Voyager Metals Reports after Tax NPV Of US$1.6 Billion and IRR of 43% For Its Preliminary Economic Assessment at the Mont Sorcier Magnetite Iron and Vanadium Project in Quebec

TORONTO, ON / ACCESSWIRE / July 25, 2022 /

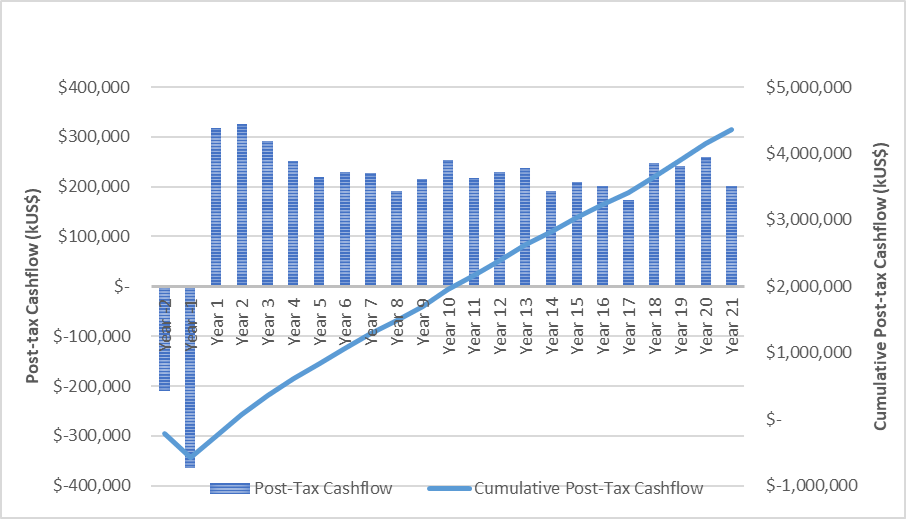

- Annual average EBITDA of US$348MM and average annual free cash flow of US$235MM over 21 year life of mine ("LOM")

- Annual production targeted at approx. 5.0 million tonnes of high grade, low impurity, iron concentrate grading ~65% iron with 0.52% V2O5 per tonne of concentrate

- Total operating costs of US$66/t of concentrate over LOM (freight to China included)

- Initial Capex estimated at US$574 million includes US$118 million contingency

- Payback period under 2 years

- 21-year LOM uses fraction of total resources

- Open pit mining operation with a LOM strip ratio less than 0.9:1

- Additional upside from the potential to expand development from the current North Zone Inferred Resources (507Mt) and South Zone Indicated (119Mt) and Inferred (89Mt) Resources

