Wesdome Announces Positive Pre-Feasibility Study and Restart Decision for the Kiena Mine in Val d'Or, Quebec; IRR of 98%

TORONTO, May 26, 2021 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX:WDO) (“Wesdome” or the “Company”) is pleased to announce positive results from the independent Pre-Feasibility Study (“PFS”) prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) at its 100% owned Kiena Complex in Val d’Or, Quebec. Based on the results of the PFS, the Board of Directors of the Company has made a restart decision for the Kiena Complex, commencing immediately.

Highlights of the PFS are outlined below. All figures are in Canadian dollars unless otherwise stated:

- After-tax NPV5% of $367 million at US$1,600 per ounce gold, increasing to an after-tax NPV5% of $491 million at US$1,900 per ounce gold using CAD/USD exchange rate of $1.32

- Internal Rate of Return of 98% and after tax payback period of 2.7 years

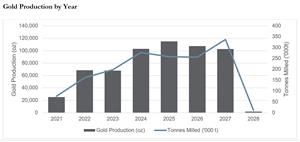

- Average annual gold production of approximately 84,000 oz per year, with peak production over 115,000 oz in 2025; over 100,000 oz per year run rate expected in 2024

- LOM average cash costs of $502/oz (US$380/oz) and all-in sustaining costs (“AISC”) of $894/oz (US$676/oz)

- Life of mine capital of $230 million ($68 million spent in 2021) fully funded by existing liquidity and operating cash flows

- Average annual free cash flow (2022-2027) of $85.5 million at US$1,600 per ounce gold or $109.5 million at US$1,900 per ounce gold

- Reserve mine life of approximately 7 years represented based on Indicated Mineral Resources as at October 2020 (average grade 11.9 grams per tonne)

- Production activities will utilize using existing mine infrastructure such as the shaft and the existing 2,000 tonne per day mill, which was successfully restarted for the bulk sample, thereby allowing for low costs and short time period to restart the mine

Mr. Duncan Middlemiss, President and CEO commented, “We are excited to be moving ahead with the Kiena re-start, less than five years following the discovery of the Kiena Deep A Zone. This transformational project continues to present compelling economics and represents a strong step toward Wesdome becoming a diversified mid-tier producer. We now expect to see initial production from Kiena as early as Q3 2021. To that end, we will maintain our previously released guidance of 15,000 – 25,000 ounces at Kiena until later in the year, when we will reassess based upon start up performance.

Compared to the Preliminary Economic Assessment dated June 17, 2020 (“PEA”), higher capital and operating costs reflect modest changes in project scope. The increases are primarily related to the addition of a paste backfill plant, water treatment facility, work at the tailings management area, as well as ventilation and power upgrades, ultimately allowing for increased production and a longer mine life as we delineate additional resources at depth and across the Kiena property. The significant infrastructure in place allows for a low capex, high return project.

Subsequent to the September 18, 2020 diamond drilling cut off date for resources included in this PFS and despite the challenges presented as a result of the ongoing COVID-19 pandemic, 41,780 meters of exploration drilling represented by 143 diamond drill holes have been completed in the Kiena Deep Zone, effective April 12, 2021 demonstrating the potential to add more ounces per vertical metre and potentially enhance economics through higher annual output over a longer mine life. This is evidenced in particular by the recent Footwall Zone discovery and intersection of hole 6760W1 at 41.2g/t over 51.2m which is interpreted as a 300 metre down plunge extension of the initial discovery (see March 23rd and May 19th, 2021 releases). As such, the PFS represents a dated snapshot in time and we strongly believe in the potential of the Kiena Deep Zone becoming a much more substantial deposit.”

Overview

The Kiena Complex is in the Province of Quebec in the Abitibi-Temiscamingue administrative region within the limits of the municipality of Val d’Or and 100 km east of Rouyn-Noranda. It lies to the northwest of the urban centre of Val d’Or and covers 7,047 ha. The Project includes the 2,000 tpd mill and tailings facilities of the Kiena mine, nine shafts including the 930 metre (“m”) Kiena hoisting shaft, related underground workings from past producers and exploration projects, and various surface facilities. Other than the exploration activities and underground exploration development, the principal infrastructure of the Project has been under care and maintenance since mid-2013. Past production from 1981 – 2013 was 12.5M tonnes at 4.5 g/t Au for 1.75 M ounces produced. The Kiena Deep A Zone was first intersected in December 2007 and is localized within the Marbenite Fault (“MF”) deformation corridor and is divided into three main lenses and a fourth smaller lens.

