Vista Gold Corp. Announces 2019 Highlights and Financial Results

DENVER, Feb. 26, 2020 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced its audited financial results and highlights for the fiscal year ended December 31, 2019. Management’s quarterly conference call to discuss these results is scheduled for 2:30 p.m. MST on March 5, 2020. The Company’s consolidated audited financial statements and Management’s Discussion and Analysis together with other important disclosures can be found in the Company’s Annual Report on Form 10-K, filed with the U.S. Securities and Exchange Commission and the Canadian securities regulatory authorities.

Highlights for 2019

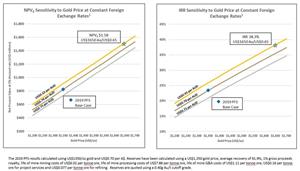

- Reported positive results for the updated October 2019 preliminary feasibility study (the “2019 PFS”) for the Mt Todd gold project (“Mt Todd” or the “Project”) with improved after-tax net present value at a 5% discount rate (“NPV5%”) of $823 million and internal rate of return (“IRR”) of 23.4% at a gold price of $1,350 per ounce and a $0.70=A$1.00 exchange rate and after-tax NPV5% of $1.5 billion and IRR of 38.3% at a gold price of $1,650 per ounce and a $0.65=A$1.00 exchange rate;

- Completed a comprehensive metallurgical optimization program that demonstrated improved life-of-mine gold recovery of 91.9% and total recovered gold of 5.3 million ounces(1);

- Completed an independent benchmarking study to assess the appropriateness of capital and operating cost estimates, construction and ramp-up schedules, owner’s costs and key components of the Project;

- Received $3.2 million cash in option payments and related fees from Prime Mining Corp. under the option agreement for the Company’s Los Reyes gold / silver project in Sinaloa, Mexico;

- Amended the Company’s royalty agreement for the Awak Mas gold project in Indonesia, pursuant to which PT Masmindo DWI Area has the option to cancel the 2% net smelter return (the “NSR”) royalty payable to Vista by making an initial payment of $100,000 and issuing 666,667 shares of Nusantara Resources Limited (received by Vista in November 2019), and making future payments to Vista in the amounts of $2.4 million payable April 30, 2020 and $2.5 million payable April 30, 2021, with each payment canceling 1% of the NSR royalty; and

- Strengthened Vista’s board of directors and senior management team with the appointments of Deborah Friedman as a Director, Doug Tobler as Chief Financial Officer, and Pamela Solly as Vice President of Investor Relations.

(1) The life of mine plan includes both proven and probable mineral reserves. See “Project Mineral Resources and Reserves” below for further information.

Frederick H. Earnest, President and Chief Executive Officer of Vista, stated, “During 2019 we achieved several significant milestones as we continued to advance and de-risk the Mt Todd gold project. We completed several major project initiatives highlighted by the 2019 PFS, generated cash of $3.3 million from non-dilutive financing opportunities, and strengthened our senior management team and board of directors with the appointments of several accomplished and experienced mining executives.

As part of our 2019 initiatives, we completed a comprehensive metallurgical optimization program, the 2019 PFS, and an independent benchmarking study. These initiatives, combined with other de-risking activities, demonstrate the robust economics and advanced stage of Mt Todd.

In 2020, our primary focus will be to secure a strategic partner for the development of Mt Todd. With the continued improvement in gold price, we are evaluating the positive impact of higher gold prices on mine plans and project economics. The following figures illustrate the Project’s after-tax economics at various gold price and exchange rate assumptions. We continue to de-risk Mt Todd in a cost-effective manner and work with NT Department of Primary Industries and Resources to receive authorization of the Mt Todd Mine Management Plan.”

A graph accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1c089604-2dec-46c3-b8a4-dbcf1e14e6e2

Summary of Financial Results

For the fiscal year ended December 31, 2019, Vista reported a net loss of $9.4 million, or $0.09 per share, compared to $8.7 million, or $0.09 per share for the fiscal year ended December 31, 2018. The loss for the fiscal year ended December 31, 2019 is comprised of $8.1 million of operating expenses and a $1.6 million mark-to-market loss on our investment in Midas Gold Corp., offset by other income of $0.3 million. The loss for the fiscal year ended December 31, 2018 is including $10.8 million of operating expenses and a $1.7 million mark-to-market gain on our investment in Midas Gold Corp., and other income of $0.4 million.

Working capital at December 31, 2019 was $7.8 million, including cash and short-term investments (comprised of government securities) of $4.7 million. Working capital at December 31, 2018 was $13.2 million, including cash and short-term investments (comprised of government securities) of $8.1 million. The Company has no debt.

Project Mineral Resources and Reserves

The table below presents the estimated mineral resources and reserves for the Project. The effective date of the Batman and Quigleys deposits mineral resource estimates is January 24, 2018. The effective date of the heap leach mineral resource estimate is July 9, 2014.

| Mt. Todd Gold Project Mineral Reserves – 50,000 tpd, 0.40 g Au/t cut-off and $1,250 per ounce gold | ||||||||||||

| Batman Deposit | Heap Leach Pad | Quigleys Deposit | Total | |||||||||

| Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | |

| Proven | 72,672 | 0.88 | 2,057 | - | - | - | - | - | - | 72,672 | 0.88 | 2,057 |

| Probable | 135,015 | 0.82 | 3,559 | 13,354 | 0.54 | 232 | - | - | - | 148,369 | 0.79 | 3,791 |

| Proven & Probable | 207,687 | 0.84 | 5,616 | 13,354 | 0.54 | 232 | - | - | - | 221,041 | 0.82 | 5,848 |

