Unigold Reports Results from Exploration Drilling at Neita Concession

- Seventeen drill holes tested six areas around the Candelones resource

- Drilling has extended the strike of the Candelones Extension mineralization a further 200 meters to the east

- Drilling at the Connector Zone identified a possible volcanic vent and returned elevated copper and zinc grades over broad, sustained intervals

TORONTO, June 09, 2021 (GLOBE NEWSWIRE) -- Unigold Inc. (“Unigold” or the “Company”) (TSX-V:UGD, OTCQX:UGDIF, FSE:UGB1) reports its latest results from 17 exploration drill holes from Candelones on its 100% owned Neita concession in the Dominican Republic. The Company is awaiting assay information for a further 12 drillholes.

In February 2021, drilling transitioned from largely infill holes towards testing geophysical anomalies around the defined mineralization at Candelones. These targets covered a number of prospective areas that were largely ignored over the past drilling. Exploration drill holes tested the following targets:

Connector Zone – The Connector zone lies between the Candelones Main mineralization and the Candelones Extension. This gap area was sparsely drilled in the past but forms an 800m wide corridor between the two deposits. Eight drill holes, DCZ20-71 to DCZ21-78, tested coincident Induced Polarity (“IP”) Chargeability and Resistivity anomalies east of the currently identified oxide resource. Drilling intersected what we interpret to be an extensive phreatomagmatic breccia system that may mark a volcanic vent area. Broad intervals of elevated zinc and copper grades occur proximal to the observed breccia and there are intervals of what appears to be intermediate intrusive interlaced throughout the package. The breccia shows a melange of angular fragments and shards of numerous rock types including syenitic and rhyolitic lithologies. Elevated copper and zinc grades were returned over several tens of meters (DCZ20-74, DCZ21-75) with low tenor gold enrichment.

The connector zone is currently interpreted to be a volcanic or hydrothermal vent that may represent the heat source for the younger epithermal systems that overprint mineralization to the east. This observation has positive implications for future exploration in the immediate vicinity of Candelones.

Candelones Oxide Expansion Drilling – The oxide mineralization at Candelones Main forms the basis for a PEA that shows a 35% after-tax IRR (see NR PR 2021-06, April 26, 2021). An expansion of the available oxide material may enhance the project economics by extending the project life. Eight holes, DCZOX21-01 through 08, were completed testing for oxide mineralization based on follow up geological mapping east of the oxide resource limit. Results for all shallow oxide holes are pending.

Extension West – Sixteen (16) holes were completed along 300 meters of strike length to the west of the Candelones Extension deposit. These holes were drilled from four platforms and targeted to intersect mineralization beneath historic drilling. No drilling had been conducted in this area since 2013. The silicified dacite breccias encountered in these areas are texturally similar to those found to the east at Target C and Target B. While silicification and other alteration indicated that the drills likely passed through epithermal systems, only low tenor gold and copper was encountered in all reported holes. Results are pending for six holes.

Extension East – Eight (8) holes were completed along a 200 meter strike length to the east of the Candelones Extension, expanding the surface sulphide mineralization intersected in holes LP20-169 (PR2021-04, March 9, 2021) and LP21-171 (PR2021-05, March 29, 2021). Broad intervals of low to moderate gold values, similar to those intersected in the discovery holes, were returned although gold grades as a whole seem to be decreasing to the east. The Company plans to continue tracing the low grade mineralization to the east for as long as it persists. This material is shallow and the sustained intervals above a 0.50 g/t gold suggest that this mineralization has the potential to increase both the oxide and near-surface sulphide resources. Results are pending for the three most easterly holes.

Eastern Oxides – Blind oxide mineralization was encountered while drilling LP20-169 (PR2021-04, March 9, 2021). This mineralization had no surface expression but returned 14 m grading 2.11 g/t gold with 8.2 g/t silver starting from 2 metres below surface. Fifteen shallow vertical holes, covering about 1 kilometre of strike extent, were completed to evaluate the potential of additional oxide resources in this area to the east. Results of all 15 holes are pending.

