SRG: Positive Preliminary Economic Assessment and Resource Additions at Lola Pre-tax IRR of 35% over a 16-year mine life

MONTREAL, July 10, 2018 /CNW Telbec/ - SRG Graphite Inc. (TSXV: SRG) ("SRG" or the "Company") is pleased to announce results of a Preliminary Economic Assessment study ("PEA") for the development of its Lola graphite project in the Republic of Guinea, West Africa. The PEA was prepared by Montréal-based Met-Chem, a division of DRA Americas Inc. ("Met-Chem/DRA"). All dollar figures are in United States dollars.

Highlights of the Lola graphite PEA:

- Production of 50,200 tons of graphite concentrate per year over a 16-year mine life

- Capital costs of $105 million ("M') including contingency of $15M

- Operational costs of $372/tonne ("t") of concentrate and $130/t of transport

- Pre-tax NPV(8%) of $204M (post-tax NPV(8%) of $121M) at an average sales price of $1,328/t

- Finished grade of over 94% and up to 98% over all size fractions

- Strip ratio of 0.39

"These results highlight the value of the Lola graphite asset for the company" said Ugo Landry-Tolszczuk, President and Chief Operating Officer of SRG, "that said, the team will continue to work on improving the design and economics of the project. During our trade-off assessment work, we have found several key points of improvement to incorporate in the feasibility study. Early works which will contribute to the next stage in the development of the project is underway and we are dedicated to meeting our objectives for the year."

The PEA follows the Mineral Resource Estimate published on June 18, 2018. A technical report detailing the PEA, and completed in accordance with National Instrument (NI) 43–101 guidelines, will be filed and available on SEDAR within 45 days from June 18, 2018, the release date of the mineral resource update published by the Company. Effective date of the estimate is June 14, 2018.

COMMERCIAL SALES, REVENUES & PROJECT ECONOMIC SENSITIVITIES

The Lola mine will produce an average of 50,200 tonnes of saleable graphite annually. At an average sale price of $1,328 per tonne, this represents $66.6M annual revenue. Given the volatility of graphite prices in recent years and the bilateral nature of sales contracts a sensitivity analysis of the project economics is presented below in Table 1.

|

Table 1 Project economics sensitivity analysis (pre-tax) | |||||

|

Average Sale Price ($/t) |

1,195 |

1,261 |

13281 |

1,394 |

1,460 |

|

Average annual revenue (million)2 |

60.0 |

63.3 |

66.6 |

70.0 |

73.3 |

|

Pre-tax returns | |||||

|

Average annual cash flow (million) 2 |

31.2 |

34.5 |

37.9 |

41.2 |

44.5 |

|

NPV (million) @ 8% discount |

151 |

177 |

204 |

231 |

257 |

|

IRR (%) |

28.5 |

31.7% |

34.8% |

37.9% |

41.0% |

|

Payback (years) |

3.1 |

2.8 |

2.6 |

2.4 |

2.3 |

|

Post-tax returns | |||||

|

Average annual cash flow (million) 2 |

22.7 |

25.0 |

27.3 |

29.5 |

31.8 |

|

NPV (million) @ 8% discount |

84 |

102 |

121 |

139 |

157 |

|

IRR (%) |

20.3% |

22.7% |

24.9% |

27.2% |

29.4% |

|

Payback (years) |

4.2 |

3.9 |

3.5 |

3.3 |

3.0 |

|

1 |

Base case |

|

2 |

Does not include year 16 as it is not a full year |

MINERAL RESOURCES UPDATE

The PEA was prepared using data from the Mineral Resource Estimate published on June 18, 2018, and including the latest drill campaign. To maximize the life of mine of the project, the PEA uses the resource at a cut-off grade of 1.64% graphitic carbon ("Cg"), which includes measured resources of 2.1 million tonnes ("Mt") grading 4.31% Cg, indicated resources of 17.0Mt grading 4.39% Cg and inferred resources of 2.1Mt grading 4.79% Cg. The resource has been pit-constrained at $1,300/t. Figure 1 depicts the resource locations on the deposit and represents approximately 30% of the deposit outline.

