Yamana Gold Announces the Discovery of New Mineralized Zones at Wasamac and Provides an Update on Its Growth Projects

Download a PDF of detailed drill hole results for Wasamac

TORONTO, Dec. 01, 2021 (GLOBE NEWSWIRE) -- YAMANA GOLD INC. (TSX:YRI; NYSE:AUY; LSE:AUY) (“Yamana” or “the Company”) is pleased to announce the following updates.

- At Wasamac, exploration has defined an entirely new shear zone which demonstrates the excellent exploration potential and opportunity to further grow the mineral inventory and support a production platform of 200,000 ounces per year over a mine life of at least 15 years, significantly improving the approved development plan of an average of 169,000 ounces per year over a mine life of 10 years, thereby meaningfully increasing overall value.

- At Odyssey, continuing exploration successes support the longer term potential for higher annual production than the currently contemplated average annual production of 545,000 ounces (100% basis) from 2029 onward and for extending mine life beyond 2039.

- At Jacobina, the Phase 2 expansion is progressing ahead of schedule with permitting now expected by early 2022 which would advance the Company’s second phase expansion to a production level of 230,000 ounces per year for multi-decades at low cost and high cash flow.

- At Minera Florida, the Environmental and Social Impact Assessment (“ESIA”) has been submitted and with expected permitting timelines, the mine could begin operating at a planned 100,000 tonnes per month by 2025 and producing 120,000 ounces per year.

Wasamac: New Mineralized Zones Discovered, Initiating Permitting for the Bulk Sample, Engineering Advancing

Wasamac is a development-stage underground gold project located 15 kilometres west of Rouyn-Noranda in the prolific Abitibi-Témiscamingue region of the mining-friendly province of Quebec. The project is well located, adjacent to the Trans-Canada highway and 100 kilometres west of the Company’s 50%-owned Canadian Malartic mine.

Exploration

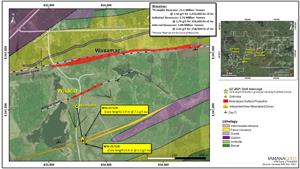

Exploration drilling at Wasamac continues to deliver promising results. An exploration hole WS-21-524, drilled south of the Wildcat zone testing targets from the 2021 magnetic susceptibility survey, intersected two new mineralized zones, referred to as South Wildcat. The first is a zone of shearing and quartz carbonate stockwork in altered mafic volcanic rocks intercepted at a downhole depth of 402.93 metres, which returned 7.31 grams per tonne (“g/t”) of gold over an estimated true width of 3.37 metres (please see Figure 1 below). The drill hole ended in a wide zone of shearing and strong alteration with anomalous gold grades including 2.3 g/t of gold over a core length of 0.6 metres and 1.3 g/t of gold over a core length of 0.3 metres. This drill hole demonstrates the excellent potential of the area south of the Wasamac shear and north of the Cadillac Tectonic zone and follow-up drilling is planned for early 2022.

Figure 1: Wasamac Project, Map of Wildcat Target with Recent Drill Highlights at South Wildcat.

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3429f96-775e-4a4a-a7a1-9b5557bdeeb7

The Company believes that the discovery of the two new parallel mineralized structures in between the Wasamac shear and the Cadillac Tectonic zone is further evidence of the excellent geological upside on the large Wasamac property, and it plans to continue the drilling programs to grow the mineral inventories with an accelerated program. These results are aligned with the Company’s strategic objective to achieve a production platform of 200,000 ounces per year over a mine life of at least 15 years. Furthermore, the Wasamac project further solidifies the Company’s long-term growth profile with a top-tier gold project in Quebec’s Abitibi-Témiscamingue Region, where Yamana has deep operational and technical expertise.

Yamana’s average annual gold production in Quebec, including production from Wasamac and the Odyssey underground at Canadian Malartic, has the potential to increase to approximately 500,000 ounces by 2028, and continue at this level through at least 2041.

“The discovery of a new shear zone and further exploration successes support our higher annual production plan of 200,000 ounces over a longer mine life now expected to be fifteen years” said Yohann Bouchard, Senior Vice President and Chief Operating Officer.

