Triumph Gold Releases Updated Mineral Resource Estimates for Nucleus, Revenue and Tinta Deposits on the Freegold Mountain Property, Yukon Territory

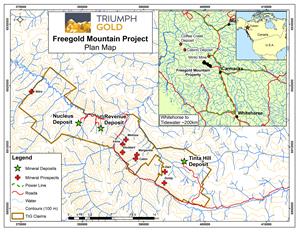

VANCOUVER, British Columbia, Feb. 11, 2020 (GLOBE NEWSWIRE) -- Triumph Gold Corp., (TSX-V: TIG) (OTCMKTS: TIGCF) (“Triumph Gold” or the “Company”) is pleased to release updated mineral resource estimates for the three deposits (Nucleus, Revenue and Tinta) on the Company’s 100% owned, 200 km2, road accessible Freegold Mountain Property in the Yukon Territory.

The new mineral resource estimates were generated by Robert Sim (P.Geo.) of SIM Geological Inc., an independent qualified person and resource expert with over thirty five years of experience. A new NI43-101 technical report will be available on SEDAR within 45 days. The new mineral resource estimates are effective as of February 11, 2020 and supersede the previous mineral resource estimate (Campbell et. al, 2015. Technical report on the Freegold Mountain Project, Yukon Canada Resource Estimates), which is available on SEDAR.

Triumph Gold President, Tony Barresi (Ph.D., P.Geo.), comments: “We are pleased to present three pit-constrained resources, two of which also have high-grade underground resources. The new pit constraint, and other stringent economic parameters applied to the three resource estimates demonstrate that the mineral deposits exhibit reasonable prospects for eventual economic extraction as required under NI 43-101. Since 2016 Triumph has been dedicated to bringing shareholder value by first focusing on grassroots exploration with resource definition to follow. This effort resulted in a number of new discoveries, including the high-grade Blue Sky Porphyry Breccia, and the WAu Breccia, both located within the Revenue deposit. While our attention will remain on discovery-focused exploration in the near term, we are pleased to provide updated mineral resource estimates that we believe accurately assess the resources identified to date, which are contained on our 100% owned Freegold Mountain Property.”

Technical Highlights of Freegold Mountain Property Mineral Deposits:

- Three deposits (Figure 1) host open-pit constrained mineral resources, two of which also include deeper, high-grade, additional mineral resources that are considered amenable to underground extraction methods.

- Combined Indicated Mineral Resources from Revenue and Nucleus deposits total 42.4 million tonnes at 0.58 grams per tonne (g/t) gold (Au), 0.08% copper (Cu) and 1.2 g/t silver (Ag) for a total of 1 million contained gold equivalent (AuEq) ounces (oz). Combined Inferred Mineral Resources at Revenue, Nucleus and Tinta total 39 million tonnes at 0.56 g/t gold, 0.10% copper and 4.5 g/t silver for a total of 1.1 million contained gold equivalent ounces (see Tables 1,2, and 3 for details).

- Higher grade (>1.4 g/t AuEq) mineralization from the newly discovered Blue Sky Porphyry Breccia is now included in an underground portion of the Revenue resource.

- Inclusion of tungsten (W) in the estimate of mineral resources at the Revenue deposit.

Triumph Gold’s Freegold Mountain Property hosts three road-accessible mineral deposits (Figure 1). Changes from the 2015 mineral resource estimates, which were unconstrained, are the result of a combination of new drilling and the application of updated technical and economic parameters. The new estimates are either constrained within pit shells or, in the case of underground mineral resources, show favourable geometry and continuity of grade and thickness so as to exhibit reasonable prospects for eventual economic extraction.

