Wesdome Announces 2019 Fourth Quarter and Full Year Production Results; Provides 2020 Guidance

TORONTO, Jan. 15, 2020 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces fourth quarter (“Q4”) and full year 2019 production results and 2020 guidance. All figures are stated in Canadian dollars unless otherwise stated.

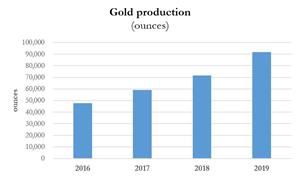

Production from the Eagle River Complex in Q4 2019 totaled 21,332 ounces of gold, representing an increase of 24% from the same period last year. Full year 2019 production of 91,688 ounces of gold as compared to 71,625 ounces of gold production of fiscal 2018 represents a 28% increase year on year and an almost a two fold increase since 2016.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e0b9a99c-0dff-4d75-bf0c-5f5c836af2b4

Duncan Middlemiss, President and CEO commented, “The Eagle River Complex continued to perform very well, with 2019 full year gold production of 91,688 ounces, far exceeding our original guidance of 72,000 - 80,000 Au ounces and achieving the high end of our upwards revised guidance of 88,000 -93,000 ounces. On behalf of the management team and Board, we would like to thank the team at Eagle River for once again delivering an excellent year in terms of operational performance and especially safety performance. The company’s Total Medical Injury Frequency Rate (TMIFR) metric has decreased by 23% over 2018 representing a substantial improvement.”

“In 2020, we will continue the upward trajectory of organic growth and are setting guidance at 90,000 – 100,000 ounces. Operating and all-in sustaining costs are expected to be flat as we continue to aggressively drill and develop underground workplaces in order to fill the Eagle River mill entirely from higher grade underground ore in the future.”

“At Kiena, drilling and development will be increased substantially over our 2019 program. We plan to drill a total of 85,000 metres in exploration drilling, invest $8.2 million in exploration drifts and continued ramp development, and continue our metallurgical and environmental scoping studies in preparation for a possible mine restart. Work on the PEA is ongoing and we expect to publish results in the first half of the year.”

| Amounts are denominated in Canadian dollars | Fourth Quarter | Fiscal Year | ||

| 2019 | 2018 | 2019 | 2018 | |

| Ore milled (tonnes) 1 | ||||

| Eagle River | 23,257 | 50,536 | 122,405 | 185,171 |

| Mishi | 9,108 | 8,478 | 46,405 | 70,633 |

| 32,365 | 59,014 | 168,809 | 255,804 | |

| Head grade (grams per tonne, “g/t”) | ||||

| Eagle River | 28.6 | 10.6 | 23.1 | 11.7 |

| Mishi | 1.9 | 2.4 | 2.5 | 2.3 |

| Gold production (ounces) 1 | ||||

| Eagle River | 20,894 | 16,712 | 88,617 | 67,315 |

| Mishi | 438 | 542 | 3,072 | 4,310 |

| 21,332 | 17,254 | 91,688 | 71,625 | |

| Production sold (ounces) | 22,100 | 18,077 | 88,423 | 70,480 |

| Revenue from gold sales ($ millions) | $43.2 | $29.4 | $163.8 | $115.9 |

| Average realized price per ounce 2 | $1,954 | $1,628 | $1,853 | $1,645 |

Notes:

- Numbers may not add due to rounding.

- Average realized price per ounce is a non-IFRS measure and is calculated by dividing the reported revenue from gold sales by the number of ounces sold for a given period. Please reference the Company’s interim management discussion and analysis for the period ended September 30, 2019 filed on SEDAR for their calculations.

2020 Guidance

| Amounts are denominated in Canadian dollars, or otherwise indicated | Guidance |

| Gold production | |

| Eagle River | 87,000 – 96,000 ounces |

| Mishi | 3,000 - 4,000 ounces |

| 90,000 – 100,000 ounces | |

| Head grade (g/t) | |

| Eagle River | 15.0 – 16.7 |

| Mishi | 2.0 – 2.4 |

| Operating cost per ounce 1 | $800 - $875 US$615-US$670 |

| All-in sustaining cost per ounce 1 | $1,280 - $1,350 US$985 – US$1,040 |

- Operating cost per ounce and All-in sustaining cost per ounce are non-IFRS measures, please reference the Company’s interim management discussion and analysis for the period ended September 30, 2019 filed on SEDAR for their calculations.

2020 Exploration Programs

Eagle River Complex

- The 2020 exploration program at Eagle River consists of approximately 119,000 metres (“m”) of underground (“UG’) definition and exploration drilling (72,000 m exploration and 47,000 m of definition drilling) using 5 underground drill rigs, and 33,500 m of surface drilling using 2 drills.

