD per ounce | 1,036 | 675 – 775 | 790 – 850 |

| Sissingué Gold Mine | ||||

| Production | Ounces | 48,763 | 25,000 – 35,000 | 73,763 – 83,763 |

| All-in Site Cost | USD per ounce | 715 | 950 – 1,070 | 825 – 885 |

| Edikan Gold Mine | ||||

| Production | Ounces | 83,045 | 70,000 – 80,000 | 153,046 – 163,046 |

| All-in Site Cost | USD per ounce | 1,213 | 1,350 – 1,450 | 1,270 – 1,330 |

| PERSEUS GROUP | ||||

| Production | Ounces | 191,246 | 225,000 – 255,000 | 416,247 – 446,247 |

| All-in Site Cost | USD per ounce | 1,030 | 925 – 1,025 | 975 – 1,035 |

YAOURÉ GOLD MINE, CÔTE D’IVOIRE

During the quarter, Yaouré increased its quarterly gold production by 73% to 64,558 ounces of gold at a production cost of US$572 per ounce and an AISC of US$671 per ounce, the latter 35% less than the prior quarter. The weighted average sales price of the 60,055 ounces of gold sold during the quarter was US$1,690 per ounce, giving rise to a cash margin of US$1,019 per ounce. Notional cashflow generated from the Yaouré operations amounted to US$65.8 million for the quarter, US$41.6 million more than the June 2021 quarter. Refer to Table 5 below for details of operating and financial parameters.

Yaouré’s excellent result was achieved despite an unusually high 715 millimetres of rain that fell on the Yaouré site during the quarter, periodically disrupting the mining schedule and access to high grade ore. Several mechanical failures during the quarter also required urgent maintenance and temporarily disrupted crushing and grinding operations for short periods. Notwithstanding these challenges and greatly assisted by the availability of higher-grade fresh ore from the CMA pit and materially better than expected gold recovery rates, production levels were maintained close to targets and well in line with Half Year production guidance.

The rise in unit mining costs during the quarter was largely a function of a larger proportion of the mined material requiring drilling and blasting as well as the reduced tonnes of material mined due to the wet weather. Unit processing costs were higher due to higher maintenance costs due to mechanical failures, higher grinding costs due to an increase in the proportion of fresh ore in the feed and slightly higher power costs due to running the newly commissioned standby power generators for short periods of time offsetting the impact of an increase in tonnes of ore processed.

AISCs at US$671 per ounce were 35% lower than the AISC recorded in the prior period. This was largely driven by the 73% quarter-on-quarter increase in gold production off-set to an extent by increases in unit mining and processing costs as described above.

Table 5: Yaouré Quarterly Performance

| PARAMETER | UNIT | MARCH 2021 QUARTER | JUNE 2021 QUARTER | JUNE 2021 HALF YEAR | SEPTEMBER 2021 QUARTER | 2021 CALENDAR YEAR TO DATE |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 8,816,630 | 8,162,858 | 16,979,488 | 6,340,478 | 23,319,966 |

| Total ore mined | Tonnes | 163,476 | 496,144 | 659,620 | 1,070,285 | 1,729,905 |

| Average ore grade | g/t gold | 0.82 | 1.37 | 1.23 | 2.07 | 1.75 |

| Strip ratio | t:t | 52.9 | 15.45 | 24.74 | 4.92 | 12.48 |

| Ore milled | Tonnes | 624,827 | 837,350 | 1,462,177 | 913,530 | 2,375,707 |

| Milled head grade | g/t gold | 1.27 | 1.51 | 1.4 | 2.37 | 1.77 |

| Gold recovery | % | 86.8 | 92.09 | 90.01 | 92.7 | 91.6 |

| Gold produced | ounces | 22,095 | 37,343 | 59,438 | 64,558 | 123,996 |

| Gold sales2 | ounces | 11,918 | 42,264 | 54,182 | 60,055 | 114,237 |

| Average sales price1 | US$/ounce | - | 1,684 | 1,692 | 1,690 | 1,691 |

| Unit Production Costs1 | ||||||

| Mining cost | US$/t mined | - | 2.71 | 2.71 | 2.95 | 2.82 |

| Processing cost | US$/t milled | - | 9.90 | 9.90 | 13.74 | 11.90 |

| G & A cost | US$M/month | - | 1.70 | 1.70 | 1.89 | 1.80 |

| All-In Site Cost1 | - | |||||

| Production cost | US$/ounce | - | 951 | 951 | 572 | 711 |

| Royalties | US$/ounce | - | 83 | 83 | 85 | 84 |

| Sub-total | US$/ounce | - | 1,033 | 1,033 | 657 | 795 |

| Sustaining capital | US$/ounce | - | 3 | 3 | 14 | 10 |

| Total All-In Site Cost3 | US$/ounce | - | 1,036 | 1,036 | 671 | 805 |

| Notional Cash Flow from Operations1 | - | |||||

| Cash Margin | US$/ounce | - | 648 | 648 | 1,019 | 883 |

| Notional Cash Flow | US$M | - | 24.2 | 24.2 | 65.8 | 109.5 |

Notes:

1. Includes Yaouré data from declaration of Commercial Production on 31 March 2021.

2. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

3. Included in the AISC for the quarter is US$1.04 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained gold relative to the Yaouré Mineral Resource block model during the quarter, last six and nine-month periods are shown in Table 6. During the last three months, 8% more ore tonnes at 6% lower grade have been produced compared to the Mineral Resource model. Over each of the last six and nine-month periods of operation, Yaouré has produced slightly more metal than predicted by the Mineral Resource model. The performance of the Yaouré Mineral Resource model to date is considered satisfactory.

