Strategic Metals Announces Promising Geological and Analytical Results From Mint Porphyry Cu-Au-Ag-Mo Project, SW Yukon

VANCOUVER, BC / ACCESSWIRE / August 11, 2021 / Strategic Metals Ltd. (TSXV:SMD) ("Strategic" or the "Company") announces highly encouraging results from a recently completed program involving detailed geological mapping and rock sampling at its Mint porphyry copper-gold-silver-molybdenum project located in southwestern Yukon. Highlights from the program include:

- Delineation of a 300 m by 300 m zone featuring strong alteration and abundant well-mineralized, sheeted and stockwork veinlets, 800 m north of a 2012 diamond drill hole that averaged 0.204 g/t gold over its entire 331 m length; and,

- Numerous high values from rock samples collected within the newly defined zone, which include 2.3% copper, 1.365 g/t gold, 32 g/t silver and 0.337% molybdenum.

"Results from the 2021 mapping combined with results from earlier work confirm that Mint hosts a large, high-level porphyry system and suggest that the core of the system may lie to the north of the area that was drilled in 2012," states Doug Eaton, CEO of Strategic Metals. "The best porphyry discoveries that have been made in the Canadian Cordillera in recent years have come from drill programs that explored beneath weaker, near-surface mineralization. We feel that Mint could be this type of target."

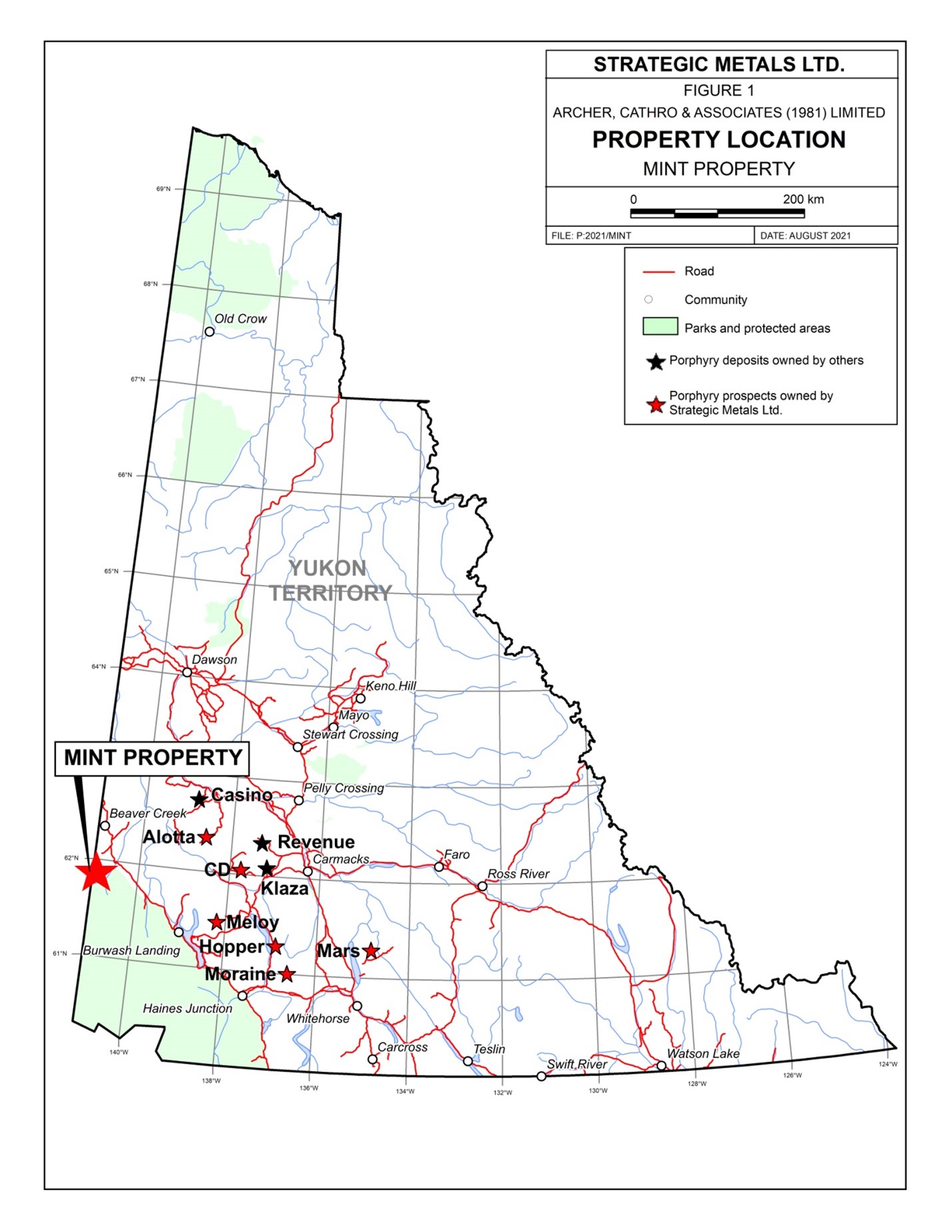

The Mint project is wholly-owned by Strategic and is not subject to any underlying royalty interests. It lies 26 km south of the Alaska Highway (Figure 1), within the Traditional Territory of the White River First Nation. The project area comprises 250 mineral claims, encompassing approximately 5000 hectares (50 km 2 ).

