Vista Gold Corp. Announces Final Results from Phase 2 Drilling at Mt Todd

DENVER, Sept. 22, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced positive results for the two remaining holes in Phase 2 of the ongoing drilling program at the Company’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) located in Northern Territory, Australia.

Highlights

VB21-012 – Intersected over 100 meters of mineralization, inclusive of three zones of +1 grams gold per tonne (“g Au/t”) subvertical vein-sets

- 10.0 meters @ 1.29 g Au/t from 469 meters down hole

- 22.7 meters @ 1.10 g Au/t from 503 meters down hole

- 13.2 meters @ 1.03 g Au/t from 566 meters down hole

VB21-013 – Drilled perpendicular to VB21-002 and VB21-005 to validate structural orientation

- 6.0 meters @ 1.25 g Au/t from 130 meters down hole

- 12.0 meters @ 3.11 g Au/t from 144 meters down hole

Frederick Earnest, President and CEO of Vista, commented, “Phase 2 of our drilling program successfully achieved our primary objective of identifying multiple areas north of the Batman deposit where additional resources might be added most efficiently in the future. In all, we drilled 3,725 meters in this phase and intersected good intervals and gold grades in each hole. We have verified continuity of gold mineralization extending from the Batman deposit northeast over 1.4 km and down dip more than 400 meters. Holes VB21-012 and VB21-013 are the last two holes in this phase of drilling. Our next phase of drilling will provide some infill to our drilling to date, but importantly, continue to step out toward the Quigleys deposit.”

“We were very pleased to have received a grant from the Northern Territory Government under its Geophysics and Drilling Collaborations Program (the “Program”) to co-fund VB21-012. This gave us the opportunity to drill a hole directed at increasing our understanding of the geology as we move north of the Batman deposit. The Program awarded $1.7 million in grants to support a diverse range of exploration drilling programs and geophysical surveys across the Northern Territory. Mt Todd was one of 15 successful projects to receive a grant from a total of 38 applicants. Fifty percent of the applicable direct drilling and assay costs, up to a maximum of A$110,000, will be co-funded from the Program.”

“Hole VB21-012 was drilled to a total depth of 901 meters. The primary objective was to intersect the granite intrusive. From our drilling at Batman, we expected the intrusive to be present at a depth of approximately 800 meters. We did not intercept the intrusive, but gained a great deal of information about the basement rocks at Mt Todd. And while not the primary objective of this hole, we intersected three zones of +1 g Au/t material within a broad zone of mineralization. Hole VB21-013 was drilled to validate the orientation of our drilling and to provide the assurance that we have not introduced a bias into our understanding of the structures due to drillhole orientation. I’m pleased with the thoroughness of our exploration programs and our understanding of the geology and resource growth potential in the area north of the Batman deposit.”

Mr. Earnest concluded, “In addition to the ongoing exploration, completing a definitive feasibility study (“DFS”) for Mt Todd will be an important milestone and catalyst. We are pleased to report that engineering and other work related to the DFS is on schedule and on budget. We are closely reviewing interim reports and look forward to announcing the results of the DFS in Q1 of 2022. Australia is making significant progress in achieving its vaccination goals and we are hopeful this will lead to a relaxing of the present travel restrictions, which will play an important role in obtaining a strategic development partner.”

Table 1 – Summary of Assay Results

| Hole No. | Grid Co-ordinates | Survey Data | Intersections | ||||||||||

| MGA94 Grid Easting | MGA94 Grid Northing | RL (m) | Azimuth (°) | Dip (°) | Depth (m) | From (m) | To (m) | Interval (m) | True Thickness (m) | Grade (g/t Au) | Sample Type | ||

| VB21-012 | 188435.0 | 8436405.0 | 155.0 | 260.9 | -50.0 | 901.0 | 469.0 | 479.0 | 10.0 | 6.4 | 1.29 | HQ ½ Core | |

| including | 477.0 | 479.0 | 2.0 | 1.3 | 4.48 | HQ ½ Core | |||||||

| and | 503.0 | 525.7 | 22.7 | 14.6 | 1.10 | HQ ½ Core | |||||||

| and | 555.3 | 579.2 | 23.9 | 15.3 | 0.77 | HQ ½ Core | |||||||

| including | 566.0 | 579.2 | 13.2 | 8.5 | 1.03 | HQ ½ Core | |||||||

| VB21-013 | 187423.0 | 8436409.0 | 169.0 | 86.4 | -53.0 | 311.9 | 130.0 | 136.0 | 6.0 | 3.9 | 1.25 | HQ ½ Core | |

| and | 144.0 | 156.0 | 12.0 | 7.9 | 3.11 | HQ ½ Core | |||||||

| including | 144.0 | 148.6 | 4.6 | 3.0 | 1.62 | HQ ½ Core | |||||||

| including | 151.0 | 154.0 | 3.0 | 2.0 | 2.67 | HQ ½ Core | |||||||

Notes:

| (i) | Results are based on 50g fire assay for Au. |

| (ii) | Intersections are from diamond core drilling with half-core samples with 1 meter representative samples. |

| (iii) | Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters. |

| (iv) | Mean grades have been calculated on a 0.4 g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters. |

| (v) | All intersections are downhole intervals and reflect approximate true widths. |

| (vi) | All downhole deviations have been verified by downhole camera and/or downhole gyro. |

| (vii) | Collar coordinates surveyed by Earl James & Assoc., an independent surveyor, using Trimble R8 GNSS. |

| (viii) | The Company maintains a quality assurance/quality control (“QA/QC”) program, as further described below. |

| (ix) | The assay laboratories responsible for the assays were Northern Analytical Laboratories Pty Ltd (“NAL”), an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista. |

