Sherritt Reports Strong 2022 Results, Improved Balance Sheet and Receipt of First Cobalt Swap Distribution

Sherritt International Corporation (“Sherritt”, the “Corporation”, the “Company”) (TSX: S), a world leader in the mining and hydrometallurgical refining of nickel and cobalt from lateritic ores, today reported its financial results for the three months and year ended December 31, 2022. All amounts are in Canadian currency unless otherwise noted.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230207006175/en/

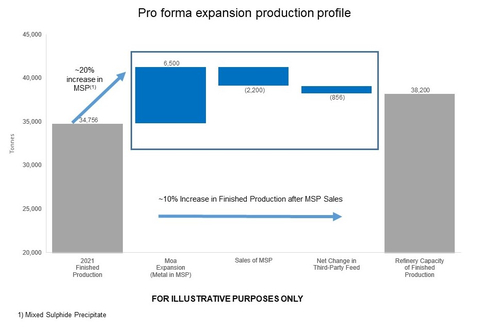

Appendix 1. Pro forma expansion production profile (Graphic: Business Wire)

“2022 was a pivotal year for Sherritt. On the strength of higher nickel and fertilizer prices, we achieved strong operating and financial results while delivering on each of our 2022 strategic priorities to set the stage for continued success in the future. We were able to commence a low capital intensity expansion program, significantly deleverage our balance sheet, finalize transformative payment agreements with our Cuban partners to recover $368 million of total outstanding receivables, advance our portfolio of proprietary technologies, and meet our sustainability targets,” said Leon Binedell, President and CEO of Sherritt International Corporation.

Mr. Binedell added, “We are encouraged by the progress we have made on these building blocks for the future while maintaining sound operational focus and fiscal responsibility. Our Cobalt Swap agreement yielded its first distribution following the year-end, demonstrating the significant value associated with our outstanding receivables, and will provide financial support to deliver on our strategic priorities going forward. In addition, we set both our Metals and Power businesses up for the long-term, with on-going work at the Moa mine to extend the mine life beyond 2040, and the 20-year extension to the Power production agreement. Combined with the Moa Swap, it enables the Power business to run efficiently, including a mechanism to distribute funds to Sherritt in the future.”

SELECTED Q4 2022 DEVELOPMENTS

- Sherritt finalized an agreement with its Cuban partners to recover $368 million total outstanding Cuban receivables over five years beginning January 1, 2023 (the Cobalt Swap). Under this agreement, the Moa JV will prioritize payment of dividends in the form of finished cobalt to each partner, up to an annual maximum of cobalt, with any additional dividends in a given year to be distributed in cash. All of the Cuban partner’s share of these cobalt dividends, and potentially additional cash dividends, will be redirected to Sherritt as payment to settle the receivables until the annual maximum cobalt volume and dollar amount limits, including the collection of any prior year shortfalls, has been reached.

- Sherritt repurchased an aggregate of almost $90 million in principal of its second lien secured notes and junior notes at a discounted value of $80 million.

- Sherritt and its Cuban partners finalized an extension to the Energas Payment Agreement (the Moa Swap) to fund the operating and maintenance costs of Energas, as well as cover future payments that would be owed to Sherritt, including dividends. Sherritt expects to continue to receive approximately US$4.2 million ($5.6 million) per month under a payment agreement between Sherritt, Moa JV and Energas. The Moa JV converts foreign currency to Cuban pesos through Energas to support Moa JV’s local Cuban operating activities. The foreign currency is then paid to Sherritt primarily to facilitate foreign currency payments for the Energas operations and capital as well as to fund dividend repatriations to Sherritt. During the quarter Sherritt received $22.8 million (US$16.8 million) pursuant to this agreement.

- Cuba’s Executive Committee of the Council of Ministers approved the twenty-year extension of the Energas Joint Venture contract with the Cuban government to March 2043. The extension of this economically beneficial contract supports Sherritt's on-going investments in Cuba, helps facilitate the Cobalt and Moa Swaps, and supports Cuba’s long-term energy security.

- Sherritt received distributions from the Moa JV of $57.2 million (US$42.5 million) which resulted in H2 distributions exceeding those received in H1.

- Net loss from continuing operations was $7.3 million, or $(0.02) per share in Q4 2022, compared to net earnings from continuing operation of $14.4 million, or $0.04 per share, in Q4 2021 while Adjusted EBITDA(1) in the quarter was $19.7 million compared to $46.4 million in Q4 2021. Higher nickel and fertilizer sales volume and realized prices in the current-year period were offset by lower cobalt sales volume and realized price and higher input commodity prices. In addition, Sherritt recognized a $12.8 million environmental rehabilitation obligation (ERO) expense adjustment on legacy Oil and Gas Spanish assets, and a $10.7 million share-based compensation expense. Net earnings from continuing operations also includes a $7.1 million gain on the repurchase of notes.

- Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) was 4,112 tonnes and 423 tonnes, 4% and 11% lower, respectively, than the prior year periods. Lower finished nickel and cobalt production was impacted by lower mixed sulphides availability at the refinery. The higher nickel-to-cobalt ratio in the feed from Moa further contributed to lower cobalt production.

- Net direct cash cost (NDCC)(1) at the Moa JV was US$7.00/lb in Q4 2022 compared to US$3.60/lb in Q4 2021. NDCC was higher due to higher input commodity costs, including a 55% increase in global sulphur prices, 133% increase in diesel prices, and a 15% increase in fuel oil prices, alongside lower cobalt by-product credit, partly offset by higher net fertilizer by-product credit.

- Sherritt issued its 2021 sustainability, climate, and tailings management reports as well as its sustainability scorecard outlining the Corporation’s performance on environmental, social, and governance (ESG) matters. Sherritt continues to progress on its commitments to achieving net zero greenhouse (GHG) emissions by 2050, obtaining 15% of overall energy from renewable sources by 2030, reducing nitrogen oxide emission intensity by 10% by 2024, and increasing the number of women in its workforce to 36% by 2030.

- Technologies entered into an agreement with Open Mineral AG to jointly develop a business case in 2023 for the hydrometallurgical treatment of complex precious metal concentrates. Sherritt will partner with Open Mineral to explore the implementation of its proprietary technologies to solve ESG and precious metal concentrate market challenges regarding arsenic pollution. Open Mineral is a physical commodity trader powered by technology and market intelligence, enabling profitable and efficient trading of raw material commodities and has been recognized by the World Economic Forum as a Technology Pioneer (2019) and was an S&P Global Metals Awards Winner as a Rising Star Company (2020).

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

SELECTED FULL YEAR 2022 DEVELOPMENTS

- Including the repurchase of notes in Q4, Sherritt repurchased an aggregate of almost $150 million in principal of its second lien secured notes and junior notes at a 16% discount, reducing its principal debt by 35% from the beginning of the year and reducing its annual interest expense by approximately $13 million.

- Sherritt received distributions from the Moa JV of $100.6 million (US$76.5 million) which were more than double those received in each of the three prior years.

- Net earnings from continuing operations was $63.7 million, or $0.16 per share in 2022, compared to a net loss from continuing operations of $13.4 million, or $(0.03) per share, in 2021 while Adjusted EBITDA(1) for 2022 was $217.6 million compared to $112.2 million in 2021. Higher nickel and fertilizer sales volume and realized prices were partly offset by higher input commodity prices, a $15.0 million ERO expense adjustment on legacy Oil and Gas Spanish assets, and a $17.5 million share-based compensation expense. Net earnings from continuing operations were also impacted by the recognition of a $49.0 million non-cash loss on revaluation of the allowances for expected credit losses (ACL) related to the repayment of the Energas conditional sales agreement (CSA) receivable under the Cobalt Swap agreement and a $20.9 million gain on the repurchase of notes.

- Sherritt’s adjusted net earnings from continuing operations(1) was $88.4 million, or $0.22 per share, in 2022 compared to an adjusted net loss from continuing operations of $13.9 million, or $(0.03) per share, in 2021.

- Finished nickel production was 32,268 tonnes (100% basis), in line with guidance, representing a 3% increase year-over-year primarily due to increased refinery reliability, while finished cobalt production of 3,368 tonnes (100% basis) was materially within guidance and 4% lower than the prior year as a result of the higher nickel-to-cobalt ratio in the Moa mixed sulphide feed and lower availability of third-party feed.

