Victoria Gold: Maiden Mineral Resource Estimate at Raven

WHITEHORSE, Yukon, Sept. 15, 2022 (GLOBE NEWSWIRE) -- Victoria Gold Corp. (TSX-VGCX) (“Victoria” or the “Company”) is pleased to report the inaugural Mineral Resource Estimate (“MRE”) for the Raven Gold Deposit, located approximately 15 kilometers (“km”) east of the Eagle Gold Mine. The MRE was undertaken by the Company with the assistance of Independent QP, Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc. The MRE represents the culmination of diamond drilling and surface exploration programs conducted on the Raven target through 2021. Results from the ongoing 2022 drill program at Raven have not been included in this maiden resource and will be incorporated into subsequent resource updates.

The Initial MRE comprises a total Inferred Mineral Resource of 1,070,239 ounces of gold for the near-surface Raven Deposit.

“Raven is a new discovery made by our team in 2018 through geophysics, geochemistry, prospecting, trenching, and drilling along the contact of the Nugget intrusive, 15 kilometers east of Eagle. Follow-up exploration was hampered by COVID, yet in three exploration seasons we have identified a significant Resource,” stated John McConnell, President & CEO. “In 2022, we have carried out Victoria’s largest ever exploration program, with 25,000 meters of drilling planned to expand Raven along strike and at depth.”

Table 1: Pit-Constrained Inferred Mineral Resources at a 0.50 g/t Au Cut-Off

Effective September 15, 2022 – Raven Deposit

| Au Cut-off Grade g/t | Classification | Tonnage tonnes | Average Au Grade g/t | Au Content oz |

| 0.50 | Inferred | 19,956,934 | 1.67 | 1,070,239 |

Notes:

- The effective date for the Mineral Resource is September 15, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.50 g/t Au, within a Lerchs-Grossman pit shell using a gold price of US$1,700/ounce and a US$/CAN$ exchange rate of 0.75.

A supporting NI 43-101 Technical Report will be filed on SEDAR at www.sedar.com within 45 days of this press release.

Picture 1: Idealized Long-Section of Raven Resource Pit and MRE bounds

https://www.globenewswire.com/NewsRoom/AttachmentNg/4bffd12c-3046-45d2-b1a9-8f540e8a9a49

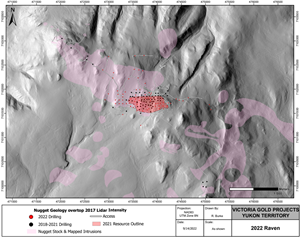

Picture 2: Raven Resource Outline and Nugget intrusions

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f65666b-03de-4553-9134-9557a01c1093

Additional pictures will be made available on the company website at https://vgcx.com/site/assets/files/6950/raven_mre_visuals4.pdf.

Mineral Resource Estimate Discussion

The drill hole database utilized for this MRE utilizes 78 diamond drill holes collared between August 2018 and September 2021 and is comprised of 11,956 assays from 18,217 meters (“m”) of drilling. Additionally, 55 surface trenches with 3,464 assays and 7,443m of sampling were included in establishing the MRE.

A geologic model of the Raven Massive Sulphide Veins (“MSV”) was created as a wireframe for the Raven deposit by Victoria based on interpretation and measurements of the Raven veins geologic controls, including veins identified in drillholes and surface exposures, structural measurements from oriented core and surface trenches as well as high-grade gold analytical values. For the purposes of the estimation, this MSV domain was treated as a hard boundary to restrict the influence of the high-grade assays within this domain. Three separate grade shell domains within the Lower Grade (“LG”) unit were built: above 0.2 g/t Au, 0.6 g/t Au and 4.0 g/t Au, respectively, for the MRE.

Original Au assays were composited to 1.3m as it is the most common sampling length within the MSV. Overall, 19,757 composites were generated with 1,591 composites within the MSV unit, 3,273 composites within the LG unit above 0.2 g/t Au, 3,709 composites within the LG unit above 0.6 g/t, and 491 composites within the LG unit above 4.0 g/t Au.

The high-grade gold outliers of the 1.3m composites were capped to 25.0 g/t Au for the MSV, 5.0 g/t Au for the LG > 0.2 g/t Au domain, 6.0 g/t Au for the LG > 0.6 g/t Au domain, and 21.0 g/t Au for the LG > 4.0 g/t Au domain.

Statistics conducted on the capped composites showed lognormal distributions with reasonably well-behaved gold grade distributions.

The spatial continuity of the gold grades was examined with a variographic study. Results showed main orientations of gold grade continuity along the strike of the deposit oriented approximately east-west and along the dip of the deposit at a 65° towards north. Ranges of gold grade continuity for the MSV were approximately 60m along strike and 44m down dip, while for the LG zone they were approximately 50m along strike and 40m down dip.

