2 Stocks Threatened By Amazon

Morgan Stanley downgraded healthcare stocks Henry Schein, Inc. (NASDAQ:HSIC) and Patterson Companies, Inc. (NASDAQ:PDCO) to "underweight" from "equal weight," citing risk from Amazon's (AMZN) entry into the pharmaceutical field, as well as expectations for a possible consolidation in the dental consumables market that could create headwinds. The bearish note has shares of HSIC and PDCO trading lower in today's session, but the worst may not be over for the potential Amazon victims.

Henry Schein Stock Trading Below Key Technical Resistance

Though Morgan Stanley said Henry Schein was likely to benefit from bigger struggles for Patterson, the brokerage firm cut its price target on the stock to $65 -- sending HSIC down 3.3% at $68.76. This is just more of the same for the equity, which has shed more than 26% since hitting a record high of $93.50 on June 9. Plus, a recent rally off its Nov. 17 two-year low of $65.28 was quickly halted near $72, home to HSIC stock's early November bear gap and its descending 30-day moving average.

Part of this downside has likely been the result of intense selling pressure from shorts. Short interest on Henry Schein stock has quadrupled since mid-July to 10.83 million shares -- the most in seven years. The equity could be at risk of additional losses, as shorts increase their positions. Plus, with bears effectively "in control," there's little to motivate current shorts to exit their winning positions.

Short Sellers Could Put More Pressure on Patterson Stock

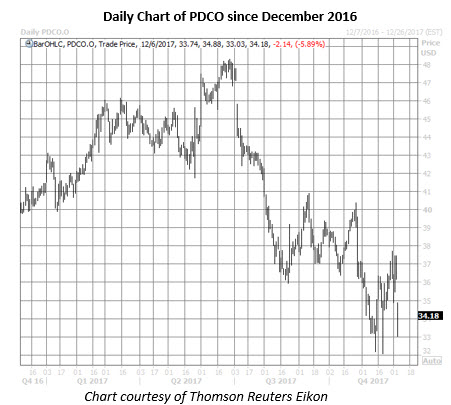

Morgan Stanley lowered its price target on Patterson stock to $29, with the shares last seen down 5.6% at $34.27. Though PDCO shares have not traded below $29 since December 2011, they have had a tough second half of 2017. After tagging an annual high of $48.30 on June 28, the equity has shed 29% -- and notched a five-year low of $32.07 on Nov. 21.

This downside has come even as short sellers have been covering their bearish bets, speaking volumes to PDCO stock's underlying weakness. After arriving at 14.24 million shares in the Oct. 1 reporting period -- the loftiest perch in at least 15 years -- short interest on PDCO is down 7.9%. The equity could get hit with bigger headwinds, if short sellers start to ramp up their exposure to the struggling healthcare stock.