Table 6: Yaouré Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 9 MONTHS | |

| Tonnes of Ore | 1.08 | 1.12 | 1.04 |

| Head Grade | 0.94 | 0.98 | 1.01 |

| Contained Gold | 1.02 | 1.09 | 1.05 |

SISSINGUÉ GOLD MINE, CÔTE D’IVOIRE

During the quarter, and slightly ahead of expectations, 16,067 ounces of gold were produced at Sissingué at a production cost of US$830 per ounce and an AISC of US$ 931 per ounce. The weighted average sales price of the 18,250 ounces of gold sold during the quarter was US$1,624 per ounce, giving rise to a cash margin of US$693 per ounce. Notional cashflow generated from the Sissingué operations amounted to US$11.1 million for the quarter, US$9.4 million less than in the prior quarter largely due to the planned reduction in head grade leading to an increase in AISC and a 31% decrease in gold production during the period as well as a marginally lower realised gold price. (Refer to Table 7 below).

The overall result for the quarter, while less than that achieved in the June 2021 quarter, was very much in line with Perseus’s forecasts and was achieved regardless of the unusually high 788 millimetres of rain that fell on the site during the period. Runtime and head grade were both better than expected while the throughput rate and the gold recovery rate were both marginally below targets.

Unit production costs for the quarter at US$830 per ounce were 32% higher than in the prior period mirroring the 31% decrease in gold production during the period. The rise in unit mining costs was largely a function of reduced tonnes of material mined due to very wet weather during the quarter and also deepening of the pits. The modest rise in unit processing costs was lower than might have been expected given that tonnes of ore processed during the quarter decreased by 8% due to weather delays and changes in the blend of ore fed to the mill.

AISCs at US$931 per ounce were 23% higher than the AISC recorded in the prior period. As noted above, production fell by 31% during the quarter and accounted for most of the increase which was offset to a degree by lower royalty charges and also lower sustaining capital costs.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained ounces relative to the Sissingué Mineral Resource block model on which mine plans are based is shown in Table 8. During the last three months, grade control has predicted less tonnes (18%) with a similar grade (2%) resulting in less ounces (19%) when compared to the Mineral Resource Estimate (MRE). Other reconciliation factors remain stable (F2 to F4), indicating the Mineral Resource estimate is currently underperforming in tonnage. This trend is being monitored to determine if the decrease is due to smaller volumes being mined and accuracy of end-of-month surveys due to rainwater prohibiting access. Over the last six and 12-month periods, Sissingué has produced more metal than predicted by the Mineral Resource model, primarily because of grade control outlining increased tonnages of ore. Perseus regards the overall outperformance as being within normal industry standards but continue to monitor trends.

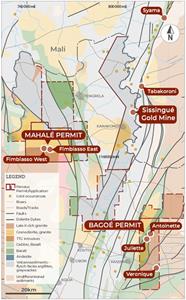

UPDATED LIFE OF MINE PLAN FOR the SISSINGUÉ PRECINCT

An updated Life of Mine Plan for the Sissingué Precinct that models ore being mined at each of the Sissingué, Fimbiasso and Bagoé Mining Leases, and trucked to the Sissingué plant for processing, is being prepared and will be published when finalised. Based on preliminary numbers it appears likely that the life of the Sissingué operation can be extended by several years. Current work is focussing on the sequencing of mining to optimise the return on the investment of capital required to access the new mining areas.

Table 7: Sissingué Quarterly Performance

| PARAMETER | UNIT | MARCH 2021 QUARTER | JUNE 2020 QUARTER | JUNE 2021 HALF YEAR | SEPTEMBER 2021 QUARTER | 2021 CALENDAR YEAR TO DATE | |

| Gold Production & Sales | |||||||

| Total material mined | Tonnes | 1,047,159 | 690,977 | 1,738,136 | 395,727 | 2,133,863 | |

| Total ore mined | Tonnes | 515,902 | 335,650 | 851,552 | 162,912 | 1,014,464 | |

