Wolfden Announces Robust Preliminary Economic Assessment for Pickett Mt. Project in Maine

THUNDER BAY, ON / ACCESSWIRE / September 14, 2020 / Wolfden Resources Corporation (TSXV:WLF) ("Wolfden" or the "Company") is pleased to announce the positive results of an independent Preliminary Economic Assessment (the "PEA") for its wholly owned Pickett Mountain high-grade polymetallic project in Northeastern Maine.

The Base Case Financial Model Yields:

- After-tax IRR of 37%

- After-tax NPV8% of US$198 million to Wolfden for an underground mine plan scenario

- Initial capital expenditure of US$147.4 million including 20% contingency and closure costs

- Payback 2.4 years

The PEA financial model used consensus metal prices assumptions of $1.15/lb Zinc, $1.00/lb Lead, $3.00/lb Copper, $18.00/oz Silver and $1,500/oz Gold. Full details of the Preliminary Economic Assessment in the form of a technical report for the purposes of NI 43-101 will be filed on SEDAR within the next 45 days. All financial figures are in US dollars.

"The PEA underscores our belief that the solid economics of the Pickett Mt. Project and its resource are still largely unrecognized by investors and not reflected in the current market capitalization of the company," stated Ron Little President and CEO of Wolfden. "With base metal prices moving higher, these results reaffirm our commitment to increase and upgrade the mineral resources through aggressive exploration and to further de-risk the project with our ongoing pre-permitting efforts and additional technical and baseline studies."

"The Pickett Mountain deposit represents one of North America's highest-grade undeveloped polymetallic deposits with fundamentals that are indicative of a top quartile project, including one of the lowest C1 Costs $0.38/lb zinc (Net Direct Cash Cost) in our sector," stated Jeremy Ouellette Vice President of Project Development. "With this kind of a break-even zinc price, the project can sustain metal price market declines that have not been seen in decades. In addition, the project is extremely well located close to infrastructure and services yet is far enough removed from the nearby towns (10 miles) with a site location that exhibits very low environmental and social impacts. The project is expected to generate over 100 full time jobs and add significantly to the local and state economies."

Summary of Base Case Financials

The PEA for NI 43-101 purposes, is considered preliminary in nature which includes inferred resources within the economic analysis that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. The Base Case assumptions include revenues using $1.15/lb Zinc, $1.00/lb Lead, $3.00/lb Copper, $18.00/oz Silver, $1,500/oz Gold prices. Cost inputs are generally constructed by first principle or by estimates supplied within the region. The financial highlights are as follows:

Description | Base Case Results (financial figures in USD) |

Mine Life (years) | 10.7 |

NPV after tax (5%) ($M) | $258.7 |

NPV after tax (8%) ($M) | $198.3 |

IRR after tax | 37.0 |

Payback (years) | 2.4 |

Gross Revenue ($M) | $1,359 |

C1 - Net Direct Cash Cost ($/lb Zn) | $0.38 |

Operating Cost ($/tonne) | $93.07 |

Initial Capital ($M) including 20% Contingency and Closure | $147.4 |

Sustaining Capital ($M) | $74.7 |

Mineral Resource used in Mine Plan (tonnes) | 4,470,688 |

Planned tonnes (Recovered/Diluted) | 4,180,094 |

Average Diluted Grade (% ZnEq) | 15.11 |

Average Diluted Grade (% Zinc) | 8.56 |

Average Diluted Grade (% Lead) | 3.40 |

Average Diluted Grade (% Copper) | 1.11 |

Average Diluted Grade (g/t Silver) | 88.80 |

Average Diluted Grade (g/t Gold) | 0.79 |

Average diluted NSR ($/t) | 260.54 |

Processing Throughput (tpa) | 432,000 |

Zinc Recovery (%) | 89.5% |

Lead Recovery (%) | 80.5% |

Copper Recovery (%) | 77.5% |

Silver Recovery (%) | 38.1% |

Gold Recovery (%) | 68.6% |

Payable Zn Produced (lbs) | 600,145,735 |

Payable Pb Produced (lbs) | 230,414,715 |

Payable Cu Produced (lbs) | 78,314,898 |

Payable Ag Produced (Oz) | 8,129,054 |

Payable Au Produced (Oz) | 38,324 |

The PEA was completed by A-Z Mining Professionals Ltd. of Toronto, Canada ("A-Z Mining") and included inputs by ProSolve Consulting Ltd, Mine Paste Ltd., Wood Environment and Infrastructure Inc. and SLR Consulting Ltd., and was based on an updated resource estimate prepared by A-Z Mining of Toronto.

