Wesdome Delivers Independent Positive Preliminary Economic Assessment at the Kiena Complex in Val d'Or, Quebec; After Tax IRR of 102%

TORONTO, May 27, 2020 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) is pleased to announce positive results from the independent Preliminary Economic Assessment (“PEA”) prepared in accordance with National Instrument 43-101 at its 100% owned Kiena Complex in Val d’Or, Quebec. All figures are stated in Canadian dollars unless otherwise stated.

Highlights of the PEA:

- After-tax IRR of 102%

- After-tax NPV (discount rate 5%) $416 million

- Preproduction capital cost of $35 million

- Sustaining Life of Mine (“LOM”) Capital Cost of $121 million

- After-tax payback period (after resumption of operations) 1.7 years

- Average diluted grade of 10.65 grams per tonne (“gpt”) based on current Kiena Mine Resource Estimate of September 2019

- Contained gold in Mined Resources: 709,000 ounces

- PEA Life of Mine of 8 years

- Total Unit Cash Operating Costs CDN$ 492 per ounce (US$374 per ounce)

- All-in sustaining costs CDN$674 per ounce (US$512 per ounce)

- Gold Price US$1,532 per ounce

- Exchange Rate: C$1.00:US$0.76

Mr. Duncan Middlemiss, President and CEO, commented, “We are pleased with the results of the PEA that clearly illustrates the viability to restart production at the Kiena Mine in a very short-term horizon. The PEA demonstrates a low-cost and high margin operation, with low capital requirements and a short payback period, while minimizing risks and maximizing shareholders' return. The Company is well-financed to advance the project to the next level with a cash position as of the end of the first quarter of $49.4M. This PEA is based on the Mineral Resource Estimate ('MRE') dated September 2019 and includes only those resources proximal to the mine infrastructure, specifically the A Zone, B Zone, S50, VC Zones and the South Zone. Diamond drilling activities at Kiena restarted on May 11th, focusing on the continuation of converting inferred into indicated resources, exploring the A zone up-plunge potential and expanding the resources at depth in the Kiena Deep A Zone. The success of this drill program and drilling post September 2019, will further enhance the project economics outlined above. An updated resource estimate is planned early in Q4 2020 followed by a pre-feasibility study ('PFS') and a production restart decision in H1 2021. The COVID-19 pandemic has impacted our abilities to drill and develop at our full capacity, therefore this timeline includes contingencies until further information is available regarding the pandemic and necessary protocols going forward. Longer term, our focus will turn to the remaining resources on the Kiena property, which all together total 2.83M tonnes at 8.7 g/t for 788,000 ounces in the measured and indicated category, and 2.92M tonnes at 8.6 g/t for 798,000 ounces in the inferred category. There is certainly no lack of prospective targets.”

Overview

The Kiena Complex is in the Province of Quebec in the Abitibi-Temiscamingue administrative region within the limits of the municipality of Val d’Or and 100 km east of Rouyn-Noranda. It lies to the northwest of the urban centre of Val d’Or and covers 7,047 ha. The Project includes the milling and tailings facilities of the Kiena mine, nine shafts including the 930 metre (m”) Kiena shaft, related underground workings from past producers and exploration projects, various surface facilities and is fully permitted. Other than the exploration activities and underground exploration development, the principal infrastructure of the Project has been under care and maintenance since mid-2013. Past production from 1981 – 2013 was 12.5M tonnes at 4.5 g/t Au for 1.75 M ounces produced.

The Kiena Deep A Zone was first intersected in December 2007 and is localized within the Marbenite Fault (“MF”) deformation corridor and is divided into three main lenses and a fourth smaller lens.

Mineral Resources

The mineral resource estimate released on September 25, 2019 was used for the PEA. Only five out of thirteen zones that comprise the resources on the Kiena property were considered due to their proximity to the mine infrastructure.