| Average ore grade | g/t gold | 2.34 | 1.80 | 2.13 | 1.52 | 2.03 | |

| Strip ratio | t:t | 1.0 | 1.1 | 1.0 | 1.43 | 1.10 | |

| Ore milled | Tonnes | 269,373 | 327,043 | 596,416 | 299,757 | 896,173 | |

| Milled head grade | g/t gold | 3.13 | 2.42 | 2.70 | 1.91 | 2.44 | |

| Gold recovery | % | 93.7 | 91.4 | 92.6 | 87.1 | 91.2 | |

| Gold produced | ounces | 25,539 | 23,224 | 48,763 | 16,067 | 64,830 | |

| Gold sales1 | ounces | 33,847 | 21,672 | 55,519 | 18,250 | 73,769 | |

| Average sales price | US$/ounce | 1,693 | 1,637 | 1,670 | 1,624 | 1,659 | |

| Unit Costs | |||||||

| Mining cost | US$/t mined | 5.40 | 7.30 | 6.20 | 9.62 | 6.83 | |

| Processing cost | US$/t milled | 18.61 | 19.00 | 18.8 | 19.4 | 19.00 | |

| G & A cost | US$M/month | 0.99 | 1.10 | 1.05 | 1.24 | 1.11 | |

| All-In Site Costs | |||||||

| Production cost | US$/ounce | 533 | 628 | 580 | 830 | 642 | |

| Royalties | US$/ounce | 102 | 114 | 107 | 94 | 104 | |

| Sub-total | US$/ounce | 635 | 742 | 687 | 924 | 746 | |

| Sustaining capital | US$/ounce | 40 | 12 | 28 | 7 | 23 | |

| Total All-In Site Cost | US$/ounce | 675 | 754 | 715 | 931 | 769 | |

| Notional Cash Flow from Operations | |||||||

| Cash Margin | US$/ounce | 1,018 | 883 | 956 | 693 | 890 | |

| Notional Cash Flow | US$M | 26.0 | 20.5 | 46.6 | 11.1 | 57.7 | |

Notes: 1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

Table 8: Sissingué Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 0.82 | 0.97 | 1.13 |

| Head Grade | 0.98 | 1.03 | 0.98 |

| Contained Gold | 0.81 | 1.00 | 1.11 |

BAGOÉ MINING LEASE

Work by consultants (CECAF), on preparing an Environmental and Social Impact Assessment for the Bagoé exploration permit area advanced during the quarter. Once completed, this document together with the recently completed Definitive Feasibility Study of an operation involving mining and trucking of ore from three satellite deposits located on the Bagoé exploration permit to the Sissingué process plant, will be lodged with the Department of Mines, Petroleum and Energy, along with an application for the granting of the Bagoé Mining Lease.

EDIKAN GOLD MINE, GHANA

In the September 2021 quarter, Perseus produced 32,161 ounces of gold at Edikan (24% less than in the June quarter) at a production cost of US$1,445 per ounce and an AISC of US$1,574 per ounce. Gold sales of 29,345 ounces were 32% less than in the prior quarter, at a weighted average realised gold price of US$1,602 per ounce. This generated a cash margin of US$28 per ounce, and notional cashflow of US$0.9 million, US$16.5 million less than in the prior period. In short, this was a substandard performance by the Edikan mine relative to expectations.

This performance was driven principally by the grade of the ore that was processed by the mill during the quarter. All other key operating parameters including mill run time, throughput rate, quantity of ore milled and recovery were in line with forecasts. Ore from the AG pit, ROM and heap leach stockpiles and a small amount of material mined from the remnants of the Stage 2 Fetish pit were blended in varying proportions, dependent on availability and fed to the mill.

The head grade of ore fed to the mill during the quarter averaged 0.72 g/t gold which was well below the average grade of prior quarters. This reduced head grade was caused by several factors, including poor equipment availability by the mining contractor generating a shortfall in availability of fresh ore from the AG pit for processing, creating the need for mill feed to be supplemented by low grade ore drawn from the ROM stockpile. Compounding this problem, the grade of the fresh ore mined that was mined from the AG Pit, did not reconcile well with the block model and poor mining practices in the AG pit resulted in excessive mining dilution for a brief period. Each of these matters has been addressed and this remedial action is expected to result in a significant improvement in operating performance at Edikan in coming quarters.

Production costs for the quarter at US$1,445 per ounce were 37% higher than the previous quarter reflecting 24% less gold production in the period as well as increase G&A costs. Unit mining costs at US$3.36 per tonne were 2% higher than the prior period, with 3% more tonnes mined in this period. Unit processing costs at $8.56 per tonne were 5% less than the prior period, driven by a 3% increase in tonnes of ore milled. G&A costs at US$1.78 million per month were 29% higher than the G&A costs incurred in the preceding quarter resulting from the timing of specific charges.

The quarterly AISC at US$1,574 per ounce was US$357 per ounce or 29% higher than the prior quarter driven mainly by higher production costs as noted above, plus slightly higher royalties resulting from the timing of royalty payments, adding US$7 per ounce increase in AISC, partially offset by a significant reduction in sustaining capital (US$32 per ounce compared to US$69 per ounce).

Table 9 summarises the key performance statistics at Edikan during the quarter as well as in prior periods.

