Strategic Metals Discovers New Veins at its Mt. Hinton Gold-Silver Project, Yukon

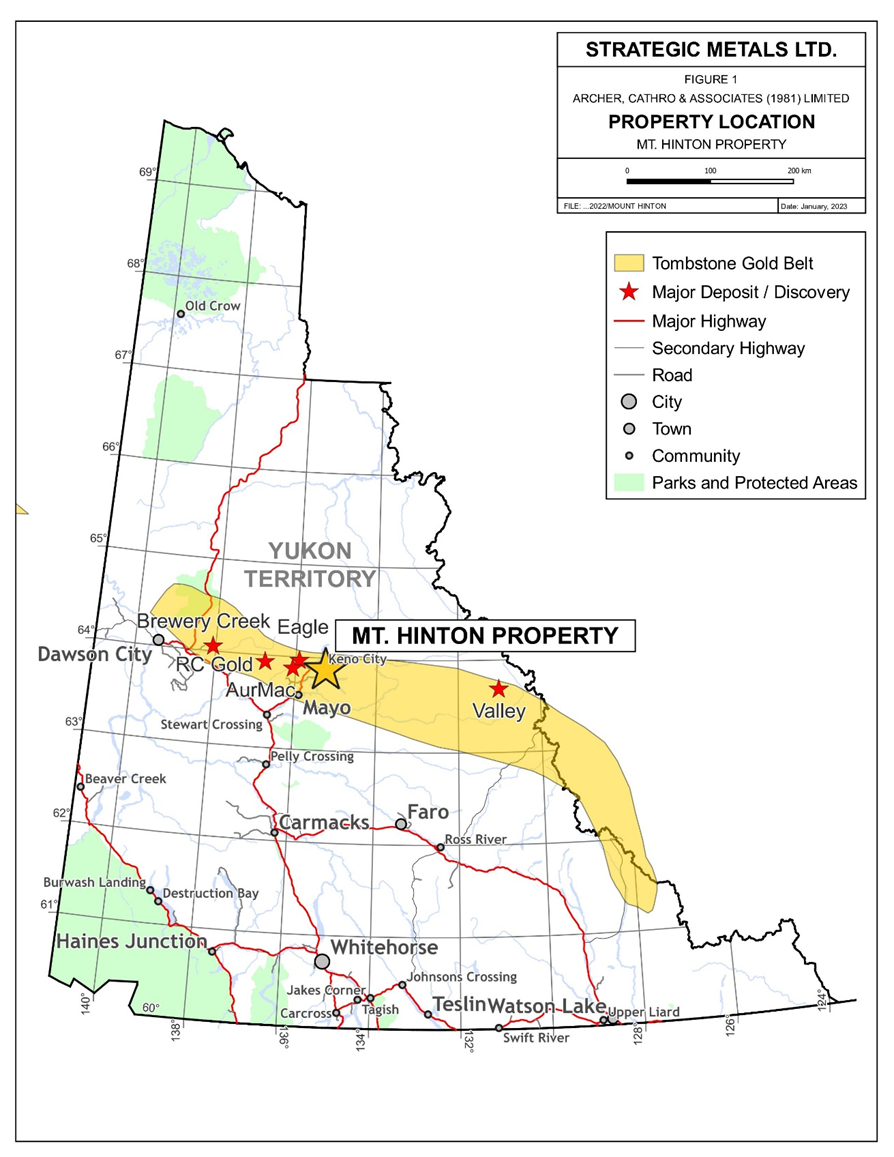

VANCOUVER, BC / ACCESSWIRE / January 23, 2023 / Strategic Metals Ltd. (TSXV:SMD) ("Strategic" or "the Company") is pleased to provide an update on exploration at its road accessible Mt. Hinton gold-silver project, located in central Yukon. Mt. Hinton lies within the Keno Hill District of the Tombstone Gold Belt, immediately southeast of Hecla Mining Company's Keno Hill Silver Mining Project, 35 km southeast of Victoria Gold's Eagle Mine, and 25 km east-southeast of Banyan Gold's AurMac Deposit (Figure 1). The Mt. Hinton project is wholly owned by Strategic with no underlying royalties. Highlights include:

- Discovery of the 85 Vein: 273 g/t gold with 284 g/t silver and 138.5 g/t gold with 57.5 g/t silver from float samples.

- Outcrop samples from the 15 Vein up to 126.5 g/t gold with 79.1 g/t silver.

