Vista Gold Announces Feasibility Study Delivering 7 Million Ounce Gold Reserve Underpinning Large-Scale Production at High Operating Margins over a 16-Year Mine Life

Vista Gold Corp. (“Vista” or the “Company”) (NYSE American and TSX: VGZ) today announced the results of the feasibility study (the “FS”) for its 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) in the Northern Territory, Australia (“NT”). Gold reserves increased 19% to 6.98 million ounces resulting in average annual production of 479,000 ounces of gold during the first seven years of commercial operations. With economics based on Q4 2021 costs, the Project is projected to deliver compelling cashflows over a 16-year mine life.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220207006009/en/

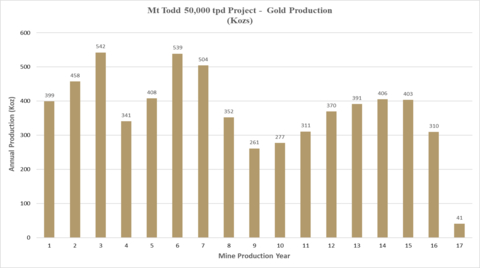

Mt Todd Gold Production (Graphic: Business Wire)

Highlights of the FS for a 50,000 tonne per day (“tpd”) project include:

- After-tax NPV5% of $999.5 million and IRR of 20.6% at a $1,600 gold price and a $0.71 Fx rate(1);

- After-tax NPV5% of $1.5 billion and IRR of 26.7% at a $1,800 gold price and $0.71 Fx rate;

- After-tax cash flow at a $1,800 gold price of $2.1 billion for years 1-7 of commercial operations;

- 19% increase in proven and probable mineral reserves, now estimated to be 6.98 million ounces of gold (280.4 million tonnes at 0.77 grams of gold per tonne (“g Au/t”)) at a cut-off grade of 0.35 g Au/t; life of mine grade to the grinding circuit after ore sorting of 0.84 grams of gold per tonne;

- Average annual life of mine production of 395,000 ounces, including average annual production of 479,000 ounces of gold during the first seven years of commercial operations;

- Life of mine average gold recovery of 91.6%;

- Average cash costs of $817 per ounce (life of mine), including average cash costs of $752 per ounce during the first seven years of commercial operations(2);

- Average all-in sustaining cost (“AISC”) of $928 per ounce (life of mine), including average AISC of $860 per ounce during the first seven years of commercial operations;

- Mine life of 16 years (increase of 3 years); and

- Initial capital requirements of $892 million (8% increase), which reflects the use of a third-party owner/operator of the power plant.

(1) |

All dollar amounts stated herein are in U.S. currency and are expressed as $ unless specified otherwise. All foreign exchange (“Fx") rates are in U.S. dollars per Australian dollar. |

(2) |

Cash costs per ounce and AISC per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to U.S. GAAP measures. |

Vista’s President and CEO, Frederick H. Earnest, commented, “The FS affirms the strength of Mt Todd’s gold production capacity and ability to deliver solid economic results at a time when inflationary pressures are having significant impacts on operating mines and development projects alike. Completion of the FS represents another major step in de-risking Mt Todd and readying the Project for development. The scale, quality of work completed and location of Mt Todd, together with the completion of the FS and the fact that all major authorizations for development have been obtained, distinguish Mt Todd as a unique development opportunity. We believe the results of the FS will appeal to many potential partners, investors and lenders and allow us to evaluate a broad range of development alternatives as we continue to focus on maximizing shareholder value. (CEO Video)

With Q4 2021 costs, the FS reflects the inflationary pressures being faced currently by all operators in the mining industry. While we believe this inflationary trend is transitory, the resilience of Mt Todd is amply demonstrated by the robust project economics reflected in the FS. Mt Todd’s attributes, together with the deep understanding of the various Project components create valuable optionality in the approach to its development.

Mt Todd’s economic returns benefit from the increase in the gold reserve estimate, favorable results of the power plant trade-off study and slightly lower energy costs in the NT. In view of the current gold price, we increased the gold price used in the reserve estimate from $1,000 to $1,125 and changed the cut-off grade from 0.40 g Au/t to 0.35 g Au/t. These changes, while very conservative, significantly increased the reserve estimate from 5.85 million ounces to 6.98 million ounces. Our power plant trade-off study identified a number of highly-credentialled, well-capitalized power generating companies. Our decision to use a third-party power provider has resulted in important positive impacts to our capital costs and insulates the Project from certain construction and operating risks while maintaining what we believe to be attractive operating costs. While our operating costs have increased as a result of higher labor, reagent, grinding media and over-the-fence power costs, our core energy costs yield some offsetting savings.