Table 9: Edikan Quarterly Performance

| PARAMETER | UNIT | MARCH 2021 QUARTER | JUNE 2020 QUARTER | JUNE 2021 HALF YEAR | SEPTEMBER 2021 QUARTER | 2021 CALENDAR YEAR TO DATE | |

| Gold Production & Sales | |||||||

| Total material mined | Tonnes | 7,266,051 | 7,563,884 | 14,829,935 | 7,823,678 | 22,653,613 | |

| Total ore mined | Tonnes | 887,650 | 1,081,133 | 1,968,783 | 788,612 | 2,757,395 | |

| Average ore grade | g/t gold | 1.06 | 1.10 | 1.08 | 0.92 | 1.03 | |

| Strip ratio | t:t | 7.2 | 6.00 | 6.5 | 8.9 | 7.2 | |

| Ore milled | Tonnes | 1,595,443 | 1,684,992 | 3,280,435 | 1,731,146 | 5,011,581 | |

| Milled head grade | g/t gold | 0.95 | 0.92 | 0.93 | 0.72 | 0.86 | |

| Gold recovery | % | 85.1 | 85.0 | 85.0 | 80.2 | 83.6 | |

| Gold produced | ounces | 40,824 | 42,221 | 83,045 | 32,161 | 115,206 | |

| Gold sales1 | ounces | 41,450 | 42,962 | 84,412 | 29,345 | 113,757 | |

| Average sales price | US$/ounce | 1,574 | 1,628 | 1602 | 1,602 | 1,602 | |

| Unit Costs | |||||||

| Mining cost | US$/t mined | 3.10 | 3.30 | 3.22 | 3.36 | 3.27 | |

| Processing cost | US$/t milled | 10.20 | 9.00 | 9.60 | 8.56 | 9.24 | |

| G & A cost | US$M/month | 1.36 | 1.38 | 1.39 | 1.78 | 1.52 | |

| All-In Site Costs | |||||||

| Production cost | US$/ounce | 1,051 | 1,057 | 1,054 | 1,445 | 1,163 | |

| Royalties | US$/ounce | 121 | 91 | 106 | 98 | 104 | |

| Sub-total | US$/ounce | 1,172 | 1,148 | 1,160 | 1,543 | 1,267 | |

| Sustaining capital | US$/ounce | 30 | 69 | 53 | 32 | 44 | |

| Total All-In Site Cost2 | US$/ounce | 1,202 | 1,217 | 1,213 | 1,574 | 1,311 | |

| Cash Margin | US$/ounce | 372 | 411 | 389 | 28 | 291 | |

| Notional Cash Flow | US$M | 15.2 | 17.4 | 32.6 | 0.9 | 33.5 | |

Notes:

1. Gold sales are recognised in Perseus’ accounts when gold is delivered to the customer from Perseus’ metal account.

2. Included in the AISC for the quarter is US$8.56 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

Reconciliation of processed tonnes and grade of ore relative to the Mineral Resource block models for Edikan’s Fetish and AG pit indicated a continuation of the deteriorating performance of the Resource model recorded in prior periods. The reconciliation figures for the three, six, and twelve-month periods to 30 September are shown in Table 10 below.

Table 10: Edikan Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 0.78 | 0.87 | 0.89 |

| Head Grade | 0.81 | 0.84 | 0.87 |

| Contained Gold | 0.63 | 0.73 | 0.77 |

The key drivers of the poor reconciliation are largely understood, and changes are in the process of being implemented to address the issues going forward.

SUSTAINABILITY

COVID UPDATE

In response to a third wave of COVID -19 that spread in West Africa during the quarter, Perseus continued to update its COVID-19 critical controls, with focus on keeping our people safe and well, maintaining safe and stable operations and supporting our host governments and local communities. Although around 130 cases of COVID-19 have been recorded across our operations since the commencement of the pandemic, no cases have led to serious illness and our controls have been effective in limiting the spread in our workforce.

During the quarter, we experienced 66 new cases of COVID-19, with over half of the cases occurring at Edikan with the remaining cases spread evenly across Sissingué and Yaouré. Case occurrence at Edikan reduced as the quarter progressed following several vaccination campaigns, with around 74 per cent of employees and contractors at the site now partially or fully vaccinated. Vaccination campaigns also progressed at Sissingué, with 25 per cent of employees and contractors now partially or fully vaccinated. Efforts continue to improve vaccination rates at Yaouré which remain low. In the coming quarter we will continue to pursue vaccination for our employees and contractors as vaccines become available under government programs.

SUSTAINABILITY GOVERNANCE

During the quarter, Perseus continued to strengthen its sustainability governance by:

- Releasing our third consolidated sustainability report, for the period 1 July 2020 to 30 June 2021, aligning our Sustainability Report with our Annual and Financial Reporting cycle. This has further embedded our integrated approach to financial, operational and sustainability performance.

- Broadening our reported sustainability metrics in our FY2022 business performance scorecards (linked to executive remuneration) beyond safety to also include social and environmental metrics.

- Completing external assurance of our FY2021 sustainability data and advancing our alignment with the World Gold Council Responsible Gold Mining Principles, starting with a review of our health, safety and social risks and their control and governance.

- Developing our three-year sustainability strategic plan to strengthen our financial value and grow our social value by actively supporting the countries in which we operate to advance their progress on the United Nations Sustainable Development Goals.

SUSTAINABILITY PERFORMANCE

This quarter, Perseus continued our strong sustainability performance relative to our social and environmental objectives and targets, as shown below in Table 11 and summarised as follows:

- Safety: Our record of zero fatalities across the operations was maintained.