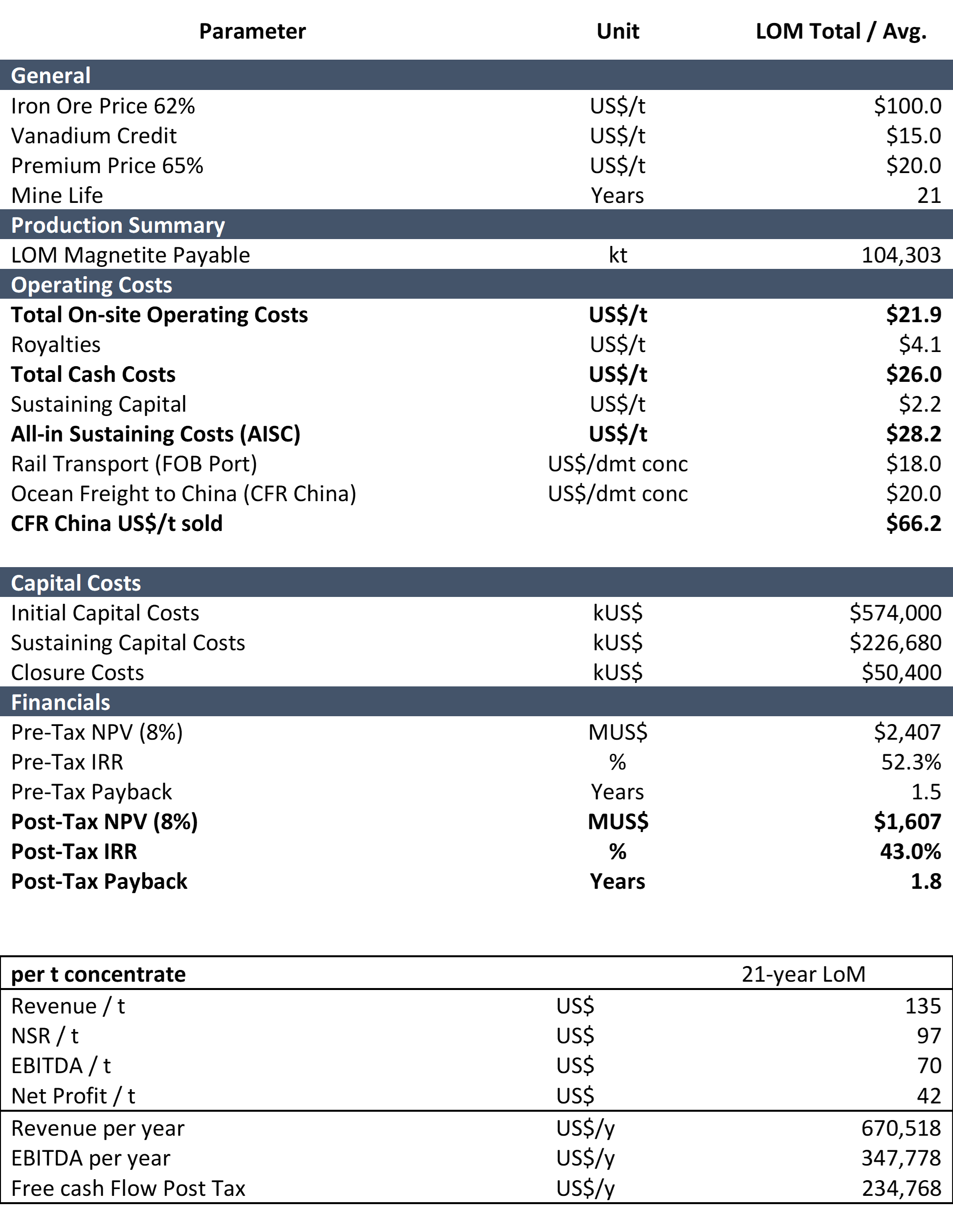

PEA Summary Results (Note: All Figures in US$, unless otherwise noted)

Voyager Metals Inc. ("Voyager" or the "Company") (TSXV:VONE), is pleased to announce the results of a new Preliminary Economic Assessment ("PEA") at its 100% owned Mont Sorcier iron and vanadium project located near Chibougamau, Quebec. The PEA was completed by Clinton Swemmer P.Eng. (PEO), VP Technical Services for Voyager Metals and a "qualified person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects of the Canadian Securities Regulators ("NI 43-101"), with input from independent consulting group InnovExplo Inc ("InnovExplo") for the Mineral Resource Estimate and independent consulting group Soutex Inc ("Soutex") for the Mineral Processing & Metallurgical Testing and Recovery Methods, Pierre-Jean Lafleur, P.Eng. (OIQ), VP Exploration at Voyager Metals and also a "qualified person" under NI 43-101 who completed the preliminary Mine Planning.

The PEA for Mont Sorcier has been conducted based upon the Mineral Resource Estimate completed by InnovExplo and filed by Voyager on July 22, 2022, uses only the Measured and Indicated Resource in the North Zone outlined in the Company's most recently released NI 43-101 Technical Report dated July 22, 2022, and available on SEDAR. The PEA outlines a robust economic assessment for Mont Sorcier based upon a traditional open pit mining scenario with magnetic separation processing and a reverse flotation circuit to produce approximately 5.0 million tonnes per annum of low sulphur, vanadium rich iron concentrates, with low levels of impurities. Based on test work to date, this material is amenable for blast furnace use in either China or Europe. The general project development plan outlined in the PEA is in line with the potential development scenario being contemplated by Voyager management as it advances towards completion of a Feasibility Study ("FS") that is targeted for completion in Q1 2023.

Cliff Hale-Sanders, President and CEO of Voyager commented "We are very pleased that the results of this PEA more than support our continued efforts to improve the economics and progress with development plans for the Mont Sorcier project, we see the potential of the project to be a profitable, long-life mine. Located in an established mining region, Mont Sorcier has excellent access to existing infrastructure already in place, which reduces upfront capital requirements and shortens the development schedule. The production of premium 65% high grade magnetite iron concentrate with valuable vanadium credits in conjunction with the advantageous infrastructure; positions Mont Sorcier as one of the premier iron development projects in the world.

