Vista Gold Corp. Announces Drill Results at Mt Todd

DENVER, June 30, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced assay results for drilling at the Company’s Mt Todd gold project (“Mt Todd” or the “Project”). Four additional holes have been completed north of the Batman deposit which demonstrate that Vista’s model of the controlling structures is reliable in predicting where mineralization is most likely to be encountered.

Highlights

- VB21-006 – contains two near surface intercepts, including 6.0 meters @ 1.58 grams gold per tonne (“g Au/t”) and 3.2 meters @ 1.39 g Au/t;

- VB21-007 – contains three near surface intercepts, including 2.5 meters @ 1.77 g Au/t, 0.3 meters @ 10.93 g Au/t, and 6.7 meters @ 0.93 g Au/t, and a deeper intercept of 3.2 meters @ 1.57 g Au/t;

- VB21-008 – contains three deeper intercepts of 8.5 meters @ 1.89 g Au/t, 1.5 meters @ 7.24 g Au/t, and 7.1 meters @ 2.39 g Au/t; and

- VB21-009 – contains three intercepts at 1.1 g Au/t or better, including 1.5 meters @ 1.88 g Au/t, 2.2 meters @ 1.10 g Au/t, and 1.1 meters @ 5.15 g Au/t.

Frederick Earnest, President and CEO commented, “The ongoing drilling continues to confirm our structural and geological interpretations north of the Batman deposit and, given the significant area within the Batman-Driffield structural corridor, increases our confidence in the potential for future mineral resource growth at Mt Todd, with the appropriate future in-fill drilling. Based on our model, each of the holes that we reported today targeted specific structures and not only confirmed our structural interpretations, but also increased our understanding of the size, orientation, and gold-bearing potential of the mineralized structures north of the Batman deposit. Drilling is ongoing to further expand our understanding of the mineralized structures in this area and additional drilling is planned to systematically expand our understanding of the geologic potential of the area toward the Golf-Tollis and Penguin targets to the north.”

Table 1 – Summary of Assay Results

| Hole No. | Grid Co-ordinates | Survey Data | Intersections | ||||||||||

| MGA94 Grid Easting | MGA94 Grid Northing | RL (m) | Azimuth (°) | Dip (°) | Total Length (m) | From (m) | To (m) | Interval (m) | True Thickness (m) | Grade (g/t Au) | Sample Type | ||

| VB21-006 | 187629.0 | 8435852.0 | 132.0 | 92.9 | -50.0 | 347.7 | 53.0 | 59.0 | 6.0 | 4.3 | 1.58 | HQ ½ Core | |

| and | 101.8 | 105.0 | 3.2 | 2.3 | 1.39 | HQ ½ Core | |||||||

| and | 167.7 | 175.1 | 7.4 | 5.3 | 0.73 | HQ ½ Core | |||||||

| and | 188.0 | 192.0 | 4.0 | 2.9 | 0.82 | HQ ½ Core | |||||||

| VB21-007 | 187618.0 | 8436518.0 | 148.0 | 272.9 | -50.0 | 299.9 | 42.5 | 45.0 | 2.5 | 1.8 | 1.77 | HQ ½ Core | |

| and | 69.0 | 78.2 | 9.2 | 6.6 | 0.63 | HQ ½ Core | |||||||

| incl | 72.0 | 72.3 | 0.3 | 0.2 | 10.93 | HQ ½ Core | |||||||

| and | 87.3 | 94.0 | 6.7 | 4.8 | 0.93 | HQ ½ Core | |||||||

| and | 149.0 | 155.0 | 6.0 | 4.3 | 0.44 | HQ ½ Core | |||||||

| and | 262.8 | 266.0 | 3.2 | 2.3 | 1.57 | HQ ½ Core | |||||||

| VB21-008 | 187758.0 | 8436406.0 | 137.0 | 276.0 | -48.0 | 477.3 | 265.0 | 282.0 | 17.0 | 11.9 | 0.56 | HQ ½ Core | |

| and | 355.0 | 363.5 | 8.5 | 5.9 | 1.89 | HQ ½ Core | |||||||

| incl | 362.0 | 363.5 | 1.5 | 1.1 | 7.24 | HQ ½ Core | |||||||

| and | 385.0 | 389.0 | 4.0 | 2.8 | 0.75 | HQ ½ Core | |||||||

| and | 395.0 | 402.1 | 7.1 | 4.9 | 2.39 | HQ ½ Core | |||||||

| VB21-009 | 188222.0 | 8436800.0 | 143.0 | 89.9 | -50.0 | 437.5 | 71.0 | 79.0 | 8.0 | 5.7 | 0.48 | HQ ½ Core | |