Initiating Permitting for the Bulk Sample

The Company has decided to advance the bulk sample permitting process for Wasamac and expects to obtain the required permitting in the first quarter of 2023. The bulk sample permit would allow construction to commence on the ramp enabling earlier access to the deposit in order to increase the level of confidence in metallurgical and geotechnical assumptions and optimize the processing flow sheet and mining sequence. Construction on surface facilities to support the ramp development activity and associated environmental requirements would also advance.

The bulk sample was not considered in the feasibility study base case and initiating the process has the potential to further enhance the economics and mitigate risks of the project. Additional benefits of the bulk sample include:

- Build production ready models for the grade, recovery, and geotechnical aspects of the project, to support the first three years of production.

- Capture opportunities to optimize the processing performance, as preliminary results of optimization studies indicate the potential to improve average gold recovery by 3%, and up to 5.5% for certain zones of the deposit.

- Confirm stope stability parameters to optimize stope dimensions, backfilling strategy and mining sequence while contributing to ensuring a safe working environment.

- Establish drilling platforms to perform delineation and exploration drilling at Wasamac, Wildcat and new zones from underground.

Project Engineering and Optimization

A program has been implemented to improve recovery, simplifying the process and to better understand the metallurgy of the different areas of the deposit. Preliminary testing indicates that average gold recovery could potentially increase by approximately 3% as compared to the feasibility study.

Substantial work is also underway to select the leading technologies available for the development and operation of Wasamac. The key objectives remain to increase worker safety, minimize impact on the environment and the community, reduce consumption of non-renewable energy and improve energy efficiency. Technologies under evaluation include electric production vehicles, autonomous vehicles, bio-lubricants and ventilation on demand.

The Company relies on a collaborative approach to ensure the success of Wasamac. In this regard, our environmental assessment process is conducted in collaboration with our neighbors, stakeholders and First Nations. A community relations office has now been established to further facilitate ongoing engagement with local residents and accessibility to the Company's team, as well as providing up-to-date information on the project. A campaign of environmental baseline monitoring and testing is currently underway with the objective of completing the Environmental Impact Assessment (“EIA”) by the second quarter of 2022.

Odyssey: Development Advancing with Continued Exploration Success

Yamana and Agnico Eagle Mines Ltd., who each hold a 50% interest in the Canadian Malartic General Partnership (“the Partnership”), owner and operator of the Canadian Malartic mine, announced a positive construction decision for the Odyssey underground project at Canadian Malartic on February 11, 2021.

The project has advanced significantly throughout 2021, with several milestones achieved in the past several months. In October, the concrete pour to construct the 93-metre-tall headframe was completed on schedule, in preparation for shaft sinking to begin in 2022. The production shaft will be 6.5 metres in diameter and 1,800 metres deep, with the first of two loading stations at 1,135 metres below surface.

In parallel, the ramp from surface to the upper zones is advancing according to plan and, as of the end of November, the ramp heading is approximately 250 metres below surface. By the end of the year, the ramp is expected to be at the elevation of the third production level and the base of the first stoping horizon. Underground development is planned to increase in 2022 with the opening of additional headings and the addition of Canadian Malartic development crews to complement the existing contractor crews. As an employer of choice in the Abitibi, the Odyssey project is successfully building a highly skilled team. The first underground ore from Odyssey South is on track to be processed through the existing Canadian Malartic plant in early 2023.

The combination of shaft hoisting from the lower zones of East Gouldie and Odyssey North with truck haulage from the upper zones of Odyssey South and East Malartic supports an underground production rate of 19,500 tonnes per day (“tpd”) when operating at full capacity. Additionally, the mineralization geometry and very good rock quality are ideal for bulk mining. The East Gouldie zone in particular is at least one kilometre in height, one kilometre in strike length and typically 15 metres wide, with maximum widths of up to 80 metres. Infill drilling confirms that grade continuity throughout the deposit is excellent. As such, large stopes of 30 to 50 metres high by 20 metres wide are achievable.