TABLE 1: ESTIMATE OF MINERAL RESOURCE FOR THE NUCLEUS DEPOSIT

| Class | Tonnes (million) | Average Grade | Contained Metal | ||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | AuEq koz | Au koz | Cu Mlbs | Ag koz | ||

| Indicated | 31.0 | 0.75 | 0.65 | 0.07 | 0.70 | 748 | 651 | 44 | 698 |

| Inferred | 9.4 | 0.63 | 0.56 | 0.04 | 0.72 | 189 | 169 | 9 | 217 |

Note: 0.30 g/t AuEq cut-off grade for pit constrained resources. Koz = thousands of ounces; Mlbs – millions of pounds

TABLE 2: ESTIMATE OF MINERAL RESOURCES FOR THE REVENUE DEPOSIT

| Type | Tonnes (million) | Average Grade | Contained Metal | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (%) | W (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Mo klbs | W klbs | ||

| Indicated | |||||||||||||

| Pit Constrained | 11.4 | 0.69 | 0.38 | 0.12 | 2.4 | 0.016 | 0.008 | 252 | 140 | 30 | 895 | 4089 | 2082 |

| Inferred | |||||||||||||

| Pit Constrained | 25.0 | 0.70 | 0.46 | 0.11 | 2.2 | 0.009 | 0.005 | 565 | 367 | 61 | 1786 | 4954 | 2807 |

| Underground | 2.5 | 1.40 | 0.99 | 0.22 | 5.2 | 0.010 | 0.001 | 112 | 79 | 12 | 417 | 525 | 60 |

| Combined Inferred | 27.5 | 0.77 | 0.51 | 0.12 | 2.5 | 0.009 | 0.005 | 677 | 446 | 73 | 2203 | 5478 | 2867 |

Note: 0.30 g/t AuEq cut-off grade for pit constrained resources and 1.0g/tAuEq cut-off grade for underground resources. Mo = Molybdenum

TABLE 3: ESTIMATE OF INFERRED MINERAL RESOURCE AT THE TINTA DEPOSIT

| Type | Tonnes (000) | Average grade: | Contained Metal: | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Pb (%) | Zn (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Pb Mlbs | Zn Mlbs | ||

| Pit Constrained | 908 | 3.01 | 1.09 | 0.18 | 42.5 | 0.72 | 1.47 | 88 | 32 | 4 | 1240 | 14 | 29 |

| Underground | 1313 | 3.13 | 1.43 | 0.16 | 46.3 | 0.56 | 1.17 | 132 | 60 | 5 | 1955 | 16 | 34 |

| Combined | 2221 | 3.08 | 1.29 | 0.17 | 44.7 | 0.63 | 1.29 | 220 | 92 | 8 | 3195 | 31 | 63 |

Note: 0.35 g/t AuEq cut-off grade for pit constrained resources and 1.8 g/t AuEq cut-off for underground resources.

TABLE 4: COMBINED ESTIMATE OF MINERAL RESOURCES ON THE FREEGOLD MOUNTAIN PROPERTY

| Deposit | Tonnes (million) | Average Grade | Contained Metal | Comments | ||||||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (%) | W (%) | Pb (%) | Zn (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Mo (klbs) | W (klbs) | Pb Mlbs | Zn Mlbs | |||

| Indicated | ||||||||||||||||||

| Nucleus | 31.0 | 0.75 | 0.65 | 0.07 | 0.7 | n/a | n/a | n/a | n/a | 748 | 651 | 44 | 698 | n/a | n/a | n/a | n/a | Pit resources 0.3 g/tAuEq cut-off grade |

| Revenue | 11.4 | 0.69 | 0.38 | 0.12 | 2.4 | 0.016 | 0.008 | n/a | n/a | 252 | 140 | 30 | 895 | 4089 | 2082 | n/a | n/a | Pit resources 0.3 g/tAuEq cut-off grade |

| Total Indicated | 42.4 | 0.73 | 0.58 | 0.08 | 1.2 | 1000 | 791 | 74 | 1593 | 4089 | 2082 | |||||||

| Inferred | ||||||||||||||||||

| Nucleus | 9.4 | 0.63 | 0.56 | 0.04 | 0.7 | n/a | n/a | n/a | n/a | 189 | 169 | 9 | 217 | n/a | n/a | n/a | n/a | Pit resources 0.3 g/tAuEq cut-off grade |

| Revenue | 27.5 | 0.77 | 0.51 | 0.12 | 2.5 | 0.009 | 0.005 | n/a | n/a | 677 | 446 | 73 | 2203 | 5478 | 2867 | n/a | n/a | Pit resources 0.3 g/tAuEq cut-off grade and U/G resources at 1.0 g/tAuEq cut-off grade. |

| Tinta | 2.2 | 3.08 | 1.29 | 0.17 | 44.7 | n/a | n/a | 0.63 | 1.29 | 220 | 92 | 8 | 3195 | n/a | n/a | 31 | 63 | Pit resources 0.35 g/tAuEq cut-off grade and U/G resources at 1.8 g/tAuEq cut-off grade. |

| Total Inferred | 39.0 | 0.86 | 0.56 | 0.10 | 4.5 | 1085 | 707 | 90 | 5614 | 5499 | 3094 | 31 | 63 | |||||

