Yamana Gold Provides Update on Its Generative Exploration Program and on Plans to Unlock Value From Advanced and Advancing Exploration Projects in the Program and Lay the Foundation for Its Next Generation of Mines in This Decade

TORONTO, Feb. 20, 2020 (GLOBE NEWSWIRE) -- YAMANA GOLD INC. (TSX:YRI; NYSE:AUY) (“Yamana” or “the Company”) today provided an update on its generative exploration program whose primary objective is to advance the Company’s pipeline of highly prospective exploration projects.

The Company has built large land positions in all countries where it has producing assets, and it is pursuing exploration projects in these countries that are at different stages of advancement. Investing prudently and responsibly in these projects today will ensure Yamana maintains its status as a dominant gold company while continuing to grow and meet its corporate objective to maximize free cash flow.

The Company will also continue to invest in near-mine exploration to extend the lives of its current operations, including the Canadian Malartic underground project, and advance the Agua Rica project to feasibility study. The generative exploration program will allow the Company to target a number of other advanced and advancing opportunities in its portfolio and help lay the foundation for the next generation of Yamana mines in the coming decade.

“Yamana has always taken a long-term strategic perspective,” said Henry Marsden, Senior Vice President of Exploration at Yamana. “We believe that investing in a generative exploration program today will secure our future tomorrow. We have strong prospects in mine-friendly jurisdictions that we know well, and we are confident that they will become a cornerstone of Yamana’s next generation of mines.”

The following are key elements and objectives of the generative exploration program:

- Target the Company’s most advanced exploration projects while retaining the flexibility to prioritize other projects in the portfolio as and when merited by drill results.

- Add new inferred mineral resources of at least 1.5 million ounces of gold equivalent within the next three years to move at least one project towards a preliminary economic assessment.

- On a longer term basis, advance at least one project to a mineral inventory that is large enough to support a mine plan demonstrating positive economics with annual gold production of approximately 150,000 ounces for at least eight years.

- Advance both gold-only and copper-gold projects and, in the latter case, consider joint venture agreements aimed at increasing mineral resource and advancing the project to development while Yamana maintains an economic interest in the project.

The Company expects to invest approximately $53 million in the program over the next three years, with $14 million budgeted for 2020, $18 million budgeted for 2021, and $21 million for 2022. Funding will be derived primarily from proceeds from monetizations of non-cash producing assets and, where applicable, flow-through funding agreements. The Company also expects to derive funding from expected joint venture opportunities, particularly for copper-gold projects. For information on exploration budgeting related to the Company’s core assets, please refer to the press release issued February 13, 2020, titled: ‘Yamana Gold Provides 2020-2022 Outlook.’

The generative exploration program will at first focus on the most advanced projects in Yamana’s portfolio while continuing drilling activity at a number of the Company’s highly prospective earlier stage projects. These projects are categorized as Tier One, Tier Two, or Tier Three projects, which are defined as follows:

| Tier One | Projects with well-defined gold mineral resources and opportunities to grow to a potentially economic threshold in the next three years |

| Tier Two | Projects that have achieved significant drill intercepts and whose geology along with other factors support rapid resource growth |

| Tier Three | Highly prospective projects with known mineralization defined with rock and soil geochemistry that warrant future drill testing |

The Company is confident that its exploration pipeline includes projects that can meet its shorter-term objective of at least one project achieving 1.5 million ounces of gold in the inferred mineral resource category within three years as well as its longer-term objective of building at least one gold mineral resource that can support a mine with annual production of approximately 150,000 ounces per year for at least eight years. Further, the Company is very confident that the allocated exploration budget will be sufficient to achieve these goals.

While the Company is prioritizing its most advanced exploration projects, a key element of the generative exploration program is to build in the flexibility and agility to shift focus quickly if a Tier Two or Tier Three project shows the greatest potential to meet the Company’s objectives. The Company is currently prioritizing projects in Brazil and Canada, but it also holds large land packages in Chile and Argentina that it continues to explore and evaluate.

SOURCES OF FUNDING

The Company does not intend to fund the program from its free cash flow. Yamana holds a number of assets in its portfolio that do not currently generate cash. The Company is currently evaluating the monetization of some of these assets, and it anticipates using the proceeds to fund the $53 million investment in the generative exploration program. Where applicable, the Company will also consider flow-through funding as an alternative source of capital, and it will also consider joint venture or similar arrangements to advance projects with large prospective copper mineral resources.