One of the advantages of the Odyssey project is that it will utilize the existing processing plant and infrastructure of the open pit operation. The Canadian Malartic mill is currently planned to be downsized from approximately 60,000 tpd to 20,000 tpd in 2026 as open pit feed declines, with one ball mill and two crushers planned to be put in care-and-maintenance. However, if additional ore sources are identified in future, this equipment could remain in operation or be re-started at a later date for possible throughput increases.

Regarding permitting, the process is advancing according to expectations with the decree modification expected for Q1 2022 and the mining lease expected for Q4 2022.

Exploration Update

Infill drilling at East Gouldie continues to return significant values, confirming the continuity, grade and widths of the mineralization. The Company expects to report first indicated mineral resources at East Gouldie at year-end. Additionally, drilling continues to expand the East Gouldie mineral resource envelope on all sides, which is expected to add inferred mineral resources at year-end, confirming our view that mine life is expected to continue far beyond the 2039 mine plan included in the technical study.

Shallow drilling in the Odyssey and Jupiter zones is helping define new resources as internal zones proximal to the Odyssey North and South deposits with most verified drill results pending.

Exploration drilling continues to test the east extension of the East Gouldie shear zone where previously reported results (Please see the press release issued September 7, 2021, titled ‘Yamana Gold Reports Positive Exploration Results at Its Producing Mines’, available at www.yamana.com), included 6.29 g/t of gold over an estimated true width of 4.81 metres (RD21-4678) that extended the mineralized zone 1,260 metres beyond the reported East Gouldie mineral resource and RD20-4674 with 3.50 g/t of gold over an estimated true width of 9.26 metres in a new subparallel zone, located 400 metres in the footwall for the East Gouldie zone. Drilling is ongoing and further results from four new deep pierce points are expected to be reported with year-end results.

In October 2021, the Canadian Malartic exploration team was presented with the "Discovery of the Year" Award at the Quebec Mineral Exploration Association virtual 2021 Xplor Convention in recognition for the discovery of the East Gouldie deposit of the Odyssey mine in September 2018. The discovery of East Gouldie at depth has significantly changed the Odyssey project by ensuring its economic viability and providing a long term production profile beyond the life of the open pit.

Opportunities Providing Upside to the Technical Study

Gold production from the Odyssey mine is planned to ramp up from 2023 to 2028 as the Canadian Malartic open pit operation winds down. The underground operation will be in full production from 2029, producing an expected 500,000 to 600,000 ounces per year on a 100% basis (Please see the press release issued February 11, 2021, titled ‘Yamana Gold Reports Strong Fourth Quarter and Full Year 2020 Results’, and NI 43-101 Technical Report ‘Canadian Malartic Mine, Quebec, Canada’ effective December 31, 2020 available at www.yamana.com or on SEDAR at www.sedar.com).

The technical study completed in December 2020, demonstrates robust project economics with significant leverage to higher gold prices and thus supporting the approval for project construction. The intention of the Partnership was always to build upon this base case scenario by realizing value enhancement opportunities improving the production profile and extending mine life. Throughout 2021, these opportunities have increased in confidence and definition as a result of the ongoing exploration success and the rapid advancement of the project.

In the near-term, Canadian Malartic has the opportunity to improve the gold production profile during the transition from open pit to underground mining, especially from 2026 to 2028. As a first step, the Barnat pit design was optimized, adding 290,000 ounces (100% basis) to year-end 2020 open pit mineral reserves. Processing of the marginal grade stockpile also remains an opportunity, especially if the gold price remains at current levels. Furthermore, infill drilling of the Odyssey Internal zones from the underground ramp in 2021 has defined potentially mineable zones that are currently not included in the technical study mine plan and could potentially be mined from the Odyssey South ramp within the next five years.

In the technical study, gold production during the 2021 to 2028 construction period is expected at 932,000 ounces (100% basis), with net proceeds from the sale of these ounces significantly reducing the capital requirements for the construction of the project. Assuming a gold price of $1,550 per ounce, the projected initial expansionary capital of $1.14 billion over this eight-year period would be reduced in half. Proceeds from additional underground production, from Odyssey Internal zones or other, would further reduce capital requirements.

