Sokoman Provides Drilling Update - Moosehead Gold Project, Central Newfoundland

MH-22-505 Completed to 559 m Depth; Top of 463 Zone Intersected; Assays Pending

ST. JOHN'S, NL / ACCESSWIRE / December 15, 2022 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) ("Sokoman" or the "Company") is pleased to provide an update on the structural analysis of hole MH-22-463 as well as an update on diamond drilling in the immediate area. MH-22-463 (see press release September 6, 2022) intersected a 39.60 m intercept (core length) of 12.50 g/t Au (from 295.30 m downhole) including a higher-grade interval of 10.25 m grading 41.97 g/t Au (from 312.35 m downhole) from what is now termed the "463 Zone".

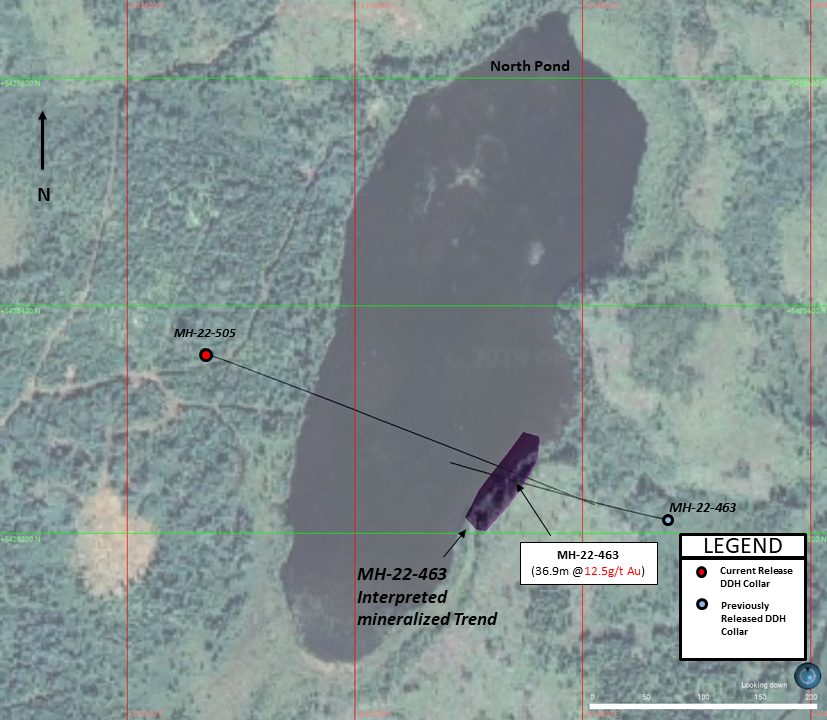

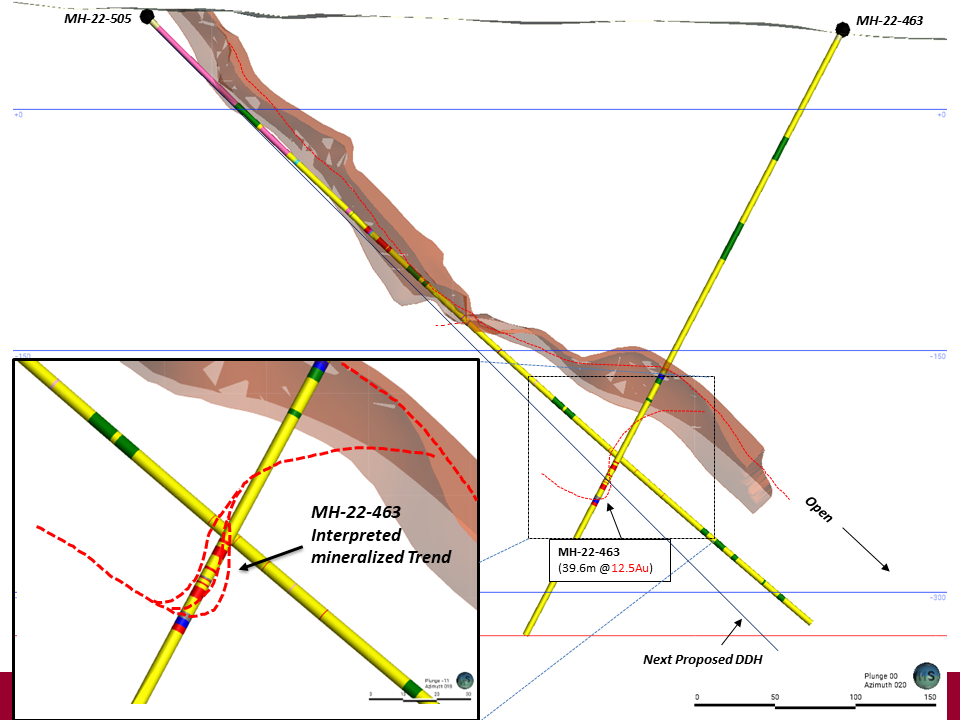

MH-22-505 was collared on the western shore of North Pond to provide the proper angle to test the geometry of the 463 Zone as it was designed to intersect the mid-point of the 463 Zone at depths from 390 m to 410 m. The hole flattened slightly and cut through the top portion of the inferred location of the 463 Zone and intersected three (< 1 m-wide) visible gold (VG) bearing veins, with characteristics similar to veins intersected in MH-22-463, at depths between 393 m and 414 m downhole. The upper part of the hole was projected to cut through a portion of the main Eastern Trend Fault system and significant quartz veining was intersected from 189 m to 194 m and 199 m to 210 m with VG specks noted in both intervals. Other veining with one (1) speck of VG was intersected in a breccia zone from 275 m to 277 m. The mineralized breccia occurs in a similar orientation to the breccia in the 463 Zone and is interpreted to represent another splay or offset in the footwall of the Eastern Trend.

The deepest mineralized zone with 1%-5% stringer/disseminated pyrite +/- arsenopyrite associated with massive (1 m) quartz veins and irregular narrow veins and stringers was intersected from 480 m to 520 m. Significant quartz veining (10%-30%) noted in other parts of the hole will also be assayed. Final assay results are not expected before the end of the year.

463 Zone