The ongoing project optimization efforts and additional metallurgical test work being carried out as part of the ongoing FS are anticipated to enhance product quality and project economics even further. Moving forward, the company will focus on completing the Feasibility Study in Q1 2023 to bring Mont Sorcier to a formal development decision as quickly as possible. The company continues its proactive engagement with local communities to ensure key ESG matters and other local issues are adequately addressed and properly understood by all parties"'

The PEA is preliminary in nature and there is no certainty that the preliminary economic assessment will be realized.

Project Summary

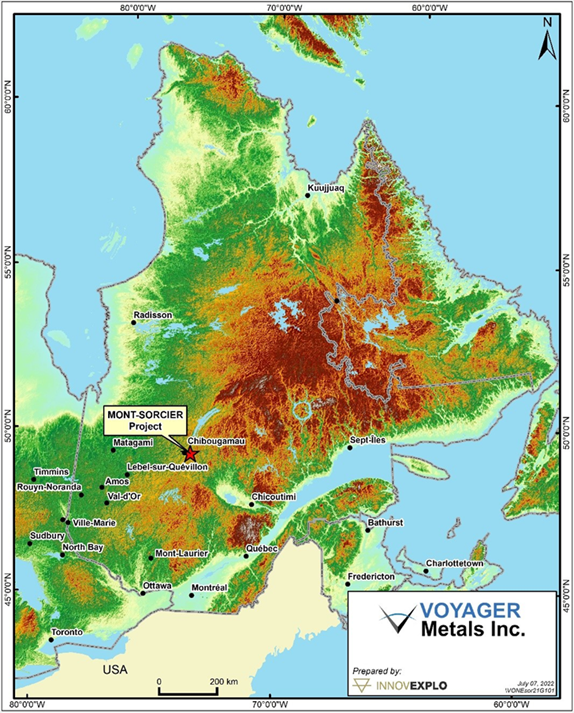

Mont Sorcier is located approximately 18 km east of Chibougamau, Quebec, in a region with a long history of mining and robust infrastructure in place to support future development. Mont Sorcier has access to all season roads, low-cost provincial hydro power and is within 50km of rail connection to two all-season, ocean-going ports. The railway runs approximately 370 km to the Port of Saguenay which is currently underutilized and can provide sufficient capacity for the project needs.

Figure 1: Property and Project Locations

Iron and Vanadium Pricing Market Study

In late 2019 the Company had commissioned an Independent Market Pricing Study to review the expected credit that can be achieved for the contained Vanadium within iron concentrates. The study reviewed a value in use methodology based upon a review of the grade and concentrate chemistry from Mont Sorcier relative to other similar iron products and the study concluded that the concentrate from Mont Sorcier should receive a US$15/t premium to the Platts 65 price iron Index for the contained vanadium credits (based on a net attributable value using a long term V2O5 price of $7.25/lb). Since that time the outlook for premium high-grade concentrates has remained robust. Iron has seen peak pricing of over US$140/t for Fe62% with an additional premium for Fe65% typically being around a 20% premium to this price level. This premium is expected to be sustained in the market due to the significant environmental benefits. Equally, the metal price has flexed with transportation shipping rate increases. To fairly assess the potential scenario a long-term metal price in line with the Life of Mine estimate of 21 years outlined in the PEA has been adopted and at the same time this has been assessed using long term shipping costs. The Base Case metal price assumptions are outlined below.

Table 1: Base case Metal Price Assumptions used in Preliminary Economic Analysis

*The premium price is taken as 20% of 62% Fe concentrate Price.