Further opportunities are being evaluated to extend mine life at a sustainable production rate of 500,000 to 600,000 ounces per year (100% basis). The technical study mine plan includes 7.3 million ounces, or approximately 50% of the project’s 14.3 million ounces of mineral resources. Increased conversion of mineral resources and ongoing extension of the mineral resource envelopes, especially at the higher grade East Gouldie zone, confirms the Partnership’s view that mine life will continue for more than 20 years.

Opportunities also exist for supplemental production sources to increase throughput beyond 20,000 tpd and utilize the excess process capacity of the 60,000 tpd Canadian Malartic plant. Exploration drilling of the East Gouldie Extension and parallel structures, while widely spaced, indicate that a corridor of mineralization extends at least 1.3 kilometres to the east of East Gouldie. Although at the very early stages, these results suggest the potential for a second production shaft that could increase throughput over the longer term. Open pit and underground exploration targets within the Canadian Malartic land package present additional potential ore sources.

Daniel Racine, President and Chief Executive Officer commented: “Exploration is continuing to deliver exciting results at Odyssey and we believe that exploration successes will in time allow the Partnership to take advantage of the excess plant capacity in order to maximize underground production above currently planned levels. The possible addition of a second shaft and further production from upper ore bodies accessed by ramp are additional opportunities that merit continuing investigation and assessment.”

Jacobina: Phase 2 Ahead of Schedule

Phase 2 Expansion

At Jacobina, the Phase 2 expansion is progressing ahead of schedule. The Company’s second phase expansion is expected to bring a production level of 230,000 ounces per year for multi-decades at low cost and high cash flow.

Permitting for throughput of up to 10,000 tpd is advancing according to plan, with the timeline for completion now expected by early 2022. Based on this accelerated permitting progress, the company expects to start producing at the throughput rate of 8,500 tpd in 2022, significantly ahead of the original 2024 timeline.

The Company expects to achieve the Phase 2 throughput rate of 8,500 tpd by implementing a simplified approach of debottlenecking and incremental operational improvements, without requiring the installation of an additional ball mill. This approach is expected to significantly reduce capital expenditures, increase energy efficiency, and derisk the project. As such, capital costs for the plant expansion are expected to be in the range of $15 million to $20 million as compared to the original $57 million capital cost originally planned.

Throughput during the quarter has remained stable at the currently permitted level of 7,500 tpd and preparations are being made to expedite the ramp up to 8,500 tpd as soon as the new permitting is received. Optimization of the crushing circuit which did not require the installation of new equipment has now been completed. Further initiatives which are expected to be completed during the first half of 2022 include optimizing the grinding process with the installation of ultrasonic density meters to optimize ore feed control to the mills and increasing the capacity of the electro-winning circuit.

The Phase 3 expansion is being evaluated to increase throughput to 10,000 tpd. Engineering will advance in parallel with Phase 2, with a feasibility study for Phase 3 scheduled for completion in 2023.

Minera Florida: ESIA Submitted

At Minera Florida, the plant debottlenecking study is advancing on schedule with the objective of increasing mine and plant throughput from 74,500 to 100,000 tonnes per month and thereby increasing gold production to 120,000 ounces per year. The Company has now submitted the ESIA with the timeline expected to be approximately 18 months for approval, with another 12 months to receive sectorial permits. With the expected permitting timelines, the mine could begin operating at a planned 100,000 tonnes per month level in 2025.

Qualified Persons

Scientific and technical information contained in this news release has been reviewed and approved by Sébastien Bernier (P. Geo and Senior Director, Geology and Mineral Resources). Sébastien Bernier is an employee of Yamana Gold Inc. and a "Qualified Person" as defined by Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Quality Assurance and Quality Control

Yamana incorporates a Quality Assurance and Quality Control (“QA/QC”) program for all of its mines and exploration projects which conforms to industry best practices.