Mineral Resources used in the Mine Plan

The mineral resource used in the PEA includes indicated and inferred resources and is an update from the January 7th, 2019 mineral resource statement. The estimate uses a 7% cutoff grade (or an NSR value of $139/t) rather than the previous 9% cutoff grade ($178/t NSR). The same methodology used in the 2019 estimate was applied to the updated estimate where the metal prices were not updated (to those used in the PEA financial model) and no additional information was either included or excluded. Infill drill results since the 2019 resource estimate are expected to upgrade the mineral resource and could potentially lead to an increase.

Tonnes | Zn % | Pb % | Cu % | Ag g/t | Au g/t | Density | ZnEq % | |

Indicated Resource | 2,177,000 | 9.25 | 3.68 | 1.32 | 96.4 | 0.9 | 3.98 | 18.23 |

Inferred Resource | 2,294,000 | 9.79 | 3.88 | 1.15 | 101.1 | 0.9 | 3.99 | 18.62 |

The mineral resources were estimated using the metal prices of US$1.20/lb Zn, $2.50/lb Cu, $1.00/lb Pb, $16.00/oz Ag, and $1,200/oz/Au, using a 7% cutoff grade that equates to an NSR cut-off of $139/tonne at the same metal prices. An average recovery of 75% for all metals was assumed. A 10% mining dilution at zero grade was only added to the financial model which also used different metal prices. | ||||||||

Estimated Annual Production

Production at Pickett Mountain will be using combined Long Hole Open Stoping and Alimak mining methods. Since the deposit is near surface, ramp up to full production is possible within one year of development and construction. Estimated throughput is 432,000 tonnes per annum (1,200 tonnes per day).

Yr -1 | Yr 1 | Yr 2 | Yr 3 | Yr 4 | Yr 5 | Yr 6 | Yr 7 | Yr 8 | Yr 9 | Yr 10 | Average | |

Mill Feed (kt) | 64.8 | 367.2 | 432.0 | 432.0 | 432.0 | 432.0 | 432.0 | 432.0 | 432.0 | 432.0 | 292.1 | 418.0 |

Mined Grades | ||||||||||||

Zn (%) | 8.43 | 8.43 | 8.43 | 11.79 | 11.46 | 11.46 | 9.04 | 6.43 | 6.52 | 5.93 | 4.93 | 8.56 |

Cu(% ) | 1.52 | 1.52 | 1.52 | 1.01 | 1.02 | 1.02 | 1.03 | 0.92 | 0.97 | 1.08 | 0.98 | 1.11 |

Pb (%) | 3.47 | 3.47 | 3.47 | 4.64 | 4.53 | 4.53 | 3.56 | 2.48 | 2.53 | 2.36 | 1.89 | 3.40 |

Au (g/t) | 0.80 | 0.80 | 0.80 | 0.92 | 0.90 | 0.90 | 0.78 | 0.76 | 0.71 | 0.65 | 0.59 | 0.79 |

Ag (g/t) | 94.34 | 94.34 | 94.34 | 118.82 | 116.62 | 116.62 | 92.17 | 65.88 | 67.44 | 59.08 | 50.19 | 88.80 |

NSR ($/t) | 293.28 | 293.27 | 279.03 | 328.80 | 321.93 | 321.93 | 265.27 | 200.07 | 204.10 | 194.43 | 166.00 | 260.54 |

Summary of Project Costs

All cost inputs were estimated on the basis of first principals as well as several local and regional contract estimates.

Project Operating Costs | |

Underground Mining ($/t) | $47.73 |

Processing ($/t) | $31.25 |

Dry Stack Placement of Tailings ($/t) | $1.30 |

Surface Services ($/t) | $2.63 |

General and Administration ($/t) | $7.95 |

Environmental and Sustainable Development ($/t) | $2.21 |

Total | $93.07 |

Cost inputs are generally constructed by first principle or by estimates supplied within the region.