Note: U/G = underground; n/a = non applicable

Nucleus

The Nucleus deposit is an epithermal style gold-silver-copper deposit. Indicated mineral resources at Nucleus include 31 M tonnes at 0.65 g/t Au, 0.7 g/t Ag and 0.07% Cu using a 0.3 g/t AuEq cut-off grade. Inferred mineral resources at Nucleus include 9.4 M tonnes at 0.56 g/t Au, 0.7 g/t Ag and 0.04% Cu. The Nucleus deposit is open to the south and at depth.

The Nucleus deposit has been tested with a total of 359 drill holes with a cumulative length of 60,061m. The mineral resource estimate was generated using drill hole sample assay results and the interpretation of a geological model which relates to the spatial distribution of gold, copper and silver. Interpolation characteristics are defined based on the geology, drill hole spacing, and geostatistical analysis of the data. The effects of potentially anomalous high-grade sample data, composited to 1.5 metre intervals, are controlled using both traditional top-cutting as well as limiting the distance of influence during block grade interpolation. Block grades are estimated into a three-dimensional block model with nominal block size measuring 10x10x5m (LengthxWidthxHeight), using ordinary kriging and have been validated using a combination of visual and statistical methods. Resources in the indicated category are delineated by drilling spaced at maximum 50 metre intervals. Resources in the inferred mineral category are within a maximum distance of 150 metres from a drill hole. The estimate of the indicated and inferred mineral resources is constrained within a limiting pit-shell derived using projected technical and economic parameters*. The cut-off grade of the base case estimate of mineral resource is projected to be 0.30 g/t AuEq, calculated using the formula AuEq=Au g/t + (Ag g/t x 0.012) + (Cu% x 1.371). The sensitivity of the Nucleus mineral resource to cut-off grade, constrained by the $1500/oz gold pit shell, is shown in Tables 5 and 6.

TABLE 5: SENSITIVITY OF INDICATED MINERAL RESOURCE TO CUT-OFF GRADE FOR THE NUCLEUS DEPOSIT

| Cut-off Grade AuEq (g/t) | Tonnes (million) | Average Grade | Contained Metal | ||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | AuEq koz | Au koz | Cu Mlbs | Ag koz | ||

| 0.2 | 39.5 | 0.64 | 0.55 | 0.06 | 0.64 | 815 | 701 | 52 | 812 |

| 0.3 base case | 31.0 | 0.75 | 0.65 | 0.07 | 0.70 | 748 | 651 | 44 | 698 |

| 0.4 | 23.2 | 0.88 | 0.78 | 0.07 | 0.75 | 661 | 583 | 35 | 560 |

| 0.5 | 17.0 | 1.04 | 0.93 | 0.07 | 0.82 | 571 | 510 | 28 | 448 |

Notes: Resources constrained within $1500/ozAu pit shell. Base case cut-off grade is 0.30 g/t AuEq for pit constrained resources.

TABLE 6: SENSITIVITY OF INFERRED MINERAL RESOURCE TO CUT-OFF GRADE FOR THE NUCLEUS DEPOSIT

| Cut-off Grade AuEq (g/t) | Tonnes (million) | Average Grade | Contained Metal | ||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | AuEq koz | Au koz | Cu Mlbs | Ag koz | ||

| 0.2 | 11.5 | 0.56 | 0.50 | 0.04 | 0.66 | 206 | 183 | 10 | 243 |

| 0.3 base case | 9.4 | 0.63 | 0.56 | 0.04 | 0.72 | 189 | 169 | 9 | 217 |

| 0.4 | 6.5 | 0.75 | 0.67 | 0.05 | 0.82 | 156 | 141 | 7 | 171 |

| 0.5 | 4.4 | 0.89 | 0.81 | 0.05 | 0.91 | 126 | 115 | 5 | 128 |

Note: Resources constrained within $1500/ozAu pit shell. Base case cut-off grade is 0.30 g/t AuEq for pit constrained resources.

