Yamana Gold Provides Exploration Update on the Canadian Malartic Mine; Announces Discovery of East Gouldie Zone

TORONTO, Sept. 09, 2019 (GLOBE NEWSWIRE) -- YAMANA GOLD INC. (TSX: YRI; NYSE: AUY) (“Yamana” or “the Company”) today provided an update on exploration activities at its 50% owned Canadian Malartic mine in northern Quebec.1 The Company also indicated that an exploration update is planned for each of El Peñón and Minera Florida in the fourth quarter.

Canadian Malartic Exploration Highlights:

- Discovery of a new mineralized zone, East Gouldie. Drill intercepts are helping to define a significant new mineralized zone located south of the East Malartic zone.

- Indicated and inferred mineral resources for East Malartic mineralized zone. East Malartic inferred mineral resources above 1,000 metres below surface showed a 14% increase between year-end 2017 and year-end 2018 to 1,403,000 ounces of contained gold (50% interest) as well as a new indicated mineral resource of 361,000 ounces of contained gold (50% interest). Inferred mineral resources at year-end 2018 below 1,000 metres totaled 1,481,000 ounces of contained gold (50% interest) and have not been previously reported.

- Indicated and inferred mineral resources for the Odyssey mineralized zone. Indicated mineral resources at year-end 2018 totaled 68,000 ounces of contained gold (50% interest), including 63,000 ounces above 1,000 metres below surface and 5,000 ounces below 1,000 metres. Inferred mineral resources at year-end 2018 totaled 809,000 ounces (50% interest), including 449,000 ounces above 1,000 metres below surface and 360,000 ounces below 1,000 metres.

- Odyssey Ramp. The permit allowing for the development of an underground ramp at the Odyssey project was received in December 2018.

- Purchase of Rand Malartic. The Canadian Malartic General Partnership acquired a 100% interest in the Rand Malartic property in March 2019, which provides an additional 262 hectares adjacent to the east side of the Canadian Malartic property and has the same favourable geological setting as the Odyssey zone.

(All amounts are expressed in United States Dollars unless otherwise indicated.)

1. Yamana and Agnico Eagle Mines Limited each hold an indirect 50% interest in the Canadian Malartic mine. The mine is operated by the Canadian Malartic General Partnership under a joint management committee.

The primary objective of exploration at Canadian Malartic in 2019 is defining and increasing underground mineral resources, with a focus on Odyssey, East Malartic, and now the newly discovered East Gouldie zone. The potential exists in these areas to increase production by supplementing open pit production with higher grade underground feed and also to extend mine life.

Drilling to date has defined considerable mineral resources that continue to grow at depth, and identified a new zone which points to the potential of a larger converging mineralized zone, thereby suggesting the prospect for a large underground bulk tonnage opportunity.

East Gouldie

Drilling this year at East Gouldie, which lies south of the main East Malartic shear and dips north, has yielded a number of positive intercepts. Results indicate that the East Gouldie, East Malartic, and Sladen zones are converging at depth, increasing the level of confidence in the economic potential of overall mineral resource below 1,000 metres and, as such, contributed to the new disclosure of the updated mineral resource figures for East Malartic at year-end 2018. The deeper portions of both zones are currently being investigated with ongoing deep drilling.

Among the more notable results are the two discovery holes drilled in late 2018: MEX18-121, which intersected 3.1 grams per tonne (“g/t”) of gold over 28.0 metres (estimated true width), and MEX18-108AC, which intersected 5.5 g/t of gold over 18.1 metres (estimated true width), as well as MEX18-127W, which intersected 8.1 g/t of gold over 26.6 metres (estimated true width). Follow-up drilling in 2019 has continued to outline additional gold mineralization, highlighted by holes MEX19-140, which intersected 7.2 g/t of gold over 9.0 metres (estimated true width), and MEX19-139, which intersected 5.1 g/t of gold over 25.2 metres (estimated true width).

Mineralization at East Gouldie has been intercepted by drilling along 1,200 metres of strike over up to a 700-metre vertical extent, including across wide intercepts as demonstrated by the examples noted above. Drilling is ongoing and a preliminary inferred mineral resource is expected by year-end 2019. A summary of the main intercepts as well as a long section are provided below.