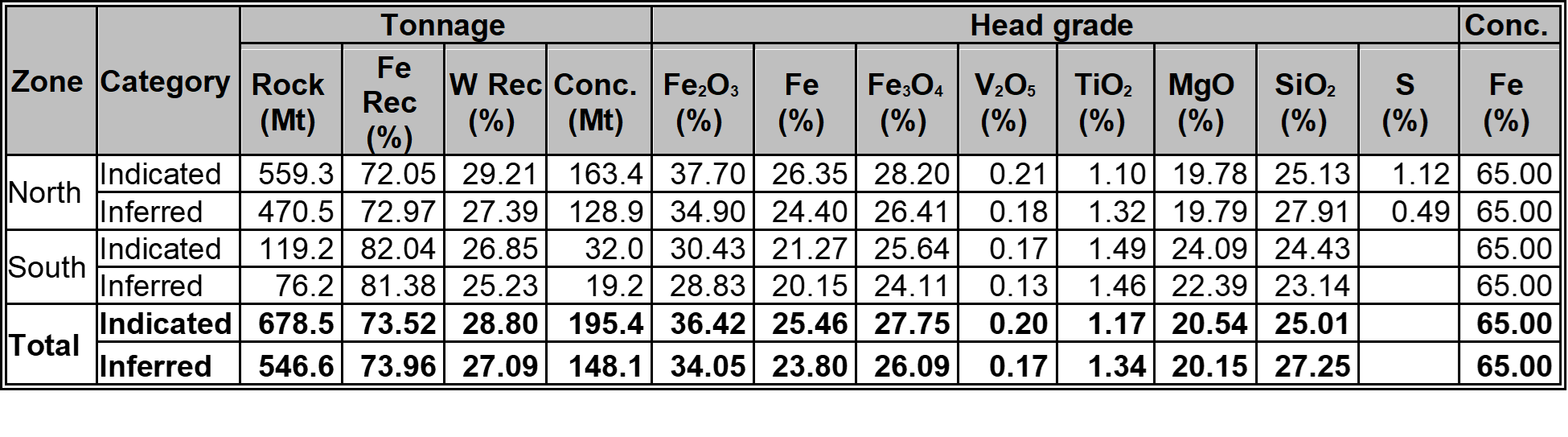

Mineral Resource Estimate

The PEA is based on a mine plan derived from the North Zone Indicated Material of the Mineral Resource Estimate dated June 6, 2022, outlined below.

Table 2: Mineral Resource Estimate used in Preliminary Economic Analysis

Notes to accompany the Mineral Resource Estimate:

- The independent and qualified persons for the Mineral Resource Estimate, as defined by NI 43-101, are Marina Iund, P.Geo., Carl Pelletier, P.Geo., Simon Boudreau, P.Eng. all from InnovExplo Inc. and Mathieu Girard P.Eng. from Soutex. The effective date is June 6th, 2022

- These mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The Mineral Resource Estimate follows current CIM Definition Standards.

- The results are presented undiluted and are considered to have reasonable prospects for eventual economic extraction by having constraining volumes applied to any blocks using Whittle software and by the application of cut-off grades for potential open-pit extraction method.

- The estimate encompasses two (2) deposits (North and South), subdivided into 8 individual zones (7 for North, 1 for South).

- No high-grade capping was applied.

- The estimate was completed using sub-block models in GEOVIA Surpac 2021.

- Grade interpolation was performed with the ID2 method on 4 m composites for the North deposit and on 10 m composites for the South deposit.

- The density of the mineralized zones was interpolated with the ID2 method. When no density analysis was available, the density value was estimated using linear regression with Fe2O3 analysis. For the unmineralized material, a density value of 2.8 g/cm3 (anorthosite and volcanics), 3.5 g/cm3 (Massive sulfide formation) and 2.00 g/cm3 (overburden) was assign.

- The Mineral Resource Estimate is classified as Indicated and Inferred. The Inferred category is defined with a minimum of two (2) drill holes for areas where the drill spacing is less than 400 m, and reasonable geological and grade continuity have been shown. The Indicated category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 200 m, and reasonable geological and grade continuity have been shown. Clipping boundaries were used for classification based on those criteria.

- The Mineral Resource Estimate is locally pit-constrained for potential open-pit extraction method with a bedrock slope angle of 50° and an overburden slope angle of 30°. It is reported at a rounded cut-off grade of 2.30 % Weight Recovery. The cut-off grade was calculated for the concentrate using the following parameters: royalty = 3%; mining cost = CA$3.30; mining overburden cost = CA$2.45; processing cost = CA$3.62; G&A = CA$0.75; selling costs = CA$58.36; Fe price = CA$190/t; USD:CAD exchange rate = 1.3; and mill recovery = 100% (concentrate). The cut-off grades should be re-evaluated considering future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects.

- The authors are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.