The June 2020 PEA had demonstrated a low-cost, high margin operation with low capital requirements with a short payback period. The PEA was based on the Mineral Resource Estimate (“MRE”) dated September 2019. Consequently, the Company decided to begin a definition diamond drilling program to convert the inferred resources into indicated resources. The updated mineral resource estimate was used as a basis for the PFS.

Mineral Resources

The 2020 mineral resource model with a drill database closeout date of September 18, 2020 (issued on December 15, 2020) was used as the base for the PFS. Drilling efforts converted a large portion of the existing A Zone’s inferred resources to indicated resources despite the lower than planned drill metres due to the operational disruptions attributed to the COVID-19 restrictions. A decision by the company was taken in May 2020 to focus 100% on inferred to indicated resource conversion within the A Zone, as the ability to drill metres had become challenged with the pandemic.

Table 1: Indicated and Inferred Kiena Mine Complex Mineral Resource Estimate per area (exclusive of mineral reserves)

| Area | Indicated | Inferred | ||||

| Tonnes | Gold Grade (g/t) | Gold Ounces | Tonnes | Gold Grade (g/t) | Gold Ounces | |

| Kiena Deep | 281,400 | 11.65 | 105,400 | 311,200 | 11.22 | 112,200 |

| S50 | 69,300 | 3.82 | 8,500 | 99,300 | 3.72 | 11,900 |

| VC | 137,700 | 4.79 | 21,200 | 169,500 | 5.30 | 28,600 |

| ZB | - | - | - | 74,000 | 4.10 | 9,800 |

| South Zones | 63,200 | 4.15 | 8,400 | 226,800 | 3.85 | 28,000 |

| Presquile | - | - | - | 255,600 | 6.70 | 55,100 |

| Dubuisson | - | - | - | 744,600 | 6.70 | 160,200 |

| Martin | 92,100 | 4.38 | 13,000 | 108,200 | 4.28 | 14,900 |

| North West | - | - | - | 285,800 | 4.00 | 37,100 |

| Wesdome* | - | - | - | 1,129,400 | 5.30 | 191,400 |

| Total | 643,700 | 7.56 | 156,500 | 3,404,400 | 5.94 | 649,200 |

| * Wesdome at 3.6 g/t Au cut-off | ||||||

Notes to Table 1:

(1) The independent qualified persons for the 2020 MRE, as defined by National Instrument (“NI”) 43-101 guidelines, are Pierre-Luc Richard, P. Geo., and Charlotte Athurion, P. Geo., both of BBA Inc.

(2) These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

(3) These mineral resources are exclusive of mineral reserves.

(4) The mineral resource estimate follows CIM definitions (2014) for mineral resources.

(5) Results are presented in situ and undiluted and considered to have reasonable prospects for economic extraction, below a 100 m crown pillar.

(6) The resources include 46 zones with a minimum true thickness of 3.0 m (2.4 m for Wesdome zones) using the grade of the adjacent material when assayed or a value of zero when not assayed. High-grade capping varies from 20 to 265 g/t Au (when required) and was applied to composited assay grades for interpolation using an Ordinary Kriging interpolation method (ID2 for Dubuisson zones 1220 and 1230) based on 1.0 m composite and block size of 5 m x 5 m x 5 m, with bulk density values of 2.8 (g/cm3). A three-step capping strategy was applied, where capping value decreased as interpolation search distance increased, in order to restrict high-grade impact at greater distance. Indicated resources are manually defined and encloses areas where drill spacing is generally less than 30 m, blocks are informed by a minimum of three drillholes, and reasonable geological and grade continuity is shown.

(7) The estimate is reported for potential underground scenario at cut-off grades of 2.8 g/t Au (>40 degree dip) and 3.6 g/t Au (<40 degree dip, Wesdome zones only). The cut-off grades were calculated using a gold price of US$1,450 per ounce, a CAD/USD exchange rate of $1.32 (resulting in C$1,914 per ounce gold price); mining cost C$100/t (>40 degree dip); C$150/t (<40 degree dip); processing cost C$40/t; G&A C$25/t.

(8) The number of metric tonnes and ounces were rounded to the nearest hundred and the metal contents are presented in troy ounces (tonne x grade/31.10348). Rounding may result in apparent summation differences between tonnes, grades and contained metals content.

