SILVER ONE INTERCEPTS 1,339 g/t SILVER and 1.21 g/t GOLD OVER 10.67 METRES WITHIN 48 METRES OF 332 g/t SILVER and 0.39 g/t GOLD

STEP-OUT HOLES CONTINUE EXTENDING THE MINERALIZATION DOWN DIP AND ALONG STRIKE

VANCOUVER, BC, Aug. 16, 2022 /PRNewswire/ -- Silver One Resources Inc. (TSXV: SVE; OTCQX: SLVRF; FSE: BRK1 - "Silver One" or the "Company") is pleased to report results from its reverse circulation (RC) 7,500-metre ("m") drilling program recently completed at its Candelaria project, Nevada. The objectives of the program, which included examining the extensions to silver-oxide mineralization adjacent to the past producing open pits and filling in between step-out holes drilled in 2021, were all successfully achieved.

Highlights:

- Since November 2018, the Company has drilled over 25,000 metres in 131 holes, including RC, core, and sonic holes.

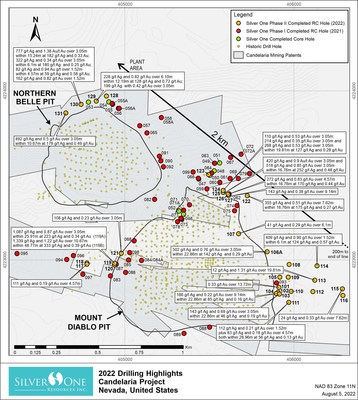

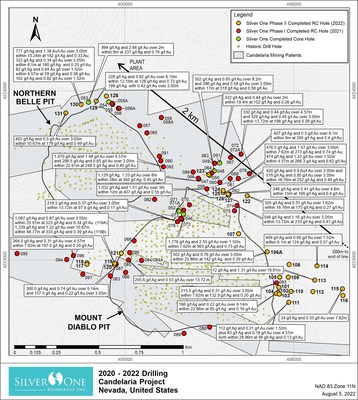

- The recent 36-hole, 7,500 m drilling program tested the extensions to the silver-oxide mineralization to the east of the Mt. Diablo pit, down-dip from the Mt. Diablo and Northern Belle open pits and filled-in areas of silver mineralization between step-out holes drilled in 2021 west of the Mt. Diablo open pit (Figures 1 and 2).

- Assays include:

- 1,339 grams/tonne ("g/t") Ag and 1.22 g/t Au over 10.67 m from 68.58 m, within a broad interval of 48.77 m @ 332 g/t Ag and 0.39 g/t Au from 60.96 m in hole SO-C-22-119B (in-fill hole west of Mt. Diablo pit).

- 501.5 g/t Ag and 0.76 g/t Au over 3.05 m from 263.65 m within a 22.86 m zone @ 0.29 g/t Au and 142 g/t Ag from 252.98 m in hole SO-C-22-106A (Mt. Diablo eastern extension ).

- 518.5 g/t Ag and 0.85 g/t Au over 3.05 m from 284.99 m within a 16.76 m zone @ 0.48 g/t Au and 252 g/t Ag from 281.94 m in hole SO-C-22-125 (Mt. Diablo down-dip extension).

- 777 g/t Ag and 1.38 g/t Au over 3.05 m from 289.56 within a 15.24 m zone @ 0.33 g/t Au and 182 g/t Ag from 281.94 m in hole SO-C-22-130 (Northern Belle pit down-dip extension).

- Drilling results indicate the extension of the mineralization 400 m west (to drill hole SO-C-21-96) and 450 m east of the Mount Diablo pit (to drill hole SO-C-22-115). The mineralization remains open along strike in both directions as well as down-dip from both Mt. Diablo and Northern Belle pits.

- The Candelaria mineralization is now known to extend nearly 2 km along strike and 1 km in the down-dip direction and remains open in all directions (Fig.'s 1 and 2)

Silver One's President and CEO, Greg Crowe, commented: "We are very encouraged by the positive results from the assays of our recent round of reverse circulation drilling. Holes drilled confirmed continuity of the mineralization down-dip and along-strike to the east and west of the past producing Mt. Diablo pit, where drilling indicates that silver and gold grades exceed historical average grades mined by open pit. This bodes well for the possibility to expand the known mineralization and the potential for both open-pit and underground mining. The mineralization defined to-date is still open both along strike and down dip from both Mt. Diablo and Northern Belle pits and further exploration is highly warranted".

