Gold: A Pivotal Moment Has Arrived

Gold continues to follow the yen's bullish lead in the near term.

Investor uncertainty remains high as gold's safe haven bid returns.

A critical test of a benchmark trading level will be made this week.

You wouldn't know it by how much stock market volatility has declined in recent days, but investors are still feeling the urge to hedge their bets in what has been a nerve-wracking past two weeks. While the bond market is being passed over by safety-minded investors this time around, gold and the yen currency are benefiting from heightened fears. In this report, we'll discuss the relationship between these two assets which investors are now favoring as they wait for the market's latest bout of jitters to pass.

What's interesting to note about the recent stock market plunge is that U.S. Treasuries weren't the go-to safe haven among worried investors. Instead, it was the old standby - the Japanese yen - and the yellow metal. On Tuesday, the yen rallied to a multi-month high and gained almost 1 percent. The yen far outshone other safe havens, and it proved that there is still an undercurrent of fear beneath a financial market which is desperately trying to stabilize.

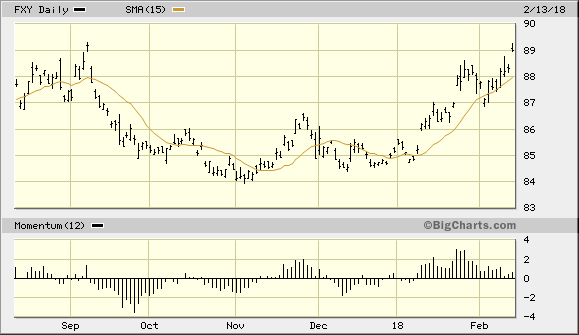

Shown here is the Guggenheim CurrencyShares Japanese Yen Trust ETF (NYSEARCA:FXY), which was highlighted in my February 12 commentary. As I previously asserted, sustained strength in the yen normally bodes well for the near-term gold price outlook. From this perspective, Tuesday's rally in FXY suggests that gold will soon attempt a similar upside breakout.

(Source: BigCharts.com)

As far as the yen goes, however, Tuesday's upside gap in FXY may represent the start of an exhaustion-type move in the currency's rally. Given that FXY experienced a similar occurrence last September when it attempted to rally above the $89.00 level, we should certainly expect at least some type of pullback in the fund's price line after its recent strong showing. If the yen does pull back from here, it wouldn't necessary spell doom for the near-term gold outlook. I'll have more to say about this in the next few days, but suffice it to say for now that gold should benefit from both the market's current inflation concerns as well as any lingering fears over the near-term equity market outlook.

Not to be outdone by the latest yen rally, gold also had a respectable showing on Tuesday in rising 0.63%. It benefited from the market's nervousness over the impending U.S. inflation data scheduled for release on Wednesday. Financial reporters have been apt to characterize gold's recent strength as a result of investors' concerns over rising inflation, and hence, the possibility of higher interest rates. Yet, it's more likely that the primary motivation of gold buyers right now is the fear of additional equity market weakness and not higher bond yields.

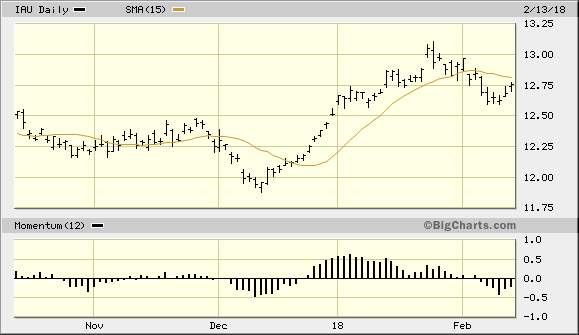

Gold prices also benefited on Tuesday from a weaker dollar as the U.S. dollar index (DXY) declined for the second straight day. The dollar's retreat has helped gold recover nearly 2 percent of last week's losses. In the process of hitting a one-week high on Tuesday, gold and the iShares Gold Trust ETF (NYSEARCA:IAU) - my tracking vehicle for gold - came within reach of the overhanging 15-day moving average. As I've emphasized in recent commentaries, a close decisively above the 15-day MA is needed to re-activate gold's immediate-term (1-4 week) uptrend and give the bulls a decisive advantage. By overcoming this trend line, the gold bulls would also likely succeed in catalyzing a short-covering rally as nervous bears are forced into retreat by the resurgent gold price.

(Source: BigCharts.com)

As intimated in the headline for today's commentary, gold's pivotal moment has likely arrived. The all-important test of gold's immediate-term technical strength will be made in the next couple of trading sessions, for a failure to overcome the 15-day moving average hurdle - which corresponds to the $12.82 level in IAU - would be seen as a sign of immediate weakness by the bears. A failure to close above $12.82 this week could also allow them to recover the initiative and force the bulls temporarily into retreat. For now, though, the bulls have the immediate advantage and will likely force an attempt to push IAU above the 15-day MA, especially in view of the recent yen rally discussed here.

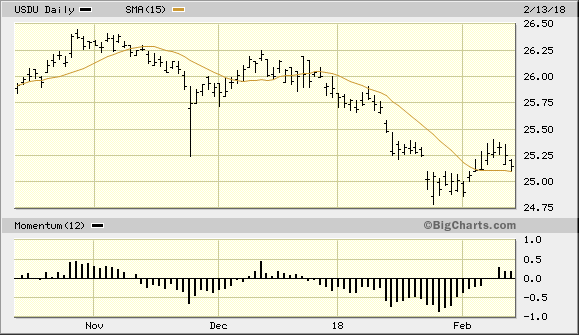

It will also be important for gold traders to monitor the 15-day moving average in the dollar index. My dollar proxy is the WisdomTree Bloomberg US Dollar Bullish ETF (NYSEARCA:USDU), which is shown below. A close under the 15-day MA by USDU would give the gold bulls an additional advantage this week in their attempt at forcing the gold shorts to cover. Moreover, a close under the nearest pivotal low in the fund - which is the $24.90 level established on February 1 - would formally reverse the immediate-term bottom signal which USDU confirmed last week when it closed two days above its 15-day moving average. A resumption of the intermediate-term declining trend in the dollar would obviously bode well for the gold price outlook.

(Source: BigCharts.com)

To reiterate my immediate-term strategic position, I don't plan on initiating a new trading position in IAU until the ETF is first able to close above its 15-day moving average and thus prove that its immediate-term strength has been fully recovered. Longer-term investment positions in gold can be retained, however, as the fundamentals underscoring gold's 2-year recovery effort remain unchanged.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.