Discussion of Results

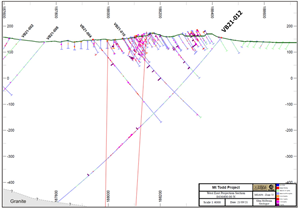

Hole VB21-012

VB21-012 was drilled to test the potential depth of the granitic intrusive under the Northern and Southern Cross zones and for an enriched zone within the Southern Cross Zone (“SXZN”) close to the intrusive. While VB21-012 did not intersect the intrusive, alteration intensity did increase with depth and, as veining persisted, the hole was pushed an additional 100 meters past planned depth (see Figure 2). VB21-012 has shown that the SXZN, both persists and thickens with depth. The SXZN has three +1 g Au/t zones with an overall width of 100 meters (when aggregated), with dip continuity of +500 meters and a strike length of approximately 1.1 km. Vein assemblages consist dominantly of quartz, pyrrhotite, chalcopyrite, and sphalerite, with galena occasionally present. The SXZN appears similar to the NXZN, which exhibits the potential to host grades twice that of the Batman deposit.

Consistent with our standard drilling protocols, VB21-012 was drilled with oriented core and has provided orientation data for bedding, veining and structures that will greatly assist in understanding the mineralizing controls and targeting future drilling.

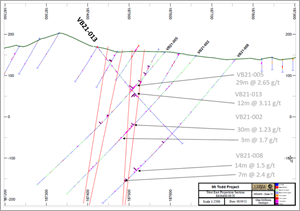

Hole VB21-013

VB21-013 was planned to intersect the Northern Cross Zone (“NXZN”) from the west instead of the east as drilled previously on section 6400N (approximately 1,000 meters north of the existing Batman Pit). VB21-013 intersected the NXZN between the intercepts in holes VB21-005 and VB21-002, while also confirming the thickness of the structure by intercepting it from the opposite direction. Structural measurements have indicated that at section 6400N, the NXZN mineralized veins are subvertical and strike nearly north-south. The veins vary in thickness and number. The NXZN has intersected four zones to date, two of which are very well developed on section 6400N.

The NXZN was intersected where predicted and displays strong upper and lower contact mineralization. Hole VB21-013, drilled from west to east, has shown a tighter, higher-grade structure than the holes drilled east to west. The revised drill direction appears appropriate and is consistent with the measured vein orientations of the high-grade.

A portion of future work will focus on defining high-grade mineralization within the NXZN, which is open in all directions.

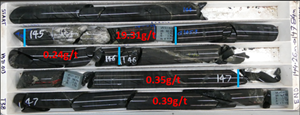

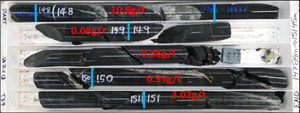

Photos – Drill intercepts from VB21-013 showing mineralization

https://www.globenewswire.com/NewsRoom/AttachmentNg/82ca94ff-4c18-4ab1-b198-e9a00c9ad28a

https://www.globenewswire.com/NewsRoom/AttachmentNg/5db7b09c-2389-463c-8523-661513b4446e

https://www.globenewswire.com/NewsRoom/AttachmentNg/b3c3ed3e-afc0-4754-a27b-66b237211520

Figure 1 – Plan View of Drill Holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/599c8cba-ff3f-497f-9ae1-f91ea96a5f43

Figure 2 - Cross Section with VB21-012

https://www.globenewswire.com/NewsRoom/AttachmentNg/e0341a92-051e-494f-97ac-69914a8b6787

Figure 3 - Cross Section with VB21-013 and interpreted zones

https://www.globenewswire.com/NewsRoom/AttachmentNg/414539ab-cb9e-4d90-9f46-8c5ba9f21069

The sampling method and approach for the surface geochemistry and grab samples is as follows:

- Soil samples are planned on a regular grid and a sample sheet is generated.

- GPS is used to locate sample positions and a pelican pick is used to clear debris and any topsoil from the sample location 3.

- The hole is dug to the B horizon and 7 to 10 kg of soil is collected and coarse sieved to remove stones etc., a fine mesh is then employed and the entire sample recovered post sieving is bagged.

- Soil sampling is usually undertaken in the dry season, however if wet samples are obtained, they are dried in the logging shed prior to sieving.