The silver and gold grades of the holes drilled by the company west of Mt. Diablo (this release, Feb 16, May 26 and July 15, 2021 news releases) exceed the average grades (88 g/t Ag and 0.1 g/t Au) mined by open pit by previous operators. Gold grades to the east of Mt. Diablo pit increase (drill holes SO-C-22-112 to SO-C-115) compared with grades mined by open pit in the past, however, silver grades decrease in this direction.

Future drilling will focus on testing the continuity of the mineralization down-dip and along strike from both Mt. Diablo and Northern Belle pits.

Drill collars are shown in Figure 1 and Figure 2. Significant gold and silver assays are summarized in Table 1, and coordinates and identification drillhole data are in Table 2.

Metallurgical Testing

Core drilling for metallurgical testing is underway on the Mt. Diablo pit extension mineralization. Core samples from the current program, in conjunction with six core holes drilled in the 2019-2020 campaign, and three bulk samples excavated with a backhoe from the bottom of the Mt. Diablo pit will be used to investigate the silver and gold extraction from the oxide, mixed (oxide-sulphide), and sulphide mineralization. The samples are distributed throughout the deposit and are representative of the grades and major types of Candelaria mineralization.

Results from the metallurgical testing will be used in an upcoming in-ground resource estimate to replace the historical resource completed by Silver Standard in 2001.

The metallurgical results will also be used to evaluate the economics of various processing scenarios, including mixing fresh mineralization with the historic heap leach mineralization versus processing the heap leach material alone.

Figure 1 – Drill Collars and Significant Assays of the 2022 RC drilling.

Note: See Table 1 and Table 2 for additional details on mineralized intervals and RC hole details.

Figure 2 – Drill Collars and Significant Assays, 2020-2021 and 2022 campaigns.

Table 1. Summary of relevant assays from recent RC drilling.