In addition to securing the approval of the Mining Management Plan since our last technical report, we have modernized our agreement with the Jawoyn Aboriginal Association Corporation (the “Jawoyn”). We continue to enjoy a close working relationship and their strong support for the Project. The economic returns reflect the increased royalty to the Jawoyn (in lieu of the previous right to a 10% direct Project ownership) as reported in November 2020.”

Mr. Earnest concluded, “Our attention will now focus more intensely on increasing shareholder value and the realization of the intrinsic value of Mt Todd. We believe Mt Todd’s location, scale, economics, permitting status, and extensive technical work represent a unique near-term development opportunity and allow us to evaluate a broad range of development partners, structures and alternatives as we continue to focus on maximizing shareholder value.”

Sabry Abdel Hafez, Ph.D., P.Eng., Rex Bryan, Ph.D., Amy Hudson, Ph.D, CPG, SME REM, April Hussey, P.E., Chris Johns, M.Sc., P.Eng., Max Johnson, P.E., , Vicki Scharnhorst, P.E., and Keith Thompson, CPG, member AIPG, on behalf of Tetra Tech, Thomas Dyer, P.E., SME REM, on behalf of Respec, Dr. Deepak Malhotra, Ph.D., SME REM on behalf of Pro Solv, LLC, Zvonimir Ponos, BE, MIEAust, CPeng, NER on behalf of Tetra Tech Proteus, are each a Qualified Person as defined under subpart 1300 of Regulation S-K under the United States Securities Exchange Act of 1934, as amended (“S-K 1300”) and an independent Qualified Person as defined by Canadian National Instrument 43-101 – Standards of Disclosure of Mineral Projects (“NI 43-101”), and prepared or supervised the preparation of the information that forms the basis for the scientific and technical information disclosed herein and have reviewed this press release and consented to its release. Dr. Deepak Malhotra has verified the metallurgical testing program and data in respect of the process improvements. For additional information applicable to the FS, including data verification, quality assurance and control, and key assumptions; and for other matters relating to the Project, see Vista’s most recent Annual Report Form 10-K as filed on EDGAR at www.sec.gov/edgar.shtml and on SEDAR at www.sedar.com.

Overview

The technical aspects of the FS are underpinned by extensive metallurgical testing and stringent design criteria that continue to reflect Vista’s rigorous approach to ensuring Mt Todd will meet design and operating specifications. This includes utilizing modern, proven technologies and oversizing processing equipment to best ensure throughput capacity. The FS also incorporates provisions of the recently approved Mt Todd Mine Management Plan, which will subsequently be amended to align with design changes in the FS.

A summary of the FS results is presented in the table below.

| 50,000 tpd Project (1) | Years 1-7 (2) |

Life of Mine (3) |

(16 years) |

||

| Average Plant Feed Grade (g Au/t) (4) | 1.01 |

0.84 |

| Average Annual Gold Production (koz) | 479 |

395 |

| Average Recovery (%) | 92.2% |

91.6% |

| Total Payable Gold (koz) | 3,353 |

6,313 |

| Cash Costs ($/oz) (5) | $752 |

$817 |

| AISC ($/oz) (5) | $860 |

$928 |

| Strip Ratio (waste:ore) | 2.77 |

2.51 |

| Initial Capital (millions) |

|

$892 |

| After-tax Payback (months) |

|

47 |

| After-tax NPV5% (millions) |

|

$999.5 |

| IRR (after-tax) |

|

20.6% |

(1) |

Economics presented using $1,600/oz gold and a $0.71 Fx rate. |

(2) |

Years 1 - 7 start after the 6 month commissioning and ramp up period. |

(3) |

Life of Mine is from start of commissioning and ramp up through final closure. |

(4) |

Post-sorted grinding circuit feed grade (g Au/t). |

(5) |

Cash costs per ounce and AISC per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to U.S. GAAP measures. |

Sensitivity Analysis

The following table provides additional details of the Project’s after-tax economics at variable gold prices and exchange rate assumptions. The Project economics are robust at the FS gold price of $1,600 per ounce and an Fx rate of $0.71 and even more compelling at today’s market conditions. Using a gold price of $1,800 per ounce and an Fx rate of $0.71, the after-tax NPV5% is $1.5 billion and the IRR is 26.7%. For every $100 increase in gold price, the Project NPV5% increases by approximately $230 million.