- Social:

- Perseus’s economic contribution to our host countries of Ghana and Côte d’Ivoire of around US$125million (70% of revenue), included approximately US$100 million paid to local suppliers, US$11 million paid as salaries and wages to local employees, US$15 million in payments to government as taxes, royalties and other payments, and US$430,000 in social investment.

- Local and national employment was maintained at 95% of our total direct workforce.

- Zero significant community issues occurred.

- Environment:

- Scope 1 and 2 greenhouse gas emissions and water use per ounce of gold produced continued to decrease as production at Yaouré ramped up.

- A study was commenced to investigate the potential for wholly or partially replacing the diesel fired back-up generators at Yaouré with a longer-term power solution involving either the full or partial use of renewable energy sources including solar and or wind power. The study will also look at the benefits of partially replacing grid power with renewable energy sources.

- Zero environmental events, or tailings dam integrity issues occurred during the period.

In achieving the above, the following key challenges to Sustainability of its business were encountered by Perseus during the quarter:

- Total Recordable Injury Frequency Rates (TRIFR) at each mine to the end of the September 2021 quarter were Edikan 1.89, Sissingué 0.5 and Yaouré 3.24 respectively. The Group Edikan and Yaouré results are currently falling short of their 2022 Financial Year TRIFR continuous improvement targets while Sissingué remains on track to achieve its targets.

- Perseus and its contractors have experienced an increase in offsite road transport safety events during the quarter at each of Edikan, Sissingué and Yaouré mines. Scoping and planning for a safety improvement program across the Group is in progress, with implementation scheduled to commence in late calendar year 2021.

- Illegal mining activities on Perseus’s mining and exploration licence areas continues to present challenges for the Company in both Ghana and Côte d’Ivoire. The Company is continuing to work closely with relevant government authorities to control these activities that have proven to negatively impact both the environmental and social fabric of local communities.

- Security risks at Sissingué and satellite exploration activity areas (Fimbiasso and Bagoé) are being closely monitored due to ongoing political and social unrest which has given rise to terrorist activities in Mali which lies immediately to the north of our Sissingué mine.

Table 4: Sustainability Quarterly Performance

| PERFORMANCE DRIVER | SUB-AREA | METRIC | UNIT | FY2021 | SEPT 2021 QUARTER | ||

| Governance | Compliance | Material legal non-compliance | Number | 0 | 0 | ||

| Social | Worker Health, Safety and Wellbeing | Workplace fatalities | Number | 0 | 0 | ||

| Total Recordable Injury Frequency (TRIF) | Total Recordable Injuries per million hours worked, rolling 12 months | Edikan - 1.49 Sissingué - 1.47 Yaouré - 1.59 Exploration - 1.92 Group - 1.76 | Edikan - 1.89 Sissingué - 0.50 Yaouré - 3.24 Exploration - 2.80 Group - 1.85 | ||||

| Lost Time Injury Frequency (LTIFR) | Lost Time Injuries (LTIFR) per million hours worked, rolling 12 months | Edikan - 0.37 Sissingué - 0.00 Yaouré - 1.59 Exploration - 0.00 Group - 0.45 | Edikan - 0.38 Sissingué - 0.00 Yaouré - 1.30 Exploration - 1.40 Group - 0.46 | ||||

| COVID-19 Cases | Number | 24 | 66 | ||||

| Community | Number of significant2 community events | Number | 0 | 0 | |||

| Community investment | US$ | US$2,100,888 | US$427,415 | ||||

| Economic Benefit | Proportion local and national employment | % of total employees | 95 | % | 95 | % | |

| Proportion local and national procurement | % of total procurement | 81 | % | 74 | % | ||

| Gender Diversity | Board gender diversity | % | 33 | % | 33 | % | |

| Executive gender diversity | % | 40 | % | 40 | % | ||

| Proportion of women employees | % | 14.7%1 | 13.8%1 | ||||

| Responsible Operations | Environment | Number of significant2 environmental events | Number | 0 | 0 | ||

| Tailings | Number of significant2 tailings dam integrity failures | Number | 0 | 0 | |||

| Water stewardship | Water used per ounce of gold produced | M3/oz | 13.8 | 6.91 | |||

| Greenhouse Gas Emissions | Scope 1 and 2 Greenhouse Gas Emissions per ounce of gold produced | Tonnes of CO2-e/oz | 0.63 | 0.57 | |||

Notes:

1. Permanent employees only

2. An event with a severity rating of 4 or above, based on Perseus’s internal severity rating (tiered from 1 to 5 by increasing severity) as per our Risk Management framework

EXPLORATION

CÔTE D’IVOIRE EXPLORATION

YAOURÉ EXPLORATION & EXPLOITATION PERMITS

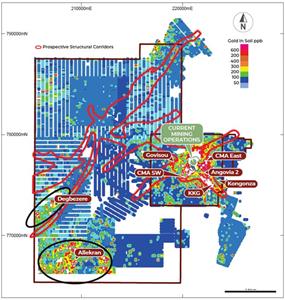

Exploration activities during the quarter on the Yaouré exploitation permit focused on drilling at the CMA Underground and CMA East seismic prospects, both within two kilometres of the Yaouré mill. Refer to ASX Announcement “Positive Exploration Results at Perseus’s Yaouré Mine” dated 14 October 2021 for details.