Drill hole | From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) | Area |

SO-C-22-101 | 112.78 | 114.30 | 1.52 | 2.99 | 0.8 | East Mt. Diablo pit |

and | 153.92 | 172.21 | 18.29 | 0.12 | 29.5 | East Mt. Diablo pit |

Includes | 158.50 | 160.02 | 1.52 | 0.22 | 89.1 | East Mt. Diablo pit |

and | 172.21 | 185.93 | 13.72 | 0.33 | 2.4 | East Mt. Diablo pit |

SO-C-22-102 | 147.83 | 166.12 | 18.29 | 0.14 | 62.6 | East Mt. Diablo pit |

Includes | 147.83 | 155.45 | 7.62 | 0.12 | 72.6 | East Mt. Diablo pit |

Includes | 158.50 | 160.02 | 1.52 | 0.30 | 109.0 | East Mt. Diablo pit |

Includes | 164.59 | 166.12 | 1.52 | 0.20 | 146.0 | East Mt. Diablo pit |

SO-C-22-103 | 137.16 | 160.02 | 22.86 | 0.19 | 45.7 | East Mt. Diablo pit |

Includes | 140.21 | 143.26 | 3.05 | 0.69 | 143.0 | East Mt. Diablo pit |

SO-C-22-104 | 97.54 | 120.40 | 22.86 | 0.16 | 85.0 | East Mt. Diablo pit |

Includes | 97.54 | 106.68 | 9.14 | 0.22 | 165.8 | East Mt. Diablo pit |

and | 123.44 | 137.16 | 13.72 | 0.23 | 10.4 | East Mt. Diablo pit |

SO-C-22-105 | 176.78 | 178.31 | 1.52 | 0.17 | 58.0 | East Mt. Diablo pit |

SO-C-22-106 | 150.88 | 173.74 | 22.86 | 0.03 | 28.2 | East Mt. Diablo pit |

Includes | 161.54 | 163.07 | 1.52 | 0.05 | 119.0 | East Mt. Diablo pit |

SO-C-22-106A | 160.02 | 163.07 | 3.05 | 0.05 | 127.0 | East Mt. Diablo pit |

and | 252.98 | 275.84 | 22.86 | 0.29 | 142.3 | East Mt. Diablo pit |

Includes | 263.65 | 266.70 | 3.05 | 0.76 | 501.5 | East Mt. Diablo pit |

SO-C-22-107 | 0 | 6.10 | 6.10 | 0.29 | 41.3 | Northeast Mt. Diablo pit |

and | 9.14 | 12.19 | 3.05 | 0.13 | 30.9 | Northeast Mt. Diablo pit |

and | 16.76 | 25.91 | 9.14 | 0.42 | 7.8 | Northeast Mt. Diablo pit |

and | 228.60 | 246.89 | 18.29 | 0.14 | 44.7 | Northeast Mt. Diablo pit |

Includes | 230.12 | 233.17 | 3.05 | 0.24 | 84.2 | Northeast Mt. Diablo pit |

SO-C-22-108 | 196.60 | 205.74 | 9.14 | 0.06 | 29.8 | East Mt. Diablo pit |

SO-C-22-109 | 155.45 | 176.78 | 21.34 | 0.11 | 42.6 | East Mt. Diablo pit |

SO-C-22-110A | 118.87 | 144.78 | 25.91 | 0.12 | 43.9 | East Mt. Diablo pit |

Includes | 132.59 | 134.11 | 1.52 | 0.28 | 87.9 | East Mt. Diablo pit |

SO-C-22-111 | 89.92 | 118.87 | 28.96 | 0.13 | 56.5 | East Mt. Diablo pit |

Includes | 92.96 | 97.54 | 4.57 | 0.18 | 82.7 | East Mt. Diablo pit |

Includes | 111.25 | 112.78 | 1.52 | 0.21 | 112.0 | East Mt. Diablo pit |

SO-C-22-112 | 41.15 | 48.77 | 7.62 | 0.31 | 16.6 | East Mt. Diablo pit |

and | 85.34 | 86.87 | 1.52 | 0.56 | 19.6 | East Mt. Diablo pit |

and | 120.40 | 121.92 | 1.52 | 0.37 | 11.2 | East Mt. Diablo pit |

and | 128.02 | 132.59 | 4.57 | 0.12 | 34.9 | East Mt. Diablo pit |

