Wesdome Announces Positive Reconciliation Results from the Kiena Deep Bulk Sample

TORONTO, April 12, 2021 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces positive results from underground bulk sample program on the Kiena Deep A Zone at the Company’s 100% owned Kiena Mine Complex in Val d'Or, Quebec. The bulk sample provided an opportunity to confirm the geologic interpretation of the deposit, test for spatial and grade continuity of the mineralized structures, validate key assumptions of the mineral resource estimate and assess the rock quality characteristics.

Highlights of the Bulk Sample

- A total of 7,032 tonnes were processed from the bulk sample at the Kiena mill. The 7,032 tonnes milled as part of the bulk sample represents the planned area of the bulk sample. Additional lower grade material outside of the planned area of the bulk sample was stockpiled on surface.

- Successfully tested an area within the December 15, 2020 Mineral Resource Estimate and confirmed the continuity of the high-grade gold mineralization within the A and A1 Zones.

- The bulk sample recovered 6% more gold than the MRE with a feed grade of 15.7 g/t versus model grade of 14.7 g/t.

- Geotechnical conditions were sound overall and allowed the Company to assess and optimize development protocols.

- Total gold produced was 3,479 ozs with gold recovery in the Kiena mill of 98.2%.

- To date, gold sales of 1,500 ounces of gold in Q4 2020 and 1,793 ounces in Q1 2021 have been sold, with the remaining to be sold in Q2.

| December 15, 2020 - Block Model * | Mill Feed ** | ||||

| Tonnes (t) | Grade (g/t Au) | Au Ounces | Tonnes (t) | Grade (g/t Au) | Au Ounces |

| 7,032 | 14.7 | 3,327 | 7,032 | 15.7 | 3,543 |

| Block Model Capped | |||||

Notes on reconciliation table - December 15, 2020 – Block Model refers to the Company's technical report, titled “Update of the Mineral Resource Estimate for the Kiena Mine Complex Project, Val-d’Or, Québec, Canada.”

- Mill Feed contained ounces and head grade calculated based on gold produced from the Kiena Mill, including mill tails which graded 0.28 g/t

- A total of 7,032 tonnes were subsequently processed at Kiena mill. Reconciliation was completed on milled tonnes only.

- The total tonnes surveyed is the base line to do the analysis towards the Resource Block Model (BM). Tonnes of the BM corresponded to the same elevation and equivalent lateral limits.

- When the calibration of tonnes was completed, in situ ounces, were redistributed to the areas that have been mined. The percentage of recovery from Mill was considered during the process.

- The grade of the muck samples allowed for the redistribution of the ounces on a pro rata basis, by zone sent to the Mill.

Mr. Duncan Middlemiss, President and CEO commented, “We are very pleased with the results of the bulk sample that confirmed the continuity of the high-grade gold mineralization of the A Zone, but more importantly demonstrated a 6% positive reconciliation in the number of ounces recovered from the bulk sample compared to the resource block model. This is very positive, and provides confidence in the resource estimate for future mining.

We are also very encouraged with the recommissioning and performance of the Kiena mill with gold recovery in excess of 98%. This certainly confirms the readiness of the mill for future production. As well, we are in the final stage of completing the pre-feasibility study and intend to publish the results this quarter.

In addition, we are continuing our aggressive exploration drilling program to further expand the A and VC zones and to follow-up on our discovery of new zones of high-grade occurring within 50 m of the footwall of the A Zone. All of these intersections illustrate the untested potential of the entire gold system proximal to the Kiena mine infrastructure and the probability of adding high grade ounces per vertical meter.

We are also currently ramping up a large surface exploration program, with the aim of unlocking additional value on the Kiena property further to the west and east of the Kiena mine initially, and later, over the entire property.”

Kiena Deep A Zone Bulk Sample

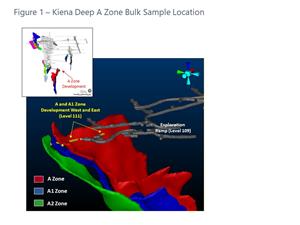

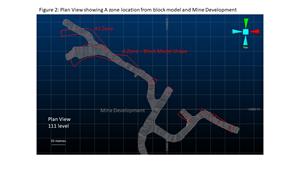

The bulk sample consisted of 3.7 m x 4.0 m lateral development on the 111 Level along the A Zone and A1 Zone (Figure 1 and 2).

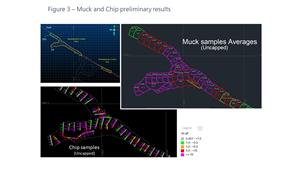

A total of approximately 66 drift rounds were blasted, which allowed for thorough geotechnical assessment and geological mapping, photographing and sampling from the faces of each development round. Chip and muck sampling was completed systematically to determine average grade for each round. A total of 984 muck and 238 chip samples were collected in addition to quality control samples. During the development of this portion of the A Zone, visible gold was observed on about 75% of the faces (Figure 4).