By funding the generative exploration program in this manner, the Company is aiming to ensure the program’s long-term viability regardless of fluctuations in metal prices. In addition, monetizing assets that are not generating free cash is consistent with the Company’s primary objectives of turning non-cash flow generating assets into assets that generate cash flow, maximizing free cash flow, and returning cash to shareholders.

The following is an overview of Yamana’s Tier One projects along with select Tier Two and Tier Three projects.

Figure 1: Tiered exploration projects in Brazil

https://www.globenewswire.com/NewsRoom/AttachmentNg/67cedd2c-7e6d-44a5-8e15-845352ee92e3

Figure 2: Tiered exploration projects in Canada

https://www.globenewswire.com/NewsRoom/AttachmentNg/26b0e56c-494f-4e9f-ace9-fa5cab7b1efb

TIER ONE PROJECTS

Lavra Velha

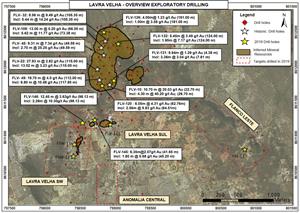

Lavra Velha is a near surface advanced exploration project located in the Lavra Velha district in Brazil’s Bahia state. Surface work and drilling has defined significant gold mineralization, building on the 2013 inferred mineral resource of 3.93 million tonnes at 4.29 grams per tonne (“g/t”) for 543,000 ounces of gold. The defined Lavra Velha deposit consists of shallowly dipping near surface mineralization that may be amenable to low capital intensity open pit mining and heap leaching. Metallurgical studies are ongoing. Drilling to date has generated a number of significant gold intercepts not currently included in the historical mineral resource estimates. Notable results reported as estimated true width include: 10.70 metres at 20.03 g/t of gold (starting at 23 metres down hole); 9.56 metres at 9.49 g/t of gold (starting at 105 metres down hole); 19.70 metres at 4.00 g/t of gold (starting at 112 metres down hole); and 27.93 metres at 2.82 g/t of gold (starting at 115 metres down hole).

Exploration has defined numerous additional gold anomalies in soil and rock which will be drill tested as part of the program. There are significant drill targets on the 55,000-hectare property, and Lavra Velha represents one of the most immediate, shorter term opportunities to achieve the Company’s stated exploration goals given the mineral resource to date and drilling following the initial mineral resource estimate. Further, Lavra Velha is highly prospective to meet the Company’s long-term objectives, as it is a shallow, flat-dipping orebody, making it ideal for open pit mining with a low strip ratio, and oxide mineralization, with potential to be processed as a heap leach operation. Therefore, the project has potential as a low capital cost, low operating cost operation.

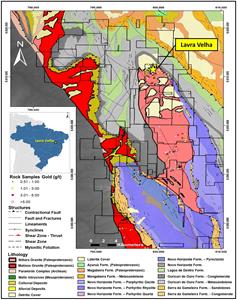

See Figure 3 for a property map of Lavra Velha and Figure 4 for an outline of a mineral resource along with adjacent exploration targets and select drilling results. Download a PDF of detailed drill hole results at Lavra Velha.

Figure 3: Lavra Velha property map showing geological setting, gold rock geochemistry, and location of the Lavra Velha target.

https://www.globenewswire.com/NewsRoom/AttachmentNg/58c7f36e-8f0a-40b1-aba6-e09ed70c3853

Figure 4: Lavra Velha map showing outline of inferred mineral resource, adjacent exploration targets, and select drilling results (reported as estimated true width, with depth of interval in parenthesis for intervals greater than 1 g/t of gold).

https://www.globenewswire.com/NewsRoom/AttachmentNg/f939d12a-5182-4f0f-9258-5ecd2ec53cd1