- NDCC(1) at the Moa JV was US$5.14/lb for 2022 compared to US$4.11/lb in 2021. NDCC was higher in the current year due to higher input commodity costs, including a 119% increase in global sulphur prices, a 109% increase in diesel prices, and a 40% increase in fuel oil prices. The Cobalt by-product credit was only 2% lower for 2022 compared to 2021 as the higher average-realized prices offset lower sales volume. Net fertilizer by-product credit increased by 210% compared to 2021 on higher sales volume and average-realized prices. NDCC was slightly above guidance as a result of higher input commodity prices and lower than anticipated cobalt prices and sales volume during the fourth quarter.

- At the Power business unit, electricity production beat updated guidance and unit operating cost(1) was lower than guidance, primarily as a result of higher equipment availability in 2022 as a result of the completion of maintenance activities in the prior year and as a result of successful efforts to increase availability of gas.

- Sherritt ended 2022 with cash and cash equivalents of $123.9 million, down from $145.6 million at the end of last year. Of these amounts, $20.3 million was held in Canada, down from $64.9 million as at December 31, 2021, and $96.7 million was held at Energas, up from $78.6 million as at December 31, 2021. Cash decreased primarily due to the use of $125.2 million to repurchase approximately $150 million in principal of second lien secured notes and junior notes, $29.1 million of interest paid on the second lien secured notes, and $28.5 million of capital expenditures, partly offset by $100.6 million of distributions received from the Moa Joint Venture, $37.0 million drawn on the revolving credit facility, and $31.3 million of cash provided by continuing operations at the Fort Site as a result of higher fertilizer sales.

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

MOA JV EXPANSION PROGRAM UPDATE

In 2022, Sherritt embarked on an expansion program focused on increasing annual mixed sulphide precipitate (MSP) production by 20% or 6,500 tonnes of contained nickel and cobalt (100% basis). The program includes completion of the Slurry Preparation Plant (SPP), Leach Plant Sixth Train and Fifth Sulphide Precipitation Train as well as construction of additional acid storage capacity at Moa. The total capital cost is expected to be US$77.0 million (100% basis) or approximately US$13,200 per additional annual tonne of contained nickel for the full expansion.

In phase one of the program, the completion of the SPP is expected to be completed in early 2024 and is anticipated to deliver several benefits including reduced ore haulage distances and lower carbon intensity from mining. Upon completion it will increase MSP production by approximately 1,700 tonnes of contained nickel and cobalt annually. Completion of the second phase of the program, the Moa processing plant improvements, which is planned for completion by the end of 2024, is expected to increase MSP production by approximately an additional 4,800 tonnes of contained metals annually and reduce NDCC by approximately US$0.20/lb. Progress in the quarter included:

Slurry Preparation Plant:

- Construction of the SPP is progressing on schedule with civil construction 100% complete, and all contracts for supply of materials and services awarded. Structural steel pre-fabrication is ongoing with 65% erected and field assembly of major equipment has commenced.

Moa Processing Plant:

- The final stage of the Feasibility Study, encompassing the full project scope, has been submitted for approval to the Cuban authorities and approval is anticipated in Q1 2023; and

- Bids have been received and are being evaluated for the long lead items for the Leach Plant Sixth Train and contracts for these items will be awarded in Q1 2023. A detailed project execution schedule is currently being developed.

Refer to the Moa Joint Venture and Fort Site review of operations section for further details.

MOA JV LIFE OF MINE/UPDATED NI 43-101 TECHNICAL REPORT

The work to complete the Economic Cut-Off Grade (ECOG) and Life of Mine (LOM) development continues at the Moa mine. ECOG and LOM analysis using the latest methodologies are expected to extend the current LOM to beyond 2040. Progress in the quarter included:

- Resource model classifications were updated and a new LOM was generated based on the ECOG methodology; and

- Sherritt and the Moa JV continued engagement with the Oficina Nacional de Recursos Minerales (ONRM), Cuba’s Natural Resources Agency, and gained alignment on the latest resource models and ECOG methodology. The Joint Venture will continue to collaborate with the ONRM to prepare detailed mine plans using the new methodologies in 2023.

Development of the NI 43-101 report and peer review will continue in early Q1 2023 with the final NI 43-101 report expected to be released by the end of Q1 2023.

DEVELOPMENTS SUBSEQUENT TO QUARTER END

-

The Moa Joint Venture distributed 760 tonnes of finished cobalt to Sherritt with an in-kind value of US$27.0 million ($36.2 million) (100% basis) under the Cobalt Swap agreement with its Cuban partners to recover its total outstanding Cuban receivables over five years. The title to both Sherritt’s and its partner’s redirected share of the cobalt was transferred immediately to a Sherritt warehouse in Fort Saskatchewan and other international warehouses. Sherritt has begun and will continue to sell the cobalt to existing and new customers.

As a result, of the distribution, US$13.5 million ($18.1 million) of the GNC receivable will be settled in the three months ended March 31, 2023, representing GNC’s 50% portion of cobalt redirected to Sherritt in satisfaction of the receivable under the Cobalt Swap.

- The syndicated revolving-term credit facility has been amended to extend its maturity for one year from April 30, 2024 to April 30, 2025, with no changes to the terms, financial covenants or restrictions.

Q4 2022 FINANCIAL HIGHLIGHTS

|

For the three months ended |

|

For the year ended |

|

||||||||||||

|

2022 |

2021 |

|

2022 |

2021 |

|

||||||||||

$ millions, except per share amount |

December 31 |

December 31 |

Change |

December 31 |

December 31 |

Change |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Revenue |

$ |

48.6 |

$ |

36.6 |

33% |

$ |

178.8 |

$ |

110.2 |

62% |

||||||

Combined revenue(1) |

|

237.1 |

|

198.6 |

19% |

|

850.9 |

|

612.8 |

39% |

||||||

Earnings from operations and joint venture |

|

(0.1) |

|

20.5 |

(100%) |

|

118.7 |

|

8.5 |

nm(2) |

||||||

Net (loss) earnings from continuing operations |

|

(7.3) |

|

14.4 |

(151%) |

|

63.7 |

|

(13.4) |

575% |

||||||

Net (loss) earnings for the period |

|

(7.0) |

|

14.1 |

(150%) |

|

63.5 |

|

(18.4) |

445% |

||||||

Adjusted EBITDA(1) |

|

19.7 |

|

46.4 |

(58%) |

|

217.6 |

|

112.2 |

94% |

||||||

Net (loss) earnings from continuing operations ($ per share) |

|

(0.02) |

|

0.04 |

(150%) |

|

0.16 |

|

(0.03) |

633% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Cash provided (used) by continuing operations for operating activities |

|

40.3 |

|

(13.4) |

401% |

|

90.3 |

|

1.3 |

nm |

||||||

Combined free cash flow(1) |

|

43.2 |

|

(26.4) |

264% |

|

65.1 |

|

14.5 |

349% |

||||||

Average exchange rate (CAD/US$) |

|

1.358 |

|

1.260 |

8% |

|

1.301 |

|

1.254 |

4% |

||||||

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

|

(2) |

Not meaningful (nm). |

$ millions, as at December 31 |

2022 |

2021 |

Change |

|||||

|

|

|

|

|

|

|||

Cash and cash equivalents |

$ |

123.9 |

$ |

145.6 |

(15%) |

|||

Loans and borrowings |

|

350.9 |

|

444.5 |

(21%) |

|||

Cash and cash equivalents at December 31, 2022 were $123.9 million, down from $137.6 million at September 30, 2022. During Q4 2022, $80.4 million of cash was used to repurchase $90.0 million of second lien secured notes and junior notes and $13.9 million of interest paid on the second lien secured notes. Partly offsetting these uses, Sherritt received $57.2 million in distributions from the Moa JV during the quarter, and the Corporation drew $37.0 million on its revolving credit facility.