SO-C-22-113 | 71.63 | 91.44 | 19.81 | 1.31 | 11.8 | East Mt. Diablo pit |

Includes | 71.63 | 76.20 | 4.57 | 2.29 | 27.0 | East Mt. Diablo pit |

Includes | 80.77 | 83.82 | 3.05 | 2.48 | 7.8 | East Mt. Diablo pit |

and | 147.83 | 179.83 | 32.00 | 0.16 | 20.6 | East Mt. Diablo pit |

SO-C-22-114 | 102.11 | 108.20 | 6.10 | 0.57 | 124.3 | East Mt. Diablo pit |

Includes | 102.11 | 103.63 | 1.52 | 0.90 | 409.0 | East Mt. Diablo pit |

and | 175.26 | 199.64 | 24.38 | 0.09 | 27.1 | East Mt. Diablo pit |

Includes | 192.02 | 195.07 | 3.05 | 0.18 | 75.2 | East Mt. Diablo pit |

SO-C-22-115 | 115.82 | 123.44 | 7.62 | 0.33 | 24.1 | East Mt. Diablo pit |

and | 170.69 | 176.78 | 6.10 | 0.35 | 17.6 | East Mt. Diablo pit |

SO-C-22-116 | 135.64 | 156.97 | 21.34 | 0.14 | 15.6 | East Mt. Diablo pit |

SO-C-22-117 | 96.01 | 103.63 | 7.62 | 0.19 | 15.7 | West Mt. Diablo pit |

and | 108.20 | 115.82 | 7.62 | 0.15 | 83.9 | West Mt. Diablo pit |

Includes | 109.73 | 114.30 | 4.57 | 0.19 | 110.8 | West Mt. Diablo pit |

SO-C-22-118A | 89.92 | 91.44 | 1.52 | 2.78 | 33.2 | West Mt. Diablo pit |

and | 108.20 | 109.73 | 1.52 | 0.15 | 54.2 | West Mt. Diablo pit |

SO-C-22-119A | 56.39 | 82.30 | 25.91 | 0.34 | 223.1 | West Mt. Diablo pit |

Includes | 68.58 | 71.63 | 3.05 | 0.87 | 1,087.0 | West Mt. Diablo pit |

and | 100.58 | 118.87 | 18.29 | 0.11 | 56.1 | West Mt. Diablo pit |

Includes | 106.68 | 111.25 | 4.57 | 0.16 | 135.2 | West Mt. Diablo pit |

SO-C-22-119B | 60.96 | 109.73 | 48.77 | 0.39 | 332.5 | West Mt. Diablo pit |

Includes | 67.06 | 83.82 | 16.76 | 0.84 | 888.4 | West Mt. Diablo pit |

Includes | 68.58 | 79.25 | 10.67 | 1.22 | 1,339.4 | West Mt. Diablo pit |

SO-C-22-120A | - | 0.00 | - | NSV | West Mt. Diablo pit | |

SO-C-22-121 | 100.58 | 118.87 | 18.29 | 0.17 | 63.0 | West Mt. Diablo pit |

Includes | 108.20 | 111.25 | 3.05 | 0.23 | 108.0 | West Mt. Diablo pit |

SO-C-22-122 | 307.85 | 324.61 | 16.76 | 0.27 | 175.3 | North Mt. Diablo pit |

Includes | 307.85 | 315.47 | 7.62 | 0.51 | 354.8 | North Mt. Diablo pit |

SO-C-22-123 | 310.90 | 312.42 | 1.52 | 0.36 | 131.0 | North Mt. Diablo pit |

and | 335.28 | 336.80 | 1.52 | 0.24 | 74.7 | North Mt. Diablo pit |

and | 349.00 | 350.52 | 1.52 | 0.25 | 41.1 | North Mt. Diablo pit |

SO-C-22-124 | 153.92 | 170.69 | 16.76 | 0.23 | 48.4 | North Mt. Diablo pit |

Includes | 156.97 | 160.02 | 3.05 | 0.53 | 110.4 | North Mt. Diablo pit |

and | 307.85 | 327.66 | 19.81 | 0.28 | 127.4 | North Mt. Diablo pit |

Includes | 307.85 | 310.90 | 3.05 | 0.35 | 214.5 | North Mt. Diablo pit |

Includes | 324.61 | 327.66 | 3.05 | 0.53 | 268.0 | North Mt. Diablo pit |