The initial development has confirmed the continuity of the A Zones high grade gold mineralization along strike. Visible gold is associated with folded quartz veins which are located within an overall zone of strong amphibole alteration within a sheared corridor. The amphibolite is located at the contact between basalt/feldspar porphyry dyke and ultramafic rocks. Detailed muck and chip samples (uncapped) presented in Figure 3, shows the grade and geological continuity. Reconciliation with capped muck samples (165 g/t Au) was 8% above mill feed.

Processing of the Bulk Sample

The Kiena mill was restarted to process the Kiena Deep bulk sample. The development material came from two zones, namely the A and A1 Zones. The milled tonnage was measured using a conveyor scale. Daily throughput reached up to 41 tonnes per hour (“tph”) with no issues during the extraction of the bulk sample. The grade and recovery values provided by the mill were determined using multiple sampling points, per cent solids measurements, tailing grade sampling, laboratory analysis and refined ounces (during the milling) and the ounces recovered during the cleaning of the SAG and ball mills after milling was completed.

All calculations and sampling methods have been validated using an independent mineral processing consultant. The material recovered during the cleaning of the balls mills was sent to a third-party refiner, Sipi Metals Corp (precious metal refinery based in Chicago, USA) and was included in the overall bulk sample reconciliation.

TECHNICAL DISCLOSURE

The technical and geoscientific content of this release has been compiled, reviewed and approved by Bruno Turcotte, P.Geo., (OGQ #453) Senior Project Geologist and Audrey Lapointe, Geo. (OGQ #975), Production Chief Geologist, of the Company and a "Qualified Person" as defined in National Instrument 43-101 -Standards of Disclosure for Mineral Projects.

QUALITY CONTROL AND REPORTING PROTOCOLS

Analytical work was performed by ALS Minerals of Val-d’Or (Quebec), a certified commercial laboratory (Accredited Lab #689). Sample preparation was done at ALS Minerals in Val d'Or (Quebec). Assaying was done by fire assay methods with an atomic absorption finish. Any sample assaying >100 g/t Au was rerun by metallic sieve method. In addition to laboratory internal duplicates, standards and blanks, the geology department inserts blind duplicates, standards and blanks into the sample stream to monitor quality control for chip and muck samples.

COVID-19

The health and safety of our employees, contractors, vendors, and consultants is the Company’s top priority. In response to the COVID-19 outbreak, Wesdome has adopted all public health guidelines regarding safety measures and protocols at all of its mine operations and corporate offices. In addition, our internal COVID-19 Taskforce continues to monitor developments and implement policies and programs intended to protect those who are engaged in business with the Company.

Through care and planning, to date the Company has successfully maintained operations at the Eagle River Complex, however there can be no assurance that this will continue despite our best efforts. Future conditions may warrant reduced or suspended production activities which could negatively impact our ability to maintain projected timelines and objectives. Consequently, the Company’s actual future production and production guidance is subject to higher levels of risk than usual. We are continuing to closely monitor the situation and will provide updates as they become available.

ABOUT WESDOME

Wesdome Gold Mines has had over 30 years of continuous gold mining operations in Canada. The Company is 100% Canadian focused with a pipeline of projects in various stages of development. The Company’s strategy is to build Canada’s next intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Quebec. The Eagle River Complex in Wawa, Ontario is currently producing gold from two mines, the Eagle River Underground Mine and the Mishi Open pit, from a central mill. Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Quebec. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill. The Company has further upside at its Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario. The Company has approximately 139.4 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO”.

For further information, please contact:

| Duncan Middlemiss | or | Lindsay Carpenter Dunlop |

| President and CEO | VP Investor Relations | |

| 416-360-3743 ext. 2029 | 416-360-3743 ext. 2025 | |

| duncan.middlemiss@wesdome.com | lindsay.dunlop@wesdome.com | |

| 220 Bay St, Suite 1200 | ||

| Toronto, ON, M5J 2W4 | ||

| Toll Free: 1-866-4-WDO-TSX | ||

| Phone: 416-360-3743, Fax: 416-360-7620 | ||

| Website: www.wesdome.com |

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management’s estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e47cee2b-ba5a-482e-a497-535acd3bb024

https://www.globenewswire.com/NewsRoom/AttachmentNg/c877c3c4-369e-4a34-8542-0677fa9d91f1

https://www.globenewswire.com/NewsRoom/AttachmentNg/35c47c7c-762b-4e2b-8a41-5caa676d272c

https://www.globenewswire.com/NewsRoom/AttachmentNg/dfe44e30-fdc7-4acb-a5d9-dfb7660575b1

PDF available: http://ml.globenewswire.com/Resource/Download/e5482677-65fb-4172-92a2-31e3c93f3f1a