Wallbridge Extends Martiniere Gold Mineralization to the East

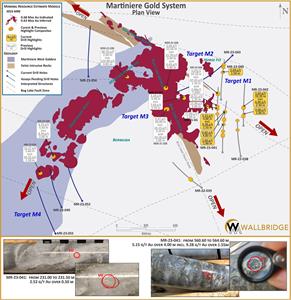

TORONTO, June 08, 2023 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX: WM, OTCQX: WLBMF) (“Wallbridge” or the “Company”) today announced that it has extended gold mineralization at the Company’s 100%-owned Martiniere Gold project (“Martiniere”) 300 metres east of the existing Mineral Resource Estimate (“MRE”) footprint. The results build upon step-out hole (MR-22-036) completed in late 2022, which identified the presence of significant gold mineralization east of the main deposit (see press release dated Oct. 12, 2022 and Fig. 1).

Attila Péntek, Wallbridge’s Vice President, Exploration, commented:

“We are excited to report that all of our follow-up holes in the M1 Target area to date have encountered gold mineralization, validating the potential to significantly expand the footprint of the Martiniere deposit to the east. Since commencing our exploration work at Martiniere in 2021, we have doubled the MRE at the project, and these results continue to reinforce the large size potential of the Martiniere gold system. In addition, a recently completed high-resolution airborne magnetic survey is providing valuable information to further improve the success of our property-wide targeting as we continue to follow up on these strong results.”

Highlights

- MR-23-041 (a 300-metre undercut of MR-22-036) intersected 5.15 g/t Au over 4.00 metres, including 9.28 g/t Au over 1.55 metres.

- MR-23-042, collared 250 metres to the east of MR-22-036, intersected 1.63 g/t Au over 19.35 metres, including 6.96 g/t Au over 2.30 metres.

- New drill holes confirm increased presence of porphyritic intrusive rocks towards the east, similar to the Bug Lake Porphyry, one of the main controls on gold mineralization at Martiniere.

Martiniere Exploration Program Underway

Prior to the temporary suspension of operations due to forest fires the Company had three drill rigs operating on its Detour-Fenelon Gold Trend property: two at its Martiniere gold project and one that was in the process of moving from Fenelon to Grasset East to test favorable target areas on this eastern, unexplored part of the land package. At Martiniere, additional holes are planned to continue testing the M1 Target following the results announced today.

So far, Wallbridge has completed over 10,000 meters of drilling at Martiniere as part of its 2023 exploration program. Assays results are being released today for three drill holes from the 2023 Martiniere drill program and two holes completed at the end of 2022. Assay results for 14 drill holes testing other exploration targets at Martiniere are currently pending (Fig. 2).

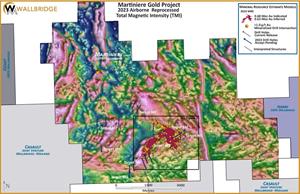

In addition to the drilling campaign, a high-resolution airborne magnetic survey was completed over Martiniere (Fig. 2), which is providing valuable information for drill targeting through the identification of potential host rocks and gold-bearing structures property wide.

Assay QA/QC and Qualified Persons

Drill core samples from the ongoing drill program at Martiniere are cut and bagged either on-site or by contractors and transported to SGS Canada Inc. for analysis. Samples, including standards and blanks for quality assurance and quality control, were prepared and analyzed at the laboratories. Samples are crushed to 90% less than 2mm. A 1kg riffle split is pulverized to 85% passing 75 microns. 50g samples are analyzed by fire assay and AAS or ICP. Samples >10g/t Au are automatically analyzed by fire assay with gravimetric finish or screen metallic analysis. To test for coarse free gold and additional quality assurance and quality control, Wallbridge requests screen metallic analysis for samples containing visible gold. These and future assay results may vary from time to time due to re-analysis for quality assurance and quality control.

The Qualified Person responsible for the technical content of this press release is Christopher Kelly, M.Sc., P.Geo., Senior Geologist of Wallbridge.

Figure 1. Martiniere Gold Property, Plan View

Figure 2. Martiniere Gold Project, Total Magnetic Survey (TMI)

| Table 1. Martiniere Gold Property, Recent Drill Assay Highlights (1,4) | |||||||