SO-C-22-125 | 109.73 | 137.16 | 27.43 | 0.13 | 22.1 | North Mt. Diablo pit |

Includes | 132.59 | 135.64 | 3.05 | 0.32 | 57.4 | North Mt. Diablo pit |

and | 281.94 | 298.70 | 16.76 | 0.48 | 252.4 | North Mt. Diablo pit |

Includes | 284.99 | 288.04 | 3.05 | 0.85 | 518.5 | North Mt. Diablo pit |

Includes | 294.13 | 297.18 | 3.05 | 0.90 | 420.0 | North Mt. Diablo pit |

SO-C-22-126 | 118.87 | 120.40 | 1.52 | 0.18 | 23.1 | North Mt. Diablo pit |

and | 294.13 | 310.90 | 16.76 | 0.44 | 169.9 | North Mt. Diablo pit |

Includes | 306.32 | 310.90 | 4.57 | 0.83 | 272.2 | North Mt. Diablo pit |

SO-C-22-127 | 77.72 | 79.25 | 1.52 | 0.27 | 99.0 | North Mt. Diablo pit |

and | 275.84 | 284.99 | 9.14 | 0.38 | 143.0 | North Mt. Diablo pit |

SO-C-22-128 | 233.17 | 234.70 | 1.52 | 0.67 | 38.1 | North Northern Belle pit |

and | 271.27 | 274.32 | 3.05 | 0.39 | 36.6 | North Northern Belle pit |

and | 303.28 | 321.56 | 18.29 | 0.11 | 24.5 | North Northern Belle pit |

SO-C-22-129 | 176.78 | 181.36 | 4.57 | 1.04 | 31.5 | North Northern Belle pit |

and | 187.45 | 199.64 | 12.19 | 0.72 | 128.2 | North Northern Belle pit |

Includes | 187.45 | 193.55 | 6.10 | 0.82 | 228.4 | North Northern Belle pit |

and | 220.98 | 224.03 | 3.05 | 0.42 | 199.0 | North Northern Belle pit |

SO-C-22-130 | 158.50 | 166.12 | 7.62 | 0.77 | 53.5 | North Northern Belle pit |

Includes | 160.02 | 161.54 | 1.52 | 0.82 | 162.0 | North Northern Belle pit |

and | 170.69 | 172.21 | 1.52 | 0.52 | 18.9 | North Northern Belle pit |

and | 184.40 | 188.98 | 4.57 | 0.58 | 59.2 | North Northern Belle pit |

Includes | 187.45 | 188.98 | 1.52 | 0.94 | 82.2 | North Northern Belle pit |

and | 202.69 | 205.74 | 3.05 | 0.40 | 18.2 | North Northern Belle pit |

and | 211.84 | 217.93 | 6.10 | 0.25 | 180.2 | North Northern Belle pit |

Includes | 214.88 | 217.93 | 3.05 | 0.34 | 322.5 | North Northern Belle pit |

and | 281.94 | 297.18 | 15.24 | 0.33 | 181.9 | North Northern Belle pit |

Includes | 289.56 | 292.61 | 3.05 | 1.38 | 777.0 | North Northern Belle pit |

SO-C-22-131 | 140.21 | 150.88 | 10.67 | 0.49 | 178.4 | North Northern Belle pit |

Includes | 147.83 | 150.88 | 3.05 | 0.50 | 491.5 | North Northern Belle pit |

and | 155.45 | 156.97 | 1.52 | 0.16 | 50.5 | North Northern Belle pit |

Mineralized intervals reported are core lengths, and true widths are estimated to be 85% to 100% of these widths based on interpreted drill sections.

Table 2. RC holes coordinates (UTM83-11) and other identification data.

Drillhole_Id | East (m) | North (m) | Elevation (m) | Azimuth (Deg) | Dip (Deg) | Total Depth (m) | Notes |