Gold Price |

$1,300 |

$1,400 |

$1,500 |

$1600 |

$1,700 |

$1,800 |

$1,900 |

|||||||

FX Rate |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

0.74 |

$214 |

8.6 |

$453 |

12.4 |

$674 |

15.7 |

$911 |

19.0 |

$1,144 |

22.1 |

$1,372 |

25.0 |

$1,589 |

27.7 |

0.71 |

$304 |

10.2 |

$541 |

14.0 |

$762 |

17.3 |

$999.5 |

20.6 |

$1,229 |

23.7 |

$1,458 |

26.7 |

$1,674 |

29.4 |

0.68 |

$393 |

11.9 |

$626 |

15.6 |

$851 |

19.0 |

$1,085 |

22.3 |

$1,313 |

25.7 |

$1,543 |

28.5 |

$1,758 |

31.3 |

Note: NPV5% values in $ millions. Changes in Fx rates are only applied to operating costs and not applied to either initial or sustaining capital costs.

Capital Costs

Management placed a high priority on controlling capital costs while maintaining the operating cost benefits of a large-scale project. Initial capital costs increased 8% and benefited from savings associated with a favorable trade-off study that supports using a third-party power provider to build, own and operate the power plant at only modestly higher power costs to the Project.

Capital expenditures for initial and sustaining capital requirements are summarized in the following table.

Capital Expenditures 50,000 tpd Project |

Initial Capital ($ millions) |

Sustaining Capital ($ millions) |

||||

| Mining | $ |

81 |

$ |

531 |

||

| Process Plant | $ |

474 |

$ |

28 |

|

|

| Project Services | $ |

56 |

$ |

89 |

|

|

| Project Infrastructure | $ |

45 |

$ |

8 |

|

|

| Site Establishment & Early Works | $ |

24 |

$ |

0 |

|

|

| Management, Engineering, EPCM Services | $ |

100 |

$ |

0 |

|

|

| Preproduction Costs | $ |

27 |

$ |

0 |

|

|

| Contingency | $ |

86 |

$ |

44 |

|

|

| Sub-Total | $ |

892 |

$ |

700 |

|

|

| Asset Sale and Salvage | $ |

0 |

$ |

(37 |

) |

|

| Total Capital | $ |

892 |

$ |

663 |

|

|

| Total Capital Per Payable ounce gold | $ |

141 |

$ |

105 |

|

|

Note: Components may not add to totals due to rounding.

Operating Costs

Operating costs continue to benefit from the economies of scale associated with a 50,000 tonne per day process plant, a low 2.5:1 stripping ratio (unchanged from the last technical report), and a locally-based labor force. Operating costs were impacted by the additional royalty granted to the Jawoyn in exchange for their prior right to a 10% participating interest in the Project.

| 50,000 tpd Project | Years 1-7 | Years 8-14 | Life of Mine Cost | |||

| Operating Cost | Per tonne processed | Per ounce | Per tonne processed | Per ounce | Per tonne processed | Per ounce |

| Mining | $8.52 |

$315.97 |

$6.14 |

$323.60 |

$6.79 |

$301.55 |

| Processing | $9.39 |

$348.23 |

$9.38 |

$494.68 |

$9.44 |

$419.35 |

| Site General and Administrative | $1.06 |

$39.19 |

$0.94 |

$49.61 |

$0.99 |

$44.04 |

| Water Treatment | $0.26 |

$9.81 |

$0.24 |

$12.91 |

$0.29 |

$13.10 |

| Tailings Management | $0.08 |

$3.10 |

$0.08 |

$4.41 |

$0.08 |

$3.74 |

| Refining | $0.09 |

$3.45 |

$0.07 |

$3.50 |

$0.08 |

$3.48 |

| Jawoyn Royalty | $0.86 |

$32.00 |

$0.61 |

$32.00 |

$0.72 |

$32.00 |

| Total Cash Costs (1) | $20.28 |

$751.75 |

$17.47 |

$920.71 |

$18.40 |

$817.25 |

Note: Jawoyn royalty and refinery costs calculated at $1,600 per ounce gold and $0.71 exchange rate. May not add to totals due to rounding.