Figure 1 Map of the Deposit With Resource Classification

The mineral resources update was estimated as at June 14, 2018, in accordance with the definitions adopted by the Canadian Institute of Mining Metallurgy and Petroleum and incorporated into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Mineral resources estimate update for the Lola graphite project was carried out by Dr. Marc-Antoine Audet, P.Geo., Lead Geologist and SRG's Qualified Person.

MINING

The Lola deposit is characterised by its saprolite surface mineralisation, which continues at depth into the fresh rock bed. For the PEA, mining operations were exclusively focused on the weathered zone, ensuring operation efficiency and competitive cost of operations. The first 30 metres of the deposit represent the weathered material. Constraining mining to the weathered portion of the deposit ensures minimal utilisation of blasting, and results in a strip ratio of only 0.39.

The average grade fed to the processing plant over the 16-year mine life is 4.43% Cg, and the total material mined per year is 1.8Mt (mineralised material and waste). Mining costs were established at 2.13$/t, considering preliminary pit design and access roads.

|

Table 2 Mining highlights | |

|

Mining costs ($/t material mined) |

2.13 |

|

Average graphite grade (% Cg) |

4.43% |

|

Stripping ratio (waste/mineralised) |

0.39 |

|

Average graphite bearing material mined per year (t/y) |

1,294,763 |

|

Average waste mined per year (t/y) |

510 178 |

|

Mine of Life (years) |

16 years |

PROCESS

The processing plant and waste dump are located on a plateau, west of the main pit, where the land is already conveniently flat and barren of trees. It is currently less than one kilometre from the visual mineralisation. This proximity will ensure short cycle times and contribute to the control of production costs.

Efforts were made to keep a simple flowsheet with limited polishing and flotation stages. Concentrate grade higher than 94% Cg is expected, with a recovery of 79%. Reagents used for processing are diesel as a collector and methyl isobutyl carbinol ("MIBC") as a frother, both commonly available and routinely used reagents in the graphite sector. The processing costs are $9.24/t of processed material resulting in $248/t of graphite concentrate produced. Table 3 provides a summary of results.

|

Table 3 Process highlights | |

|

Processing costs ($/t plant feed) |

9.24 |

|

Processing costs ($/t concentrate) |

248 |

|

Average concentrate grade (%Cg) |

>94% |

|

Graphite plant recovery |

79% |

|

Average material fed to the plant (t/year) |

1,294,763 |

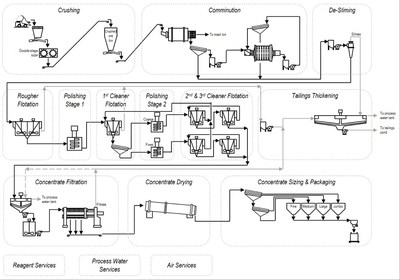

Process description:

Mineralised material handling, crushing, scrubbing, grinding and de-sliming circuits were designed considering the saprolitic properties of the deposit. The relatively low competency of the material allows the design to use two mineral sizers at the front end instead of a jaw crusher or cone crusher. These processing units are known for their low operational cost and reliability compared with conventional jaw and cone crushers.

The crushed material is fed into a scrubber which promotes flake preservation and consumes less energy compared with conventional milling methods. The scrubber discharge is screened, where the coarse fraction is fed to a closed-circuit ball mill, before being recombined with the screen fines. The combined slurry is then fed through a de-sliming stage, where ultra-fines, including slime, clay and organic material are removed. This leads to an upgraded and cleaner material feeding the flotation circuit, resulting in an overall simpler flowsheet.

After de-sliming, the material is fed to the rougher flotation bank producing a rougher concentrate. A first polishing stage further liberate the graphite flakes. The polished rougher concentrate goes through a first cleaning stag and is then fed into a splitting screen, dividing the fine from the coarse graphite, in order to apply the relevant specific polishing energy to each stream. After their respective polishing and cleaning stages, the two streams are recombined, thickened, filtered and dried. The dried concentrate is then screened into four different size fractions before being bagged, and finally stored and shipped to clients.