Table 1: East Gouldie Select Drill Intercepts for Intervals Greater Than 50 Gram Metres (Gold g/t Multiplied by Estimated True Width in Metres)

| Hole | Including | From (m) | To (m) | Interval (m) | Estimated True Width (m) | Gold Grade Uncapped (g/t) |

| MEX18-108AC | 1267.0 | 1416.0 | 149.0 | 18.1 | 5.5 | |

| incl. | 1327.0 | 1392.0 | 65.0 | 7.8 | 9.0 | |

| MEX18-121 | 1299.0 | 1328.8 | 29.8 | 28.0 | 3.1 | |

| incl. | 1300.3 | 1305.0 | 4.7 | 4.4 | 8.2 | |

| incl. | 1323.0 | 1328.1 | 5.1 | 4.8 | 5.1 | |

| MEX18-127A | 1329.1 | 1366.0 | 36.9 | 32.3 | 3.9 | |

| incl. | 1335.0 | 1341.0 | 6.0 | 5.3 | 8.2 | |

| incl. | 1358.1 | 1366.0 | 7.9 | 6.9 | 5.5 | |

| MEX18-127W | 1244.0 | 1274.0 | 30.0 | 26.6 | 8.1 | |

| incl. | 1249.8 | 1273.0 | 23.2 | 20.6 | 9.9 | |

| MEX19-135 | 1889.0 | 1916.2 | 27.3 | 25.4 | 2.3 | |

| incl. | 1902.5 | 1909.0 | 6.5 | 6.0 | 4.8 | |

| MEX19-136W | 1662.4 | 1718.7 | 56.3 | 49.2 | 2.9 | |

| incl. | 1664.6 | 1675.0 | 10.4 | 9.1 | 6.4 | |

| incl. | 1688.1 | 1695.1 | 7.0 | 6.1 | 4.9 | |

| MEX19-139 | 1763.9 | 1771.0 | 7.1 | 6.4 | 8.4 | |

| 1789.0 | 1817.0 | 28.0 | 25.2 | 5.1 | ||

| incl. | 1790.4 | 1799.0 | 8.6 | 7.7 | 8.8 | |

| MEX19-139WA | 1735.1 | 1761.9 | 26.8 | 23.2 | 3.4 | |

| incl. | 1735.9 | 1741.9 | 6.0 | 5.2 | 5.6 | |

| incl. | 1746.9 | 1753.2 | 6.4 | 5.5 | 4.9 | |

| MEX19-140 | 1556.0 | 1565.4 | 9.4 | 9.0 | 7.2 | |

| ODY15-5021EXTA | 1773.0 | 1803.2 | 30.2 | 28.7 | 1.9 |

For additional details and complete drill results, please refer to the Company’s website at www.yamana.com or click on the following link.

Figure 1: Long Section of East Gouldie Looking North

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8fcdfe4-cc79-4969-94a1-776959e6dee1

Inferred and Indicated Mineral Resources for Odyssey and East Malartic

The following tables show all mineral resources (50% interest) as of December 31, 2018, for the Odyssey and East Malartic projects. Inferred mineral resources at Odyssey totaled 809,000 ounces of gold in addition to 68,000 ounces contained in the indicated category. The larger East Malartic zone contained 2,884,000 ounces of gold in the inferred category in addition to 361,000 ounces in the indicated category.

Table 2: Odyssey Mineral Resources (50% Interest) as of December 31, 2018

| Indicated Mineral Resources | Inferred Mineral Resources | |||||

| Gold | Tonnes | Grade | Contained | Tonnes | Grade | Contained |

| (g/t) | oz. | (g/t) | oz. | |||

| Above 1,000 metres | 932,000 | 2.11 | 63,000 | 7,019,000 | 1.99 | 449,000 |

| Below 1,000 metres | 77,000 | 2.05 | 5,000 | 4,479,000 | 2.50 | 360,000 |

| Total | 1,009,000 | 2.11 | 68,000 | 11,498,000 | 2.19 | 809,000 |

Table 3: East Malartic Mineral Resources (50% Interest) as of December 31, 2018

| Indicated Mineral Resources | Inferred Mineral Resources | |||||

| Gold | Tonnes | Grade | Contained | Tonnes | Grade | Contained |

| (g/t) | oz. | (g/t) | oz. | |||

| Above 1,000 metres | 5,265,000 | 2.13 | 361,000 | 22,021,000 | 1.98 | 1,403,000 |

| Below 1,000 metres | 23,694,000 | 1.94 | 1,481,000 | |||

| Total | 5,265,000 | 2.13 | 361,000 | 45,715,000 | 1.96 | 2,884,000 |

| Mineral Resource Reporting Notes Price assumption: $1,200 gold Underground Cut-off grade at Odyssey ranges from 1.15 to 1.30 g/t AU (stope optimized) and at East Malartic underground ranges from 1.25 to 1.40 g/t Au (Stope optimized) |

| Metallurgical recoveries for gold is 95.5% |

| 1. Mineral resources have been calculated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and National Instrument 43-101. | |

| 2. Mineral resources are reported exclusive of any mineral reserves. | |

| 3. Mineral resources which are not mineral reserves and do not have demonstrated economic viability. | |

| 4. Mineral reserves and mineral resources are reported as of December 31, 2018. The inferred mineral resource figures at East Malartic below 1,000 metres have not been previously reported. | |

| 5. Results are reported inclusive of internal dilution. | |

| 6. Pascal Lehouiller, P.Geo., of Canadian Malartic Corporation is the qualified person responsible for the mineral resource estimates. | |

