Westhaven Gold Completes Initial Mineral Resource Estimate of 841,000 Indicated Ounces at 2.47 g/t Gold Equivalent and 277,000 Inferred Ounces at 0.94 g/t Gold Equivalent on the Shovelnose Gold Property

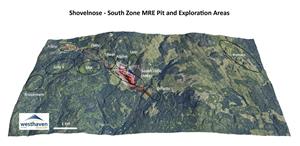

VANCOUVER, British Columbia, Jan. 10, 2022 (GLOBE NEWSWIRE) -- Westhaven Gold Corp. (TSX-V:WHN) is pleased to announce the results from its Mineral Resource Estimate (MRE) at its 100% owned 17,623-hectare Shovelnose Gold Property. The Shovelnose Gold Property is located within the prospective Spences Bridge Gold Belt (SBGB), which borders the Coquihalla Highway 30 km south of the City of Merritt, British Columbia (Canada).

The initial open-pit constrained MRE reported below (Table 1) is of the South Zone, and was completed by P&E Mining Consultants Inc., based on a total of 145 surface drill holes (56,491 m), 25,920 drill core analyses, 3,302 bulk density measurements, and preliminary metallurgical testwork.

Shovelnose South Zone MRE Highlights:

- 791,000 ounces of gold and 3,894,000 ounces of silver Indicated.

- 263,000 ounces of gold and 1,023,000 ounces of silver Inferred.

- 75% of the MRE in the higher confidence Indicated classification: 10.60 million tonnes at 2.47 g/t for 841,000 gold equivalent (AuEq) ounces.

- Average AuEq grade of Indicated MRE is 7 times higher than the cut-off grade, demonstrating excellent potential for future economic extraction (Table 2).

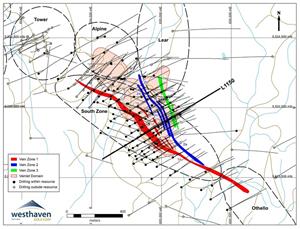

- Indicated mineralization is largely associated with the individual vein zones, whereas the Inferred is associated with the broader Veinlet Domain (please see Figure 1).

- This MRE is based on potential open-pit extraction - an MRE based on potential underground mining is in preparation and will be reported in the coming months.

- South Zone is just one of the many known mineralized zones on the Shovelnose Gold Property.

- Shovelnose is situated off a major highway, near grid power, rail, large producing mines, and within easy commuting distance from the City of Merritt.

Westhaven CEO and President, Gareth Thomas, notes "This is the first Mineral Resource Estimate on the Shovelnose Gold Property, and we are pleased to report a starting inventory of over a million ounces of gold from the first of multiple mineralized zones. It is important to highlight that 75% of this Mineral Resource is in the Indicated classification and grades 2.47 g/t AuEq. Our technical team sees significant Mineral Resource expansion potential along this key trend (see Figure 3 & 4). The 2022 expansion and exploration drill program will begin shortly, focusing on the FMN Zone, where high-grade gold mineralization (15.97 metres of 9.15 g/t Au) was intersected in drilling last year. Targeting new discoveries on undrilled exploration targets within this large, underexplored property will also remain a key focus going forward."

Investor and Analyst Webinar:

Westhaven Gold welcomes investors and analysts to join President & CEO Gareth Thomas for a webinar Monday, January 10, 2022, at 2pm ET (11 am PT), to discuss the results of the 2022 Maiden Resource Estimate. Please register at: https://bit.ly/westhaven-resource-estimate-webinar

| Table 1 Shovelnose South Zone Pit Constrained Mineral Resource Estimate @ 0.35 g/t AuEq Cut-off (1-15) | |||||||

| Classification | Tonnes (k) | Au (g/t) | Contained Au (koz) | Ag (g/t) | Contained Ag (koz) | AuEq (g/t) | Contained AuEq (koz) |

| Indicated | 10,592 | 2.32 | 791 | 11.43 | 3,894 | 2.47 | 841 |

| Inferred | 9,177 | 0.89 | 263 | 3.47 | 1,023 | 0.94 | 277 |

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

2. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

4. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. Wireframe constrained assays were composited to 1.0m lengths and subsequently capped between no cap to 95 g/t for Au and no cap to 290 g/t for Ag.