SO-C-22-101 | 405913 | 4222840 | 1848.0 | 270 | -85 | 190.5 | |

SO-C-22-102 | 405903 | 4222806 | 1852.0 | 270 | -65 | 185.93 | |

SO-C-22-103 | 405907 | 4222808 | 1852.0 | 90 | -80 | 195.07 | |

SO-C-22-104 | 405905 | 4222806 | 1852.0 | 180 | -65 | 155.45 | |

SO-C-22-105 | 405914 | 4222900 | 1841.8 | 270 | -80 | 234.7 | |

SO-C-22-106 | 405836 | 4223049 | 1831.8 | 270 | -65 | 173.74 | Abandoned * |

SO-C-22-106A | 405845 | 4223050 | 1831.6 | 270 | -65 | 275.85 | |

SO-C-22-107 | 405674 | 4223155 | 1832.5 | 224 | -60 | 284.99 | |

SO-C-22-108 | 405968 | 4222972 | 1833.9 | 180 | -60 | 225.55 | |

SO-C-22-109 | 405966 | 4222901 | 1839.8 | 180 | -60 | 195.07 | |

SO-C-22-110 | 405983 | 4222816 | 1848.5 | 180 | -60 | 100.59 | Abandoned * |

SO-C-22-110A | 405982 | 4222813 | 1848.6 | 180 | -60 | 170.69 | |

SO-C-22-111 | 405969 | 4222750 | 1858.7 | 180 | -60 | 140.21 | |

SO-C-22-112 | 406105 | 4222817 | 1839.7 | 180 | -60 | 193.55 | |

SO-C-22-113 | 406117 | 4222885 | 1830.6 | 180 | -60 | 190.5 | |

SO-C-22-114 | 406137 | 4222967 | 1824.3 | 180 | -60 | 225.55 | |

SO-C-22-115 | 406281 | 4222829 | 1833.9 | 180 | -75 | 210.31 | |

SO-C-22-116 | 406281 | 4222795 | 1837.3 | 180 | -60 | 202.69 | |

SO-C-22-117 | 404774 | 4222971 | 1886.9 | 0 | -90 | 144.78 | |

SO-C-22-118 | 404775 | 4222971 | 1886.9 | 90 | -70 | 86.87 | Abandoned * |

SO-C-22-118A | 404776 | 4222971 | 1886.9 | 90 | -65 | 132.59 | |

SO-C-22-119 | 404938 | 4222983 | 841.6 | 270 | -60 | 42.67 | |

SO-C-22-119A | 404938 | 4222981 | 1841.7 | 270 | -60 | 135.64 | |

SO-C-22-119B | 404939 | 4222982 | 1841.6 | 270 | -65 | 135.64 | |

SO-C-22-120 | 404936 | 4222978 | 1842.1 | 180 | -60 | 80.77 | Abandoned * |

SO-C-22-120A | 404940 | 4222976 | 1841.9 | 180 | -60 | 79.25 | Abandoned * |

SO-C-22-121 | 404972 | 4223043 | 1833.6 | 180 | -60 | 160.02 | |

SO-C-22-122 | 405722 | 4223383 | 1877.2 | 224 | -85 | 355.1 | |

SO-C-22-123 | 405495 | 4223513 | 1864.5 | 0 | -90 | 390.15 | |

SO-C-22-124 | 405576 | 4223406 | 1888.6 | 180 | -80 | 355.1 | |

SO-C-22-125 | 405577 | 4223402 | 1888.6 | 180 | -65 | 312.42 | |

SO-C-22-126 | 405607 | 4223394 | 1888.4 | 180 | -75 | 315.47 | |

SO-C-22-127 | 405607 | 4223391 | 1888.4 | 180 | -60 | 300.23 | |

SO-C-22-128 | 404893 | 4223971 | 1734.5 | 180 | -70 | 321.57 | |

SO-C-22-129 | 404826 | 4223944 | 1728.6 | 180 | -55 | 260.61 | |

SO-C-22-130 | 404733 | 4223927 | 1737.1 | 180 | -60 | 300.23 | |

SO-C-22-131 | 404648 | 4223874 | 1756.1 | 180 | -65 | 172.21 | |

* | Drillhole incomplete | ||||||

Candelaria Project Mineral Resources

Leach Pad Resource

In August 2020, The Company completed a resource estimate of indicated and inferred resources on Candelaria's heap leach pads. Thirty million ounces of indicated resources and 15.397 million of ounces in the inferred category were reported. The respective Technical Report, dated effective August 6, 2020, and filed on SEDAR on August 19, 2020, is titled "Technical Report on the Heap Leach Pads within the Candelaria, Property, Mineral and Esmeralda Counties, Nevada, USA". The Report was prepared by James A. McCrea, P.Geo., who is a qualified person within the meaning of NI 43-101 and is independent of the Company; McCrea has reviewed and approved the disclosure regarding the updated resource estimate included herein.

Mineral Resources were reported for each leach pad separately, using a 0.01 g/t silver fire assay cut-off grade. See table below:

Zone/ Category | Tonnes (000) | Ag (FA) (ppm) | Au (FA) (ppm) | Ag (soluble) (ppm) | Au (soluble) (ppm) | Contained Metal* Ag (Moz) Au (oz) | |

Indicated | |||||||

LP 1 | 22,184.000 | 42.1 | 0.074 | 15.6 | 0.022 | 30.017 | 52,000 |

Inferred | |||||||

LP 2 | 11,451.000 | 41.8 | 0.100 | 23.3 | 0.032 | 15.397 | 36,700 |

* Contained Metal based on fire assay grades

The effective date of the mineral resource estimate is August 6, 2020.

1. A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity.

An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation.

An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

2. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources has no known issues and do not appear materially affected by any known environmental, permitting, legal, title, socio-political, marketing, or other relevant issues. There is no guarantee that Silver One will be successful in obtaining any or all of the requisite consents, permits or approvals, regulatory or otherwise for the project or that the project will be placed into production.

3. The mineral resources in this study were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum ('CIM'), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the Standing Committee on Reserve Definitions and adopted by the CIM Council on May 10, 2014.

Metal prices used for the resource estimate are: US $1500 per ounce for gold; US $20 per ounce of silver. These prices were used for calculating silver equivalents and for the exploitation scenarios related to reasonable prospects for eventual economic extraction.