The Mint porphyry prospect is one of the youngest porphyry systems in the Canadian Cordillera. It is hosted in an Oligocene-age unit comprising basalt flows and basaltic to andesitic tuffs, which is cut by nearly coeval, fine to medium grained, hornblende granodiorite to diorite intrusions and porphyritic dykes of variable composition.

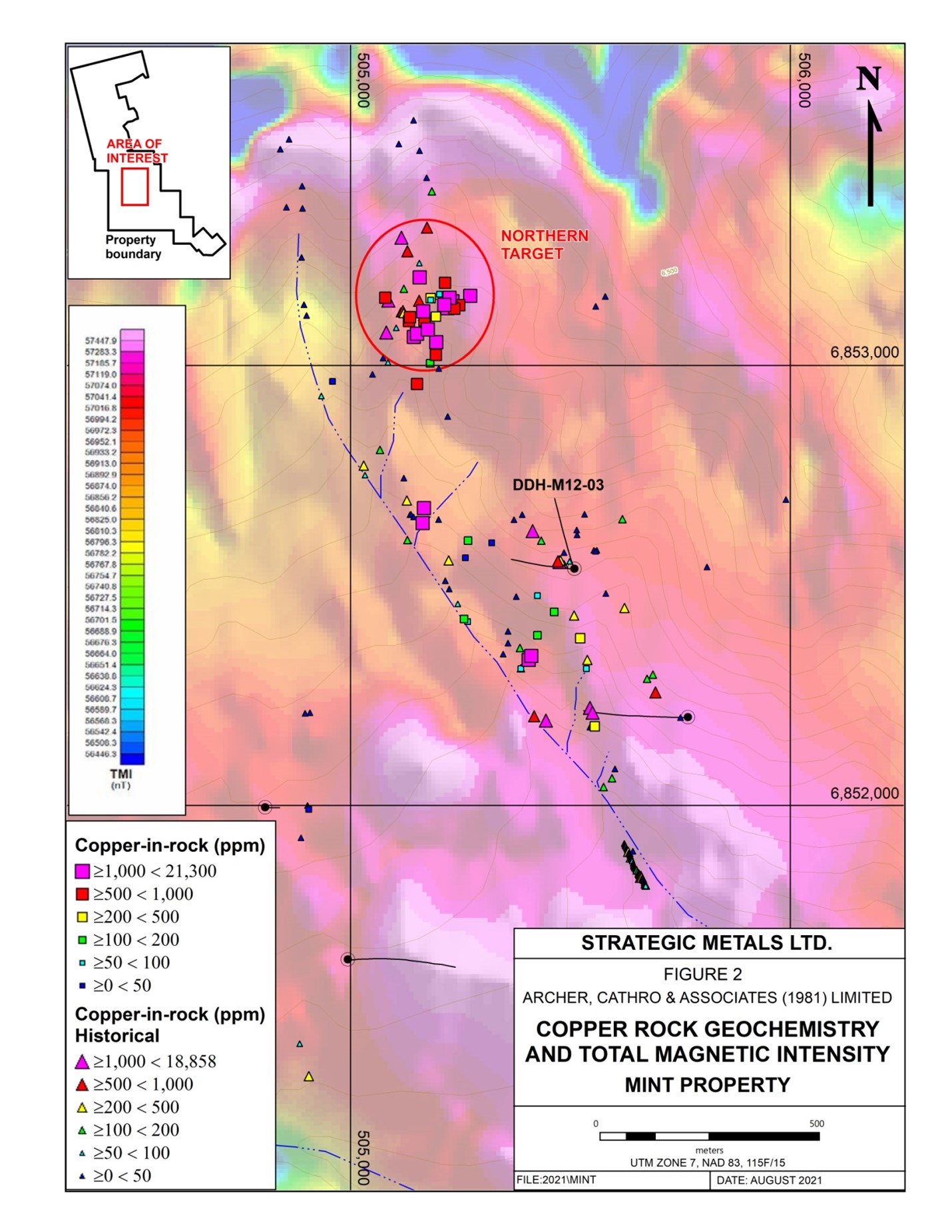

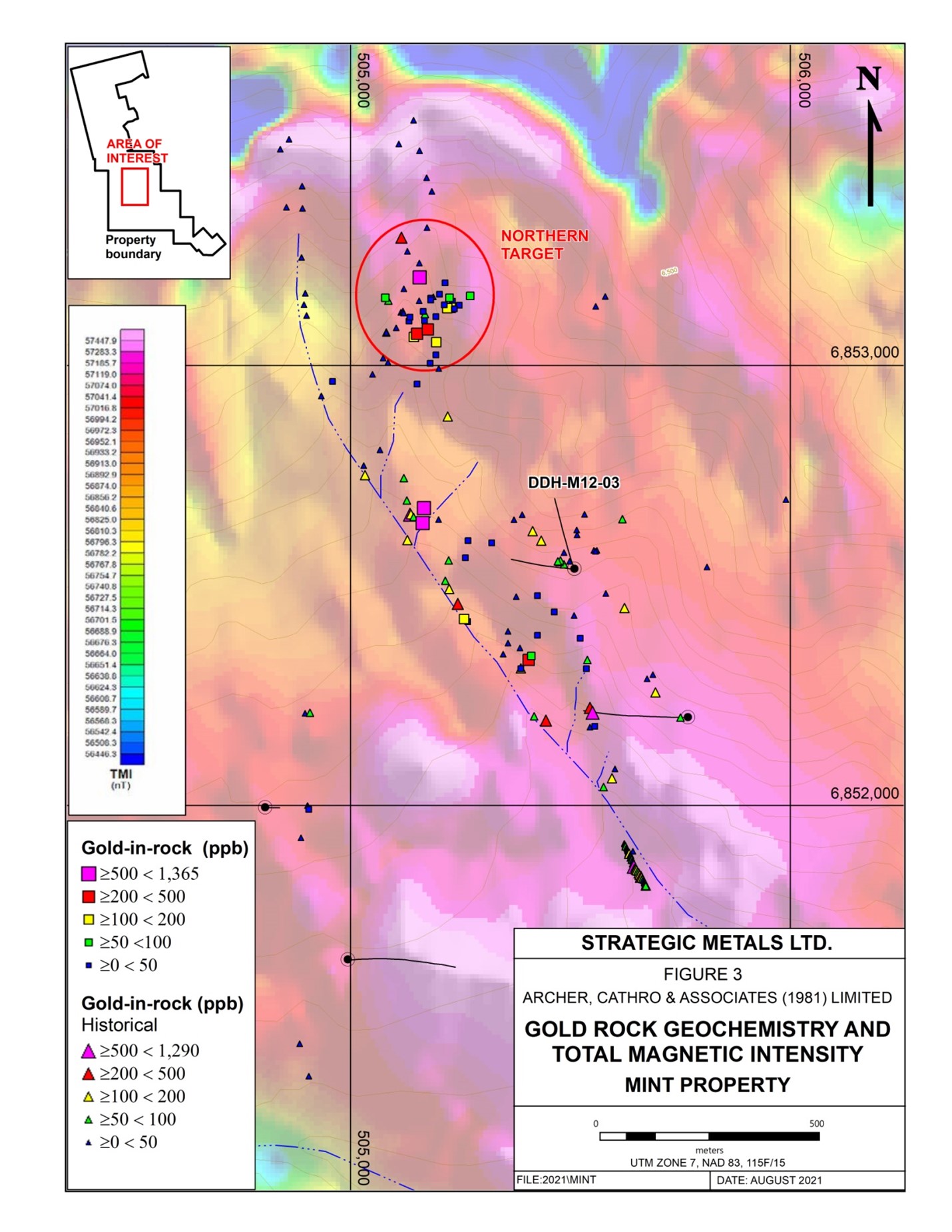

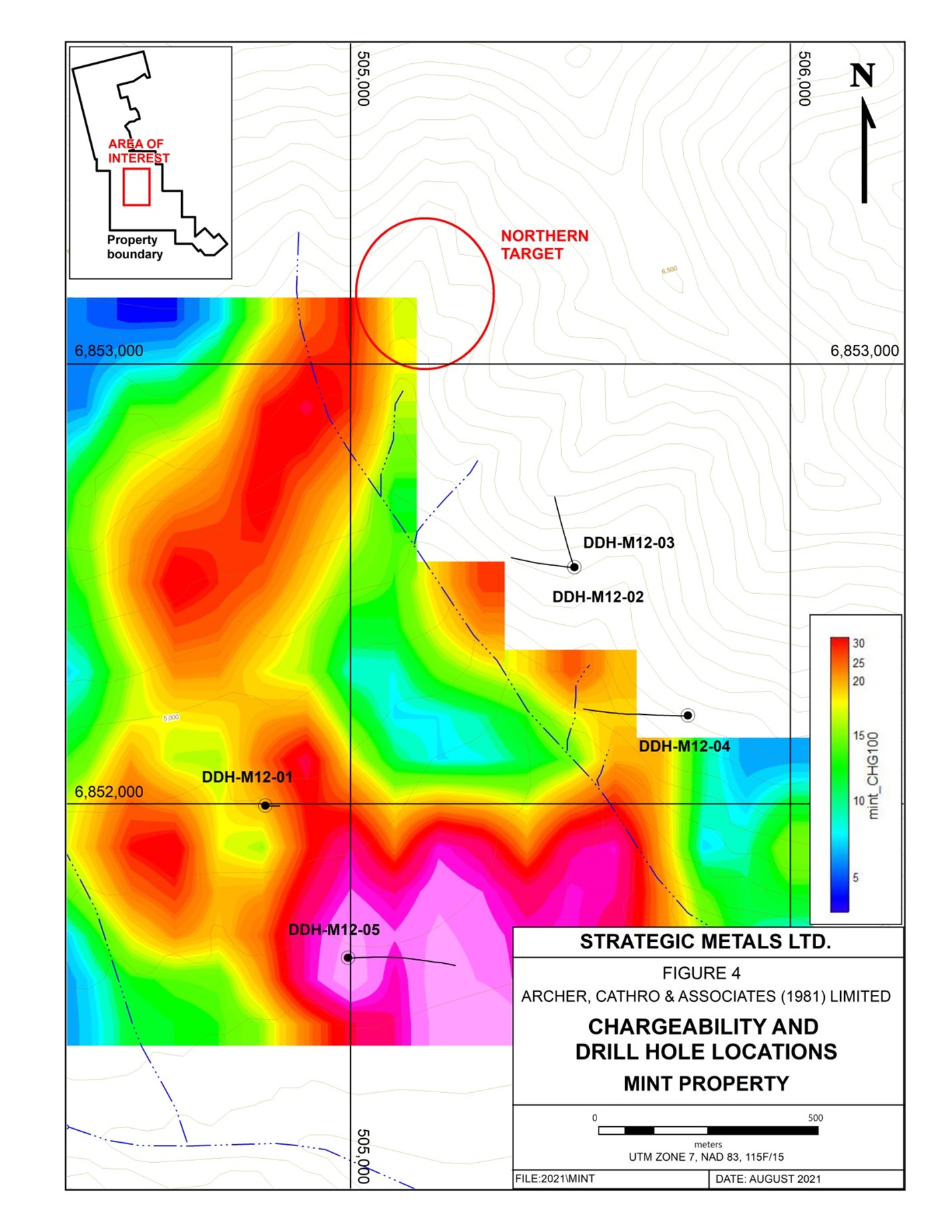

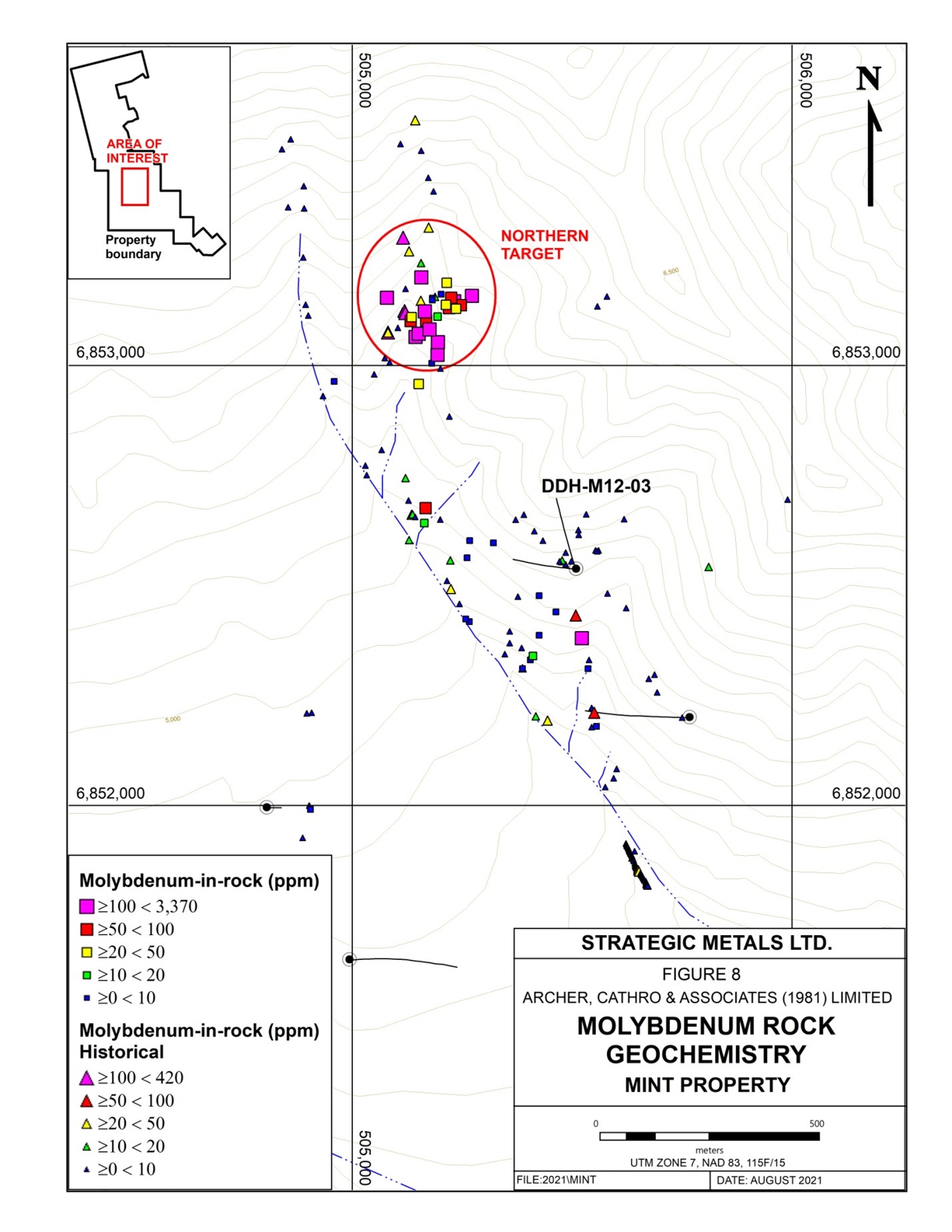

Strategic staked the Mint project in 2010 and subsequently conducted preliminary geological mapping, soil geochemical surveys and geophysical surveys (magnetics, radiometrics and induced polarization (IP)). The soil sampling outlined a large gold-copper-molybdenum anomaly, which partially coincides with a 1500 m diameter magnetic anomaly that is cored by an area of very high response (Figures 2 and 3). The radiometric survey identified an 800 m by 1200 m potassium high about 500 m north of the core of the magnetic anomaly. In 2012, five, widely-spaced diamond drill holes (totalling 1768 m) were completed, primarily targeting magnetic, chargeability and resistivity features identified by the magnetic and IP surveys (Figure 4). The best results were obtained from hole M12-03 on the northern edge of the drill area, which averaged 0.204 g/t gold over its entire 331 m length, including 53 m that averaged 0.556 g/t gold near the bottom of the hole. All of the holes intersected porphyry -style alteration, with the best mineralized hole containing long intervals of predominantly phyllic alteration with localized areas of potassic alteration and brecciation. Copper and molybdenum values were near background to slightly elevated in all holes. Despite the encouraging gold results, the property has seen relatively little work since the drill program.

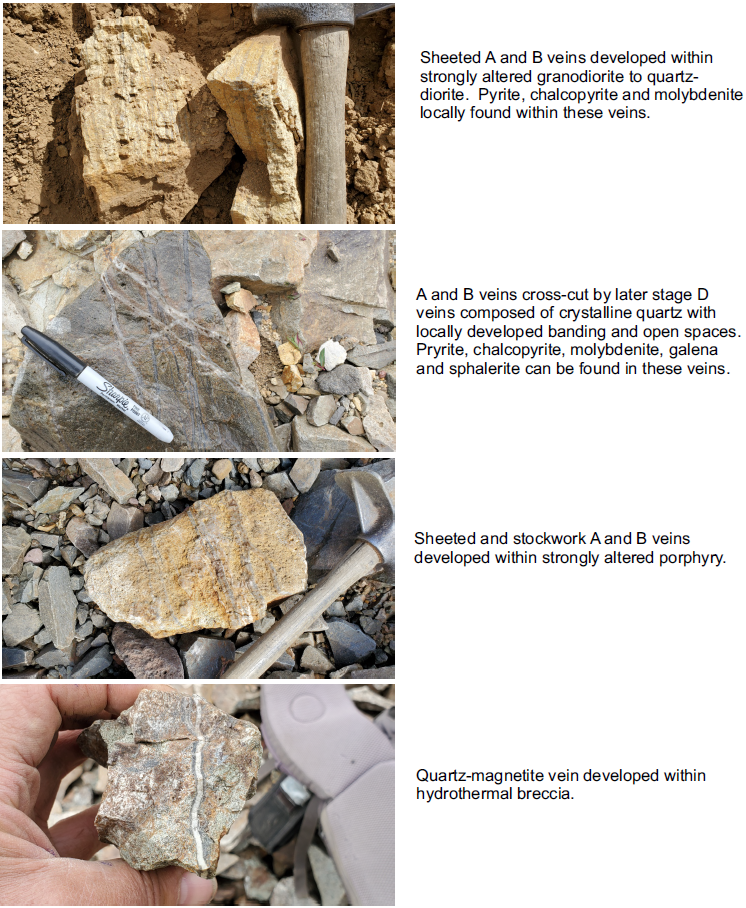

In July 2021, the Company sent a crew to the property to perform detailed mapping and rock sampling within a promising target that lies 800 m north of the area where the maiden drill program was conducted in 2012. The work identified a 300 m by 300 m area containing porphyry-style alteration and veining with abundant copper mineralization. It appears that early stage potassic alteration is over-printed by lower temperature, higher level alteration, suggesting that the system may be telescoped. The crew reported that every outcrop in the area is altered and that porphyry-style veining is ubiquitous, comprising up to 50% of the rock by volume in some exposures (see attached photos 1-4). Chalcopyrite, pyrite and rare molybdenite occur within veins, and chalcopyrite is present in wallrocks where veins form more than 20% of the rock. Sulphide mineralization has been weathered to limonite in many locations.