HIGHLIGHTS OF MINERAL RESOURCE ESTIMATE – SEPTEMBER 25, 2019

A Zone Mineral Resource Estimate (Kiena Deep)*

| Tonnes | Gold Grade g/t | Gold ounces | |

| Indicated | 679,200 | 18.55 | 405,100 |

| Total M+I | 679,200 | 18.55 | 405,100 |

| Inferred | 676,300 | 15.27 | 332,000 |

Mineral Resources proximal to Kiena mine Development (A, B, South, VC and S50 zones – includes table above)

| Tonnes | Gold Grade g/t | Gold ounces | |

| Indicated | 968,900 | 14.46 | 450,400 |

| Total M+I | 968,900 | 14.46 | 450,400 |

| Inferred | 1,121,299 | 11.02 | 397,100 |

*Please refer to the Company’s press release dated September 25, 2019 and the Technical Report filed on November 8, 2019

Mining & Milling

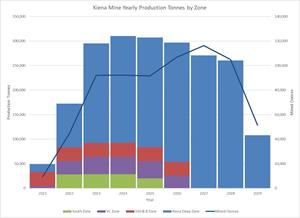

Future mining will utilize the longhole mining method, and development will be performed utilizing standard development methods. Daily production rate commences at 450 tonnes per day (tpd) increasing to over 850 tpd. The overall strategy is to maximize throughput from the high grade Kiena Deep A Zone and to augment the production with the South, VC and the S50 and B Zones. Ore will be hauled by trucks to the shaft ore passes already established in the mine. Waste rock from development and approximately 38% of the tailings produced at the process plant will be returned to underground workings for backfilling purposes. The total ore mined by Zone is as follows:

| | Zone | Tonnes mined (t) | Diluted grade (g/t) | Mined Gold (ozs) |

| | South | 105,102 | 3.95 | 13,341 |

| VC | 163,157 | 5.01 | 26,275 | |

| S50 & B | 170,572 | 3.95 | 21,652 | |

| Kiena Deep | 1,631,353 | 12.35 | 647,797 | |

| Total | 2,070,184 | 10.65 | 709,065 | |

Metallurgical test work undertaken by SGS has demonstrated the current cyanidation and carbon-in-pulp (CIP) mill circuit is well positioned to maximize the gold recovery of the five zones with a recovery averaging 97%. The installation of a free gold recovery circuit will be the subject of an optimization study included in the PFS. Yearly production tonnes and ounces mined by Zone are as follows:

Figure One: https://www.globenewswire.com/NewsRoom/AttachmentNg/9d45852b-2a94-428b-8bfa-713f575c6a44

Base Case

On an after-tax basis, the base case financial model resulted in an IRR of 102% and an NPV of $416.1M using a 5% discount rate with a Gold Price of US$1,532/oz at an exchange rate of C$1.00:US$0.76. The after-tax payback period after start of operations is 1.7 years.

The gold price used in the analysis was provided by an independent commodity specialist, CPM group. CPM Group is a commodities research, consulting, financial advisory and commodities management firm providing independent research, analysis and advisory services related to commodities markets, corporate and project finance, and the financial management of exposure to commodity-oriented investments. Analysts from CPM have been studying the gold market, along with other commodities markets, since 1980.

The pre-tax base case financial model resulted in an IRR of 126% and an NPV of $620.4M using a 5% discount rate. The pre-tax payback period after start of operations is 1.6 years.

The cash costs and all-in sustaining costs (AISC) over the LOM are US$374 and US$ 512/oz, respectively.