Revenue

Revenue is a gold-silver-copper-molybdenum-tungsten deposit located approximately 4 km to the southeast of the Nucleus deposit. The new mineral resource estimate for Revenue improves upon the previous (2015) estimate with:

1) New drilling that has better delineated the higher grade WAu Breccia domain

2) Expansion of the resource to the northeast to include higher grade mineralization at the newly discovered Blue Sky Porphyry Breccia

3) Inclusion of a >300 metre deep high grade (e.g. 1.4 g/t AuEq) portion of the Blue Sky Porphyry Breccia in an underground resource

4) Upgrading a portion of the resource into an indicated category

5) Inclusion of tungsten in the resource estimate

Indicated mineral resources at Revenue include 11.4 M tonnes at 0.38 g/t Au, 2.4 g/t Ag, 0.12% Cu, 0.016% Mo and 0.008% W. Combined open-pit constrained and underground inferred resources at Revenue include 27.5 M tonnes at 0.51 g/t Au, 2.5 g/t Ag, 0.12% Cu, 0.009% Mo, and 0.005% W. Some of the known zones of mineralization at Revenue remain open in multiple directions and to depth; for example, the Blue Sky Porphyry Breccia is open to the east, west and to depth, and the WAu breccia is open to depth. Triumph Gold believes there is significant potential in the immediate vicinity of Revenue for new discoveries.

The Revenue deposit has been tested with a total of 324 drill holes with a cumulative length of 55,100m. The mineral resource estimate was generated using drill hole sample assay results and the interpretation of a geological model which relates to the spatial distribution of gold, copper, silver, molybdenum and tungsten. Interpolation characteristics are defined based on the geology, drill hole spacing, and geostatistical analysis of the data. The effects of potentially anomalous high-grade sample data, composited to 1.5 metre intervals, are controlled using both traditional top-cutting as well as limiting the distance of influence during block grade interpolation. Block grades are estimated into the three-dimensional block model with nominal block size measuring 10x10x5m (LengthxWidthxHeight), using ordinary kriging and have been validated using a combination of visual and statistical methods. Resources in the indicated category are delineated by drilling spaced at maximum 50 metre intervals. Resources in the inferred mineral category are within a maximum distance of 150 metres from a drill hole. The estimate of the indicated and inferred mineral resources is constrained within a limiting pit shell derived using projected technical and economic parameters*. The base case cut-off grade of the estimate of open pit constrained mineral resources is projected to be 0.30 g/t AuEq calculated using the formula AuEq = Au g/t + (Ag g/t x 0.012) + (Cu% x 1.371) + (Mo% x 4.114) + (W% x 5.942). Resources below the pit shell that are considered potentially amenable to bulk underground extraction methods are estimated at a cut-off grade of 1g/t AuEq. The sensitivity of the Revenue mineral resources to cut-off grade is shown in Tables 7, 8 and 9.

TABLE 7: SENSITIVITY OF PIT CONSTRAINED INDICATED MINERAL RESOURCES TO CUT-OFF GRADE FOR THE REVENUE DEPOSIT

| Cut-Off Grade AuEq (g/t) | Tonnes (million) | Average Grade | Contained Metal | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (%) | W (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Mo klbs | W klbs | ||

| 0.2 | 12.6 | 0.65 | 0.36 | 0.11 | 2.3 | 0.015 | 0.008 | 262 | 145 | 31 | 928 | 4197 | 2196 |

| 0.3 base case | 11.4 | 0.69 | 0.38 | 0.12 | 2.4 | 0.016 | 0.008 | 252 | 140 | 30 | 895 | 4089 | 2082 |

| 0.4 | 9.2 | 0.77 | 0.43 | 0.13 | 2.7 | 0.019 | 0.009 | 228 | 127 | 26 | 809 | 3754 | 1907 |

| 0.5 | 7.1 | 0.87 | 0.48 | 0.14 | 3.1 | 0.021 | 0.011 | 197 | 110 | 22 | 701 | 3282 | 1704 |

Notes: Resources constrained within $1500/ozAu pit shell. Base case cut-off grade is 0.30 g/t AuEq for pit constrained resources.