On a full year basis, cash and cash equivalents at December 31, 2022 of $123.9 million, were down from $145.6 million at December 31, 2021. During 2022, cash decreased primarily due to the use of $125.2 million to repurchase $149.1 million in principal of second lien secured notes and junior notes, $29.1 million for interest on the second lien secured notes, and $28.5 million for capital expenditures. Partly offsetting these uses, Sherritt received $100.6 million of distributions from the Moa Joint Venture, drew $37.0 million drawn on the revolving credit facility, and realized $31.3 million of cash from continuing operations at the Fort Site as a result of higher fertilizer sales.

Sherritt also received $22.8 million (US$16.8 million) and $54.6 million (US$41.4 million) from Energas in Q4 and the full year 2022, respectively, pursuant to the Moa Swap agreement which was primarily used to facilitate foreign currency payments for the Energas operations and capital.

Of the $123.9 million of cash and cash equivalents, $20.3 million was held in Canada, and $96.7 million was held at Energas. The remaining amounts were held in Cuba and other countries.

For the two-quarter period ended December 31, 2022, excess cash flow, as defined in the second lien secured notes indenture agreement, was $43.4 million. At the interest payment date in April 2023, the Corporation will be required to redeem, at par, total second lien secured notes up to an amount equal to 50% of excess cash flow, or $21.7 million, subject to minimum liquidity of $75.0 million as defined in the indenture agreement being maintained before and after such payment is made. As such, the $80.4 million of cash used to repurchase second lien secured notes and junior notes during the six months ended December 31, 2022 and any outstanding amounts drawn on the syndicated revolving-term credit facility as at the interest payment date in April 2023 will be taken into account when calculating the minimum liquidity amount.

The Cobalt Swap agreement

In Q4 2022, Sherritt finalized the Cobalt Swap with its Cuban partners to recover the total outstanding Cuban receivables over five years, beginning January 1, 2023. Under the agreement, the Moa JV will prioritize payment of dividends in the form of finished cobalt to each partner, up to an annual maximum volume of cobalt, with any additional dividends in a given year to be distributed in cash. All of the Cuban partner’s share of these cobalt dividends, and potentially additional cash dividends, will be redirected to Sherritt as payment to settle the receivables until the annual minimum payment amount and cobalt dividend volume, including the collection of any prior year shortfalls, has been reached.

The outstanding receivable amounts owing to Sherritt from Energas S.A. (Energas) and Union Cuba-Petroleo (CUPET), totaling $368.0 million, were assumed by General Nickel Company (GNC), Sherritt’s Moa JV partner, who in turn will enter into payment agreements of an equivalent amount, denominated in Cuban pesos, with Energas and CUPET. This amount includes the Energas conditional sales agreement (Energas CSA) receivable of $336.4 million and trade accounts receivables from CUPET of $31.7 million. This reflects the total amount owing to Sherritt from Energas and CUPET rather than only the overdue amounts based on scheduled payments. The Energas CSA balance includes the total amount owing, excluding the 33 1/3% elimination reported in Sherritt’s consolidated financial statements.

No interest will accrue on the Energas CSA to ensure repayment within five years; however, in the event that the total outstanding receivables are not fully repaid by December 31, 2027, interest will accrue retroactively at 8% per annum from January 1, 2023 on the unpaid principal amount, and the unpaid principal and interest amounts will become due and payable to Sherritt by GNC.

Over the five-year period beginning January 1, 2023, the Moa JV expects to distribute a maximum of 2,082 tonnes, or approximately 60% of current production (100% basis), of finished cobalt annually to the joint venture partners (finished cobalt dividends). Accordingly, Sherritt expects to receive a maximum of 1,041 tonnes of the finished cobalt dividends per year in respect of its 50% share of the Moa JV. GNC will redirect its 50% share of the finished cobalt dividends, up to 1,041 tonnes per year, to Sherritt as repayment towards the outstanding receivables, provided that the total cobalt volume redirected has a value of at least US$57 million. If the total annual finished cobalt dividend redirected by GNC has a value of less than US$57.0 million, GNC’s share of any cash distributions from the Moa Joint Venture in such year will be redirected to Sherritt until the value of physical cobalt and cash distributions in the aggregate totals US$57.0 million. Any shortfall in the annual minimum payment amount and cobalt dividend volume, will be carried forward to the subsequent year such that full repayment is expected to be made within five years.

Upon receipt of the finished cobalt dividends, the title to both Sherritt and its partner’s redirected cobalt share will be transferred immediately to a Sherritt warehouse in Fort Saskatchewan and other international warehouses, from which Sherritt will sell the finished cobalt in the market.

This transaction represents a significant milestone for Sherritt and is expected to provide significant cash flow to deliver on the Corporation’s strategic priorities to reduce debt and actively expand its business through:

- reasonable certainty the amount will be paid over the five-year term of the loan as it is independent of Sherritt’s Cuban partner’s ability to access foreign currency;

- a reasonably certain cash flow to Sherritt of US$114 million annually through the sale of cobalt, half of which will be used to settle the amounts receivable;

- the receipt of the majority of the payments prior to maturity of the second lien notes in November 2026; and

- an opportunity for early settlement of the receivables through enhanced repayment if the market value of the cobalt increases.

Subsequent to the quarter end, the Moa Joint Venture distributed 760 tonnes of finished cobalt to Sherritt with an in-kind value of US$27.0 million ($36.2 million) (100% basis) under the Cobalt Swap with its Cuban partners to recover its total outstanding Cuban receivables over five years. The title to both Sherritt and its partner’s redirected share of the cobalt was transferred immediately to a Sherritt warehouse in Fort Saskatchewan and other international warehouses. Sherritt has begun and will continue to sell the cobalt to existing and new customers.

As a result, of the distribution, US$13.5 million ($18.1 million) of the GNC receivable will be settled in the three months ended March 31, 2023, representing GNC’s 50% portion of cobalt redirected to Sherritt in satisfaction of the receivable.

Adjusted net earnings (loss) from continuing operations(1)