- Definition drilling will be focussed at 300W, 300E, and down dip on the 711 and 811 zones.

- Underground exploration drilling will be completed down plunge at the 300E zone, as well as west of 7 Zone along the diorite contact and up plunge from the 311 Zone towards the Falcon zones. Additional underground exploration will also be completed further to the east of the current mining areas, in the east-central area of the mine at the 200 and 825 m-levels to test for parallel zones north of the historic 8 and 6 zones.

- The 33,500 m surface drilling program will initially concentrate on better defning and expanding the Falcon zones and later in the year focus on regional targets west of the mine diorite where recent surface samplng has returned a number of anomalous gold values.

- Total exploration budget (excluding the definition drilling program) at the Eagle River Complex is forecast at $9.8 million

Kiena Complex

- The 2020 exploration program at Kiena consists of 75,000 m of underground drilling and 10,000 m of surface drilling for a total budget of $10.1 million.

- In addition, we plan to invest $8.2 million on exploration drifts and ramp development to better explore and access the Kiena Deep A zone. Additional development is planned on 17 m level for a ventilation exhaust raise by-pass.

- The underground exploration drilling program will utilize 7 drill rigs to better define the Kiena Deep A zone and convert inferred resources to indicated resources in advance of an updated resource estimate, and also test the up plunge potential of the A Zone and down dip extensions of the VC Zones between the 67 and 105 m levels that will be completed from the recently developed 79 m level.

- Additional underground exploration will be completed to test the down plunge potential of the A Zone below 1,500 vertical metres where recent drilling has returned high grade results. An additional 220 m of development along the SE portion of the existing 105 m level will be established to test down plunge extension of both the A and B zones.

- Elsewhere in the mine area, drilling will occur at the South Zone and areas of S50 Zone to expand mineral resources near existing infrastructure as these zones remain an important component of any restart plan.

- The PEA study is ongoing and is expected to be completed in H1 2020, which will lead into a more detailed PFS study based upon positive results.

- Surface exploration will utilize lithologic and structural 3D modelling and deposit “fingerprinting” to guide exploration targeting in the area of the Kiena deposit.

- A 10,000 m surface drilling program is planned to explore for zones similar to the Kiena Deep A Zone.

- Total projected 2020 capital budget at Kiena is $44.8 million, which includes drilling, UG development, the completion of backfill operations initiated in 2019, and all mining and site administration activities in anticipation of a go forward scenario. These expenditures are contingent upon staged positive results.

2020 Other Capital and Operating Expenditures

- Eagle River sustaining capital development is budgeted to range between $14.0 million and $17.0 million.

- General and corporate administration expenses budgeted to range between $6.5 million and $7.0 million

The Company is adequately funded to undertake the 2020 work plan, with cash and cash equivalents of $35.7 million and an available credit facility of $41.5 million at the beginning of the year, making Wesdome well positioned to execute on its path to becoming Canada’s next mid-tier gold company.

Technical Disclosure

The technical content of this release has been compiled, reviewed and approved by Marc-Andre Pelletier, P. Eng, Chief Operating Officer, and Michael Michaud, P.Geo., Vice President, Exploration of the Company and both a "Qualified Person" as defined in National Instrument 43-101 -Standards of Disclosure for Mineral Projects.

ABOUT WESDOME

Wesdome has had over 30+ years of continuous gold mining operations in Canada. The Company is 100% Canadian focused with a pipeline of projects in various stages of development. The Company’s strategy is to build Canada’s next intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Québec. The producing Eagle River Complex in Wawa, Ontario is currently producing gold from the Eagle River Underground Mine and the Mishi Open pit. Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Québec, with the objective of bring the asset in production stage over the next two years. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill. The Company has further upside at its Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario. The Company has approximately 138.0 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO”.

For further information, please contact:

| Duncan Middlemiss | or | Lindsay Carpenter Dunlop |

| President and CEO | VP Investor Relations | |

| 416-360-3743 ext. 2029 | 416-360-3743 ext. 2025 | |

| duncan.middlemiss@wesdome.com | lindsay.dunlop@wesdome.com |

220 Bay St, Suite 1200

Toronto, ON, M5J 2W4

Toll Free: 1-866-4-WDO-TSX

416-360-3743, Fax: 416-360-7620

Website: www.wesdome.com

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management’s estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.

PDF available: http://ml.globenewswire.com/Resource/Download/29313362-8e4e-42f8-8480-f67d6aa85131