Gold grade estimates were estimated with an ordinary kriging technique, within each of the 4 domains which were each treated as hard boundary domains, into an orthogonal block model. The block model was discretized on 5.0m x 5.0m x 5.0m parent blocks and sub-blocked to 0.5m x 0.5m x 0.5m blocks. A minimum of 2 and maximum of 12 samples were used to calculate a grade estimate for each block. A two-pass estimation approach was used with the first pass having a search ellipsoid oriented and dimensioned to the second range of the variograms and the second pass having a search ellipsoid dimensioned to twice the second range of the variograms.

The Mineral Resource was classified as Inferred. The tonnage was calculated with a specific gravity value of 4.50 for the MSV and of 2.65 for the other LG domains. The mineral resource was constrained within a pit shell optimized from a Lerchs-Grossman algorithm with the following parameters: US$ 1,700/oz Au, US$ 1.50/t mining, US$ 2.00/t processing, US$ 2.50 G&A, 90% recovery and 45° pit slope.

The Mineral Resources are presented at various gold-grade cut-offs for each domain and for the entire Raven deposit below in Tables 2 through 4.

Table 2: Pit-Constrained Inferred Mineral Resources Massive Sulphide Veins – Raven Deposit

| Au Cut-Off | Tonnage | Avg Au Grade | Au Content |

| g/t | tonnes | g/t | oz |

| 0.30 | 18,601,644 | 1.63 | 976,626 |

| 0.35 | 17,581,942 | 1.71 | 965,485 |

| 0.40 | 16,782,742 | 1.77 | 956,131 |

| 0.45 | 16,037,440 | 1.84 | 946,155 |

| 0.50 | 15,390,060 | 1.89 | 936,165 |

| 0.55 | 14,775,490 | 1.95 | 925,859 |

| 0.60 | 14,042,379 | 2.02 | 911,975 |

| 0.65 | 13,326,222 | 2.10 | 897,598 |

| 0.70 | 12,671,963 | 2.17 | 883,679 |

Table 3: Pit-Constrained Inferred Mineral Resources Low-Grade Zone – Raven Deposit

| Au Cut-Off | Tonnage | Avg Au Grade | Au Content |

| g/t | tonnes | g/t | oz |

| 0.30 | 8,652,829 | 0.66 | 184,165 |

| 0.35 | 7,022,610 | 0.74 | 167,305 |

| 0.40 | 6,092,015 | 0.80 | 156,103 |

| 0.45 | 5,270,727 | 0.86 | 144,886 |

| 0.50 | 4,566,873 | 0.92 | 134,348 |

| 0.55 | 4,119,320 | 0.96 | 126,744 |

| 0.60 | 3,593,261 | 1.01 | 117,028 |

| 0.65 | 2,153,409 | 1.26 | 87,511 |

| 0.70 | 1,765,223 | 1.39 | 79,114 |

Table 4: Pit-Constrained Inferred Mineral Resources Massive Sulphide Veins + Low-Grade Zone – Raven Deposit

| Au Cut-Off | Tonnage | Avg Au Grade | Au Content |

| g/t | tonnes | g/t | oz |

| 0.30 | 27,254,472 | 1.32 | 1,160,157 |

| 0.35 | 24,604,552 | 1.43 | 1,132,790 |

| 0.40 | 22,874,757 | 1.51 | 1,111,986 |

| 0.45 | 21,308,166 | 1.59 | 1,090,637 |

| 0.50 | 19,956,934 | 1.67 | 1,070,239 |

| 0.55 | 18,894,809 | 1.73 | 1,052,159 |

| 0.60 | 17,635,639 | 1.82 | 1,029,103 |

| 0.65 | 15,479,632 | 1.98 | 985,410 |

| 0.70 | 14,437,186 | 2.07 | 962,681 |

Notes:

- The effective date for the Mineral Resource is September 15, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.50 g/t Au, within a Lerchs-Grossman pit shell using a gold price of US$1,700/ounce and a US$/CAN$ exchange rate of 0.75.

2022 Exploration Update

Victoria initiated its 2022 Dublin Gulch exploration program in late-May and currently has four drills on site with over 20,000m of drilling in 76 holes completed to date. This campaign is heavily focused on Raven where the footprint of mineralized intercepts has been extended approximately 325m east of the extents defined by the 2021 drilling.

Qualified Person

The Mineral Resource Estimate was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of National Instrument 43-101 (“NI 43-101”) and Mr. Jutras has approved the disclosure herein.

Quality Assurance, Quality Control Measures and Data Verification

All reported analytical work was conducted using industry standard procedures, including quality assurance/quality control (“QA/QC”) programs which utilized the inclusion of certified standards duplicates and blanks into the Raven sample stream with analyses conducted by certified independent analytical laboratories for all diamond drill and surface trench assays. The qualified persons detected no significant QA/QC issues during review of the data.

A comprehensive system of standards, duplicates and analytical blanks, was applied in all Victoria drilling programs and resultant data was monitored as chemical assay data were received. All control samples were within accuracy and precision thresholds required to meet data quality standards. Control samples represented approximately 10% of samples submitted to analytical laboratories.