Figure 2 Process flowsheet

Quality Control and Assurance

Silvia Del Carpio, P.Eng., MBA Met-Chem/DRA., independent Qualified Person as defined by National Instrument 43-101, for the purposes of the PEA has reviewed the technical content of this press release. Raphaël Beaudoin P. Eng., Director of Operations and a Qualified Person for SRG has read and approved this press release.

Cautionary Note

The PEA completed for the Company is preliminary in nature and includes inferred mineral resources, considered too speculative in nature to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the resources development, production, and economic forecasts on which this PEA is based will be realized.

About Met-Chem/DRA

Met-Chem, a division of DRA Americas Inc., was originally established in 1969 as a consulting engineering company, headquartered in Montreal, and provides a wide range of technical and engineering services. Met-Chem is well recognized for its capabilities in mining, geology and mineral processing and has a talented team of engineering, technical and project management personnel with experience in North America, Latin America, Europe, West Africa and India. DRA is a multidisciplinary global engineering group that originated in South Africa and delivers mining, mineral processing, energy, water treatment and infrastructure services from concept to commissioning, as well as comprehensive operations and maintenance services for the mineral resources, water, agriculture and energy sectors. DRA has offices in Africa, Australia, Canada, China, India and the United States.

ABOUT SRG

SRG is a Canadian-based company focused on developing the Lola graphite deposit and the Gogota nickel-cobalt-scandium deposit, both located in the Republic of Guinea, West Africa. SRG is committed to operating in a socially, environmentally and ethically responsible manner.

For additional information, please visit SRG's website at www.srggraphite.com.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains "forward-looking information" within the meaning of Canadian securities legislation. All information contained herein that is not clearly historical in nature may constitute forward-looking information. Generally, such forward-looking information can be identified by the use of forward-looking terminology such as "positive", "result", "improve", "dedicate", "will", "sale", "revenue", "includes", "continue", 'ensuring", "low", "demonstrate", "potential", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would" or "might". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: (i) volatile stock price; (ii) the general global markets and economic conditions; (iii) the possibility of write-downs and impairments; (iv) the risk associated with exploration, development and operations of mineral deposits; (v) the risk associated with establishing title to mineral properties and assets; (vi) fluctuations in commodity price; (viii) the risks associated with uninsurable risks arising during the course of exploration, development and production; (ix) competition faced by the Company in securing experienced personnel and financing; * access to adequate infrastructure to support mining, processing, development and exploration activities; (xi) the risks associated with changes in the mining regulatory regime governing the Company; (xii) the risks associated with the various environmental regulations the Company is subject to; (xiii) risks related to regulatory and permitting delays; (xiv) risks related to potential conflicts of interest; (xv) the reliance on key personnel; (xvi) liquidity risks; (xvii) the risk of potential dilution through the issue of common shares; (xviii) the risk of litigation; and (xix) risk management as well as other risks and factors described or referred to in the section entitled "Risk Factors" in the MD&A of the Company and which is available at www.sedar.com, all of which should be reviewed in conjunction with the information found in this news release.

Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made, including but not limited to; the capacity of the Company to execute on its plans for production of 50,200 tons of graphite per year over a 16-year mine life, to have capital costs of $105M for the project including operational costs of $372/t of concentrate, $130/t of transport cost; to produce at a finished grade of over 95% and up to 98%; a strip ratio of 0.39; to sell its products at an average selling price of $1,328; continued exploration activities and no material adverse change in mineral prices, exploration and development plans to proceed in accordance with plans and such plans to achieve their stated expected outcomes, receipt of required regulatory approvals, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Such forward-looking information has been provided for the purpose of assisting investors in understanding the Company's business, operations and exploration plans and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is given as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws.

SOURCE SRG Graphite

View original content with multimedia: http://www.newswire.ca/en/releases/archive/July2018/10/c6775.html