- Sample bags are calico and purchased pre-numbered, these are then packaged in groups of 5 for transportation to NAL, an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista.

- As the site is closed to public access, no special security measures are undertaken.

- A sample submission sheet is sent to the lab, detailing required methodology, and number of samples.

- No identifying data relating to sample location is recorded on the bags submitted or the paperwork beyond bag numbers.

Rock chip and soil geochemical samples are routinely collected to determine if the potential exists for anomalous gold values below the surface. The presence of anomalous gold grades is not a guarantee of subsurface mineralization. While both rock chip and soil samples have sampling procedures, it is not considered rigorous enough to be relied upon for use in the estimation of mineral resources. Surface soil and rock chip samples are merely considered to be potential indicators of subsurface mineralization. Since the rock chip and soil assays are not used in mineral resource estimation, it is rare that any additional QA/QC or check assaying would be completed. The data are used on an as received basis.

It is the QP’s (as defined below) opinion that the sample preparation methods and quality control measures employed before dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

John Rozelle, Vista’s Sr. Vice President, a Qualified Person (“QP”) as defined by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained in and has approved this press release. The information contained in this press release does not change any of the mineral resources or reserves estimates contained in Vista’s October 7, 2019 NI 43-101 Technical Report, Mt Todd Gold Project, 50,000 tpd Preliminary Feasibility Study, Northern Territory, Australia. The information contained in this press release is provided to inform the reader of the growth of our geologic understanding of the Project. There has been insufficient exploration to define a mineral resource with respect to the exploration target areas and it is uncertain if further exploration will result in the exploration target areas being delineated as a mineral resource.

Data Verification and QA/QC

The sampling method and approach for the drillholes are as follows:

- The drill core, upon removal from the core barrel, is placed into plastic core boxes;

- The plastic core boxes are transported to the sample preparation building;

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves. One-half is placed into sample bags as one-meter sample lengths, and the other half retained for future reference. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork;

- The bagged samples have sample tags placed both inside and on the outside of the sample bags. The individual samples are grouped into “lots” for submission to NAL, a certified lab, for preparation and analytical testing; and

- All of this work was done under the supervision of a Vista geologist.

Processing of the core included photographing, geotechnical and geologic logging, and marking the core for sampling. The nominal sample interval was one meter. When this process was completed, the core was moved into the core cutting/storage area where it was laid out for sampling. The core was laid out using the following procedures:

- One meter depth intervals were marked out on the core by a member of the geologic staff;

- Core orientation (bottom of core) was marked with a solid line when at least three orientation marks aligned and used for structural measurements. When orientation marks were insufficient an estimated orientation was indicated by a dashed line;

- Geologic logging was then done by a member of the geologic staff. Assay intervals were selected at that time and a cut line marked on the core. The standard sample interval was one meter, with a minimum of 0.2 meters and a maximum of 1.2 meters;

- Blind sample numbers were then assigned based on pre-labeled sample bags. Sample intervals were then indicated in the core tray at the appropriate locations; and

- Each core tray was photographed and restacked on pallets pending sample cutting and stored on site indefinitely.

The core was then cut using diamond saws with each interval placed in sample bags. At this time, the standards and blanks were also placed in plastic bags for inclusion in the shipment. A reference standard or a blank was inserted at a minimum ratio of 1 in 10 and at suspected high grade intervals additional blanks sample were added. Standard reference material was sourced from Ore Research & Exploration Pty Ltd and provided in 60 g sealed packets. When a sequence of five samples was completed, they were placed in a shipping bag and closed with a zip tie. All of these samples were kept in the secure area until crated for shipping.

Samples were placed in crates for shipping with 100 samples per crate (20 shipping bags). The crates were stacked outside the core shed until picked up for transport and shipped to NAL in Pine Creek, Northern Territory, for standard fire assays. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish, except where results report a result of greater than 3 g Au/tonne, and then a gravimetric finish is used to report final results.

The QP is satisfied that sample security measures meet industry standards. Statistical analysis of the various drilling populations and QA/QC samples has not identified or highlighted any reasons to not accept the data as representative of the tenor and grade of the mineralization estimated at the Batman deposit.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that drill results from VB21-012 provided a great deal of information about the basement rocks at Mt Todd; our belief that drill results from VB21-013 validated the orientation of our drilling and provided assurance that we have not introduced a bias into our understanding of the structures due to drillhole orientation; our belief that the completion of a DFS for Mt Todd will be an important catalyst; our expectation to finalize the DFS in Q1 2022; our belief that Australia is making significant progress in achieving its vaccination goals; our belief that Australia’s relaxation of its present travel restrictions will play an important role in reaching our goal of having a strategic development partner; our belief that the Southern Cross Zone, which exhibits the potential to host grades twice that of the Batman deposit; and our belief that Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainties inherent in the exploration of mineral properties, the possibility that future exploration results will not be consistent with the Company's expectations; there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; uncertainty of mineral resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed February 25, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical reports referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.