Strategic Metals Ltd. Announces Exploration Program at the GK Copper-Gold Project in BC's Golden Triangle

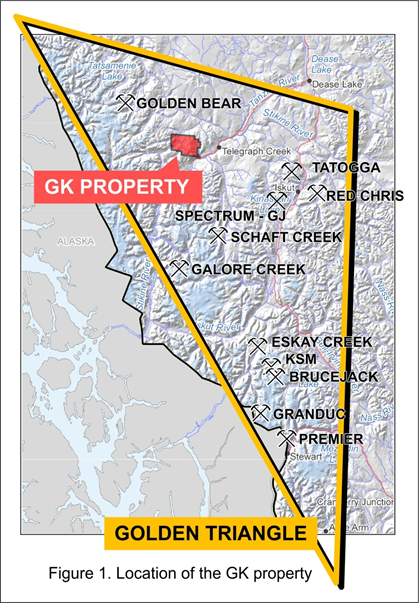

VANCOUVER, BC / ACCESSWIRE / June 1, 2021 / Strategic Metals Ltd. (TSXV:SMD) ("Strategic" or "the Company") is pleased to announce its 2021 exploration plans for the Company's wholly owned GK property, a copper-gold project located in the Golden Triangle mining district of northwestern British Columbia (Figure 1). The GK property is surrounded by several important copper and/or gold deposits, including Golden Bear, Red Chris, Schaft Creek, Spectrum-GJ, GT-Tatogga and Galore Creek. The property is situated 15 km from the town of Telegraph Creek and covers an area of approximately 274.5 km2. The southeastern-most portion of the property is accessible by road.

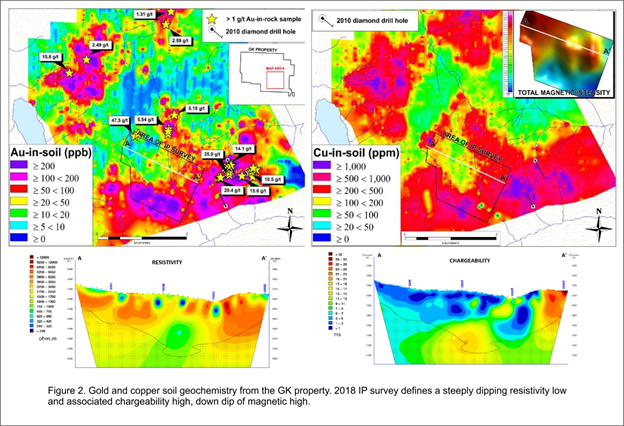

The GK property covers several porphyry targets, as well as related skarn and vein mineralization. The majority of work to date has focused on the Grass Mountain area, where large, very strong copper-gold geochemical anomalies surround the Triassic to Jurassic aged Grass Mountain pluton (Figure 2). Numerous showings have been identified within the pluton as well as in the surrounding Triassic volcanic and volcaniclastic rocks of the Stikine terrane. Extensive gold and copper mineralization occurs in veins, shears, fracture fillings, dykes and locally as disseminations in country rocks. Assay values from rock samples collected in this area have returned up to 47.5 g/t gold, 15.85% copper and 120 g/t silver. Peak soil values include 6.18 g/t gold, 0.689% copper and 59.9 g/t silver. Recent work on the property focused on gold-bearing quartz veins, including a two-hole drill program that intersected 13.1 g/t gold and 6.05% copper over 0.74 m. These are the only holes that have ever been drilled on the property.