Note: Mineral reserves have been calculated using a US$1,350 gold price, average recovery of 91.9%, 1% gross proceeds royalty, life of mine mining costs of US$6.02 per tonne ore, life of mine processing costs of US$7.88 per tonne ore, life of mine general and administrative costs of US$1.11 per tonne ore, US$0.16 per tonne ore for project services and US$0.077 per tonne ore for refining. Mineral reserves are quoted using a 0.40g Au/t cutoff grade. Mineral reserves are estimated pursuant to Canadian disclosure standards and do not constitute mineral reserves under SEC Industry Guide 7 standards. See “Cautionary Note to United States Investors” below.

| Mt. Todd Gold Project Mineral Resources | ||||||||||||

| Batman Deposit | Heap Leach Pad | Quigleys Deposit | Total | |||||||||

| Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | Tonnes (000s) | Grade (g/t) | Contained Ounces (000s) | |

| Measured | 77,725 | 0.88 | 2,191 | - | - | - | 457 | 1.27 | 19 | 78,182 | 0.88 | 2,210 |

| Indicated | 200,112 | 0.80 | 5,169 | 13,354 | 0.54 | 232 | 5,743 | 1.12 | 207 | 219,209 | 0.80 | 5,608 |

| Measured & Indicated | 277,837 | 0.82 | 7,360 | 13,354 | 0.54 | 232 | 6,200 | 1.13 | 225 | 297,391 | 0.82 | 7,818 |

| Inferred | 61,323 | 0.72 | 1,421 | - | - | - | 1,600 | 0.84 | 43 | 62,923 | 0.72 | 1,464 |

Note: Measured & indicated mineral resources include proven and probable mineral reserves. Batman and Quigleys mineral resources are quoted at a 0.40g Au/t cut-off grade. Heap Leach mineral resources are the average grade of the heap, no cut-off grade applied. Economic analysis conducted only on proven and probable mineral reserves. Rex Bryan of Tetra Tech is the Qualified Person responsible for the geologic mineral resource estimates. Thomas Dyer of Mine Development Associates is the Qualified Person responsible for developing mineral reserves for the Batman deposit. Dr. Deepak Malhotra of Resource Development Inc. is the Qualified Person responsible for the metallurgical data and program, and for developing mineral reserves for the heap leach. See “Cautionary Note to United States Investors” below.

The 2019 PFS was authored by Tetra Tech Inc. (“Tetra Tech”) with Mine Development Associates, Resource Development Inc., Proteus EPCM Engineers (a Tetra Tech Company, “Tetra Tech Proteus”), JDS Energy & Mining, Inc., and POWER Engineers, Inc.

John Rozelle, Vista’s Sr. Vice President, a Qualified Person as defined by NI 43-101, has approved the information in this press release. For additional information on data verification, quality assurance and control, key assumptions and other matters relating to the Project, see Vista’s Annual Report Form on10-K as filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.shtml on February 26, 2020.

Technical Report on Mt Todd

For further information on the Mt Todd Gold Project, see the Technical Report entitled “NI 43-101 Technical Report Mt Todd Gold Project 50,000 tpd Preliminary Feasibility Study Northern Territory, Australia” with an effective date of September 10, 2019 and an issue date of October 7, 2019, which is available on SEDAR as well as on Vista’s website under the Technical Reports section.

Management Conference Call

A conference call with management to review our financial results for the fiscal year ended December 31, 2019 and to discuss corporate and project activities is scheduled for Thursday, March 5, 2020 at 2:30 p.m. MST.

Participant Toll Free: 844-898-8648

International: 647-689-4225

Conference ID: 3097238

This call will also be web-cast and can be accessed at the following web location:

https://onlinexperiences.com/Launch/QReg/ShowUUID=3CD037F2-42AA-4A38-9B54-9C7837619AC3

This call will be archived and available at www.vistagold.com after March 5, 2020. Audio replay will be available for 21 days by calling toll-free in North America: 855-859-2056.

If you are unable to access the audio or phone-in on the day of the conference call, please email questions to Pamela Solly, Vice President of Investor Relations, at ir@vistagold.com. We will try to address these questions prior to or during the conference call.

All dollar amounts in this press release are in U.S. dollars. References to “A$” refer to Australian dollar.

About Vista Gold Corp.

The Company is a well-funded gold project developer. The Company’s principal asset is its flagship Mt Todd gold project in Northern Territory, Australia. Mt Todd is the largest undeveloped gold project in Australia.

For further information, please contact the Company at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the projected economics of the Mt Todd gold project in the 2019 PFS, including the after-tax net present value at a 5% discount rate and the internal rate of return, the estimated life of mine gold recovery and total recovered gold for the Mt Todd gold project, estimated capital and operating costs, construction and ramp-up schedules, owner’s costs and other key components of the Mt Todd gold project, receipt of future option payments for the Awak Mas project, the Company’s focus on securing a strategic partner for the development of Mt Todd, continued efforts to de-risk Mt Todd, timing and receipt of authorization of the Mt Todd Mine Management Plan from the NT Department of Primary Industries and Resources and reserve and resource estimates at Mt Todd are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: no change to laws or regulations impacting mine development or mining activities, our approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments, preliminary feasibility studies and feasibility studies on our projects, if any, our experience with regulators, our experience and knowledge of the Australian mining industry and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which the Company operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which the Company operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed on February 26, 2020 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. This press release uses the terms “Proven reserves” and “Probable reserves”. Reserve estimates contained in this press release are made pursuant to NI 43-101 standards in Canada and do not represent reserves under the standards of the SEC’s Industry Guide 7 and may not constitute reserves under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements, which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, this press release uses the terms “Measured resources”, “Indicated resources”, and “Measured & Indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in this press release have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. The term “contained gold ounces” used in this press release is not permitted under the rules of the SEC. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an Inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.