6. Grade estimation was undertaken with ID3interpolation.

7. Wireframe constrained bulk density was determined from 1,179 samples. Mineralization bulk density for veins is 2.54 t/m3, for the Veinlet Domain 2.52 t/m3, and for overburden 2.0 t/m3.

8. Au and Ag process recovery value was 95%.

9. US$ metal prices used were $1,675/oz for Au and $21.50/oz for Ag with a USD:CD FX of 0.77.

10. CDN$ operating costs used were $3/t mineralized material mining, $2.50/t waste mining, $2.00/t overburden mining, $18/t processing and $5/t G&A.

11. Pit slopes were 50 ? in rock and 30 ? in overburden.

12. AuEq g/t (gold equivalent in grams per tonne) = Au g/t + (Ag g/t/77.9).

13. Tonnage is in 000's tonnes (k); Contained Au and Ag in 000's troy ounces (koz).

14. Numbers may not add due to rounding.

15. The Effective Date for the MRE is January 01, 2022.

| Table 2 Sensitivities of South Zone Pit Constrained Mineral Resource Estimate | ||||||||

| Classification | Cut-Off | Tonnes | Au | Au | Ag | Ag | AuEq | AuEq |

| AuEq g/t | k | g/t | koz | g/t | koz | g/t | koz | |

| Indicated | 1.0 | 5,430 | 3.99 | 697 | 19.43 | 3,392 | 4.24 | 740 |

| 0.9 | 5,821 | 3.78 | 708 | 18.44 | 3,450 | 4.02 | 752 | |

| 0.8 | 6,363 | 3.53 | 722 | 17.23 | 3,524 | 3.75 | 767 | |

| 0.7 | 6,933 | 3.30 | 734 | 16.14 | 3,597 | 3.50 | 781 | |

| 0.6 | 7,777 | 3.00 | 751 | 14.73 | 3,684 | 3.19 | 798 | |

| 0.5 | 8,773 | 2.72 | 768 | 13.36 | 3,768 | 2.89 | 815 | |

| 0.4 | 10,015 | 2.44 | 784 | 11.98 | 3,856 | 2.59 | 833 | |

| 0.35 | 10,592 | 2.32 | 791 | 11.43 | 3,894 | 2.47 | 841 | |

| 0.3 | 11,473 | 2.17 | 799 | 10.70 | 3,946 | 2.30 | 849 | |

| 0.2 | 12,945 | 1.95 | 810 | 9.66 | 4,020 | 2.07 | 861 | |

| Inferred | 1.0 | 2,137 | 2.05 | 141 | 7.07 | 485 | 2.14 | 147 |

| 0.9 | 2,446 | 1.91 | 150 | 6.61 | 519 | 1.99 | 156 | |

| 0.8 | 2,964 | 1.72 | 164 | 6.00 | 571 | 1.79 | 170 | |

| 0.7 | 3,731 | 1.51 | 181 | 5.29 | 634 | 1.58 | 189 | |

| 0.6 | 4,810 | 1.31 | 203 | 4.69 | 725 | 1.37 | 211 | |

| 0.5 | 6,178 | 1.13 | 225 | 4.19 | 831 | 1.19 | 235 | |

| 0.4 | 8,239 | 0.95 | 253 | 3.66 | 968 | 1.00 | 265 | |

| 0.35 | 9,177 | 0.89 | 263 | 3.47 | 1,023 | 0.94 | 277 | |

| 0.3 | 11,207 | 0.79 | 283 | 3.13 | 1,126 | 0.83 | 297 | |

| 0.2 | 17,108 | 0.59 | 325 | 2.50 | 1,377 | 0.62 | 343 | |

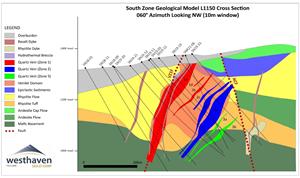

A total of thirteen mineralization veins and an encompassing low-grade halo ('Veinlet Domain') were interpreted and constructed, as shown in both plan view (Figure 1) and as a representative cross section (Figure 2) below. Models were developed for each vein using the drill core field logs and assays, and represent continuous gold and silver mineralization constrained with a cut-off value of 0.35 g/t AuEq (gold equivalent = Au g/t + Ag g/t/77.9) to a minimum thickness of 2 m drill core length. The 3-D constraining domain wireframes were treated separately for the purposes of rock coding, statistical analysis, compositing limits, and definition of the extent of potentially economic mineralization. All mineralization veins were clipped by the overburden surface.