| Drill Hole | From | To | Length | Au | Au Cut(2) | VG(3) | Zone/Corridor |

| (m) | (m) | (m) | (g/t) | (g/t) | |||

| South of Bug Lake South Zone | |||||||

| MR-22-039 | 181.00 | 182.50 | 1.50 | 0.78 | 0.78 | New Zones | |

| MR-22-039 | 204.00 | 205.50 | 1.50 | 0.81 | 0.81 | New Zones | |

| Target 1- Eastern Extension | |||||||

| MR-22-038 | 362.00 | 363.10 | 1.10 | 1.61 | 1.61 | New Zones | |

| MR-22-038 | 485.10 | 486.40 | 1.30 | 1.84 | 1.84 | New Zones | |

| MR-23-040 | 384.00 | 385.50 | 1.50 | 2.69 | 2.69 | New Zones | |

| MR-23-040 | 450.00 | 451.50 | 1.50 | 1.45 | 1.45 | New Zones | |

| MR-23-040 | 485.50 | 488.50 | 3.00 | 0.72 | 0.72 | New Zones | |

| MR-23-041 | 231.00 | 231.50 | 0.50 | 2.52 | 2.52 | VG | New Zones |

| MR-23-041 | 234.00 | 235.50 | 1.50 | 1.20 | 1.20 | New Zones | |

| MR-23-041 | 253.50 | 255.00 | 1.50 | 0.73 | 0.73 | New Zones | |

| MR-23-041 | 298.80 | 299.55 | 0.75 | 1.27 | 1.27 | New Zones | |

| MR-23-041 | 302.00 | 303.00 | 1.00 | 1.99 | 1.99 | New Zones | |

| MR-23-041 | 390.80 | 392.70 | 1.90 | 1.66 | 1.66 | New Zones | |

| MR-23-041 | 444.75 | 445.60 | 0.85 | 1.71 | 1.71 | New Zones | |

| MR-23-041 | 465.00 | 466.50 | 1.50 | 0.69 | 0.69 | New Zones | |

| MR-23-041 | 554.15 | 559.00 | 4.85 | 0.83 | 0.83 | New Zones | |

| MR-23-041 | 560.60 | 564.60 | 4.00 | 5.15 | 5.15 | VG | New Zones |

| Including… | 560.60 | 562.15 | 1.55 | 9.28 | 9.28 | VG | New Zones |

| MR-23-042 | 136.00 | 137.50 | 1.50 | 0.82 | 0.82 | New Zones | |

| MR-23-042 | 154.00 | 155.00 | 1.00 | 4.08 | 4.08 | New Zones | |

| MR-23-042 | 254.65 | 274.00 | 19.35 | 1.63 | 1.63 | New Zones | |

| Including | 266.60 | 268.90 | 2.30 | 6.96 | 6.96 | New Zones | |

Note: There is currently insufficient information available from these new zones to estimate the true widths of intersections.

(1) Table includes only assay results received since the latest press release dated October 12, 2022

(2) Au cut (high-grade capping) at: 25 g/t Au

(3) Intervals containing visible gold (“VG”)

(4) Metal factor of at least 0.95 g/t*m

All figures and a table with drill hole information of recently completed holes are posted on the Company’s website under “Current Program” at https://wallbridgemining.com/our-projects/martiniere/.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects along the Detour-Fenelon Gold Trend while respecting the environment and communities where it operates.

Wallbridge’s flagship project, Fenelon Gold (“Fenelon”), is located on the highly prospective Detour-Fenelon Gold Trend Property in Québec’s Northern Abitibi region. An updated mineral resource estimate completed in January 2023 yielded significantly improved grades and additional ounces at the 100%-owned Fenelon and Martiniere projects, incorporating a combined 3.05 million ounces of indicated gold resources and 2.35 million ounces of inferred gold resources.

Fenelon and Martiniere are located within an 830 km2 exploration land package controlled by Wallbridge. The Company believes that these two deposits have good potential for economic development, especially given their proximity to existing hydro-electric power and transportation infrastructure. In addition, Wallbridge believes that the extensive land package is extremely prospective for the discovery of additional gold deposits.

Wallbridge also holds a 19.9% interest in the common shares of Archer Exploration Corp. (“Archer”) as a result of the sale of the Company’s portfolio of nickel assets in Ontario and Québec in November of 2022.

Wallbridge will continue to focus on its core Detour-Fenelon Gold Trend Property while enabling shareholders to participate in the potential economic upside in Archer.

For further information please visit the Company’s website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited

Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682‒9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Investor Relations Advisor

Email: vvargas@wallbridgemining.com

Cautionary Note Regarding Forward-Looking Information

This press release contains forward-looking statements or information (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections, and interpretations as at the date of this press release.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI herein includes but is not limited to: statements regarding the potential future performance of Archer common shares; future drill results; the Company’s ability to convert inferred resources into measured and indicated resources; environmental matters; stakeholder engagement and relationships; parameters and methods used to estimate the MRE’s at the Fenelon Gold (defined below) and Martiniere (defined below) properties (collectively the “Deposits”); the prospects, if any, of the Deposits; future drilling at the Deposits; and the significance of historic exploration activities and results.

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI, or information contained herein.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Assumptions upon which FLI is based, without limitation, include: the results of exploration activities, the Company’s financial position and general economic conditions, the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Deposits; the accuracy of key assumptions, parameters or methods used to estimate the MREs; the ability of the Company to obtain required approvals; the results of exploration activities; the evolution of the global economic climate; metal prices; environmental expectations; community and non-governmental actions; and any impacts of the COVID-19 pandemic on the Deposits, the Company’s financial position, the Company’s ability to secure required funding, or operations. In addition to the MD&A, risks and uncertainties about Wallbridge's business are discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com.

Information Concerning Estimates of Mineral Resources

The disclosure relating to the Deposits and MRE’s in this press release and referred to herein was prepared in accordance with NI 43-101 which differs from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used in this press release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained in this press release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Investors are cautioned that while terms, are substantially similar to CIM Definition Standards, there are differences in the definitions and standards under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced in this press release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/af66973e-937e-4c98-9918-0e77c3fbb2b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/172b897e-a77e-4660-925e-bb28bc729245