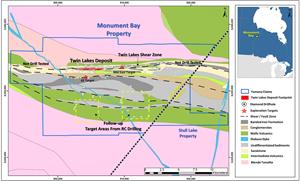

Monument Bay

Yamana is actively exploring its 31,000-hectare Monument Bay project, which is located in northeast Manitoba. The project covers the Twin Lakes shear zone, a strongly developed regional structure that hosts gold mineralization along a three-kilometre strike length. The Company has previously completed an exploration agreement with Red Sucker Lake First Nation in 2018. Mineral resources for Monument Bay demonstrate a large mineralized envelope with higher grade plunging mineralized shoots that could be accessed via open pit mining or, as mineralization continues at depth, could be mined underground. In part, the exploration program will focus on those higher grade extensions at depth. The exploration program will also focus on areas surrounding the Twin Lakes shear zone where the Company believes considerable opportunity exists to increase resources. As such, while drilling on the core Twin Lakes shear zone will continue, including down plunge, exploration has recently expanded to other targets within the existing exploration permit using reverse circulation drilling to collect basal till and top-of-bedrock samples. Property-wide exploration and follow-up diamond drilling will also continue in 2020 to build on the substantial Twin Lakes mineralization with the goal of establishing a new mineral resource and conceptual mine plan over the next year. Both open pit and underground options are being considered.

Monument Bay, although in a remote location, has certain advantages as a Canadian project, as Canada is one of the world’s highest ranked mining jurisdictions, has low power costs, and predictable mining regulations.

Figure 5: Monument Bay property geology map showing footprint of the Twin Lakes deposit, distribution of drill holes, and potential mineralization hosting structures and targets.

https://www.globenewswire.com/NewsRoom/AttachmentNg/0440b4aa-cced-4295-b1f1-3e64332268ba

TIER TWO PROJECTS

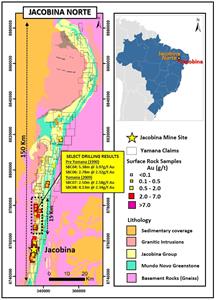

Jacobina Norte

The Jacobina Norte project, located in Brazil’s Bahia state just a few kilometres away from the Jacobina mine, is one of Yamana’s most promising advancing exploration projects. The Company controls 78,000 hectares that cover over 150 kilometres of strike extent of the Serra do Corrego Formation, which hosts paleoplacer gold mineralization at the Jacobina mine. Surface exploration along strike has defined mineralization at Jacobina Norte where surface sampling and historic shallow drilling of mineralized reefs along a 15-kilometre trend have defined significant gold grades.

Select historic drill results reported as core lengths from this zone include: 5.38 metres at 3.97 g/t of gold; 2.50 metres at 2.58 g/t of gold; 4.13 metres at 2.34 g/t of gold; and 2.78 metres at 2.32 g/t of gold. True widths are not interpreted at this time. Exploratory drilling and further surface exploration in 2020 will advance this prospect. Once a mineral resource is identified for Jacobina Norte, the Company will evaluate if the area is best developed as a standalone mine or as a source of additional mine feed to the existing Jacobina plant. The southernmost section of Jacobina Norte (the Serra Branca target) is located just nine kilometres north of Canavieiras Norte within the existing Jacobina mine infrastructure. See Figure 6 for details of the Jacobina Norte property.

The experience at the Jacobina mine leads the Company to conclude that there is a strong possibility over the next decade of a second Jacobina-type mine along the concession owned by Yamana near the current Jacobina mine. Further, the concessions extend well beyond the Jacobina mine and Jacobina Norte, which creates excellent opportunities for further prospects.

Figure 6: Jacobina Norte plan map showing Yamana mineral claims, simplified geology, surface rock sample gold geochemistry and 2009 Yamana drilling results as well as historic drilling results (reported as g/t of gold over core length in metres) where values are greater than 2.0 g/t of gold over greater than 2.0 metres core length.

https://www.globenewswire.com/NewsRoom/AttachmentNg/a1d073de-1cc9-4827-89aa-2d36f65bf04c

Borborema

The Borborema project is a 25,000-hectare land package in the Borborema district in Brazil’s Pernambuco state. The project is located in a Proterozoic magmatic arc environment that is similar to the belt hosting the Chapada mine, a large copper-gold mine developed by Yamana and put into production in 2007.

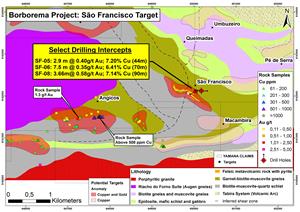

Originally explored for narrow high grade veins, exploration also identified strong copper–gold anomalies in both rocks and soils. Initial drill testing of the São Francisco target in 2019 generated near to surface, very high grade copper intercepts from massive sulphide mineralization. Notable drill intercepts with greater than 5% copper include: 3.66 metres at 0.58 g/t of gold and 7.14% copper (12.33 g/t gold equivalent)1 (starting at 90 metres down hole); 2.97 metres at 0.40 g/t of gold and 7.20% copper (12.25 g/t gold equivalent) (starting at 44.18 metres down hole); and 7.5 metres at 0.35 g/t of gold and 6.41% copper (10.90 g/t gold equivalent) (starting at 70.37 metres down hole). True widths are not interpreted at this time.

