TASEKO REPORTS $52 MILLION OF CASH FLOW FROM OPERATIONS FOR FIRST QUARTER 2022

This release should be read with the Company's Financial Statements and Management Discussion & Analysis ("MD&A"), available at www.tasekomines.com and filed on www.sedar.com. Except where otherwise noted, all currency amounts are stated in Canadian dollars. Taseko's 75% owned Gibraltar Mine is located north of the City of Williams Lake in south-central British Columbia. Production and sales volumes stated in this release are on a 100% basis unless otherwise indicated. |

VANCOUVER, BC, May 4, 2022 /CNW/ - Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) ("Taseko" or the "Company") reports Adjusted EBITDA* of $38 million for the first quarter 2022, a 61% increase over the same period 2021. Earnings from mining operations before depletion* was $43 million and Cash flows provided by operations was $52 million for the quarter. Adjusted net income* was $6 million, or $0.02 per share.

Stuart McDonald, President and CEO of Taseko, stated, "Copper markets continue to be robust and Taseko's realized copper price of US$4.59 per pound and sales volumes of 27 million pounds drove strong financial results in the first quarter. Production of 21 million pounds of copper and 236 thousand pounds of molybdenum was on plan, as development of the upper benches of the Gibraltar pit progressed. The Gibraltar pit will be the primary source of ore for the remainder of this year and grade and continuity of mineralization are expected to gradually improve as mining advances to deeper benches. Softer ore in the Gibraltar pit is allowing for increased milling rates, in line with our expectations and historical performance. Mill throughput averaged over 87,000 tons per day in March, and 90,000 tons per day in April, well above name plate capacity. We continue to expect 2022 copper production of 115 million pounds (+/-5%), with production weighted to the back half of the year."

Mr. McDonald added, "We are seeing some inflationary pressures on certain input costs, most notably higher diesel prices, which contributed to an overall 9% (or $7 million) increase in total site costs* at Gibraltar this quarter. Operating margins are expected to improve as copper production increases over the remainder of the year."

"In March, we announced a new 40% larger mineral reserve for Gibraltar, extending the mine from 16 to 23 years. The new reserve has the same average grade as the previous, but with a slightly higher strip ratio in the latter half of the mine life. The increase in reserves was a result of updating pit designs using a copper price of US$3.05 per pound (previously US$2.75 per pound), which is still conservative but more in line with the current long-term consensus price of US$3.50 per pound. The after-tax NPV8 of Gibraltar at the long-term consensus price is now $1.1 billion for Taseko's 75% share of the mine," continued Mr. McDonald.

"At Florence Copper, we are still waiting for the draft Underground Injection Control ("UIC") permit to be issued by the US Environmental Protection Agency ("EPA"), which will initiate the 45-day public comment period. This process is taking longer than expected, but we are in regular contact with the EPA who continue to confirm that the process is advancing towards the issuance of the draft UIC permit shortly. During the first quarter, we spent a further $25 million on procurement of long-lead time items and other pre-construction work. We are well positioned to move into the construction of the commercial production facility upon receipt of the final permit," concluded Mr. McDonald.

First Quarter Review

- First quarter earnings from mining operations before depletion and amortization* was $42.8 million, Adjusted EBITDA* was $38.1 million and cash flow from operations was $51.8 million;

- Gibraltar sold 27.4 million pounds of copper in the quarter (100% basis) at record average realized copper prices of US$4.59 per pound in the quarter resulting in $118.3 million of revenue for Taseko;

- The Gibraltar mine produced 21.4 million pounds of copper and 236 thousand pounds of molybdenum in the first quarter. Copper head grades were 0.19% and copper recoveries were 80.2%;

- Total site costs* increased by 9% in the quarter primarily due to the impact of higher diesel costs;

- Adjusted net income* was $6.2 million ($0.02 per share) and GAAP Net income was $5.1 million ($0.02 per share) and were reduced by a $2.3 million realized derivative loss ($0.01 per share) related to copper options that expired in the quarter;

- The Company has approximately $273 million of available liquidity at March 31, 2022, including a cash balance of $213 million and its undrawn US$50 million revolving credit facility;

- Development costs incurred for Florence Copper were $25.2 million in the quarter and included further payments for major processing equipment for the SX/EW plant, other pre-construction activities and ongoing site costs;

- The Company now has copper collar contracts in place that secure a minimum copper price of US$4.00 per pound for more than 90% of its attributable production in 2022;

- The EPA continues to advance their review process and is expected to publicly issue the draft Underground Injection Control permit shortly, and then a public comment period will commence; and

- In March 2022, the Company announced a new 706 million ton proven and probable sulphide reserve for the Gibraltar mine, a 40% increase as of December 31, 2021. The new reserve estimate allows for a significant extension of the mine life to 23 years with total recoverable metal of 3.0 billion pounds of copper and 53 million pounds of molybdenum.