Financial analysis summary

| Description | Unit | Value |

| Total Tonnes Mined | M tonne (Mt) | 2.1 |

| Average Diluted Gold Grade | g/t | 10.65 |

| Total Gold Contained | Oz | 709,065 |

| Total Gold Payable | Oz | 687,449 |

| Average Annual Gold Produced | Au oz per year | 85,931 |

| Total Preproduction Capital Cost | CAD$M | 34.8 |

| Sustaining Capital | CAD$M | 120.8 |

| Site Restoration Cost | CAD$M | 3.0 |

| Operating Costs | $/t mined | 162.66 |

| All-in Sustaining Costs (AISC) | USD/oz CAD/oz | 512 $674 |

| Total LOM NSR Revenue | CAD$M | 1376.4 |

| Total LOM Operating Costs | CAD$M | 334.4 |

| Total LOM Pre-tax Cash Flow | CAD$M | 883.3 |

| Average Annual Pre-tax Cash Flow | CAD$M | 110.4 |

| LOM Royalties | CAD$M | 0.0 |

| LOM Mining Taxes | CAD$M | 101.7 |

| LOM Income Taxes | CAD$M | 186.3 |

| Total LOM After-tax Free Cash Flow | CAD$M | 595.3 |

| Average Annual After-tax Free Cash Flow | CAD$M | 74.4 |

| Pre-tax Summary | ||

| Pre-tax NPV (@ 5% Discount Rate) | CAD$M | 620.4 |

| Pre-tax IRR | % | 126 |

| Pre-tax Payback (after start of operations) | Year | 1.6 |

| After-tax Summary | ||

| After-tax NPV (@ 5% Discount Rate) | CAD$M | 416.1 |

| After-tax IRR | % | 102 |

| After-tax Payback (after start of operations) | Year | 1.7 |

Capital and Operating Costs

The total pre-production capital cost for the Kiena Gold Project is estimated to be $43.7M including allowances for indirect costs and contingency of $2.7M and $2.9M respectively. A contingency of 25% was applied on some items where additional studies are required. The pre-production capital expenditures include refurbishments in the mine and the process plant, mine development, mining equipment, engineering, and field programs. There are $8.9M of sunk costs, which include pre-production mine development costs for the year 2020. Site reclamation and closure costs total $3M in addition to the existing $7M obligations ($1.5 in pre-production and $1.5 in sustaining cost).

The total sustaining capital cost for the project is estimated at $120.8M (not including exploration) including a $5.6M contingency. Mine sustaining costs of $92.8M consist of underground development, equipment purchases and construction work. A new tailings storage area (dry stacking deposition) combined with a new water treatment facility represent an expenditure of $16.6M.

The cumulative life of mine capital expenditure, including costs for pre-production and sustaining, is estimated to be $164.5M. The cumulative life of mine ‘Forecast to Spend’ amount, which includes reclamation and closure bonding costs and excludes sunk costs, is estimated to be $158.7M.

Project capital cost summary

| Area | Cost area description | Pre-production capital cost (CAD$M) | Sustaining capital cost (CAD$M) | Total cost (CAD$M) |

| 2000 | Administration and Services | 0.5 | 0.0 | 0.5 |

| 3000 | Mine | 29.4 | 92.8 | 122.2 |

| 5000 | Stockpiling and Conveying | 0.1 | 0.0 | 0.1 |

| 6000 | Processing Plant | 2.4 | 1.2 | 3.6 |

| 7000 | Tailings Storage Facility & Water Management | 0.02 | 16.65 | 16.7 |

| 8000 | Owner's Costs (8900 excluded) | 3.4 | 0.6 | 4.0 |

| 9000 | Project Indirect Costs (9800 excluded) | 2.7 | 4.0 | 6.7 |

| 9800 | Contingency | 2.9 | 5.6 | 8.5 |

| Pre-production Operating Costs | 2.2 | 0.0 | 2.2 | |

| Total | 43.7 | 120.8 | 164.5 | |

| Less Sunk Costs | -8.9 | - | -8.9 | |

| 8900 | Site Reclamation and Closure | 1.5 | 1.5 | 3.0 |

| Total - Forecast to Spend | 36.3 | 122.3 | 158.7 |

The average operating cost over the 8-year mine life is estimated to be $162.66/t mined.