TABLE 8: SENSITIVITY OF PIT CONSTRAINED INFERRED MINERAL RESOURCES TO CUT-OFF GRADE FOR THE REVENUE DEPOSIT

| Cut-Off Grade AuEq (g/t) | Tonnes (million) | Average Grade | Contained Metal | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (%) | W (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Mo Mlbs | W Mlbs | ||

| 0.2 | 36.1 | 0.56 | 0.36 | 0.09 | 1.8 | 0.007 | 0.004 | 653 | 419 | 72.4 | 2049 | 5807 | 3420 |

| 0.3 base case | 25.0 | 0.70 | 0.46 | 0.11 | 2.2 | 0.009 | 0.005 | 565 | 367 | 61.1 | 1786 | 4954 | 2807 |

| 0.4 | 17.2 | 0.86 | 0.57 | 0.13 | 2.7 | 0.010 | 0.006 | 479 | 318 | 50.1 | 1516 | 3836 | 2203 |

| 0.5 | 13.2 | 0.99 | 0.67 | 0.15 | 3.1 | 0.011 | 0.006 | 422 | 285 | 43.4 | 1314 | 3176 | 1807 |

Notes: Resources constrained within $1500/ozAu pit shell. Base case cut-off grade is 0.30 g/t AuEq for pit constrained resources.

TABLE 9: SENSITIVITY OF UNDERGROUND INFERRED MINERAL RESOURCES TO CUT-OFF GRADE FOR THE REVENUE DEPOSIT

| Cut-Off Grade AuEq (g/t) | Tonnes (million) | Average Grade | Contained Metal | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (%) | W (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Mo klbs | W klbs | ||

| 0.8 | 3.0 | 1.32 | 0.92 | 0.22 | 5.0 | 0.010 | 0.001 | 126 | 88 | 14 | 479 | 626 | 72 |

| 1.0 base case | 2.5 | 1.40 | 0.99 | 0.22 | 5.2 | 0.010 | 0.001 | 112 | 79 | 12 | 417 | 525 | 60 |

| 1.2 | 1.8 | 1.53 | 1.09 | 0.24 | 5.6 | 0.010 | 0.001 | 86 | 61 | 9 | 313 | 367 | 43 |

| 1.4 | 1.1 | 1.66 | 1.20 | 0.25 | 6.0 | 0.009 | 0.001 | 60 | 43 | 6 | 215 | 225 | 27 |

| 1.6 | 0.6 | 1.81 | 1.34 | 0.26 | 6.4 | 0.009 | 0.001 | 34 | 25 | 3 | 118 | 108 | 14 |

| 1.8 | 0.2 | 1.99 | 1.51 | 0.27 | 7.2 | 0.007 | 0.001 | 15 | 12 | 1.4 | 56 | 36 | 6 |

Tinta

Tinta is a vein-hosted gold-silver-copper-lead-zinc deposit located on the southern portion of Triumph Gold’s Freegold Mountain property that extends to depths approaching 400m below surface. Combined open-pit constrained and underground inferred resources at Tinta include 2.2 M tonnes at 1.29 g/t Au, 44.7 g/t Ag, 0.17% Cu, 0.63% Pb and 1.29% Zn. The Tinta deposit remains open at depth where a number of gold-rich drill intersections have not yet been followed up on with additional drilling. Grassroots exploration along strike to the northwest of the Tinta vein identified a 1.8 km long coincident soil geochemistry and geophysical anomaly. Seven trenches across the anomaly exposed quartz veins with precious and base metal mineralization similar to the Tinta vein.