|

2022 |

2021 |

||||||||||

For the three months ended December 31 |

$ millions |

$/share |

$ millions |

$/share |

||||||||

|

|

|

|

|

|

|

|

|

||||

Net (loss) earnings from continuing operations |

$ |

(7.3) |

$ |

(0.02) |

$ |

14.4 |

$ |

0.04 |

||||

|

|

|

|

|

|

|

|

|

||||

Adjusting items: |

|

|

|

|

|

|

|

|

||||

Sherritt - Unrealized foreign exchange loss (gain) - continuing operations |

|

4.1 |

|

0.01 |

|

(1.4) |

|

- |

||||

Corporate - Gain on repurchase of notes |

|

(7.1) |

|

(0.02) |

|

- |

|

- |

||||

Corporate - Transaction finance charges on repurchase of notes |

|

1.1 |

|

- |

|

- |

|

- |

||||

Corporate - Severance and other contractual benefits expense |

|

- |

|

- |

|

0.6 |

|

- |

||||

Corporate - Unrealized losses on commodity put options |

|

- |

|

- |

|

(2.2) |

|

(0.01) |

||||

Corporate - Realized loss on commodity put options |

|

- |

|

- |

|

2.3 |

|

0.01 |

||||

Moa Joint Venture - Inventory obsolescence |

|

1.6 |

|

0.01 |

|

0.5 |

|

- |

||||

Fort Site - Inventory obsolescence |

|

0.6 |

|

- |

|

- |

|

- |

||||

Oil and Gas - Impairment of intangible assets |

|

1.3 |

|

0.01 |

|

- |

|

- |

||||

Oil and Gas and Power - Trade accounts receivable, net ACL revaluation |

|

- |

|

- |

|

0.7 |

|

- |

||||

Oil and Gas and Power - Gain on modification of Cuban receivables |

|

(4.0) |

|

(0.01) |

|

- |

|

- |

||||

Power - Revaluation of Energas payable |

|

4.0 |

|

0.01 |

|

- |

|

- |

||||

Power - Revaluation of GNC receivable |

|

(2.4) |

|

(0.01) |

|

- |

|

- |

||||

Other(1) |

|

- |

|

- |

|

0.1 |

|

- |

||||

Total adjustments, before tax |

$ |

(0.8) |

$ |

- |

$ |

0.6 |

$ |

- |

||||

Tax adjustments |

|

0.6 |

|

- |

|

(0.2) |

|

- |

||||

Adjusted net (loss) earnings from continuing operations |

$ |

(7.5) |

$ |

(0.02) |

$ |

14.8 |

$ |

0.04 |

||||

(1) |

Other items primarily relate to losses in net finance (expense) income. |

|

2022 |

2021 |

||||||||||

For the year ended December 31 |

$ millions |

$/share |

$ millions |

$/share |

||||||||

|

|

|

|

|

|

|

|

|

||||

Net earnings (loss) from continuing operations |

$ |

63.7 |

$ |

0.16 |

$ |

(13.4) |

$ |

(0.03) |

||||

|

|

|

|

|

|

|

|

|

||||

Adjusting items: |

|

|

|

|

|

|

|

|

||||

Sherritt - Unrealized foreign exchange gain - continuing operations |

|

(5.4) |

|

(0.01) |

|

(4.7) |

|

(0.01) |

||||

Corporate - Gain on repurchase of notes |

|

(20.9) |

|

(0.06) |

|

(2.1) |

|

(0.01) |

||||

Corporate - Transaction finance charges on repurchase of notes |

|

2.3 |

|

0.01 |

|

- |

|

- |

||||

Corporate - Severance and other contractual benefits expense |

|

- |

|

- |

|

6.1 |

|

0.02 |

||||

Corporate - Unrealized losses on commodity put options |

|

(0.9) |

|

- |

|

0.8 |

|

- |

||||

Corporate - Realized losses on commodity put options |

|

0.9 |

|

- |

|

4.8 |

|

0.01 |

||||

Moa Joint Venture - Inventory obsolescence |

|

2.1 |

|

0.01 |

|

1.8 |

|

0.01 |

||||

Fort Site - Inventory obsolescence |

|

0.6 |

|

- |

|

1.2 |

|

- |

||||

Oil and Gas - Gain on disposal of PP&E |

|

(1.3) |

|

- |

|

(1.2) |

|

- |

||||

Oil and Gas - Impairment of intangible assets |

|

1.3 |

|

- |

|

- |

|

- |

||||

Oil and Gas - Realized foreign exchange gain due to Cuban currency unification |

|

- |

|

- |

|

(10.0) |

|

(0.03) |

||||

Oil and Gas and Power - Trade accounts receivable, net ACL revaluation |

|

0.4 |

|

- |

|

0.8 |

|

- |

||||

Oil and Gas and Power - Gain on modification of Cuban receivables |

|

(4.0) |

|

(0.01) |

|

- |

|

- |

||||

Power - Energas conditional sales agreement ACL revaluation(1) |

|

49.0 |

|

0.12 |

|

2.7 |

|

0.01 |

||||

Power - Revaluation of Energas payable |

|

4.0 |

|

0.01 |

|

- |

|

- |

||||

Power - Revaluation of GNC receivable |

|

(2.4) |

|

(0.01) |

|

- |

|

- |

||||

Other(2) |

|

- |

|

- |

|

(0.3) |

|

- |

||||

Total adjustments, before tax |

$ |

25.7 |

$ |

0.06 |

$ |

(0.1) |

$ |

- |

||||

Tax adjustments |

|

(1.0) |

|

- |

|

(0.4) |

|

- |

||||

Adjusted net earnings (loss) from continuing operations |

$ |

88.4 |

$ |

0.22 |

$ |

(13.9) |

$ |

(0.03) |

||||

(1) |

Primarily related to a non-cash loss on revaluation of the ACL on the Energas CSA receivable as a result of the Cobalt Swap signed by the Corporation during the year, in part, due to the suspension of interest over the five-year period of the agreement. |

|

(2) |

Other items primarily relate to losses in net finance (expense) income. |

METALS MARKET

As a commodity-based business, Sherritt’s operating results are primarily influenced by the prices of nickel and cobalt. In 2022, fertilizer market changes also had a significant impact on operating results.

Nickel

Nickel prices closed Q4 2022 at US$13.80/lb on December 31, 2022 compared to US$10.11/lb on September 30, 2022. The range for the quarter was between US$9.73/lb and US$13.84/lb. Class I supply and inventory remained tight, causing the London Metals Exchange (LME) prices to rally in late Q4 reaching a high of US$13.84/lb on December 28 due to the covering of short positions from prior months, with sentiment improving slightly on the expectation that relaxation of COVID-related restrictions in China will increase commodity demand. The average nickel price for Q4 was US$11.47/lb compared to US$10.01/lb for Q3 2022, a 15% increase while the average nickel price for 2022 was US$11.61/lb, 38% higher than the average for 2021 at US$8.39/lb.

Total inventory levels on the LME and Shanghai Futures Exchange (SHFE) combined remained near-term range bound and ended the quarter at 56,621 tonnes, about 5% higher than at Q3 level of 54,444 tonnes and 46% lower than at the end of 2021 (104,292 tonnes).

In December 2022, Wood Mackenzie estimated nickel demand to increase by 45% from 2023 to 2027. The continued strong growth in nickel supply, especially additions in Indonesia from Class II sources, NPI (nickel pig iron), matte and to a lesser extent MHP (mixed hydroxide precipitate) via HPAL (high pressure acid leach) is set to marginally outpace demand, resulting in the potential for a marginally oversupplied market in the near term. This is, however, in a market that is anticipated to reach demand of over 4,000 ktpa by 2026 up from 2,900 ktpa in 2022. The combined growth of stainless steel and lithium-ion battery consumption, as well as potential slower than anticipated ramp up of new projects to support supply, especially large-scale NPI, matte and HPAL projects in Indonesia, is expected to keep the nickel market in relative balance, leading to prices remaining at support levels required to incentivize continued new project growth.

On a shorter-term basis, the first half of 2023 is expected to reflect transitory downward pressure on nickel prices, as high energy prices and the conflict in Ukraine weigh on sentiment and stainless production in Europe. In the Far East, stainless production is expected to recover as China returns from the Spring Festival holiday in late January, fresh from the relaxation of COVID-related lockdowns, but subject to the potential disruptions due to future outbreaks. Global lithium-ion battery demand will continue to support consumption of nickel in the form of nickel sulphate, although consumption of Class I materials in this market segment is expected to diminish as Class II materials (especially matte and MHP) continue to be produced in large quantities in Indonesia, putting pressure on nickel sulphate premiums.

In the long-term (2027- 2032), continued strong demand from the electric vehicle and energy storage system sectors will shift the lithium-ion batteries market share to 30% from 15% by 2028. Despite stainless applications’ continued growth, albeit at a slower rate, its market share is expected to shrink to 54% from 64%. The combined growth of batteries and stainless steel is expected to push the market balance to a deficit, with new supply required to maintain market balance, thus supporting robust prices over the long-term.

Cobalt

Cobalt prices closed Q4 2022 at US$20.90/lb on December 31, 2022 compared to US$25.90/lb on September 30, 2022. The price continued to decline in Q4, from a peak of US$26.15/lb in early October to a low of US$20.90/lb by December 31, 2022. The average cobalt price for Q4 was US$23.00/lb compared to US$26.26/lb for Q3 2022, a 12% decrease while the average cobalt price for 2022 was US$30.75/lb, 26% higher than the average for 2021 at US$24.24/lb.

A continued post-pandemic decline following strong pandemic-related purchases of consumer electronics, coupled with advancement of high-nickel chemistries and lithium iron phosphate (LFP) cathode active materials (CAM) in lithium-ion batteries has led to decreased near-term cobalt demand, even with stronger aerospace demand. This lower overall demand, coupled with strong supply growth of cobalt from Indonesia HPAL MHP projects has led to cobalt continuing to trade at lower prices, highlighting near-term weakness in the chemical sector. The anticipated growth in supply may be hampered by slower than anticipated ramp up in new projects from large-scale NPI, matte and HPAL projects which may partly negate the downward pressure on pricing.