The 463 Zone is a significant departure in vein style/geometry from one suggested by earlier drill intersections in the vicinity. The "463" intercept is thicker than any other to date and includes the "typical" high-grade vuggy-type veins with abundant VG with 5%-7% accessory boulangerite and sphalerite, as well as brecciated veining with occasional specks of VG with minor boulangerite and sphalerite. The Company re-engaged Ireland-based structural geology consultant, Dr. David Coller, to review/update existing structural models for the Moosehead mineralization. Dr. Coller's preliminary conclusions are that the 463 Zone is the hinge zone of a folded footwall splay vein off the lower Eastern Trend with the geometry inferred to be a flat structure with a north-south trend.

Tim Froude, President, and CEO of Sokoman says: "Drill hole MH-22-505 is the first of a series of holes planned to test the 463 Zone. The hole flattened a few degrees more than expected and cut through the upper portion of the 463 Zone with the units and veining intersected, comparing well with hole 463. The next hole will be drilled at a steeper angle to target the middle of the 463 Zone approximately 15 m - 20 m deeper than hole 505.

It is encouraging to see the gold mineralization continuing to depths beyond our previous drilling and confirms the Eastern Trend area is a good hunting ground for additional high-grade mineralization. Drilling will pause for the holiday break with a planned startup in mid - January 2023. Approximately 20,000 m remain in Phase 6 but the program will continue beyond that figure and for the foreseeable future."

Figure 1 - Drill Plan - Moosehead Project

Figure 2 - Drill Section MH-22-505

The Moosehead Project has five open-ended zones of gold mineralization focused around the Eastern Trend in the central portion of the property with mineralization defined over a 600-m strike length and over 370 m down dip. The Company is well funded with more than $7 million in the treasury.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project Near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly-emerging gold districts. The Company also retains a 1% Net Smelter Return (NSR) interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For more information, please contact: Cathy Hume, VP Corporate Development, Director Thomas Do, IR Manager, CHF Capital Markets Website: www.sokomanmineralscorp.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/731948/Sokoman-Provides-Drilling-Update--Moosehead-Gold-Project-Central-Newfoundland