St-Georges Release More Information on the Thor Gold Project & Arrange Financing

(TheNewswire)

Montreal, Quebec / TheNewswire / April 11, 2017 - St-Georges Platinum and Base Metals Ltd. (CSE: SX) (OTC: XOOF) (FSE: 85G1) is pleased to present further information on its Thor exploration & development project in Iceland.

Please refer to our March 16, 2017 news release posted on the CSE or our website at www.st-georgesplatinum.com for additional information on location and terms.

Thor Joint-Venture Gold Project

The Thor Project is part of the recent string of acquisitions by St-Georges. The project is located in the southwest portion of Iceland, about 20 km east of the city center of Reykjavik. This area is an active rift zone.

A new internal report completed for St-Georges by Dr. Natasha Henwood, as part of the due diligence process for the acquisition of Iceland Resources, summarizes the previous work programs including the most recent work conducted in 2013. The report includes recommendations to bring the project forward to a resource estimate. St-Georges management is in contact with independent consultants in order to commission a National Instrument 43-101 Technical Report later this spring for the Thor project.

The work Dr. Henwood reviewed confirms the existence of high grade gold values contained in a low sulphidation epithermal system. The mineralized system is comprised of early banded chalcedony-ginguro veins cut by later silica-feldspar veins, and then remobilized faulting with clay gouge and disseminated sulfides.

The previous work program included detailed geologic mapping, petrography, stream sampling and core re-sampling and assaying. Geologic mapping proved difficult because of thick vegetation. Less than 10% of outcrop is available for mapping. Much of the outcrop is limited to ridge tops, cliffs and stream bottoms. The field works in conjunction with structural interpretation from aerial photos have given some limited perspective to geologic and structural controls for mineralization.

A review of past core drilling provided additional important information, Dr. Henwood determined that:

-True thickness on the vein intercepts ranged from 2.2 to 11.4 meters.

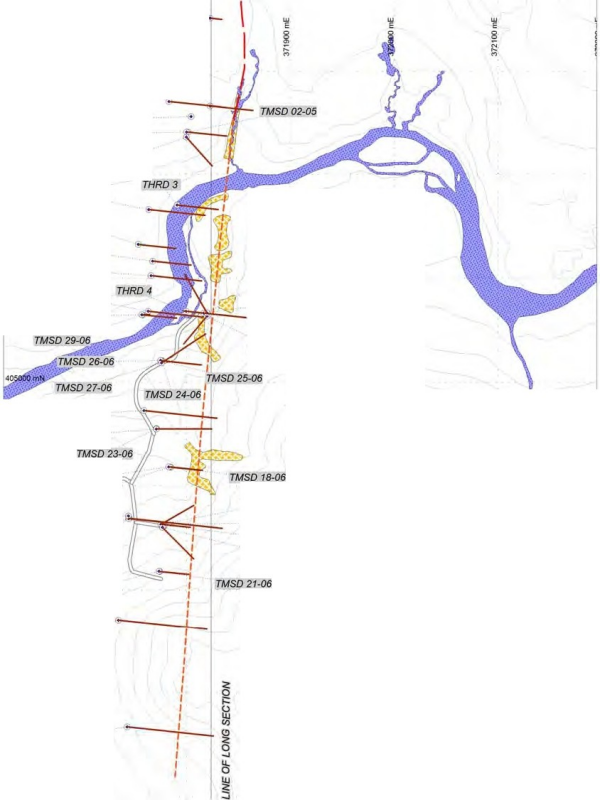

-Current length is 560 meters based on drill intercepts (Figure 2).

-Depths of mineralized intervals in core are from surface to 80 meters.

-Gold to silver ratio is approximately 2:1 with some variations.

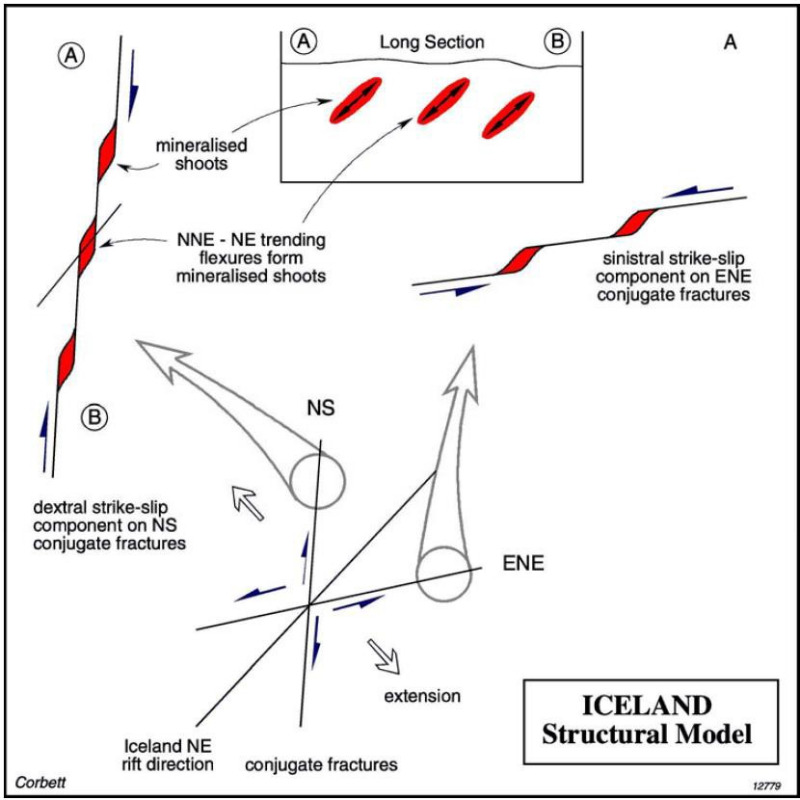

The work completed on petrology, stream sampling, and core logging and re-assaying provides a strong argument for multiple episodes of gold deposition. Dr. Greg Corbett visited the property in 2004. He postulated plunging, high grade shoots of gold mineralization associated with extensional faulting (Figure 1). His work and drilling conducted on the vein system have shown the vein is open to the north. Stream sampling suggests the vein system may also extend to the south even though drilling appears to cut it off.