(1) |

Cash costs per tonne processed and cash costs per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to U.S. GAAP measures. |

Mining and Production

The mine plan contemplates that 280.4 million tonnes of ore, containing an estimated 6.98 million ounces of gold at an average grade of 0.77 g Au/t, will be processed over the life of the Project. Total recovered gold is expected to be 6.31 million ounces with average annual gold production expected to be 395,000 ounces. Average annual production over the first seven years of commercial operations is expected to be 479,000 ounces. The Company expects commercial production to commence after two years of construction and six months of commissioning and ramp-up.

The table below highlights the FS production schedule. The shaded portion of the table demonstrates the benefit of sorting that reduces the tonnage processed by 10%, increases the processed grade by a similar percentage, and results in cost savings for grinding, leaching and tailings handling.

Years |

Pit Ore Mined (kt) |

Waste Mined (kt) |

Ore Crushed (kt) |

Crushed Grade (g/t) |

Contained Ounces (kozs) |

Ore to CIP (Post Sorting) (kt) |

CIP Grade (g/t) |

Contained Ounces (kozs) |

Gold Produced (kozs) |

Recovery (%) |

-1 |

7,188 |

14,066 |

0 |

0 |

0 |

0 |

0.00 |

0 |

0 |

0 |

1(*) |

18,216 |

25,904 |

12,334 |

1.10 |

436 |

11,100 |

1.21 |

431 |

399 |

92.6% |

2 |

30,578 |

38,623 |

17,750 |

0.88 |

503 |

15,975 |

0.97 |

497 |

458 |

92.1% |

3 |

19,696 |

63,199 |

17,750 |

1.04 |

594 |

15,975 |

1.14 |

587 |

542 |

92.5% |

4 |

15,218 |

69,774 |

17,799 |

0.66 |

378 |

16,019 |

0.73 |

373 |

341 |

91.3% |

5 |

27,591 |

66,264 |

17,750 |

0.79 |

451 |

15,975 |

0.87 |

445 |

408 |

91.7% |

6 |

25,499 |

74,510 |

17,823 |

1.03 |

591 |

16,041 |

1.13 |

583 |

539 |

92.4% |

7 |

13,229 |

77,291 |

17,750 |

0.97 |

554 |

15,975 |

1.06 |

546 |

504 |

92.3% |

8 |

7,779 |

71,277 |

17,774 |

0.69 |

392 |

15,997 |

0.75 |

386 |

352 |

91.2% |

9 |

13,866 |

59,499 |

17,774 |

0.52 |

295 |

15,997 |

0.57 |

291 |

261 |

89.8% |

10 |

14,523 |

50,082 |

17,750 |

0.55 |

312 |

15,975 |

0.60 |

308 |

277 |

90.1% |

11 |

20,830 |

40,490 |

17,750 |

0.61 |

347 |

15,975 |

0.67 |

343 |

311 |

90.7% |

12 |

18,523 |

13,685 |

17,774 |

0.72 |

410 |

15,997 |

0.79 |

404 |

370 |

91.4% |

13 |

11,307 |

4,388 |

17,774 |

0.76 |

433 |

15,997 |

0.83 |

428 |

391 |

91.6% |

14 |

13,829 |

1,866 |

17,750 |

0.79 |

448 |

15,975 |

0.86 |

442 |

406 |

91.7% |

15 |

9,149 |

412 |

17,750 |

0.78 |

446 |

16,120 |

0.85 |

440 |

403 |

91.6% |

16 (1) |

0 |

0 |

16,710 |

0.64 |

344 |

15,968 |

0.66 |

341 |

310 |

90.7% |

17 (1) |

0 |

0 |

2,612 |

0.54 |

45 |

2,612 |

0.54 |

45 |

41 |

89.8% |

Total (2) |

267,021 |

671,331 |

280,375 |

0.77 |

6,979 |

253,673 |

0.84 |

6,891 |

6,313 |

91.6% |

(*) |

|

Six months commissioning and ramp-up period ahead of full production. |

(1) |

|

Years 16 and 17 process Heap Leach ore after the pit ore is exhausted. |

(2) |

|

Components may not add to totals due to rounding. |

As demonstrated in the accompanying chart, the 19% increase in gold reserves sustains a strong production profile over the first seven years with an average of 479,000 ounces of gold per year. The Project also benefits from three additional years of mine life. This reserve growth successfully offsets much of the inflationary pressure on capital and operating costs currently affecting the entire mining sector. The Company believes resource conversion and exploration during the early years of the Project will contribute to improved gold production in years 9 through 11 and further extend the life of the Project.