The expected proliferation of EV’s provides a positive longer-term outlook for demand, which is expected to increase despite the EV industry’s efforts to minimize cobalt content to reduce both battery cost and supply risk. CRU estimates cobalt demand growth to increase at an 11% CAGR from 2023 to 2027 with EV battery consumption driving much of this increase, at a 13% CAGR. The cobalt market is largely levered to the EV growth sector providing strong long-term demand for cobalt and supporting Sherritt’s growth strategy as a reliable cobalt producer. According to the CRU outlook in December 2022, the global cobalt market in the short to medium term is expected to shift between balanced to slight surpluses until 2026, with deficits likely occurring in the long term from 2027 onwards.

Fertilizer

The two main fertilizer products produced at the Fort site are ammonia and ammonium sulphate. Revenue is derived from the sale of ammonia and ammonium sulphate fertilizers principally into the Western Canadian market. Demand for fertilizer products is mainly seasonal, consisting of a spring and a fall season. Demand in the spring season is typically greater due to more crop planting compared to the fall season, leading to higher sales volumes.

The average-realized prices for Sherritt’s fertilizer products in Q4 2022 were 19% higher than in Q4 2021. For 2022, the average-realized price was 73% higher than in 2021, largely as a result of the significant run up in reference prices in Q1 and Q2 of 2022 with the escalation of the Ukraine conflict.

Prices reflect higher raw material prices for ammonia and ammonium related fertilizer stemming from high natural gas prices due the Russia-Ukraine war. The war also put further pressure on price of grains with Ukraine being one of the biggest regional exporters. Strong corn and wheat prices improved the relative affordability in a high fertilizer price environment. A mild winter in Europe and sufficient gas storage could result in a short-term prices decline; however, energy markets and global geo-political constraints will continue to influence prices with expected elevated natural gas prices continuing to support ammonia and ammonium sulphate prices.

REVIEW OF OPERATIONS

Moa Joint Venture (50% interest) and Fort Site (100%)

|

For the three months ended |

|

For the year ended |

|

||||||||||||

|

2022 |

2021 |

|

2022 |

2021 |

|

||||||||||

$ millions (Sherritt's share), except as otherwise noted |

December 31 |

December 31 |

Change |

December 31 |

December 31 |

Change |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

FINANCIAL HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

||||||

Revenue(1) |

$ |

221.6 |

$ |

183.2 |

21% |

$ |

786.8 |

$ |

560.6 |

40% |

||||||

Cost of Sales(1) |

|

186.9 |

|

142.7 |

31% |

|

576.9 |

|

451.4 |

28% |

||||||

Earnings from operations |

|

31.0 |

|

36.2 |

(14%) |

|

200.2 |

|

98.3 |

104% |

||||||

Adjusted EBITDA(2) |

|

45.6 |

|

49.4 |

(8%) |

|

254.0 |

|

152.3 |

67% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

CASH FLOW |

|

|

|

|

|

|

|

|

|

|

||||||

Cash provided by continuing operations for operating activities |

$ |

85.7 |

$ |

8.9 |

863% |

$ |

177.1 |

$ |

90.5 |

96% |

||||||

Free cash flow(2) |

|

61.8 |

|

0.6 |

nm(7) |

|

112.9 |

|

56.5 |

100% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

PRODUCTION VOLUMES (tonnes) |

|

|

|

|

|

|

|

|

|

|

||||||

Mixed Sulphides |

|

4,000 |

|

3,881 |

3% |

|

16,248 |

|

16,498 |

(2%) |

||||||

Finished Nickel |

|

4,112 |

|

4,266 |

(4%) |

|

16,134 |

|

15,592 |

3% |

||||||

Finished Cobalt |

|

423 |

|

476 |

(11%) |

|

1,684 |

|

1,763 |

(4%) |

||||||

Fertilizer |

|

62,254 |

|

65,021 |

(4%) |

|

250,147 |

|

245,059 |

2% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

NICKEL RECOVERY(3) (%) |

|

85% |

|

90% |

(6%) |

|

87% |

|

86% |

1% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

SALES VOLUMES (tonnes) |

|

|

|

|

|

|

|

|

|

|||||||

Finished Nickel(4) |

|

4,486 |

|

4,169 |

8% |

|

15,879 |

|

15,603 |

2% |

||||||

Finished Cobalt |

|

386 |

|

474 |

(19%) |

|

1,379 |

|

1,775 |

(22%) |

||||||

Fertilizer |

|

61,664 |

|

51,748 |

19% |

|

170,427 |

|

168,782 |

1% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

AVERAGE-REFERENCE PRICE(2) (USD) |

|

|

|

|

|

|

|

|

|

|

||||||

Nickel (US$ per pound)(5) |

$ |

11.47 |

$ |

8.99 |

28% |

$ |

11.61 |

$ |

8.39 |

38% |

||||||

Cobalt (US$ per pound)(6) |

|

23.00 |

|

29.89 |

(23%) |

|

30.75 |

|

24.34 |

26% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

AVERAGE-REALIZED PRICE(2) (CAD) |

|

|

|

|

|

|

|

|

|

|

||||||

Nickel ($ per pound) |

$ |

15.55 |

$ |

11.16 |

39% |

$ |

14.93 |

$ |

10.30 |

45% |

||||||

Cobalt ($ per pound) |

|

25.72 |

|

31.88 |

(19%) |

|

34.26 |

|

25.88 |

32% |

||||||

Fertilizer ($ per tonne) |

|

647.03 |

|

545.08 |

19% |

|

759.91 |

|

438.75 |

73% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

UNIT OPERATING COST(2) (US$ per pound) |

|

|

|

|

|

|

|

|

|

|

||||||

Nickel - net direct cash cost |

$ |

7.00 |

$ |

3.60 |

94% |

$ |

5.14 |

$ |

4.11 |

25% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

SPENDING ON CAPITAL(2)(CAD) |

|

|

|

|

|

|

|

|

|

|

||||||

Sustaining |

$ |

22.3 |

$ |

12.1 |

84% |

$ |

66.7 |

$ |

37.7 |

77% |

||||||

Growth |

|

4.4 |

|

- |

- |

|

7.4 |

|

- |

- |

||||||

|

$ |

26.7 |

$ |

12.1 |

121% |

$ |

74.1 |

$ |

37.7 |

97% |

||||||

(1) |

Revenue and Cost of sales of Moa Joint Venture and Fort Site is composed of revenue/cost of sales, respectively, recognized by the Moa Joint Venture at Sherritt’s 50% share, which is equity-accounted and included in share of earnings (loss) of Moa Joint Venture, net of tax, and revenue/cost of sales recognized by Fort Site, which is included in consolidated revenue. For a breakdown of revenue between Moa Joint Venture and Fort Site see the Combined revenue section in the Non-GAAP and other financial measures section of this press release. | |

(2) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. | |

(3) |

The nickel recovery rate measures the amount of finished nickel that is produced compared to the original nickel content of the ore that was mined. | |

(4) |

For the three months and year ended December 31, 2021, excludes 600 tonnes (50% basis) of finished nickel purchased from and sold to a third party as it was not internally produced. | |

(5) |

The average nickel reference price for the year ended December 31, 2022 was impacted by the suspension of nickel trading and disruption events on the LME in March 2022. The calculation of the average nickel reference price for the year ended December 31, 2022 includes the prices prescribed by LME guidance for disruption events for the period of the disruption, which uses the next available price after a disruption event. | |

(6) |

In August 2022, the Corporation changed its cobalt reference price from the average standard-grade published price per Fastmarkets MB to the “minimum 99.8% chemical grade – Rotterdam” price per Argus Metals. All cobalt spot and average prices referenced for the three months and year ended December 31, 2022 reflect the Argus Metals price. Comparative amounts for the three months and year ended December 31, 2021 are Fastmarkets MB prices. | |

(7) |

nm = not meaningful |

Revenue in Q4 2022 increased by 21% to $221.6 million from $183.2 million in the same period last year. Full year 2022 revenue was $786.8 million, 40% higher than 2021 revenue of $560.6 million. Revenue increases in the current-year periods were largely attributable to higher sales volume and average-realized prices(1) for nickel and fertilizer. Nickel revenue was 32% and 42% higher while fertilizer by-product revenue was 41% and 75% higher in the three months and year ended December 31, 2022, respectively, compared to the same periods in the prior year.