The Tinta deposit has been tested with a total of 74 drill holes with a cumulative length of 10,063m plus a total of 450m of underground drifting in two locations. The mineral resource estimate was generated using drill hole and drift channel sample assay results and the interpretation of a geological model which relates to the spatial distribution of gold, copper, silver, lead and zinc. Interpolation characteristics are defined based on the geology, drill hole spacing, and geostatistical analysis of the data. The effects of potentially anomalous high-grade sample data, composited to 1 metre intervals, are controlled by limiting the distance of influence during block grade interpolation. Block grades are estimated into the three-dimensional block model with nominal block size measuring 2x5x5m. The block model is rotated so the short axis (2m blocks) are perpendicular to the strike of the deposit at an azimuth of 305 degrees and the larger block dimensions are oriented along strike and in the vertical dimension. Grade estimates are made using ordinary kriging and have been validated using a combination of visual and statistical methods. Resources in the inferred category are within a maximum distance of 50m from drilling or underground channel samples. The base case cut-off grade of the open pit constrained mineral resource is projected to be 0.35 g/t AuEq calculated using the formula AuEq = Au g/t + (Ag g/t x 0.012) + (Cu% x 1.371) + (Pb% x 0.457) + (Zn% x 0.571). Resources below the pit shell that are considered potentially amenable to underground extraction methods are estimated at a cut-off grade of 1.8 g/t AuEq. The sensitivity of the Tinta mineral resources to cut-off grade is shown in Tables 10 and 11.

TABLE 10: SENSITIVITY OF PIT CONSTRAINED INFERRED MINERAL RESOURCES TO CUT-OFF GRADE AT THE TINTA DEPOSIT

| Cut-Off Grade AuEq (g/t) | Tonnes (000) | Average grade: | Contained Metal: | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Pb (%) | Zn (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Pb Mlbs | Zn Mlbs | ||

| 0.25 | 919 | 2.98 | 1.07 | 0.18 | 42.0 | 0.71 | 1.45 | 88 | 32 | 3.6 | 1241 | 14 | 29 |

| 0.3 | 913 | 2.99 | 1.08 | 0.18 | 42.2 | 0.72 | 1.46 | 88 | 32 | 3.6 | 1240 | 14 | 29 |

| 0.35 Base Case | 908 | 3.01 | 1.09 | 0.18 | 42.5 | 0.72 | 1.47 | 88 | 32 | 3.6 | 1240 | 14 | 29 |

| 0.4 | 906 | 3.01 | 1.09 | 0.18 | 42.6 | 0.72 | 1.47 | 88 | 32 | 3.6 | 1240 | 14 | 29 |

| 0.45 | 901 | 3.03 | 1.09 | 0.18 | 42.8 | 0.73 | 1.48 | 88 | 32 | 3.6 | 1239 | 14 | 29 |

| 0.5 | 893 | 3.05 | 1.10 | 0.18 | 43.1 | 0.73 | 1.49 | 88 | 32 | 3.5 | 1238 | 14 | 29 |

Note: Resources constrained within $1500/ozAu pit shell.

TABLE 11: SENSITIVITY OF UNDERGROUND INFERRED MINERAL RESOURCES TO CUT-OFF GRADE AT THE TINTA DEPOSIT

| Cut-Off Grade AuEq (g/t) | Tonnes (000) | Average grade: | Contained Metal: | ||||||||||

| AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Pb (%) | Zn (%) | AuEq koz | Au koz | Cu Mlbs | Ag koz | Pb Mlbs | Zn Mlbs | ||

| 1.4 | 1,646 | 2.82 | 1.26 | 0.15 | 41.7 | 0.53 | 1.07 | 149 | 67 | 5.4 | 2204 | 19 | 39 |

| 1.6 | 1,466 | 2.98 | 1.35 | 0.16 | 44.1 | 0.55 | 1.12 | 140 | 64 | 5.0 | 2080 | 18 | 36 |

| 1.8 Base Case | 1,313 | 3.13 | 1.43 | 0.16 | 46.3 | 0.56 | 1.17 | 132 | 60 | 4.7 | 1955 | 16 | 34 |

| 2 | 1,177 | 3.27 | 1.49 | 0.17 | 48.5 | 0.58 | 1.23 | 124 | 57 | 4.3 | 1836 | 15 | 32 |

| 2.2 | 1,048 | 3.42 | 1.56 | 0.17 | 50.7 | 0.61 | 1.30 | 115 | 52 | 3.9 | 1709 | 14 | 30 |

| 2.4 | 905 | 3.59 | 1.63 | 0.18 | 53.8 | 0.64 | 1.37 | 104 | 47 | 3.5 | 1564 | 13 | 27 |

Note: Resources constrained below the $1500/ozAu pit shell.