Mineral Resources and Mineral Reserves

The tables below present the estimated mineral resources and mineral reserves for the Project. The effective date of the mineral resources and mineral reserves estimates is December 31, 2021. The following mineral resources and mineral reserves were prepared in accordance with both S-K 1300 standards and Canadian Institute of Mining, Metallurgical and Petroleum definition standards.

| Mt Todd Gold Project - Mineral Resources | ||||||||||||

| Batman Deposit | Heap Leach Pad | Quigleys Deposit | Total | |||||||||

|

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

| (000s) | (g/t) | (000s) | (g/t) | (000s) | (g/t) | (000s) | (g/t) | |||||

| Measured (M) | 77,725 |

0.88 |

2,191 |

- |

- |

- |

594 |

1.15 |

22 |

78,319 |

0.88 |

2,213 |

| Indicated (I) | 200,112 |

0.80 |

5,169 |

13,354 |

0.54 |

232 |

7,301 |

1.11 |

260 |

220,767 |

0.80 |

5,661 |

| Measured & Indicated | 277,837 |

0.82 |

7,360 |

13,354 |

0.54 |

232 |

7,895 |

1.11 |

282 |

299,086 |

0.82 |

7,874 |

| Inferred (F) | 61,323 |

0.72 |

1,421 |

- |

- |

- |

3,981 |

1.46 |

187 |

65,304 |

0.77 |

1,608 |

Notes: |

||

1) |

|

Measured & Indicated Mineral Resources include Proven and Probable Reserves. |

2) |

|

Batman and Quigleys mineral resources are quoted at a 0.40g-Au/t cut-off grade. Heap Leach resources are the average grade of the heap, no cut-off applied. |

3) |

|

Batman: Mineral resources constrained within a $1,300/oz gold Whittle™ pit shell. Pit parameters: Mining Cost $1.50/tonne, Milling Cost $7.80/tonne processed, G&A Cost $0.46/tonne processed, G&A/Year 8,201 K US4, Au Recovery, Sulfide 85%, Transition 80%, Oxide 80%, 0.2g-Au/t minimum for resource shell. |

4) |

|

Quigleys: Resources constrained within a $1,300/oz gold Whittle™ pit shell. Pit parameters: Mining cost $1.90/tonne, Processing Cost $9.779/tonne processed, Royalty 1% GPR, Gold Recovery Sulfide, 82.0% and Ox/Trans 78.0%, water treatment $0.09/tonne, Tailings $0.985/tonne. |

5) |

|

Differences in the table due to rounding are not considered material. Differences between Batman and Quigleys mining and metallurgical parameters are due to their individual geologic and engineering characteristics. |

6) |

|

Rex Bryan of Tetra Tech is the QP responsible for the Statement of Mineral Resources for the Batman, Heap Leach Pad and Quigleys deposits. |

7) |

|

Thomas Dyer of RESPEC is the QP responsible for developing the resource Whittle™ pit shell for the Batman Deposit. |

8) |

|

The effective date of the Heap Leach, Batman and Quigleys resource estimate is December 31, 2021. |

9) |

|

Mineral resources that are not mineral reserves have no demonstrated economic viability and do not meet all relevant modifying factors. |

| Mt Todd Gold Project - Mineral Reserves - 50,000 tpd, 0.35g Au/t cutoff and US$1,125 per ounce LG Pit | |||||||||

| Batman Deposit | Heap Leach Pad | Total P&P | |||||||

|

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

| Proven | 81,277 |

0.84 |

2,192 |

- |

- |

- |

81,277 |

0.84 |

2,192 |

| Probable | 185,744 |

0.76 |

4,555 |

13,354 |

0.54 |

232 |

199,098 |

0.75 |

4,787 |

| Proven & Probable | 267,021 |

0.79 |

6,747 |

13,354 |

0.54 |

232 |

280,375 |

0.77 |

6,979 |

| Notes: | ||

1) |

|

Thomas L. Dyer, P.E., is the QP responsible for reporting the Batman Deposit Proven and Probable Mineral Reserves. |