Cobalt revenue was 34% lower in Q4 2022 and marginally higher in full year 2022 compared to the same periods in the prior year. The decline in cobalt revenue for Q4 2022 was a result of both a 19% lower average realized price and a 19% lower sales volume as a result of continued near-term softness in the market. Despite the lower Q4 cobalt revenue, revenue for 2022 was 3% higher than 2021 as the higher realized and reference prices in 2022 offset lower sales volume.

Mixed sulphides production at the Moa JV in Q4 2022 was 4,000 tonnes, up 3% from the 3,881 tonnes produced in Q4 2021. The variance was primarily due to higher leach train availability compared to the prior year which was impacted by unplanned maintenance. Full year 2022 production was 16,248 tonnes, slightly lower than the 16,498 tonnes produced in 2021 as a result of mining limitations caused by a combination of higher precipitation, lower diesel supply and lower equipment availabilities.

Sherritt’s share of finished nickel production in Q4 2022 totaled 4,112 tonnes, 4% lower than the 4,266 tonnes produced in Q4 2021. Q4 2022 nickel production was impacted by lower mixed sulphide feed availability at the refinery.

Finished cobalt production for Q4 2022 was 423 tonnes, down 11% from the 476 tonnes produced in Q4 2021 due lower feed coupled with a higher nickel-to-cobalt ratio.

For the full year 2022, finished nickel production was 16,134 tonnes, 3% higher than the 15,592 tonnes produced in 2021 primarily due to improved equipment reliability during the year and the drawdown of feed stock inventory at the refinery.

Full year 2022, cobalt production was down 4% to 1,684 tonnes from 1,763 tonnes in 2021 primarily due to the higher nickel-to-cobalt ratio in the Moa mixed sulphide feed and lower availability of cobalt rich third-party feed.

As a result, 2022 finished nickel production was in line with guidance and finished cobalt production materially within guidance.

Finished nickel sales volume in Q4 2022 was higher than production volume during the quarter bringing inventory back to more typical levels following a build-up in Q3. Finished cobalt sales volume and prices continued to be impacted by contract delays, logistical challenges and a general near-term softness in the market due to high global inventory levels and weaker downstream demand for cobalt which we expect to normalize during 2023. Moa JV cobalt inventory remained higher than normal but is expected to reduce to more typical levels as market conditions rebound.

Fertilizer production for the three months and year ended December 31, 2022 was 4% lower and 2% higher, respectively, compared to the same period in the prior year, in line with metals production.

Mining, processing and refining (MPR) costs per pound of nickel sold in Q4 2022 were up 54% from Q4 2021. Higher MPR costs in Q4 2022 continue to be driven by the rise in input costs, including a 55% increase in global sulphur prices, a 133% increase in diesel prices, and a 15% increase in fuel oil prices. Sulphur prices have declined since Q3 2022, however they continued to be higher than 2021. For full year 2022, MPR costs per pound of nickel sold were up 36% primarily due to higher input costs, including a 119% increase in global sulphur prices, a 109% increase in diesel prices, and a 40% increase in fuel oil prices.

NDCC(1) per pound of nickel sold increased by 94% to US$7.00/lb in Q4 2022 from US$3.60/lb in Q4 2021. The higher NDCC was primarily due to higher MPR costs, discussed above, and lower cobalt by-product credits, partly offset by higher net fertilizer by-product credits.

Full year 2022 NDCC was US$5.14/lb compared to US$4.11/lb in 2021 as increased MPR costs more than offset higher net fertilizer by-product credits. Overall for the year, cobalt by-product credit was only slightly lower than in 2021 as higher average-realized price in 2022 on lower sales volume offset the lower average-realized price on higher sales volume in 2021. Full year 2022 NDCC was slightly above the updated guidance range primarily as a result higher input commodity prices and lower than anticipated cobalt prices and sales volume during the fourth quarter.

Sustaining spending on capital(1) in Q4 2022 was $22.3 million, up 84% from $12.1 million in Q4 2021. The year-over-year increase was due primarily to higher planned spending at both the Moa JV and Fort Site. Growth spending on capital, which represents spending on the joint venture’s expansion program, was $4.4 million, most of which was related to spending on the slurry preparation plant.

Sustaining spending on capital for 2022 of $66.7 million was above guidance while growth spending on capital of $7.4 million was lower than guidance primarily as a result of logistics challenges in getting materials to the site.

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

Moa JV expansion program update

In 2022, Sherritt embarked on an expansion program focused on increasing annual mixed sulphide precipitate (MSP) production by 20% or 6,500 tonnes of contained nickel and cobalt (100% basis). The program includes completion of the Slurry Preparation Plant (SPP), Leach Plant Sixth Train and Fifth Sulphide Precipitation Train as well as construction of additional acid storage capacity at Moa. The total capital cost is expected to be US$77.0 million (100% basis) or approximately US$13,200 per additional annual tonne of contained nickel for the full expansion.

In phase one of the program, the completion of the SPP is expected to be completed in early 2024 and is anticipated to deliver several benefits including reduced ore haulage distances and lower carbon intensity from mining. Upon completion it will increase MSP production by approximately 1,700 tonnes of contained nickel and cobalt annually. Completion of the second phase of the program, the Moa processing plant improvements, which is planned for completion by the end of 2024 is expected to increase annual MSP production by approximately an additional 4,800 tonnes of contained metals annually and reduce NDCC(1) by approximately US$0.20/lb.

With substantial growth in demand stemming from EV batteries, Sherritt sees an opportunity to focus its strategy on increasing production of intermediary products that will enable it to fully utilize existing capacity at the refinery and also consider direct sales of intermediate product into the EV battery supply chain. Of the total increased production, Sherritt estimates that two thirds of the increased Moa feed will be processed into finished nickel and cobalt and the remaining could be sold as MSP into the EV battery supply chain. This increased feed will likely result in the displacement of some current lower margin third-party processing at the refinery.

The diagram in Appendix 1 provides a pro forma example of the expected impact of the expansion.

Growth spending on capital(1) is expected to be self-funded by the Moa Joint Venture primarily using operating cash flows. Total growth spending on capital in 2022 was $14.8 million (100% basis), primarily related to the SPP, ordering of long lead items, and basic engineering work related to the expansion program.

Progress for the expansion program in Q4 2022 included:

Slurry Preparation Plant:

- Construction of the SPP is progressing on schedule with civil construction 100% complete, and all contracts for supply of materials and services awarded. Structural steel pre-fabrication is ongoing with 65% erected and field assembly of major equipment has commenced; and

- Up until Q4 2022, US$19.5 million (100% basis) in spending has been committed and is prioritized on long lead materials and equipment, construction supplies and civil, mechanical, and electrical construction.

Moa Processing Plant:

The Moa processing expansion consists of the completion of the Leach Plant Sixth Train and Fifth Sulphide Precipitation Train and construction of additional acid storage capacity.

- The final stage of the Feasibility Study, encompassing the full project scope, has been submitted for approval to the Cuban authorities and approval is anticipated in Q1 2023; and

- Bids have been received and are being evaluated for the long lead items for the Leach Plant Sixth Train and contracts for these items will be awarded in Q1 2023. A detailed project execution schedule is currently being developed.

Basic engineering will commence in Q1 2023 on the Fifth Sulphide Precipitation Train and additional acid storage capacity.

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

Moa JV Life of mine/Updated NI 43-101 technical report

The work to complete the Economic Cut-Off Grade (ECOG) and Life of Mine (LOM) development continues at the Moa mine. ECOG and LOM analysis using the latest methodologies are expected to extend the current LOM to beyond 2040. Progress in the quarter included:

- Resource model classifications were updated and a new LOM was generated based on the ECOG methodology; and

- Sherritt and Moa JV continued engagement with the Oficina Nacional de Recursos Minerales (ONRM), Cuba’s Natural Resources Agency, and gained alignment on the latest resource models and ECOG methodology. The Joint Venture will continue to collaborate with the ONRM to prepare detailed mine plans using the new methodologies in 2023.

Development of the NI 43-101 report and peer review will continue in early Q1 2023 with the final NI 43-101 report expected to be released by the end of Q1 2023.