Extension North – One hole was completed testing a coincident airborne Magnetic low and IP resistivity high response 800 meters north of the Candelones resource envelope. Higher grade intervals of 1 to 2 metres with chalcopyrite veining assaying between 0.5% to 1.5% copper were intersected. Gold values were generally low. The northerly anomalies are broad and continuous across 2.5 kilometres of strike extent. While the gold grades provided little excitement, the alteration and copper mineralization indicates that the mineralizing systems are persistent into this underexplored area.

Montazo – Montazo is a separate target to the east of Candelones. It appears to be a discrete set of gold-in-soil and geophysical anomalies clustered into an area that is along the trend of the Candelones mineralization, about 3.5 kilomteres to the east. Five holes were completed probing the interpreted andesite-dacite contact at the Montazo target where a coincident, WNW trending IP chargeability anomaly persists for 2000 meters, parallel to the interpreted andesite – dacite contact. A four hole fence of drill holes targeted the southern IP chargeability response and failed to report any significant mineralization. The Company notes that oxide mineralization at the top of holes MN21-11 and MN21-13 was not initially sampled. This oversight was corrected and the samples for the strongly oxidized dacite breccia from the collar to approximately 20 meters depth has been submitted for analysis. MN21-14, testing a second IP chargeability anomaly 500 meters the north, intersected low tenor gold and silver grades from surface to a depth of 113.0 meters down hole. Oxide mineralization was encountered over the top 11 metres in this hole, returning 0.34 g/t gold and 15.8 g/t silver. It is the Company’s opinion that Montazo remains priority target with an IP chargeability response similar to the Candelones mineralization which hosts a 1.0 million ounce measured and indicated resource with an additional 1.0 million ounces of inferred resource.

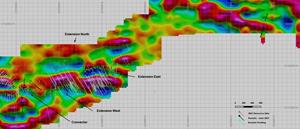

Table 1.0 summarizes the results received to date as well as the holes for which results are pending. Figure 1.0 is a drill hole location plan showing the general location of the latest exploration drill holes.

A detailed review of the geophysical and geochemical data is in progress. The latest drill results are being evaluated relative to the historical geochemical and geophysical data searching for potential vectors to assist with exploration drill hole targeting particularly along the Montazo, Guano, Naranja trend to the east of the Candelones Extension resource. No geophysical work has been completed in this area since 2012. The Company is examining the utility of completing more advanced airborne and ground geophysical surveys to support further drill targeting.

Table 1.0 – Summary of Exploration Drill Hole Results – June 2021

| Target | Hole (#) | From(m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | |

| Extension | LP20-167 D | NO SIGNIFICANT VALUES | |||||||

| Extension North | LP21-175 | NO SIGNIFICANT VALUES | |||||||

| Extension West | LP21-177 | 124.65 | 209.80 | 85.15 | 0.31 | 0.89 | 0.12 | 0.02 | |

| including | 130.10 | 135.00 | 4.90 | 1.17 | 2.60 | 0.29 | 0.00 | ||

| including | 188.00 | 191.00 | 3.00 | 0.76 | 1.67 | 1.00 | 0.11 | ||

| LP21-179 | 125.10 | 132.70 | 7.60 | 0.36 | 3.83 | 0.15 | 0.08 | ||

| and | 165.40 | 201.00 | 35.60 | 0.14 | 0.44 | 0.10 | 0.00 | ||

| LP21-181 | 214.00 | 239.00 | 25.00 | 0.16 | 0.64 | 0.07 | 0.24 | ||

| LP21-183 | NO SIGNIFICANT VALUES | ||||||||

| LP21-184 | 212.00 | 216.00 | 4.00 | 0.73 | 4.80 | 0.34 | 0.04 | ||

| LP21-186 | 279.00 | 306.00 | 27.00 | 0.16 | 0.64 | 0.07 | 0.24 | ||

| LP21-188 | NO SIGNIFICANT VALUES | ||||||||

| LP21-190 | 289.80 | 318.00 | 28.20 | 0.14 | 0.61 | 0.08 | 0.05 | ||

| LP21-192 | NO SIGNIFICANT VALUES | ||||||||

| LP21-194 | RESULTS PENDING | ||||||||

| LP21-196 | RESULTS PENDING | ||||||||

| LP21-198 | RESULTS PENDING | ||||||||

| LP21-200 | 103.00 | 116.00 | 13.00 | 0.02 | 1.39 | 0.09 | 0.06 | ||

| and | 311.00 | 339.00 | 28.00 | 0.04 | 0.86 | 0.31 | 0.01 | ||

| including | 316.00 | 320.00 | 4.00 | 0.06 | 2.63 | 1.29 | 0.00 | ||

| LP21-202 | RESULTS PENDING | ||||||||

| LP21-204 | RESULTS PENDING | ||||||||

| LP21-206 | RESULTS PENDING | ||||||||

| Extension East | LP21-185 | 297.70 | 426.00 | 128.30 | 0.20 | 0.63 | 0.05 | 0.02 | |