2) |

|

Batman deposit mineral reserves are reported using a 0.35 g Au/t cutoff grade. |

3) |

|

Deepak Malhotra is the QP responsible for reporting the heap-leach pad mineral reserves. |

4) |

|

Because all the heap-leach pad reserves are to be fed through the mill, these mineral reserves are reported without a cutoff grade applied. |

5) |

|

The mineral reserves point of reference is the point where material is fed into the mill. |

6) |

|

The effective date of the mineral reserve estimates is December 31, 2021. |

Project Description

Gold mineralization in the Batman Deposit occurs in sheeted veins within silicified greywackes/shales/siltstones. The Batman deposit strikes north-northeast and dips steeply to the east. Higher grade zones of the deposit plunge to the south. The core zone is approximately 200-250 meters wide and 1.5 kilometers long, with several hanging wall structures providing additional width to the deposit. Mineralization is open at depth as well as along strike, although the intensity of mineralization weakens to the north and south along strike.

The Project is designed to be a conventional, owner-operated, open-pit mining operation that will utilize large-scale mining equipment in a drill/blast/load/haul operation. The Company continues to evaluate the potential use of contract mining and/or autonomous truck haulage. Ore is planned to be processed in a comminution circuit consisting of a gyratory crusher, two cone crushers, two high pressure grinding roll crushers with primary grinding by two ball mills and secondary grinding by 10 FLSmidth VXP mills. Vista plans to recover gold in a conventional carbon-in-pulp recovery circuit.

Opportunities for Adding Value

Additional resources are predominantly at depth and lateral along strike. A portion of the Inferred Mineral Resources are contained within the existing pit design and are currently included in the mine plan as waste material. Potential to convert part of the mineral resources to mineral reserves represents an opportunity to improve existing LOM economics and extend mine life.

The Company also has known mineral resources at the Quigleys Deposit, which is close to the planned processing plant. The estimated grade of the Quigleys Deposit is higher than the estimated average grade of the Batman Deposit and could provide a source of higher-grade feed in the mid years of the Project when the average grade of feed to the plant is expected to decrease. Additional drilling and metallurgical testing are required to develop mine plans and ultimately establish proven and probable mineral reserves at the Quigleys deposit.

Growth through exploration represents additional opportunity to add value at Mt Todd. Both the Batman Deposit and Quigleys Deposit remain open. Recent drilling demonstrates the continuity of mineralization between these two deposits. In addition, Vista controls over 1,500 sq. km of contiguous exploration licenses at the southeast end of the Pine Creek Mining District. Various gold targets have been identified through early-stage, grass roots exploration programs along the Cullen-Australis and Batman-Driffield structural corridors, the latter of which is the host to the Batman Deposit. To-date, Vista’s exploration efforts have primarily focused on the Batman Deposit.

The FS uses a natural gas price comparable to other facilities that self-generate power in the NT. Due to the location of the Project and its close proximity to the main NT natural gas transmission line, the Company believes that there is significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract. This belief is in part based on local expectations of significantly increased gas reserves in the Beetaloo Basin south of Mt Todd.

Conference Call Details

A conference call and webcast to discuss highlights of the FS will be held Wednesday, February 9, 2022 at 4:00 p.m. EDT (2:00 p.m. MDT).

Toll-free in North America: 844-898-8648

International: 647-689-4225

Confirmation Code: 5074108

To participate in the webcast and view the slide presentation, please follow the steps below at least 15 minutes prior to the start time:

Step 1 – Registration Page:

https://onlinexperiences.com/Launch/QReg/ShowUUID=803ED6AB-ABDC-4C7F-B282-A98D4DCB25D7

Step 2 – Login Page:

https://onlinexperiences.com/Launch/Event/ShowKey=187237

This call will be archived and available at www.vistagold.com after February 9, 2022. Audio replay will be available for 14 days by calling toll-free in North America: 855-859-2056 or (404) 537-3406.