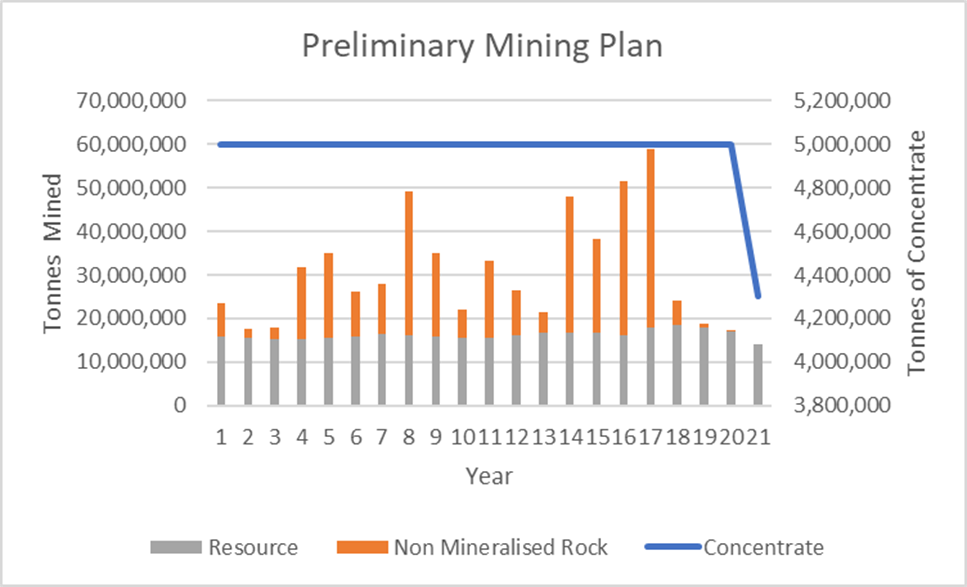

Mining

The mine design of this PEA is based only upon the current Indicated Resources contained in the North Zone alone and assumes standard open pit mining techniques of drill, blast and haul. Voyager developed a mine plan which processes 341.5 million tonnes of the current Indicated Resource base over a 21-year mine life at an average strip ratio of 0.87 to 1. Mining costs are estimated at US$2.03/t of material moved, which accounts for recent inflationary pressures such as recent fuel costs increase seen worldwide. Sulphur head grade content will be kept under 2.5% and will average less than 1.5%. This is readily achieved through pit grade-control practice to maintain above 65% Fe in concentrate.

Figure 2. Mont Sorcier Preliminary Mine Production Profile

Source: Voyager Metals

Metallurgy and Processing

The results of the test work to date have indicated that the production of premium high grade 65% magnetite iron concentrate with approximately 0.52% V2O5 can be achieved.

The processing plant designed for Mont Sorcier is forecast to be in line with similar projects in production locally and globally using standard equipment and technologies. The PEA envisages a conventional crushing and grinding circuit, with three stages of low intensity magnetic separation (LIMS). In addition to the flow sheet previously contemplated, this PEA includes a reverse flotation circuit. The reverse flotation circuit has been included so that the concentrate will have a sulphur content of approximately 0.1% which allows for sale in both Europe and China. The initial testing results support and indicate the viability of Sulphur removal performance. This addition and updating equipment sizes used in the PEA to meet the metallurgical testing and new mass balance is planned as part of the Feasibility Study and will be further developed and optimised in the Feasibility Study that is in progress and anticipated for completion in Q1 2023.

Infrastructure

The site is located with access to all weather roads, water, low-cost grid hydro power and sufficient railway capacity to support project development with only modest infrastructure capital needs. The PEA incorporates expenditures required for additional infrastructure including auxiliary buildings, electrical grid connection, rail loading facilities at the mine site and unloading facilities at the Port of Saguenay. This also includes a new rail loop at the mine to improve loading efficiencies and a new rail spur to connect to the main line to the Port of Saguenay. For the PEA it has been assumed all concentrate production will be rail hauled to the Port of Saguenay for international shipment to China or Europe. Given the proximity to Chibougamau, no permanent camp is required for the anticipated permanent workforce.

In addition, the project will also include new tailing facilities in a location to the North of the open pit. The location of a Non-Mineralized Rock waste dump will be determined after consultation with local stakeholders and additional engineering and design.

Capital Costs

Upfront capital costs are estimated in the PEA at US$574M, deemed in accordance with the requirements of the Association for the Advancement of Cost Engineering (AACE) International Cost Estimate Classification System Recommended Practice No. 18R-97 Class 5, with an estimated pay back of under 2-years with an estimated after-tax IRR of 43%. Upfront capital costs have been factored to allow for current inflationary pressures, anticipated changes in equipment sizing, an increase in rail spur length, estimated costs for enabling of construction of accommodation, and the addition of the reverse flotation circuit to the process plant. The Feasibility Study currently in progress plans to complete numerous trade-off studies, develop a new process equipment list and associated datasheets, and obtain Request for Quotations to increase the level of confidence and accuracy of the PEA estimate.

The PEA capital cost estimates include a 15% contingency for mining equipment and Indirect costs and 30% for plant and infrastructure.

Table 3: Upfront Capital Cost Estimate used in Preliminary Economic Analysis

Sustaining capital is estimated at approximately US$2.2/t over the LOM and is principally related to equipment replacement and future tailings dam raises during operation.

Operating Costs

The LOM operating costs are estimated at US$66.23/t CFR China. This value has been benchmarked against actual costs of Operators in the area.