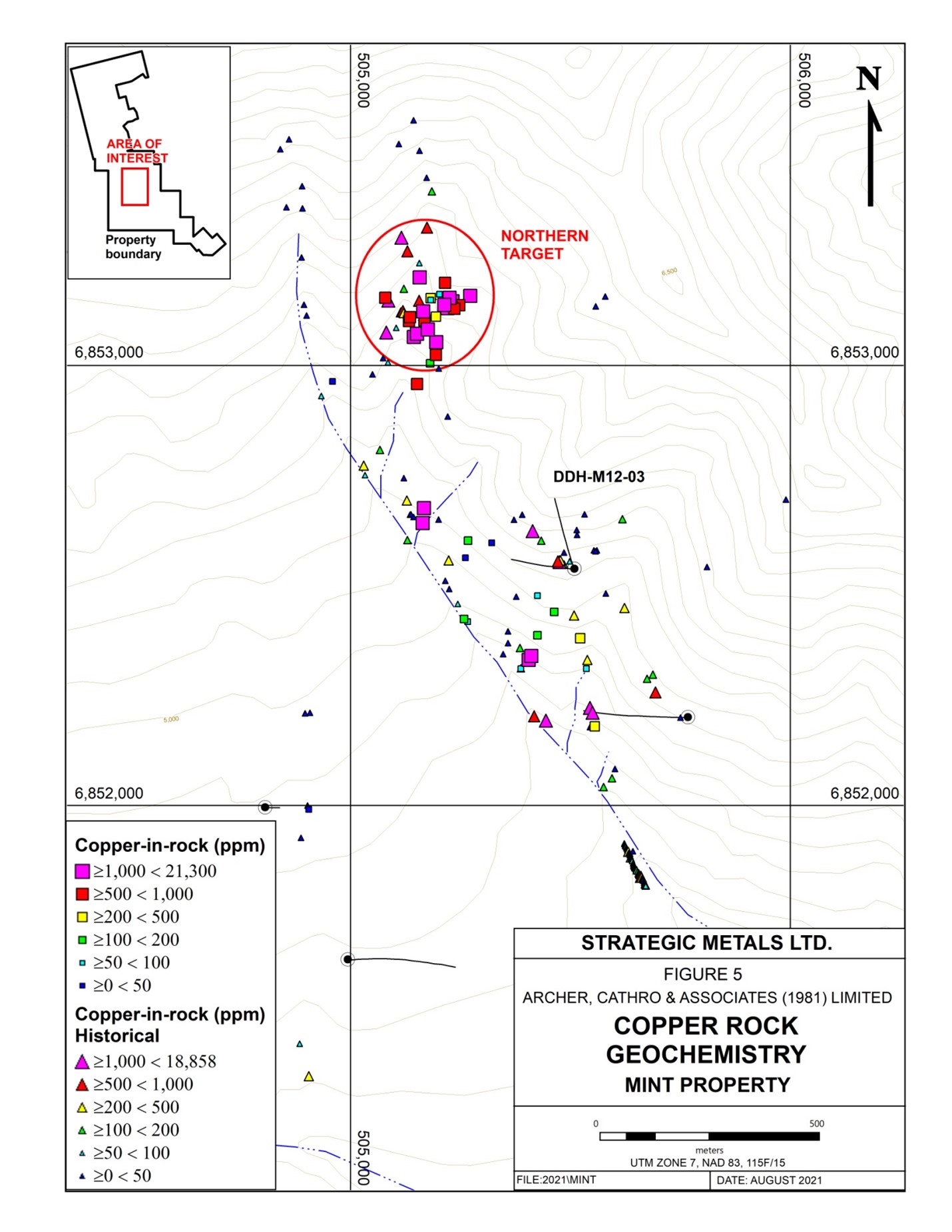

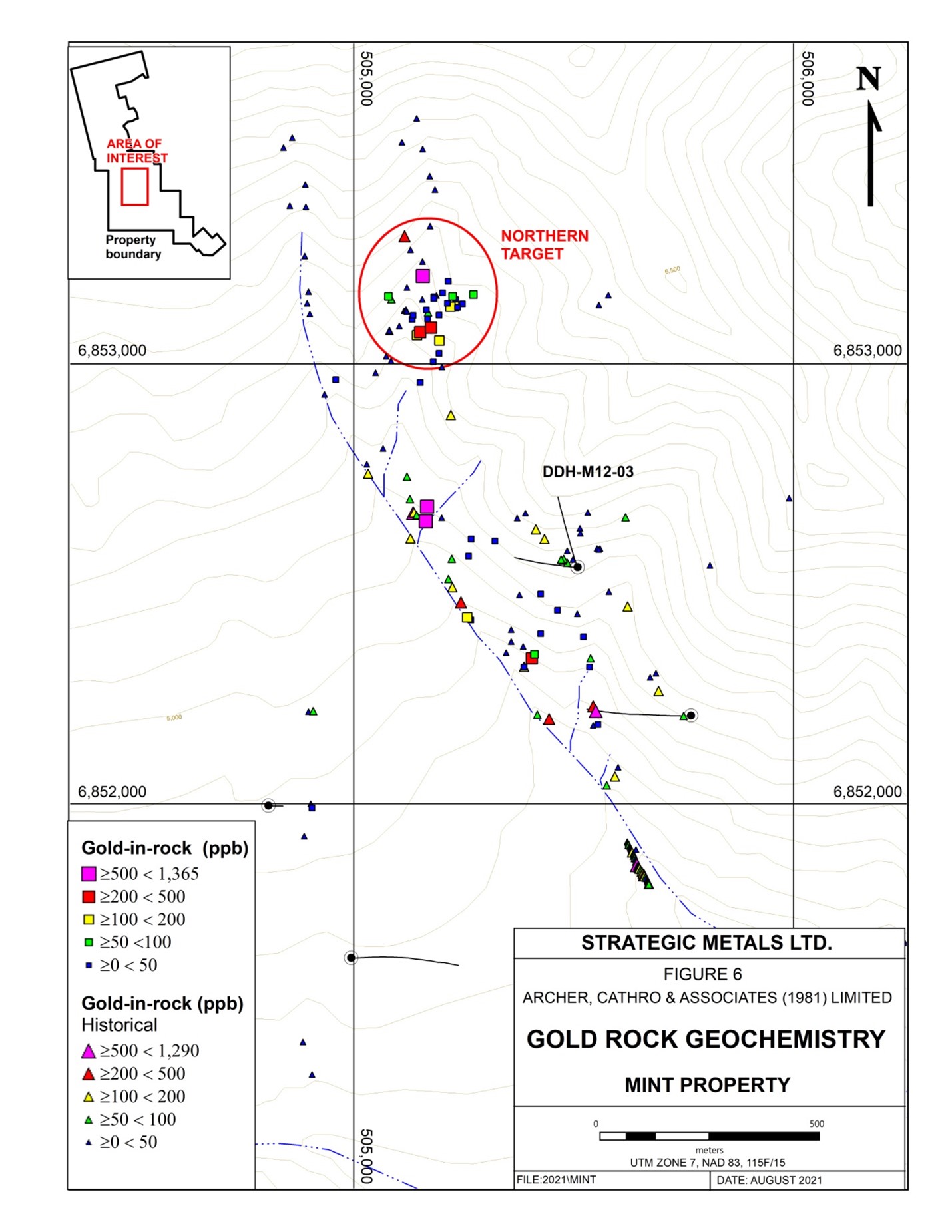

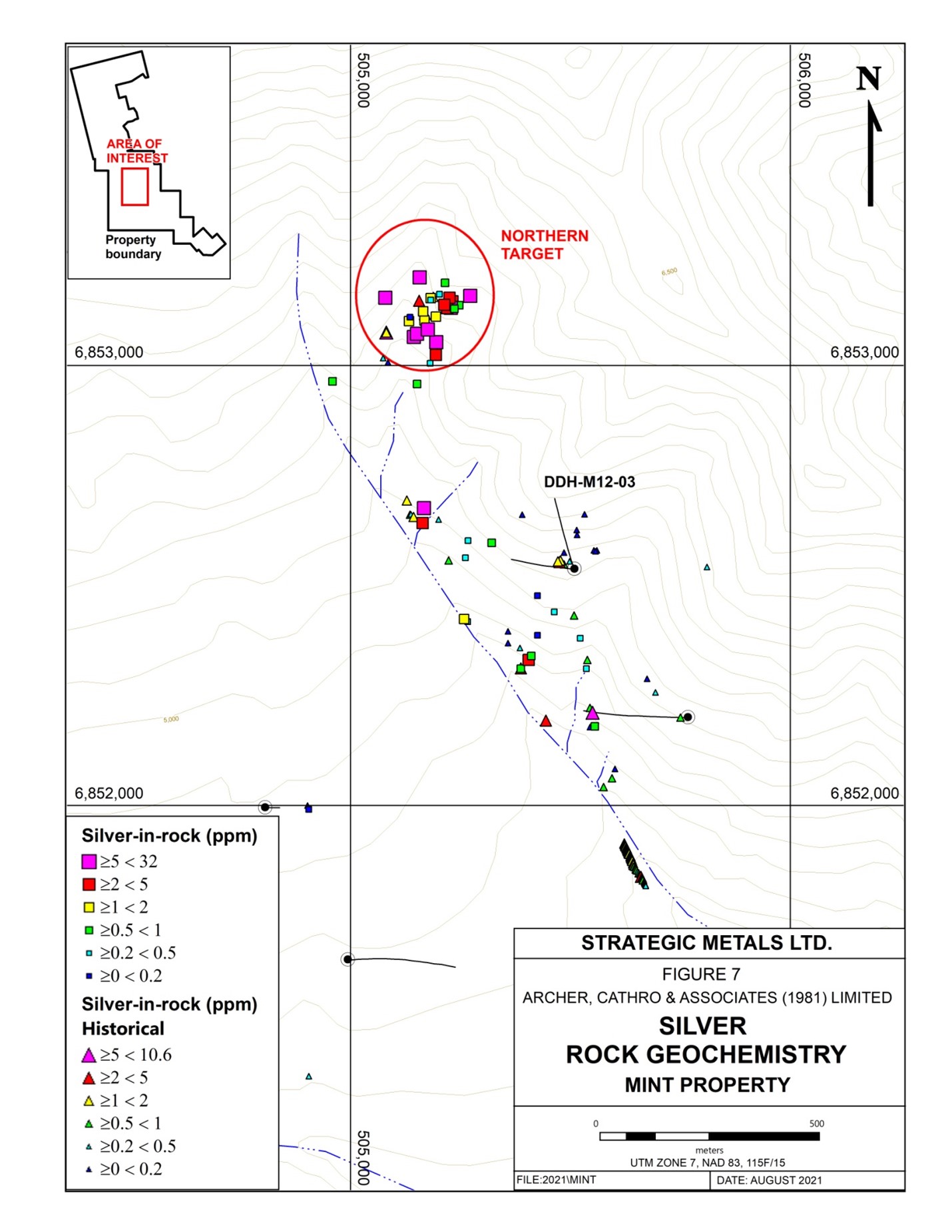

A total of 45 rock samples were collected in 2021, and of these 16 graded better than 0.1 % copper, 11 assayed 0.1 g/t or higher gold, 9 returned 5 g/t or better silver and 11 yielded more than 0.01% molybdenum. Peak values are 2.3 % copper, 1.365 g/t gold, 32 g/t silver and 0.337 % molybdenum.

The majority of the strongly elevated 2021 results were from samples collected within the newly-defined northern target. The average values for the 26 rock samples collected in 2021 from the northern target are 0.32% copper, 0.088 g/t gold, 5.7 g/t silver and 0.038 % molybdenum. A compilation of 2021 and historical results shows that surface rock sample values for all four metals are generally much higher within the northern target than the area that was drilled in 2012 (Figures 5-8).