*Non-GAAP performance measure. See end of news release |

HIGHLIGHTS

Operating Data (Gibraltar - 100% basis) | Three months ended March 31, | ||

2022 | 2021 | Change | |

Tons mined (millions) | 20.3 | 32.0 | (11.7) |

Tons milled (millions) | 7.0 | 7.2 | (0.2) |

Production (million pounds Cu) | 21.4 | 22.2 | (0.8) |

Sales (million pounds Cu) | 27.4 | 22.0 | 5.4 |

Financial Data | Three months ended March 31, | ||

(Cdn$ in thousands, except for per share amounts) | 2022 | 2021 | Change |

Revenues | 118,333 | 86,741 | 31,592 |

Earnings from mining operations before depletion and amortization* | 42,773 | 30,313 | 12,460 |

Cash flows provided by (used for) operations | 51,753 | (3,283) | 55,036 |

Adjusted EBITDA* | 38,139 | 23,722 | 14,417 |

Adjusted net income (loss)* | 6,162 | (5,534) | 11,696 |

Per share - basic ("Adjusted EPS")* | 0.02 | (0.02) | 0.04 |

Net income (loss) (GAAP) | 5,095 | (11,217) | 16,312 |

Per share - basic ("EPS") | 0.02 | (0.04) | 0.06 |

*Non-GAAP performance measure. See end of news release |

REVIEW OF OPERATIONS

Gibraltar mine (75% Owned)

Operating data (100% basis) | Q1 | Q4 | Q3 | Q2 | Q1 | |

Tons mined (millions) | 20.3 | 23.3 | 25.2 | 24.9 | 32.0 | |

Tons milled (millions) | 7.0 | 7.4 | 7.4 | 7.2 | 7.2 | |

Strip ratio | 2.6 | 2.2 | 1.3 | 2.3 | 6.0 | |

Site operating cost per ton milled (Cdn$)* | $11.33 | $9.94 | $8.99 | $9.16 | $8.73 | |

Copper concentrate | ||||||

Head grade (%) | 0.19 | 0.24 | 0.28 | 0.22 | 0.19 | |

Copper recovery (%) | 80.2 | 80.4 | 84.2 | 83.3 | 81.5 | |

Production (million pounds Cu) | 21.4 | 28.8 | 34.5 | 26.8 | 22.2 | |

Sales (million pounds Cu) | 27.4 | 23.8 | 32.4 | 26.7 | 22.0 | |

Inventory (million pounds Cu) | 4.0 | 9.9 | 4.9 | 3.5 | 3.6 | |

Molybdenum concentrate | ||||||

Production (thousand pounds Mo) | 236 | 450 | 571 | 402 | 530 | |

Sales (thousand pounds Mo) | 229 | 491 | 502 | 455 | 552 | |

Per unit data (US$ per pound produced)* | ||||||

Site operating costs* | $2.95 | $2.02 | $1.53 | $2.02 | $2.23 | |

By-product credits* | (0.18) | (0.30) | (0.25) | (0.25) | (0.27) | |

Site operating costs, net of by-product credits* | $2.77 | $1.72 | $1.28 | $1.77 | $1.96 | |

Off-property costs | 0.36 | 0.22 | 0.29 | 0.25 | 0.27 | |

Total operating costs (C1)* | $3.13 | $1.94 | $1.57 | $2.02 | $2.23 |

First Quarter Review

Copper production in the first quarter was 21.4 million pounds and was impacted by lower grades and recoveries from ore mined in the upper benches of the Gibraltar pit. Ore quality is expected to improve for the remainder of the year as mining progresses deeper into the Gibraltar pit.

A total of 20.3 million tons were mined in the first quarter with the decrease from 2021 rates due to longer haul distances in the current phase of mining. Heavy snowfall coupled with extremely cold temperatures also impacted mine equipment and mill availabilities in January. Mill throughput improved throughout the quarter exceeding name plate capacity (85,000 tpd) by 3% in March due to the softer nature of Gibraltar ore.

