Stellar AfricaGold Samples 3.40 g/t Au over 20 Metres Confirming Gold Discovery at Tichka Est Project, Morocco

(TheNewswire)

Montreal - TheNewswire - October 25, 2021 - J. François Lalonde, President and CEO of Stellar AfricaGold Inc., (TSXV:SPX) ("Stellar" or the "Company") is pleased to announce that the second trenching program on the Zones B and A gold structures of its Tichka Est project in the High Atlas region confirms that Stellar has a new gold discovery in the High Atlas region of Morocco.

Summary of Results

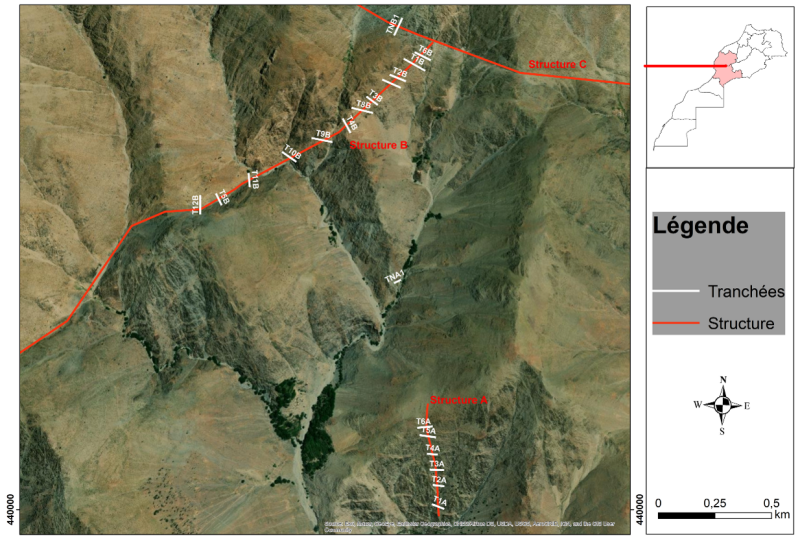

Stellar successfully completed a second 10-trench surface sampling program extending the mineralized strike of both the Zones B and A gold structures on its 90% earn-in Tichka Est gold project in Morocco. The trenching program, which totalled 200 linear metres, yielded intervals in Zone B as high as 3.40 g/t Au over 20 meters including internals of 5.23 g/t Au over 11 meters and 8.14 g/t Au over 5 meters in Trench 7B, 4.64 g/t Au over 14 meters including 11.16 g/t Au over 5 meters in Trench 9B, and 3.4 g/t Au over 17 meters including 9.55 g/t Au over 4 meters in Trench 6B. This second trenching program builds upon Stellar’s previous program (see news release April 19, 2021) which yielded intervals up to 4.55 g/t Au over 15 meters including an internal of 7.47 g/t Au over 6.0 meters in Zone B, and 3.36 g/t Au over 10 meters including an interval of 8.73 g/t Au over 3.0 meters in Zone A.

The Zone B structure has been mapped at surface for a strike length of over 2 km of which 750 meters has been trenched and channel sampled. The Zone A structure has been mapped for over 500 meters along strike of which 450 meters has been trenched and channel sampled.

About the Tichka Est Project, Morocco

The Tichka Est property is comprised of three contiguous permits covering an area of 44.6 km2 within the High Atlas Western Domain approximately 100 km SSW of the city of Marrakech. The general area is accessible year-round by road via a national road to the village of Analghi located near the mineralized gold zone. Stellar is awaiting permits for construction of a heavy equipment access road to proposed drill sites at Zones B and A.

Details of the Second Trenching Program

This second trenching program was designed to provide a better understanding of the geological and structural nature of the Zone B and A structures and to confirm the lateral extension of the two previously identified highly metamorphosed gold mineralized shear zones. The trenches were dug to an average depth of 1.5 meters and over lengths of 15 to 25 meters depending upon the visible width of the structure at that point. Seven trenches were dug across the Zone B structure and two across the Zone A structure. One trench was dug in another area of interest outside of the Zones B and A structures.