- 19 Vein sampling: Float samples up to 101 g/t gold with 182 g/t silver and chip samples up to 16.4 g/t gold with 202 g/t silver over 1.7 m.

- Significantly expands the area of highly anomalous soil geochemistry.

Update on Exploration Work

Since its 2020 diamond drilling program (see Strategic Metals News Release - January 13, 2021), exploration has largely been focused on: (1) discovering new gold- and silver-rich veins, (2) strengthening geological and deposit models relating to the many known veins on the property, and (3) generating additional targets for future drill programs. Highlight results from this work, which includes rock sampling, geological mapping, soil sampling and reverse circulation (RC) drilling, are described below.

Rock Sampling

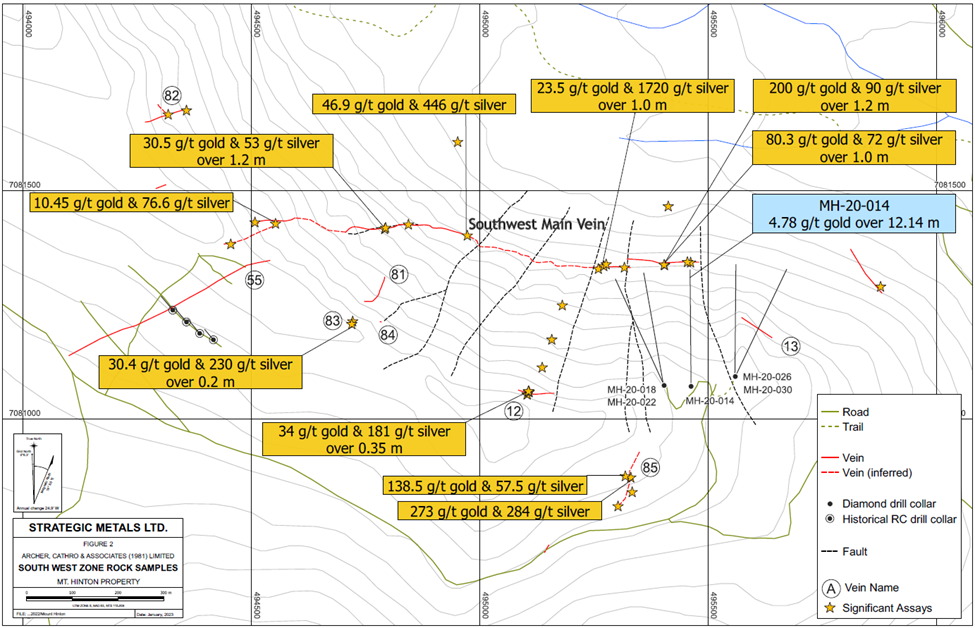

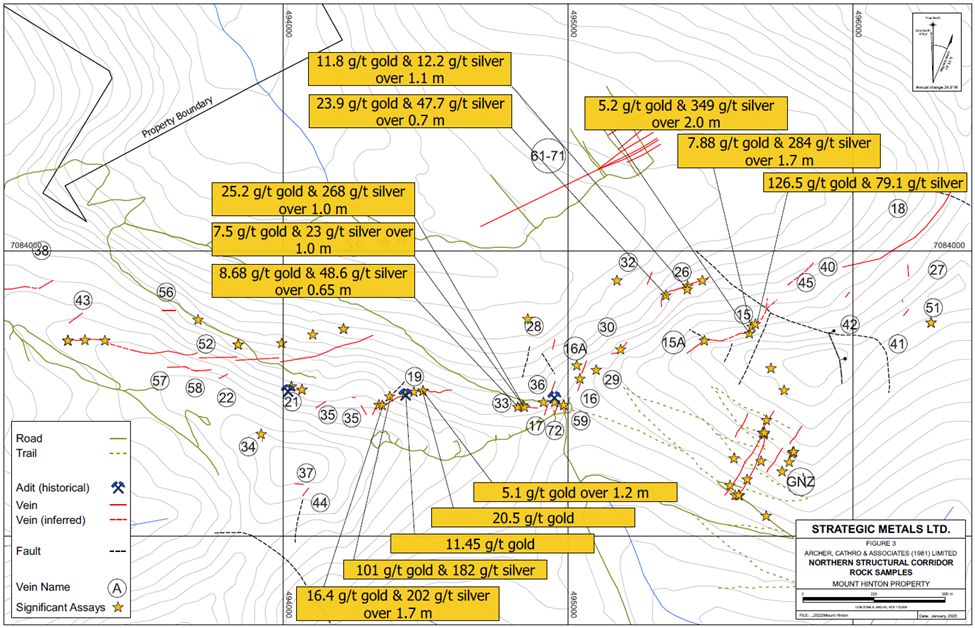

Prospecting and follow-up of soil geochemical anomalies has resulted in several new vein discoveries in the Southwest Zone (Figure 2) and Northern Structural Corridor (Figure 3). Geological mapping done in conjunction with this prospecting has also resulted in new structural interpretations concerning the distribution of mineralization in new and previously known zones.