Detailed Report

A technical report for the FS prepared in accordance with NI 43-101 disclosure standards will be filed on SEDAR and a technical report summary prepared in accordance with S-K 1300 will be filed on EDGAR with our annual report on Form 10-K, in each case, within 45 days of the date hereof and will be available on our website at that time.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia. All major environmental permits have now been approved. The recently approved Mine Management Plan will be amended to align with the design changes in the FS.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

For more information about our projects, including technical studies and mineral resource estimates, please visit our website at www.vistagold.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that Vista expects or anticipates will or may occur in the future, including such things as, the Company’s anticipated plans for the Project, including finding potential development alternatives and the Company’s focus on maximizing shareholder value and the realization of the intrinsic value of Mt Todd; our belief that Mt Todd’s location, scale, economics, permitting status, coupled with extensive technical work represent a unique near-term development opportunity; the results of the FS will appeal to many potential partners, investors and lenders; estimates of mineral reserves and resources; projected Project economics, including anticipated production, average cash costs, before and after-tax NPV, IRR, capital requirements and expenditures, gold recovery after-tax payback, operating costs, average tonne per day milling, mining methods procedures, estimated gold recovery, Project design, and life of mine; that the Project is an advanced stage development project; average annual production overtime; commencement of commercial production; timing for construction and commissioning; exploration of new deposits at Mt Todd and the surrounding exploration areas; ore processing plans; our belief that resource conversion and exploration during the early years of the Project will contribute to improved gold production in years 9 through 11 and further extend the mine life; potential costs or savings related to gas price; ability to convert estimated mineral resources to proven or probable mineral reserves; the estimated grade of minerals at the Quigleys deposit; ability to add higher grade feed from the Quigleys deposit to the Project in its mid years; our belief that there is a significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract; timing for and completion of the NI 43-101 technical report and the S-K 1300 technical report summary for the FS; and other such matters are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: the accuracy of the results of the FS, mineral resource and reserve estimates, and exploration and assay results; the terms and conditions of our agreements with contractors and our approved business plan; the anticipated receipt of required permits; no change in laws that materially impact mining development or operations of a mining business; the potential occurrence and timing of a production decision; the anticipated gold production at the Project; the life of any mine at the Project; local expectations of significantly increased gas reserves in the Beetaloo Basin; all economic projections relating to the Project, including estimated cash cost, NPV, IRR, and initial capital requirements; and Vista’s goal of becoming a gold producer. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “plans,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Vista to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of mineral resource estimates, estimates of results based on such mineral resource estimates; risks relating to cost increases for capital and operating costs; risks related to the timing and the ability to obtain the necessary permits, risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on Vista’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in Vista’s most recent Annual Report Form 10-K as filed on EDGAR at www.sec.gov/edgar.shtml and on SEDAR at www.sedar.com. Although Vista has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, Vista assumes no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Note Regarding Non-GAAP Financial Measures

In this press release, we have provided information prepared or calculated according to non-U.S. GAAP prospective financial performance measures. Because the non-U.S. GAAP performance measures do not have standardized meanings prescribed by U.S. GAAP, they may not be comparable to similar measures presented by other companies. These measures should not be considered in isolation or as substitutes for measures of performance prepared in accordance with U.S. GAAP. There are limitations associated with the use of such non-U.S. GAAP measures. Since these measures do not incorporate revenues, changes in working capital and non-operating cash costs, they are not necessarily indicative of potential operating profit or loss, or cash flow from operations as determined in accordance with U.S. GAAP.

The non-U.S. GAAP measures associated with Cash Operating Costs, Cash Costs, AISC and resulting per ounce and per tonne processed metrics are not, and are not intended to be, presentations in accordance with U.S. GAAP. These measures represent costs and unit-cost measured related to the Project.

We believe that these metrics help investors understand the economics of the Project. We present the non-U.S. GAAP financial measures for our Project in the tables below. Actual U.S. GAAP results will vary from the amounts disclosed in this news release. Other companies may calculate these measures differently.

Cash Operating Costs, Cash Costs, AISC and Respective Unit Cost Measures

Cash Operating Costs is a non-U.S. GAAP metric used by the Company to measure aggregate costs of operations that will generally be within the Company’s direct control. We believe this metric reflects the operating performance potential for Mt Todd for the mining, processing, administration, and sales functions. Contractual obligations for surface land rights (the Jawoyn Royalty) are excluded from this metric.

Cash Costs and AISC are non-U.S. GAAP metrics developed by the World Gold Council to provide transparency into the costs associated with producing gold and provide a comparable standard. The Company reports Cash Costs and AISC on a per ounce and per tonne processed basis because we believe these metrics more completely reflect mining costs over specified periods and the life of mine. Similar metrics are widely used in the gold mining industry as comparative benchmarks of performance.

