Updated Resource Estimate Significantly Expands Noram's Zeus Lithium Deposit, Clayton Valley, Nevada

VANCOUVER, BC / ACCESSWIRE / February 21, 2019 / Noram Ventures Inc. is pleased to report a new inferred resource estimate for the Zeus lithium property, which is adjacent to Albemarle's lithium brine producer in Clayton Valley, Nevada. At a 900 ppm lithium cut-off, the new inferred resource is 145 million tonnes at a grade of 1145 ppm lithium; more than 8.5x the previously reported estimate.

In 2018, Noram completed two additional phases of drilling, (the Phase II and Phase III drill programs), which are newly incorporated into the new inferred resource calculation. In total, 60 drill holes have been included within the resource area. The new inferred resource estimate is 145 million tonnes at a grade of 1145 ppm lithium, at a cut-off grade of 900 ppm Li (Table 1). Sensitivity analysis at 300 ppm Li cutoff and 600 ppm Li cutoff are also given in Table 1. While the updated NI 43-101 report is not yet finalized, it is expected within the next 45 days and the Company's Qualified Person (Bradley C. Peek) feels sufficiently certain that these preliminary calculated values are reasonable and will not vary significantly from the final NI 43-101 report values.

| Cutoff Grade | ||

300 ppm Li – Sensitivity Analysis | 600 ppm Li – Sensitivity Analysis | 900 ppm Li: Mineral Resource Estimate | |

Tonnes (1000s) | 330,670 | 251,526 | 145,168 |

Grade (ppm) | 858 | 984 | 1145 |

Contained Li (kg) | 283,796,297 | 247,569,218 | 166,238,452 |

Table 1. Inferred resources for the Zeus lithium deposit, Clayton Valley, Nevada

This expanded resource estimate for the Zeus lithium deposit is 8.5 times the tonnage of the previous resource reported in 2017 and at a higher grade, (the previous inferred resource reported 17 million tonnes at 1060 ppm Li: see Noram press release Nov. 21, 2017; and Peek and Spanjers, 2017). At a cut-off grade of 900 ppm, the grade of 1145 ppm lithium corresponds to a lithium carbonate equivalent grade of 0.61 wt.% Li2CO3, and the contained lithium corresponds to 0.88 million tonnes lithium carbonate equivalent (1 kg Li = 5.323 kg Li2CO3). Current lithium carbonate (99.5% purity) prices in China are $12,500 - $14,500 per tonne (as of Feb. 9, 2019: www.metalsbulletin.com).

The inferred resource reported here is considered an update of the inferred resource reported in Peek and Spanjers (2017) and was estimated using a block model and the inverse distance squared method for the calculations.

