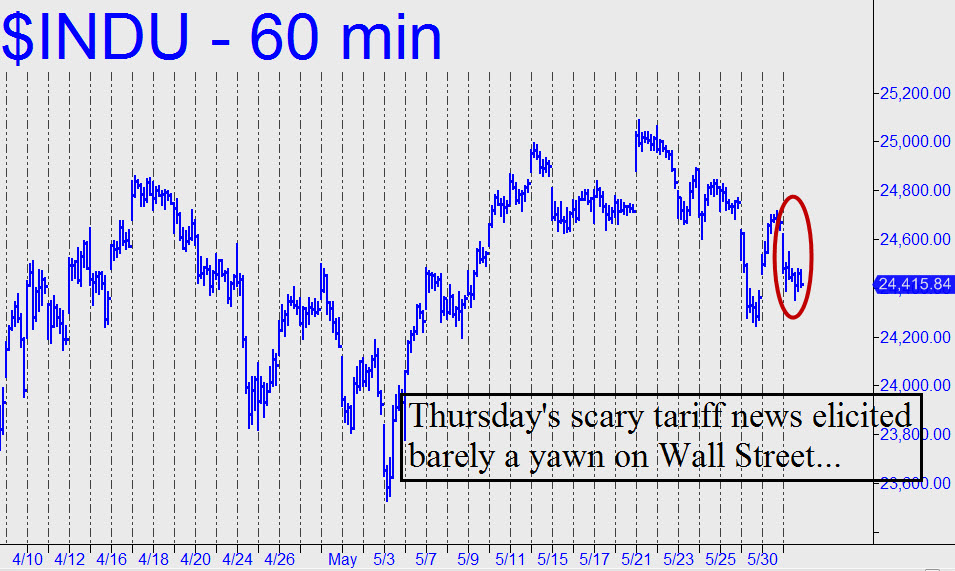

Street Reacts Mildly To Trade-War Bombs

Published Thursday, May 31, 6:30 p.m.. EDT

The Dow Industrials held up surprisingly well on Thursday, considering the scary news about tariffs. Two months ago, talk of a global trade war sounded like just another ginned-up story from a news media desperate for headlines. In fact, however, Trump's latest levies, which effectively cancel existing exemptions for steel and aluminum imports from Canada, Mexico and Europe, are sufficiently punitive to have provoked an instant, $12.8B retaliation by Canada. It was characterized as "the strongest trade action Canada has taken in the post-war era" and will take effect on July 1, matching the U.S. levy dollar-for-dollar. The tariff will add 25 percent to the cost of steel and 10 percent to aluminum, meaning consumers will feel it down to the level of canned soups and key rings.

The fact that the Dow Average managed to close down a mere 250 points suggests that the money-managing chimpanzees who are paid princely sums to throw good money at a relative handful of U.S. stocks are as oblivious to events in the real world as their simian progenitors. My hunch is that they will catch up with the bad news in the days and weeks ahead with a string of days like today, punctuated by an occasional really bad day. Even so, from a technical standpoint the worst I could see would be a nearly 2000-point drop to 22544. I'd suggest jotting that number down if you want to get ahead of it.

If you don't subscribe but want to join in the fun, click here for a two-week free trial to Rick's Picks, including access to a 24/7 chat room that draws great traders from around the world.