Cash Operating Costs consist of Project operating costs and refining costs, and exclude the Jawoyn royalty. Cash Operating Costs are presented by year in the operating margin summary.

Cash Costs consist of Cash Operating Costs (as described above), plus the Jawoyn royalty. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively.

AISC consists of Cash Costs (as described above), plus sustaining capital costs. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively.

Other costs excluded from Cash Operating Costs, Cash Costs, and AISC include depreciation and amortization, income taxes, government royalties, financing charges, costs related to business combinations, asset acquisitions other than sustaining capital, and asset dispositions.

The following tables demonstrate the calculation of Cash Operating Costs, Cash Costs, AISC, and related unit-cost metrics for amounts presented in this press release.

| Units | Years 1-7* | Life of Mine | |

| Payable Gold | koz | 3,353 |

6,313 |

| Operating Costs | $ Millions | $2,402 |

$4,936 |

| Refining Cost | $ Millions | 12 |

22 |

| Cash Operating Costs | $ Millions | 2,413 |

4,958 |

| Jawoyn Royalty | $ Millions | 107 |

202 |

| Cash Costs | $ Millions | $2,521 |

$5,160 |

| Cash Cost per ounce | $/oz | $752 |

$817 |

| Sustaining Capital | $ Millions | 363 |

700 |

| All-In-Sustaining Costs | $ Millions | $2,884 |

$5,860 |

| AISC per ounce | $/oz | $860 |

$928 |

Note: Amounts may not add to totals due to rounding. |

* Years 1-7 start after the 6-month commissioning and ramp up period. |

| Units | Years 1-7* | Years 8-14* | Life of Mine | |

| Payable Gold | koz | 3,353 |

2,359 |

6,313 |

| Tonnes processed | kt | 124,298 |

124,347 |

280,375 |

| Mining Costs | $ Millions | $1,059 |

$763 |

$1,904 |

| Processing Costs | $ Millions | 1,167 |

1,167 |

2,648 |

| Site General and Administrative Costs | $ Millions | 131 |

117 |

278 |

| Water Treatment | $ Millions | 33 |

30 |

83 |

| Tailings Management | $ Millions | 11 |

10 |

24 |

| Operating Costs | $ Millions | 2,402 |

2,088 |

4,936 |

| Refining Cost | $ Millions | 12 |

8 |

22 |

| Cash Operating Costs | $ Millions | 2,413 |

2,096 |

4,958 |

| Jawoyn Royalty | $ Millions | 107 |

75 |

202 |

| Cash Costs | $ Millions | $2,521 |

$2,172 |

$5,160 |

| Per Payable Ounce: | ||||

| Mining Cost per ounce | $/oz | $315.97 |

$323.60 |

$301.55 |

| Processing Cost per ounce | $/oz | 348.23 |

494.68 |

419.35 |

| Site General and Administrative Costs per ounce | $/oz | 39.19 |

49.61 |

44.04 |

| Water Treatment per ounce | $/oz | 9.81 |

12.91 |

13.10 |

| Tailings Management per ounce | $/oz | 3.10 |

4.41 |

3.74 |

| Refining Cost per ounce | $/oz | 3.45 |

3.50 |

3.48 |

| Jawoyn Royalty per ounce | $/oz | 32.00 |

32.00 |

32.00 |

| Cash Cost per ounce | $/oz | $751.75 |

$920.71 |

$817.25 |

| Per Tonne Processed: | ||||

| Mining Cost per tonne processed | $/tonne | $8.52 |

$6.14 |

$6.79 |

| Processing Cost per tonne processed | $/tonne | 9.39 |

9.38 |

9.44 |

| Site General and Administrative Costs per tonne processed | $/tonne | 1.06 |

0.94 |

0.99 |

| Water Treatment per tonne processed | $/tonne | 0.26 |

0.24 |

0.29 |

| Tailings Management per tonne processed | $/tonne | 0.08 |

0.08 |

0.08 |

| Refining Cost per tonne processed | $/tonne | 0.09 |

0.07 |

0.08 |

| Jawoyn Royalty per tonne processed | $/tonne | 0.86 |

0.61 |

0.72 |

| Cash Cost per tonne processed | $/tonne | $20.28 |

$17.47 |

$18.40 |

Note: Amounts may not add to totals due to rounding. |

* Years 1-7 and 8-14 are measured after the start of the 6-month commissioning and ramp up period. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220207006009/en/