At East Malartic, recent exploration activities have focused on deep drilling on the still open Sladen and South Sladen structures at depth where drilling continues to expand the deeper mineral envelope with widely spaced drilling. Notable intercepts include hole MEV18-106AWA, which intersected 2.3 g/t of gold over 71.1 metres (estimated true width), and hole MEV18-096, which intersected 2.5 g/t of gold over 161.3 metres (estimated true width). A summary of the main intercepts is provided in Table 4 below.

Table 4: South Sladen Select Drill Intercepts for Intervals Greater Than 10 Gram Metres (Gold g/t Multiplied by Estimated True Width in Metres)

| Hole | Including | From (m) | To (m) | Interval (m) | Estimated True Width (m) | Gold Grade Uncapped (g/t) |

| MEV18-096 | 1337.0 | 1502.4 | 165.4 | 161.3 | 2.5 | |

| incl. | 1351.0 | 1367.0 | 16.0 | 15.5 | 3.7 | |

| incl. | 1409.0 | 1420.0 | 11.0 | 10.7 | 3.2 | |

| incl. | 1472.0 | 1489.0 | 17.0 | 16.6 | 3.6 | |

| MEV18-096W | 1412.9 | 1428.0 | 15.1 | 14.6 | 1.9 | |

| MEV18-083EXT | 1455.1 | 1481.6 | 26.5 | 24.1 | 1.2 | |

| MEV18-106AWA | 1821.0 | 1915.0 | 94.0 | 71.1 | 2.3 | |

| incl. | 1833.9 | 1839.0 | 5.2 | 3.9 | 3.4 | |

| incl. | 1848.8 | 1852.8 | 4.0 | 3.0 | 6.7 | |

| incl. | 1893.4 | 1900.0 | 6.6 | 5.0 | 3.2 | |

| MEV17-043EXTA | 1285.0 | 1293.5 | 8.5 | 8.3 | 1.5 | |

| MEV17-043EXTA | 1317.0 | 1337.0 | 20.0 | 19.4 | 2.9 | |

| incl. | 1326.0 | 1337.0 | 11.0 | 10.7 | 3.7 | |

| MEV17-046EXT | 1301.3 | 1349.5 | 48.2 | 47.1 | 2.1 | |

| incl. | 1322.0 | 1334.0 | 12.0 | 11.7 | 3.0 | |

| MEV19-138 | 1704.0 | 1726.0 | 22.0 | 21.2 | 1.8 | |

| MEV19-144W | 1503.0 | 1516.2 | 13.2 | 12.9 | 2.0 |

For additional details and complete drill results, please refer to the Company’s website at www.yamana.com or click on the following link.

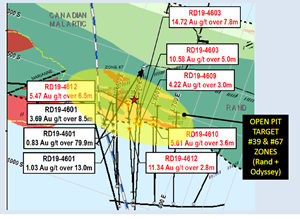

Rand Malartic

The Rand Malartic property extends 1.7 kilometres eastward along the Cadillac-Larder Lake break within the Piché Group, immediately east of the Odyssey project. The property has the same favourable geological setting as Odyssey, with several porphyry intrusions located near surface in the southernmost position of Piché volcanic rocks along the Odyssey South structure. The acquisition of Rand Malartic has allowed for further exploration both within the Rand Malartic property and in the Canadian Malartic mine boundary area. In the boundary area, infill drilling has helped define the high-grade internal Marianne zone at Odyssey. Notable results include hole ODY19-5284A, which intersected 10.1 g/t of gold over 5.39 metres (estimated true width). Within the Rand Malartic property, drilling has focused on defining porphyry-hosted mineralization in the extension of Odyssey south. The host porphyry at Odyssey is exposed at surface on the Rand Malartic claims providing both shallow open pit targets and deeper targets. The initial 2019 exploration budget of C$1.9 million for Rand Malartic has been increased to C$2.45 million (100% basis) by shifting budget priorities. To date, 14,800 metres of drilling has been completed. Preliminary drill results are promising, with select intercepts listed in Table 5 below.

While Rand Malartic has been an important focus of exploration since being acquired, exploration work also continues in the Midway and 117 zones along with a data compilation of the East Amphi project, located west of the main Canadian Malartic pit.