Power

|

For the three months ended |

|

For the year ended |

|

||||||||||||

|

2022 |

2021 |

|

2022 |

2021 |

|

||||||||||

$ millions (33 ⅓% basis), except as otherwise noted |

December 31 |

December 31 |

Change |

December 31 |

December 31 |

Change |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

FINANCIAL HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

||||||

Revenue |

$ |

10.5 |

$ |

8.1 |

30% |

$ |

37.1 |

$ |

28.3 |

31% |

||||||

Cost of sales |

|

4.9 |

|

7.0 |

(30%) |

|

24.2 |

|

26.1 |

(7%) |

||||||

Earnings (loss) from operations |

|

4.5 |

|

0.5 |

800% |

|

8.7 |

|

(0.6) |

nm(3) |

||||||

Adjusted EBITDA(1) |

|

6.1 |

|

4.5 |

36% |

|

22.3 |

|

15.1 |

48% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

CASH FLOW |

|

|

|

|

|

|

|

|

|

|

||||||

Cash provided by continuing operations for operating activities |

$ |

13.5 |

$ |

0.8 |

nm |

$ |

37.4 |

$ |

18.1 |

107% |

||||||

Free cash flow(1) |

|

12.0 |

|

0.7 |

nm |

|

32.3 |

|

18.0 |

79% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

PRODUCTION AND SALES |

|

|

|

|

|

|

|

|

|

|

||||||

Electricity (GWh(2)) |

|

159 |

|

130 |

22% |

|

568 |

|

450 |

26% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

AVERAGE-REALIZED PRICE(1) |

|

|

|

|

|

|

|

|

|

|

||||||

Electricity ($/MWh(2)) |

$ |

58.54 |

$ |

54.33 |

8% |

$ |

56.47 |

$ |

54.05 |

4% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

UNIT OPERATING COSTS(1) |

|

|

|

|

|

|

|

|

|

|

||||||

Electricity ($/MWh) |

|

21.41 |

|

22.72 |

(6%) |

|

19.39 |

|

23.06 |

(16%) |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

NET CAPACITY FACTOR (%) |

|

49 |

|

40 |

23% |

|

44 |

|

36 |

22% |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

SPENDING ON CAPITAL(1) |

|

|

|

|

|

|

||||||||||

Sustaining |

$ |

1.6 |

$ |

0.1 |

nm |

$ |

5.1 |

$ |

0.1 |

nm |

||||||

|

$ |

1.6 |

$ |

0.1 |

nm |

$ |

5.1 |

$ |

0.1 |

nm |

||||||

(1) |

Non-GAAP financial measures. For additional information see the Non-GAAP and other financial measures section of this press release. |

|

(2) |

Gigawatt hours (GWh), Megawatt hours (MWh). |

|

(3) |

nm = not meaningful |

Revenue in Power for the three months and year ended December 31, 2022 was $10.5 million and $37.1 million, respectively, which is up 30% and 31% compared to the same periods in the prior year primarily due to higher equipment availability in 2022 as a result of the completion of maintenance activities in the prior year and additional gas supply.

Electricity production in Q4 and full-year 2022 was 159 GWh and 568 GWh compared to 130 GWh and 450 GWh, respectively in the prior year periods. The increase in electricity production in Q4 is a result of successful efforts to increase availability of gas which enabled Power to beat its updated annual guidance.

Unit operating costs(1) for the three months and year ended December 31, 2022 were $21.41/MWh, and $19.39/MWh, down 6% and 16%, respectively, from the same periods in 2021. The improvement in each of the current-year periods was driven by higher electricity production and sale volume. The annual unit cost was lower than the updated guidance range as a result of higher than anticipated gas availability and lower than anticipated maintenance costs in Q4.

The Power business unit had $1.6 million and $5.1 million spending on capital(1) in the Q4 and for the full year 2022, respectively, primarily driven by maintenance activities much of which was deferred from the prior year. Spending on capital was at guidance for the year.

Additionally during the quarter:

- Sherritt and its Cuban partners finalized an extension to the Energas Payment Agreement to fund the operating, maintenance costs and capital of Energas, as well as cover future payments that would be owed to Sherritt, including dividends (the Moa Swap). Under the agreement between Sherritt, Moa JV and Energas, Sherritt receives approximately US$4.2 million ($5.6 million) per month; and

- Cuba’s Executive Committee of the Council of Ministers approved the twenty-year extension of the Energas Joint Venture contract with the Cuban government to March 2043.

Sherritt received $22.8 million (US$16.8 million) and $54.6 million (US$41.4 million) from Energas in Q4 and the full year 2022, respectively, pursuant to the Moa Swap agreement which was primarily used to facilitate foreign currency payments for the Energas operations and capital.

Sherritt continues to work with its Cuban partners to access additional gas supply for the Boca facility from two new gas wells to be drilled in Puerto Escondido that are scheduled to begin production in Q4 2023.

(1) |

Non-GAAP financial measure. For additional information see the Non-GAAP and other financial measures section of this press release. |

Technologies

During the three months ended December 31, 2022, Sherritt Technologies (Technologies) continued to support the Moa JV’s expansion strategy. These activities included establishing an updated life of mine plan based on an economic cut-off grade for determining reserves to optimize mine planning and upgrade resources into reserves, as well as supporting on-going process plant capacity testing and debottlenecking work at both Moa and the Fort Site locations.

Sherritt Technologies continued to advance development and commercialization of its most promising and innovative proprietary technologies:

“Chimera”/”D-POX” – a suite of processes for the treatment of complex copper and precious metals concentrates (or other high arsenic content feeds) that enable high recoveries of base and precious metals while providing a significant step change in the stabilization of arsenic bearing solid waste. Chimera combines complex copper concentrate and laterite processing into a single facility that enables additional environmental and economic benefits and the production of nickel and cobalt intermediate by-products. D-POX is a pressure oxidation process that enables treatment of higher arsenic concentrations while simplifying silver recovery.

- During the quarter, Technologies continued discussions with potential interested parties within the copper and precious metals industries and advanced proposals for potential batch testing and piloting programs on existing concentrate feeds and specific development project opportunities.

- Technologies entered into an agreement with Open Mineral AG to jointly develop a business case in 2023 for the hydrometallurgical treatment of complex precious metal concentrates. Sherritt will partner with Open Mineral to explore the implementation of its proprietary technologies to solve ESG and precious metal concentrate market challenges regarding arsenic pollution. Open Mineral is a physical commodity trader powered by technology and market intelligence, enabling profitable and efficient trading of raw material commodities and has been recognized by the World Economic Forum as a Technology Pioneer (2019) and was an S&P Global Metals Awards Winner as a Rising Star Company (2020).

Dense slurry hydroprocessing (DSH) – a metallurgical reactor technology being applied to the processing of bio-oils into second-generation renewable fuels, upgrading of refinery vacuum residue to create value add products and upgrading heavy oils and bitumen. Utilizing the DSH reactor platform for bio-oils would overcome many of the challenges associated with commonly utilized fixed bed designs.

- During Q4, Technologies continued to advance its assessment of the technology on bio-oils and refinery vacuum residues. Batch testing and process condition refinements demonstrated improvements in the renewable diesel product quality to satisfy industry requirements.

- Technologies also continued engagement with specific external refineries on the potential to add significant value to their operations with the ability for significant conversion of their vacuum residues into higher value products. Implementation of a cost-effective, laboratory-scale catalyst-life testing system continues, with testing to commence in Q1 2023. Sherritt Technologies will continue to work with interested external parties to secure interest and support to advance a full piloting program for the new catalyst system on bio-oils and refinery residues in 2023.

Next-generation laterite (NGL) processing – a novel processing flowsheet with the potential to make processing of lateritic ores more economically viable and sustainable while enabling the supply of nickel and cobalt products from lateritic ores to the battery sector.

- Following completion of the unit operation pilot testing in Q2 2022 which demonstrated the ability for selective leaching of nickel and cobalt from both saprolite and limonite ores, in Q3 the piloting on the other unit operations were completed and results demonstrated high metal extraction rates into a final mixed hydroxide product.

During the quarter, additional batch tests and initial engineering work was completed to refine key operating and commercial aspects of the process. Technologies commenced discussions with specific external parties on the potential to jointly develop this technology and looks to conduct batch testing on specific projects in 2023.