Other drilling programs conducted on the Yaouré tenements during the quarter, included air core (AC) drilling at Degbezere, and reverse circulation (RC) and diamond drilling (DD) at the CMA SW and Kongonza prospects (Appendix 1 – Figure 1.1). In all, 9,619 metres of RC and 6,272 metres of DD were drilled across the Yaouré exploitation permit during the quarter.

Work at the CMA Underground prospect focused on infill drilling to firm up previously defined underground resources extending below the currently planned CMA pit. Perseus defined an Inferred Mineral Resource of 1.8 million tonnes grading 6.1 g/t Au, extending to a maximum 275m down dip beneath the open pit resource with potential to extend mineralisation further down dip beyond this. Perseus has also completed a Scoping Study which identified the potential to mine the CMA structure using underground mining methods (refer to ASX release entitled “Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré” dated 5th November 2018).

Due to the imminent cutback of the CMA South open pit, and likely loss of suitable sites for drill pads, the first stage of down-dip drilling focused on the southern end of the CMA structure where grades are generally lower than at the northern end. Drilling to date has comprised 6,476.7m in 34 RC pre-collared DD holes, infilling the existing 50 x 50m coverage to a nominal 25 x 25m pattern to allow conversion of the Inferred resource to Indicated. Results to date from the infill drilling program have been encouraging, with intercepts generally consistent with those previously encountered in both thickness and grade. The style of mineralisation is also consistent with previous intersections, comprising pervasive, moderate to strong, pink-pale brown albite and carbonate alteration developed within a well-defined structure marked by quartz carbonate veins, fault veins, multi dilatant fault breccia, cataclasis and shearing.

Step-out drilling to investigate the next 300m down-dip from the current CMA Underground resource has also commenced, with 2,512m of RC pre-collars drilled in 27 holes. Drilling of diamond tails to complete these holes to their targeted depth has commenced, with 827.3m drilled in two holes. The step-out program is guided by Perseus’s early 2020 3D seismic survey that clearly identified the CMA structure extending to depth beyond the current drill coverage. Drilling is being undertaken on an initial 100 x 200m pattern to better define the position of the CMA structure and the intensity of mineralisation. If results are encouraging, this will be infilled to 100 x 100m to allow an initial Inferred Mineral Resource Estimate. The results from the CMA Underground infill and extension drilling received to date demonstrate the potential for the Company to materially grow its gold inventory at Yaouré organically, as is more fully detailed in the Company’s ASX release of 14 October 2021 referred to above.

Drilling to test near-surface extensions of CMA look-alike structures in the hanging wall of the main CMA structure, now termed the CMA East prospect continued, with 1,426 metres drilled in 17 RC holes. Results from this drilling, plus drilling conducted in the previous quarter, were also reported in detail in the Company’s ASX release of 14 October 2021.

Limited extensional drilling was conducted at both the CMA SW (previously CMA South Extension) and Angovia 2 prospects. At CMA SW, two DD holes were drilled into the link between the CMA SW structure and the Sayikro prospect, whilst 913 metres were drilled in 16 RC holes at Angovia 2 to determine the western limits of the deposit. Results from these programs are being evaluated.

On the Yaouré West exploration permit AC drilling was undertaken at the Degbezere prospect, with 2,122 metres drilled in 42 holes, whilst augering continued along the Degbezere NE trend, with 1,952 metres drilled in 149 holes. The AC drilling and augering covers the Degbezere Shear Zone, a structural target identified from soil geochemistry, airborne geophysical surveys and the 2D seismic line surveyed in 2020. Results for both programs remain pending.

BAGOÉ EXPLORATION PERMIT

No drilling was conducted on the Bagoé permit during the September Quarter as results were awaited from infill and extensional AC and RC drilling completed during the previous quarter at the Veronique South and SE, Juliette, A-J Gap and Brigitte prospects (Appendix 1 – Figure 1.2). The results from these programs will be discussed in detail when all assays are to hand, expected to be late-October.

MINIGNAN EXPLORATION PERMIT

Results from a 3,020-metre auger drilling program on Perseus’s Minignan exploration permit located in north-western Côte d’Ivoire were received. Gold values were generally weak, with no coherent zones of significant anomalism identified. As a result, the Company plans to relinquish this property.