Table 5: Odyssey/Rand Malartic Area Select Drill Intercepts for Intervals Greater Than 10 Gram Metres (Gold g/t Multiplied by Estimated True Width in Metres)

| Hole | Including | From (m) | To (m) | Interval (m) | Estimated True Width (m) or *Horizontal Width1 (m) | Gold Grade Uncapped (g/t) |

| ODY19-5284 | 108.9 | 125.5 | 16.6 | 9.4 | 1.9 | |

| ODY19-5283 | 350.2 | 363.0 | 12.8 | *7.9 | 1.8 | |

| ODY19-5284A | 645.2 | 648.2 | 3.1 | *1.3 | 7.7 | |

| 712.9 | 729.6 | 16.8 | 5.4 | 10.1 | ||

| ODY19-5287 | 91.0 | 928.8 | 15.8 | 9.0 | 9.8 | |

| ODY19-5286 | 1031.0 | 1032.3 | 1.3 | 1.2 | 113.2 | |

| RD19-4603 | 551.7 | 559.5 | 7.8 | *6.0 | 14.7 | |

| incl. | 529.0 | 534.0 | 5.0 | *4.0 | 10.6 | |

| RD19-4612 | 734.0 | 740.5 | 6.5 | *5.0 | 5.5 | |

| RD19-4601 | 409.5 | 422.5 | 13.0 | *8.3 | 1.0 | |

| 511.5 | 520.0 | 8.5 | *5.6 | 3.7 | ||

| RD19-4623 | 244.5 | 260.5 | 16.0 | *11.2 | 1.8 | |

| RD19-4610 | 604.0 | 607.6 | 3.6 | *2.5 | 5.6 |

For additional details and complete drill results, refer to the Company’s website at www.yamana.com or click on the following link.

- Horizontal width is the reported drill interval projected to the horizontal and is provided for zones that lack sufficient data to accurately estimate true width.

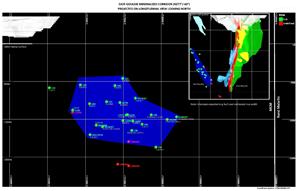

Figure 2: Surface View of the Rand Malartic Property with Select 2019 Drill Results Projected to Surface.

https://www.globenewswire.com/NewsRoom/AttachmentNg/3479dc53-bfd0-487b-8967-d09db81dd2d8

Progress on El Peñón and Minera Florida

Exploration at El Peñón continues to replace depletion with new discoveries in the core mine and in satellite deposits. Recently identified faults have been determined to displace extensions of previously mined ore bodies. New significant drill intersections on the Orito vein at depth resulting from this interpretation continue to be tested and plans are in progress to test this model at other principal veins.

At Minera Florida, with underground access now established, drilling continues to confirm new areas of mineralization which are expected to lead to mineral resource increases.

An exploration update is planned for each of El Peñón and Minera Florida in the fourth quarter.

Qualified Persons

Scientific and technical information contained in this press release has been reviewed and approved by Henry Marsden (P. Geo. and Senior Vice President, Exploration). Mr. Marsden is an employee of Yamana Gold Inc. and a “Qualified Person” as defined by Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Yamana

Yamana Gold Inc. is a Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Canada, Brazil, Chile and Argentina. Yamana plans to continue to build on this base through expansion and optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in the Americas.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations and Corporate Communications

416-815-0220

1-888-809-0925

Email: investor@yamana.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This news release contains or incorporates by reference “forward‐looking statements” and “forward‐looking information” under applicable Canadian securities legislation within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward‐looking information includes, but is not limited to information with respect to the Company's strategy, plans or future exploration and operating performance; the objective of exploration at Canadian Malartic in 2019; and the anticipated development of a larger underground operation and extension of mine life at Canadian Malartic and increase in production. Forward‐looking statements are characterized by words such as "plan," "expect", "budget", "target", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward‐looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward‐looking statements. These factors include the Company's expectations in connection with plans to continue to build on the Company’s existing base through existing operating mine expansions, throughput increases, development of new mines, the advancement of its exploration properties and, at times, by targeting other gold consolidation opportunities with a primary focus in the Americas; as well as those risk factors discussed or referred to herein and in the Company's Annual Information Form filed with the securities regulatory authorities in all provinces of Canada and available at www.sedar.com, and the Company's Annual Report on Form 40‐F filed with the United States Securities and Exchange Commission. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward‐looking statements, including market conditions, the results of preliminary inferred mineral resources at East Gouldie; construction of the exploration ramp at the Odyssey deposit, results of all continuing exploration and development work, and there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward‐looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward‐looking statements if circumstances or management's estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward‐looking statements. The forward‐looking information contained herein is presented for the purpose of assisting investors in understanding the Company's expected plans and objectives and may not be appropriate for other purposes.