The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issues not reported in this Technical Report that could materially affect the mineral resource estimate

Mining

Future production mining will utilize the long hole stope method and development will be advanced utilizing conventional drilling and blasting methods. Daily ore production commences at 413tonnes per day (tpd) increasing to over 920 tpd. Detailed mine design and economic analysis have demonstrated the technical viability and economic feasibility of the Kiena Deep A Zone, S50 and Martin Zones. Although included in the PEA, South and VC Zones are not included in the PFS as they are currently uneconomic. A larger resource base is required to bring those mineral resources into mineral reserves. Stope mining sequence in the A Zone consists of mining blocks containing five sublevels each mined bottom up from the A2 lens towards the A lens.

The overall strategy is to maximize throughput from the high grade Kiena Deep A Zone and to augment the production from the other zones. Ore will be hauled by trucks to the hoisting shaft ore passes already established in the mine. Paste backfill will be utilised in the Kiena Deep A Zone in order to optimize stope cycle, mineability and maximize throughput. The total ore mined by Zone is presented in Table 2.

Mineral Reserves

Table 2: Probable Mineral Reserves estimate by mineralized zone

| Zone | Tonnes Mined | ||

| Tonnes | Diluted Gold Grade | Mined Gold Ounces | |

| Martin | 92,237 | 4.00 | 11,875 |

| S50 | 95,106 | 4.12 | 12,609 |

| Deep A | 1,387,091 | 12.90 | 577,296 |

| Total | 1,574,434 | 11.89 | 601,780 |

| Notes to Table 2: 1. CIM Definitions Standards on Mineral Resource and Reserves (2014) were followed. 2. Underground Mineral Reserves are diluted tonnes and grades; the reference point is the mill feed at the primary crusher. 3. Cut-off grade considers a gold price of C$1,914 per ounce (US$1,450 per ounce at CAD/USD exchange rate of $1.32) for mine design purposes, a 97% metallurgical processing recovery for both the S50 & Martin Zones and 98.5% for the Kiena Deep Zone, life of mine operating cost of C$122.92/t mining, C$28.25/t processing, C$36.53/t General and Administration. An incremental cut-off grade excluding the mine operating cost was not considered for lateral drift development required through mineralization and would present opportunity to increase the Mineral Reserve estimate. 4. A minimum mining width of 3.0 m, and minimum footwall angle of 45° was used in the creation of all mineral reserve solids. Longitudinal long hole stoping is the predominant method considered for production mining. The life of mine mining recovery factor is 90% and combined planned and unplanned dilution factor is 27%. 5. A bulk density of 2.8 t/mᶾ was used for both ore and waste rock. 6. The application to expand the mining concession to include Martin Zone is being pursued by Wesdome. Martin Zone is scheduled to begin development and production mining in 2024 to provide time for the permitting process to be approved. 7. Diluted ore tonnes and gold ounces were rounded to the nearest hundred. Numbers may not add due to rounding. |

Milling

Metallurgical test work undertaken by Base Metallurgical Laboratories Ltd. in Kamloops, British Columbia has demonstrated the current cyanidation and carbon-in-pulp (CIP) mill circuit is well suited to maximize the gold recovery averaging 98.5% for Kiena Deep ore. Wesdome has processed 7,032 tonnes of the Kiena Deep ore in December 2020 and the reconciled recovery was in the predicted range. A mill recovery rate of 97% was used for other zones.

Gold Production

The production plan is based on a mill start-up in the second half of 2021. Each zone was reviewed, and a composite mining rate developed in tonnes per day (tpd) that accounts for sill development and the mining activities (drill, blast, muck and backfill). Over the life of mine (LOM), a total of 592,113 oz of gold (payable) (average annual: 83,574 oz) will be produced.

Gold Production by Year

An image accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/04821855-0f6e-44a1-a979-b9204426b6af

PFS Economics Assessment

On an after-tax basis, the base case financial model resulted in an IRR of 98% (PEA: 102%) and an NPV of $366.6M (PEA $416.1M) using a 5% discount rate with a Gold Price of US$1,600/oz at a CAD/USD exchange rate of $1.32. The after-tax payback period after start of operations is 2.7 years.

The cash costs and all-in sustaining costs (AISC) over the LOM are US$380 and US$ 676/oz, respectively (PEA: US$374/oz and US$ 512/oz) at an exchange rate of US$1.00:C$1.32.