The strip ratio increased over the prior quarter due to the higher initial stripping rates of the Gibraltar pit. Gibraltar ore will make up the balance of ore for the rest of 2022 as mining in the current phase of Pollyanna will be completed in the second quarter. Ore stockpiles also decreased by 1.4 million tons in the first quarter in accordance with the mine plan.

Total site costs* at Gibraltar of $75.0 million (which includes capitalized stripping of $15.1 million) for Taseko's 75% share was $6.4 million higher than the same quarter last year due primarily to higher diesel prices which were 46% higher than 2021, rising steel prices in grinding media as well as increases in other mining costs.

*Non-GAAP performance measure. See end of news release |

REVIEW OF OPERATIONS - CONTINUED

Molybdenum production was 236 thousand pounds in the first quarter with lower grades associated with the Gibraltar ore. At an average molybdenum price of US$19.08 per pound, molybdenum generated a by-product credit per pound of copper produced of US$0.18 in the first quarter.

The Company realized 27.4 million pounds of copper sales in the first quarter which was 6.0 million pounds higher than copper production of 21.4 million pounds. Major disruption to the highway and rail infrastructure in southwest British Columbia from severe rainstorms and flooding in November 2021 prevented significant production from being delivered to the port for shipping last quarter. Finished inventory was 4.0 million pounds at the end of March in line with historical average levels.

Off-property costs per pound produced* were US$0.36 for the first quarter which is higher than normal as it includes the off-property costs related to the additional 6.0 million pounds of excess inventory sold in the period.

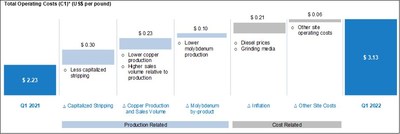

Total operating costs per pound produced (C1)* were US$3.13 for the quarter and were US$0.90 per pound higher than the first quarter last year as shown in the graph below:

Of the US$0.90 variance in C1 costs in the first quarter of 2022 compared to the prior year quarter, US$0.30 was due to less mining costs being capitalized, US$0.23 was due to decreased copper production and higher offsite costs which are a result of high sales volumes (i.e. not variable with production volumes), US$0.21 was due to increased prices for diesel and other inputs, US$0.10 was due to lower molybdenum production, and US$0.06 was due to other site operating costs increases.

GIBRALTAR OUTLOOK

Gibraltar is expected to produce 115 million pounds (+/- 5%) of copper in 2022 on a 100% basis, with production weighted to the back half of the year and with the first quarter being the lowest production quarter.

Strong metal prices and US dollar combined with our copper hedge protection should continue to provide tailwinds for strong financial performance and operating margins at the Gibraltar mine over the coming year. Copper prices in the first quarter averaged US$4.53 per pound and are currently around US$4.30 per pound. Molybdenum prices are currently US$19.22 per pound, 20% higher than the average price in 2021.

*Non-GAAP performance measure. See end of news release |

GIBRALTAR OUTLOOK - CONTINUED

The Company has a long track record of purchasing copper price options to manage copper price volatility. This strategy provides security over the Company's cash flow as it prepares for construction of Florence Copper while continuing to provide significant copper price upside should copper prices continue at current levels or increase further. In particular, the Company currently has copper collar contracts in place that secure a minimum copper price of US$4.00 per pound for more than 90% of its attributable production for the remainder of 2022.

In March 2022, the Company announced a new 706 million ton proven and probable sulphide reserve for the Gibraltar mine, a 40% increase as of December 31, 2021. The new reserve estimate allows for a significant extension of the mine life to 23 years with total recoverable metal of 3.0 billion pounds of copper and 53 million pounds of molybdenum.

Highlights from the new reserve:

- 706 million tons grading 0.25% copper;

- Recoverable copper of 3.0 billion pounds and 53 million pounds of molybdenum;

- 23 year mine life with average annual production of approximately 129 million pounds of copper and 2.3 million pounds of molybdenum;

- Life-of-mine average strip ratio of 2.4:1; and

- After-tax NPV of $1.1 billion (75% basis) and free cash flow of $2.3 billion (75% basis) at a long-term copper price of US$3.50 per pound1.