| and | 85.0 | 94.1 | 9.1 | 6.5 | 0.64 | HQ ½ Core | |||||||

| and | 120.8 | 132.4 | 11.6 | 8.3 | 0.55 | HQ ½ Core | |||||||

| and | 137.7 | 139.2 | 1.5 | 1.1 | 1.88 | HQ ½ Core | |||||||

| and | 145.6 | 149.1 | 3.5 | 2.5 | 0.69 | HQ ½ Core | |||||||

| and | 153.3 | 155.5 | 2.2 | 1.6 | 1.10 | HQ ½ Core | |||||||

| and | 177.8 | 181.0 | 3.3 | 2.3 | 0.89 | HQ ½ Core | |||||||

| and | 208.0 | 209.1 | 1.1 | 0.8 | 5.15 | HQ ½ Core | |||||||

Notes:

(i) Results are based on ore grade 50g fire assay for Au.

(ii) Intersections are from diamond core drilling with half-core samples with 1 meter representative samples.

(iii) Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters.

(iv) Mean grades have been calculated on a 0.4g/t Au lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters.

(v) All intersections are downhole intervals, and reflect approximate true widths.

(vi) All downhole deviations have been verified by downhole camera and/or downhole gyro.

(vii) Collar coordinates surveyed by Earl James & Assoc., an independent surveyor, using Trimble R8 GNSS.

(viii) The Company maintains a quality assurance/quality control (“QA/QC”) program, as further described below.

(ix) The assay laboratories responsible for the assays were Northern Analytical Laboratories Pty Ltd (“NAL”), an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista.

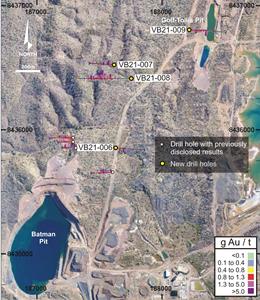

Discussion of Results

Our current exploration program has concentrated on the southern portion of the Batman-Driffield structural corridor between the Batman deposit and the Golf-Tollis deposits. This area has a significant amount of shallow historic drilling, and when combined with past geochemical and magnetic studies has allowed us to develop a new geologic model. Most importantly, current drilling suggests that what were thought to be discrete deposits, may actually be part of a continuous mineralized trend, both horizontally and vertically. To date, we have not drilled a diamond core hole within the Batman-Driffield structural corridor that was absent of any mineralized intercepts.

- VB21-006 – confirmed the continuity of the south cross structure in the upper part of the hole;

- VB21-007 – tested the continuity of mineralization of the Batman North structure in the area approximately 120 meters north of holes VB21-002 and VB21-005 and was located to test the potential intersection of the north cross structure with the Batman North structure;

- VB21-008 – confirmed the vertical continuity of mineralization below holes VB21-002 and VB-005; and

- VB21-009 – drilled approximately 400 meters north of holes VB21-002, -005 and -008 and the first hole to be drilled deeper into the Golf-Tollis target.

Figure 1 – Plan View of Drill Holes: https://www.globenewswire.com/NewsRoom/AttachmentNg/738817e0-afa7-4cad-85b4-f745d641689a

The sampling method and approach for the surface geochemistry and grab samples is as follows:

- Soil samples are planned on a regular grid and a sample sheet is generated.

- GPS is used to locate sample positions and a pelican pick is used to clear debris and any topsoil from the sample location 3.

- The hole is dug to the B horizon and 7 to 10 kg of soil is collected and coarse sieved to remove stones etc., a fine mesh is then employed and the entire sample recovered post sieving is bagged.

- Soil sampling is usually undertaken in the dry season, however if wet samples are obtained, they are dried in the logging shed prior to sieving.

- Sample bags are calico and purchased pre-numbered, these are then packaged in groups of 5 for transportation to NAL, an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista.

- As the site is closed to public access, no special security measures are undertaken.

- A sample submission sheet is sent to the lab, detailing required methodology, and number of samples.

- No identifying data relating to sample location is recorded on the bags submitted or the paperwork beyond bag numbers.

Rock chip and soil geochemical samples are routinely collected to determine if the potential exists for anomalous gold values below the surface. The presence of anomalous gold grades is not a guarantee of subsurface mineralization. While both rock chip and soil samples have sampling procedures, it is not considered rigorous enough to be relied upon for use in the estimation of mineral resources. Surface soil and rock chip samples are merely considered to be potential indicators of subsurface mineralization. Since the rock chip and soil assays are not used in mineral resource estimation, it is rare that any additional QA/QC or check assaying would be completed. The data are used on an as received basis.