Table 3: PFS Summary (reported in C$, unless otherwise indicated)

| Description | Unit | Value (PFS) |

| Total Tonnes Mined | Mt | 1.6 |

| Average Diluted Gold Grade | g/t | 11.9 |

| Total Gold Contained | oz | 601,653 |

| Overall Gold Recovery | % | 98.4 |

| Total Gold Payable | oz | 592,113 |

| Mine Life | years | 7 |

| Average Annual Gold Produced | Au oz per year | 83,574 |

| Life of Mine Operating Costs | ||

| Mining | $/t milled | 113.79 |

| Paste Plant | $/t milled | 5.58 |

| Processing, Lab & Tailings Management | $/t milled | 28.25 |

| Water Treatment | $/t milled | 3.55 |

| General and Administration | $/t milled | 36.53 |

| Total Operating Costs | $/t milled | 187.71 |

| Total Capital | $M | 230 |

| Site Restoration Cost | $M | 2 |

| All-in Sustaining Costs ("AISC") | US$/oz | 676 |

| Economic Profile | ||

| Long Term Gold Price | US$/oz | 1,600 |

| Exchange Rate | USD/CAD | 0.76 |

| Discount Rate | % | 5 |

| Total LOM NSR Revenue | $M | 1,250 |

| Total LOM Operating Costs | $M | 296 |

| Total LOM Pre-tax Cash Flow | $M | 723 |

| LOM Royalties | $M | - |

| LOM Mining Taxes | $M | 78 |

| LOM Income Taxes | $M | 174 |

| Total LOM After-tax Free Cash Flow | $M | 471 |

| Pre-tax Summary | ||

| Pre-tax NPV5% | $M | 569 |

| Pre-tax IRR | % | 135 |

| Pre-tax Payback (after start of operations) | year | 2.2 |

| After-tax Summary | ||

| After-tax NPV5% | $M | 367 |

| After-tax IRR | % | 98 |

| After-tax Payback (after start of operations) | year | 2.7 |

Table 4: Project Capital Cost Summary

| Cost Area | Unit |

| Administration and Services | 3.8 |

| Mine | 130.3 |

| Processing Plant | 2.4 |

| Tailings Storage Facility, Backfill Plant & Water Management | 53.4 |

| Owner's Costs | 2.7 |

| Project Indirect Costs | 14.7 |

| Contingency | 22.5 |

| Total | 229.8 |

| Site Reclamation and Closure | 2.0 |

| Total | 231.8 |

Life of mine capital costs for the Kiena Gold Project are estimated to be $229.8M including allowances for indirect costs and contingency of $19.4M and $22.5M respectively. A contingency of 26% was applied where required for an overall blended rate of 11%. The level of engineering and design completed for the PFS places the capital estimate to an accuracy of +/- 25%.

Mine sustaining costs of $130.2M consist of underground development, equipment purchases, ventilation upgrades and construction work including the underground distribution system for paste backfill.

Upgrades at the tailing’s facility will allow the expansion of the existing facility and consequently minimize the impact on the environment. Total expenditure is estimated at $20.4M. Also, a new water treatment facility has been included for the effluent discharge ($23.3M).

Surface infrastructure includes paste plant for a total of $9.6M.

The average operating cost over the 7-year mine life is estimated to be $187.71/t milled Operating cost between 2024-2027 averages $163.94/t as production peaks in 2025.

Table 5: Operating Costs

| Item | Unit | Life of Mine | 2024-2027 |

| Mining & Paste | $/t milled | 119.38 | 106.65 |

| Processing, Lab & Tailings Management | $/t milled | 28.25 | 25.96 |

| Water Treatment | $/t milled | 3.55 | 2.83 |

| General and Administration | $/t milled | 36.53 | 28.50 |

| Total | $/t milled | 187.71 | 163.94 |

Opportunities

- Potential to add additional reserves and resources (over 40,000 metres drilled since last drill cut off date)

- Positive grade reconciliation

- Reduced sand consumption at the paste backfill plant and maximize tailings material sent underground

- Lower costs for water treatment facility

Table 6: Sensitivity

NPV sensitivity results (after-tax) for metal price and exchange rate variations

| Description | Unit | ||||||||||||||||||||||||||||

| Gold Price | US$/oz | $ | 1,200 | $ | 1,300 | $ | 1,400 | $ | 1,500 | $ | 1,600 | $ | 1,700 | $ | 1,800 | $ | 1,900 | $ | 2,000 | ||||||||||

| Pre-tax NPV5% | $M | 312 | 377 | 441 | 505 | 569 | 633 | 698 | 762 | 826 | |||||||||||||||||||