GHANA

AGYAKUSU OPTION

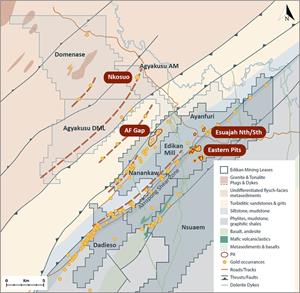

As fully reported in Perseus’s ASX announcement entitled “Exploration Success for Perseus in Ghana” dated 13 October 2021, exploration drilling commenced at the Nkosuo (previously Breman) prospect on the Agyakusu permit on 1st July 2021 (Appendix 1 – Figure 1.3). Up to 30 September 2021, a total of 7,801 metres had been drilled in 13 Reverse Circulation (“RC”), eight diamond (“DD”) holes (including five metallurgical holes) and 26 RC pre-collared diamond holes (“RD”). Drilling was conducted on a nominal 80 x 80 metre grid to scope out the extent and overall geometry of the host granite and contained mineralisation. Results from this program have been highly encouraging, indicating strong potential for delineation of shallow open-pitable gold resources just seven kilometres from the Edikan mill.

Drilling now underway at Nkosuo, will focus on closing up the current hole spacing to 40 x 40 metres and ultimately to locally 20 x 20 metres to support a maiden Mineral Resource Estimate to be undertaken in the March 2022 quarter, with further results to be released as they come to hand. Metallurgical test work and geotechnical drilling is also about to commence so the Ore Reserve potential can be evaluated early in the September Quarter of 2022.

In anticipation that this work will lead to a positive outcome, Perseus is in the process of exercising its option over the Agyakusu permit. Early work to meet the requirements of the ESIA process is also being planned to enable an application for a Mining Lease to be lodged at the earliest opportunity.

AGYAKUSU-DML OPTION

A planned AC drilling program to test gold-in-soil anomalism along the main structural/intrusive corridor extending SW from the Nkosuo prospect on the adjoining Agyakusu permit has been deferred in favour of an initial lower impact auger program (Appendix A - Figure 1.3). Auger drilling is expected to commence during the next quarter.

DOMENASE OPTION

Planned first-pass soil sampling covering the main structural/intrusive corridors on this property is being planned, following the expected signing of an option agreement over the property in October.

EXPLORATION EXPENDITURE

Expenditure on exploration activities throughout West Africa up to 30 September 2021 is outlined in Table 5 below.

Table 5: Group Exploration Expenditure September Quarter

| REGION | UNITS | MARCH 2021 QUARTER | JUNE 2021 QUARTER | JUNE 2021 HALF YEAR | SEPTEMBER 2021 QUARTER | 2021 CALANDAR YEAR TO DATE |

| Ghana | US$ million | 0.46 | 0.39 | 0.85 | 2.14 | 2.99 |

| Côte d’Ivoire | ||||||

| Sissingué | US$ million | 1.86 | 2.55 | 4.41 | 1.10 | 5.51 |

| Yaouré | US$ million | 2.43 | 3.52 | 5.95 | 4.16 | 10.11 |

| Regional | US$ million | 0.12 | 0.07 | 0.19 | 0.25 | 0.44 |

| Sub-total | US$ million | 4.41 | 6.14 | 10.55 | 5.52 | 16.07 |

| Total West Africa | US$ million | 4.87 | 6.53 | 11.40 | 7.66 | 19.06 |

GROUP FINANCIAL POSITION

CASHFLOW AND BALANCE SHEET (UNAUDITED)

Perseus achieved yet another strong quarter of cash generation, with a US$40.1 million increase in its overall net cash position (or cash plus bullion less interest-bearing debt) relative to the prior quarter. The Yaouré Gold Mine led the way and more than compensated for planned reductions in cashflow at Sissingué, and a weaker performance at Edikan.

Based on the spot gold price of US$1,742.8 per ounce and a A$:US$ exchange rate of 0.721234 at 30 September 2021, the total value of cash and bullion on hand at the end of the quarter was A$272.0 million, (US$196.2 million) including cash of A$241.1 million (US$173.9 million) and 12,776 ounces of bullion on hand, valued at A$30.9 million (US$22.3 million). There were no debt repayments made in this quarter.

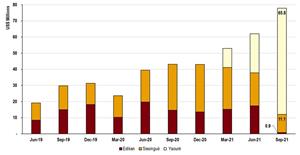

The graph below (Figure 1) shows the notional operating cash flows from the three mines, the largest single driver of cash movement, and how this compares historically over the past 2.5 years. Note that “Notional Operating Cash Flow” is obtained by multiplying average sales price less AISC (the “notional margin”) by the ounces of gold recovered.

Figure 1: Notional Operating Cashflow is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/128a9479-9163-4093-bcb7-d710de7eeb6d

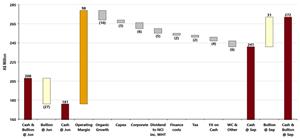

The overall movement in cash and bullion during the quarter is shown below in Figure 2. Aside from the operating margin, other relevant movements are, Australian and West African corporate costs (A$5.5 million), business growth (A$10.4 million), debt service and other finance costs (A$2.2 million), other capex (A$3.1 million), a tax instalment of US$1.5 million (A$2.2 million), and money paid to minority shareholders and WHT as a result of an internal dividend from one of our mines (A$5.3 million).