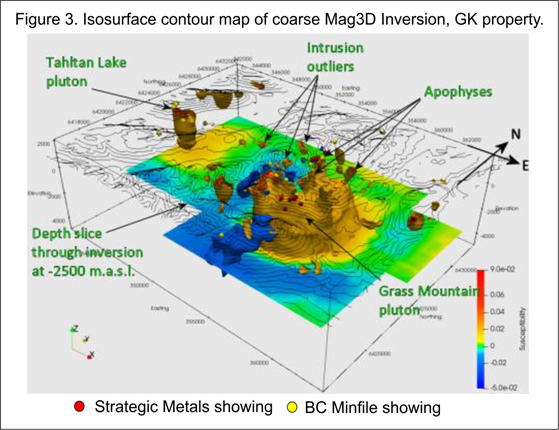

An interpretation of property-wide, helicopter-borne magnetic and radiometric data set has just been completed by SJV Consultants Ltd., on behalf of Strategic. 3D interpretation of the magnetic data shows that the Grass Mountain pluton forms a circular magnetic high, which models as a large, steep-sided body that gradually widens with depth. Across the northern portion of the pluton, circular to elliptical pipes extend upwards and form apophyses from the buried intrusion. Several of the showings identified by historical work are now revealed to be associated with the surface expression of these apophyses (Figure 3). Only limited prospecting and rock sampling in the vicinity of these apophyses has been performed; however, rock samples collected from these areas have returned up to 1.31 g/t gold and 1.5% copper, and on the periphery of one of these apophyses, a surface chip sample assayed 20.2 g/t gold and 0.68% copper over 0.7 m. An induced polarization (IP) survey conducted across a glacial-till covered area within one of the copper-gold geochemical anomalies has defined a steeply dipping resistivity low and associated chargeability high, down-dip of the magnetic high (Figure 2). This highly prospective target has not been drill tested. Interpretation of the property-wide radiometric data has also identified several areas of interest outside of the main showings. The most interesting target is a large area at the southwest edge of the Grass Mountain pluton, where low Th/K values overlie a recently identified magnetic high. These characteristics suggest the presence of extensive potassic alteration associated with a buried intrusion or another apophysis off the Grass Lake pluton.

Soil geochemical and geophysical data point towards the presence of one or more large porphyry copper-gold system(s) on the property, but because most historical work focused on the gold-rich vein systems, the porphyry potential remains largely untested. The 2021 field program is designed to evaluate the porphyry concept and will comprise geological mapping and prospecting, including detailed structural and alteration mapping, soil geochemical surveying and targeted hand trenching and chip sampling. The work will ground check several high priority targets identified by the 3D geophysical modeling in the Grass Mountain area and elsewhere on the property, in the context of porphyry copper-gold mineralizing systems. These targets include areas west of the Grass Mountain area, where little to no modern mapping and sampling. One of these westerly targets is in the vicinity of the VB showing, where skarn mineralization is found adjacent to the Tahltan Lake pluton (Figure 3). Six historical rock samples taken from outcrops in this area, which are intermittently exposed over a distance of 740 m, averaged 1.34 g/t gold, 2.29% copper and 31.86 g/t silver. Historical soil sampling over the VB showing outlined a strong copper anomaly, but no gold analyses were performed on these samples.

"The GK property is an exceptional but vastly under-explored prospect in an important porphyry belt, where new world-class discoveries have been made in recent years by deep drilling" states Doug Eaton, CEO and President of Strategic Metals. "We look forward to results from 2021 work at GK and from a number of other promising porphyry copper-gold projects in the Company's stellar portfolio."

Technical information in this news release has been approved by Jackson Morton, P.Geo., a geologist with Archer, Cathro & Associates (1981) Limited and a qualified person for the purposes of National Instrument 43-101.

About Strategic Metals Ltd.

Strategic is a project generator with a portfolio of more than 130 projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. The projects include more than 80 properties where precious metals are the major component, several promising copper prospects and a number of excellent critical metal targets. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of over $9 million and large shareholdings in a number of active mineral exploration companies including 38.9% of GGL Resources Corp., 33.5% of Rockhaven Resources Ltd., 19.2% of Precipitate Gold Corp. and 18.7% of Silver Range Resources Ltd. All of these companies are well funded and are engaged in promising exploration projects. Strategic also owns 21.9% of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed a US$9.2 million financing to advance its environmentally-friendly, cost-effective alternative to Portland cement. The current value of Strategic's stock portfolio is approximately $25 million.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

Corporate Information | Investor Inquiries |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.

SOURCE: Strategic Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/649829/Strategic-Metals-Ltd-Announces-Exploration-Program-at-the-GK-Copper-Gold-Project-in-BCs-Golden-Triangle