Southwest Zone (SWZ)

Prospecting resulted in the discovery of the 85 Vein in an area where no veins had previously been identified. The surface expression of the vein is a 125 by 50 m float train containing numerous well mineralized quartz vein boulders. Four samples were collected from these mineralized boulders, and all returned greater than 7 g/t gold and 40 g/t silver. The two best samples, taken 15 m apart at the apex of the float train, returned 273 g/t gold with 284 g/t silver and 138.5 g/t gold with 57.5 g/t silver. The vein that is the source of this mineralization is thought to be buried beneath large talus boulders in the immediate vicinity of the uppermost samples. The 85 Vein is located less than 100 m from an existing access road and has not yet been drill tested. It lies approximately 200 m south of the 12 Vein (34 g/t gold and 181 g/t silver over 0.35 m from chip sampling) and 400 m south of the Southwest Main Vein (see description below).

Recent prospecting also discovered the 83 Vein, a 20-cm wide quartz vein that returned 30.4 g/t gold and 230 g/t silver over 0.2 m from chip sampling. The vein can be traced for 10 m before being obscured by talus and remains open in all directions. Although narrow at its outcropping location, this discovery is significant because the outcropping vein is hosted within phyllite and, throughout the Mt. Hinton and Keno Hill areas, veins typically become broader and better mineralized where they pass from phyllite into more competent quartzite units.

Geological mapping completed along the Southwest Main Vein has resulted in a greatly enhanced understanding of its geometry and style of mineralization. The Southwest Main Vein is a discontinuously exposed quartz vein, up to 7 m wide, that has been traced along strike for over 1 km. Surface sampling has returned significant values along the vein, including 200 g/t gold with 90 g/t silver over 1.2 m and 80.3 g/t gold with 72 g/t silver over 1.0 m from chip sampling and 48.5 g/t gold with 73 g/t silver and 46.9 g/t gold with 446 g/t silver from rock samples. A 100 m segment of the Southwest Main Vein was successfully tested by five diamond drill holes in 2020, returning impressive results that include 4.78 g/t gold over 12.14 m (see Strategic Metals News Release - January 13, 2021 for full results). This vein remains open to extension along strike and to depth.

Northern Structural Corridor (NSC)

Sampling and geological mapping has been completed along several known veins that lie within the NSC.

The 19 Vein has an average width of 1.7 m and is exposed on surface for approximately 300 m. The vein is truncated by a fault to the south but is open along strike to the north beneath talus. Rock sampling results from mineralized bedrock and vein float include 101 g/t gold with 182 g/t silver, 20.5 g/t gold, and 11.4 g/t gold, while chip sampling returned 16.4 g/t gold with 202 g/t silver over 1.7 m and 5.1 g/t gold over 1.2 m.

The 15 Vein is a 1.5 m wide vein exposed on surface for 80 m, which is open in all directions and has never been drill tested. During recent work programs the vein, which was mostly buried under talus, was re-exposed and sampled. Highlight results from this sampling include 126.5 g/t gold with 79.1 g/t silver from rock sampling and 5.2 g/t gold with 349 g/t silver over 2.0 m and 7.88 g/t gold with 284 g/t silver over 1.7 m from chip sampling.

The 26 Vein, which is intermittently exposed on surface for 175 m and averages 1 m in width, was comprehensively mapped and sampled. This vein is open along strike in all direction and has never been drill tested. Chip sampling across this vein yielded 23.9 g/t gold with 47.7 g/t silver over 0.7 m and 11.8 g/t gold with 12.2 g/t silver over 1.10 m.