1 The NPV and cash flow is based on copper prices of $4.25 (2022), $3.90 (2023) and US$3.50 per pound long-term, and a molybdenum price of US$18 (2022), US$15 (2023) and US$13 per pound long-term, a foreign exchange rate of 1.3:1 (C$:US$), and a discount rate of 8%.

FLORENCE COPPER

The commercial production facility at Florence Copper will be one of the greenest sources of copper for US domestic consumption, with carbon emissions, water and energy consumption all dramatically lower than a conventional mine. It is a low-cost copper project with an annual production capacity of 85 million pounds of copper over a 21-year mine life. With the expected C1* operating cost of US$1.10 per pound, Florence Copper will be in the lowest quartile of the global copper cost curve and will have one of the smallest environmental footprints of any copper mine in the world.

The Company has successfully operated a Production Test Facility ("PTF") since 2018 at Florence to demonstrate that the in-situ copper recovery ("ISCR") process can produce high quality cathode while operating within permit conditions.

The next phase of Florence Copper will be the construction and operation of the commercial ISCR facility with an estimated capital cost of US$230 million (including reclamation bonding and working capital) based on the Company's published 2017 NI 43-101 technical report. At a conservative copper price of US$3.00 per pound, Florence Copper is expected to generate an after-tax internal rate of return of 37%, an after-tax net present value of US$680 million at a 7.5% discount rate, and an after-tax payback period of 2.5 years.

In December 2020, the Company received the Aquifer Protection Permit ("APP") from the Arizona Department of Environmental Quality ("ADEQ"). During the APP process, Florence Copper received strong support from local community members, business owners and elected officials. The other required permit is the Underground Injection Control permit ("UIC") from the U.S. Environmental Protection Agency ("EPA"), which is the final permitting step required prior to construction of the commercial ISCR facility. On November 22, 2021, the EPA

FLORENCE COPPER - CONTINUED

provided the Company with an initial draft of the UIC permit. Taseko's project technical team completed its review of the draft UIC permit in early December 2021 and no significant issues were identified. The EPA continues to advance their review process and is expected to publicly issue the draft UIC permit shortly, and then a 45-day public comment period will commence.

Detailed engineering and design for the commercial production facility was completed in 2021 and procurement activities are well advanced with the Company making initial deposits and awarding the key contract for the major processing equipment associated with the SX/EW plant. The Company incurred $25.2 million of costs for Florence in the first quarter of 2022 including for the commercial facility activities and also had outstanding purchase commitments of $27.9 million as at March 31, 2022. Deploying this strategic capital and awarding key contracts will assist with protecting the project execution plan, mitigating inflation risk and the potential impact of supply chain disruptions and ensure a smooth transition into construction once the final UIC permit is received.

At current copper prices, the Company expects to be able to fund construction of the commercial facility from its existing sources of liquidity and cashflows from Gibraltar.

LONG-TERM GROWTH STRATEGY

Taseko's strategy has been to grow the Company by acquiring and developing a pipeline of complementary projects focused on copper in stable mining jurisdictions. We continue to believe this will generate long-term returns for shareholders. Our other development projects are located in British Columbia.

Yellowhead Copper Project

Yellowhead Mining Inc. ("Yellowhead") has an 817 million tonnes reserve and a 25-year mine life with a pre-tax net present value of $1.3 billion at an 8% discount rate using a US$3.10 per pound copper price based on the Company's 2020 NI 43-101 technical report. Capital costs of the project are estimated at $1.3 billion over a 2-year construction period. Over the first 5 years of operation, the copper equivalent grade will average 0.35% producing an average of 200 million pounds of copper per year at an average C1* cost, net of by-product credit, of US$1.67 per pound of copper. The Yellowhead copper project contains valuable precious metal by-products with 440,000 ounces of gold and 19 million ounces of silver with a life of mine value of over $1 billion at current prices.

The Company is focusing its current efforts on advancing into the environmental assessment process and is undertaking some additional engineering work in conjunction with ongoing engagement with local communities including First Nations. The Company is also collecting baseline data and modeling which will be used to support the environmental assessment and permitting of the project.

New Prosperity Gold-Copper Project

In December 2019, the Tŝilhqot'in Nation, as represented by the Tŝilhqot'in National Government, and Taseko entered into a confidential dialogue, with the involvement of the Province of British Columbia, to try to obtain a long-term resolution to the conflict regarding Taseko's proposed gold-copper mine currently known as New Prosperity, acknowledging Taseko's commercial interests and the Tŝilhqot'in Nation's opposition to the project.