Exploration will expand on the known intercepts and drill test other copper-gold soil anomalies to better define the size and nature of the asset. While the Company will continue to advance Borborema, the project is primarily a high grade copper deposit with some gold. As such, Borborema represents an excellent opportunity for a joint venture pursuant to which Yamana would continue to benefit and create value while it maintains its focus on its precious metals opportunities.

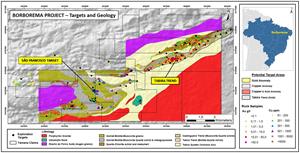

See Figure 7 for a property map of Borborema and Figure 8 for drilling highlights at São Francisco. Download a PDF of detailed drill hole results for the São Francisco target.

Figure 7: Borborema property map showing claims, geological setting, surface rock copper and gold geochemistry, and copper and gold targets.

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9e47440-12e6-4633-90d2-35a0fdf0c436

Figure 8: São Francisco target geological setting with select surface rock sample gold and copper geochemistry and drilling highlights (drilling results reported as core length, with depth of interval indicated in parenthesis for intercepts with greater than 5% copper).

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc855f59-0674-486f-83e0-6995abf886aa

Ivolandia

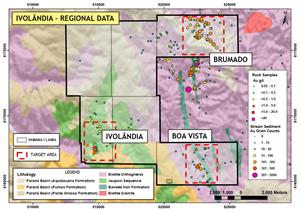

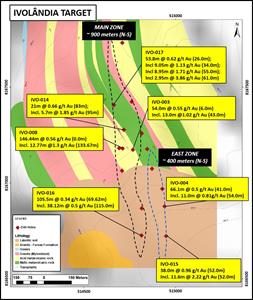

The Ivolandia project is located in Brazil’s Goias state, south of the Chapada mine. Gold-in-soil anomalies and surface gold mineralization were drill tested in wide-spaced exploration holes in 2011-12 and more recently in 2019. Results to date suggest lower grade although very near to surface oxide mineralization with large tonnage potential. Select drilling results greater than 50 metres core length with over 0.5 g/t of gold include: IVO-08 with 146.44 metres at 0.56 g/t of gold (from surface), including 12.77 metres at 1.30 g/t of gold; and IVO-03 with 54.0 metres at 0.55 g/t of gold starting at a hole depth of six metres. True widths are not interpreted at this time. Exploration will continue in 2020 on this 67,500-hectare land package to drill test known targets, and expand the mineralization footprint. As Ivolandia is very near to surface and mineralization is oxide, there is a possible opportunity for a very shallow open pit heap leach operation. See Figure 9 for a property map of Ivolandia and Figure 10 for a target zone map. Download a PDF of detailed drill hole results at Ivolandia.

Figure 9: Ivolandia property map showing claims, geology, surface rock gold geochemistry and stream sediment sample results (gold grain counts).

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e13eb83-93df-43c1-b0e6-8493bbbe73f2

Figure 10: Ivolandia main zone target map showing geology and select drilling results (reported as g/t of gold over core length, with starting point of interval indicated in parenthesis) for drill holes with greater than 0.5 g/t gold over greater than 20 metres core length.

https://www.globenewswire.com/NewsRoom/AttachmentNg/5b16088b-e1cf-4b4f-b756-d77bed2efbd1

Domain

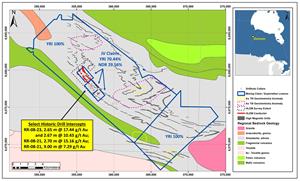

The Domain project is located near Oxford Lake in northeast Manitoba. The land position consists of a 20,000-hectare property 100%-controlled by Yamana that is largely unexplored. Interpretation of regional airborne magnetics together with government geological survey till geochemistry support a highly prospective environment for folded iron formation hosted gold. The Yamana property surrounds three claims totaling 576 hectares that are under a joint venture agreement with New Dimension Resources, which holds a 29.6% interest. The joint venture claims cover an area of historic drilling with significant gold intercepts hosted by iron formation that includes intervals reported by Rolling Rock Resources in 2008 and New Dimension Resources in 2017. Notable drill intercepts include: RR-08-23, 2.65 metres at 17.44 g/t of gold and 2.67 metres at 10.43 g/t of gold; RR-08-21, 2.70 metres at 15.16 g/t of gold; and RR-08-20, 9.0 metres at 7.29 g/t of gold. True widths are estimated to be 80-100% of core length based on limited drilling.