It is the QP’s (as defined below) opinion that the sample preparation methods and quality control measures employed before dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

John Rozelle, Vista’s Sr. Vice President, a Qualified Person (“QP”) as defined by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained in and has approved this press release. The information contained in this press release does not change any of the mineral resources or reserves estimates contained in Vista’s October 7, 2019 NI 43-101 Technical Report, Mt Todd Gold Project, 50,000 tpd Preliminary Feasibility Study, Northern Territory, Australia. The information contained in this press release is provided to inform the reader of the growth of our geologic understanding of the Project. There has been insufficient exploration to define a mineral resource with respect to the exploration target areas and it is uncertain if further exploration will result in the exploration target areas being delineated as a mineral resource.

Data Verification and QA/QC

The sampling method and approach for the drillholes are as follows:

- The drill core, upon removal from the core barrel, is placed into plastic core boxes;

- The plastic core boxes are transported to the sample preparation building;

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves. One-half is placed into sample bags as one-meter sample lengths, and the other half retained for future reference. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork;

- The bagged samples have sample tags placed both inside and on the outside of the sample bags. The individual samples are grouped into “lots” for submission to NAL, a certified lab, for preparation and analytical testing; and

- All of this work was done under the supervision of a Vista geologist.

Processing of the core included photographing, geotechnical and geologic logging, and marking the core for sampling. The nominal sample interval was one meter. When this process was completed, the core was moved into the core cutting/storage area where it was laid out for sampling. The core was laid out using the following procedures:

- One meter depth intervals were marked out on the core by a member of the geologic staff;

- Core orientation (bottom of core) was marked with a solid line when at least three orientation marks aligned and used for structural measurements. When orientation marks were insufficient an estimated orientation was indicated by a dashed line;

- Geologic logging was then done by a member of the geologic staff. Assay intervals were selected at that time and a cut line marked on the core. The standard sample interval was one meter, with a minimum of 0.2 m and a maximum of 1.2 m;

- Blind sample numbers were then assigned based on pre-labeled sample bags. Sample intervals were then indicated in the core tray at the appropriate locations; and

- Each core tray was photographed and restacked on pallets pending sample cutting and stored on site indefinitely.

The core was then cut using diamond saws with each interval placed in sample bags. At this time, the standards and blanks were also placed in plastic bags for inclusion in the shipment. A reference standard or a blank was inserted at a minimum ratio of 1 in 10 and at suspected high grade intervals additional blanks sample were added. Standard reference material was sourced from Ore Research & Exploration Pty Ltd and provided in 60 g sealed packets. When a sequence of five samples was completed, they were placed in a shipping bag and closed with a zip tie. All of these samples were kept in the secure area until crated for shipping.

Samples were placed in crates for shipping with 100 samples per crate (20 shipping bags). The crates were stacked outside the core shed until picked up for transport and shipped to NAL in Pine Creek, Northern Territory, for standard fire assays. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish, except where results report a result of greater than 3 g Au/tonne, and then a gravimetric finish is used to report final results.

The QP is satisfied that sample security measures meet industry standards. Statistical analysis of the various drilling populations and QA/QC samples has not identified or highlighted any reasons to not accept the data as representative of the tenor and grade of the mineralization estimated at the Batman deposit.

About Vista Gold Corp.

The Company is a gold project developer. Our principal asset is our flagship Mt Todd gold project in Northern Territory, Australia. Mt Todd is the largest undeveloped gold project in Australia.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that drill results from VB21-006 through 009 demonstrate that our exploration model is proving to be reliable in predicting where mineralization is most likely to be encountered based on our improved understanding of the controlling structures; our belief that ongoing drilling continues to confirm our structural and geological interpretation and increases our confidence in the potential for future mineral resource growth at Mt Todd; our belief that the holes reported today increased our understanding of the size, orientation, and gold-bearing potential of the mineralized structures north of our Batman deposit; our belief that current drilling suggests that what were thought to be discrete deposits may actually be part of a continuous mineralized trend; our belief that ongoing and planned additional drilling will further expand our understanding of mineralized structures in the area and systematically increase our understanding of the geologic potential in the area; and our belief that Mt Todd is the largest undeveloped gold project in Australia are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainties inherent in the exploration of mineral properties, the possibility that future exploration results will not be consistent with the Company's expectations; there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; uncertainty of mineral resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed February 25, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical reports referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.