The dialogue was supported by the parties' agreement on December 7, 2019 to a one-year standstill on certain outstanding litigation and regulatory matters that relate to Taseko's tenures and the area in the vicinity of Teẑtan Biny (Fish Lake). The standstill was extended on December 4, 2020, to continue what was a constructive

LONG-TERM GROWTH STRATEGY - CONTINUED

dialogue that had been delayed by the COVID-19 pandemic. The dialogue is not complete but it remains constructive, and in December 2021, the parties agreed to extend the standstill for a further year so that they and the Province of British Columbia can continue to pursue a long-term and mutually acceptable resolution of the conflict.

Aley Niobium Project

Environmental monitoring and product marketing initiatives on the Aley niobium project continue. The converter pilot test is ongoing and is providing additional process data to support the design of the commercial process facilities and will provide final product samples for marketing purposes.

The Company will host a telephone conference call and live webcast on Thursday, May 5, 2022 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific) to discuss these results. After opening remarks by management, there will be a question and answer session open to analysts and investors. |

Stuart McDonald

President & CEO

No regulatory authority has approved or disapproved of the information in this news release.

NON-GAAP PERFORMANCE MEASURES

This document includes certain non-GAAP performance measures that do not have a standardized meaning prescribed by IFRS. These measures may differ from those used by, and may not be comparable to such measures as reported by, other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction with conventional IFRS measures, to enhance their understanding of the Company's performance. These measures have been derived from the Company's financial statements and applied on a consistent basis. The following tables below provide a reconciliation of these non-GAAP measures to the most directly comparable IFRS measure.

Total operating costs and site operating costs, net of by-product credits

Total costs of sales include all costs absorbed into inventory, as well as transportation costs and insurance recoverable. Site operating costs are calculated by removing net changes in inventory, depletion and amortization, insurance recoverable, and transportation costs from cost of sales. Site operating costs, net of by-product credits is calculated by subtracting by-product credits from the site operating costs. Site operating costs, net of by-product credits per pound are calculated by dividing the aggregate of the applicable costs by copper pounds produced. Total operating costs per pound is the sum of site operating costs, net of by-product credits and off-property costs divided by the copper pounds produced. By-product credits are calculated based on actual sales of molybdenum (net of treatment costs) and silver during the period divided by the total pounds of copper produced during the period. These measures are calculated on a consistent basis for the periods presented.

(Cdn$ in thousands, unless otherwise indicated) – 75% basis | 2022 Q1 | 2021 Q4 | 2021 Q3 | 2021 Q2 | 2021 Q1 |

Cost of sales | 89,066 | 57,258 | 65,893 | 74,056 | 72,266 |

Less: | |||||

Depletion and amortization | (13,506) | (16,202) | (17,011) | (17,536) | (15,838) |

Net change in inventories of finished goods | (7,577) | 13,497 | 762 | (4,723) | 2,259 |

Net change in inventories of ore stockpiles | (3,009) | 4,804 | 6,291 | 2,259 | (8,226) |

Transportation costs | (5,115) | (4,436) | (5,801) | (4,303) | (3,305) |

Site operating costs | 59,859 | 54,921 | 50,134 | 49,753 | 47,156 |

Less by-product credits: | |||||

Molybdenum, net of treatment costs | (3,831) | (7,755) | (8,574) | (6,138) | (5,604) |

Silver, excluding amortization of deferred revenue | 202 | (330) | 300 | 64 | (238) |

Site operating costs, net of by-product credits | 56,230 | 46,836 | 41,860 | 43,679 | 41,314 |

Total copper produced (thousand pounds) | 16,024 | 21,590 | 25,891 | 20,082 | 16,684 |

Total costs per pound produced | 3.51 | 2.17 | 1.62 | 2.18 | 2.48 |

Average exchange rate for the period (CAD/USD) | 1.27 | 1.26 | 1.26 | 1.23 | 1.27 |

Site operating costs, net of by-product credits (US$ per pound) | 2.77 | 1.72 | 1.28 | 1.77 | 1.96 |

Site operating costs, net of by-product credits | 56,230 | 46,836 | 41,860 | 43,679 | 41,314 |