The 33 Vein is a 1 m wide quartz vein that was traced through outcrop and float over a 55 m strike length before being fully obscured by talus. The vein is open in all directions and has never been drill tested. Chip sampling across the vein returned 25.2 g/t gold with 268 g/t silver over 1.0 m, 7.5 g/t gold with 23 g/t silver over 1.0 m and 8.68 g/t gold with 48.6 g/t silver over 0.65 m.

Geological Mapping

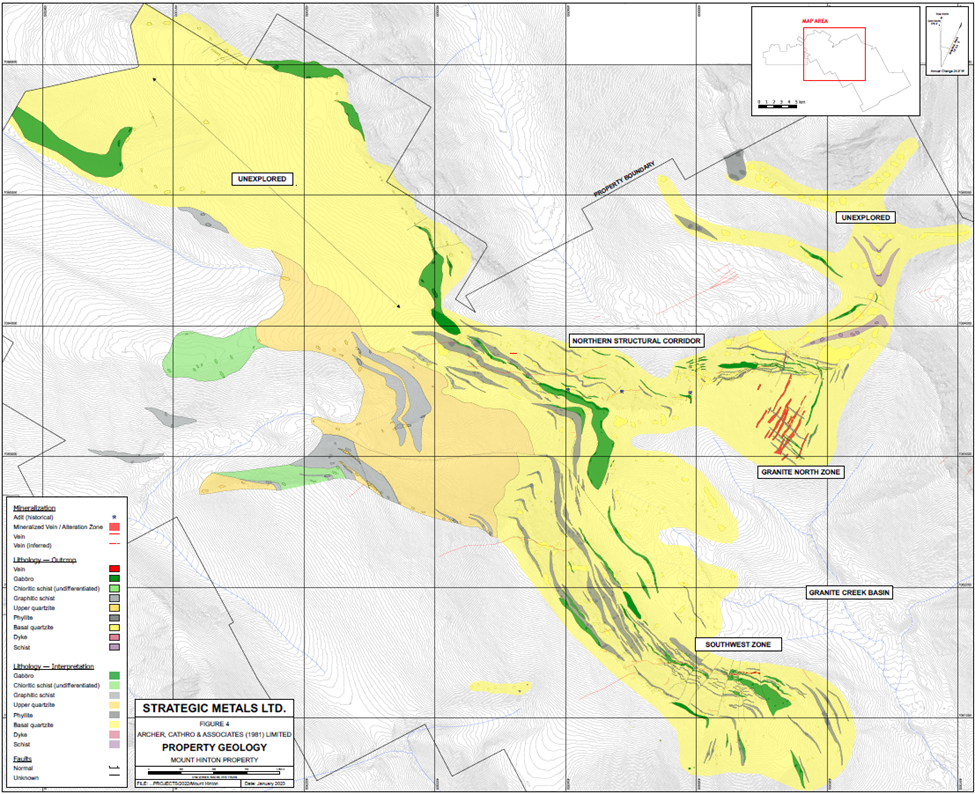

Detailed and systematic geological mapping was completed during the 2021 and 2022 field programs. This work generated a detailed lithological map of the Mt. Hinton project area (Figure 4), which ties into a recently published map covering the Keno Hill Silver District (Read et al., 2021). Mapping completed by Strategic Metals has delineated favourable Keno Hill Quartzite stratigraphy over an 8.1 by 3.7 km area on the Mt. Hinton property, including several unexplored parts of the property. This quartzite unit is the favourable host of mineralization in the Keno Hill district and is the main host of gold- and silver-rich veins on the Mt. Hinton property.

The vein mineralization that typifies Mt. Hinton is thought to be the distal expression of an intrusion related hydrothermal system. To date, intrusive rocks have not been observed by Strategic Metals on the property; however, historical drill logs from limited exploration drilling done in the mostly till-covered and lightly explored East Granite Creek drainage reference the presence of widespread intrusive rocks. Unfortunately, drill core from the holes containing intrusive rocks has not yet been relocated.

The presence of intrusive rocks on the Mt. Hinton property is highly significant because it supports the model for a buried intrusive source for magmatic hydrothermal fluids feeding the known veins and also points to bulk-tonnage potential. The Company's geologists believe that the buried intrusion is likely part of the Mayo Suite, a belt of Late Cretaceous reduced intrusions that host significant, bulk-tonnage, intrusion-related gold deposits elsewhere in central Yukon. The closest Mayo Suite intrusion to the property is the Roops Lake Pluton, which lies three kilometres east of the claim boundary and about 10 km east of the Granite Creek basin. Reduced intrusion related gold deposits within the Yukon are primarily hosted by Mayo Suite or Tombstone Suite intrusions, which are both reduced and Late Cretaceous in age. In addition to Victoria Gold's Eagle Mine and Raven deposit, recent discoveries in Yukon that are related to reduced intrusions include Sitka Gold Corp.'s RC Gold project, Snowline Gold Corp.'s Rogue project and Banyan Gold Corp.'s AurMac deposit.