Samples are transported in security sealed bags for preparation at ALS Geochemistry. ALS and SGS are both ISO 9001:2008 and 17025 certified laboratories. Gold is analyzed by gold fire assay with 30 grams aliquot and AAS finish (lab code: Au-AA25). Au-AA25 is certified from 0.01 to 100 g/t gold. Samples over 100 g/t gold are re-analyzed by gravimetric finish methods. Silver is determined using a four acid digestion and ICP-MS finish (ultra trace). The ME-MS61 method we use for silver is certified 0.01 to 100 ppm. Five percent of all pulps are further checked by a secondary certified laboratory (SGS) using the same ore grade fire assay analytical method.

All exploration diamond drill cores are split in half by core sawing and sampled at appropriate intervals for assay. The remaining core, and pulps are stored on-site in a secure location. We disposed of the rejects at the lab after the QAQC was complete.

Certified reference standards, blanks and duplicates (preparation and analytical) are routinely inserted into the sample stream as a control for assay accuracy, bias, precision and contamination. The results of these checks are tracked and failures are re-analyzed. This information also includes pulp checks carried out in the secondary lab.

About Yamana

Yamana Gold Inc. is a Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Canada, Brazil, Chile and Argentina. Yamana plans to continue to build on this base through expansion and optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in the Americas.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

416-815-0220

1-888-809-0925

Email: investor@yamana.com

FTI Consulting (UK Public Relations)

Sara Powell / Ben Brewerton

+44 7931 765 223 / +44 203 727 1000

Peel Hunt LLP (Joint UK Corporate Broker)

Ross Allister / David McKeown / Alexander Allen

Telephone: +44 (0) 20 7418 8900

Berenberg (Joint UK Corporate Broker)

Matthew Armitt / Jennifer Wyllie / Detlir Elezi

Telephone: +44 (0) 20 3207 7800

Credit Suisse (Joint UK Corporate Broker)

Ben Lawrence / David Nangle

Telephone: +44 (0) 20 7888 8888

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” under applicable Canadian securities legislation and within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking information includes, but is not limited to information with respect to the Company’s strategy, plans or future financial or operating performance, including exploration drilling plans and results from the Company’s generative program and potential to significantly extend mine lives at the Company’s projects; expected permitting and commencement of operations; expected fourth quarter production and guidance . Forward-looking statements are characterized by words such as “plan", “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the Company’s expectations in connection with the production and exploration, development and expansion plans at the Company's projects discussed herein being met, the impact of proposed optimizations at the Company's projects, changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, and the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating metal prices (such as gold, silver, copper and zinc), currency exchange rates (such as the Canadian Dollar, the Brazilian Real, the Chilean Peso and the Argentine Peso versus the United States Dollar), the impact of inflation, possible variations in ore grade or recovery rates, changes in the Company’s hedging program, changes in accounting policies, changes in mineral resources and mineral reserves, risks related to asset dispositions, risks related to metal purchase agreements, risks related to acquisitions, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, risks associated with infectious diseases, including COVID-19, unanticipated costs and expenses, higher prices for fuel, steel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, final pricing for concentrate sales, unanticipated results of future studies, seasonality and unanticipated weather changes, costs and timing of the development of new deposits, success of exploration activities, permitting timelines, government regulation and the risk of government expropriation or nationalization of mining operations, risks related to relying on local advisors and consultants in foreign jurisdictions, environmental risks, unanticipated reclamation expenses, risks relating to joint venture operations, title disputes or claims, limitations on insurance coverage, timing and possible outcome of pending and outstanding litigation and labour disputes, risks related to enforcing legal rights in foreign jurisdictions, as well as those risk factors discussed or referred to herein and in the Company's Annual Information Form filed with the securities regulatory authorities in all provinces of Canada and available at www.sedar.com, and the Company’s Annual Report on Form 40-F filed with the United States Securities and Exchange Commission. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s plans and objectives in connection with its exploration programs and results of exploration and its expected fourth quarter production and may not be appropriate for other purposes.

(All amounts are expressed in United States Dollars unless otherwise indicated.)