Add off-property costs: | |||||

Treatment and refining costs | 2,133 | 1,480 | 3,643 | 1,879 | 2,414 |

Transportation costs | 5,115 | 4,436 | 5,801 | 4,303 | 3,305 |

Total operating costs | 63,478 | 52,752 | 51,304 | 49,861 | 47,033 |

Total operating costs (C1) (US$ per pound) | 3.13 | 1.94 | 1.57 | 2.02 | 2.23 |

NON-GAAP PERFORMANCE MEASURES - CONTINUED

Total Site Costs

Total site costs is comprised of the site operating costs charged to cost of sales as well as mining costs capitalized to property, plant and equipment in the period. This measure is intended to capture Taseko's share of the total site operating costs incurred in the quarter at the Gibraltar mine calculated on a consistent basis for the periods presented.

(Cdn$ in thousands, unless otherwise indicated) – 75% basis | 2022 Q1 | 2021 Q4 | 2021 Q3 | 2021 Q2 | 2021 Q1 |

Site operating costs | 59,859 | 54,921 | 50,134 | 49,753 | 47,156 |

Add: | |||||

Capitalized stripping costs | 15,142 | 12,737 | 10,882 | 14,794 | 21,452 |

Total site costs | 75,001 | 67,658 | 61,016 | 64,547 | 68,608 |

Adjusted net income (loss)

Adjusted net income (loss) removes the effect of the following transactions from net income as reported under IFRS:

- Unrealized foreign currency gains/losses;

- Unrealized gain/loss on derivatives; and

- Loss on settlement of long-term debt and call premium, including realized foreign exchange gains.

Management believes these transactions do not reflect the underlying operating performance of our core mining business and are not necessarily indicative of future operating results. Furthermore, unrealized gains/losses on derivative instruments, changes in the fair value of financial instruments, and unrealized foreign currency gains/losses are not necessarily reflective of the underlying operating results for the reporting periods presented.

(Cdn$ in thousands, except per share amounts) | 2022 Q1 | 2021 Q4 | 2021 Q3 | 2021 Q2 |

Net income | 5,095 | 11,762 | 22,485 | 13,442 |

Unrealized foreign exchange (gain) loss | (4,398) | (1,817) | 9,511 | (3,764) |

Unrealized (gain) loss on derivatives | 7,486 | 4,612 | (6,817) | 370 |

Estimated tax effect of adjustments | (2,021) | (1,245) | 1,841 | (100) |

Adjusted net income | 6,162 | 13,312 | 27,020 | 9,948 |

Adjusted EPS | 0.02 | 0.05 | 0.10 | 0.04 |

(Cdn$ in thousands, except per share amounts) | 2021 Q1 | 2020 Q4 | 2020 Q3 | 2020 Q2 |

Net income (loss) | (11,217) | 5,694 | 987 | 18,745 |

Unrealized foreign exchange (gain) loss | 8,798 | (13,595) | (7,512) | (12,985) |

Realized foreign exchange gain on settlement of long-term debt | (13,000) | - | - | - |

Loss on settlement of long-term debt | 5,798 | - | - | - |

Call premium on settlement of long-term debt | 6,941 | - | - | - |

Unrealized loss on derivatives | 802 | 586 | 1,056 | 3,528 |

Estimated tax effect of adjustments | (3,656) | (158) | (285) | (953) |

Adjusted net income (loss) | (5,534) | (7,473) | (5,754) | 8,335 |

Adjusted EPS | (0.02) | (0.03) | (0.02) | 0.03 |

NON-GAAP PERFORMANCE MEASURES - CONTINUED

Adjusted EBITDA

Adjusted EBITDA is presented as a supplemental measure of the Company's performance and ability to service debt. Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present Adjusted EBITDA when reporting their results. Issuers of "high yield" securities also present Adjusted EBITDA because investors, analysts and rating agencies consider it useful in measuring the ability of those issuers to meet debt service obligations.

Adjusted EBITDA represents net income before interest, income taxes, and depreciation and also eliminates the impact of a number of items that are not considered indicative of ongoing operating performance. Certain items of expense are added and certain items of income are deducted from net income that are not likely to recur or are not indicative of the Company's underlying operating results for the reporting periods presented or for future operating performance and consist of:

- Unrealized foreign exchange gains/losses;

- Unrealized gain/loss on derivatives;

- Loss on settlement of long-term debt (included in finance expenses) and call premium;

- Realized foreign exchange gains on settlement of long-term debt; and

- Amortization of share-based compensation expense.