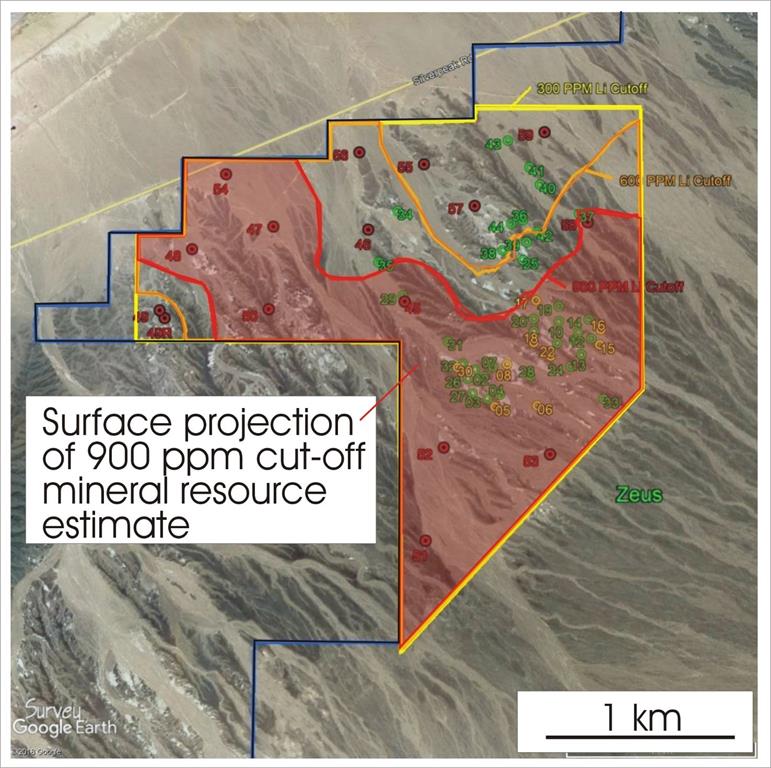

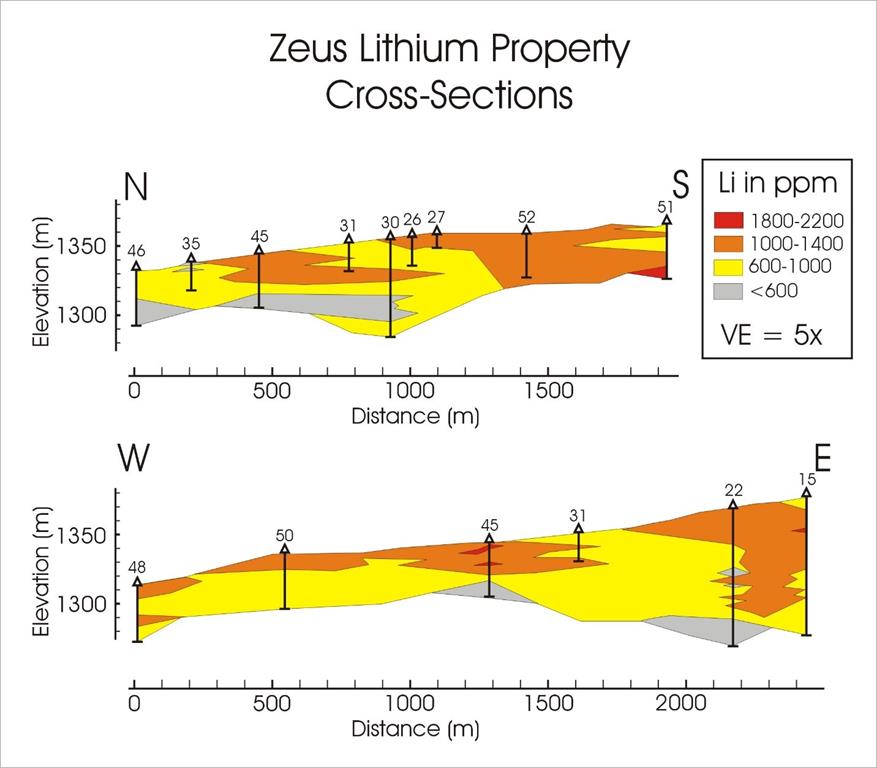

A Google Earth image of the property with the drill holes used in this resource calculation, and with outlines for the >300 ppm Li, >600 ppm Li and >900 ppm Li is seen below in Figure 1. In Figure 2, North – South and West – East cross-sections are shown, based on all three phases of drilling. Higher grade (>1000 ppm Li) material is open at depth and to the southeast, with the property boundary from 1-2 km away from the currently defined inferred resource.

Figure 1. Google Earth image showing the area underlain by the mineral resrouce estimate (area in red, 900 ppm Li cutoff); and the boundaries for the 300 ppm Li and 600 ppm Li cutoff sensitivity analyses (orange and yellow lines, respectively). Also shown are the 3 phases of drill holes (Phase I in green; Phase 2 in yellow; Phase 3 in red). The blue line is a portion of the Zeus claim block outline. Albemarle's Silver Peak lithium brine ponds lie 1 km to west and northwest of the Zeus property in Clayton Valley. (To view the full-size image, please click here)

Figure 2. Zeus lithium deposit cross sections, with drill holes labeled (see figure 1 for locations). Above: North – South cross section. Below: West – East cross-section. The lithium clays are within playa lake sediments of the Esmeralda Formation. (To view the full-size image, please click here)

The deposit is within playa lake clays of the Miocene-Pliocene (23 – 2.5 million years old) Esmeralda Formation. Initial mineralogy studies on the clays at surface and in drill core indicate the following favorable features: 1) 35%-65% of the material is detrital gravel and sand, and can be separated from the clay minerals during processing using sieves and cyclones. Separating this material effectively increases the grade two-fold before leach treatment of the clays. 2) The clay minerals are non-refractory and can be successfully treated with sulfuric acid to extract lithium (see Barrie et al., 2018). 3) Approximately 5 percent of the material is calcium carbonate and may be separated along with the other coarse-grained material. This can significantly reduce the amount of acid necessary to extract lithium during processing.

Two other favorable indicators come from the assay ICP geochemical data, as follows: 1) There is marked sodium enrichment within 10 meters of the surface, which is believed to reflect residual salts and suggests that some of the lithium resource may be soluble in water alone, as is the case elsewhere in the Esmeralda Formation. 2) There is a notable enrichment in rubidium at the hundreds of ppm level. Rubidium, like lithium is an alkali element and may be recoverable during processing.

In the coming months, Noram intends to conduct a preliminary economic assessmentstudy aimed at a detailed understanding of the geological and mineralogical controls on mineralization in order to determine the most cost-effective, efficient and environmentally-friendly methods of lithium extraction; with the goal of producing a marketable lithium carbonate or lithium hydroxide product.

The Noram management team commented that "if you want to develop a lithium deposit, Clayton Valley is high on the list of places to do so, with Albemarle's Silver Peak lithium brine operations next door. We note that the Tesla lithium battery gigafactory is 220 km down the road and is one of at least ten lithium battery factories recently built or under construction for the global auto sector. We aim to work with our neighbors in Clayton Valley, under the guidance of the U.S. Bureau of Land Management and the Nevada Bureau of Mines, to develop these lithium resources to support the future of green energy."

The mineral resource estimates in this press release use the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Standards on Mineral Resources and Reserves, Definitions and Guidelines. According to the CIM definitions, a Mineral Resource must be potentially economic in that it must be "in such form and quantity and of such grade or quality that it has reasonable prospects for eventual economic extraction".

The technical information contained in this news release has been reviewed and approved by Bradley C. Peek MSc., a Certified Professional Geologist who is independent of Noram Ventures and is a Qualified Person with respect to Noram's Clayton Valley Lithium Project as defined under National Instrument 43-101.

References

Barrie, C. T., Peek, B., and Whittaker, P., 2018, Lithium clay deposits of the Zeus Property, Eastern Clayton Valley, Nevada: American Geophysical Union Annual Meeting, Washington, D.C., extended abstract 6 p.

Peek, B. C., and Spanjers, R. P., 2017, NI 43-101 Technical Report, Lithium inferred mineral resource estimate, Clayton Valley, Esmeralda County, Nevada, USA, for Noram Ventures Ltd., 67 p.

About Noram Ventures Inc.

Noram Ventures Inc. (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) is a Canadian based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company's primary business focus since formation has been the exploration of mineral projects. Noram's long term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramventures.com

ON BEHALF OF THE COMPANY

/s/ "C. Tucker Barrie, Ph.D., P.Geo."

President and CEO, Noram Ventures Inc.

Direct: (604) 553-2279

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities.

SOURCE: Noram Ventures Inc.