Table 4: Operating Cost Estimate used in Preliminary Economic Analysis

Note: See section on non IFRS measures provided as supplementary information that management believes may be useful to investors.

Royalty and Tax Assumptions

Three Royalties are currently applicable to the project as defined in the PEA:

- Net Profit Royalty of 10% to Federal and Provincial Governments

- Mines Indépendantes Chibougamau retain a 2% Gross Metal Royalty (GMR) on future production

- Globex Mining Enterprises Inc. retains a 1% GMR,

For the PEA a simple after-tax model was developed for the Mont Sorcier Project pending a more detailed review in the future. All costs are in 2022 United States dollars with no allowance for further inflation or escalation not already incorporated and using a USDCAD exchange rate of 1.30. The Mont Sorcier Project is subject to three levels of taxation, including federal income tax, provincial income tax and provincial mining taxes:

- Quebec mining tax using the Mine Mouth Output method

- Income tax rate of 26.5% (federal and provincial combined).

The federal and provincial corporate tax rates currently applicable over the operating life are 15.0% and 11.5% of taxable income, respectively. The marginal tax rates applicable under the recently adopted mining tax regulations in Quebec depend on the profit margin. The PEA considers that the processing of iron concentrate at the mine site could allow the processing allowance rate of 10% to be applied. Actual taxes payable will be affected by corporate activities, profitability and current and future tax benefits that have not been considered.

The combined effect on the project of the three levels of taxation, including the elements described above, is an appropriate cumulative effective tax rate of over 30%, based on projected earnings. It is anticipated, based on the current projected assumptions, that the Company will pay approximately US$1.8Bn in direct tax payments to the provincial and federal governments over the life of mine based on the operating and commodity price assumptions used in the PEA.

Overall Project Economics

The overall project shows potentially robust economic results for a preliminary mine plan using only Indicated Resources of the North Zone and leaves significant upside potential from the conversion of Inferred Resources in the future:

- An after tax NPV at 8% discount rate of US$1.6 Billion and IRR of 43%

- Potential 21-year mine life, with positive after-tax cash flow commencing in Year 1 of operation.

- Free cash flow post tax is estimated to be approximately US$235/annum over 21-year Life of Mine.

There is potential to enhance the value of the overall project through future upgrading of the North Zone Inferred Resource (507Mt) and the potential mining of the South Zone Indicated Resource (119Mt) and Inferred Resource (76Mt) that would be expected to improve the economics by potentially increasing the overall Life of Mine or open up the potential for future expansion in production capacity.

Figure 3: Estimated Post-Tax Cashflow (in US$)

Source: Voyager Metals

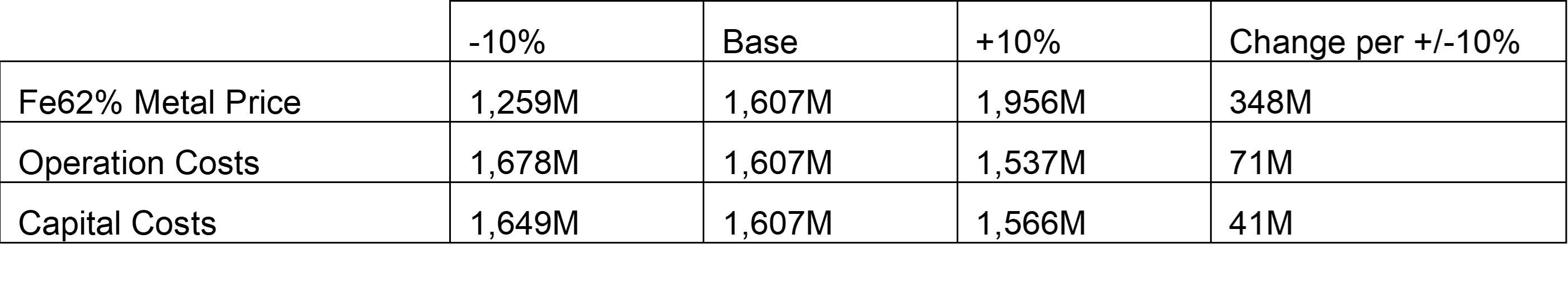

Sensitivities

The Table below highlights the primary sensitivity of the NPV to the Metal Price, followed by Operating Costs and then Capital Costs.