Operating costs summary

| Cost area | LOM ($M) | Annual average cost ($M) | Average LOM ($/t mined) | Average LOM ($/oz) | OPEX (%) |

| U/G Mining | 214.1 | 26.8 | 104.15 | 315.7 | 64.0 |

| Processing & Lab | 48.6 | 6.1 | 23.62 | 71.6 | 14.5 |

| Surface Operations | 17.4 | 2.2 | 8.47 | 25.7 | 5.2 |

| Technical Services | 12.3 | 1.5 | 6.00 | 18.2 | 3.7 |

| HSE & Training | 11.5 | 1.4 | 5.61 | 17.0 | 3.4 |

| Administration | 24.8 | 3.1 | 12.07 | 36.6 | 7.4 |

| Tailings Management (new facility) | 5.6 | 0.7 | 2.75 | 8.3 | 1.7 |

| Total | 334.4 | 41.8 | 162.66 | 493.1 | 100.0 |

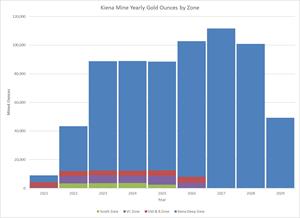

Gold Production

The production plan is based on a mill start-up in H2 2021. Prior to which, ore sill production is planned in the first half of 2021, and will be stockpiled during this period. Each zone was reviewed, and a composite mining rate developed in tonnes per day (tpd) that accounts for sill development and the mining activities (drill, blast, muck and fill). Over the life of mine (LOM), a total of 687,449 oz of gold (payable) (average annual: 85,931 oz) will be produced.

Figure Two: https://www.globenewswire.com/NewsRoom/AttachmentNg/1040f271-270a-4ae0-82a2-828674dea6aa

Next Steps

The results of the PEA indicate that the proposed Project has technical and financial merit using the base case assumptions. It has also identified additional field work, metallurgical testwork, trade-off studies and analysis required to support more advanced mining studies. The QPs consider the PEA results sufficiently reliable and recommend that the Kiena Mine Complex Gold project be advanced to next stage of development through the initiation of a PFS.

An extensive work program including additional exploration drilling and the details of the pre-feasibility study has been developed based on QP recommendations. While the PEA is based on the Mineral Resource Estimate dated September 2019, an additional 47,800 m in 164 new drill holes completed since September 2019, will be included in the MRE to be updated early in Q4 2020. The updated mineral resource estimate will then be used as a basis for the PFS. It is intended that the PFS will be the basis for evaluating a construction decision to justify the mine restart.

Financial Analysis

A 5% discount rate was applied in calculating the Project’s NPV on a pre-tax and after-tax basis. Cash flows have been discounted to 2020 under the assumption that the Project will start in H1 2021. The summary of the financial evaluation for the PEA of the Project is presented in the table below:

Financial analysis summary (pre-tax and after-tax)

| Description | Unit | Base case | |

| Pre-tax | Net Present Value (0% disc) | CAD$M | 883.3 |

| Net Present Value (5% disc) | CAD$M | 620.4 | |

| Internal Rate of Return | % | 125.7 | |

| Payback Period (simple) | year | 3.1 | |

| Payback Period (after start of operations) | year | 1.6 | |

| After-tax | Net Present Value (0% disc) | CAD$M | 595.3 |

| Net Present Value (5% disc) | CAD$M | 416.1 | |

| Internal Rate of Return | % | 101.6 | |

| Payback Period (simple) | year | 3.2 | |

| Payback Period (after start of operations) | year | 1.7 | |

The pre-tax base case financial model resulted in an IRR of 126% and an NPV of $620M with a discount rate of 5%. The pre-tax payback period after the start of operations is 1.6 years. On an after-tax basis, the base case financial model resulted in an IRR of 102% and an NPV of $416M with a discount rate of 5%. The after-tax payback period after the start of operations is 1.7 years.

Sensitivity

A financial sensitivity analysis was conducted on the PEA, after-tax NPV ($M) and IRR of the Project, using the following variables: capital costs, operating costs, USD:CAD exchange rate, price of gold and discount rate. The after-tax results for the Project IRR and NPV ($M) based on the sensitivity analysis are summarized below:

NPV sensitivity results (after-tax) for metal price and exchange rate variations

| USD:CAD | Gold Price (USD/ounce) | ||||||||

| 1,100 | 1,200 | 1,300 | 1,400 | 1,532 | 1,600 | 1,700 | 1,800 | 1,900 | |

| 0.60 | 359.8 | 414.4 | 469.0 | 523.4 | 595.0 | 631.9 | 686.2 | 740.5 | 794.7 |

| 0.65 | 313.6 | 364.0 | 414.4 | 464.8 | 531.1 | 565.1 | 615.2 | 665.3 | 715.4 |

| 0.70 | 274.1 | 320.8 | 367.6 | 414.4 | 476.2 | 507.9 | 554.4 | 600.9 | 647.4 |

| 0.76 | 231.1 | 273.9 | 316.7 | 359.5 | 416.1 | 445.3 | 488.2 | 530.8 | 573.4 |

| 0.80 | 210.0 | 250.8 | 291.6 | 332.5 | 386.6 | 414.4 | 455.4 | 496.3 | 537.0 |

| 0.85 | 183.5 | 222.0 | 260.4 | 298.8 | 349.7 | 375.9 | 414.4 | 453.0 | 491.5 |

| 0.90 | 159.6 | 196.3 | 232.7 | 269.0 | 316.9 | 341.6 | 378.0 | 414.4 | 450.8 |

NPV sensitivity results (after-tax) for capital (LOM) and operating costs variations

| OPEX | CAPEX | ||||||||||||||

| -30% | -20% | -10% | 0% | 10% | 20% | 30% | |||||||||

| -30% | 505.2 | 491.7 | 478.2 | 464.7 | 451.2 | 437.7 | 424.3 | ||||||||

| -20% | 489.0 | 475.5 | 462.0 | 448.5 | 435.0 | 421.5 | 408.1 | ||||||||

| -10% | 472.8 | 459.3 | 445.8 | 432.3 | 418.8 | 405.3 | 391.9 | ||||||||

| 0% | 456.6 | 443.1 | 429.6 | 416.1 | 402.6 | 389.1 | 375.7 | ||||||||

| 10% | 440.4 | 426.9 | 413.4 | 399.9 | 386.4 | 372.9 | 359.5 | ||||||||

| 20% | 424.2 | 410.7 | 397.2 | 383.7 | 370.2 | 356.8 | 343.3 | ||||||||

| 30% | 408.0 | 394.5 | 381.0 | 367.5 | 354.0 | 340.6 | 327.1 | ||||||||

The sensitivity analysis reveals that the price of gold has the most significant influence on both the NPV and IRR compared to the other parameters, based on the range of values evaluated. After the price of gold, the NPV and IRR were most impacted by changes in the USD:CAD exchange rate and then, to a lesser extent, by variations in operating costs and capital costs. It should be noted that the economic viability of the Project will not be significantly impacted by variations in the capital or operating costs, within the margins of error associated with the PEA cost estimates.

Overall, the NPV and IRR of the Project are positive over the range of values used for the sensitivity analysis when analyzed individually.

Financial model parameters

| Description | Unit | Value |

| Long Term Gold Price | USD/oz | 1,532 |

| Exchange Rate | USD:CAD | 0.76 |

| Discount Rate | % | 5 |

| Mine Life | year | 8 |

| Total Mined | Mt | 2.1 |

| Gold Grade | g/t | 10.65 |

| Process Overall Gold Recovery | % | 97.0 |

| U/G Mining Operating Costs | $/t mined | 104.15 |

| Processing & Lab Operating Costs (Phase 1, Years 0 to 3) | $/t mined | 22.02 |

| Processing & Lab Operating Costs (Phase 2, Year 3+) | $/t mined | 23.80 |

| Surface Operations Operating Costs | $/t mined | 8.47 |

| Technical Services Operating Costs | $/t mined | 6.00 |

| HSE & Training Operating Costs | $/t mined | 5.61 |

| Administration Operating Costs | $/t mined | 12.07 |

| Tailings Management Operating Costs (New Tailings Facility) | $/t mined | 3.06 |

| Royalties | % NSR | 0.00 |

| Pre-production Capital Costs | $M | 34.8 |

| Sustaining Capital Costs | $M | 120.8 |

| Reclamation and Closure Costs | $M | 3.0 |

A conference call to discuss these results will be held on May 28 at 10:00 am ET. Wesdome invites participants to join the call using the following details:

Wesdome Gold Mines Kiena Preliminary Economic Assessment Conference Call:

North American Toll Free: 844-202-7109

International Dial-In Number: 703-639-1272

Conference ID: 4389839

Webcast link: https://edge.media-server.com/mmc/p/pud5hb6d

The full technical report Will be published on SEDAR and the Company’s website within 45 days of this announcement.