Figure 2: Quarterly cash and bullion movements is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/47e30c07-9565-4c01-b057-eeb31a28ba36

GOLD PRICE HEDGING

At the end of the quarter, Perseus held gold forward sales contracts for 209,985 ounces of gold at a weighted average sales price of US$1,626 per ounce. These hedges are designated for delivery progressively over the period up to 31 December 2022. Perseus also held spot deferred sales contracts for a further 90,637 ounces of gold at a weighted average sales price of US$1,679 per ounce. Combining both sets of sales contracts, Perseus’s total hedged position at the end of the quarter was 300,622 ounces at a weighted average sales price of US$1,642 per ounce.

Perseus’s hedge position has decreased slightly by 132 ounces since the end of the June 2021 quarter. As a result of our policy of replacing lower priced hedges with higher priced hedge contracts when possible, the weighted average sales price of the hedge book increased by US$47 per ounce or 2.9% during the quarter.

Hedging contracts currently provide downside price protection to approximately 20% of Perseus’s currently forecast gold production for the next three years, leaving 80% of forecast production potentially exposed to movements (both up and down) in the gold price.

PLANNED ANNOUNCEMENTS FOR DECEMBER 2021 QUARTER

- 13 October – Edikan Exploration Update

- 14 October – Yaouré Exploration Update

- 18 October – FY2021 Sustainability Report

- 18 October - FY2021 Annual Report

- November – Sissingué Life of Mine Update

- 25 November - Annual General Meeting

- 10 December 2021 – Payment of Capital Return (subject to Shareholder approval)

This market announcement was authorised for release by the board of Perseus Mining Limited.

COMPETENT PERSON STATEMENT:

All production targets referred to in this report are underpinned by estimated Ore Reserves which have been prepared by competent persons in accordance with the requirements of the JORC Code.

Edikan. The information in this report that relates to AF Gap Mineral Resources and Ore Reserve estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for the Fetish deposit and the Heap Leach was first reported by the Company in a market announcement “Perseus Mining Updates Edikan Gold Mine’s Mineral Resources and Ore Reserves” released on 20 February 2020. The Mineral Reserve and Ore Reserve estimates for the abovementioned deposits were updated for depletion as at 30 June 2021 in a market announcement. “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The information in this report that relates to Esuajah North Mineral Resources estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 29 August 2018. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for Esuajah South Underground deposit was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in those market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Central Ashanti Gold Project, Ghana” dated 30 May 2011 continue to apply.

Sissingué, Fimbiasso, Bagoé. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Fimbiasso deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Sissingué and Bagoé deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015 continue to apply.

Yaouré. The information in this report that relates to Open Pit and Heap Leach Mineral Resources and Ore Reserves at Yaouré was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019 and updated for mining depletion as at 30 June 2021 in a market announcement released on 24 August 2021. The information in this report that relates to Underground Mineral Resources at Yaouré was first reported by the Company in a market announcement “Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré” released on 5 November 2018 and adjusted to exclude material lying within the US$1,800/oz pit shell that constrains the Open Pit Mineral Resources in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019. The information in this report that relates to the Yaouré near mine satellite deposit Mineral Resource and Ore Reserve estimates was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, in that market release continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 18 December 2017 continue to apply.

The information in this report relating to exploration results was first reported by the Company in compliance with the JORC Code 2012 and NI43-101 in market updates “Exploration Success for Perseus in Ghana” released on 13 October 2021 and “Positive Exploration Results at Perseus’s Yaouré Mine” released on 14 October 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases.

CAUTION REGARDING FORWARD LOOKING INFORMATION:

This report contains forward-looking information which is based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of gold, continuing commercial production at the Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine without any major disruption due to the COVID-19 pandemic or otherwise, , the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual market price of gold, the actual results of current exploration, the actual results of future exploration, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. The Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company’s ability to carry on its exploration and development activities, the timely receipt of required approvals, the price of gold, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Perseus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| ASX/TSX CODE: PRU CAPITAL STRUCTURE: Ordinary shares: 1,226,969,570 Performance rights: 26,741,697 REGISTERED OFFICE: Level 2 437 Roberts Road Subiaco WA 6008 Telephone: +61 8 6144 1700 Email: IR@perseusmining.com www.perseusmining.com | DIRECTORS: Mr Sean Harvey Non-Executive Chairman Mr Jeff Quartermaine Managing Director & CEO Ms Elissa Brown Non-Executive Director Mr Dan Lougher Non-Executive Director Mr John McGloin Non-Executive Director Mr David Ransom Non-Executive Director Amber Banfield Non-Executive Director | CONTACTS: Jeff Quartermaine Managing Director & CEO jeff.quartermaine@perseusmining.com Claire Hall Corporate Communications +61 414 558 202 claire.hall@perseusmining.com Nathan Ryan Media Relations +61 4 20 582 887 nathan.ryan@nwrcommunications.com.au |

APPENDIX 1 – FIGURES

Figure 1.1: Yaouré Gold Project – Tenements and Prospects is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/08779f1c-dd02-4522-a374-ea0225cae4e6

Figure 1.2: Sissingué Gold Mine and Bagoé Project – Tenements and Prospects is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4f5140be-b0cc-4f0a-a433-cb6246b38fcf

Figure 1.3: Edikan Gold Mine – Regional Geology, Tenements and Prospects is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/05c82f51-f6e3-46c4-8214-4d6aed82a2f6