Table 5: Estimated Sensitivities for Key Drivers of NPV Determined in PEA

*Note rounding errors may apply as reported to nearest US$M

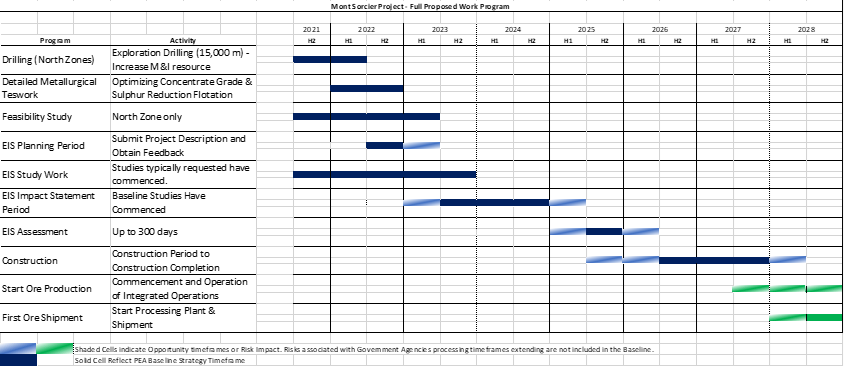

Proposed Development Program

In light of the robust PEA results, the Company has elected to continue on the basis of developing the North Zone as outlined as opposed to developing it in combination with the South Zone as previously contemplated. The Company is in the process of developing a detailed development plan and budget to determine the requirements to bring Mont Sorcier to a development decision as part of the ongoing Feasibility Study work that is currently underway.

Completion of a formal Feasibility Study remains on track for Q1/2023. While details are still being finalized, a construction decision could be made as detailed below based upon the current estimate for permitting and approval process. Depending on the permitting process construction could commence in late 2025 with initial production possible in 2027. This updated schedule takes into account a more conservative timeline to the permitting process than previously anticipated. The outline plan to production is shown below:

Figure 4: Estimated Plan to Production Adopted in the Preliminary Economic Analysis

Source: Voyager Metals

Of important note, the time for the Federal Impact Assessment Decision is the critical path and highest risk to the proposed program. Initial discussions with both the Federal Agencies and Provincial Agencies have commenced.

With the recent completion of the MRE to support the preliminary mine plan the Feasibility Study work that is now ongoing and expected to be incorporated into the Feasibility Study includes:

- Undertake further metallurgical testing to determine final concentrate characteristics to optimize final product specifications and to enhance overall recovery based upon more detailed resource and mine sequencing details;

- Develop a Reserve;

- Environmental base line studies reporting;

- Commencement of formal discussions with first nations and local community groups to negotiate an Impact and Benefits Agreement (IBA) will commence Q3/2022;

- Commence the required permitting process;

- Increased management and operational capacity with the addition of key specialists and a local community engagement team; and

- Commence and Complete project financing negotiations.

Environmental Studies, Permitting and Social or Community Impact

WSP Golder (Quebec) have been engaged to manage the Studies, Permitting and Impact Assessment work. Baseline studies have commenced and at this stage there are no fatal flaws identified. WSP Golder (Quebec) have identified the Federal IA process remains the critical activity whereby timeframes may extend beyond the current development plan. Voyager Metals have engaged the lead Agencies and file managers have been assigned.

In addition, community and interested and affected parties will continue to be engaged over the coming periods and this will undoubtedly impact on improvements to the current PEA that address any concerns and are necessary for the Project to proceed into construction.

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions. Where reference is made to Inferred Mineral Resources, these are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. The PEA summarized herein is based solely on Inferred Minerals Resources and not based on any Inferred Mineral Resources. There is no guarantee the project economics described herein will be achieved.

Voyager will within 45 days, publish a Technical Report prepared in accordance with NI 43-101 that documents the PEA study and supports the current disclosure.

Non-IFRS Measures

This news release may contain references to EBITDA, Cash Costs, free cash flow and other such measures, all of which are non-IFRS measures and do not have standardized meanings under IFRS. Therefore, these measures may not be comparable to similar measures presented by other issuers.

Management uses EBITDA, Cash Costs, free cash flow and other such measures as measures of operating performance to assist in assessing the Company's ability to generate future liquidity through operating cash flow to fund future working capital needs and to fund future capital expenditures, as well as to assist in comparing financial performance from period to period on a consistent basis. The Company believes that these measures are used by and are useful to investors and other users of the Company's financial statements in evaluating the Company's operating and cash performance because they allow for analysis of its financial results without regard to special, non-cash and other non-core items, which can vary substantially from company to company and over different periods.

The Company calculates EBITDA as NSR subtracting operational expenditure (OPEX) and subtracting Royalties.

