2 Retail Stocks to Buy Before Bullish Time of Year

Retail stocks Lululemon Athletica Inc. (NASDAQ:LULU) and Gap Inc (NYSE:GPS) are both off to a strong start in 2018, with the shares recently notching new highs. However, although both stocks have been on a tear lately, near-term options on LULU and GPS are priced at a relative bargain -- and more upside could be in store for the shares, if history repeats. Plus, seasonality is on the side of retail bulls, too, with the SPDR S&P Retail ETF (XRT) on the verge of its best time of the year.

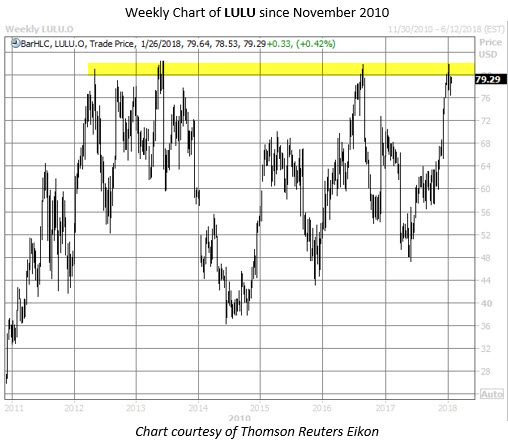

Lululemon Stock Could Assail Record Heights

The shares of yoga apparel maker Lululemon have rallied more than 51% in the past nine months, and scored a four-year high of $81.92 on Jan. 8, after the company reported solid holiday sales. Nevertheless, the stock's Schaeffer's Volatility Index (SVI) of 26% is in just the 3rd percentile of its annual range, pointing to relatively muted volatility expectations being priced into short-term LULU options.

Since 2008, there have been just three other times where LULU stock was trading within 2% of a 52-week high and sported an SVI in the bottom 10% of its annual range, per data from Schaeffer's Senior Quantitative Analyst Rocky White. One month after those signals, Lululemon shares were up 4.44%, on average. From the equity's current perch of $79.30, a similar rally would place the stock around $82.82 -- in record-high territory, and north of long-term resistance in the $80-$82.50 neighborhood.

A short squeeze could also propel the security higher. Short interest dropped 15.5% during the most recent reporting period, yet these bearish bets still make up about a week's worth of pent-up buying demand, at LULU stock's average pace of trading.

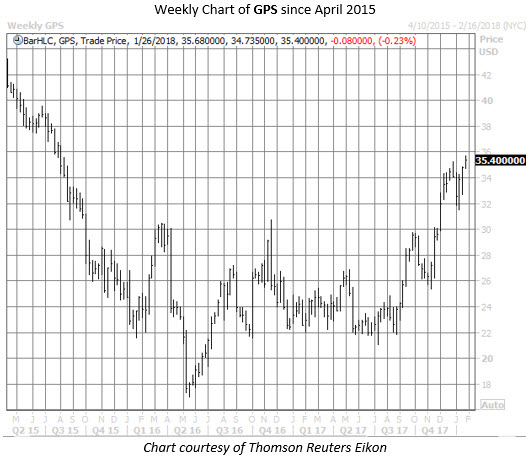

Gap Options Signal Preceded Huge Gains

Gap stock has soared nearly 50% in the past six months, and scored a fresh two-year high of $35.68 today. The shares have since pulled back 0.2% to trade at $35.40, but considering the equity's one-week rally of more than 8% -- putting its 14-day Relative Strength Index (RSI) near overbought territory -- a breather may have been in the short-term cards for GPS.

The retail stock's SVI of 30% is in just the 7th percentile of its annual range, however, pointing to relatively attractive short-term options prices for Gap. The last and only other time that GPS shares were flirting with new highs while simultaneously sporting a bottom-dwelling SVI, the stock went on to rally a whopping 15.95% in the subsequent month! A similar rally would place Gap stock around $41.01 -- territory not charted since mid-2015.

As with LULU, GPS could also benefit from a continued short squeeze. Short interest fell 17.1% during the most recent reporting period, but still represents more than 8% of the stock's total available float. At the security's average pace of trading, it would take about eight sessions for the remaining pessimistic positions to be repurchased.

Plus, Gap stock could score some well-deserved upgrades. Despite the equity's ascent of late, just three of 19 analysts offer up "buy" or better endorsements. A round of positive analyst attention could lure even more buyers to the table.

Seasonality Favors Retailers, Too

Further, it should be noted that the retail sector tends to perform well over the next few months. Since inception, theXRT exchange-traded fund (ETF) has averaged big gains in February, March, and April, rallying 3%, 4.2%, and 2.8%, respectively, according to data from Schaeffer's Quantitative Analyst Chris Prybal. As such, the three-month period is hands-down the best time of the year to own retail stocks, historically.