Rock sample preparation and multi-element analyses were carried out at ALS in Whitehorse, YT and North Vancouver, BC, respectively. Each sample was dried, fine crushed to better than 70% passing 2 mm and then a 250 g split was pulverized to better than 85% passing 75 microns. The fine fractions were analyzed for 35 elements using aqua regia digestion followed by inductively coupled plasma (ME-ICP41). An additional 30 g charge was further analysed for gold by fire assay and inductively coupled plasma - atomic emissions spectroscopy finish (Au-ICP21). Samples with overlimit values were further analyzed by four-acid digestion for copper using Cu-OG62.

About Strategic Metals Ltd.

Strategic is a project generator with 11 royalty interests, 8 projects under option to others, and a portfolio of more than 100 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of over $8 million and large shareholdings in a number of active mineral exploration companies including 38.9% of GGL Resources Corp., 33.5% of Rockhaven Resources Ltd., 19.9% of Honey Badger Silver Inc., 19.2% of Precipitate Gold Corp. and 18.7% of Silver Range Resources Ltd. All of these companies are well funded and are engaged in promising exploration projects. Strategic also owns 21.9% of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed a US$9.2 million financing to advance its environmentally-friendly, cost-effective alternative to Portland cement. The current value of Strategic's stock portfolio is approximately $22 million.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

Corporate Information

Strategic Metals Ltd.

W. Douglas Eaton

President and C.E.O.

Tel: (604) 688-2568

Investor Inquiries

Richard Drechsler

V.P. Communications

Tel: (604) 687-2522

NA Toll-Free: (888) 688-2522

rdrechsler@strategicmetalsltd.com

http://www.strategicmetalsltd.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.

SOURCE: Strategic Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/659223/Strategic-Metals-Announces-Promising-Geological-and-Analytical-Results-From-Mint-Porphyry-Cu-Au-Ag-Mo-Project-SW-Yukon