The Mineral Resource was classified as either Indicated or Inferred based on the geological interpretation, variogram performance and drill hole spacing. Indicated Mineral Resources were classified within the veins using at least two holes within a spacing of 45 m or less. Inferred Mineral Resources were classified for vein blocks at a lower density of drilling, and for the entire Veinlet Domain. Mineralization of the South Zone is considered to be potentially amenable to open pit mining methods, and the Mineral Resource Estimate reported herein is constrained within a pit shell based on a gold equivalent cut-off of 0.35 g/t. Additional mineralization exists outside of that pit shell. Mineralization at the South Zone may also be potentially economic for underground mining, however, that work has not yet been undertaken. The reader is cautioned that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Drilling, assaying and exploration work on the South Zone demonstrate spatial continuity of the mineralization within potentially mineable shapes, and are sufficient to indicate a reasonable potential for economic extraction, thus qualifying it as a Mineral Resource in accordance with the Canadian Securities Administrators' National Instrument 43-101 and was estimated in conformity with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") "Estimation of Mineral Resource and Mineral Reserves Best Practice Guidelines" (November 2019) and the definitions set out in the 2014 CIM Definition Standards.

A Technical Report to support the initial Mineral Resource Estimate for the Shovelnose Gold Property - South Zone, prepared in accordance with National Instrument 43-101, will be filed on SEDAR (www.sedar.com) within 45 days of this news release.

On behalf of the Board of Directors

WESTHAVEN GOLD CORP.

"Gareth Thomas

Gareth Thomas, President, CEO & Director

Qualified Person Statement

The Mineral Resource Estimate for the Shovelnose Gold Property - South Zone was prepared by Yungang Wu, P.Geo., Antoine Yassa, P.Geo. and Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc., Brampton, Ontario, all Independent Qualified Persons as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Puritch has reviewed and approved the technical contents of this news release.

QA/QC

Drill core samples were prepared using the PREP-31 package in ALS's Kamloops facility. Each drill core sample is crushed to better than 70% passing a 2 mm (Tyler 9 mesh, US Std. No.10) screen. A split of 250 g is taken and pulverized to better than 85% passing a 75-micron (Tyler 200 mesh, US Std. No. 200) screen. Subsequently 0.75 g of this pulverized split is digested by Four Acid and analyzed via ICP-MS (method code ME-MS61m (+Hg)), which reports a 49-element suite of elements. All samples are analyzed by Fire Assay with an AES finish, method code Au-ICP21 (30 g sample size). Additional Au screening is performed using ALS's Au-SCR24 method, whereby select samples are dry screened to 100 microns. A duplicate 50 g fire assay is conducted on the undersized fraction as well as an assay on the entire oversize fraction. Total Au content, individual assays and weight fractions are reported. All analytical and assay procedures are conducted in ALS's North Vancouver facility. Westhaven's QA/QC program includes the collection and submission of regular field core duplicates (quartered core), as well as laboratory and field certified reference materials inserted every 25 samples. At least one field blank is inserted in every batch of 25 samples, with additional blanks inserted following samples with visible gold. Selected drill core pulps and reject material were submitted to a third-party laboratory for check assays.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

About Westhaven Gold Corp.

Westhaven is a gold-focused exploration company advancing the high-grade discovery on the Shovelnose Project in Canada's newest gold district, the Spences Bridge Gold Belt. Westhaven controls 37,000 hectares (370 square kilometres) with four 100% owned gold properties spread along this underexplored belt. The Shovelnose Gold Property is situated off a major highway, near power, rail, large producing mines, and within easy commuting distance from the City of Merritt, which translates into low-cost exploration.

Westhaven trades on the TSX Venture Exchange under the ticker symbol WHN. For further information, please call 604-681-5558 or visit Westhaven's website at www.westhavengold.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/57dfcac5-56d7-490b-9b99-9b685b163d42

https://www.globenewswire.com/NewsRoom/AttachmentNg/982aee21-73e3-4770-abd7-be833826afa6

https://www.globenewswire.com/NewsRoom/AttachmentNg/11a873a1-9fc2-4adc-96bb-96d0b20f257d

https://www.globenewswire.com/NewsRoom/AttachmentNg/83271f72-baf9-44f3-a578-6a8ece64d8ac