| including | 297.70 | 300.05 | 2.35 | 1.67 | 9.54 | 0.06 | 0.54 | ||

| including | 335.00 | 379.15 | 44.15 | 0.34 | 0.74 | 0.11 | 0.00 | ||

| LP21-187 | 156.80 | 203.00 | 46.20 | 0.95 | 1.26 | 0.06 | 0.81 | ||

| including | 158.00 | 176.00 | 18.00 | 1.19 | 1.96 | 0.06 | 0.98 | ||

| and | 221.00 | 223.00 | 2.00 | 6.64 | 0.25 | 0.02 | 0.00 | ||

| and | 306.00 | 343.00 | 37.00 | 0.02 | 0.29 | 0.11 | 0.01 | ||

| LP21-189 | 137.00 | 251.00 | 114.00 | 0.50 | 0.97 | 0.03 | 0.29 | ||

| including | 137.00 | 210.00 | 73.00 | 0.55 | 1.21 | 0.03 | 0.32 | ||

| including | 137.00 | 144.00 | 7.00 | 1.15 | 4.16 | 0.49 | 0.57 | ||

| LP21-191 | 80.00 | 200.00 | 120.00 | 0.36 | 0.32 | 0.03 | 0.11 | ||

| including | 95.00 | 159.00 | 64.00 | 0.57 | 0.33 | 0.04 | 0.19 | ||

| including | 124.00 | 134.00 | 10.00 | 1.80 | 0.67 | 0.05 | 0.82 | ||

| LP21-193 | RESULTS PENDING | ||||||||

| LP21-195 | RESULTS PENDING | ||||||||

| LP21-197 | 9.65 | 95.15 | 85.50 | 0.50 | 2.22 | 0.07 | 0.34 | ||

| including | 35.65 | 57.00 | 21.35 | 1.38 | 5.87 | 0.18 | 1.14 | ||

| LP21-201 | RESULTS PENDING | ||||||||

| Eastern Oxides | LPOX21-01 - 15 | RESULTS PENDING | |||||||

Table 1 continued on next page…

Table 1.0: Continued

| Target | Hole (#) | From(m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | Zn (%) | |