QUALIFIED PERSONS AND TECHNICAL INFORMATION

The reader is advised that the PEA Technical Report referenced in this press release is preliminary in nature and is intended to provide only an initial, high-level review of the Project potential and design options. Readers are encouraged to read the PEA Technical Report in its entirety, including all qualifications and assumptions. The PEA Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Resources. Inferred Resources are considered to be too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no guarantee that the PEA mine plan and economic model will be realized, and that Inferred Resources can be converted to Indicated or Measured Resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability. As such, there is no guarantee the Project economics described herein will be achieved.

The Preliminary Economic Analysis production scenario is based on Indicated and Inferred resources from the Updated Mineral Resource Estimate (MRE) published on September 25th, 2019.

The block model mineral resource estimate, proximal to Kiena Mine Development, was prepared by Karine Brousseau P.Eng (OIQ #121871), Senior Engineer – Mineral Resources of the Company and a "Qualified Person" as defined in NI-43-101. The mineral resource estimate has been reviewed and audited by BBA Consulting, Toronto, Ontario. Pierre-Luc Richard P.Geo (OGQ #1119) of BBA Consulting, is a "Qualified Persons" for the resource estimate as defined in NI-43-101 and is considered to be “independent” of Wesdome for purposes of NI-43-101.

The full technical report, which is being prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI-43-101”) will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days from this news release. The effective date of the current Preliminary Economic Analysis is March 31, 2020.

The Preliminary Economic Analysis has been prepared by BBA, Toronto, Ontario. The contributors to the report are Qualified Persons (“QP”) under National Instrument 43-101 and are considered to be independent of Wesdome for the purposes of the NI 43-101. The technical content of the PEA and this press release has been reviewed and approved by

Tom Corkal, P.Eng, Senior Mining Engineer

Colin Hardie, P.Eng, Senior Process Engineer

Luciano Piciacchia, P.Eng, Senior Geotechnical Engineer

Pierre-Luc Richard, P.Geo, Senior Geologist

Jorge Torrealba, P.Eng, Senior Process Engineer

About BBA

BBA has been providing a wide range of consulting engineering services for nearly 40 years. Engineering, environment and commissioning experts team up to quickly and accurately pinpoint the needs of industrial and institutional clients. Recognized for its innovative, sustainable and reliable solutions, the firm stands out for its expertise in the fields of energy, mining and metals, biofuels, and oil and gas. BBA has 12 offices across Canada to provide local support and offer clients increased onsite presence.

ABOUT WESDOME

Wesdome Gold Mines has had over 30 years of continuous gold mining operations in Canada. The Company is 100% Canadian focused with a pipeline of projects in various stages of development. The Company’s strategy is to build Canada’s next intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Quebec. The Eagle River Complex in Wawa, Ontario is currently producing gold from two mines, the Eagle River Underground Mine and the Mishi Open pit, from a central mill. Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Quebec. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill. The Company has further upside at its Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario. The Company has approximately 138.2 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO”.

For further information, please contact:

| Duncan Middlemiss President and CEO 416-360-3743 ext. 2019 duncan.middlemiss@wesdome.com | or | Lindsay Carpenter Dunlop VP Investor Relations 416-360-3743 ext. 2025 lindsay.dunlop@wesdome.com |

220 Bay St, Suite 1200

Toronto, ON, M5L 1E9

Toll Free: 1-866-4-WDO-TSX

Phone: 416-360-3743, Fax: 416-360-7620

Website: www.wesdome.com

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management’s estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.

PDF available: http://ml.globenewswire.com/Resource/Download/71fbd671-58a3-4e00-ba6f-e00d887e3d01