The core resampling program indicated substantial repeatability of higher grades of gold. However, no resamples were conducted on low and moderate grade samples in 2013. Historic sampling of the low and moderate grades was generally less than 10% difference. This problem will likely require twinning of past high grade drill holes with larger core.

Figure 1: Structural model for Iceland (Corbett 2004)

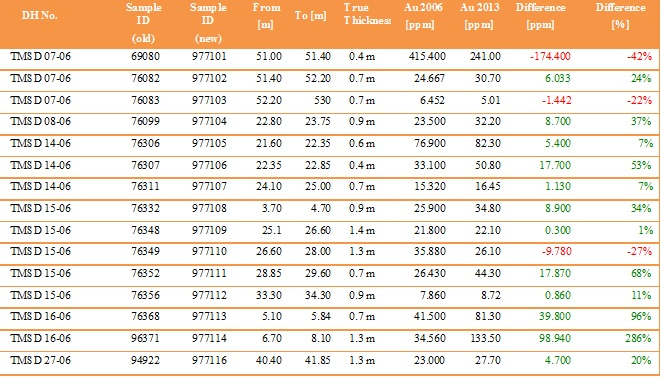

The poor repeatability of the higher grade samples can be attributed to nugget effect and the current condition of the available core. Much of the resampling (12 of 15 samples) exceeded a 10% difference between the original 2006 sampling and the 2013 sampling. Eight of the samples measured significantly higher (24% to 286%) while 3 were significantly lower (-27% to -42%). Table 1 below shows the results of the sampling of best grades correlation of resampling of these intervals.

Table 1 - Results showing 2006 assays and 2013 re-assay

Figure 2: Plan map of

Thor project with drilling and vein intercepts.

Click Image To View Full Size

.

Past work along with Dr. Henwood's summary analysis provides an excellent framework for St. Georges upcoming work programs. The company is determining the best geophysical methods to test for extensions of the known mineralization along strike and at depth. A drill program will then be permitted to test the results. The drilling will target specific high grade gold shoots based on past drilling and Dr. Corbett's model. Deeper drilling will assess the gold encountered at depths of 420 meters with the goal of identifying additional high grade resources.

Financing

Management has been approached by different parties to finance the company. Conditional to regulatory approval the Company is proposing an equity financing of up to $500,000 that could be increased by a 20% over-allocation under certain conditions.

Terms

$0.03 per unit. Each unit includes one common share and one unit special warrant. Each unit's special warrant will have an execution price of $0.06 and an 18 months life span. When executed the special unit warrants will enable the warrant holder to acquire one common share and one standard warrant. The standard warrant will be valid for 18 month concurrently to the special warrant and bear an execution price of $0.12. This warrant will allow the holder to receive one common share. All securities issued under this financing will be restricted from resale for 4 months.

If all warrants are executed, the holder of the units would have acquired 3 common shares for each unit subscribed at an average of $0.07 per share.

Related Parties Participation

Insiders and related parties, including geological contractors in Iceland may decide to participate in this financing. Insiders and related parties will participate on the basis of a voluntary 18 months restriction on the common share subscribed.

Multilateral Instrument 61-101

Given the proposed participation of the insider holders, the proposed financing constitutes a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security holders in Special Transactions ("MI 61-101").

St-Georges is relying on an exemption to both the formal valuation and the minority shareholder approval requirements of MI 61-101, as neither the fair market value of the Units to be distributed to, nor the fair market value of the consideration to be received by St-Georges from the insider holders in connection with the proposed financing exceeds 25% of St-Georges' share capitalisation.

The technical information in this release has been reviewed and approved by Mr. Herb Duerr, P. Geo. a 'qualified person' as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

"Frank Dumas'

FRANK DUMAS, PRESIDENT & CEO

About St-Georges

St-Georges is developing new technologies to solve the biggest environmental problems in the mining industry. If these new technologies are successful, they should improve the financial bottom line of current mining producers. The potential success of these technologies would also involve upgrading certain current known metal resources to economic status while addressing the environmental and social acceptability issues.

The Company control directly or indirectly all of the active mineral tenures in Iceland. It also explores for Nickel on the Julie Nickel Project & for industrial minerals on the Quebec's North Shore and for Lithium and rare metals in Northern Quebec and in the Abitibi area. Headquartered in Montreal, St-Georges' stock is listed on the CSE under the symbol SX, on the US OTC under the Symbol SXOOF and on the Frankfurt Stock Exchange under the symbol 85G1. For additional information, please visit our website at www.st-georgesplatinum.com

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

Copyright (c) 2017 TheNewswire - All rights reserved.