Yamana will continue to engage with the Bunibonibee Cree Nation in 2020 in an effort to reach a mutually beneficial agreement supporting the advancement of exploration within this large, prospective land package. See Figure 11 for a Domain property map. Download a PDF of detailed drill hole results at Domain.

Figure 11: Domain Property map showing claim outlines, geological setting, location of drill collars, and geophysical HLEM (horizontal loop electromagnetics) conductors and high magnetic responses. Historic drilling highlights reported for holes with gold in g/t multiplied by core length in metres (g/t*m) greater than 25. True widths are estimated to be 80-100% of core length based on limited drilling.

https://www.globenewswire.com/NewsRoom/AttachmentNg/a8760ff0-227f-455f-b00e-18c124b2c77c

TIER THREE PROJECTS

Yamana controls a number of prospective land packages with mineralization defined by surface exploration but with little or no drilling completed to date. Notable Tier Three projects include the Mara Rosa and Colider projects in Brazil along with the Red Lake project in Canada.

Mara Rosa, located north of the Chapada mine in Goias state, consists of 120,000 hectares of prospective mineral concessions. This land package is marked by the same alteration footprint as Chapada with widespread kyanite schist. Extensive soil geochemistry has established the presence of a number of significant copper, copper-gold, and gold only targets, several of which are drill ready. Exploration in 2020 will systematically test the stronger anomalies while continuing to build surface targets with geochemical, geological, and geophysical data.

Colider is an early stage project located in Mato Grosso state in the newly developing Alta Floresta district, which is being explored for porphyry copper deposits by Anglo American and Aura Minerals. Yamana has completed soil and rock geochemistry on parts of the 9,700-hectare property with several drill-ready gold targets defined. Surface work will continue and initial exploratory drilling is expected in 2020.

The Red Lake project, located in northwestern Ontario, consists of 543 hectares of land in two property positions: North Madsen and Headway. North Madsen covers a significant mineral envelope defined by 280 drill holes immediately west of the Hasaga gold deposit owned by Premier Gold Mines. Headway consists of 127 hectares south and adjacent to Newmont’s Red Lake Gold Mines operation. Exploration targets at Headway include potential down-dip projections of gold-bearing structures occurring in the hanging wall of the high grade zone at the Red Lake complex.

Qualified Persons and Data Verification

Scientific and technical information contained in this press release has been reviewed and approved by Henry Marsden (P. Geo. and Senior Vice President, Exploration). Mr. Marsden is an employee of Yamana Gold Inc. and a “Qualified Person” as defined by Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Yamana

Yamana Gold Inc. is a Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Canada, Brazil, Chile and Argentina. Yamana plans to continue to build on this base through expansion and optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in the Americas.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

416-815-0220

1-888-809-0925

Email: investor@yamana.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” under applicable Canadian securities legislation and within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking information includes, but is not limited to information with respect to the Company’s proposed generative exploration program and prospective and highly prospective targets and projects, the Company’s short-term and longer-term goals and objectives of the program; the Company’s expectation that it will continue to generate cash flow and execute on monetization initiatives, possible flow-through funding agreements and joint venture funding opportunities, some of which will support the generative exploration program. . Forward-looking statements are characterized by words such as “plan", “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include unforeseen impacts on cash flow, monetization initiatives, available residual cash, and other funding opportunities; unforeseen exploration and test results, and other risk factors discussed in the Company's Annual Information Form filed with the securities regulatory authorities in all provinces of Canada and available at www.sedar.com, and the Company’s Annual Report on Form 40-F filed with the United States Securities and Exchange Commission. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s proposed generative exploration program and the short-term and longer-term goals and objectives thereof, as well as the Company’s expected sources of funding for the program and may not be appropriate for other purposes.

(All amounts are expressed in United States dollars unless otherwise indicated)

1 Gold equivalent grade calculated using a gold value of US$1,250 per ounce and a copper value of US$3 per pound.