(Cdn$ in thousands) | 2022 Q1 | 2021 Q4 | 2021 Q3 | 2021 Q2 |

Net income | 5,095 | 11,762 | 22,485 | 13,442 |

Add: | ||||

Depletion and amortization | 13,506 | 16,202 | 17,011 | 17,536 |

Finance expense | 12,155 | 12,072 | 11,875 | 11,649 |

Finance income | (166) | (218) | (201) | (184) |

Income tax expense | 1,188 | 9,300 | 22,310 | 7,033 |

Unrealized foreign exchange (gain) loss | (4,398) | (1,817) | 9,511 | (3,764) |

Unrealized (gain) loss on derivatives | 7,486 | 4,612 | (6,817) | 370 |

Amortization of share-based compensation expense | 3,273 | 1,075 | 117 | 1,650 |

Adjusted EBITDA | 38,139 | 52,988 | 76,291 | 47,732 |

(Cdn$ in thousands) | 2021 Q1 | 2020 Q4 | 2020 Q3 | 2020 Q2 |

Net income (loss) | (11,217) | 5,694 | 987 | 18,745 |

Add: | ||||

Depletion and amortization | 15,838 | 18,747 | 23,894 | 25,512 |

Finance expense (includes loss on settlement of long-term debt and call premium) | 23,958 | 10,575 | 11,203 | 10,461 |

Finance income | (75) | (47) | (4) | (48) |

Income tax (recovery) expense | (4,302) | (2,724) | (580) | 4,326 |

Unrealized foreign exchange (gain) loss | 8,798 | (13,595) | (7,512) | (12,985) |

Realized foreign exchange gain on settlement of long-term debt | (13,000) | - | - | - |

Unrealized loss on derivatives | 802 | 586 | 1,056 | 3,528 |

Amortization of share-based compensation expense | 2,920 | 1,242 | 2,501 | 1,321 |

Adjusted EBITDA | 23,722 | 20,478 | 31,545 | 50,860 |

NON-GAAP PERFORMANCE MEASURES - CONTINUED

Earnings from mining operations before depletion and amortization

Earnings from mining operations before depletion and amortization is earnings from mining operations with depletion and amortization added back. The Company discloses this measure, which has been derived from our financial statements and applied on a consistent basis, to provide assistance in understanding the results of the Company's operations and financial position and it is meant to provide further information about the financial results to investors.

Three months ended March 31, | ||

(Cdn$ in thousands) | 2022 | 2021 |

Earnings from mining operations | 29,267 | 14,475 |

Add: | ||

Depletion and amortization | 13,506 | 15,838 |

Earnings from mining operations before depletion and amortization | 42,773 | 30,313 |

Site operating costs per ton milled

(Cdn$ in thousands, except per ton milled amounts) | 2022 | 2021 | 2021 | 2021 | 2021 | ||||

Site operating costs (included in cost of sales) | 59,859 | 54,921 | 50,134 | 49,753 | 47,156 | ||||

Tons milled (thousands) (75% basis) | 5,285 | 5,523 | 5,576 | 5,429 | 5,402 | ||||

Site operating costs per ton milled | $11.33 | $9.94 | $8.99 | $9.16 | $8.73 |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This document contains "forward-looking statements" that were based on Taseko's expectations, estimates and projections as of the dates as of which those statements were made. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "outlook", "anticipate", "project", "target", "believe", "estimate", "expect", "intend", "should" and similar expressions.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These included but are not limited to:

- uncertainties about the future market price of copper and the other metals that we produce or may seek to produce;

- changes in general economic conditions, the financial markets, inflation and interest rates and in the demand and market price for our input costs, such as diesel fuel, reagents, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar and Canadian dollar, and the continued availability of capital and financing;

- uncertainties resulting from the war in Ukraine, and the accompanying international response including economic sanctions levied against Russia, which has disrupted the global economy, created increased volatility in commodity markets (including oil and gas prices), and disrupted international trade and financial markets, all of which have an ongoing and uncertain effect on global economics, supply chains, availability of materials and equipment and execution timelines for project development;