Map 1 - Aerial View of the Zones B and A Trenching Program

ZONE B

A portion of the two-kilometer plus surface exposure of Zone B has now been investigated by two trenching programs. A total of 12 trenches were dug by teams using hand tools down to a depth of 1.5 meters. There, fresh rock exposures were channel sampled across one-meter intervals using a rock saw for a better conformity of the samples (See figure 1 below). In this recent trenching program, seven trenches were dug across the Zone B mineralized structure which extended the trenched gold-mineralized zone to over 750 meters of strike length trending Northeast to Southwest.

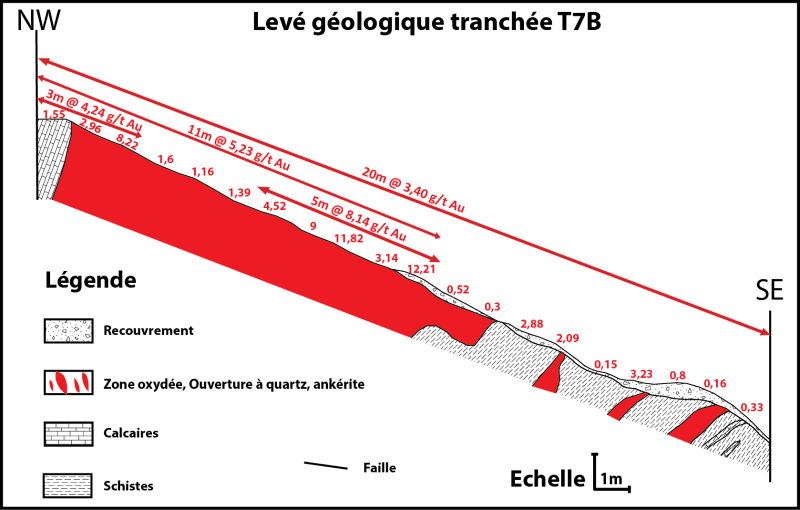

Figure 1 - Zone B - Oxidized gold mineralization in trench 7B

The Zone B gold mineralized structure is oriented N800 and located along the contact of a limestone and a schist. The contact is highly sheared and injected by quartz-ankerite-calcite veins and veinlets with trace of sulphide, pyrite, chalcopyrite and arsenopyrite to which the gold mineralization is closely associated. Within the 750-meter trenched mineralized zone the best results appear to be on the Northeastern end of Zone B. The highest assay results, which were obtained in trenches T6B, T7B and T9B, and are listed below.

Trench 6B - 3.4 g/t Au over 17 meters including 9.55 g/t Au over 4 meters.

Trench 7B - 3.40 g/t Au over 20 meters including 5.23 g/t Au over 11 meters and 8.14 g/t Au over 5 meters. Note also that Trench 7B is mineralised over its entire 20-meter length and that the width of the mineralised Zone B structure exceeds the trench length at that location.