Environmental, Social and Governance update

In Q4, Sherritt issued its 2021 sustainability, climate and tailings management reports as well as its sustainability scorecard outlining the Corporation’s performance on ESG matters.

Successes seen in 2021 carried into 2022 and included:

- Further improved upon safety performance, with the Total Recordable Incident Frequency Rate of 0.14 and the Lost Time Incident Frequency Rate of 0.07, a decrease of 59% and 50%, respectively, between 2021 and 2022.

- Donations of another approximately $1 million to community investment projects in 2022.

- Completed a Task Force on Climate-related Disclosures (TFCD)-aligned Risk and Opportunity Assessment for the Fort Site.

- Initiated a Greenhouse Gas Emissions Baseline Study in the Energas business.

- Advanced project planning for carbon capture opportunities at the Fort Site.

- Received confirmation of conformity with the LME’s Track B Responsible Sourcing Requirements. Sherritt received independent verification that its minerals are not associated with conflict, risks such as human rights abuses, forced labour, or corruption.

- Improved gender balance in the operations senior management team and board.

Sherritt continues to meet safety and production targets at all its sites, prioritizing the health and safety of its employees, contractors and the communities in which Sherritt operates. Once again in 2022, across all Sherritt’s sites, there were zero work-related fatalities, zero significant environmental incidents, zero security incidents involving allegations of human rights abuses, and no material tailings-related incidents.

2022 REVIEW OF STRATEGIC PRIORITIES

The table below lists Sherritt’s Strategic Priorities for 2022, and summarizes how the Corporation has performed against those priorities.

2022 Strategic Priorities |

Selected Actions |

Status |

||

| ESTABLISH SHERRITT AS A LEADING GREEN METALS PRODUCER | Accelerate plans to expand Moa JV nickel and cobalt production by up to 20% from the combined 34,710 tonnes produced in 2021. | Sherritt and its Moa JV advanced the US$77.0 million (100% basis) two-phase expansion to increase total mixed sulphide precipitate intermediate production by 6,500 tonnes of contained metals at Moa at a low capital intensity of approximately US$13,200 per annual tonne of contained nickel. The program remains on time and budget for completion in 2024. Implementation of ECOG methodology is expected to extend the current LOM to beyond 2040. |

||

Rank in lowest quartile of HPAL nickel producers for NDCC. |

NDCC(1) for 2022 of US$5.14/lb ranked Sherritt in the first cost quartile for HPAL nickel producers and the second cost quartile of all nickel producers. Normalization of key input costs and cobalt by-product credits would help return Sherritt to ranking in the first quartile. |

|||

LEVERAGE TECHNOLOGIES FOR TRANSFORMATIONAL GROWTH |

Support Moa JV expansion, operational improvements, and life of mine extension. |

Continued to support the Moa JV expansion and life of mine extension at Moa. |

||

|

Advance Technologies solutions toward commercialization. |

Continued to advance development and commercialization of most promising and innovative technologies, including: Chimera/D-POX – engaged with interested parties to advance batch testing and piloting programs for specific copper and precious metal opportunities. DSH – advanced assessment of the technology on bio-oils and refinery vacuum residues. Batch testing demonstrated the ability to produce a renewable diesel product. NGL – completed unit operations piloting and initial engineering work to refine key operating and commercial aspects. Engaged with external parties on the potential to jointly develop this technology. |

||

ACHIEVE BALANCE SHEET STRENGTH |

Maximize collections of overdue Cuban receivables. Maximize available liquidity to support growth strategy. |

Signed agreements to recover the full amount – $368.0 million – of receivables on the Energas CSA and Oil and Gas trade receivables by the end of 2027 through the use of the Cobalt Swap. Repurchased approximately $150 million principal amount of notes at a 16% discount reducing debt by 35% from the beginning of the year and annual interest expense of approximately $13 million. |

||

|

Continue to optimize costs to reflect operating footprint. |

Implemented measures relating to director compensation and employee costs that resulted in savings of approximately $3 million. |

||

| BE RECOGNIZED AS A SUSTAINABLE ORGANIZATION | Deliver on actions identified in the Sustainability Report. |

Issued Sherritt’s 2021 sustainability reports and scorecard in October 2022. |

||

Achieve year-over-year ESG improvements including reduction of carbon intensity. |

Developed a climate plan to advance a road map to achieve long-term net-zero GHG emissions by 2050. Continued replacing vehicles and equipment with EVs and electric equipment at Moa and the Fort Site. |

|||

|

Deliver on ‘Diversity and Inclusion’ global framework |

Made progress in defining metrics, analyzing workforce demographics and aligning Sustainability (CSR) investments with D&I initiatives.

Improved gender balance in the operations senior management team and board. |

||

MAXIMIZE VALUE FROM CUBAN ENERGY BUSINESSES |

Extend economically beneficial Energas power generation contract beyond 2023. |

Received approval for extension of the Energas Joint Venture contract to March 2043, and finalized extension of the Moa Swap agreement to support liquidity and secure sustainable operations. Power was successful in working with its Cuban partners to successfully increase gas supply in the fourth quarter. |

(1) |

Non-GAAP and other financial measures. For additional information, see the Non-GAAP and other financial measures section. |

2023 strategic priorities

The table below lists Sherritt’s Strategic Priorities for 2023. Summaries of how the Corporation is performing against these priorities will be provided on a quarterly basis during 2023.

Strategic Priorities |

2023 Actions |

|

ESTABLISH SHERRITT AS A LEADING GREEN METALS PRODUCER |

Execute on plans to expand Moa JV mixed sulphide precipitate intermediate production by 20% or 6,500 tonnes of contained metals annually. Rank in lowest quartile of HPAL nickel producers for NDCC. Complete and publish NI 43-101 Report. Expand sales into battery supply chain. |

|

|

|

|

LEVERAGE TECHNOLOGIES FOR TRANSFORMATIONAL GROWTH |

Support Moa JV expansion, operational improvements, ECOG implementation and life of mine extension, and marketing initiatives. Advance Technologies solutions toward commercialization with external partnerships and funding. Develop innovative processing solutions for treatment of blackmass for battery recycling. |

|

|

|

|

ACHIEVE BALANCE SHEET STRENGTH |

Effectively leverage collections on the Cobalt Swap agreement. Maximize available liquidity to support growth strategy. Continue to optimize costs to reflect operating footprint. |

|

|

|

|

BE RECOGNIZED AS A SUSTAINABLE ORGANIZATION |

Deliver on actions identified in the Sustainability Report. Achieve year-over-year ESG improvements including reduction of carbon intensity. Deliver on ‘Diversity and Inclusion’ global framework. |

|

|

|

|

MAXIMIZE VALUE FROM CUBAN ENERGY BUSINESSES |

Access additional gas supply to increase electrical power generation. Maximize value from Oil and Gas business. |

OUTLOOK

2022 and 2023 production volumes, unit operating costs and spending on capital guidance

|

|

Year-to-date |

|

|||

|

2022 |

actual to |

2023 |

|||

Production volumes, unit operating costs and spending on capital |

Guidance |

December 31, 2022 |

Guidance |

|||

|

|

|

|

|||

Production volumes |

|

|

|

|||

Moa Joint Venture (tonnes, 100% basis) |

|

|

|

|||

Nickel, finished |

32,000 - 34,000 |

32,268 |

30,000 - 32,000 |

|||

Cobalt, finished |

3,400 - 3,700 |

3,368 |

3,100 - 3,400 |

|||

Electricity (GWh, 33⅓% basis)(1) |

525 - 550 |

568 |

575 - 625 |

|||

|

|

|

|

|||

Unit operating costs(2) |

|

|

|

|||

Moa Joint Venture - NDCC (US$ per pound)(1) |

$4.50 - $5.00 |

$5.14 |

$5.00 - $5.50 |

|||

Electricity - unit operating cost, ($ per MWh)(1) |

$22.00 - $23.00 |

$19.39 |

$28.50 - $30.00 |

|||

|

|

|

|

|||

Spending on capital(2)($ millions) |

|

|

|

|||

Sustaining |

|

|

|

|||

Moa Joint Venture (50% basis), Fort Site (100% basis)(3) |

$60.0 |

$66.7 |

$70.0 |