Historical Resource

Historic resource estimates of the remaining downdip mineral resources in the project were determined for both the Mount Diablo and Northern Belle deposits by Snowden and reported in a NI 43-101 Technical Report prepared for Silver Standard Resources Inc. in 2001. The resources reported include a historic measured and indicated resource for Mount Diablo of 13.6 million short tons averaging 3.23 opt Agtotal and 0.003 opt Ausoluble, for 44.1 million ounces of silver. Additionally, there is a historic inferred resource for Mount Diablo and Northern Belle of 14.4 million short tons averaging 2.21 opt Agtotal and 0.002 opt Ausoluble, for 31.7 million ounces of silver.

The technical report titled "Candelaria Project Technical Report" dated May 24, 2001 (filed on SEDAR on June 20, 2002), prepared by Pincock Allen & Holt, disclosed the historical mineral resource estimate shown in the table below.

Candelaria Project | |||||||

Historical Resource Estimate | |||||||

Area/Type | Classification | Tons | Factored Ag Agtotal) | Sol. Au | AqEq Grade | Ag Ounces | Aq Equiv. |

Mount Diablo | Measured | 3,391,000 | 4.44 | 0.004 | 4.67 | 15,054,000 | 15,838,000 |

Indicated | 10,231,185 | 2.84 | 0.003 | 3.01 | 29,005,000 | 30,796,000 | |

Subtotal, Measured + Indicated | 13,623,000 | 3.23 | 0.003 | 3.42 | 44,060,000 | 46,633,000 | |

Mount Diablo | Inferred | 5,191,000 | 2.12 | 0.003 | 2.30 | 11,015,000 | 11,939,000 |

Northern Belle | 9,162,000 | 2.26 | 0.002 | 2.37 | 20,661,000 | 21,714,000 | |

L.G. Stockpiles | 4,000,000 | 0.75 | --- | 0.75 | 3,000,000 | 3,000,000 | |

Subtotal. Inferred | 18,353,000 | 1.89 | 0.002 | 2.00 | 34,676,000 | 36,653,000 | |

Notes: | 1) Mount Diablo and Northern Belle resources tabulated at a 0.5 opt Agsoluble cut-off grades, with only Agtotal shown in this table | ||||||

2) Low-grade stockpile resources tabulated for entire accumulation of material. | |||||||

3) Total silver grades factored from soluble silver grades using regression formulas developed by Snowden. | |||||||

4) Silver equivalent grade includes the contribution from the gold grade (soluble) using an Ag:Au equivalency ratio of 57.8:1. | |||||||

The historical mineral resource estimate used "measured mineral resource", "indicated mineral resource" and "inferred mineral resource", which are categories set out in NI 43-101. Silver One considers these historical estimates reliable as well as relevant as it represents key targets for exploration by Silver One.

Additional technical details on preparation of the historical resource estimate:

(1) Mount Diablo Deposit - Consisted of 538 drill holes by previous owners and 10 drill holes by SSR Mining. For drill holes that were twinned, the author used the lower of the two values assigned to the original holes. The mineral resource estimate used a kriging estimation method to establish ore zones with a cut-off grade of 0.5 opt Ag. Ordinary kriging was used to interpolate grades in the block model. The block models were set up with block dimensions of 25 feet by 25 feet in plan and 10 feet in height. The maximum search range used in the higher-grade zone was 235 feet, in the lower grade zone it was 1,000 feet and in the background zone it was 350 feet. Block models more than 300 feet from the nearest composite only constituted 3 percent of the total number of estimated blocks and were assigned to an inferred category.

(2) Northern Belle Deposit - Consisted of 226 drill holes by previous owners, of which a portion of these holes were duplicated for the Mount Diablo Deposit database. The mineral resource estimate used a kriging estimation method to establish ore zones with a cut-off grade of 0.5 opt Ag. The mineral resource estimate used multiple indicator kriging to interpolate grades in the block model. Block models were set up with block dimensions of 50 feet by 50 feet in plan and 20 feet in height. The maximum search range used in the higher-grade zone was 85 feet, in the intermediate-grade zone was 120 feet and the lower-grade zone was 140 feet and in the lower undifferentiated material below the current pit topography was 260 feet. Block models more than 300 feet from the nearest composite only constituted 3 percent of the total number of estimated blocks and were assigned to an inferred category.

(3) Low-Grade Stockpile - Based on limited and incomplete data and documentation. Material placed on the stockpiles ranged from 0.5 to 0.65 opt Ag.