All geological data in the Raven MRE was verified by Ginto Consulting Inc. (“Ginto”), to the extent possible, as accurate and all geological information was reviewed and confirmed. Ginto conducted site visits to Raven in 2018, 2020 and 2021, where Victoria’s drilling, logging, sampling, shipment and core preservation procedures were observed; additionally, during these visits drill core was physically inspected. Ginto confirms that Victoria’ analytical sampling and QA/QC procedures provides adequate verification of the data and accepts exploration activities to have been conducted within accordance to the guidelines of NI 43-101.

Analytical Methods

All core samples were split on-site at Victoria’s core processing facilities. Once split, half samples were placed into core boxes with the remaining half sealed in sample bags after one part of a three-part sample tag was inserted into the bags containing the specific sample. Samples were delivered by Victoria staff, or a dedicated expediter, to an ISO compliant preparatory laboratory where samples were prepared and then shipped to an analytical laboratory for pulverization and final chemical analysis.

About Raven

Raven represents a potentially high-grade, on-surface gold deposit that lies at the extreme Southeast contact of the Nugget intrusive stock with the surrounding Hyland Group metasedimentary package. This large, approximately 3km by 2km, medium to coarse grained granodiorite stock of Cretaceous age represents the second largest intrusive body on the Dublin Gulch property (second only the Dublin Gulch stock that hosts the Eagle Gold Mine). The Nugget stock is highly prospective to host Eagle-style sheeted vein mineralization, and the vast majority of the > 5 square km stock remains untested.

Drilling at Raven from the 2018 through 2021 field seasons have repeatedly returned high-grade gold intersections accompanied by prolific visible gold occurrences along a major and consistently mineralized shear-zone corridor which has grown from an area covered only by the initial 2018 trenches to 1.2km after drilling in 2021 and remains open for expansion.

About the Dublin Gulch Property

Victoria Gold's 100%-owned Dublin Gulch gold property (the “Property”) is situated in central Yukon Territory, Canada, approximately 375 kilometers north of the capital city of Whitehorse, and approximately 85 kilometers from the town of Mayo. The Property is accessible by road year-round, and is located within Yukon Energy's electrical grid. The Property covers an area of approximately 555 square kilometers, and is the site of the Company's Eagle Gold Mine.

Cautionary Language and Forward-Looking Statements

This press release includes certain statements that may be deemed "forward-looking statements". Except for statements of historical fact relating to Victoria, information contained herein constitutes forward-looking information, including any information related to Victoria's strategy, plans or future financial or operating performance. Forward-looking information is characterized by words such as “plan”, “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may”, “will”, “could” or “should” occur, and includes any guidance and forecasts set out herein (including, but not limited to, production and operational guidance of the Corporation). In order to give such forward-looking information, the Corporation has made certain assumptions about the its business, operations, the economy and the mineral exploration industry in general, in particular in light of the impact of the novel coronavirus and the COVID-19 disease (“COVID-19”) on each of the foregoing. In this respect, the Corporation has assumed that production levels will remain consistent with management’s expectations, contracted parties provide goods and services on agreed timeframes, equipment works as anticipated, required regulatory approvals are received, no unusual geological or technical problems occur, no material adverse change in the price of gold occurs and no significant events occur outside of the Corporation's normal course of business. Forward-looking information is based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those described in, or implied by, the forward-looking information. These factors include the impact of general business and economic conditions, risks related to COVID-19 on the Company, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, anticipated metal production, fluctuating metal prices, currency exchange rates, estimated ore grades, possible variations in ore grade or recovery rates, changes in accounting policies, changes in Victoria's corporate resources, changes in project parameters as plans continue to be refined, changes in development and production time frames, the possibility of cost overruns or unanticipated costs and expenses, uncertainty of mineral reserve and mineral resource estimates, higher prices for fuel, steel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, final pricing for metal sales, unanticipated results of future studies, seasonality and unanticipated weather changes, costs and timing of the development of new deposits, success of exploration activities, requirements for additional capital, permitting time lines, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage and timing and possible outcomes of pending litigation and labour disputes, risks related to remote operations and the availability of adequate infrastructure, fluctuations in price and availability of energy and other inputs necessary for mining operations. Although Victoria has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in, or implied by, the forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding Victoria's expected financial and operational performance and Victoria's plans and objectives and may not be appropriate for other purposes. All forward-looking information contained herein is given as of the date hereof, as the case may be, and is based upon the opinions and estimates of management and information available to management of the Corporation as at the date hereof. The Corporation undertakes no obligation to update or revise the forward-looking information contained herein and the documents incorporated by reference herein, whether as a result of new information, future events or otherwise, except as required by applicable laws.

For Further Information Contact:

John McConnell President & CEO

Victoria Gold Corp.

Tel: 604-696-6605

ceo@vgcx.com