Capital Costs

Capital Expenditures | Initial Capex | Sustaining Capex |

Underground Development | $21,435,688 | $65,987,769 |

Mine Facilities and Equipment | $10,167,505 | $7,021,481 |

Mine Equipment Leasing and Remanufacturing | $1,974,859 | $15,277,454 |

Infrastructure | $20,112,000 | $0 |

Surface Mobile Equipment | $1,000,000 | $0 |

Tailings Storage Facility | $2,001,495 | $11,670,655 |

Build and equip mill | $34,581,000 | $0 |

Owners Indirects | $6,333,000 | $0 |

Reclamation and Closure | $13,684,557 | $0 |

Working Capital | $11,524,000 | -$11,524,000 |

Contingency @ 20% | $24,562,821 | $0 |

Total | $147,376,925 | $88,433,359 |

Initial Capital costs include $24.6M based on a flat 20% contingency estimate on all capital items. In addition, the $13.7M in reclamation and closure costs will be required as financial assurance in trust to the state of Maine redeemable upon the commencement of reclamation and closure of the project.

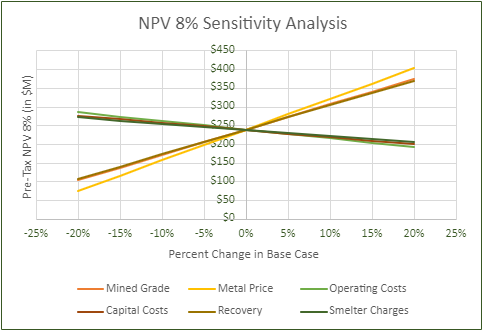

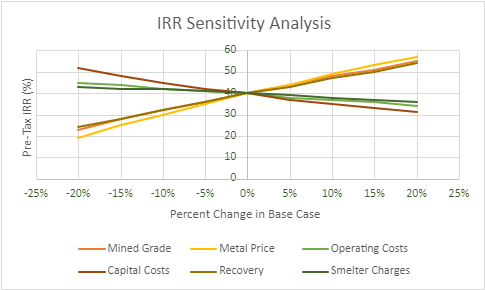

Project Sensitivities

The project is sensitive to metal prices and head grade, and to a lesser extent the capital and operating costs as demonstrated in the following table:

Qualified Person

The Preliminary Economic Assessment was prepared by A-Z Mining Professionals Ltd under the supervision of Brian Leblanc, P.Eng., with input by Deepak Malhotra of ProSolve Consulting Ltd, Frank Palkovits of Mine Paste Ltd., and Eric Sellars of SLR Consulting Ltd. whom are "qualified persons" under the standards set forth in NI 43?EUR'101. All four are independent of Wolfden for purposes of NI 43-101. Jeremy Ouellette, Vice President of Project Development, Don Dudek, Vice President Exploration, and Ron Little, President and CEO, are the Company's designated Qualified Persons for the purposes of the PEA. All parties have reviewed and approved their respective content of this press release. Full details of the PEA in the form of a technical report for the purposes of NI 43-101 will be filed on SEDAR within the next 45 days.

About Wolfden and the Pickett Mountain Project

With the support of major investors Kinross Gold Corporation and Altius Minerals, Wolfden plans to explore and develop its wholly owned Pickett Mountain Project in Maine, USA, one of the highest-grade polymetallic projects in North America (Zn, Pb, Cu, Ag, Au). The project is well-located near excellent infrastructure and services that will support straight forward development as outlined in a robust Preliminary Economic Assessment released on September 14, 2020.

For further information please contact Ron Little, President & CEO, at (807) 624-1136 or Jeremy Ouellette, VP Project Developments at (807) 624-1134.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, statements relating to metal price assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates, and other assumptions used in Preliminary Economic Assessment dated September 14, 2020, infill drill results since 2019 that are expected to upgrade resources and could potentially lead to an increase in resources, information about future activities at the Pickett Mountain Project that include plans to complete additional drilling and pre-permitting (rezoning petition), the results of the Preliminary Economic Assessment dated September 14, 2020 and potential upside of the Pickett Mt. Project. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Wolfden Resources Corporation

View source version on accesswire.com:

https://www.accesswire.com/605923/Wolfden-Announces-Robust-Preliminary-Economic-Assessment-for-Pickett-Mt-Project-in-Maine