- uncertainties about the continuing impact of the novel coronavirus ("COVID-19") and the response of local, provincial, state, federal and international governments to the ongoing threat of COVID-19, on our operations (including our suppliers, customers, supply chains, employees and contractors) and economic conditions generally including rising inflation levels and in particular with respect to the demand for copper and other metals we produce;

- inherent risks associated with mining operations, including our current mining operations at Gibraltar, and their potential impact on our ability to achieve our production estimates;

- uncertainties as to our ability to control our operating costs, including inflationary cost pressures at Gibraltar without impacting our planned copper production;

- the risk of inadequate insurance or inability to obtain insurance to cover material mining or operational risks;

- uncertainties related to the feasibility study for Florence copper project (the "Florence Copper Project" or "Florence Copper") that provides estimates of expected or anticipated capital and operating costs, expenditures and economic returns from this mining project, including the impact of inflation on the estimated costs related to the construction of the Florence Copper Project and our other development projects;

- the risk that the results from our operations of the Florence Copper production test facility ("PTF") and ongoing engineering work including updated capital and operating costs will negatively impact our estimates for current projected economics for commercial operations at Florence Copper;

- uncertainties related to the accuracy of our estimates of Mineral Reserves (as defined below), Mineral Resources (as defined below), production rates and timing of production, future production and future cash and total costs of production and milling;

- the risk that we may not be able to expand or replace reserves as our existing mineral reserves are mined;

- the availability of, and uncertainties relating to the development of, additional financing and infrastructure necessary for the advancement of our development projects, including with respect to our ability to obtain any remaining construction financing potentially needed to move forward with commercial operations at Florence Copper;

- our ability to comply with the extensive governmental regulation to which our business is subject;

- uncertainties related to our ability to obtain necessary title, licenses and permits for our development projects and project delays due to third party opposition, particularly in respect to Florence Copper that requires one key regulatory permit from the U.S. Environmental Protection Agency ("EPA") in order to advance to commercial operations;

- our ability to deploy strategic capital and award key contracts to assist with protecting the Florence Copper project execution plan, mitigating inflation risk and the potential impact of supply chain disruptions on our construction schedule and ensuring a smooth transition into construction once the final permit is received from the EPA;

- uncertainties related to First Nations claims and consultation issues;

- our reliance on rail transportation and port terminals for shipping our copper concentrate production from Gibraltar;

- uncertainties related to unexpected judicial or regulatory proceedings;

- changes in, and the effects of, the laws, regulations and government policies affecting our exploration and development activities and mining operations and mine closure and bonding requirements;

- our dependence solely on our 75% interest in Gibraltar (as defined below) for revenues and operating cashflows;

- our ability to collect payments from customers, extend existing concentrate off-take agreements or enter into new agreements;

- environmental issues and liabilities associated with mining including processing and stock piling ore;

- labour strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labour in markets in which we operate our mine, industrial accidents, equipment failure or other events or occurrences, including third party interference that interrupt the production of minerals in our mine;

- environmental hazards and risks associated with climate change, including the potential for damage to infrastructure and stoppages of operations due to forest fires, flooding, drought, or other natural events in the vicinity of our operations;

- litigation risks and the inherent uncertainty of litigation, including litigation to which Florence Copper could be subject to;

- our actual costs of reclamation and mine closure may exceed our current estimates of these liabilities;

- our ability to meet the financial reclamation security requirements for the Gibraltar mine and Florence Project;

- the capital intensive nature of our business both to sustain current mining operations and to develop any new projects, including Florence Copper;

- our reliance upon key management and operating personnel;

- the competitive environment in which we operate;

- the effects of forward selling instruments to protect against fluctuations in copper prices, foreign exchange, interest rates or input costs such as fuel;

- the risk of changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates; and Management Discussion and Analysis ("MD&A"), quarterly reports and material change reports filed with and furnished to securities regulators, and those risks which are discussed under the heading "Risk Factors".

For further information on Taseko, investors should review the Company's annual Form 40-F filing with the United States Securities and Exchange Commission www.sec.gov and home jurisdiction filings that are available at www.sedar.com, including the "Risk Factors" included in our Annual Information Form.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/taseko-reports-52-million-of-cash-flow-from-operations-for-first-quarter-2022-301540215.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/taseko-reports-52-million-of-cash-flow-from-operations-for-first-quarter-2022-301540215.html

SOURCE Taseko Mines Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2022/04/c0177.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2022/04/c0177.html