Taku Gold to Acquire Three Gold Exploration Properties in Newfoundland and Announces $1,000,000 Private Placement

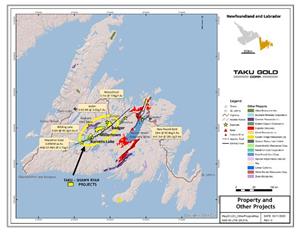

VANCOUVER, British Columbia, Nov. 04, 2020 (GLOBE NEWSWIRE) -- Taku Gold Corp. (CSE: TAK; OTCQB: TAKUF) (the “Company” or “Taku”) is pleased to announce it has entered into three separate option agreements with Mr. Shawn Ryan and Wildwood Exploration Inc. (the “Optionors”) to acquire a 100% interest in three properties in Newfoundland. The properties are located in the Central Newfoundland Gold Belt and encompass 455 sq km with road access and proximity to local communities and power lines.

The Newfoundland projects are located in an area of historic mines and operating gold mines. The recent surge in gold prices combined with New Found Gold Corp.’s recent discoveries (Keats and Lotto zones), a robust public geoscience database, and an effective and transparent regulatory regime are factors contributing to a sharp uptick in gold exploration across Newfoundland, which is now considered a top exploration jurisdiction in Canada.

Janet Lee-Sheriff, Executive Chair comments: “With this acquisition Taku Gold has accumulated a significant land position in the highly regarded Newfoundland jurisdiction, providing our shareholders with the benefit of jurisdictional diversification. We are excited to continue our working relationship with Shawn Ryan who has brought his world-renowned exploration skills and gold deposit discovery track record to Newfoundland. The province is highly regarded as a top mineral exploration jurisdiction in Canada, with significant exploration and development underway, a government supportive of mineral exploration and development investment and a regulatory regime which provides reasonable timelines, clarity and certainty in the permitting and assessment process.”

Lori Walton, P.Geo. and Chief Executive Officer added: “These acquisitions consolidate some of the most prospective areas along the eastern Exploits zone based on government studies of gold in till, airborne geophysics and detailed soils (2015) and detailed tills (2016). The government data combines with recent age dating from the Jaclyn deposit (2.5 km to the northwest of the Badger property) and points to prospective Fosterville style targets on all three claim blocks. We will be working with Mr. Ryan to review existing information to develop a rigorous and systematic exploration program going forward.”

The Company also announces a private placement offering of up to 10,000,000 units (the “Units”) at a price of $0.10 per Unit for gross proceeds of up to $1,000,000 (the “Offering”). Each Unit will consist of one common share and one-half of one share purchase warrant (each whole warrant, a “Warrant”). Each full Warrant is exercisable at a price of $0.15 per share for a period of two years. A total of 2,500,000 common shares under the Offering will be flow-through shares pursuant to the Income Tax Act (Canada).

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1ca42663-fec2-4164-80ec-cb9c30e29544

Option Agreements on Newfoundland Properties

The Company announces it has entered into three separate option agreements with Mr. Shawn Ryan and Wildwood Exploration Inc. (the “Optionors”) to acquire a 100% interest in three properties as follows: (i) 712 mineral claims known as the Badger Property (the “Badger Option”); (ii) 354 mineral claims known as the Barrens Lake Property (the “Barrens Lake Option”); and (iii) 908 mineral claims known as the Millertown Property (the “Millertown Option”).

Pursuant to each of the Badger Option and Barrens Lake Option agreements, the Company may acquire the Badger Property and the Barrens Lake Property, respectively, in each case for consideration consisting of cash payments of $250,000 and the issuance of 2,200,000 common shares of the Company to the Optionors, and by incurring property expenditures of $1,000,000, over a period of 5 years. The Badger Option and Barrens Lake Option agreements also each provide for a 2% net smelter return royalty (a “Royalty”) on the optioned property in favour of the Optionors. The Company may elect to reduce the Royalty to 1% by paying the Optionors $2,500,000.

Pursuant to the Millertown Option, the Company may acquire the property in consideration for cash payments of $500,000 and the issuance of 3,000,000 common shares of the Company to the Optionors, and by incurring property expenditures of $1,000,000, in each case over a period of 5 years. The Millertown Option agreement also provides for a 2% Royalty on the property in favour of the Optionors. The Company may elect to reduce the Royalty to 1% by paying the Optionors $2,500,000.

The proceeds of the private placement will be used to fund exploration expenditures on mineral exploration properties located in Newfoundland which the Company may acquire under the terms of three property option agreements described below, and for general working capital.

In connection with the Offering, the Company may pay finder’s fees of 6% in cash and 6% in finder’s warrants on all or a portion of the Offering. Each finder’s warrant will entitle the holder to acquire one unit at a price of $0.10 per unit on the same terms as the Units in the Offering.

All securities issued pursuant to the Offering will be subject to a four-month hold period, in accordance with applicable securities laws. The securities offered have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements. The Offering and option agreements are subject to completing required filings with the Canadian Securities Exchange.

The technical information in this news release has been approved by Lori Walton, P. Geo. who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Taku Gold Corp.

Taku Gold Corp. is a mineral exploration company. The Company holds one of the largest land packages within the prolific White Gold and Klondike districts in Canada’s Yukon and a large land position and expansion plans in Newfoundland.

For additional information:

Janet Lee-Sheriff, Chair

(604) 260-0289

info@takugold.com

www.takugold.com

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.