The Company defines free cash flow as a measure of the Corporation's ability to generate and manage liquidity. It is calculated starting with the net cash flows from operating activities (as per IFRS) and then subtracting capital expenditures and lease payments.

Qualified Persons Statements

The PEA and other scientific and technical information contained in this news release were prepared by various "qualified persons" in accordance with the Canadian regulatory requirements set out in NI 43-101. The content has been reviewed and approved by as it relates to geology, deposit, sampling, drilling, exploration, QAQC and mineral resources: Marin IUND Ordre des Géologues du Québec (OGQ No.?EUR?1525), the Association of Professional Geoscientists of Ontario (PGO, No.?EUR?3123), and the Northwest Territories and Nunavut Association of Professional Engineers and Professional Geoscientists (NAPEG licence No.?EUR?L4431); Carl Pelletier Ordre des Géologues du Québec (OGQ, No.?EUR?384), the Association of Professional Geoscientists of Ontario (PGO, No.?EUR?1713), the Association of Professional Engineers and Geoscientists of British Columbia (EGBC, No.?EUR?43167), the Northwest Territories Association of Professional Engineers and Geoscientists (NAPEG, No.?EUR?L4160), and the Canadian Institute of Mines (CIM) as it relates to Mineral Processing and Metallurgical Testing and Recovery Methods: Mathieu Girard Ordre des Ingénieurs du Québec (OIQ, No.?EUR?106546); and are all Independent qualified persons, as defined under NI 43-101

The technical information contained in this news release relating to the Preliminary Mining Plan has been reviewed and approved by Pierre-Jean Lafleur, P.Eng. (OIQ), who is a Non-Independent Qualified Person with respect to the Company's Mont Sorcier Project as defined under NI 43-101.

The technical Information contained in this news release as it relates to infrastructure, mining costs, project development and financial modelling has been reviewed and approved by Clinton Swemmer, P.Eng. (PEO) who is a Non-Independent Qualified Person with respect to the Company's Mont Sorcier Project as defined under NI 43-101.

About Voyager Metals Inc.

Voyager Metals Inc is a mineral exploration company headquartered in Toronto, Canada. The Company is focused on advancing its Mont Sorcier, Vanadium-rich, Magnetite Iron Ore Project, located just outside of Chibougamau, Quebec.

At Mont Sorcier, Voyager is rapidly advancing the project towards Feasibility and permitting The project currently has Indicated Resources of 679M tonnes grading 27.8% magnetite and 0.20% V2O5, with the potential to produce 195M tonnes of magnetite concentrate grading at least 65% Fe and 0.52% vanadium pentoxide (V2O5) and a further Inferred Resource estimated at 547M tonnes grading 26.1% magnetite and 0.17% V2O5, with the potential to produce 148M tonnes of magnetite concentrate grading at least 65% Fe and 0.52% vanadium pentoxide (V2O5)..

For more information about Voyager please visit our website at: www.voyagermetals.com

ON BEHALF OF THE BOARD OF DIRECTORS OF VOYAGER METALS INC.

Cliff Hale-Sanders,

President and CEO

Tel: +1-416-819-8558

csanders@voyagermetals.com

info@voyagermetals.com

www.voyagermetals.com

Nicholas Campbell, CFA

Director, Corporate Development

Tel.: +1-905-630-0148

ncampbell@voyagermetals.com

Cautionary Note Regarding Forward-Looking Statements:

This news release contains "forward looking statements" or "forward-looking information" (collectively "Forward-Looking Statements") that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "guidance", "outlook", "intends", "anticipates", "believes", or variations of such words and phrases or that state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward-Looking Statements in this press release relate to, among other things: the future exploration performance of the Company. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and Qualified Persons (in the case of technical and scientific information), as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others: there being no assurance that the Company will upgrade a significant portion of the North Zone to the Measured and Indicated categories to support the pending feasibility study; as well as those risk factors discussed or referred to in the Company's MD&A under the heading "Risk Factors" and under the heading "Forward-looking statements and use of estimates" which include further details on material assumptions used to develop such Forward Looking Statements and material risk factors that could cause actual results to differ materially from Forward Looking Statements, and other documents filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR at www.sedar.com.

The reader has been cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company's Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Other than as it may be required by law, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management's estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Voyager Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/709596/Voyager-Metals-Reports-after-Tax-NPV-Of-US16-Billion-and-IRR-of-43-For-Its-Preliminary-Economic-Assessment-at-the-Mont-Sorcier-Magnetite-Iron-and-Vanadium-Project-in-Quebec