Notes

* The economic viability of the mineral resources at the Freegold property were tested by constraining them within a floating cone pit shells, or evaluating the viability of possible underground extraction using the following technical and economic parameters:

| • | Mining Cost (open pit) | $2.50/t |

| • | Mining Cost (underground) | $25/t at Revenue, $60/t at Tinta |

| • | Process | $11/t at Nucleus and Revenue, $12/t at Tinta |

| • | G&A | $1.50/t at Nucleus and Revenue, $2.50/t at Tinta |

| • | Gold Price | $1,500/oz |

| • | Silver Price | $18/oz |

| • | Copper Price | $3.00/lb |

| • | Lead Price | $1.00/lb |

| • | Zinc Price | $1.25/lb |

| • | Molybdenum price | $9.00/lb |

| • | Tungsten price | $13.00/lb |

| • | Gold Process Recovery | 85% |

| • | Silver Process Recovery | 60% |

| • | Copper Process Recovery | 75% (80% at Tinta) |

| • | Lead Process Recovery | 75% (Tinta only) |

| • | Zinc Process Recovery | 75% (Tinta Only) |

| • | Mo Process Recovery | 50% (Revenue Only) |

| • | Tungsten Process Recovery | 50% (Revenue Only) |

| • | Pit Slope | 45 degrees |

There are no adjustments for mining recoveries or dilution. The open pit testing indicates that some of the deeper mineralization may not be economic due to the increased waste stripping requirements. Underground mineral resources exhibit continuity of thickness and grade and are considered to exhibit reasonable prospects for eventual economic extraction using underground extraction methods at the projected cut-off grades. It is important to recognize that these discussions of surface and underground mining parameters are used solely to test the “reasonable prospects for eventual economic extraction,” and that they do not represent an attempt to estimate mineral reserves. There are no mineral reserves calculated for this Project. These preliminary evaluations are used to prepare the mineral resource estimates and to select appropriate reporting assumptions.

Quality Assurance

All Triumph’s sample assay results have been independently monitored through a quality control / quality assurance (“QA/QC”) program that includes the insertion of blind standards, blanks and pulp and reject duplicate samples. Logging and sampling are completed at Triumph’s secure facility located at the Freegold project. Predominately NTW and HTW sized drill core is sawn in half on site and half drill-core samples are securely transported to prep laboratories in Whitehorse for crushing and pulverizing and then to geochemical laboratories located in Vancouver, Canada for analysis. Gold content is determined by fire assay of a 30 gram charge and the additional elements are determined by four-acid, or historically aqua regia, digestion with ICP finish. ALS and SGS Labs have been used and both are independent from Triumph.

Triumph is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Persons

Robert Sim, P.Geo., a Qualified Person as defined by NI 43-101, is responsible for the estimate of mineral resources presented in this news release and has reviewed, verified and approved the contents of this news release as they relate to the mineral resource estimate, including the sampling, analytical, and test data underlying the mineral resource estimate. Mr. Sim is independent from Triumph and confirms there were no limitations from the company in verifying the drilling and sample data with site visit observations and monitoring of the QAQC program.

Tony Barresi, Ph.D., P.Geo., President of the Company, and qualified person as defined by NI 43-101 for the Freegold Mountain project has reviewed, verified and approved the contents of this news release as they relate to the ongoing exploration and development program at the Freegold Mountain project.

About Triumph Gold Corp.

Triumph Gold Corp. is a growth oriented Canadian-based precious metals exploration and development company. Triumph Gold Corp. is focused on creating value through the advancement of the district scale Freegold Mountain Project in Yukon. For maps and more information, please visit our website www.triumphgoldcorp.com

On behalf of the Board of Directors

Signed "Tony Barresi"

Tony Barresi, President

| For further information please contact: John Anderson, Executive Chairman Triumph Gold Corp. (604) 218-7400 janderson@triumphgoldcorp.com | Nancy Massicotte IR Pro Communications Inc. (604)-507-3377 nancy@irprocommunications.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectations. Important factors - including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities - that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time on SEDAR (see www.sedar.com). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

A photo accompanying this announcement is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/09f34c67-f8c9-419c-9478-d89d003cce5e