The qualified person has not done sufficient work to classify the historical estimate as a current mineral resource. Silver One is not treating this historical estimate as a current mineral resource.

Analytical and QA/QC Procedures

All samples were assayed by American Assay Laboratories ("AAL") in Sparks, NV, USA (ISO accredited Laboratory, ISO/IEC 17025:2017). Samples were analyzed for thirty-five elements by ICP-MS. Gold and silver were analyzed by cyanide extraction, FA with ICP finish, samples over 100 g/t Ag were analyzed by gravimetric methods. Over limit Cu, Pb and Zn were analyzed by ore-grade volumetric analysis. The QA/QC program included the submission of Certified Standards, blanks, core duplicates, as well as the insertion of crushed duplicates and pulp duplicates at random intervals. Certified Standards were inserted at a rate of one standard for every 20 samples (5% of total) and one blank for every 20 samples (5% of total). Pulp and crush duplicates combined were inserted at a rate of one duplicate per every 20 samples (5% of total). The standards used in Candelaria's drilling program range in grade from 5.88 g/t Ag to 493.0 g/t Ag, and were sourced from Analytical Solutions, Ltd., in Mulmur, ON, Canada and from OREAS, Bayswater North, VIC, Australia. Blanks have been sourced locally from barren silica. Drill sample duplicates were obtained via a 1/8th split of RC cuttings or from quartered core, crush and 'pulp' duplicates were taken from coarse reject material or pulverized splits, respectively. AAL also inserts blanks, standards and includes duplicate analyses to ensure proper sample preparation and equipment calibration.

About Candelaria

Candelaria was historically the highest-grade silver producer in the state of Nevada, averaging over 1,250 g/t AgEq (40 oz/ton AgEq) from high-grade vein mining between the mid-1800s and the mid-1900s. Open pit mining operations were undertaken in the 1970s through 1998 by several companies, including Nerco Inc. and Kinross Gold Corporation ("Kinross"). Kinross closed the open pit and leach operation in 1998 due to low silver prices. Leaching of the historic pads was not fully completed, leaving a substantial amount of silver unprocessed. It is estimated that the property has produced over 68 million ounces of silver. Historical information was obtained from "Geology of the Candelaria Mining District, Mineral County, Nevada, 1959, Nevada Bureau of Mines, Bulletin 56", and the 2001 SSR Mining Inc. technical report titled "Candelaria Project".

Qualified Person The technical content of this news release has been reviewed and approved by Robert M. Cann, P. Geo, and a Qualified Person as defined by National Instrument 43-101.

About Silver One

Silver One is focused on the exploration and development of quality silver projects. The Company holds an option to acquire a 100%-interest in its flagship project, the past-producing Candelaria Mine located in Nevada. Potential reprocessing of silver from the historic leach pads at Candelaria provides an opportunity for possible near-term production. Additional opportunities lie in previously identified high-grade silver intercepts down-dip and potentially increasing the substantive silver mineralization along-strike from the two past-producing open pits.

The Company has staked 636 lode claims and entered into a Lease/Purchase Agreement to acquire five patented claims on its Cherokee project located in Lincoln County, Nevada, host to multiple silver-copper-gold vein systems, traced to date for over 11 km along-strike.

Silver One holds an option to acquire a 100% interest in the Silver Phoenix Project. The Silver Phoenix Project is a very high-grade native silver prospect that lies within the "Arizona Silver Belt", immediately adjacent to the prolific copper producing area of Globe, Arizona.

For more information, please contact:

Silver One Resources Inc.

Gary Lindsey - VP, Investor Relations

Phone: 604-974–5274

Mobile: (720) 273-6224

Email: gary@strata-star.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Silver One cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Silver One's control. Such factors include, among other things: risks and uncertainties relating to Silver One's limited operating history, ability to obtain sufficient financing to carry out its exploration and development objectives on the Candelaria Project, obtaining the necessary permits to carry out its activities and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Silver One undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Photo - https://mma.prnewswire.com/media/1878702/Figure_1.jpg

Photo - https://mma.prnewswire.com/media/1878704/Figure_2.jpg

Logo - https://mma.prnewswire.com/media/1574720/Silver_One_Logo.jpg