RC Drilling

In 2021, Strategic Metals completed a total of 335.81 m of drilling in 5 RC drill holes in the Granite North Zone. Drilling was designed to expand on drill results from the 2020 program and evaluate additional veins; however, frequent mechanical breakdowns severely hampered the program and caused it to be terminated prematurely.

The best results from the 2021 drill program came from hole MH-21-036, the final drill hole of the program. This hole produced intervals containing highly oxidized and limonitic quartz vein chips, which graded 2.17 g/t Au over 1.52 m (starting at 15.24 m depth) and 2.62 g/t gold and 25.4 g/t silver over 3.05 m (starting at 30.48 m depth).

Soil Sampling

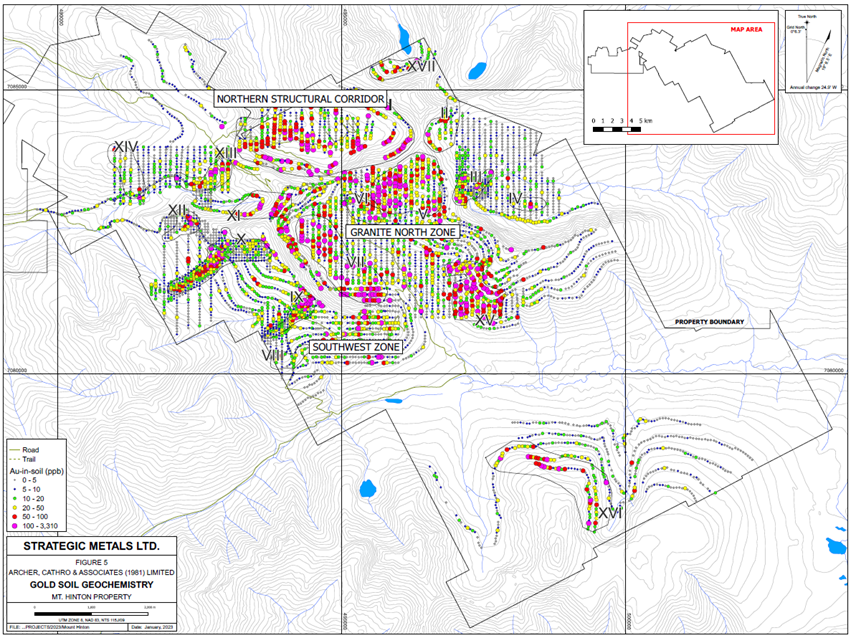

Since 2021, Strategic Metals has collected a total of 383 soil samples in the northern and southern parts of the property. Recent soil sampling has identified and delineated two new soil geochemical anomalies, Anomaly XVI and XVII (Figure 5).

A total of 17 multi-element soil geochemical anomalies are found on the Mt. Hinton property and collectively span a 10 by 5 km area. These anomalies contain highly elevated values for gold (up to 3310 ppm) with varying additional pathfinder elements. Eleven of these anomalies are associated with known mineralized veins, while the remaining six anomalies have seen limited to no follow up work.

Technical information in this news release has been approved by Kelson Willms, P.Geo., a senior geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

About Strategic Metals Ltd.

Strategic is a project generator with 23 royalty interests, eight projects under option to others, and a portfolio of more than 90 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of approximately $3.6 million and large shareholdings in several active mineral exploration companies including 32.8% of Broden Mining Ltd., 34.5% of GGL Resources Corp., 29.6% of Rockhaven Resources Ltd., 19.6% of Honey Badger Silver Inc., 15.7% of Precipitate Gold Corp. and 17.2% of Silver Range Resources Ltd. All these companies are well funded and are engaged in promising exploration projects. Strategic also owns 15 million shares and 5 million warrants of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed another large financing to advance its environmentally friendly, cost-effective alternative to Portland cement.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

Corporate Information | Investor Inquiries |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.

SOURCE: Strategic Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/736194/Strategic-Metals-Discovers-New-Veins-at-its-Mt-Hinton-Gold-Silver-Project-Yukon