| Post-tax NPV5% | $M | 197 | 239 | 282 | 324 | 367 | 408 | 449 | 491 | 533 | |||||||||||||||||||

| Pre-Tax IRR | 67 | % | 81 | % | 97 | % | 115 | % | 135 | % | 158 | % | 186 | % | 218 | % | 257 | % | |||||||||||

| After-Tax IRR | 50 | % | 60 | % | 72 | % | 84 | % | 98 | % | 112 | % | 127 | % | 144 | % | 163 | % | |||||||||||

| Pre-Tax Payback | Years | 3.3 | 3.1 | 2.7 | 2.5 | 2.2 | 2.1 | 1.9 | 1.7 | 1.5 | |||||||||||||||||||

| After-Tax Payback | Years | 3.6 | 3.4 | 3.1 | 2.9 | 2.7 | 2.5 | 2.3 | 2.2 | 2.0 | |||||||||||||||||||

| Description | Unit | ||||||||||||||||||||||||||||

| Exchange Rate | USD/CAD | $ | 1.00 | $ | 0.90 | $ | 0.85 | $ | 0.80 | $ | 0.76 | $ | 0.70 | $ | 0.65 | $ | 0.60 | $ | 0.55 | ||||||||||

| Pre-tax NPV5% | $M | 319 | 406 | 456 | 514 | 569 | 652 | 738 | 837 | 955 | |||||||||||||||||||

| Post-tax NPV5% | $M | 202 | 258 | 293 | 330 | 367 | 420 | 476 | 540 | 617 | |||||||||||||||||||

| Pre-Tax IRR | 68 | % | 88 | % | 101 | % | 118 | % | 135 | % | 166 | % | 205 | % | 265 | % | 367 | % | |||||||||||

| After-Tax IRR | 51 | % | 65 | % | 75 | % | 86 | % | 98 | % | 116 | % | 137 | % | 167 | % | 211 | % | |||||||||||

| Pre-Tax Payback | Years | 3.3 | 2.9 | 2.7 | 2.4 | 2.2 | 2.0 | 1.7 | 1.5 | 1.3 | |||||||||||||||||||

| After-Tax Payback | Years | 3.6 | 3.3 | 3.1 | 2.9 | 2.7 | 2.4 | 2.2 | 2.0 | 1.7 | |||||||||||||||||||

A conference call to discuss these results will be held on May 27 at 10:00 am ET. Wesdome invites participants to join the call using the following details:

Wesdome Gold Mines Kiena Pre-Feasibility Study Teach-In:

North American Toll Free: (844) 202-7109

International Dial-In Number: (703) 639-1272

Conference ID: 3153756

Webcast link: https://edge.media-server.com/mmc/p/wkk3rxfd

The full technical report will be published on SEDAR and the Company’s website within 45 days of this announcement.

QUALIFIED PERSONS

The Pre-Feasibility Study Analysis production scenario is based on Indicated mineral resources only from the 2020 Mineral Resource Estimate (MRE) issued on December 15th, 2020.

The block model mineral resource estimate, proximal to Kiena Mine Development, was prepared by Karine Brousseau P.Eng. (OIQ #121871), Senior Engineer – Mineral Resources of the Company and a "Qualified Person" as defined in NI 43-101. The mineral resource estimate has been reviewed and audited by BBA Consulting, Toronto, Ontario. Pierre-Luc Richard P. Geo (OGQ #1119) and Charlotte Athurion P.Geo. (OGQ #1784) of BBA Consulting, are "Qualified Persons" for the resource estimate as defined in NI-43-101 and are considered to be “independent” of Wesdome for purposes of NI 43-101.

The full technical report, which is being prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days from this news release. The effective date of the current Pre-Feasibility Study is April 12, 2021.

The PFS was prepared by the following Qualified Persons under NI 43-101, each of whom is independent of the Company under NI 43-101, who have reviewed, verified, and approved the scientific and technical data for which they have responsibility contained in this news release pertaining to the PFS.

| Qualified Person | Company | Scope of Responsibility |

| Charlotte Athurion, P. Geo. Pierre-Luc Richard, P. Geo. | BBA Inc. | Geology and mineral resource estimation |

| Navin Gangadin, P. Eng. | BBA Inc. | Surface infrastructure, estimate integration, financial model, overall NI 43-101 integration |

| Michael Stochmal, P. Eng. | BBA Inc. | Mineral reserve estimation, mine planning, mining infrastructure |

| Frank Palkovits, P. Eng. | Mine Paste Ltd. | Paste backfill |

| Pierre Roy, P. Eng. | Soutex Inc. | Processing and water treatment |

| Sheila Daniel, P. Geo. | Wood Canada Ltd. | Environmental |

| Narendra Verma, P. Eng. | Wood Canada Ltd. | Tailings management |

About BBA

BBA has been providing a wide range of consulting engineering services for nearly 40 years. Engineering, environment and commissioning experts team up to quickly and accurately pinpoint the needs of industrial and institutional clients. Recognized for its innovative, sustainable and reliable solutions, the firm stands out for its expertise in the fields of energy, mining and metals, biofuels, and oil and gas. BBA has 14 offices across Canada to provide local support and offer clients onsite presence.