Trench T9B - 4.64 g/t Au over 14 meters including 11.16 g/t Au over 5 meters

Figure 2 - Zone B - Geological cross section of trench 7B

ZONE A

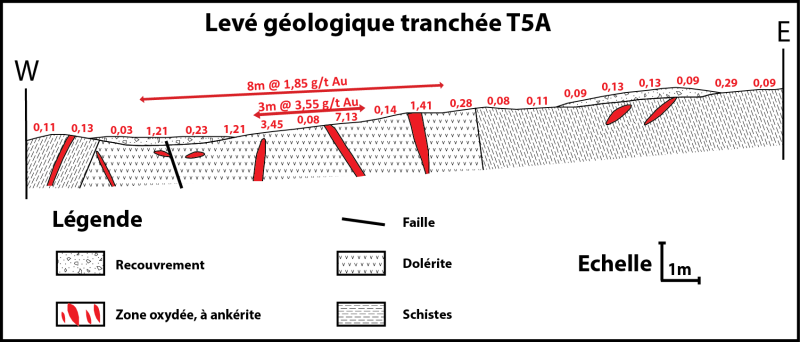

Zone A is a N3500 trending structure. During this program two new trenches were dug to confirm the northern extension of the structure. The two new trenches successfully confirmed the northern extension of the zone for an additional 125 meters increasing the confirmed gold-mineralized Zone A to approximately 450 meters along strike. In Zone A the mineralisation is in a shear zone at the contact of a dolerite dyke and a schist unit. The sheared zone is also injected by quartz-ankerite veins and veinlets.

Figure 3 - Zone A - Quartz and ankerite mineralization in trench 5A

The highest assay results in Zone A were obtained in trenches T5A and T6A are listed as follow.

T5A - 1.85 g/t Au over 8.0 meters including 3.55 g/t Au over 3 meters

T6A - 2.70 g/t Au over 5.0 meters including 3.71 g/t Au over 3 meters

Figure 4 – Zone A geological cross section of trench 5A

Technical Information and Quality Control Notes

The trenches were excavated across the Zones A and B structures using hand tools to an average depth of 1.5 metres. The trenches were mapped at a scale of 1:100 and channeled sampled at 1 metre intervals using a mechanical rock saw for a better sample accuracy as recommended in Stellar’s Technical Report of November 15, 2020.

Sample collection was done by two experienced senior local geologists under the supervision of Yassine Belakbir, Stellar’s Director in Morocco and by Dr. Ali Saquaque, Stellar’s Technical Advisor for Africa. The samples were bagged at the sampling site and stored in safe areas until being transported to African Laboratory for Mining and Environment (“Afrilab”) in Marrakech for analysis.

200 samples were sent to Afrilab for this program. In addition, for the purpose of quality control, 7 standard, 7 duplicate and 7 blank samples were added to the batch and, except for one duplicate that is showing a probable nugget effect, all standard analysis results fall within the tolerance range of the original samples. The blank sample values were all below the detection limit for gold.

CONCLUSION

In conclusion, the second Tichka Est trenching program of the Zone A and B structures extended the mineralized strike lengths of both zones and successfully outlined wider gold mineralization with some high-grade intersections of considerable widths confirming Stellar’s gold discovery in Morocco. The gold is associated with injected quartz-carbonate veins in highly brecciated sheared structures context. The results fully justify the drill program currently in preparation beginning on the Zone B structure and progressing to the Zone A structure thereafter.

Additionally, this program provided Stellar with valuable geological information which will facilitate the exploration of other areas of interest within the Tichka Est Permits area.

About Tichka Est Project

The Tichka Est property is comprised of three contiguous prospecting permits covering an area of 44.6 km2. The Tichka Est Property lies within the High Atlas Western Domain about 100 km SSW of the city of Marrakech. The area is accessible year-round by road via a national road to the village of Analghi located near the mineralized gold zone.

About Stellar AfricaGold Inc.

Stellar AfricaGold Inc. is a Canadian gold company with offices in Vancouver, BC and in Montreal, QC. Stellar President François Lalonde can be contacted at 514-992-0929 or by email at lalonde@stellarafricagold.com.

The technical content of this press release has been reviewed and approved by M. Yassine Belkabir, MScDIC, CEng, MIMMM, a Stellar director and a Qualified Person as defined in NI 43-101.

On Behalf of the Board

J. François Lalonde

President & CEO

This release contains certain "forward-looking information" under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases forward-looking information can be identified by terminology such as "may", "will", "should", "expect", "intend", "plan", "anticipate", "believe", "estimate", "projects", "potential", "scheduled", "forecast", "budget" or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2021 TheNewswire - All rights reserved.