| Connector | DCZ20-72 | 287.00 | 305.00 | 18.00 | 0.76 | 1.40 | 0.01 | 0.07 | |

| including | 290.00 | 295.00 | 5.00 | 1.72 | 1.66 | 0.02 | 0.14 | ||

| DCZ20-73 | 267.00 | 283.00 | 16.00 | 0.29 | 1.69 | 0.01 | 0.12 | ||

| and | 304.00 | 315.00 | 11.00 | 0.41 | 0.58 | 0.02 | 0.13 | ||

| DCZ20-74 | 117.00 | 122.00 | 5.00 | 0.05 | 1.26 | 0.02 | 0.57 | ||

| and | 122.00 | 140.00 | 18.00 | RESULTS PENDING | |||||

| and | 140.00 | 150.00 | 10.00 | 0.02 | 0.25 | 0.04 | 0.82 | ||

| and | 195.00 | 241.00 | 46.00 | 0.06 | 1.11 | 0.16 | 0.00 | ||

| DCZ21-75 | 265.00 | 295.00 | 30.00 | 0.03 | 0.38 | 0.07 | 1.59 | ||

| DCZ21-76 | 85.15 | 116.25 | 31.10 | 0.02 | 1.94 | 0.04 | 0.27 | ||

| DCZ21-77 | 132.00 | 139.60 | 7.60 | 0.01 | 0.81 | 0.18 | 0.01 | ||

| DCZ21-78 | NO SIGNIFICANT VALUES | ||||||||

| DCZOX21-01 - 08 | RESULTS PENDING | ||||||||

| Montazo | MN21-10 | NO SIGNIFICANT VALUES | |||||||

| MN21-11 | NO SIGNIFICANT VALUES | ||||||||

| MN21-12 | NO SIGNIFICANT VALUES | ||||||||

| MN21-13 | 69.20 | 72.00 | 2.80 | 0.05 | 1.52 | 0.53 | 0.00 | ||

| MN21-14 | 0.00 | 113.00 | 113.00 | 0.12 | 3.36 | 0.02 | 0.08 | ||

| including | 0.00 | 11.10 | 11.10 | 0.34 | 15.80 | 0.00 | 0.00 | ||

| including | 80.00 | 104.60 | 24.60 | 0.14 | 3.01 | 0.05 | 0.22 | ||

| (1) Interval represents drilled length in meters and not true width. | |||||||||

Figure 1.0 – Drill Hole Locations – June 2021: https://www.globenewswire.com/NewsRoom/AttachmentNg/d6df64f6-4227-4594-80a9-17c6f4ae1e40

QA/QC

Diamond drilling utilizes both HQ and NQ diameter tooling. Holes are established using HQ diameter tooling before reducing to NQ tooling to complete the hole. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical and geological data and subjected to other physical tests including magnetic susceptibility and specific gravity analysis. Samples are identified, recorded, split by wet diamond saw, and half the core is sent for assay with the remaining half stored on site. A minimum sample length of 0.3 meters and a maximum sample length of 1.5 metres is employed with most samples averaging 1.0 meters in length except where geological contacts dictate. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 5-10% of the sample stream. Samples are shipped to a sample preparation facility in the Dominican Republic operated by Bureau Veritas. Assaying is performed at Bureau Veritas Commodities Canada Ltd.’s laboratory in Vancouver, B.C. Canada. All samples are analyzed for gold using a 50 gram lead collection fire assay fusion with an atomic adsorption finish. In addition, most samples are also assayed using a 36 element multi-acid ICP-ES analysis method.

Wes Hanson P.Geo., Chief Operating Officer of Unigold has reviewed and approved the contents of this press release.

About Unigold Inc. – Discovering Gold in the Caribbean

Unigold is a Canadian based mineral exploration company traded on the TSX Venture Exchange under the symbol UGD, the OTCQX exchange under the symbol UGDIF, and on the Frankfurt Stock Exchange under the symbol UGB1. The Company is focused primarily on exploring and developing its gold assets in the Dominican Republic. The Candelones oxide gold deposit is within the 100% owned Neita Fase II exploration concession located in Dajabón province, in the northwest part of the Dominican Republic. The Candelones project area is about 20 kilometers south of the town of Restauraćion. The oxide deposit occurs at surface as a result of the tropical weathering of underlying mineralization. Unigold has been active in the Dominican Republic since 2002 and remains the most active exploration Company in the country. The Neita Fase II exploration concession is the largest single exploration concession covering volcanic rocks of the Cretaceous Tireo Formation. This island arc terrain is host to Volcanogenic Massive Sulphide deposits, Intermediate and High Sulphidation Epithermal Systems and Copper-gold porphyry systems. Unigold has identified over 20 areas within the concession area that host surface expressions of gold systems. Unigold has been concentrating on the Candelones mineralization and continues to expand the deeper sulphide resources with on-going drilling.

Forward-looking Statements

Certain statements contained in this document, including statements regarding events and financial trends that may affect our future operating results, financial position and cash flows, may constitute forward-looking statements within the meaning of the federal securities laws. These statements are based on our assumptions and estimates and are subject to risk and uncertainties. You can identify these forward-looking statements by the use of words like “strategy”, “expects”, “plans”, “believes”, “will”, “estimates”, “intends”, “projects”, “goals”, “targets”, and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. We wish to caution you that such statements contained are just predictions or opinions and that actual events or results may differ materially. The forward-looking statements contained in this document are made as of the date hereof and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ materially from those projected in the forward-looking statements. Where applicable, we claim the protection of the safe harbour for forward- looking statements provided by the (United States) Private Securities Litigation Reform Act of 1995.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information please visit www.unigoldinc.com or contact: Mr. Joseph Hamilton Chairman & CEO jhamilton@unigoldinc.com T. (416) 866-8157