About Soutex

Soutex is a consulting firm specializing in mineral processing and metallurgical processes. Founded in 2000 and with offices in Canada (Quebec City and Longueuil) and Germany (Munich). Soutex has more than 35 metallurgists and process engineers representing one of the largest groups of specialists in this field in Canada. Soutex offers a wide range of services with its personnel having experience in plant operation, engineering, technical services, research and development, training, and process control, simulation and optimization. High quality standards, rigor in work execution, and customer-oriented services contribute to Soutex’s client satisfaction.

About Wood

“Wood is a global leader in consulting and engineering across energy and the built environment, helping to unlock solutions to some of the world’s most critical challenges from concept through closure. We provide consulting, projects and operations solutions in more than 60 countries, employing around 40,000 people. Our involvement in the mining industry ranges from initial planning and concept, through approvals and construction, into operations and through closure and reclamation. In Canada Wood has over 3,000 employees in 35 offices across the country.”

About Mine Paste Ltd.

Mine Paste Ltd has been providing mine backfill and alternative tailings consulting to EPC projects, including corporate audits, design reviews, optimization and evaluation. Our background is multi-faceted, bringing over 20 years of operational experience and over 20 years of consulting/EPC experience coupled with extensive laboratory testing to bring about cost effective and sustainable concepts to the market place. Our expertise lies in having a detailed understanding of underground mining covering historic and modern mining methodologies, backfill techniques from hydraulic fill to CRF to paste and blended paste, tailings dewatering (all thickeners, filter and associated systems) and tying these together within an environmentally sustainable yet productive plan benefiting shareholders and stakeholders.

ABOUT WESDOME

Wesdome Gold Mines is a 100% Canadian focused Company that has had over 30 years of continuous gold mining operations in Canada. The Company’s strategy is to build an intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Quebec. The Eagle River Complex in Wawa, Ontario is currently increasing gold production from the high grade Eagle River Underground Mine. Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Quebec. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill, and a restart of operations was announced on May 26, 2021. The Company has completed a PFS in support of the production restart decision. Additionally the Company is in the process of divesting of its Moss Lake gold deposit, located 100 kilometres (“kms”) west of Thunder Bay, Ontario. The Company has approximately 139.4 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO.”

COVID-19

The health and safety of our employees, contractors, vendors, and consultants is the Company’s top priority. In response to the COVID-19 outbreak, Wesdome has adopted all public health guidelines regarding safety measures and protocols at all of its mine operations and corporate offices. In addition, our internal COVID-19 Taskforce continues to monitor developments and implement policies and programs intended to protect those who are engaged in business with the Company.

Through care and planning, to date the Company has successfully maintained operations, however there can be no assurance that this will continue despite our best efforts. Future conditions may warrant reduced or suspended production and / or project activities which could negatively impact our ability to maintain projected timelines and objectives. Consequently, the Company’s actual future production and production guidance is subject to higher levels of risk than usual. We are continuing to closely monitor the situation and will provide updates as they become available.

The potential impact of COVID-19 or other risks have not been included in the financials of the project. A summary of risks will be included in the technical reports to be posted on SEDAR.

For further information, please contact:

| Duncan Middlemiss | or | Lindsay Carpenter Dunlop |

| President and CEO | VP Investor Relations | |

| 416-360-3743 ext. 2029 | 416-360-3743 ext. 2025 | |

| duncan.middlemiss@wesdome.com | lindsay.dunlop@wesdome.com |

220 Bay St. East, Suite 1200

Toronto, ON, M5J 2W4

Toll Free: 1-866-4-WDO-TSX

Phone: 416-360-3743, Fax: 416-360-7620

Website: www.wesdome.com

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management’s estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.

PDF available: http://ml.globenewswire.com/Resource/Download/1e28581e-494d-4fb5-9579-84ebd5becc2e